Vivek Kaul

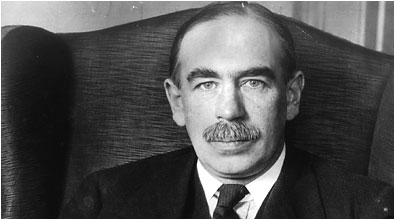

John Maynard Keynes (pictured above) was a rare economist whose books sold well even among the common public. The only exception to this was his magnum opus, The General Theory of Employment, Interest and Money, which was published towards the end of 1936.

In this book Keynes discussed the paradox of thrift or saving. What Keynes said was that when it comes to thrift or saving, the economics of the individual differed from the economics of the system as a whole. An individual saving more by cutting down on expenditure made tremendous sense. But when a society as a whole starts to save more then there is a problem. This is primarily because what is expenditure for one person is income for someone else. Hence when expenditures start to go down, incomes start to go down, which leads to a further reduction in expenditure and so the cycle continues. In this way the aggregate demand of a society as a whole falls which slows down economic growth.

This Keynes felt went a long way in explaining the real cause behind The Great Depression which started sometime in 1929. After the stock market crash in late October 1929, people’s perception of the future changed and this led them to cutting down on their expenditure, which slowed down different economies all over the world.

As per Keynes, the way out of this situation was for someone to spend more. The best way out was the government spending more money, and becoming the “spender of the last resort”. Also it did not matter if the government ended up running a fiscal deficit doing so. Fiscal deficit is the difference between what the government earns and what it spends.

What Keynes said in the General Theory was largely ignored initially. Gradually what Keynes had suggested started playing out on its own in different parts of the world.

Adolf Hitler had put 100,000 construction workers for the construction of Autobahn, a nationally coordinated motorway system in Germany, which was supposed to have no speed limits. Hitler first came to power in 1934. By 1936, the Germany economy was chugging along nicely having recovered from the devastating slump and unemployment. Italy and Japan had also worked along similar lines.

Very soon Britain would end up doing what Keynes had been recommending. The rise of Hitler led to a situation where Britain had to build massive defence capabilities in a very short period of time. The Prime Minister Neville Chamberlain was in no position to raise taxes to finance the defence expenditure. What he did was instead borrow money from the public and by the time the Second World War started in 1939, the British fiscal deficit was already projected to be around £1billion or around 25% of the national income. The deficit spending which started to happen even before the Second World War started led to the British economy booming.

This evidence left very little doubt in the minds of politicians, budding economists and people around the world that the economy worked like Keynes said it did. Keynesianism became the economic philosophy of the world.

Lest we come to the conclusion that Keynes was an advocate of government’s running fiscal deficits all the time, it needs to be clarified that his stated position was far from that. What Keynes believed in was that on an average the government budget should be balanced. This meant that during years of prosperity the governments should run budget surpluses. But when the environment was recessionary and things were not looking good, governments should spend more than what they earn and even run a fiscal deficit.

The politicians over the decades just took one part of Keynes’ argument and ran with it. The belief in running deficits in bad times became permanently etched in their minds. In the meanwhile they forgot that Keynes had also wanted them to run surpluses during good times. So they ran deficits even in good times. The expenditure of the government was always more than its income.

Thus, governments all over the world have run fiscal deficits over the years. This has been largely financed by borrowing money. With all this borrowing governments, at least in the developed world, have ended up with huge debts to repay. What has added to the trouble is the financial crisis which started in late 2008. In the aftermath of the crisis, governments have gone back to Keynes and increased their expenditure considerably in the hope of reviving their moribund economies.

In fact the increase in expenditure has been so huge that its not been possible to meet all of it through borrowing money. So several governments have got their respective central banks to buy the bonds they issue in order to finance their fiscal deficit. Central banks buy these bonds by simply printing money.

All this money printing has led to the Federal Reserve of United States expanding its balance sheet by 220% since early 2008. The Bank of England has done even better at 350%. The European Central Bank(ECB) has expanded its balance sheet by around 98%. The ECB is the central bank of the seventeen countries which use the euro as their currency. Countries using the euro as their currency are in total referred to as the euro zone.

The ECB and the euro zone have been rather subdued in their money printing operations. In fact, when one of the member countries Cyprus was given a bailout of € 10 billion (or around $13billion), a couple of days back, it was asked to partly finance the deal by seizing deposits of over €100,000 in its second largest bank, the Laiki Bank. This move is expected to generate €4.2 billion. The remaining money is expected to come from privatisation and tax increases, over a period of time.

It would have been simpler to just print and handover the money to Cyprus, rather than seizing deposits and creating insecurities in the minds of depositors all over the Euro Zone.

Spain, another member of the Euro Zone, seems to be working along similar lines. Loans given to real estate developers and construction companies by Spanish banks amount to nearly $700 billion, or nearly 50 percent of the Spain’s current GDP of nearly $1.4 trillion. With homes lying unsold developers are in no position to repay. And hence Spanish banks are in big trouble.

The government is not bailing out the Spanish banks totally by handing them freshly printed money or by pumping in borrowed money, as has been the case globally, over the last few years. It has asked the shareholders and bondholders of the five nationalised banks in the country, to share the cost of restructuring.

The modus operandi being resorted to in Cyprus and Spain can be termed as an extreme form of financial repression. Russell Napier, a consultant with CLSA, defines this term as “There is a thing called financial repression which is effectively forcing people to lend money to the…government.” In case of Cyprus and Spain the government has simply decided to seize the money from the depositors/shareholders/bondholders in order to fund itself. If the government had not done so, it would have had to borrow more money and increase its already burgeoning level of debt.

In effect the citizens of these countries are bailing out the governments. In case of Cyprus this may not be totally true, given that it is widely held that a significant portion of deposit holders with more than €100,000 in the Cyprian bank accounts are held by Russians laundering their black money.

But the broader point is that governments in the Euro Zone are coming around to the idea of financial repression where citizens of these countries will effectively bailout their troubled governments and banks.

Financing expenditure by money printing which has been the trend in other parts of the world hasn’t caught on as much in continental Europe. There are historical reasons for the same which go back to Germany and the way it was in the aftermath of the First World War.

The government was printing huge amounts of money to meet its expenditure. And this in turn led to very high inflation or hyperinflation as it is called, as this new money chased the same amount of goods and services. A kilo of butter cost ended up costing 250 billion marks and a kilo of bacon 180 billion marks. Interest rates as high as 22% per day were deemed to be legally fair.

Inflation in Germany at its peak touched a 1000 million %. This led to people losing faith in the politicians of the day, which in turn led to the rise of Adolf Hitler, the Second World War and the division of Germany.

Due to this historical reason, Germany has never come around to the idea of printing money to finance expenditure. And this to some extent has kept the total Euro Zone in control(given that Germany is the biggest economy in the zone) when it comes to printing money at the same rate as other governments in the world are. It has also led to the current policy of financial repression where the savings of the citizens of the country are forcefully being used to finance its government and rescue its banks.

The question is will the United States get around to the idea of financial repression and force its citizens to finance the government by either forcing them to buy bonds issued by the government or by simply seizing their savings, as is happening in Europe.

Currently the United States seems happy printing money to meet its expenditure. The trouble with printing too much money is that one day it does lead to inflation as more and more money chases the same number of goods, leading to higher prices. But that inflation is still to be seen.

As Nicholas NassimTaleb puts it in Anti Fragile “central banks can print money; they print print and print with no effect (and claim the “safety” of such a measure), then, “unexpectedly,” the printing causes a jump in inflation.”

It is when this inflation appears that the United States is likely to resort to financial repression and force its citizens to fund the government. As Russell Napier of CLSA told this writer in an interview “I am sure that if the Federal Reserve sees inflation climbing to anywhere near 10% it would go to the government and say that we cannot continue to print money to buy these treasuries and we need to force financial institutions and people to buy these treasuries.” Treasuries are the bonds that the American government sells to finance its fiscal deficit.

“May you live in interesting times,” goes the old Chinese curse. These surely are interesting times.

The article originally appeared on www.firstpost.com on March 27,2013

(Vivek Kaul is a writer. He tweets @kaul_vivek)

Month: March 2013

If Sanjay Dutt is innocent, I am Amitabh Bachchan

Vivek Kaul

Subhash Ghai’s Khalnayak with Sanjay Dutt in the lead role released on June 15, 1993. This was around two months after Dutt was first arrested on April 19, 1993, for his involvement in the Bombay bomb blasts which happened on March 12, 1993 (Bombay is now Mumbai). The story goes that Ghai had shot multiple ends for the movie, and after Dutt’s arrest he used the one which showed Ballu, the character played by Dutt, in a positive light.

That’s the thing with reel life, if the director does not like the end, he can change it. Real life should work a little differently, that’s what you and I might think. But it doesn’t always work like that. At least, not if you are Sanjay Dutt.

On March 21, 2013, the Supreme Court of India, convicted Dutt for illegal possession of arms and sentenced him to five years in prison. Between then and now a small cottage industry seems to have evolved which is trying to tell the world that Dutt is innocent and is trying to change the end of a long judicial process which has finally delivered some justice.

This cottage industry includes those working with him in the Hindi film industry. They cannot believe that Sanju Sir, as they like to call him, will have to go to jail. Rakhi Sawant, who is largely famous for what the Hindi film industry refers to as item numbers, has even volunteered to go to jail instead of Dutt. “If there is any provision in the law, then I’d like to request the court to send me to jail in place of Sanjay. Not because he is a big actor today, but because he has a family and kids at home to take care of,” she has remarked.

Support has also come in from Marakandey Katju, Chairman of the Press Council of India, who on other occasions has spoken out strongly against media’s obsession with celebrities. Katju is also a former judge of Supreme Court. He wants Sanjay Dutt to be pardoned.

He has offered various reasons for the same. In the last twenty years Dutt has suffered a lot. He had to take the permission of the Court for foreign shootings. He has two small children. And to top it Dutt has through his film revived the memory of Mahatma Gandhi and the message of Gandhiji, the father of the nation. Justice Katju in his appeal to grant pardon to Dutt had also said that “his parents Sunil Dutt and Nargis worked for the good of society and the nation.”

Congress General Secretary Digvijay Singh has jumped into the rescue Sanjay Dutt bandwagon as well. “Sanjay Dutt is not a criminal, he is not a terrorist. Sanjay Dutt, at a young age, in the atmosphere of that time, thought that perhaps the way Sunil Dutt had been raising his voice against communalism and favoured the minorities, then perhaps he could be attacked. So, as an obvious reaction of a kid to do something, if he has committed a mistake then I feel that he has undergone the punishment for it,” Singh said.

Mamata Banerjee, chief minister of West Bengal, who normally goes cholbe na cholbe na against everything, has also come out in support of Dutt. “Today, I fondly remember Sunil Dutt ji. He used to come to my residence whenever he was in Calcutta. If he were alive, he would have no doubt made all efforts to see that Sanjay does not suffer any more. My heart echoes the same sentiments ,” the Trinamool Congress chief wrote on Facebook, getting nostalgic.

Let me demolish this arguments one by one. In 1993, Sanjay Dutt was 33, going on 34. He was no kid, as Digvijay Singh makes him out to be. On the other hand Ajmal Kasab, who was recently hanged to death, was actually a kid, when he carried out the gruesome act that he did.

In the last twenty years Dutt has suffered a lot, feels Katju. But so has everyone else who was accused in the Mumbai bomb blasts case. Yusuf Memon, one of the accused, who will serving a life sentence, is schizophrenic and the Supreme Court dismissed his plea seeking relief from his conviction and life sentence.

During the last twenty years Dutt managed to marry twice (Rhea Pillai and now Manyata earlier known as Dilnawaz Sheikh ). So much for him suffering. And as far as kids go, if people were pardoned because they had kids, nobody in India would ever go to jail.

The movies Katju is talking about are Munnabhai MBBS and Lageraho Munnabhai. Dutt did not make these movies, he just acted in them. The movies were the vision of director Rajkumar Hirani, who also co-wrote them. In fact, Dutt was not even supposed to play the role of Munnabhai in Munnabhai MBBS. The original choice was Shah Rukh Khan, who later declined due to a back injury. So Sanjay Dutt was simply lucky to have first landed and then played the role which made Gandhi fashionable again. And that is no reason to let him go.

Digivijay Singh in his statement seems to be justifying Sanjay Dutt possessing illegal weapons for self defence. What he forgets is that we are not talking about some desi katta or a revolver here. We are talking about AK-56 rifles. Its worth remembering that the year was 1993 and not 2013. “And AKs were not weapons you almost ever saw outside some militant districts in Punjab and Kashmir,” writes Shekhar Gupta in a column in The Indian Express.

And as far as the nostalgia of Mamata Banerjee goes there are people who might still feel nostalgic about the late Head Constable Ibrahim Kaskar of Mumbai police. As S Hussain Zaidi writes in Dongri to Dubai – Six Decades of the Mumbai Mafia “In the predominantly Muslim stronghold of Dongri, Ibrahim’s baithak was the first place people went to if they had a problem. It was privy to everything-from people discussing their choking lavatory drain to the excitement of the elopement of lovers or cases of police harassment.” Kaskar’s son is Dawood Ibrahim. So should sons committing crimes be let go because their fathers happened to be nice men? Maybe Justice Katju and Mamata Banerjee can give us an answer to that.

In fact, it would be safe to say that Sanjay Dutt was very lucky not be convicted under the the Terrorist and Disruptive Activities (Prevention) Act (or what we better know as TADA). Dutt was arrested in 1993, for acquiring three AK-56s rifles, nine magazines, 450 cartridges and over 20 hand grenades. One doesn’t need so many weapons and ammunitions for self defence. This despite the fact that Dutt already had three licensed weapons. And when was the last time you heard anyone keeping hand grenades at home for self protection?

Some of these weapons were later stored at the home of a woman called Zaibunissa Kazi. This included two of the three AK-56s rifles that Dutt had got. Kazi was convicted under TADA. Same was the case with Baba Mussa Chauhan and Samir Hingora, who delivered the consignment of arms to Dutt’s house. And so was Manzoor Ahmed, whose car was used to ferry the arms out of Dutt’s residence.

But the special TADA court did not convict Dutt under TADA. This is very ironical given that those who got the arms to Dutt’s house were convicted under TADA. So was the women in whose house the arms were placed, after they were moved from Dutt’s house. He had also admitted to being directly in touch with Anees Ibrahim, the main conspirator Dawood Ibrahim’s younger brother. Further, CBI did not challenge the TADA court’s decision which relieved Dutt of charges under TADA, in the Supreme Court.

In fact Satish Manishinde, Dutt’s lawyer later admitted in front of a spy camera in a sting operation carried out by Tehehlka that “The moment she (Zaibunissa Kazi) was convicted, I thought Sanjay too would be convicted under TADA .” No wonder Kazi’s daughter feels “I wish I was a celebrity or my mother was a celebrity or a sister of an MP. Even my mother would have got the kind of support Sanjay Dutt is getting. If it is on humanitarian grounds then why only Sanjay Dutt, why not Zaibunisa. Isn’t she a human? Isn’t she a citizen of this country?”

As a line from the song Yaaram written by Gulzar, from the still to be released Ek Thi Daayan goes “koi khabar aayi na pasand to end badal denge”. Everyone who is trying to appeal for a pardon for Sanjay Dutt is trying to change the end of a long judicial process which has finally delivered some justice.

To conclude, let me say this loudly and emphatically, if Sanjay Dutt is innocent, then I am Amitabh Bachchan.

The article also appeared with a different headline on www.firstpost.com on March 29,2013.

(Vivek Kaul is a writer. He tweets @kaul_vivek. He can be reached at [email protected])

Question after Cyprus: Will govts loot depositors again?

Vivek Kaul

So why is the world worried about the Cyprus? A country of less than a million people, which accounts for just 0.2% of the euro zone economy. Euro Zone is a term used in reference to the seventeen countries that have adopted the euro as their currency.

The answer lies in the fact that what is happening in Cyprus might just play itself out in other parts of continental Europe, sooner rather than later. Allow me to explain.

Cyprus has been given a bailout amounting to € 10 billion (or around $13billion) by the International Monetary Fund and the European Union. As The New York Times reports “The money is supposed to help the country cope with the severe recession by financing government programs and refinancing debt held by private investors.”

Hence, a part of the bailout money will be used to repay government debt that is maturing. Governments all over the world typically spend more than they earn. The difference is made up for by borrowing. The Cyprian government has been no different on this account. An estimate made by Satyajit Das, a derivatives expert and the author of Extreme Money, in a note titled The Cyprus File suggests that the country might require around €7-8billion “for general government operations including debt servicing”.

But there is a twist in this tale. In return for the bailout IMF and the European Union want Cyprus to make its share of sacrifice as well. The Popular Bank of Cyprus (better known as the Laiki Bank), the second largest bank in the country, will shut down operations. Deposits of up to € 100,000 will be protected. These deposits will be shifted to the Bank of Cyprus, the largest bank in the country.

Deposits greater than € 100,000 will be frozen, seized by the government and used to partly pay for the deal. This move is expected to generate €4.2 billion. The remaining money is expected to come from privatisation and tax increases.

As The Huffington Post writes “The country of about 800,000 people has a banking sector eight times larger than its gross domestic product, with nearly a third of the roughly 68 billion euros in the country’s banks believed to be held by Russians.” Hence, it is widely believed that most deposits of greater than € 100,000 in Cyprian banks are held by Russians. And the move to seize these deposits thus cannot impact the local population.

This move is line with the German belief that any bailout money shouldn’t be rescuing the Russians, who are not a part of the European Union. “Germany wants to prevent any bailout fund flowing to Russian depositors, such as oligarchs or organised criminals who have used Cypriot banks to launder money. Carsten Schneider, a SPD politician, spoke gleefully about burning “Russian black money,”” writes Das.

It need not be said that this move will have a big impact on the Cyprian economy given that the country has evolved into an offshore banking centre over the years. The move to seize deposits will keep foreign money way from Cyprus and thus impact incomes as well as jobs.

The New York Times DealBook writes “Exotix, the brokerage firm, is predicting a 10 percent slump in gross domestic product this year followed by 8 percent next year and a total 23 percent decline before nadir is reached. Using Okun’s Law, which translates every one percentage point fall in G.D.P. (gross domestic product) to half a percentage point increase in unemployment, such a depression would push the unemployment rate up 11.5 percentage points, taking it to about 26 percent.”

But then that is not something that the world at large is worried about. The world at large is worried about the fact “what if”what has happened in Cyprus starts to happen in other parts of Europe?

The modus operandi being resorted to in Cyprus can be termed as an extreme form of financial repression. Russell Napier, a consultant with CLSA, defines this term as “There is a thing called financial repression which is effectively forcing people to lend money to the…government.” In case of Cyprus the government has simply decided to seize the money from the depositors in order to fund itself, albeit under outside pressure.

The question is will this become a model for other parts of the European Union where banks and governments are in trouble. Take the case of Spain, a country which forms 12% of the total GDP of the European Union. Loans given to real estate developers and construction companies by Spanish banks amount to nearly $700 billion, or nearly 50 percent of the Spain’s current GDP of nearly $1.4 trillion. With homes lying unsold developers are in no position to repay. Spain built nearly 30 percent of all the homes in the EU since 2000. The country has as many unsold homes as the United States of America which is many times bigger than Spain.

And Spain’s biggest three banks have assets worth $2.7trillion, which is two times Spain’s GDP. Estimates suggest that troubled Spanish banks are supposed to require anywhere between €75 billion and €100 billion to continue operating. This is many times the size of the crisis in Cyprus which is currently being dealt with.

The fear is “what if” a Cyprus like plan is implemented in Spain, or other countries in Europe, like Greece, Portugal, Ireland or Italy, for that matter, where both governments as well as banks are in trouble. “For Spain, Italy and other troubled euro zone countries, Cyprus is an unnerving example. Individuals and businesses in those countries will probably split up their savings into smaller accounts or move some of their money to another country. If a lot of depositors withdraw cash from the weakest banks in those countries, Europe could have another crisis on its hands,” The New York Times points out.

Given this there can be several repercussions in the future. “The Cyprus package highlights the increasing reluctance of countries like Germany, Finland and the Netherlands to support weaker Euro-Zone members,” writes Das. The German public has never been in great favour of bailing out the weaker countries. But their politicians have been going against this till now simply because they did not want to be seen responsible for the failure of the euro as a currency. Hence, they have cleared bailout packages for countries like Ireland, Greece etc in the past. Nevertheless that may not continue to happen given that Parliamentary elections are due in September later this year. So deposit holders in other countries which are likely to get bailout packages in the future maybe asked to share a part of the burden or even fully finance themselves.

This becomes clear with the statement made by Jeroen Dijsselbloem, the Dutch finance minister who heads the Eurogroup of euro-zone finance ministers “when failing banks need rescuing, euro-zone officials would turn to the bank’s shareholders, bondholders and uninsured depositors to contribute to their recapitalization.”

“He also said that Cyprus was a template for handling the region’s other debt-strapped countries,” reports Reuters. In the Euro Zone deposits above €100,000 are uninsured.

Given this likely possibility, even a hint of financial trouble will lead to people withdrawing their deposits. As Steve Forbes writes in The Forbes “After this, all it will take is just a hint of a financial crisis to send Spaniards, Italians, the French and others scurrying to ATMs and banks to pull out their cash.” Even the most well capitalised bank cannot hold onto a sustained bank run beyond a point.

It could also mean that people would look at parking their money outside the banking system.

“Even in the absence of a disaster individuals and companies will be looking to park at least a portion of their money outside the banking system,” writes Forbes. Does that imply more money flowing into gold, or simply more money under the pillow? That time will tell.

Also this could lead to more rescues and further bailouts in the days to come. As Das writes “If depositors withdraw funds in significant size and capital flight accelerates, then the European Central Bank, national central banks and governments will have intervene, funding affected banks and potentially restricting withdrawals, electronic funds transfers and imposing cross-border capital controls.” And this can’t be a good sign for the world economy.

The question being asked in Cyprus as The Forbes magazine puts it is “if something goes wrong again, what’s stopping the government from dipping back into their deposits?” To deal with this government has closed the banks until Thursday morning, in order to stop people from withdrawing money. Also the two largest banks in the country, the Bank of Cyprus and the Laiki Bank have imposed a daily withdrawal limit of €100 (or $130).

It will be interesting to see how the situation plays out once the banks open. Will depositors make a run for their deposits? Or will they continue to keep their money in banks? That might very well decide how the rest of the Europe behaves in the days to come.

Watch this space.

This article originally appeared on www.firstpost.com on March 26, 2013.

(Vivek Kaul is a writer. He tweets @kaul_vivek)

It’s time someone sang Subah Ho Gayi Mamu to Sanjay Dutt

Vivek Kaul

Saurabh Shukla in a stupendous performance as Judge Tiwari in the recent hit Jolly LLB tells Jolly, the protagonist of the movie (played by Arshad Warsi), “Kanoon andha hota hai, judge nahi! Judge ko sab dikhta hai. (The law is blind not the judge. The judge can see everything).” The Supreme Court judges have shown that they are not blind and that they can see things as they are. And so Sanjay Dutt is finally going to jail. Its taken twenty years, yes, but justice though delayed has been delivered.

Somehow this hasn’t gone down well with a lot of Indians and there has been tremendous outpouring of public sympathy in support of the 53 year old man the world loves to call Sanju baba, acknowledging that the man never grew up. The are multiple arguments being made against Dutt’s sentencing.

The first argument being made in support of the man is that so many people who have committed other crimes have gone unpunished, so why should he be punished? The man behind the Bombay blasts (the city is now known as Mumbai), Dawood Ibrahim, is still a free man, so why punish Sanjay Dutt ?

A former magazine editor turned film producer who likes to see himself as a poet these days, tweeted saying that Dawood has the protection of many ministers, and Dutt doesn’t have much political support, and hence he is being punished. The tweet seems to have been removed since then.

This is a totally stupid argument to make. Since when did two negatives start to cancel out each other? Just because Dawood is still free, doesn’t mean Dutt did not commit a crime and thus shouldn’t be punished.

And don’t these people remember that in the 20 years that it has taken the Indian judicial system to arrive at a the decision, Sanjay Dutt has been a free man for nearly 18.5 years. During the period he has acted and produced movies and earned a lot of money. He has also married twice and produced progeny as well. So much for him being a troubled man.

The second argument being made particularly on television channels is about the money riding on Sanjay Dutt. What happens to all those movies which are being made right now with Dutt acting in them? Well, if Dutt has a major role, the movies get canned. If he doesn’t have a major role, then the producer shoots his part with some other actor. The losses faced by a few individuals shouldn’t be coming in the way of justice.

Also by signing Dutt to play a part in their movie, the producers were taking a risk. Dutt has been out on bail for a while now, and a bail can be cancelled. When a bail is cancelled the individual out on bail goes back to the prison. This isn’t rocket science. And every producer signing Dutt should have understood this risk that he was taking.

And now that risk has come to the fore, Dutt sympathisers can’t be asking but what about the money riding on him? The money riding on him was always risky. I would like to use an analogy which I have used in the past. The producers who signed on Dutt essentially became victims of what Nassim Nicholas Taleb calls the turkey problem.

As he writes in his latest book Antifragile: “A turkey is fed for a thousand days by a butcher; every day confirms to its staff of analysts that butchers love turkeys ‘with increased statistical confidence.’” With the butcher feeding it on a regular basis, the turkey starts to expect that the good times will continue forever and the butcher will continue feeding it. But then a day comes when the butcher decides to kill the turkey and sell its meat. The producers assumed that Sanjay Dutt will always be out on bail and are now paying for that mistake. But like turkeys Dutt has also been slaughtered, suddenly and out of the blue.

As The Indian Express points out “The fate of three big budget films is riding on Sanjay Dutt with Zanjeer remake, Policegiri and Rajkumar Hirani’s Peekay, currently under production.” I am sure the nation can suffer this loss.

The third argument being made in support of Dutt, particularly by those who work for the Hindi film industry, is, that he is such a nice and a helpful man. He may be the nicest man in the world, but that doesn’t mean he did not commit a crime. And possessing illegal arms (a 9mm pistol and an AK-56 rifle) is no small matter.

As far as the general public goes, his gentle image is essentially an extension of two super-hit movies: Munnabhai MBBS and Lageraho Mubbabhai, where he played a lovable goon. But real life is different from reel life. Also to extend the argument every criminal’s mother must love him and find him to be a nice man, but that doesn’t change the fact that he is a criminal.

Sanjay Dutt was first arrested on April 19,1993. Two months after his arrest Subhash Ghai’s badly made Khalnayak hit the screens and was a super-duper hit, such was the outpouring of sympathy for Dutt. The world also discovered “choli ke peeche kya hai!”, as if they did not know it already.

Sadly, no such anti-hero (the Bollywood term for a hero who plays a villain’s role) films are scheduled to be released. Dutt will have to thus spend time in jail, remembering his big superhit song from Munnabhai MBBS, which gave his career a much needed push. As the lines of the song written by Rahat Indori, one of the greatest living urdu poets, go:

Chanda mama so gaye sooraj chachu jage

Dekho pakdo yaaron, ghadi ke kaante bhage

Ek kahani khatam to dooji shuru ho gayi mamu

Subah ho gayi mamu, mamu, mamu

Subah ho gayi mamu, mamu, re mamu

The article originally appeared on www.firstpost.com on March 21, 2013

(Vivek Kaul is a writer. He tweets @kaul_vivek)

What the humble electric toaster tells us about the global financial system

Vivek Kaul

Tim Harford writer of such excellent books like The Undercover Economist, The Logic of Life and Adapt, once wrote a blog discussing the perils of a design student trying to make an electric toaster from scratch.

Harford discusses the experience of Thomsan Thwaites, a postgraduate design student, who decided to embark on what he called “The Toaster Project”. “Quite simply, Thwaites wanted to build a toaster from scratch,” writes Harford.

The toaster was first invented in 1893 and is a household good in Great Britain and almost all other parts of the developed world. It costs a few pounds and is very reliable and efficient. But building it from scratch was still not a joke. “To obtain the iron ore, Thwaites had to travel to a former mine in Wales that now serves as a museum. His first attempt to smelt the iron using 15th-century technology failed dismally. His second attempt was something of a cheat, using a recently patented smelting method and a microwave oven – the microwave oven was a casualty of the process – to produce a coin-size lump of iron,” writes Harford.

Next Thwaites needed plastic. Plastic is made from oil. But Thwaites never made it to an oil rig. He finally settled at scavenging plastic from a local dump, which he melted and then moulded into a toaster casing.

More short cuts followed. As Harford writes “Copper he obtained via electrolysis from the polluted water of an old mine… Nickel was even harder; he cheated and bought some commemorative coins, melting them with an oxyacetylene torch. These compromises were inevitable.”

A simple toaster has nearly 400 components and sub components which is made from nearly 100 different materials. So imagine the difficulty if everything had to be procured and made from scratch. As Thwaites told Harford “I realised that if you started absolutely from scratch, you could easily spend your life making a toaster.”

Thwaites finally did manage to make an electric toaster, but it was nowhere as good as the ones easily available in the market. As Harford writes “Thwaites’s home-made toaster is a simpler affair, using just iron, copper, plastic, nickel and mica, a ceramic. It looks more like a toaster-shaped birthday cake than a real toaster, its coating dripping and oozing like icing gone wrong. “It warms bread when I plug it into a battery,” he says, brightly. “But I’m not sure what will happen if I plug it into the mains.””

So dear reader, you might be reading this piece sitting in the air-conditioned comforts of your office on an ergonomically designed chair (hopefully). Or you might be sitting at home reading this on your laptop. Or you must be travelling in a bus/metro/local train hanging onto your life and reading this on your android smartphone. Or you must be waiting for your aircraft to take off and must be quickly glancing through this on your iPad.

The question that crops up here is that how many of the things mentioned in the last paragraph, would you dear reader, be able to make on your own? The answer is none. So then where did all these things that make life so comfortable come from?

Dylan Grice answers this question in the latest issue (dated March 11, 2013) of the Edelweiss Journal. “So where did it all come from? Strangers, basically. You don’t know them and they don’t know you. In fact virtually none of us know each other. Nevertheless, strangers somehow pooled their skills, their experience and their expertise so as to conceive, design, manufacture and distribute whatever you are looking at right now so that it could be right there right now.”

Estimates suggest that cities like London and New York offer ten billion distinct kinds of products. So what makes this possible? “Exchange. To be able to consume the skills of these strangers, you must sell yours,” writes Grice. It is impossible for a single human being to even make something as simple as a toaster from scratch. But when many people specialise in their respective areas and develop certain skills, only then does a product as simple as a toaster become possible.

Let me take my example. I sell my writing skills. With the compensation that I get I buy goods and services that I need for my existence. From something as basic as food, water and electricity, which I need to survive or comforts like buying a washing machine to wash clothes, a refrigerator so that I don’t need to cook on a day to day basis, hiring a taxi to travel in or catching the latest movie at the local multiplex.

At the heart of any exchange is trust. As Grice puts it “we must also understand that exchange is only possible to the extent that people trust each other: when eating in a restaurant we trust the chef not to put things in our food; when hiring a builder we trust him to build a wall which won’t fall down; when we book a flight we entrust our lives and the lives of our families to complete strangers.”

So for any exchange to happen, there needs to be trust. But trust is not the only thing that facilitates exchange. There is another important ingredient. And that is money.

Money has been thoroughly abused all over the world in the aftermath of the financial crisis which broke out officially in September 2008. Central banks egged on by governments all over the world have printed money, in an effort to revive their respective economies. The idea being that with more money in the financial system, banks will lend more which will lead to people spending more and that will help revive the economy.

But all this comes with a cost. “So when central banks play the games with money of which they are so fond, we wonder if they realize that they are also playing games with social bonding. Do they realize that by devaluing money they are devaluing society?” asks Grice.

Allow me to explain. In the aftermath of the financial crisis, government expenditure all over the world has shot up dramatically. This expenditure could have been met by raising taxes. But when economies are slowing down this isn’t the most prudent thing to do. The next option was to borrow money. But there was only so much money that could be borrowed. So the governments utilised the third possible option. They got their central banks to print money. Central banks used this printed money to buy government bonds. Thus the governments could meet their increased expenditure.

When a government increases tax to meet its expenditure, everyone knows who is paying for it. It’s the taxpayer. But the answer is not so simple when the government meets its expenditure by printing money. As Grice puts it “When the government raises revenue by selling bonds to the central bank, which has financed its purchases with printed money, no one knows who ultimately pays.”

But then that doesn’t mean that nobody pays.

With the central bank printing money, the money supply in the financial system goes up. And this benefits those who are closest to the “new” money. Richard Cantillon, a contemporary of Adam Smith, explained this in the context of gold and silver coming into Spain from what was then called the New World (now South America).

As he wrote: “If the increase of actual money comes from mines of gold or silver… the owner of these mines, the adventurers, the smelters, refiners, and all the other workers will increase their expenditures in proportion to their gains.” These individuals would end up with a greater amount of gold and silver, which was used as money, back then. This money they would spend and thus drive up the prices of meat, wine, wool, wheat etc. This rise in prices would impact even people not associated with the mining industry even though they wouldn’t have seen a rise in their incomes like the people associated with the mining industry had.

So is this applicable in the present day context? The money printing that has happened in recent years has benefited those who are closest to the money creation. This basically means the financial sector and anyone who has access to cheap credit. Institutional investors have been able to raise money at close to zero percent interest rates and invest them in all kinds of assets all over the world. As Ruchir Sharma writes in Breakout Nations – In Pursuit of the Next Economic Miracles:

“What is apparent that central banks can print all the money they want, they can’t dictate where it goes. This time around, much of that money has flown into speculative oil futures, luxury real estate in major financial capitals, and other non productive investments…The hype has created a new industry that turns commodities into financial products that can be traded like stocks. Oil, wheat, and platinum used to be sold primarily as raw materials, and now they are sold largely as speculative investments.”

While financial investors benefit, the common man ends up paying more for the goods and services that he buys, something that is not always captured in the inflation number. As Grice puts it: “So now we know we have a slightly better understanding of who pays: whoever is furthest away from the newly created money. And we have a better understanding of how they pay: through a reduction in their own spending power. The problem is that while they will be acutely aware of the reduction in their own spending power, they will be less aware of why their spending power has declined. So if they find groceries becoming more expensive they blame the retailers for raising prices; if they find petrol unaffordable, they blame the oil companies; if they find rents too expensive they blame landlords, and so on. So now we see the mechanism by which debasing money debases trust. The unaware victims of this accidental redistribution don’t know who the enemy is, so they create an enemy.”

And people all over the world are doing a thoroughly good job of creating “enemies”. “The 99% blame the 1%; the 1% blame the 47%. In the aftermath of the Eurozone’s own credit bubbles, the Germans blame the Greeks. The Greeks round on the foreigners. The Catalans blame the Castilians. And as 25% of the Italian electorate vote for a professional comedian whose party slogan “vaffa” means roughly “f**k off ” (to everything it seems, including the common currency), the Germans are repatriating their gold from New York and Paris. Meanwhile in China, that centrally planned mother of all credit inflations, popular anger is being directed at Japan.”

This is only going to increase in the days and years to come. As Grice writes in a report titled Memo to Central Banks: You’re debasing more than our currency (October 12, 2012) “History is replete with Great Disorders in which social cohesion has been undermined by currency debasements…Yet central banks continue down the same route. The writing is on the wall. Further debasement of money will cause further debasement of society. I fear a Great Disorder.”

The article originally appeared on www.firstpost.com on March 21, 2013

Vivek Kaul is a writer. He tweets @kaul_vivek