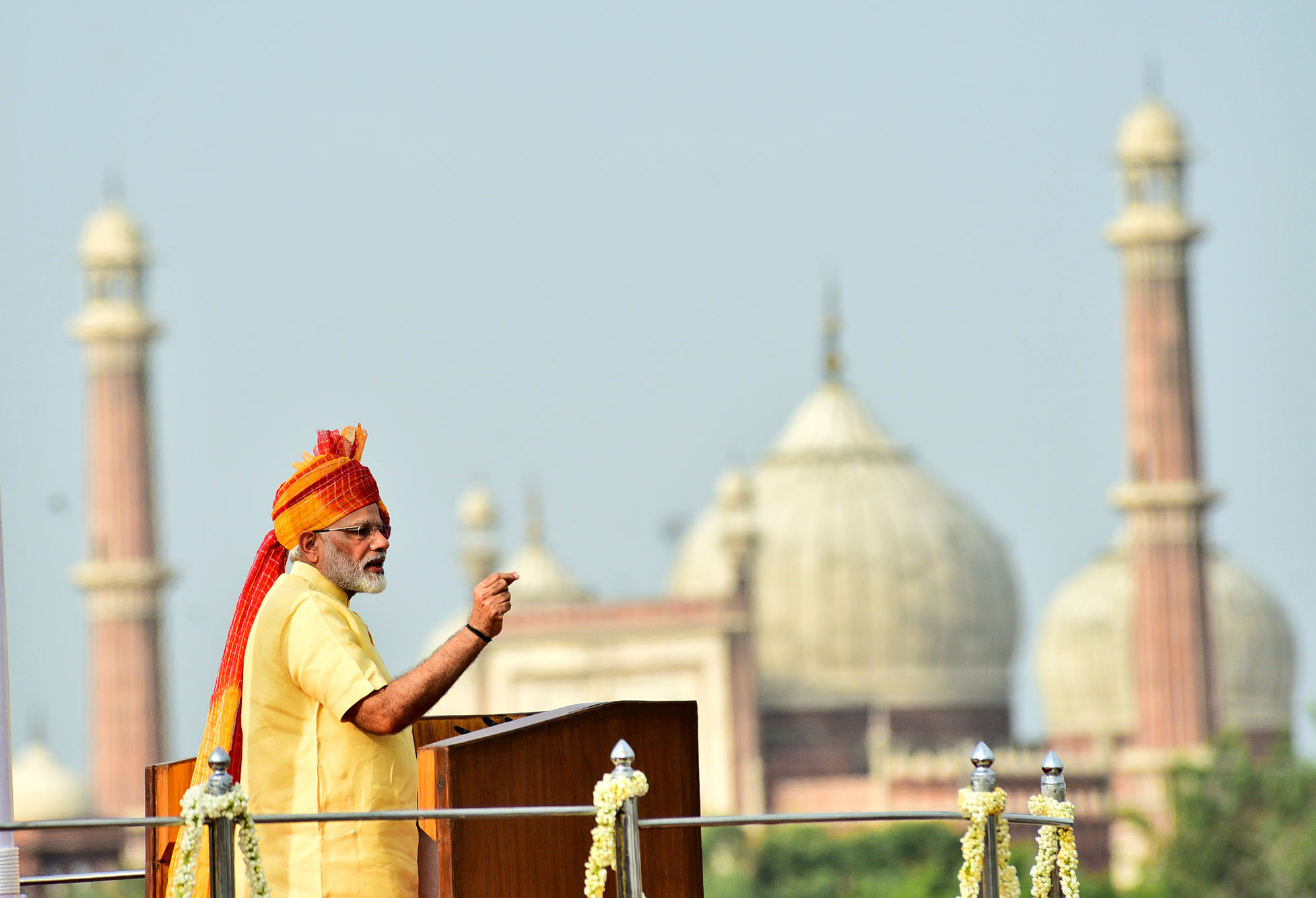

Prime Minister Narendra Modi briefly turned economist, in a speech, a couple of days ago, and in his charismatic and characteristic style told the country that there is no reason to worry, all is well.

He further said that people who were critical of the current economic scenario were spreading pessimism because only after spreading pessimism could they sleep well at night.

Modi offered us a whole host of economic data to show that India continues to do well. On economic growth slowing down to 5.7 per cent during April to June 2017, the Prime Minister had this to say: “Is it the first time that economic growth during a quarter has reached 5.7 per cent?”

He then went on to point out: “In six years of the previous government, eight times the economic growth rate had fallen to 5.7 per cent or lower.”

By this logic, nothing that is happening now is a reason to worry because it has, more or less, already happened before. This seems like pretty convoluted logic. Also, it goes back to what the Bharatiya Janata Party (BJP) does every time it is in some sort of a soup: blame the Congress.

In this piece, I will stick to the economic growth point, having made a point-to-point rebuttal of Modi’s cherry-picking of data to build a positive economic narrative, elsewhere.

Let’s look at Figure 1, which basically plots the quarterly (three-month period) gross domestic product (GDP) growth from June 2012 onwards.

Figure 1

Source: Ministry of Statistics and Programme Implementation

What is plotted as June 2012 in Figure 1 is basically the economic growth (GDP growth) during April to June 2012 in comparison to April to June 2011. This is true for all other data points.

The question is why have I taken economic growth from the period of three months ending June 2012 onwards? The answer lies in the fact that the new GDP series that the government started using from January 2015, has data starting from April to June 2011 onwards.

Given this, economic growth can be calculated only from April to June 2012 onwards. It will become clear later in this piece as to why am I making this point.

As is clear from Figure 1, economic growth has been falling from March 2016 onwards. The economic growth has fallen for the last six quarters. This is a real reason for worry. This is something that PM Modi forgot to mention in his big speech. This has never happened before if we were to just look at the new GDP series.

As mentioned earlier, Modi pointed out in his speech: “In the six years of the previous government, eight times the economic growth rate had fallen to 5.7 per cent or lower.”

As can be seen from Figure 1, economic growth has fallen below 5.7 per cent five times. Of this, economic growth fell below 5.7 per cent four times when Manmohan Singh was PM. It needs to be mentioned here that Manmohan Singh was the PM for 10 years, whereas Modi has been for three-and-a-half.

So, how Prime Minister Modi ended up saying that during the previous government “eight times the economic growth rate had fallen to 5.7 per cent or lower”, is a question well worth asking.

Did he use the old GDP series along with the new GDP series? Let’s merge the data from the two series (which is not the right way of going about things, but nonetheless) and see what we get.

Basically, we use GDP growth from the old series between the period of three months ending June 2005 and the period of three months ending March 2012, and after that we use the new GDP series. Take a look at Figure 2.

Figure 2

Source: Ministry of Statistics and Programme Implementation

Even after merging the two series, we get only five instances of growth falling below 5.7 per cent during the previous regime. This makes me wonder, where did Prime Minister Modi’s speech writer get the data from?

Modi had also said in his speech: “The country’s economy has seen quarters when the economic growth rate has fallen to levels of 0.2 per cent, 1.5 per cent.”

This hasn’t happened any time since June 2005 (again, we come to this conclusion only by wrongly merging the two GDP series, but Prime Minister Modi’s speech doesn’t leave us with any other option).

While the new GDP series has been in use from January 2015 onwards, the government hasn’t come up with GDP data based on the series for the period before April to June 2011, up until now.

The reason perhaps lies in the fact that the old GDP series under-declared growth to the extent of 2 per cent. Hence, any economic growth data from before April to June 2011 will basically end up showing the current slow rate of economic growth, in further bad light.

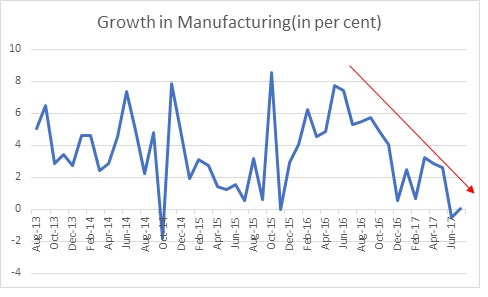

Now let’s take a look at Figure 3.

Figure 3

Source: Author calculations on data from the Ministry of Statistics and Programme Implementation

Figure 3 basically plots the growth of the non-government part of the economy, which typically constitutes 87 to 92 per cent of the economy. The growth of the non-government part of the economy has fallen to around a little over 4 per cent. This extremely important detail did not find a place anywhere in Prime Minister Modi’s speech.

If the non-government part of the economy is growing at such a slow rate, how will jobs for the one million youth entering the workforce every month, ever be created. The situation becomes even more worrisome if we look at Figure 4.

Figure 4

Source: Ministry of Statistics and Programme Implementation

As is clear from Figure 4, the growth rate of industry in general and manufacturing and construction in particular is at a five-year low. The manufacturing part of industry grew at 1.17 per cent during April to June 2017, whereas construction grew by 2 per cent during the same period.

This is a big reason to worry simply because manufacturing and construction have the potential to create new jobs. An estimate made by Crisil Research suggests that in construction, 12 workers are typically required to create Rs 10 lakh worth of output. In case of manufacturing, it is seven workers.

India’s economy has a problem. The sooner the government acknowledges and works towards it, the better it is going to be for all of us. But in this era of post-truth, it is more important for the government to keep spinning things than acknowledge the truth.

The column originally appeared on Newslaundry on October 6, 2017.

As can be seen from Table 3, in the previous two financial years, the total number of loans given to new entrepreneurs stood at 2.25 crore. This amounts to a little over 30 per cent of the total loans. Hence, the claim that 8 crore self-employment opportunities have been created because of PMMY loans doesn’t really add up. A bulk of the loans has been given to people who are already self-employed.

As can be seen from Table 3, in the previous two financial years, the total number of loans given to new entrepreneurs stood at 2.25 crore. This amounts to a little over 30 per cent of the total loans. Hence, the claim that 8 crore self-employment opportunities have been created because of PMMY loans doesn’t really add up. A bulk of the loans has been given to people who are already self-employed.