Source: Reserve Bank of India

Source: Reserve Bank of India

In December 2018, consumer price inflation came in at an 18-month low of 2.19%. After this, the government expects the monetary policy committee (MPC) of the Reserve Bank of India (RBI) to cut the repo rate when it meets next, in early February. Repo rate is the interest rate at which RBI lends to banks.

Why does the government expect the RBI to cut the repo rate?

The finance minister Arun Jaitley recently said: “We can’t have real interest rates higher than anywhere in the world”. Real interest rates are basically interest rates adjusted for inflation. If the interest rate on a one year fixed deposit is 6.8%, then the real interest rate works out to 4.61% (6.8% interest minus 2.19% inflation). The government hopes that once the RBI cuts the repo rate, the banks will cut their deposit rates and their lending rates as well. At lower interest rates people will borrow and spend more, companies will borrow and expand. This will benefit the economy.

What’s the problem with this argument?

A major reason why consumer price inflation has been low is because of low food inflation In December 2018, it was in a negative territory (-2.51%). RBI has no control over food inflation. Given this, let’s look at just core inflation (inflation after leaving out food and fuel items). In December 2018, it stood at 5.48%. If we take this rate of inflation into account, then the real rate of interest no longer remains one of the highest in the world, as the finance minister had said. It is at 1.32% (6.8% interest minus 5.48% inflation).

So, basically inflation exists beyond food items?

In December 2018, housing prices went up by 5.32%. Health costs were up 9.02%, whereas education costs went up by 8.38%.

Let’s say the MPC cuts the repo rate, will banks pass on the cut?

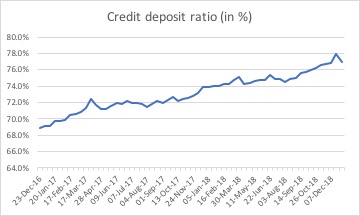

Take a look at the accompanying chart. The credit deposit ratio (non-food credit) of banks as on January 4, stood at 77%, after peaking at 77.9%, a fortnight before. Basically, once we take into account a statutory liquidity ratio of 19.25% (the proportion of deposits a bank needs to invest in government securities) and the cash reserve ratio of 4% (the proportion of deposits a bank needs to maintain with the RBI), the banks are already lending out their deposits full tilt.

Which are the sectors leading the lending?

In November 2018, lending to the services sector went up 28.1%, whereas lending to retail went up 17.20%. Even industrial lending growth hit a two-year high of 4%, with lending to medium-level industry growing 11%. Sector wise details are available only up to November. The growth rates in December would have been even faster. In this scenario, banks will need more deposits to keep funding the increase in lending. So, are they really in a position to cut interest rates?

This originally appeared in the Mint on January 21, 2019.