Vivek Kaul

So why is the world worried about the Cyprus? A country of less than a million people, which accounts for just 0.2% of the euro zone economy. Euro Zone is a term used in reference to the seventeen countries that have adopted the euro as their currency.

The answer lies in the fact that what is happening in Cyprus might just play itself out in other parts of continental Europe, sooner rather than later. Allow me to explain.

Cyprus has been given a bailout amounting to € 10 billion (or around $13billion) by the International Monetary Fund and the European Union. As The New York Times reports “The money is supposed to help the country cope with the severe recession by financing government programs and refinancing debt held by private investors.”

Hence, a part of the bailout money will be used to repay government debt that is maturing. Governments all over the world typically spend more than they earn. The difference is made up for by borrowing. The Cyprian government has been no different on this account. An estimate made by Satyajit Das, a derivatives expert and the author of Extreme Money, in a note titled The Cyprus File suggests that the country might require around €7-8billion “for general government operations including debt servicing”.

But there is a twist in this tale. In return for the bailout IMF and the European Union want Cyprus to make its share of sacrifice as well. The Popular Bank of Cyprus (better known as the Laiki Bank), the second largest bank in the country, will shut down operations. Deposits of up to € 100,000 will be protected. These deposits will be shifted to the Bank of Cyprus, the largest bank in the country.

Deposits greater than € 100,000 will be frozen, seized by the government and used to partly pay for the deal. This move is expected to generate €4.2 billion. The remaining money is expected to come from privatisation and tax increases.

As The Huffington Post writes “The country of about 800,000 people has a banking sector eight times larger than its gross domestic product, with nearly a third of the roughly 68 billion euros in the country’s banks believed to be held by Russians.” Hence, it is widely believed that most deposits of greater than € 100,000 in Cyprian banks are held by Russians. And the move to seize these deposits thus cannot impact the local population.

This move is line with the German belief that any bailout money shouldn’t be rescuing the Russians, who are not a part of the European Union. “Germany wants to prevent any bailout fund flowing to Russian depositors, such as oligarchs or organised criminals who have used Cypriot banks to launder money. Carsten Schneider, a SPD politician, spoke gleefully about burning “Russian black money,”” writes Das.

It need not be said that this move will have a big impact on the Cyprian economy given that the country has evolved into an offshore banking centre over the years. The move to seize deposits will keep foreign money way from Cyprus and thus impact incomes as well as jobs.

The New York Times DealBook writes “Exotix, the brokerage firm, is predicting a 10 percent slump in gross domestic product this year followed by 8 percent next year and a total 23 percent decline before nadir is reached. Using Okun’s Law, which translates every one percentage point fall in G.D.P. (gross domestic product) to half a percentage point increase in unemployment, such a depression would push the unemployment rate up 11.5 percentage points, taking it to about 26 percent.”

But then that is not something that the world at large is worried about. The world at large is worried about the fact “what if”what has happened in Cyprus starts to happen in other parts of Europe?

The modus operandi being resorted to in Cyprus can be termed as an extreme form of financial repression. Russell Napier, a consultant with CLSA, defines this term as “There is a thing called financial repression which is effectively forcing people to lend money to the…government.” In case of Cyprus the government has simply decided to seize the money from the depositors in order to fund itself, albeit under outside pressure.

The question is will this become a model for other parts of the European Union where banks and governments are in trouble. Take the case of Spain, a country which forms 12% of the total GDP of the European Union. Loans given to real estate developers and construction companies by Spanish banks amount to nearly $700 billion, or nearly 50 percent of the Spain’s current GDP of nearly $1.4 trillion. With homes lying unsold developers are in no position to repay. Spain built nearly 30 percent of all the homes in the EU since 2000. The country has as many unsold homes as the United States of America which is many times bigger than Spain.

And Spain’s biggest three banks have assets worth $2.7trillion, which is two times Spain’s GDP. Estimates suggest that troubled Spanish banks are supposed to require anywhere between €75 billion and €100 billion to continue operating. This is many times the size of the crisis in Cyprus which is currently being dealt with.

The fear is “what if” a Cyprus like plan is implemented in Spain, or other countries in Europe, like Greece, Portugal, Ireland or Italy, for that matter, where both governments as well as banks are in trouble. “For Spain, Italy and other troubled euro zone countries, Cyprus is an unnerving example. Individuals and businesses in those countries will probably split up their savings into smaller accounts or move some of their money to another country. If a lot of depositors withdraw cash from the weakest banks in those countries, Europe could have another crisis on its hands,” The New York Times points out.

Given this there can be several repercussions in the future. “The Cyprus package highlights the increasing reluctance of countries like Germany, Finland and the Netherlands to support weaker Euro-Zone members,” writes Das. The German public has never been in great favour of bailing out the weaker countries. But their politicians have been going against this till now simply because they did not want to be seen responsible for the failure of the euro as a currency. Hence, they have cleared bailout packages for countries like Ireland, Greece etc in the past. Nevertheless that may not continue to happen given that Parliamentary elections are due in September later this year. So deposit holders in other countries which are likely to get bailout packages in the future maybe asked to share a part of the burden or even fully finance themselves.

This becomes clear with the statement made by Jeroen Dijsselbloem, the Dutch finance minister who heads the Eurogroup of euro-zone finance ministers “when failing banks need rescuing, euro-zone officials would turn to the bank’s shareholders, bondholders and uninsured depositors to contribute to their recapitalization.”

“He also said that Cyprus was a template for handling the region’s other debt-strapped countries,” reports Reuters. In the Euro Zone deposits above €100,000 are uninsured.

Given this likely possibility, even a hint of financial trouble will lead to people withdrawing their deposits. As Steve Forbes writes in The Forbes “After this, all it will take is just a hint of a financial crisis to send Spaniards, Italians, the French and others scurrying to ATMs and banks to pull out their cash.” Even the most well capitalised bank cannot hold onto a sustained bank run beyond a point.

It could also mean that people would look at parking their money outside the banking system.

“Even in the absence of a disaster individuals and companies will be looking to park at least a portion of their money outside the banking system,” writes Forbes. Does that imply more money flowing into gold, or simply more money under the pillow? That time will tell.

Also this could lead to more rescues and further bailouts in the days to come. As Das writes “If depositors withdraw funds in significant size and capital flight accelerates, then the European Central Bank, national central banks and governments will have intervene, funding affected banks and potentially restricting withdrawals, electronic funds transfers and imposing cross-border capital controls.” And this can’t be a good sign for the world economy.

The question being asked in Cyprus as The Forbes magazine puts it is “if something goes wrong again, what’s stopping the government from dipping back into their deposits?” To deal with this government has closed the banks until Thursday morning, in order to stop people from withdrawing money. Also the two largest banks in the country, the Bank of Cyprus and the Laiki Bank have imposed a daily withdrawal limit of €100 (or $130).

It will be interesting to see how the situation plays out once the banks open. Will depositors make a run for their deposits? Or will they continue to keep their money in banks? That might very well decide how the rest of the Europe behaves in the days to come.

Watch this space.

This article originally appeared on www.firstpost.com on March 26, 2013.

(Vivek Kaul is a writer. He tweets @kaul_vivek)

CLSA

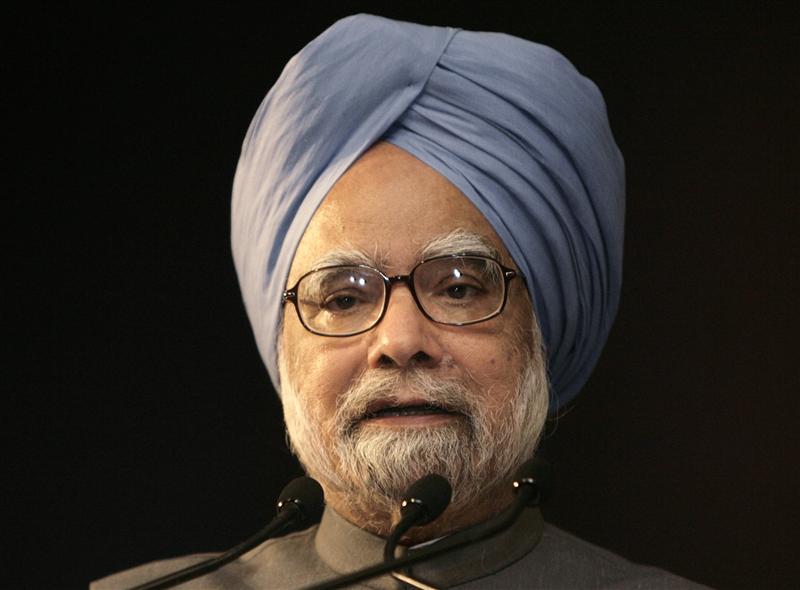

Why Manmohan Singh was better off being silent

Vivek Kaul

So the Prime Minister (PM) Manmohan Singh has finally spoken. But there are multiple reasons why his defence of the free allocation of coal blocks to the private sector and public sector companies is rather weak.

“The policy of allocation of coal blocks to private parties…was not a new policy introduced by the UPA (United Progressive Alliance). The policy has existed since 1993,” the PM said in a statement to the Parliament yesterday.

But what the statement does not tell us is that of the 192 coal blocks allocated between 1993 and 2009, only 39 blocks were allocated to private and public sector companies between 1993 and 2003.

The remaining 153 blocks or around 80% of the blocks were allocated between 2004 and 2009. Manmohan Singh has been PM since May 22, 2004. What makes things even more interesting is the fact that 128 coal blocks were given away between 2006 and 2009. Manmohan Singh was the coal minister for most of this period.

Hence, the defence of Manmohan Singh that they were following only past policy falls flat. Given this, giving away coal blocks for free is clearly UPA policy. Also, we need to remember that even in 1993, when the policy was first initiated a Congress party led government was in power.

The PM further says that “According to the assumptions and computations made by the CAG, there is a financial gain of about Rs. 1.86 lakh crore to private parties. The observations of the CAG are clearly disputable.”

What is interesting is that in its draft report which was leaked earlier in March this year, the Comptroler and Auditor General(CAG) of India had put the losses due to the free giveaway of coal blocks at Rs 10,67,000 crore, which was equal to around 81% of the expenditure of the government of India in 2011-2012.

Since then the number has been revised to a much lower Rs 1,86,000 crore. The CAG has arrived at this number using certain assumptions.

The CAG did not consider the coal blocks given to public sector companies while calculating losses. The transaction of handing over a coal block was between two arms of the government. The ministry of coal and a government owned public sector company (like NTPC). In the past when such transactions have happened revenue from such transactions have been recognized.

A very good example is when the government forces the Life Insurance Corporation (LIC) of India to forcefully buy shares of public sector companies to meet its disinvestment target. One arm of the government (LIC) is buying shares of another arm of the government (for eg: ONGC). And the money received by the government is recognized as revenue in the annual financial statement.

So when revenues from such transactions are recognized so should losses. Hence, the entire idea of the CAG not taking losses on account of coal blocks given to pubic sector companies does not make sense. If they had recognized these losses as well, losses would have been greater than Rs 1.86lakh crore. So this is one assumption that works in favour of the government. The losses on account of underground mines were also not taken into account.

The coal that is available in a block is referred to as geological reserve. But the entire coal cannot be mined due to various reasons including those of safety. The part that can be mined is referred to as extractable reserve. The extractable reserves of these blocks (after ignoring the public sector companies and the underground mines) came to around 6282.5 million tonnes. The average benefit per tonne was estimated to be at Rs 295.41.

As Abhishek Tyagi and Rajesh Panjwani of CLSA write in a report dated August 21, 2012,”The average benefit per tonne has been arrived at by first, taking the difference between the average sale price (Rs1028.42) per tonne for all grades of CIL(Coal India Ltd) coal for 2010-11 and the average cost of production (Rs583.01) per tonne for all grades of CIL coal for 2010-11. Secondly, as advised by the Ministry of Coal vide letter dated 15 March 2012 a further allowance of Rs150 per tonne has been made for financing cost. Accordingly the average benefit of Rs295.41 per tonne has been applied to the extractable reserve of 6282.5 million tonne calculated as above.”

Using this is a very conservative method CAG arrived at the loss figure of Rs 1,85,591.33 crore (Rs 295.41 x 6282.5million tonnes).

Manmohan Singh in his statement has contested this. In his statement the PM said “Firstly, computation of extractable reserves based on averages would not be correct. Secondly, the cost of production of coal varies significantly from mine to mine even for CIL due to varying geo-mining conditions, method of extraction, surface features, number of settlements, availability of infrastructure etc.”

As the conditions vary the profit per tonne of coal varies. To take this into account the CAG has calculated the average benefit per tonne and that takes into account the different conditions that the PM is referring to. So his two statements in a way contradict each other. Averages will have been to be taken into consideration to account for varying conditions. And that’s what the CAG has done.

The PM’s statement further says “Thirdly, CIL has been generally mining coal in areas with

better infrastructure and more favourable mining conditions, whereas the coal blocks offered for captive mining are generally located in areas with more difficult geological conditions.”

Let’s try and understand why this statement also does not make much sense. As The Economic Times recently reported, in November 2008, the Madhya Pradesh State Mining Corporation (MPSMC) auctioned six mines. In this auction the winning bids ranged from a royalty of Rs 700-2100 per tonne.

In comparison the CAG has estimated a profit of only Rs 295.41 per tonne from the coal blocks it has considered to calculate the loss figure. Also the mines auctioned in Madhya Pradesh were underground mines and the extraction cost in these mines is greater than open cast mines. The profit of Rs 295.41was arrived at by the CAG by considering only open cast mines were costs of extraction are lower than that of underground mines.

The fourth point that the PM’s statement makes is that “Fourthly, a part of the gains would in any case get appropriated by the government through taxation and under the MMDR Bill, presently being considered by the parliament, 26% of the profits earned on coal mining operations would have to be made available for local area development.”

Fair point. But this will happen only as and when the bill is passed. And CAG needs to work with the laws and regulations currently in place.

A major reason put forward by Manmohan Singh for not putting in place an auction process is that “major coal and lignite bearing states like West Bengal, Chhattisgarh, Jharkhand, Orissa and Rajasthan that were ruled by opposition parties, were strongly opposed to a switch over to the process of competitive bidding as they felt that it would increase the cost of coal, adversely impact value addition and development of industries in their areas.”

That still doesn’t explain why the coal blocks should have been given away for free. The only thing that it does explain is that maybe the opposition parties also played a small part in the coal-gate scam.

To conclude Manmohan Singh might have been better off staying quiet. His statement has raised more questions than provided answers. As he said yesterday “Hazaaron jawabon se acchi hai meri khamoshi, na jaane kitne sawaalon ka aabru rakhe”.For once he should have practiced what he preached.

(The article originally appeared in the Daily News and Analysis on August 29,2012. http://www.dnaindia.com/analysis/column_why-manmohan-singh-was-better-off-being-silent_1734007))

(Vivek Kaul is a writer and can be reached at [email protected])

Chimpanzee Ai knows what zero means, but does Chidambaram?

Vivek Kaul

Tetsuor Matsuzawa is the director of the Primate Research Institute at Kyoto University in Japan. Among other things, Matsuzawa has taught a chimpanzee named ‘Ai’ to recognize the number zero.

As Alex Bellos writes in Alex’s Adventures in Numberland, “Ai had mastered the cardinality of the digits from 1 to 9…Matsuzawa then introduced the concept of zero. Ai picked up the cardinality of the symbol easily. Whenever a square appeared on the screen with nothing in it, she would tap the digit.”

So human beings are not the only ones to understand the concept of zero and what it means these days. Even chimpanzees do.

But one individual who does not seem to understand the concept of zero is Finance Minister P Chidambaram. He said on Friday that the government of India did not incur any losses by giving away coal blocks for free, while the Comptroller and Auditor General (CAG) of India put the losses at Rs 1,86,000 crore.

“If coal is not mined, where is the loss? The loss will only occur if coal is sold at a certain price or undervalued,” said Chidambaram. So what he essentially meant was that the government incurred zero losses by giving away the coal blocks for free.

Let’s go into some detail to try and understand why Chidambaram does not understand – or pretends he doesn’t – the concept of zero, his education credentials of having studied at Harvard Business School (HBS) notwithstanding. But then, even George Bush studied at HBS.

Between 2004 and 2011, the government allocated 218 coal blocks to private sector and public sector companies (including ultra mega power projects). Of these, the major allocations were made between 2004 and 2009 with only two allocations being made in 2010 and 2011. Twenty-one allocations made during the period have since been cancelled.

“If coal is not mined, where is the loss? The loss will only occur if coal is sold at a certain price or undervalued,” said Chidambaram.

These coal blocks were given away for free. This was done in order to increase the total coal production in the country. The government-owned Coal India Ltd, which accounts for 80 percent of the total coal production in the country, hasn’t been able to produce enough to meet the growing energy needs of the country.

Between 1 April 2004 and 31 March 2012, the production of coal by Coal India has increased by just 65 million tonnes to 436 million tonnes. This means a growth of 2.3 percent per year on an average.

Hence, to increase the overall production, the government gave away coal blocks for free so that power plants, including captive plants, are not starved of coal.

The CAG put the losses on giving away these blocks at Rs 1,86,000 crore. They used a certain methodology to arrive at the figure. First and foremost the blocks given to the public sector companies were ignored while computing losses. Secondly, only open-cast mines were considered while calculating these losses, underground mines were ignored.

The coal that is available in a block is referred to as geological reserve. But due to various reasons, including those relating to safety, the entire coal cannot be mined. What can be mined is referred to as an extractable reserve. The extractable reserves of these blocks (after ignoring the public sector companies and the underground mines) came to around 6,282.5 million tonnes. The average benefit per tonne was estimated to be at Rs 295.41.

As Abhishek Tyagi and Rajesh Panjwani of CLSA write in a report dated 21 August 2012, “The average benefit per tonne has been arrived at by first, taking the difference between the average sale price (Rs 1,028.42) per tonne for all grades of CIL (Coal India Ltd) coal for 2010-11 and the average cost of production (Rs 583.01) per tonne for all grades of CIL coal for 2010-11. Secondly, as advised by the ministry of coal vide letter dated 15 March 2012, a further allowance of Rs 150 per tonne has been made for financing cost. Accordingly, the average benefit of Rs 295.41 per tonne has been applied to the extractable reserve of 6,282.5 million tonnes calculated as above.”

Using this very very conservative methodology the losses were calculated to be at Rs 1,85,591.33 crore (Rs 295.41 x 6,282.5million tonnes) by the CAG.

These coal blocks, after being handed over for free, have been producing very little coal. Guidelines issued by the coal ministry call for captive blocks to start production within 36 or 42 months. According to CAG, these blocks were producing around 34.64 million tonnes of coal as on 31 March 2011. This is minuscule in comparison to the extractable reserves of 6,282.5 million tonnes that these blocks are supposed to have.

The fact that there has been very little production of coal is what Chidamabaram was referring to when he said that if coal has not been mined, how can there be a loss?

But this is a specious argument to make and in no way takes away the fact that the government of India gave away coal blocks for free. The CAG needed a method to calculate the losses on account of this. And it went about it in the best possible way. It essentially assumed that if the government had sold the coal that could be extracted from these mines it would have made around Rs 1,86,000 crore. In fact, by not taking into account the blocks given to public sector companies and and the underground mines, CAG underestimated the quantum of the loss.

The CAG can be criticised for not taking the time value of money into account. But the moot point is that whatever the assumptions made to calculate the losses, the resulting number would have been very big. And that is something that the government cannot shy away from.

Chidambaram is basically trying to confuse us by mixing two issues here. One is the fact that the government gave away the blocks for free. And another is the inability of the companies who got these blocks to start mining coal. Just because these companies haven’t been able to mine coal doesn’t mean that the government of India did not face a loss by giving away the mines for free.

All this does not change the fact that between 2006 and 2009 the Congress-led UPA government gave away 146 coal blocks to private and public sector companies for free. These blocks had geological reserves amounting to a total of around 40 billion tonnes of coal.

The CAG, in its report, points out that India has geological reserves of coal amounting to around 286 billion tonnes. Of this nearly 40 billion tonnes, or nearly 14 per cent, was given away free.

If Chidambaram still feels this means zero losses, then I guess we will have to redefine the entire concept of zero and mathematics. And this, during a time when even chimpanzees have started understanding the concept of zero.

The article originally appeared on www.firstpost.com on August 25,2012. http://www.firstpost.com/business/chimpanzee-ai-knows-what-zero-means-but-does-chidambaram-430073.html

Vivek Kaul is a writer and can be reached at [email protected]