The ill-effects of demonetisation are still coming to the fore. In this issue of the Diary, I will talk about how demonetisation destroyed Indian jobs and “possibly” helped create jobs abroad.

Before I get into explaining why I am saying what I am saying, a recap of some basic economics is necessary here.

At its most basic level, the gross domestic product(GDP), a measure of the economic size of a country, is expressed as Y = C + I + G + NX, where:

Y = GDP

C = Private Consumption Expenditure

I = Investment

G = Government Expenditure

NX = Exports minus imports

The point to remember here is that imports are a negative entry in the GDP formula. The more a country imports, its GDP falls to that extent. Having said that imports also represent consumer demand at the end of the day, even though that demand does not add to the country’s GDP. For example, every time an Indian buys an electronic good manufactured in China, he is adding to the consumer demand but not to the GDP. Of course, he is adding to the Chinese GDP because exports are a positive entry into the GDP formula.

Hence, if we remove the imports of oil, gold and silver, from the total imports number (in dollars), what remains (i.e. non-oil non-gold non-silver imports) is a good indicator of consumer demand.

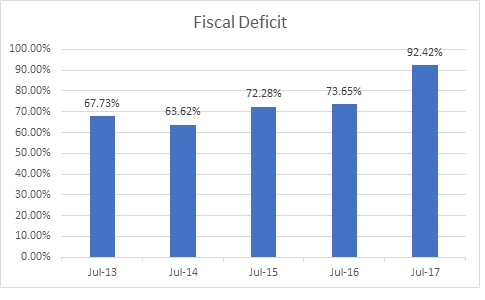

Now let’s take a look at Figure 1, which basically plots the year on year growth in the monthly non-oil non-gold non-silver imports. Hence, the non-oil non-gold non-silver imports in April 2017 went up by 42.5 per cent in comparison to the imports in April 2016. And that’s how it is for all other data points in Figure 1.

Figure 1:

What does Figure 1 tell us? It tells that non-oil non-gold non-silver imports have grown at an extremely fast rate after October 2016. They are growing at rates at which they haven’t grown for a couple of years. What is happening here?

As Jahangir Aziz, head of emerging market economic research, told Bloomberg Quint recently: “What we had also feared was the demonetisation would disrupt the supply chains that run through both the formal and the informal economies. And if those supply chains get disrupted, then the revival in demand would not get fulfilled by domestic production.”

This basically means that demonetisation destroyed domestic supply chains. Without supply chains products can’t move. This has resulted in consumer demand being fulfilled through imports.

This is clearly visible in the huge growth of non-oil non-gold non-silver imports. What this also means is that as demonetisation destroyed supply chains in India, it also led to a huge job destruction. If goods weren’t moving, there was no point in producing them either. This meant shutdown of firms and massive job losses.

Further, by importing stuff that we used to produce in India earlier, we have helped the manufacturing business in foreign countries and in the process “possibly” helped create jobs there.

The irony is that one million youth are entering the workforce in India, every month. The economist Kaushik Basu had said in November 2016 that “[The] economics [of demonetisation] is complex & the collateral damage is likely to far outstrip the benefits.”The impact of this complex economics is still playing out and along with the botched up implementation of GST, has pulled down non-government GDP growth to around 4.3 per cent.

The column was originally published on Equitymaster on September 26, 2017.