V Kasturi Rangan is the Malcolm P McNair Professor of Marketing at the Harvard Business School. He is also the co-chairman of the school’s Social Enterprise Initiative. In this interview with Vivek Kaul, Rangan talks about why it is important for companies to have a corporate social responsibility (CSR) strategy and how can they go about creating it. Kaul is the author of the Easy Money trilogy, which deals with the evolution of money and the financial system and how that led to the current financial crisis.

Does every company needs a CSR strategy?

Absolutely. Any business in the world operates in the context of a community. Not all members of the community are investors in the company or are its customers. But they are impacted by what the company does. Businesses operate in a social, cultural and regulatory context, a lot of which is not directly in the value chain. If that is the context in which a business operates it is absolutely important for business to have a CSR strategy.

Does every company have a CSR strategy?

They don’t, including the big companies. A lot of big companies have CSR programmes, but that is different from having a CSR strategy. They always do something useful. Take for example a textile mill sets up a school feeding programme and decides to feed ten schools by providing them a mid day meal. Someone else says that I am going to provide education. Or I am going to provide free food in the canteen for all my workers. So they have programmes. I am not faulting them for not having programmes. Just having programmes is not equal to having a CSR strategy. The CSR strategy requires the company to think very carefully about its business purpose.

Could you substantiate that through an example?

There is a terrific water utility in Philippines called the Manila Water Company. They have got the concession to run the water utility in Eastern Manila. Eastern Manila has some 5-6 million people. As a part of the water franchise, other than providing water, the company needed to ensure that within 10 years they provided water connections to 95% of the households. Of the five million, around 2.5 million people did not have a water connection. These were people who lived in the slums. The company looked at them as an opportunity because ultimately they got water from somewhere, which was typically poor quality water, which had been stolen from the main pipe anyway.

What happened next?

The company said these poor people are paying more for poor quality water. So they came up with a brilliant idea making sure that they gave a connection to everybody, but the water bill was collected through a community leader. If they went to collect the water bill from every hut it would be very expensive. So the community leader collected the bill. This lowered their cost. But the community leader also ensured that when the water mafia came to steal water illegally, the community acted as a self policing force. Its also worked like a self help group. If one member of the community could not pay the water bill, other people pitched in for one or two months. Also, it was an incremental revenue for the company because water pipes are a fixed cost.

Anything else that they did?

The government gave them the permission to dump the sewage in the sea. But they processed it and made it into sewage cakes which went to regenerate areas which had seen a volcanic eruption in the Philippines. The took the grey water for city boulevards. So it is a very profitable company and is directly linked to the business, where the poor people are seen as an opportunity. And it is a completely integrated company where you will not be able to separate their CSR from their business strategy. It is all integrated. And when the company so profitable the consumers are not saying that they are making too much money like has been the case with micro-finance in Andhra Pradesh.

Any other example that you can share?

There is a bank called the Pittsburgh National Bank(PNC), which operates in mid-west United States, in places like Pittsburgh, Cleveland. The parts that they operate in used to be an industrial area, where the factories have left and so there is a lot of unemployment. The area also has families with a lot of single mothers. They decided to put all their effort into early childhood education.

So how is that a strategy?

Earlier they were doing philanthropy. Some sections were giving to art and culture organizations. Some other directors were supporting their local sports team. They said, let’s aggregate and put it behind one initiative—early childhood education. They got $100 million in early childhood education. So when a company puts in $100 million, then the CEO of the company sits on the national board of education. This $100 million leverages the state budget. They can move the needle. What I am saying is that if you do CSR and if you can focus only one or two things which can move the needle, then it has an impact. The point about CSR is that just like you measure business impact you also have to measure social impact.

How does a company go about having a CSR strategy?

Here is my view. If you go in and take the helicopter view of some of the better companies. You will find that they have their CSR programmes which falls into three theatres. Theatres one is by and large like philanthropy. Theatre two CSR is more like shared value. I am going to be environmentally responsible by using alternate fuels rather than fossil fuels. That sort of thing. The third theatre is transforming the business. It is like Manila Water. It is like saying I am going to do a completely different business formula.

Could you elaborate on that?

When you go in, the company will have all the three theatres operating at the same time. What you have to do is two things. First, you have to look at each of these silos, whatever programme is their in the silo has got some kind of a connection to the business purpose. The second thing which is the biggest drawback of companies whether international or Indian, the philanthropic CSR programmes are usually run by their community affairs director or the CSR manager or the foundation head. The operation stuff is usually run by the line managers, the factory head, the functional manager etc. And “change the business” is run by the executive committee of the CEO. These three rarely talk to each other on CSR. When the three talk to each other, a CSR strategy emerges.

Any examples?

That is what Ambuja Cement has done. They have the Ambuja foundation that does very good community development work. The mining managers work with local managers. They think in terms of water usage because they produce cement which needs water. They are thinking in terms of how can we give water back to the farms. And then the CEO is thinking in terms of how can we sustain the mining activity etc. They put together a process where the CEO, the operational manager and the foundation started talking to each other. The CSR strategy emerged from that. Now the company has a CSR strategy where they are saying that we have to be a sustainable business where we should put in more into the environment than we take from it. So they are not only water positive they are 3x water positive i.e. they put three times the water back than the water they consume. They want to be plastic positive. They are not yet.

What does that mean?

They sell cement in plastic bags. So the plastic goes into a landfill somewhere and that is not good for the environment. What they have thought of doing is collecting the plastic bags and burning it as alternate fuel in the kiln. If they do that they don’t have to use so much of fossil fuel. So, the strategy is that this whole process of becoming plastic positive. Also, now that they are 3x water positive the farm yields have improved in and around them. The profits of farmers has gone up. So, what I am saying is that a CSR strategy emerges when you link the three theatres and that changes the way the business operates.

The interview originally appeared in The Corporate Dossier, The Economic Times on June 20, 2014

The Corporate Dossier

Capitalism and the common good

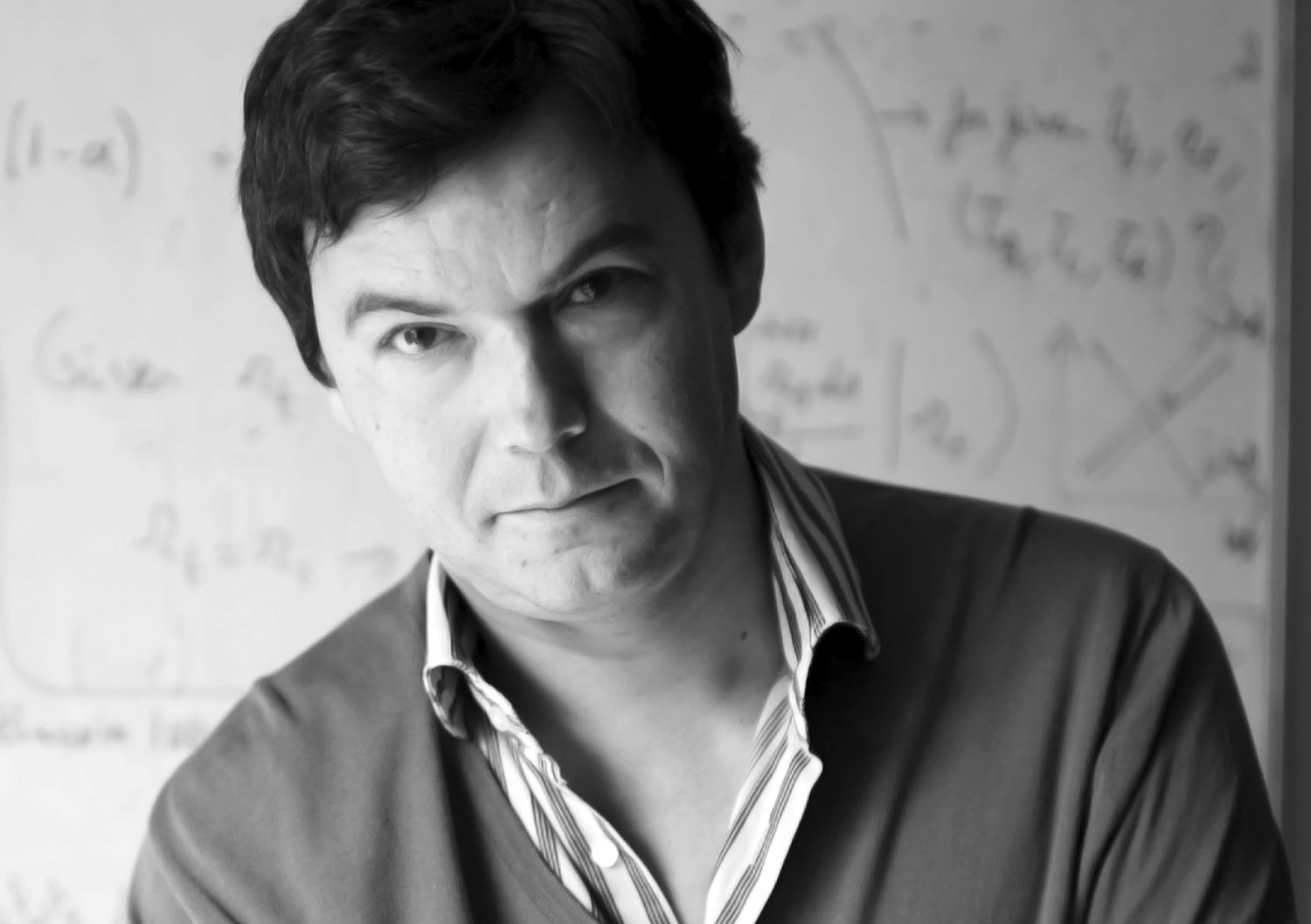

Thomas Piketty is a professor at the Paris School of Economics. Over the last few months he has become the most talked about economist globally with the release of the English edition of his book Capital in the Twenty-First Century (The Belknap Press of the Harvard University Press). The original was written in French.

Capital has been the second best-selling book on Amazon.com for a while now. This is a rarity for a book which is not exactly a bed time read and runs into 577 pages (without including the nearly 80 pages of notes). But that is not a surprise given the important issues the book tries to address. In this book Piketty deals in great detail about the “distribution of wealth”.

As he writes “The distribution of wealth is one of today’ most widely discussed and controversial issues. But what do we really know about its evolution over the long term? Do the dynamics of private capital accumulation inevitably lead to the concentration of wealth in fewer hands, as Karl Marx believed in the nineteenth century? Or do the balancing forces of growth, competition, and technological progress lead in later stages of development to reduced inequality and greater harmony among the classes…?”

In this interview he speaks to Vivek Kaul. Kaul is the author of the Easy Money trilogy which deals with the evolution of money and the financial system and how that led to the current financial crisis. The second book in the trilogy Easy Money—Evolution of the Global Financial System to the Great Bubble Burst releases in June 2014.

Excerpts:

You write that “It is an illusion to think that something about the nature of the modern growth or the laws of the market economy ensures the inequality of wealth will decrease and harmonious stability will be achieved”. Why is that incorrect? Has capitalism failed the world? Capitalism and market forces are very good at producing new wealth. The problem is simply that they know no limit nor morality. They can sometime lead to a distribution of wealth that is so extremely concentrated that it threatens the working of democratic institutions. We need adequate policies, particularly in the educational and fiscal areas, to ensure that all groups in society benefit from globalisation and economic openness. We want capitalism to be the slave of democracy and the common good, not the opposite.

A major part of your book deals with how capitalism leads to inequality…

History tells us that there are powerful forces going in both directions — the reduction or the amplification of inequality. Which one will prevail depends on the institutions and policies that we will collectively adopt. Historically, the main equalizing force — both between and within countries — has been the diffusion of knowledge and skills. However, this virtuous process cannot work properly without inclusive educational institutions and continuous investment in skills. This is a major challenge for all countries in the century underway.

What is the central contradiction in capitalism? How does that lead to inequality?

In the very long run, one powerful force pushing in the direction of rising inequality is the tendency of the rate of return to capital rto exceed the rate of output growth g. That is, when rexceeds g, as it did in the 19th century and seems quite likely to do again in the 21st, initial wealth inequalities tend to amplify and to converge towards extreme levels. The top few percents of the wealth hierarchy tend to appropriate a very large share of national wealth, at the expense of the middle and lower classes. This is what happened in the past, and this could well happen again in the future. According to Forbes global billionaire rankings, top wealth holders have been rising more than three times faster than the size of the world economy between 1987 and 2013.

That clearly is a reason to worry. Why are you confident that in the years to come economic growth rate will be lower than the return on capital. What implications will that have on capitalism and the inequality that it breeds?

Nobody can be sure about the future values of the rate of return and the economy’s growth rate. I am just saying that with the decline of population growth in most parts of the world, total GDP (gross domestic product) growth rates are likely to fall. Also, as emerging economies catch up with developed economies, productivity growth rates are likely to resemble what we have always observed at the world technological frontier since the Industrial revolution, i.e. between 1 and 2% per year. With zero or negative population growth, this suggests that total GDP growth rates will fall much below 4-5%, which has been the typical value for the average rate of return to capital in the very long run.

So what is the point that you are trying to make?

My main point is not to make predictions, which by nature are highly uncertain. My main point is that we should have more democratic transparency about how the different income and wealth groups are doing, so that we can adjust our policies and tax rates to whatever we observe. As long as top groups grow at approximately the same speed as the rest of society, there is no problem with inequality per se. But if the top rises three times faster than the size of the economy, you need to worry about it.

Your book is being compared to Karl Marx’s Capital. How different is your work from his?

One obvious difference is that I believe in private property and markets. Not only are they necessary to achieve economic efficiency and development — they are also a condition of our personal freedom. The other difference is that my book is primarily about the history of income and wealth distribution. It contains a lot of historical evidence. With the help of Tony Atkinson, Emmanuel Saez, Abhijit Banerjee, Facundo Alvaredo, Gilles Postel-Vinay, Jean-Laurent Rosenthal, Gabriel Zucman and many other scholars, we have been able to collect a unique set of data covering three centuries and over 20 countries. This is by far the most extensive database available in regard to the historical evolution of income and wealth. This book proposes an interpretative synthesis based upon this collective data collection project.

Any other differences?

Finally, Marx’s main conclusion was about the falling rate of profit. My reading of the historical evidence is that there is no such tendency. The rate of return to capital can be permanently and substantially higher than the growth rate. This tends to lead to very high level of wealth inequality, which may raise democratic and political problems. But this does not raise economic problems per se.

One of the most interesting points in your book is about the rise of the supermanager in the US and large parts of the developed world and the huge salaries that these individuals earn. You term this as meritocratic extremism. How did this phenomenon also contribute to the financial crisis?

According to supermanagers, their supersalaries are justified by their performance. The problem is that you don’t see it the statistics. In the US, between two thirds and three quarters of primary income growth since 1980 has been absorbed by the top 10% income earners, and most of it by the top 1% income earners. If the economy’s growth rate had been very high, rising inequality would not have been such a big deal. But with a per capita GDP growth rate around 1.5%, if most of it goes to the top, then this is not a good deal for the middle class. This has clearly contributed to rising household debt and financial fragility.

(Vivek Kaul can be reached at [email protected])

The interview originally appeared in The Corporate Dossier, The Economic Times on May 23, 2014