When the whole world was going gaga about Facebook’s Initial Public Offering (IPO), there was one man who did not fall for all the hype, looked at the numbers of the company, asked some basic questions and concluded “they don’t know how they are going to make money.” Looks like, he was proved right in the end. The stock was sold at a price of $38 per share, and has fallen since then. Aswath Damodaran was the man who got it right. “In hindsight everybody will tell you that they were bearish on Facebook. Nobody will admit to buying the shares,” points out Damodaran. He is a Professor of Finance at the Stern School of Business at New York University where he teaches corporate finance and equity valuation. In some circles he is referred to as the “god of valuation”. In this interview he speaks to Vivek Kaul.

Excerpts:

Let us start with Facebook, you have been critical about their IPO pricing?

The trouble with Facebook is figuring out, first what business they are going to be in, because they haven’t figured it out themselves. How are they going to convert a billion users into revenues and income? And second, if they even manage to do it, how much those revenues will be, what will the margins etc. They don’t know how they are going to make money. Whether they are going sell advertising to these users? Whether they are going to sell products to these users? Services to these users? I think all they know right now is that they have a lot of users.

But if they have no idea of what to do with their users, how did they make the $4billion in sales that they did last year?

They are selling. 12% of that came from selling stuff for Zynga (The maker of popular games such as “FarmVille” and “CityVille,”). The remaining 88% did come from very subtle advertising. The question is that whether they can scale that up? Because right now it is kind of invisible. You can’t see it because it is relatively small. But if they want to generate the kind of revenues they want, you are going to see it on your Facebook page. And it is going to be very very clear that they are using what they know about you to pick those ads. And I am not sure people will be comfortable with that knowing that they are seeing not just your profile but your interactions. So they can see how old you are. What political party your support? What sports you like? It is all going to go. And that’s their selling point.

So it will be some sort of invasion of privacy?

It is not some sort of invasion of privacy. It is an invasion of privacy. The question is can they do that without people getting pissed off and saying I am leaving Facebook and going elsewhere. And that I think is the big unknown. Because let’s face it, they have not just a billion users, but they know more about these users than any other company on the face of this earth. If you want a company to find 35million people who fit a specific demographic characteristic, the place to go is Facebook. They can show it to you. The only question is that if you did advertise through Facebook to those 35million is this the kind of forum were they are inclined to click on an ad.

How does it compare with Google?

In case of Google it is a much more direct business model. It’s search. You click and that’s it, everybody could see what they were doing. Facebook is a much more subtle model. On Facebook you are talking to your friends, which is a private conversation between you and your friends, but when you see these intrusive ads on the side, you realize you are not just talking to your friends, you are talking to your friends and somebody at Facebook is monitoring you at the same time. That’s a very tricky challenge. So they have made the $4billion, but at the value (the market capitalization of the Facebook stock) they have they have to make $35billion. And that’s a very different game because that would mean a lot more ads on every page directly focused in on what the users are doing.

In face very frankly I didn’t realize there are ads on my Facebook page for a long time…

It is pretty subtle right now because they don’t have that much advertising. If you think of revenue of $4billion spread out across a billion users, you are going to see a very few ads because it is still on the sides. And sometimes it doesn’t even look like an ad. Right. It’s a Facebook friend with GM. You click on it and before you know it you are looking at GM’s product offerings. So it is very subtle right now. But it can’t stay subtle for them to make the kind of revenues they have to make to justify their price now. The kind of scary thing here is that Mark Zuckerberg has said that he wants to build a social enterprise and not a business enterprise.

What does he mean by that?

What he means by that is he built Facebook so that people could talk to each other. He didn’t want ads on it. For a long time he refused to take ads on Facebook until he was told that if you can’t take ads there is no other way to make money in this. So I am not sure how willing he is to go the distance because it is going to be a fight. It’s going to be a fight against not other social media companies but against the big players. The Googles and The New York Times of the world. This is a tough game to fight and you got be willing to act like a business and I am not sure is willing to yet.

You called the business model of Facebook, a Field of Dreams. Why is that?

Yeah. You ever seen that movie? Field of Dreams.

No.

In the movie Kevin Costner moves to the American Midwest and he is walking through this cornfield. And hears this voice and it says “if you build it he will come”. He being Shoeless Joe Jackson, a baseball player from a 100 years ago. On the faith that these old baseball players will show up, he builds this baseball field in the middle of Iowa and everybody asks him, why are you building this huge baseball field in the middle of nowhere? And he tells them, if I build it they will come. And that in a sense is what social media companies are doing right now. They are building this place where there are lots of users and they are telling people trust us if we build this, they will come. They being advertisers, product sellers, they will come. But in the Field of Dreams they did come but I am not sure in these companies that they will.

Talking about the current price of Facebook how do you see it? Yesterday is closed at around $33.(The interview was conducted on Thursday, May 24,2012) Has it fallen enough?

I think it fell enough in those two days that you are going to get a consolidation. The next run on them will tell how far they might go back. The low 30s are close enough to my intrinsic value that I wouldn’t call them massively overvalued. I think there is enough potential in the company. If it dropped to $15 then it’s pretty much a bargain. At $31-32 its pretty close to intrinsic value

The intrinsic value you calculated for Facebook was $29?

Yeah.

So why was the stock valued at such a high price of $38 per share when it was sold to the public?

It wasn’t valued. It was priced.

So why was it priced at such a high price?

Remember they weren’t pricing it on a blank slate. They could see transactions happening in the private share market where people were buying and selling Facebook shares. And there the prices were going at about $42-43. So they said if people are buying and selling at this price, these are real transactions.

What sort of stock market was this?

For the last two years Facebook has been on what’s called a private share market where people who owned shares of Facebook were allowed to trade.

So is it like over the counter?

Not even over the counter. They are actually beyond the counter. These are private companies that are not incorporated. So this is a completely unregulated share market. Like Goldman Sachs could sell shares. Players in this market are pretty big institutional investors they are not individual investors. Transactions here have particular merit because these are two informed investors transacting and they are coming to a price. And investment bankers saw that price and they said if they are paying $42, then we should be able to sell it at $38. And they also got onto the phone and they called institutional investors. They tried to gauge demand until Thursday evening (May 17,2012). And that’s why they set the price at 4 o’clock on Thursday because that’s how late they were pushing this off to make sure that there was enough demand.

Wasn’t this a throwback to the days of the dotcom bubble?

This is how all pricing is done in IPOs. IPOs are always priced they are never valued because essentially your job as an investment banker is to sell at that price. What was unusual here was that demand and supply that they gauged collapsed. They didn’t realize how thin the market was until one hour into the offering when they saw the price collapse. It started at $38, it went to $43, and then very quickly it kind of collapsed. My theory is when you price things you are building in market perceptions, what you think will happen etc. You are basing it in on momentum. That’s a very fragile thing. You don’t want mess with it. Even people who are buying based on pricing and momentum like to tell themselves that they are buying based on value. So they look for a good story and they don’t want to have their face rubbed at the fact that they are buying because everybody else is paying the price.

In case of Facebook it was quite the opposite…

If you look at what the investment banks and Facebook insiders did in the last week they almost rubbed the investors faces in this. They rubbed it in the sense that they kept hiking up the offering price, saying we know you are suckers. At the same time the insiders were selling the shares in the week leading up to the offering. If I had been the investment banker I would have spent the last week talking about the user base, and advertising because that would have given the momentum investors a crutch. I am purely buying it because of advertising revenues. Instead it was all about pricing. They made it very transparent that they were not valuing the company. It was all demand and supply. I have a feeling that if you point to midday on Friday (May 18,2012) and say that was the time when the momentum on social media companies, not just on Facebook, shifted. And if you look at what has happened since it is not just Facebook which has seen its price collapse. It’s Groupon. It’s LinkedIn. It’s the entire sector. And I wager that there are IPOs lined up to go to investment banks of social media companies, that are either being pulled right now or being dramatically repriced.

You have said in the past that Facebook has huge corporate governance issues. Can you elaborate on that?

It has got voting shares and non-voting shares. Zuckerberg has got the voting rights. It is also incorporated as a controlled corporation which basically means that you don’t have to follow the corporate governance rules (like the Sarbanes Oxley Act) that publically traded companies need to do. They can have insiders on the board.

Is that allowed?

If you are controlled corporation it is. And Facebook has been very open about that they are going to be a controlled corporation.

How does regulation allow for something like that?

As long as you make it public. If it is a controlled corporation investors have to make a judgement as to whether they care. In case of Facebook initially it looked like they didn’t care. Right from the beginning Facebook has been very open that they are not really going to be a publically traded company and that really they are a private business that wants the capital that public markets give them. But it is going to be Zuckerberg’s company.

So they won’t give out much information?

They might give out the information but you will have no say in what they do. So if they do an acquisition…

Did they overpay for Instagram?

They paid. I don’t know whether they overpaid. But the paid and there was no accountability. Zuckerberg basically decided to pay a billion (dollars) then he told the board that I have bought the company and I have paid a billion. This is not the way a company should be bought. A CEO shouldn’t be deciding what to pay overnight and you shouldn’t be telling the board of directors after you have bought a company that I just bought a company for a billion and I just want you to know.

This is like how mom and pop shops down the road operate…

It is a way a dictatorship operates. Facebook is a corporate dictatorship.

So who influenced Zuckerberg to do what he is doing?

Google set the framework that Facebook is using right now. The voting shares, non-voting shares. Sergey Brin and Larry Page are the models that Zuckerberg is using.

Can you elaborate on that?

Until Google came along, US companies generally did not have two classes of shares. Voting shares and nonvoting shares were for a long time banned by the New York Stock Exchange. So most companies didn’t even try. So if you look at Apple, you look at Microsoft they had only one class of shares. Google essentially did two things. They did their IPO through an auction rather than through investment banks. And secondly they decided to have voting and nonvoting shares. If institutional investors had risen at that point of time and said we are not buying these shares because we don’t have enough voting rights, then Google would have been forced to go back to drawing board and then come back. Institutional investors were okay with Google doing that. Once they opened that door every social media company you look at LinkedIn and Groupon, they follow what Google did.

So these shares are listed on NASDAQ?

Yes. NASDAQ allows for voting and nonvoting shares that is the part of the reason for listing on it. The New York Stock Exchange because it is in competition with NASDAQ has now also started relaxing, they want the money, they want the listings. So they will take Facebook even if it’s voting and nonvoting shares. So this will be a race to the bottom.

So the shares sold to the public were nonvoting shares?

They are low voting shares. The shares that Zuckerberg owns have 10 times the voting rights, which means he has 57% of voting rights with 35% of the shares. And he will always make sure that remains above 50%.

So he can go ahead and buy anything without requiring clearance from the board?

Google for instance recently issued new shares which have no voting right at all. So that is the third layer. You have ten voting rights shares. One voting rights shares. And no voting rights shares. Zuckerberg can go out and raise as much capital as he wants. If he issues no voting rights he will always have 57%. He going to lock in that voting percentage.

But how is something like this allowed in a developed market like the US?

I don’t think it should be banned. Let the investors decide for themselves. Lots of countries you have two classes of shares. Its par for the course. And you just price it in.

It’s just that it hasn’t happened in the US for a long time?

I think you will wake up one day and see I wish I had voting rights. But you chose to be a part of this game. I am not feeling sorry for the institutional investors in Google who are crying about the fact that Google does things they don’t like. You bought the stock you live with it.

(The interview was originally published in the Daily News and Analysis(DNA) on May 28,2012. http://www.dnaindia.com/money/interview_facebook-is-a-corporate-dictatorship_1694603)

(Interviewer Kaul is a writer and can be reached at [email protected])

Month: May 2012

Higher Oil Prices or Higher EMIs? Take your pick

Vivek Kaul

The petrol prices were raised by Rs 6.28 per litre yesterday. With taxes the total comes to Rs 7.54 per litre. Let’s try and understand what impact this increase in prices will have.

The primary beneficiary of this increase will be the oil marketing companies like Indian Oil, Bharat Petroleum and Hindustan Petroleum. The companies had been losing Rs 6.28 per litre of petrol they sold. Since December, when prices were last raised the companies had lost $830million in total. With the increase in prices the companies will not lose money when they sell petrol.

The increase in price will have no impact on the fiscal deficit of the government. The fiscal deficit is the difference between what the government spends and what it earns. The government does not subsidize the oil marketing companies for the losses they make on selling petrol.

It subsidizes them for losses made on selling diesel, kerosene and LPG, below cost.

The losses on account of this currently run at Rs 512 crore a day. The loss last year to these companies because of selling diesel, kerosene and LPG below cost was at Rs 138,541crore. They were compensated for this loss by the government. Out of this the government got the oil and gas producing companies like ONGC, Oil India Ltd and GAIL to pick up a tab of Rs 55,000 crore. The remaining Rs 83,000 odd crore came from the coffers of the government.

What is interesting that when the budget was presented in March, the oil subsidy bill for the year 2011-2012 (from April 1, 2011 to March 31,2012) was expected to be at around Rs 68,500 crore. The final number was Rs 14,500 crore higher.

The losses for this financial year (from April 1, 2012 to March 31,2012) are expected to be at Rs Rs. 193,880 crore. If the losses are divided between the government and the oil and gas producing companies in the same ratio as last year, then the government will have to compensate the oil marketing companies with around Rs 1,14,000 crore. The remaining money will come from the oil and gas producing companies.

The trouble is in two fronts. It will pull down the earnings of the oil and gas producing companies. But that’s the smaller problem. The bigger problem is it will push up the fiscal deficit. If we look at the assumptions made in the budget for the current financial year, the oil subsidies have been assumed at Rs Rs 43,580 crore. If the government has to compensate the oil marketing companies to the extent of Rs 1,14,000 crore, it means that the fiscal deficit will be pushed up by around Rs 70,000 crore more (Rs 1,14,000crore minus Rs 43,580 crore), assuming all other expenses remain the same.

A higher fiscal deficit would mean that the government would have to borrow more. A higher government borrowing will ‘crowd-out’ the private borrowing and push interest rates higher. This would mean higher equated monthly installments(EMIs) for people who have loans to pay off or are even thinking of borrowing.

The only way of bringing down the interest rates is to bring down the fiscal deficit. The fiscal deficit target for the financial year 2012-2013 has been set at Rs 5,13,590 crore. The government raises this money from the financial system by issuing bonds which pay interest and mature at various points of time. Of this amount that the government will raise, it will spend Rs 3,19,759 crore to pay interest on the debt that it already has. Rs 1,24,302 crore will be spent to payback the debt that was raised in the previous years and matures during the course of the year 2012-2013. Hence a total of Rs 4,44,061 crore or a whopping 86.5% of the fiscal deficit will be spent in paying interest on and paying off previously issued debt. This is an expenditure that cannot be done away with.

The other major expenditure for the government during the course of the year are subsidies. The total cost of subsidies during the course of this year has been estimated to be at Rs Rs 1,90,015 crore. The subsidies are basically of three kinds: oil, food and petroleum. The food subsidy is at Rs 75,000 crore. This is a favourite with Sonia Gandhi and hence cannot be lowered. And more than that there is a humanitarian angle to it as well.

The fertizlier subsidies have been estimated at Rs 60,974 crore. This is a political hot potato and any attempts to cut this in the pst have been unsuccessful and have had to be rolled back. There are other subsidies amounting to Rs 10,461 crore which are minuscule in comparison to the numbers we are talking about.

This leaves us with oil subsidies which have been estimated to be at Rs 43,580 crore. This as we see will be overshot by a huge level, if oil prices continue to be current levels. Even if prices fall a little, the subsidy will not come down by much. .

Hence if the government has to even maintain its deficit (forget bringing it down) the only way out currently is to increase the price of diesel, LPG and kerosene. Diesel is a transport fuel and an increase in its price will push prices inflation in the short term. But maintain the fiscal deficit will at least keep interest rates at their current levels and not push them up from their already high levels.

If the government continues to subsidize diesel, LPG and kerosene, interest rates are bound to go up because it will have to borrow more. This will mean higher EMIs for sure. It would also mean businesses postponing expansion because higher interest rates would mean that projects may not be financially viable. It would also mean people borrowing lesser to buy homes, cars and other things, leading to a further slowdown in a lot of sectors. In turn it would mean lower economic growth.

That’s the choice the government has to make. Does it want the citizens of this country to pay higher fuel and gas prices? Or does it want them to pay higher EMIs? There is no way of providing both.

(The article originally appeared at www.rediff.com on May 24,2012. http://www.rediff.com/business/slide-show/slide-show-1-special-higher-oil-prices-or-higher-emis-take-your-pick/20120524.htm)

(Vivek Kaul is a writer and can be reached at [email protected])

Petrol bomb is a dud: If only Dr Singh had listened…

Vivek Kaul

The Congress led United Progressive Alliance (UPA) government finally acted hoping to halt the fall of the falling rupee, by raising petrol prices by Rs 6.28 per litre, before taxes. Let us try and understand what will be the implications of this move.

Some relief for oil companies:

The oil companies like Indian Oil Company (IOC), Bharat Petroleum (BP) and Hindustan Petroleum(HP) had been selling oil at a loss of Rs 6.28 per litre since the last hike in December. That loss will now be eliminated with this increase in prices. The oil companies have lost $830million on selling petrol at below its cost since the prices were last hiked in December last year. If the increase in price stays and is not withdrawn the oil companies will not face any further losses on selling petrol, unless the price of oil goes up and the increase is not passed on to the consumers.

No impact on fiscal deficit:

The government compensates the oil marketing companies like Indian Oil, BP and HP, for selling diesel, LPG gas and kerosene at a loss. Petrol losses are not reimbursed by the government. Hence the move will have no impact on the projected fiscal deficit of Rs 5,13,590 crore. The losses on selling diesel, LPG and kerosene at below cost are much higher at Rs 512 crore a day. For this the companies are compensated for by the government. The companies had lost Rs 138,541 crore during the last financial year i.e.2011-2012 (Between April 1,2011 and March 31,2012).

Of this the government had borne around Rs 83,000 crore and the remaining Rs 55,000 crore came from government owned oil and gas producing companies like ONGC, Oil India Ltd and GAIL.

When the finance minister Pranab Mukherjee presented the budget in March, the oil subsidies for the year 2011-2012 had been expected to be at Rs Rs 68,481 crore. The final bill has turned out to be at around Rs 83,000 crore, this after the oil producing companies owned by the government, were forced to pick up around 40% of the bill.

For the current year the expected losses of the oil companies on selling kerosene, LPG and diesel at below cost is expected to be around Rs 190,000 crore. In the budget, the oil subsidy for the year 2012-2013, has been assumed to be at Rs 43,580 crore. If the government picks up 60% of this bill like it did in the last financial year, it works out to around Rs 114,000 crore. This is around Rs 70,000 crore more than the oil subsidy that the government has budgeted for.

Interest rates will continue to remain high

The difference between what the government earns and what it spends is referred to as the fiscal deficit. The government finances this difference by borrowing. As stated above, the fiscal deficit for the year 2012-2013 is expected to be at Rs 5,13,590 crore. This, when we assume Rs 43,580crore as oil subsidy. But the way things currently are, the government might end up paying Rs 70,000 crore more for oil subsidy, unless the oil prices crash. The amount of Rs 70,000 crore will have to be borrowed from financial markets. This extra borrowing will “crowd-out” the private borrowers in the market even further leading to higher interest rates. At the retail level, this means two things. One EMIs will keep going up. And two, with interest rates being high, investors will prefer to invest in fixed income instruments like fixed deposits, corporate bonds and fixed maturity plans from mutual funds. This in other terms will mean that the money will stay away from the stock market.

The trade deficit

One dollar is worth around Rs 56 now, the reason being that India imports more than it exports. When the difference between exports and imports is negative, the situation is referred to as a trade deficit. This trade deficit is largely on two accounts. We import 80% of our oil requirements and at the same time we have a great fascination for gold. During the last financial year India imported $150billion worth of oil and $60billion worth of gold. This meant that India ran up a huge trade deficit of $185billion during the course of the last financial year. The trend has continued in this financial year. The imports for the month of April 2012 were at $37.9billion, nearly 54.7% more than the exports which stood at $24.5billion.

These imports have to be paid for in dollars. When payments are to be made importers buy dollars and sell rupees. When this happens, the foreign exchange market has an excess supply of rupees and a short fall of dollars. This leads to the rupee losing value against the dollar. In case our exports matched our imports, then exporters who brought in dollars would be converting them into rupees, and thus there would be a balance in the market. Importers would be buying dollars and selling rupees. And exporters would be selling dollars and buying rupees. But that isn’t happening in a balanced way.

What has also not helped is the fact that foreign institutional investors(FIIs) have been selling out of the stock as well as the bond market. Since April 1, the FIIs have sold around $758 million worth of stocks and bonds. When the FIIs repatriate this money they sell rupees and buy dollars, this puts further pressure on the rupee. The impact from this is marginal because $758 million over a period of more than 50 days is not a huge amount.

When it comes to foreign investors, a falling rupee feeds on itself. Lets us try and understand this through an example. When the dollar was worth Rs 50, a foreign investor wanting to repatriate Rs 50 crore would have got $10million. If he wants to repatriate the same amount now he would get only $8.33million. So the fear of the rupee falling further gets foreign investors to sell out, which in turn pushes the rupee down even further.

What could have helped is dollars coming into India through the foreign direct investment route, where multinational companies bring money into India to establish businesses here. But for that the government will have to open up sectors like retail, print media and insurance (from the current 26% cap) more. That hasn’t happened and the way the government is operating currently, it is unlikely to happen.

The Reserve Bank of India does intervene at times to stem the fall of the rupee. This it does by selling dollars and buying rupee to ensure that there is adequate supply of dollars in the market and the excess supply of rupee is sucked out. But the RBI does not have an unlimited supply of dollars and hence cannot keep intervening indefinitely.

What about the trade deficit?

The trade deficit might come down a little if the increase in price of petrol leads to people consuming less petrol. This in turn would mean lesser import of oil and hence a slightly lower trade deficit. A lower trade deficit would mean lesser pressure on the rupee. But the fact of the matter is that even if the consumption of petrol comes down, its overall impact on the import of oil would not be that much. For the trade deficit to come down the government has to increase prices of kerosene, LPG and diesel. That would have a major impact on the oil imports and thus would push down the demand for the dollar. It would also mean a lower fiscal deficit, which in turn will lead to lower interest rates. Lower interest rates might lead to businesses looking to expand and people borrowing and spending that money, leading to a better economic growth rate. It might also motivate Multi National Companies (MNCs) to increase their investments in India, bringing in more dollars and thus lightening the pressure on the rupee. In the short run an increase in the prices of diesel particularly will lead higher inflation because transportation costs will increase.

Freeing the price

The government had last increased the price of petrol in December before this. For nearly five months it did not do anything and now has gone ahead and increased the price by Rs 6.28 per litre, which after taxes works out to around Rs 7.54 per litre. It need not be said that such a stupendous increase at one go makes it very difficult for the consumers to handle. If a normal market (like it is with vegetables where prices change everyday) was allowed to operate, the price of oil would have risen gradually from December to May and the consumers would have adjusted their consumption of petrol at the same pace. By raising the price suddenly the last person on the mind of the government is the aam aadmi, a term which the UPAwallahs do not stop using time and again.

The other option of course is to continue subsidize diesel, LPG and kerosene. As a known stock bull said on television show a couple of months back, even Saudi Arabia doesn’t sell kerosene at the price at which we do. And that is why a lot of kerosene gets smuggled into neighbouring countries and is used to adulterate diesel and petrol.

If the subsidies continue it is likely that the consumption of the various oil products will not fall. And that in turn would mean oil imports would remain at their current level, meaning that the trade deficit will continue to remain high. It will also mean a higher fiscal deficit and hence high interest rates. The economic growth will remain stagnant, keeping foreign businesses looking to invest in India away.

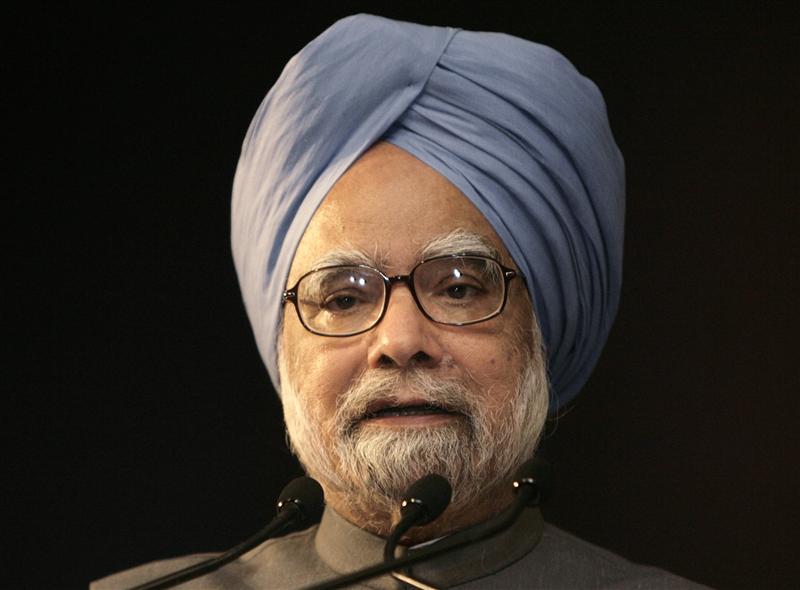

Manmohan Singh as the finance minister started India’s reform process. On July 24, 1991, he backed his “then” revolutionary proposals of opening up India’s economy by paraphrasing Victor Hugo: “No power on Earth can stop an idea whose time has come.”

Good economics is also good politics. That is an idea whose time has come. Now only if Mr Singh were listening. Or should we say be allowed to listen..

(The article originally appeared at www.firstpost.com on May 24,2012. http://www.firstpost.com/economy/petrol-bomb-is-a-dud-if-only-dr-singh-had-listened-319594.html)

(Vivek Kaul is a writer and can be reached at [email protected])

It’s not Greece: Cong policies responsible for rupee crash

Vivek Kaul

All is well in India under the rule of the “Gandhi” family. That’s what the Finance Minister Pranab Mukjerjee has been telling us. And the rupee’s fall against the dollar is primarily because of problems in Greece. And Spain. And Europe. And other parts of the world. As I write this one dollar is worth around Rs 55 (actually Rs 54.965 to be precise, but we can ignore a few decimal points). The rupee has fallen around 22% in value against the dollar in the last one year.

The larger view among analysts and experts who track the foreign exchange market is that a dollar will soon be worth Rs 60. And by then there might be problems in some other part of the world and the rupee’s fall might be blamed on the problems there. As a late professor of mine used to say, with a wry smile on his face “Since we are all born on this mother earth, there is some sort of symbiosis between us.”

So let’s try and understand why the underlying logic to the rupee’s fall against the dollar is not as simple as it is made out to be.

Dollar is the safe haven

As economic problems have come to the fore in Europe (As I have highlighted in If PIIGS have to fly they will have to exit the Euro http://www.firstpost.com/world/if-piigs-have-to-fly-they-will-need-to-exit-the-euro-314589.html) the large institutional investors have moved out of the Euro into the dollar. A year back one dollar was worth €0.71, now it’s worth €0.78. So the dollar has gained against the Euro, no doubt.

But the argument being made is that this is global trend and that dollar has gained in value against lot of other major currencies. Is that true? A year back one dollar was worth 0.88 Swiss Francs, now it is worth 0.93 Swiss Francs. So it has gained in value against the Swiss currency.

What about the British pound? A year back the dollar was worth £0.62, now it’s worth £0.63. Hence the dollar has barely moved against the pound. A dollar was worth around 82 Japanese yen around a year back. Now it’s worth around 79.5yen. It has lost value against the Japanese yen. The dollar has gained in value against the Brazilian Real. It was worth around 1.63real a year back. It is now worth over 2 real. So yes, the dollar has gained in value against the other currencies but not against all currencies.

What is ironic is that the world at large is considering dollar to be a safe haven and moving money into it, by buying bonds issued by the American government. The debt of the US government is now around $14.6trillion, which is almost equal to the US gross domestic product of $15trillion. But since everyone considers it to be a safe haven it has become a safe haven.

But let’s get back to the point at hand. So, not all currencies have lost value against the dollar and those that have lost value, have lost it in varying degrees. This tells us that there are other individual issues at play as well when it comes to currencies losing value against the dollar.

What is happening in India?

The Indian government has been spending much more money than it has been earning over the last few years. In other words the fiscal deficit of the government has been on its way up. For the financial year 2007-2008 (i.e. the period between April 1,2007 and March 31, 2008) the fiscal deficit stood at Rs 1,26,912 crore. This shot up to Rs 5,21,980 crore for the financial year 2011-2012. In a time frame of five years the fiscal deficit has shot up by nearly 312%. During the same period the income earned by the government has gone up by only 36% to Rs 7,96,740 crore. The fiscal deficit targeted for the current financial year 2012-2013(i.e. between April 1, 2012 and March 31,2013) is a little lower at Rs 5,13,590 crore. The huge increase in fiscal deficit has primarily happened because of the subsidy on food, fertilizer and petroleum.

The tendency to overshoot

Also it is highly likely that the government might overshoot its fiscal deficit target like it did last year. In his budget speech last year Pranab Mukherjee had set the fiscal deficit target for the financial year 2011-2012, at 4.6% of GDP. He missed his target by a huge margin when the real number came in at 5.9% of GDP. The major reason for this was the fact that Mukherjee had underestimated the level of subsidies that the government would have to bear. He had estimated the subsidies at Rs 1,43,750 crore but they ended up costing the government 50.5% more at Rs 2,16,297 crore.

Generally all the three subsidies of food, fertilizer and petroleum are underestimated, but the estimates on the oil subsidies are way off the mark. For the year 2011-2012, oil subsidies were assumed to be at Rs 23,640crore. They came in at Rs 68,481 crore. This has been the case in the past as well. In 2010-2011 (i.e. the period between April 1, 2010 and March 31, 2011) he had estimated the oil subsidies to be at Rs 3108 crore. They finally came in 20 times higher at Rs 62,301 crore. Same was the case in the year 2009-2010 (i.e. the period between April 1, 2009 and March 31, 2010). The estimate was Rs 3109 crore. The real bill came in nearly eight times higher at Rs 25,257 crore (direct subsidies + oil bonds issued to the oil companies).

The increasing fiscal deficit

The fiscal deficit has gone up over the years primarily because an increase in expenditure has not been matched with an increase in revenue. Revenue for the government means various forms of taxes and other forms of revenue like selling stakes in public sector enterprises.

The fact of the matter is that Indians do not like to pay income tax or any other kind of tax. This a throw back from the days of the high income tax rate in the 60s, 70s and the 80s, when a series of Finance Ministers (from C D Deshmukh to Yashwantrao Chavan and bureaucrats like Manmohan Singh) implemented high income tax rates in the hope that taxing the “rich” would solve all of India’s problems.

In the early 1970s the highest marginal rate of tax was 97%. The story goes that JRD Tata sold some property every year to pay taxes (income tax plus wealth tax) which worked out to be more than his yearly income. Of course everybody was not like the great JRD, and because of the high tax rates implemented by various Congress governments over the years, a major part of the Indian economy became black. Dealings were carried out in cash. Transactions were made but they were never recorded, because if they were recorded tax would have to be paid on them.

A series of exemptions were granted to corporate India as well, and companies like Reliance Industries did not pay any income tax for years. As a result of this India and Indians did not and do not like paying tax.

Various lobbies have also emerged which have ensured that those that they represent are not taxed. As Professor Amartya Sen wrote in a column in The Hindu earlier this year “It is worth asking why there is hardly any media discussion about other revenue-involving problems, such as the exemption of diamond and gold from customs duty, which, according to the Ministry of Finance, involves a loss of a much larger amount of revenue (Rs.50,000 crore per year)”.

As he further points out “The total “revenue forgone” under different headings, presented in the Ministry document, an annual publication, is placed at the staggering figure of Rs.511,000 crore per year. This is, of course, a big overestimation of revenue that can be actually obtained (or saved), since many of the revenues allegedly forgone would be difficult to capture — and so I am not accepting that rosy evaluation.”

But even with the overestimation the fact of the matter is that a lot of tax that can be collected from those who can pay is not being collected, and that of course means a higher fiscal deficit.

The twin deficit hypothesis

The hypothesis basically states that as the fiscal deficit of the country goes up its trade deficit (i.e. the difference between its exports and imports) also goes up. Hence when a government of a country spends more than what it earns, the country also ends up importing more than exporting.

But why is that? The fiscal deficit goes up because the increase in expenditure is not matched by an increase in taxes. This leaves people with a greater amount of money in their hands. Some portion of this money is used towards buying goods and services, which might be imported from abroad. This leads to greater imports and thus a higher trade deficit. The situation in India is similar. The government of India has been spending more than it has been earning without matching the increase in income with higher taxes, which in turn has led to increasing incomes and that to some extent has been responsible for an increase in Indian imports. But that could have hardly been responsible for the trade deficit of $185billion that India ran in 2011-2012. The imports for the month of April 2012 were at $37.9billion, nearly 54.7% more than the exports which stood at $24.5billion. So the trend has continued even in this financial year.

The golden oil shock

India exports a major part of its oil needs. On top of that it is obsessed with gold. Last year we imported 1000 tonnes of it. Very little of both these commodities priced in dollars is dug up in India. So we have to import them.

This pushes up our imports and makes them greater than our exports. These imports have to be paid for in dollar. When payments are to be made importers buy dollars and sell rupees. When this happens, the foreign exchange market has an excess supply of rupees and a short fall of dollars. This leads to rupee losing value against the dollar. In case our exports matched our imports, then exporters who brought in dollars would be converting them into rupees, and thus there would be a balance in the market. Importers would be buying dollars and selling rupees. And exporters would be selling dollars and buying rupees. But that isn’t happening in a balanced way.

This to some extent explains the current rupee dollar rate of $1 = Rs 55. The Reserve Bank of India does intervene at times to stem the fall of the rupee. This it does by selling dollars and buying rupee. But the RBI does not have an unlimited supply of dollars and hence cannot keep intervening indefinitely.

As mentioned earlier the major part of the trade deficit is because of the fact that we need to import oil. Oil prices have been high for the last few years, though recently they have fallen. Oil is sold in dollars. Hence when India needs to buy oil it needs to pay in dollars. But with the rupee constantly losing value against the dollar, it means that Indian companies have to more per barrel of oil in rupees.

The government of India does not pass on a major part of the increase in the price of oil to the end consumer and hence subsidizes the prices of diesel, LPG, kerosene etc. This means that the oil companies have to sell these products at a loss to the consumer. The government in turn compensates these companies for the loss. This leads to the expenditure of the government going up and hence it incurs a higher fiscal deficit.

No passing the buck

If the government had not subsidized prices of oil products and passed them onto the end consumer, their consumption would have come down. With prices of oil products not rising as much as they should people have not adjusted their consumption accordingly. An increase in price typically leads to a fall in demand. If the increased price of oil had been passed onto the end consumer, the demand for oil would have come down. This would have meant that a fewer number of dollars would have been required to pay for the oil being imported, in turn leading to a lower trade deficit and hence lesser pressure on the rupee-dollar rate.

So let me summarise the argument I am making. The higher fiscal deficit in the form of subsidies has pushed up the trade deficit which in turn has led to rupee losing value against the dollar. The solution is to get consumers to pay the “right” price. With this the fiscal deficit can be brought down to some extent. If these products are priced correctly, their consumption is likely to come down as well in the near future, given that their prices will go up. Lower consumption is likely to lead to lower imports and thus a lower trade deficit. A lower trade deficit would also mean that the fall of the rupee against the dollar may stop. This in turn would mean a lower price for the oil we import in rupee terms and that in turn help overall economic growth. A lower fiscal deficit will lead to lower government borrowing and hence lesser “crowding out” and so lower interest rates, which might get corporates and individuals interested in borrowing again.

The long term solution

What has been suggested above is a short term solution, which given the way the Congress led UPA government operates is unlikely to be implemented. The main problem is that while it’s quite a noble idea to provide subsidies in the form of food, fertilizer, kerosene etc to the India’s poor, it has to be matched with an increase in taxes. An increase in income taxes rates isn’t going to help much because only a minuscule portion of India pays income tax (basically the salaried class).

What is needed is to get larger number of people to pay tax to pay for all the subsidies that are doled out. This can be done by simplifying the income tax act. This was tried when the government tried to come up with the Direct Taxes Code(DTC), which was very simple and straightforward and had done away with most exemptions. In its original form the DTC was a pleasure to read. But of course if it had been implemented scores of people who do not pay income tax would have to pay income tax. In its current form the DTC is another version of Income Tax Act.

Another way is to target specific communities of people who do not pay income tax even though they earn a huge amount of money, but all in “black”. For starters the targeting property dealers that line up almost every street in Delhi might be a good idea. Once, people see that the government is serious about collecting taxes, they are more likely to pay up than not. And there is no better way than starting with the capital.

(The article originally appeared at www.firstpost.com on May 23,2012. http://www.firstpost.com/economy/dont-blame-greece-cong-policies-responsible-for-rupees-crash-318280.html)

(Vivek Kaul is a writer and he can be reached at [email protected])

Why Greece is the canary in the PIIGS coal mine

Vivek Kaul

Greece is a puny economy. It economy makes up less than 0.5% of the world’s Gross Domestic Product (GDP). And historically that’s how it has been, after the days of Alexander the Great ended. As economist Bill Bonner points out in a column “Greece, a small country with a small GDP and no oil…whose strategic export is olives…and whose last real military victory was the Battle of Jhelum in 326 BC, in which Alexander the Great defeated an Indian Rajah named Porus.”

Given this background why is the world going mad over Greece. There are several reasons for the same.

Huge debt:

As John Mauldin and Jonathan Tepper write in Endgame – The End of the Debt Supercycle and How it Changes Everything “Why is Greece important? Because so much of their debt is on the books of European banks. Hundreds of billions of dollars worth.”

The fear is that if Greece defaults a lot of European banks particularly in Germany and France might get into trouble. In fact, Greece has already defaulted. Banks wrote off more than €100billion of Greek debt in March earlier this year.

But the market now fears a larger default. This could mean the Greek government stopping repayment of €240billion of bailout loans it has received from the International Monetary Fund and the European Union. The Greek central bank may also be in trouble and not be able to repay the €100billion it has borrowed from the European Central Bank in order to prop up the Greek banks, which in turn have lent money to the Greek government.

But didn’t we know all this already?

Satyajit Das, an internationally renowned derivatives expert and the author of Extreme Money – Masters of Universe and the Cult of Risk wrote in a column titled Nowhere To Run, Nowhere to Hide in July 2010 that “Greece’s significance is not its economic size (around 0.5% of global Gross Domestic Product (“GDP”)) but its significant debts. Profligate public spending, a large public sector, generous welfare systems particularly for public servants, low productivity, an inadequate tax base, rampant corruption and successive poor governments created the parlous state of public finances.”

In fact the welfare system of Greece is legendary. Greece categorises certain jobs as arduous. For such jobs the retirement age is 55 for men and 50 for women. “As this is also the moment when the state begins to shovel out generous pensions, more than 600 Greek professions somehow managed to get themselves classified as arduous: hairdressers, radio announcers, musicians…” write Mauldin and Tepper in Endgame, a book released in early 2011.

What also does not help is the fact that the average government job pays three times the average private sector job. “The national railroad has annual revenues of 100 million euros against an annual wage bill of 400 million, plus 300 million euros in other expenses. The average state railroad employee earns 65,000 euros a year. Twenty years ago a successful businessman turned finance minister named Stefanos Manos pointed out that it would be cheaper to put all Greece’s rail passengers into taxicabs,” write the authors.

And it doesn’t end with this. “The Greek public-school system is the site of breath taking inefficiency: one of the lowest-ranked systems in Europe, it nonetheless employs four times as many teachers per pupil as the highest ranked, Finland’s.” The worst thing of course is that the Greeks never learnt to pay their taxes because no one is ever punished.

But these things have been known for some time, so why is all the hullaballoo happening now?

So what has changed?

While the European Union and the International Monetary Fund may have been doling out rescue packages to Greece, but in lieu of that they expect Greece to reduce its fiscal deficit over the years by practicing austerity measures. Fiscal deficit is the difference between what the country earns and what it spends. This measure it is hoped will help Greece enough to repay its loans. But the loans are so large it is unlikely that something like this will ever happen.

Resorting to austerity measures is the traditional way of tackling debt problems. But when a government spends less; it also leads to the GDP shrinking in such situations because the private sector is not spending anyway, despite the interest rates being very low. As John Kenneth Galbraith The Economics of Innocent Fraud:

If in recession the interest rate is lowered by the central bank, the member banks are counted on to pass the lower rate along to their customers, thus encouraging them to borrow. Producers will thus produce goods and services, buy the plant and machinery they can afford now and from which they can make money, and consumption paid for by cheaper loans will expand..The difficulty is that this highly plausible, wholly agreeable process exists only in well-established economic belief and not in real life… Business firms borrow when they can make money and not because interest rates are low.

This is true of Greece as well as other sections of the European Union. So the private sector is not borrowing and spending. Neither are the consumers. Also with the government spending lesser, the economy has slowed down even further. With the entire economy spending lesser, tax collections are also down.

The unemployment rate has reached 25% and one in every two youths in Greece is unemployed. The GDP of Greece is expected to go down by 7% this year.

Hence in the eyes of the ordinary citizens of Greece the so called austerity programme is a villain which has made life difficult. In the recent elections Greeks voted for parties which are against the austerity programme that Greece is running in order to repay its loans. But the they ended up voting for a large number of small parties, making it difficult for anyone to form the government. Hence another election has now been scheduled for June 17. While no one knows what will happen on that day, chances are Greece might vote in favour of parties which are not in favour of any austerity programmes.

Greece is the canary in the coal mine

The austerity programme also requires Greece to collect taxes that are owed to the government. But like us Indians, Greeks also hate to pay taxes. As Satyajit Das points out in Extreme Money “Greece gives an appearance of a developed economy. In fact, Greece’s economy and its institutional infrastructure are weak with low productivity, low quality and endemic corruption. Around 30% of the Greek economy is unreported and informal, resulting in tax revenue losses of $30billion per month.”

One tax which almost no one pays in Greece is property tax. Recent attempts by the government to get the citizens to pay this tax by including it in their electricity bills came a cropper after unions led a massive civil disobedience movement. The government which had hoped to raise around €2billion through this move is now running out of cash. In total it owes around €500billion to various European entities. How can a government which is not able to collect €2billion of unpaid taxes mange t repay debt to the tune of €500billion?

Due to these reasons it is expected that Greece might leave the euro and technically default on its debts. For Greece it makes sense to do so (as I discuss here http://www.firstpost.com/world/if-piigs-have-to-fly-they-will-need-to-exit-the-euro-314589.html) and deem its debts to be in its own new currency.

But Greece is the smaller worry. The market and the European Union can handle Greece opting out of the euro and deciding to pay off its loans in its own new drachma. But what if Greece’s exit inspires the likes of Spain, Italy, Portugal etc. Then there will be real trouble because the amount of debt in these countries is bigger than that of Greece. Satyajit Das feels that Greece is the “canary in the coal mine”, which highlights similar problems in the other PIIGS countries(i.e. Portugal, Ireland, Italy, Greece and Spain) as well as some Eastern European countries. These countries have around €2 trillion of debt outstanding, much more than that of Greece. And that is the bigger problem.

To conclude, let me quote economist Tyler Cowen who runs the world’s most popular economics blog www.marginalrevolution.com:

“It’s a moot point whether Greece is a poor country masquerading as a wealthy country or vice versa…If the old illusion was that Greece was a

wealthy country, the new illusion is that Greece will, in short order, become wealthy enough to pay back ever-growing sums of debt.”

(The article originally appeared at www.firstpost.com on May 22,2012. http://www.firstpost.com/economy/why-greece-is-the-canary-in-the-piigs-coalmine-317078.html)

(Vivek Kaul is a writer and can be reached at [email protected])