The devil, like beauty, always lies in the detail.

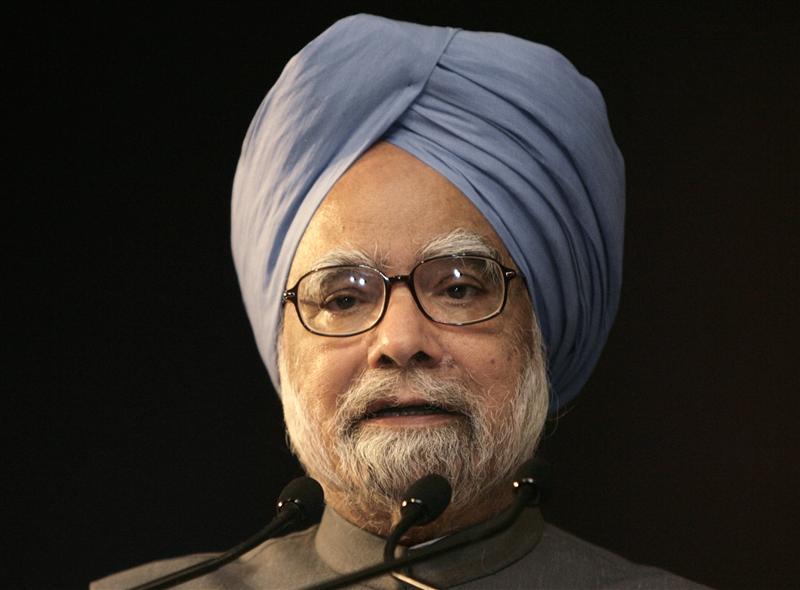

Sometime last week the Central Statistics Office(CSO) put out data which clearly shows that India is still facing the ill-effects of the inflationary era unleashed by the Congress led United Progressive Alliance (UPA) government.

Between 2008-2009 and 2013-2014, the average consumer price inflation was higher than 10%. Food inflation was higher than 11%. High inflation essentially forced people to spend more and in the process they had lesser money to save.

Take a look at the following table. The household savings fell from 23.39% of the nominal Gross Domestic Product (GDP) to 19.06%. Nominal GDP does not take inflation into account.

| In Rs crore | 2011-2012 | 2012-2013 | 2013-2014 | 2014-2015 |

| Household Savings | 2065453 | 2233950 | 2360936 | 2380488 |

| As a % of total savings | 68.20% | 66.40% | 63.40% | 57.20% |

| As a % of nominal GDP | 23.39% | 22.36% | 20.94% | 19.06% |

| Net Financial Savings (Gross financial savings minus financial liabilities) | 642609 | 733616 | 862873 | 961307 |

| As a % of nominal GDP | 7.28% | 7.34% | 7.65% | 7.70% |

| Saving in physical assets | 1389209 | 1463684 | 1460844 | 1379411 |

| As a % of nominal GDP | 15.73% | 14.65% | 12.96% | 11.05% |

The household savings primarily comprise of financial savings as well as savings in physical assets and savings in the form of gold and silver ornaments. The overall household savings have fallen from 23.39% of the GDP in 2011-2012 to 19.06% in 2014-2015.

The household financial savings (i.e. investments made in fixed deposits, provident funds, shares and debentures and life insurance) rose marginally from 7.28% to 7.70% of the GDP.

What the table does not tell you is that in 2007-2008, before the Congress led UPA government initiated an era of high-inflation, the household financial savings had stood at 11.45% of the GDP. Between 2007-2008 and 2011-2012, household financial savings fell dramatically. They haven’t really recovered since then despite lower inflation numbers.

In 2014-2015, the consumer price inflation was at an average of 5.83% during the course of the year. Food inflation was at 6.26%. The after-effects of the era of high inflation are still being felt. The low growth in household financial savings also explains why despite a massive fall in inflation, interest rates haven’t fallen at the same pace. If savings had risen at a much faster rate, the interest rates would have fallen more.

Savings in physical assets (homes, land, flats etc.) have fallen dramatically between 2011-2012 and 2014-2015 from 15.73% of the GDP to around 11.05%. This is again a reflection of the fact that people are not saving enough despite low inflation. One possible explanation for this is that incomes are not going up at a fast pace.

The other point that needs to be made here is that the real estate prices have gone way beyond what most people can afford. And that explains to some extent why household financial savings have risen between 2011-2012 and 2014-2015, but physical assets have not.

Now take a look at the following table. Companies (non-financial corporations) have been saving more over the years. Their savings have gone up from 9.59% of the GDP in 2011-2012 to 12.27% of the GDP in 2014-2015. What does this tell us?

| In Rs crore | 2011-2012 | 2012-2013 | 2013-2014 | 2014-2015 |

| Savings of non-financial corporations | 847134 | 990322 | 1218020 | 1532262 |

| As a % of total savings | 28.00% | 29.40% | 32.70% | 37.20% |

| As a % of nominal GDP | 9.59% | 9.91% | 10.80% | 12.27% |

| Savings of financial corporations | 272371 | 300599 | 294180 | 335679 |

| As a % of total savings | 9.00% | 8.90% | 7.90% | 8.20% |

| As a % of nominal GDP | 3.08% | 3.01% | 2.61% | 2.69% |

| Savings of general government | -158234 | -160048 | -148089 | -131729 |

| As a % of total savings | -5.20% | -4.80% | -4.00% | 3.20% |

| As a % of nominal GDP | -1.79% | -1.60% | -1.31% | -1.05% |

It tells us that there are not enough investment opportunities going around and hence the profits that these companies are making are not being invested to expand but being saved. This is again a good indicator of the overall slow trend of the economy.

For sustainable economic growth to happen a country needs to produce things. As the Say’s Law states “A product is no sooner created, than it, from that instant, affords a market for other products to the full extent of its own value.”

The law essentially states that the production of goods ensures that the workers and suppliers of these goods are paid enough for them to be able to buy all the other goods that are being produced. Production of goods also creates new jobs.

A pithier version of this law is, “Supply creates its own demand.” And that is why industrial expansion is important for economic growth to happen. But currently that doesn’t seem to be happening.

(Vivek Kaul is the author of the Easy Money trilogy. He can be reached at [email protected])

The column originally appeared on Swarajya on February 3, 2016