The household financial savings, which form a bulk of the overall savings in the Indian economy, went up in 2019-20. This after they had fallen in 2018-19. The question is how did this happen and what does this mean for the Indian economy in the post-covid world? Mint takes a look.

What was household financial savings rate in 2019-20?

Household financial savings essentially refers to the savings of households in the form of currency, bank deposits, debt securities, mutual funds, insurance, pension funds and investments in small savings schemes. The total of these savings is referred to as gross household financial savings. Once the financial liabilities, that is, loans from banks, non-banking finance companies and housing finance companies, are subtracted from the gross savings, what remains is referred to as net household financial savings. The net household financial savings in 2019-20 rose to 7.7% of the GDP from 7.2% in 2018-19. This primarily happened because the liabilities fell from 3.9% of the GDP in 2018-19 to 2.9% in 2019-20.

What explains this uptick in household financial savings?

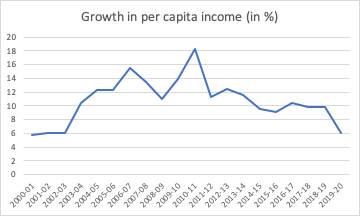

The gross financial savings of households in 2019-20 stood at Rs 21.63 lakh crore, marginally better than the gross savings in 2018-19 which was at Rs 21.23 lakh crore. Nevertheless, the net financial savings jumped to Rs 15.62 lakh crore in 2019-20 from Rs 13.73 lakh crore, a year earlier. This was primarily because the financial liabilities reduced from Rs 7.5 lakh crore to Rs 6.01 lakh crore. This pushed up net financial savings. Why did this happen? This happened primarily because the Indian economy has been slowing down from start of 2019. The per capita income in 2019-20 grew by just 6.1% (nominal terms, not adjusted for inflation), the slowest since 2002-03, when it had grown by 6.03%.

How did slow growth in per capita income impact savings?

A double digit growth in per capita income has happened only once since 2013-2014. In 2016-17, the per-capita income grew by 10.39%. Over the last few years, income growth has slowed down, and in 2019-20, it slowed down dramatically to 6.1%. This has led to a slowdown in lending growth. The non-food credit growth of banks in 2019-20 was at 6.7%, the slowest in more than a decade.

What does this tell about the overall state of the economy?

A slowdown in income growth has led to a slowdown in consumption as well as a slowdown in loan growth. What hasn’t helped is the weak financial state of non-banking finance companies, which has added to the lending slowdown. Also, this means that people were looking at their economic future bleakly, even before covid-19 had struck. At an individual level, the good part for them is that they tried to go slow on their borrowing in comparison to the past. But at the societal level, this hurt the economy because it led to a consumption slowdown.

Where will the household financial savings settle in 2020-21?

The period between April and June will lead to higher savings. As a recent RBI research paper states, a spike in household financial savings “is likely in the first quarter of 2020-21 on account of a sharp drop in lockdown induced consumption.” In fact, this explains why bank deposit rates have fallen in the recent past. The money deposited with banks has gone up, while the banks are unable to lend. But this spike in savings is likely to taper in the months to come simply because of “lags in the pickup of economic activity”.

A slightly different version of the piece appeared in the Mint on June 15, 2020.