Vivek Kaul

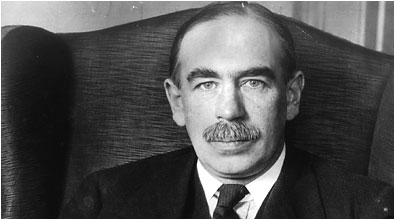

John Maynard Keynes (pictured above) was a rare economist whose books sold well even among the common public. The only exception to this was his magnum opus, The General Theory of Employment, Interest and Money, which was published towards the end of 1936.

In this book Keynes discussed the paradox of thrift or saving. What Keynes said was that when it comes to thrift or saving, the economics of the individual differed from the economics of the system as a whole. An individual saving more by cutting down on expenditure made tremendous sense. But when a society as a whole starts to save more then there is a problem. This is primarily because what is expenditure for one person is income for someone else. Hence when expenditures start to go down, incomes start to go down, which leads to a further reduction in expenditure and so the cycle continues. In this way the aggregate demand of a society as a whole falls which slows down economic growth.

This Keynes felt went a long way in explaining the real cause behind The Great Depression which started sometime in 1929. After the stock market crash in late October 1929, people’s perception of the future changed and this led them to cutting down on their expenditure, which slowed down different economies all over the world.

As per Keynes, the way out of this situation was for someone to spend more. The best way out was the government spending more money, and becoming the “spender of the last resort”. Also it did not matter if the government ended up running a fiscal deficit doing so. Fiscal deficit is the difference between what the government earns and what it spends.

What Keynes said in the General Theory was largely ignored initially. Gradually what Keynes had suggested started playing out on its own in different parts of the world.

Adolf Hitler had put 100,000 construction workers for the construction of Autobahn, a nationally coordinated motorway system in Germany, which was supposed to have no speed limits. Hitler first came to power in 1934. By 1936, the Germany economy was chugging along nicely having recovered from the devastating slump and unemployment. Italy and Japan had also worked along similar lines.

Very soon Britain would end up doing what Keynes had been recommending. The rise of Hitler led to a situation where Britain had to build massive defence capabilities in a very short period of time. The Prime Minister Neville Chamberlain was in no position to raise taxes to finance the defence expenditure. What he did was instead borrow money from the public and by the time the Second World War started in 1939, the British fiscal deficit was already projected to be around £1billion or around 25% of the national income. The deficit spending which started to happen even before the Second World War started led to the British economy booming.

This evidence left very little doubt in the minds of politicians, budding economists and people around the world that the economy worked like Keynes said it did. Keynesianism became the economic philosophy of the world.

Lest we come to the conclusion that Keynes was an advocate of government’s running fiscal deficits all the time, it needs to be clarified that his stated position was far from that. What Keynes believed in was that on an average the government budget should be balanced. This meant that during years of prosperity the governments should run budget surpluses. But when the environment was recessionary and things were not looking good, governments should spend more than what they earn and even run a fiscal deficit.

The politicians over the decades just took one part of Keynes’ argument and ran with it. The belief in running deficits in bad times became permanently etched in their minds. In the meanwhile they forgot that Keynes had also wanted them to run surpluses during good times. So they ran deficits even in good times. The expenditure of the government was always more than its income.

Thus, governments all over the world have run fiscal deficits over the years. This has been largely financed by borrowing money. With all this borrowing governments, at least in the developed world, have ended up with huge debts to repay. What has added to the trouble is the financial crisis which started in late 2008. In the aftermath of the crisis, governments have gone back to Keynes and increased their expenditure considerably in the hope of reviving their moribund economies.

In fact the increase in expenditure has been so huge that its not been possible to meet all of it through borrowing money. So several governments have got their respective central banks to buy the bonds they issue in order to finance their fiscal deficit. Central banks buy these bonds by simply printing money.

All this money printing has led to the Federal Reserve of United States expanding its balance sheet by 220% since early 2008. The Bank of England has done even better at 350%. The European Central Bank(ECB) has expanded its balance sheet by around 98%. The ECB is the central bank of the seventeen countries which use the euro as their currency. Countries using the euro as their currency are in total referred to as the euro zone.

The ECB and the euro zone have been rather subdued in their money printing operations. In fact, when one of the member countries Cyprus was given a bailout of € 10 billion (or around $13billion), a couple of days back, it was asked to partly finance the deal by seizing deposits of over €100,000 in its second largest bank, the Laiki Bank. This move is expected to generate €4.2 billion. The remaining money is expected to come from privatisation and tax increases, over a period of time.

It would have been simpler to just print and handover the money to Cyprus, rather than seizing deposits and creating insecurities in the minds of depositors all over the Euro Zone.

Spain, another member of the Euro Zone, seems to be working along similar lines. Loans given to real estate developers and construction companies by Spanish banks amount to nearly $700 billion, or nearly 50 percent of the Spain’s current GDP of nearly $1.4 trillion. With homes lying unsold developers are in no position to repay. And hence Spanish banks are in big trouble.

The government is not bailing out the Spanish banks totally by handing them freshly printed money or by pumping in borrowed money, as has been the case globally, over the last few years. It has asked the shareholders and bondholders of the five nationalised banks in the country, to share the cost of restructuring.

The modus operandi being resorted to in Cyprus and Spain can be termed as an extreme form of financial repression. Russell Napier, a consultant with CLSA, defines this term as “There is a thing called financial repression which is effectively forcing people to lend money to the…government.” In case of Cyprus and Spain the government has simply decided to seize the money from the depositors/shareholders/bondholders in order to fund itself. If the government had not done so, it would have had to borrow more money and increase its already burgeoning level of debt.

In effect the citizens of these countries are bailing out the governments. In case of Cyprus this may not be totally true, given that it is widely held that a significant portion of deposit holders with more than €100,000 in the Cyprian bank accounts are held by Russians laundering their black money.

But the broader point is that governments in the Euro Zone are coming around to the idea of financial repression where citizens of these countries will effectively bailout their troubled governments and banks.

Financing expenditure by money printing which has been the trend in other parts of the world hasn’t caught on as much in continental Europe. There are historical reasons for the same which go back to Germany and the way it was in the aftermath of the First World War.

The government was printing huge amounts of money to meet its expenditure. And this in turn led to very high inflation or hyperinflation as it is called, as this new money chased the same amount of goods and services. A kilo of butter cost ended up costing 250 billion marks and a kilo of bacon 180 billion marks. Interest rates as high as 22% per day were deemed to be legally fair.

Inflation in Germany at its peak touched a 1000 million %. This led to people losing faith in the politicians of the day, which in turn led to the rise of Adolf Hitler, the Second World War and the division of Germany.

Due to this historical reason, Germany has never come around to the idea of printing money to finance expenditure. And this to some extent has kept the total Euro Zone in control(given that Germany is the biggest economy in the zone) when it comes to printing money at the same rate as other governments in the world are. It has also led to the current policy of financial repression where the savings of the citizens of the country are forcefully being used to finance its government and rescue its banks.

The question is will the United States get around to the idea of financial repression and force its citizens to finance the government by either forcing them to buy bonds issued by the government or by simply seizing their savings, as is happening in Europe.

Currently the United States seems happy printing money to meet its expenditure. The trouble with printing too much money is that one day it does lead to inflation as more and more money chases the same number of goods, leading to higher prices. But that inflation is still to be seen.

As Nicholas NassimTaleb puts it in Anti Fragile “central banks can print money; they print print and print with no effect (and claim the “safety” of such a measure), then, “unexpectedly,” the printing causes a jump in inflation.”

It is when this inflation appears that the United States is likely to resort to financial repression and force its citizens to fund the government. As Russell Napier of CLSA told this writer in an interview “I am sure that if the Federal Reserve sees inflation climbing to anywhere near 10% it would go to the government and say that we cannot continue to print money to buy these treasuries and we need to force financial institutions and people to buy these treasuries.” Treasuries are the bonds that the American government sells to finance its fiscal deficit.

“May you live in interesting times,” goes the old Chinese curse. These surely are interesting times.

The article originally appeared on www.firstpost.com on March 27,2013

(Vivek Kaul is a writer. He tweets @kaul_vivek)