The Confederation of real estate developers association of India (CREDAI) a real estate lobby, has written to the government to provide relief to the real estate sector in the upcoming budget which is scheduled towards the end of this month.

“We want infrastructure status for real estate apart from that there should be exemption from the tax and less formalities to obtain home loans for the buyers,” a CREDAI official told the Times News Network.

These moves, the lobby believes, will provide the sector some “cheer”.

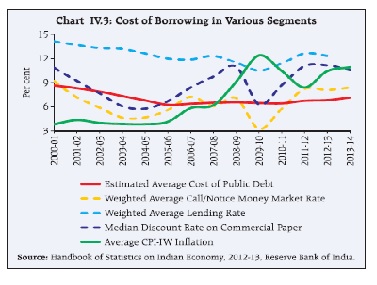

Before this, CREDAI had constantly been talking about the need for the Reserve Bank of India(RBI) to cut the repo rate or the rate at which it lends to banks. Raj Modi, president of CREDAI in the National Capital Region had said in January 2015 : “We have been raising the concerns of developers over higher rates from the government. We are happy that RBI has taken a step by cutting the rates. We expect that this will encourage banks to ease their home loan rates…This will help developers to expedite their projects which were otherwise facing fund crunch. Home buyers’ dreams of owning a home would also get a boost as we expect an accelerated purchase cycle.”

This comment came after the RBI decided to cut the repo rate by 25 basis points to 7.75%:

The position taken by CREDAI till date seems to be that people are not buying homes because interest rates are high. If RBI starts cutting the repo rate it will lead to banks cutting the interest rate they charge on their home loans. People will borrow and buy homes. And everybody will live happily ever after.

Only if things were as straightforward as that. I have explained in the past that the major reason why Indians are not buying as many homes as they were in the past is because prices are too high in comparison to the income of people. Further, despite slowing sales, most real estate companies and builders have not budged and refused to cut prices.

This becomes clear through the research report titled India Residential Market Preview for the period October to December 2014, released by Liases Foras, a real estate research and rating company. The research report provides data for six cities (Mumbai Metropolitan Region, National Capital Region, Chennai, Bangalore, Hyderabad and Pune).

The report clearly shows that sales continue to remain slow as the total number of unsold homes pile up. “The unsold stock rose 17% from 709 mn SqL in Dec 13 (Oct to Dec 2013) to 832 mn SqL in Dec 14 (Oct to Dec 2014),” the report points out. Yearly sales across the six cities that the report covers declined by 1.1%.

Despite huge number of unsold homes and falling sales, home prices continued to rise, though not at the same pace as they have in the past (as can be seen from the accompanying table).

City | Weighted Average Price of a Flat in Oct to Dec 2013 | Weighted Average Price of a Flat in Oct to Dec 2014 | % increase in price | Months of unsold inventory as on Dec 2014 | Months of unsold inventory as on Dec 2013 |

Mumbai Metropolitan Region | Rs 1.23 crore | Rs1.32 crore | 6.62% | 40 | 48 |

National Capital Region | Rs 73.09 lakh | Rs 74.79 lakh | 2.33% | 40 | 56 |

Bangalore | Rs 85.21 lakh | Rs 85.55 lakh | 0.40% | 17 | 35 |

Chennai | Rs 61.57 lakh | Rs 63.37 lakh | 2.92% | 22 | 41 |

Pune | Rs 55.84 lakh | Rs 56.94 lakh | 1.96% | 21 | 15 |

Hyderabad | Rs 70.51 lakh | Rs 74.77 lakh | 6.05% | 31 | 24 |

Source: Liases Foras

A glance through the column in the table which lists the weighted average price of a flat across various cities, makes it clear how homes have become totally unaffordable across the length and breadth of India. And this is where the problem lies.

Other data also clearly shows this unaffordability of homes across India. Take a look at the following table from the National Housing Bank. It shows the breakdown of home loans given by housing finance companies for buying old homes.

|

Source: National Housing Bank

As is clear from the above table more than half of the total loans given by housing finance companies have been given to homes worth more than Rs 25 lakh. The data for 2014 is not available. Nevertheless, there is not much reason to believe that the situation would have changed much from what it was in 2013.

The following table shows a breakdown of home loans given by housing finance companies towards the buying of homes (both old and new).

|

Source: National Housing Bank

The above table shows that more than 47% of all home loans given by housing finance companies were for homes above Rs 25 lakh. This number has jumped dramatically since 2012, when it was at 43%. It also needs to be pointed out that at Rs 25 lakh it would be next to impossible to buy anything half decent in the six cities that Liases Foras tracks. It would be interesting to know, what portion of the total home loans is made of home loans over Rs 50 lakh.

Hence, homes are so expensive that it has led to a situation where the share of housing as a proportion of the Indian GDP is very small. As can be seen from the following table, the only countries that are behind us when it comes to housing are Bangladesh, Sri Lanka and Pakistan.

|

Source: National Housing Bank

Hence, affordability is the major issue when it comes to real estate. As the Report on Trend and Progress of Housing in India 2013 points out: “This phenomenon[i.e. affordability] has the potential to exclude a large segment of the society as they get priced out of the formal housing finance market…It continues to remain the most critical aspect of housing for a vast segment of the population.”

Interestingly, the Technical Group of Housing Shortage estimates that the housing shortage in urban India was at 18.78 million in 2012. In rural India the number was at 43.9 million.

What this clearly tells us is that India’s real estate companies and builders have been building homes for only a a very small segment of the population. And even this segment is now not in a position to buy the homes that are being build, given the price that they are being sold at.

It is time the real estate sector woke up to this opportunity. The government also needs to address this, by rapidly addressing supply side issues like archaic building bye-laws, delays in project approvals etc. At the same time it also needs to figure out how to drive down high land costs. And on top of everything, it needs to figure out how to tackle the massive amount of black money that the sector attracts.

The column originally appeared on www.equitymaster.com as a part of The Daily Reckoning on February 9, 2015