Bernie Madoff, the man who ran the biggest Ponzi scheme of all time, died in jail on April 14, 2021, fifteen days shy of turning 83.

A Ponzi scheme is a fraudulent investment scheme in which older investors are paid by using money being brought in by newer ones. It keeps running until the money being brought in by the newer investors is greater than the money being paid to the older ones. Once this reverses, the scheme collapses . Or the scamster running the scheme, runs away with the money before the scheme collapses.

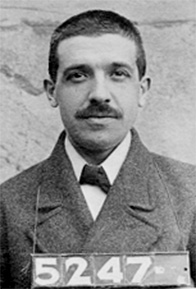

The scheme is named after an Italian American, Charles Ponzi, who tried running such an investment scheme in Boston, United States, in 1920. He had promised to double investors’ money in 90 days, which meant an annual return of 1500%. At its peak, 40,000 investors had invested $15 million in Ponzi’s scheme.

Not surprisingly, the scheme collapsed in less than a year’s time, under its own weight. All Ponzi was doing was taking money from newer investors and paying off the older ones.

Once Boston Post ran a story exposing his scheme in July 1920, many investors demanded their money back and Ponzi’s Ponzi scheme simply collapsed, as money being brought in by newer investors dried up, while older investors had to be paid.

Madoff was smarter that way. His scheme gave consistent returns of around 10% per year, year on year. The fact that Madoff promised reasonable returns, helped him keep running his Ponzi scheme for decades. But when the financial crisis of 2008 struck, it became difficult for him to carry on with the pretence and the scheme collapsed.

As I wrote in a piece for the Mint newspaper yesterday, Madoff was Ponzi’s most successful disciple ever. While Ponzi’s investment scheme started in December 1919, it collapsed in less than a year’s time in August 1920. On the other hand, documents suggest that Madoff’s scheme started sometime in the 1960s and ran for close to five decades.

Nevertheless, both Madoff and Ponzi, would have been proud of the Ponzi schemes of 2021. The only difference being that the current day Ponzi schemes are what economist Nobel Prize winning Robert Shiller calls naturally occurring Ponzi schemes and not fraudulent ones like the kind Ponzi and Madoff ran.

A conventional Ponzi scheme has a fraudulent manager at the centre of it all and the intention is to defraud investors and take the money and run before the scheme collapses. A naturally occurring Ponzi scheme is slightly different to that extent.

Shiller defines naturally occurring Ponzi schemes in his book Irrational Exuberance:

“Ponzi schemes do arise from time to time without the contrivance of a fraudulent manager. Even if there is no manipulator fabricating false stories and deliberately deceiving investors in the aggregate stock market, tales about the market are everywhere. When prices go up a number of times, investors are rewarded sequentially by price movements in these markets just as they are in Ponzi schemes. There are still many people (indeed, the stock brokerage and mutual fund industries as a whole) who benefit from telling stories that suggest that the markets will go up further. There is no reason for these stories to be fraudulent; they need to only emphasize the positive news and give less emphasis to the negative.”

Basically, what Shiller is saying here is that the stock markets enter a phase at various points of time, where stock prices go up simply because new money keeps coming in and not because of the expectations of earnings of companies going up in the days to come.

Ultimately, stock prices should reflect a discounted value of future company earnings. But quite often that is not the case and the price goes totally out of whack, for considerably long periods of time.

A lot of money comes in simply because the smarter investors know that newer money will keep coming in and stock prices will keep going up, and thus, stocks can be unloaded on to the newer investors. Hence, like in a Ponzi scheme, the money being brought in by the newer investors pays off the older ones. In simpler terms, this can be referred to as the greater fool theory.

The investors buying stocks at a certain point of time, when stock prices do not justify the expected future earnings, know that greater fools can be expected to invest in stocks in the time to come and to whom they can sell their stocks.

Of course, this is not the story that is sold. If you want money to keep coming into stocks, you can’t call a prospective fool a fool. There is a whole setup, from stock brokerages to mutual funds to portfolio management services to insurance companies selling investment plans, which benefit from the status quo. Their incomes depend on how well the stock market continues to do.

They are the deep state of investment and need to keep selling stories that all is well, that stocks are not expensive, that this time is different, that a new era is here or is on its way, that stock prices will keep going up and that if you want to get rich you should invest in the stock market, to keep luring fools in and keep the legal Ponzi scheme, for the lack of a better term, going.

— Bernie Madoff

— Bernie Madoff

This is precisely what has been happening all across the world since the covid pandemic broke out. With central banks printing a humongous amount of money, interest rates are at very low levels, forcing investors to look for higher returns. A lot of this money has found its way into stock markets. The newer investors have bid stock prices up, thus benefitting the older investors. The deep state of investment has played its role.

Of course, the counterpoint to whatever I have said up until now is that unless new money comes in, how will stock prices ever go up. This is a fair point. But what needs to be understood here is that in the last one year, the total amount of money invested in stocks has turned into a flood. Take the case of foreign institutional investors investing in Indian stocks.

They net invested a total of $37.03 billion in Indian stocks in 2020-21. This was almost 23% more than what they invested in Indian stocks in the previous six years, from April 2014 to March 2020. This flood of money can be seen in stock markets all across the world.

Clearly, there is a difference, and the stock market has worked like a naturally occurring Ponzi scheme, at least over the last one year.

This Ponziness is not just limited to stocks. Take a look at what is happening to Indian startups…oh pardon me…we don’t call them startups anymore, we call them unicorns, these days. A unicorn is a startup which has a valuation of greater than billion dollars.

How can a startup have a valuation of more than a billion dollars, is a question well worth asking. I try and answer this question in a piece I have written in today’s edition of the Mint newspaper.

As mentioned earlier, there is too much money floating all around the world, particularly in the rich world, looking for higher returns. Venture capitalists (VCs) have access to this money and thus are picking up stakes in Indian startups at extremely high prices.

Many of these startups have revenues of a few lakhs and losses running into hundreds or thousands of crore. The losses are funded out of money invested by VCs into these unicorns.

The losses are primarily on account of selling, the service or the good that the startup is offering, at a discounted price. The idea is to show that a monopoly (or a duopoly, if there is more than one player in the same line of business) is being built in that line of business and then cash in on that through a very expensive initial public offering (IPO).

As and when, the IPO happens, a newer set of investors, including retail investors, buy into the business, at a very high price, in the hope that the company will make lots of money in the days to come. Interestingly, IPOs which used to help entrepreneurs raise capital to expand businesses, now have become exit options for VCs.

If an IPO is not possible, then the VC hopes to unload the stake on to another VC or a company and get out of the business.

In that sense, the hope is that a newer set of investors will pay off an older set, like is the case in any Ponzi scheme. Of course, this newer set then needs another newer set to keep the Ponzi going.

The good thing is that when investors buy a stock of an existing company or in a new company’s IPO, they are at least buying a part of an underlying business. In case of existing companies, chances are that the business is profitable. In case of an IPO, the business may already be profitable or is expected to be profitable.

But the same cannot be said about many digital assets that are being frantically bought and sold these days. There is no underlying business or asset, for which money is being paid. Take the case of Dogecoin which was created as a satire on cryptocurrencies.

As I write this, it has given a return of 24% in the last 24 hours. An Indian fixed deposit investor will take more than four years to earn that kind of return and that too if he doesn’t pay any tax on the interest earned.

Why is Dogecoin delivering such fantastic returns? As James Surowiecki writes in a column: “There is no good answer to that question, other than to say Dogecoins have gotten dramatically more valuable because people have decided to act as if they’re more valuable.”

As John Maynard Keynes puts it, investors are currently anticipating “what average opinion expects the average opinion to be.” Carried away by the high returns on Dogecoin, the expectation is that newer investors will keep investing in it and hence, prices will keep going up. The newer investors will keep paying the older ones. That is the hope, like is the case with any Ponzi scheme, except for the fact that in this case, there is no fraudulent manager at the centre of it all.

Of course, the only way the value of Dogecoin and many other cryptocurrencies can be sustained, is if newer investors keep coming in and at the same time, people who already own these cryptocurrencies don’t rush out all at once to cash in on their gains.

If this does not happen, as is the case with any Ponzi scheme, when existing investors demand their money back and not enough newer investors are coming in, this Ponzi scheme will also collapse.

–– Charles Ponzi

–– Charles Ponzi

Given this, like is the case with people who are heavily invested in stocks, it is important for people who are heavily invested in cryptos to keep defending them. Of course, a lot of times this is technical mumbo jumbo, which basically amounts to that old phrase, this time is different.

But this time is different is probably the oldest lie in finance. It rarely is.

And if dogecoin was not enough, we now have investors going crazy about non-fungible tokens (NFTs), which in simple terms is basically certified digital art. As Jazmin Goodwin points out: “For example, Jack Dorsey’s first tweet is now bidding for $2.5 million, a video clip of a LeBron James slam dunk sold for over $200,000 and a decade-old “Nyan Cat” GIF went for $600,000.” The auction house Christie sold its first ever NFT artwork for $69 million, in March.

In a world of extremely low interest rates and massive amount of printing carried out by central banks, there is too much money going around chasing returns.

There aren’t enough avenues and which is why we have financial and digital assets now turning into naturally occurring Ponzi schemes, giving the kind of returns that the original Ponzi scamsters, like Ponzi himself and his disciple Madoff, would be proud off.

Madoff’s scheme delivered returns of 10% returns per year. Ponzi promised to double investors’ money in three months or a return of 100% over three months. As I write this, Dogecoin has given a return of more than 600% over the last one month.

Here’s is how the price chart of Dogecoin looks like over the last one month.

Source: https://www.coindesk.com/price/dogecoin.

Source: https://www.coindesk.com/price/dogecoin.