Vivek Kaul

One of my favourite Hollywood comedies is Mel Brooks’ Silent Movie made in 1976. As its name suggests, the film had no dialogue and the only audible word in the movie is spoken by Marcel Marceau, when he utters the word “No!” Rather ironically Marceau was one of the most famous mime artists of the era.

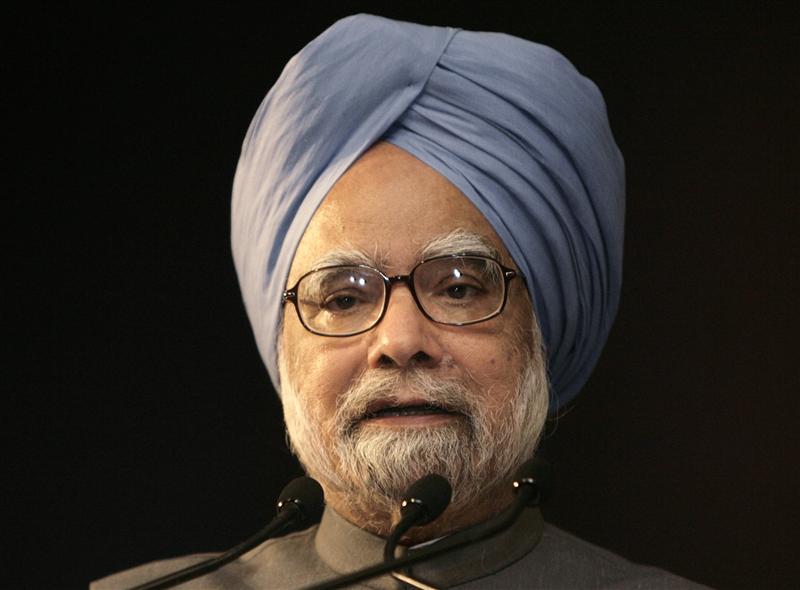

The Congress party led UPA in the last few years has been behaving in the opposite way.In the Congress movie every leader other than Prime Minister Manmohan Singh, the man at the top, had a dialogue. Singh chose to keep quiet rarely telling us what was going on inside his head, as his government moved from one scam to another.

But over the last two weeks he has suddenly found his voice, initiated a wave of reforms, from increasing the price of diesel by Rs 5 per litre to allowing foreign direct investment in the retail sector. “It will take courage and some risks but it should be our endeavour to ensure that it succeeds. The country deserves no less,” Singh said after the announcements were made.

He even addressed the nation and explained the rationale behind the decisions. The media went to town saying that Manmohan has got his mojo back. But the question is what has got our silent Prime Minister talking?

When Pranab Mukherjee presented the budget earlier this year he had projected a fiscal deficit of Rs 5,13,590 crore or 5.1% of the gross domestic product(GDP). Fiscal deficit is the difference between what the government earns and what it spends.

The projected fiscal deficit has gone all awry primarily because the price of oil has continued to remain high, despite a slowdown in the global economy. Currently, the price of the Indian basket of crude oil is at around $114.4 per barrel.

This wouldn’t have been a problem if the diesel, kerosene and cooking gas, would have been sold at their market price. But the Indian government hasn’t allowed that to happen over the years and has protected the consumers against the price rise. This means that the oil marketing companies (OMCs) Indian Oil, Bharat Petroleum and Hindustan Petroleum have had to sell diesel, kerosene and cooking gas at a loss.

The government needs to compensate these companies from the losses they incur, so that they don’t go bankrupt. These losses were close to touching Rs 1,90,000 crore, when the government decided to increase the price of diesel by Rs 5 per litre. Even after this increase the OMCs will lose over Rs 1,00,000 crore just on the sale of diesel this year. The total loss on diesel, kerosene and cooking gas is now estimated to be at Rs 1,67,000 crore. The OMCs are also losing around Rs 6 per litre on selling petrol, but the government doesn’t compensate them for this.

The government hadn’t budgeted for such huge losses on the oil front in the budget. The budgeted amount was a miniscule Rs 43,580 crore. Of this nearly Rs 38,500 crore was used to compensate the OMCs for losses made during the course of the lost financial year, leaving a little over Rs 5,000 crore to meet the losses for the current financial year.

The subsidies allocated for food and fertiliser are also likely to be not enough. In fact as per the Controller General of Accounts the fiscal deficit during the first four months of the year has already crossed half of the budgeted fiscal deficit of Rs 5,13,590 crore. This was a really worrying situation. More than that with tensions flaring up again in various countries in the Middle East, it is unlikely that the price of oil will come down in a hurry.

Given these reasons if the government had carried on in its current state there was a danger of the fiscal deficit crossing Rs 7,00,000 crore or 7% of the GDP. This is a situation which India has never had to face since the country first initiated and embraced economic reforms in July 1991. The fiscal deficit for the year 1990-1991 had stood at 8% of the GDP.

Reforms like allowing foreign investment in multi brand retailing will have an impact on economic growth over a very long period of time, if at all they do. Allowing foreign investors to pick up 49% stake in domestic airlines will also not have any immediate impact. But what is more important is the signals that these reforms send out to the market i.e. policy logjam that was holding economic growth back is over and the government is now in the mood for reforms.

As a result the rupee has appreciated against the dollar. One dollar was worth Rs 55.4 on September 14. Since then it has gained 3% to Rs 53.8. This will help in bringing the oil bill down. Oil is sold internationally in dollars. When one barrel costs $115 and one dollar is worth Rs 55.4, India pays Rs 6,371 per barrel. If one dollar is worth Rs 53.8, then India pays a lower Rs 6,187 per barrel. So an appreciating rupee brings down the oil bill, which in turn pushes down the fiscal deficit of the government.

The thirty share BSE Sensex has rallied by 2.9% to 18,542.3 points, from its close on September 13 to September 17. Nevertheless, even after these moves the actual fiscal deficit of the government will be substantially higher than the targeted Rs 5,13,590 crore. To bring that down the government needs to come up with more reforms so that the rupee continues to appreciate against the dollar and brings down the oil subsidy bill. The market rally also needs to continue, so that the government meets its disinvestment target of Rs 30,000 crore for the year. And on top of all this the government also needs to reign in the oil subsidy by gradually increasing prices of petrol, diesel, kerosene and cooking gas. Unless this happens, the government will continue to borrow more and this will keep interest rates high. Interest rates need to come down if businesses and consumers are to start borrowing again. This is necessary to revive economic growth, which has slowed down considerably.

If all this wasn’t enough we also need to hope that a certain Mrs G and Master G need to continue to understand that good economics also means good politics. If they switch off anytime now, Manmohan Singh is likely to go quiet again.

(A slightly different version of the article with a different headline appeared in the Asian Age/Deccan Chronicle on September 26, 2012. http://www.deccanchronicle.com/editorial/dc-comment/good-economics-good-politics-too-426)

(Vivek Kaul is a Mumbai based writer. He can be reached at [email protected])

Oil

How Mamata is denting the rupee and bloating the oil bill

Vivek Kaul

A major reason for announcing the so called economic reforms that the Manmohan Singh UPA government did over the last weekend was to get India’s burgeoning oil subsidy bill which was expected to cross Rs 1,90,000 crore during the course of the year, under some control.

One move was the increase in diesel price by Rs 5 per litre and limiting the number of cooking gas cylinders that one could get at the subsidisedprice to six per year. This was a direct step to reduce the loss that the oil marketing companies (OMCs) face every time they sell diesel and cooking gas to the end consumer.

The other part of the reform game was about expectations management. The announcement of reforms like allowing foreign direct investment in multi-brand foreign retailing or the airline sector was not expected to have any direct impact anytime soon. But what it was expected to do was shore up the image of the government and tell the world at large that this government is committed to economic reform.

Now how does that help in controlling the burgeoning oil bill?

Oil is sold internationally in dollars. The price of the Indian basket of crude oil is currently quoting at around $115.3 per barrel of oil (one barrel equals around 159litres).

Before the reforms were announced one dollar was worth around Rs 55.4(on September 13, 2012 i.e.). So if an Indian OMC wanted to buy one barrel of oil it had to convert Rs 6387.2 into $115.3 dollars, and pay for the oil.

After the reforms were announced the rupee started increasing in value against the dollar. By September 17, one dollar was worth around Rs 53.7. Now if an Indian OMC wanted to buy one barrel of oil it had to convert Rs 6191.6 into $115.3 to pay for the oil.

Hence, as the rupee increases in value against the dollar, the Indian OMCs pay less for the oil the buy internationally. A major reason for the increase in value of the rupee was that on September 14 and September 17, the foreign institutional investors poured money into the stock market. They bought stocks worth Rs 5086 crore over the two day period. This meant dollars had to be sold and rupee had to be bought, thus increasing the demand for rupee and helping it gain in value against the dollar.

But this rupee rally was short lived and the dollar has gained some value against the rupee and is currently worth around Rs 54.

The question is why did this happen? Initially the market and the foreign investors bought the idea that the government was committed at ending the policy logjam and initiating various economic reforms. Hence the foreign investors invested money into the stock market, the stock market rallied and so did the rupee against the dollar.

But now the realisation is setting in that the reform process might be derailed even before it has been earnestly started. This was reflected in the amount of money the foreign investors brought into the stock market on September 18. The number was down to around Rs 1049.2 crore. In comparison they had invested more than Rs 5080 crore over the last two trading sessions.

Mamata Banerjee’s Trinamool Congress, a key constituent of the UPA government, has decided to withdraw support to the government. At the same time it has asked the government to withdraw a major part of the reforms it has already initiated by Friday. If the government does that the Trinamool Congress will reconsider its decision.

How the political scenario plays out remains to be seen. But if the government does bow to Mamata’s diktats then the economic repercussions of that decision will be huge. The government had hoped that the losses on account of selling, diesel, kerosene and cooking gas, could have been brought down to Rs 1,67,000 crore, from the earlier Rs 1,92,000 crore by increasing the price of diesel and limiting the consumption of subsidised cooking gas.

If the government goes back on these moves, the oil subsidy bill will go back to attaining a monstrous size. Also, what the calculation of Rs 1,67,000 crore did not take into account was the fact that rupee would gain in value against the dollar. And that would have further brought down the oil subsidy bill. In fact HSBC which had earlier forecast Rs 57 to a dollar by December 2012, revised its forecast to Rs 52 to a dollar on Monday. But by then the Mamata factor hadn’t come into play.

If the government bows to Mamata, the rupee will definitely start losing value against the dollar again. This will happen because the foreign investors will stay away from both the stock market as well as direct investment. In fact, the foreign direct investment during the period of April to June 2012 has been disastrous. It has fallen by 67% to $4.41billion in comparison to $13.44billion, during the same period in 2011. If the government goes back on the few reforms that it unleashed over the last weekend, foreign direct investment is likely to remain low.

One factor that can change things for India is the if the price of crude oil were to fall. But that looks unlikely. The immediate reason is the tension in the Middle East and the threat of war between Iran and Israel. Hillary Clinton, the US Secretary of State, recently said that the United States would not set any deadline for the ongoing negotiations with Iran. This hasn’t gone down terribly well with Israel. Reacting to this Benjamin Netanyahu, the Prime Minister of Israel said “the world tells Israel, wait, there’s still time, and I say, ‘Wait for what, wait until when? Those in the international community who refuse to put a red line before Iran don’t have the moral right to place a red light before Israel.” (Source: www.oilprice.com)

Iran does not recognise Israel as a nation. This has led to countries buying up more oil than they need and building stocks to take care of this geopolitical risk. “In the recent period, since the start of 2012, the increase in stocks has been substantial, i.e. 2 to 3 million barrels per day. These are probably precautionary stocks linked to geopolitical risks,” writes Patrick Artus of Flash Economics in a recent report titled Why is the oil price not falling?

At the same time the United States is pushing nations across the world to not source their oil from Iran, which is the second largest producer of oil within the Organisation of Petroleum Exporting Countries (Opec). This includes India as well.

With the rupee losing value against the dollar and the oil price remaining high the oil subsidy bill is likely to continue to remain high. And this means the trade deficit (the difference between exports and imports) is likely to remain high. The exports for the period between April and July 2012, stood at $97.64billion. The imports on the other hand were at $153.2billion. Of this, $53.81billion was spent on oil imports. If we take oil imports out of the equation the difference between India’s exports and imports is very low.

Now what does this impact the value of the rupee against the dollar? An exporter gets paid in dollars. When he brings those dollars back into the country he has to convert them into rupees. This means he has to buy rupees and sell dollars. This helps shore up the value of the rupee as the demand for rupee goes up.

In case of an importer the things work exactly the opposite way. An importer has to pay for the imports in terms of dollars. To do this, he has to buy dollars by paying in rupees. This increases the demand for the dollar and pushes up its value against the rupee.

As we see the difference between imports and exports for the first four months of the year has been around $55billion. This means that the demand for the dollar has been greater than the demand for the rupee.

One way to fill this gap would be if foreign investors would bring in money into the stock market as well as for direct investment. They would have had to convert the dollars they want to invest into rupees and that would have increased the demand for the rupee.

The foreign institutional investors have brought in around $3.86billion (at the current rate of $1 equals Rs 54) since the beginning of the year. The foreign direct investment for the first three months of the year has been at $4.41 billion.

So what this tells us that there is a huge gap between the demand for dollars and the supply of dollars. And precisely because of this the dollar has gained in value against the rupee. On April 2, 2012, at the beginning of the financial year, one dollar was worth around Rs 50.8. Now it’s worth Rs 54.

This situation is likely to continue. And I wouldn’t be surprised if rupee goes back to its earlier levels of Rs 56 to a dollar in the days to come. It might even cross those levels, if the government does bow to the diktats of Mamata.

This would mean that India would have to pay more for the oil that it buys in dollars. This in turn will push up the demand for dollars leading to a further fall in the value of the rupee against the dollar.

Since the government forces the OMCs to sell diesel, kerosene and cooking gas much below their cost to consumers, the losses will continue to mount. The current losses have been projected to be at Rs 1,67,000 crore. I won’t be surprised if they cross Rs 2,00,000 crore. The government has to compensate the OMCs for these losses in order to ensure that they don’t go bankrupt.

This also means that the government will cross its fiscal deficit target of Rs 5,13,590 crore. The fiscal deficit, which is the difference between what the government earns and what it spends, might well be on its way to touch Rs 7,00,000 crore or 7% of GDP. (For a detailed exposition of this argument click here). And that will be a disastrous situation to be in. Interest rates will continue to remain high. And so will inflation. To conclude, the traffic in Mumbai before the Ganesh Chaturthi festival gets really bad. Any five people can get together while taking the Ganesh statue to their homes, put on a loudspeaker, start dancing on the road and thus delay the entire traffic on the road for hours. Indian politics is getting more and more like that.

Reforms, like the traffic, may have to wait. Mamata’s revolt is single-handedly worsening the oil bill, thanks, in part, to the rupee’s worsening fortunes. By not raising prices now, the subsidy bill bloat further, and in due course we will be truly in the soup.

The article originally appeared on www.firstpost.com on September 20, 2012. http://www.firstpost.com/economy/how-mamata-is-denting-the-rupee-and-bloating-the-oil-bill-461919.html

Vivek Kaul is a writer and can be reached at [email protected]

How Manmohan’s omelette came out as scrambled egg

Vivek Kaul

Around half way through Manu Joseph’s new book The Illicit Happiness of Other People, Ousep Chacko, one of the main characters in the book, says “Don’t hate me, son. There are people in this world who set out to make an omelette but end up with scrambled eggs. I am one of them.”

I just couldn’t help comparing this statement to Manmohan Singh, the current Prime Minister of the country. When he started out in 2004 he had all the economic ingredients that could be used to make a good omelette but what he has given us instead is burnt bhurji (the closest Indian representation of scrambled eggs and with due apologies to all the vegetarians out there).

When Manmohan Singh took over as the Prime Minister on May 22, 2004, things were looking good on the economic front. Consumer price index (CPI) inflation was at a rather benign 2.83%(Source: http://www.tradingeconomics.com/india/inflation-cpi) in May 2004. Interest rates were low.

The fiscal deficit projected by the government for 2004-2005(or the period between April 1, 2004 and March 31, 2005) was at 4.4% of the gross domestic product (GDP). Fiscal deficit is the difference between what the government earns and what it spends.

The interest payments that the government had to make on previous debt formed around 94% of the fiscal deficit. Interest payments stood at Rs 1,29,500 crore whereas the fiscal deficit was at Rs 1,37,407 crore. Thus the primary deficit or the difference between expenditure and income, after leaving out the interest payments, came to just 0.3% of the GDP.

What this meant was that the government was more or less meeting its expenditure from the income that it was earning during the course of the year. Thus the deficit was on account of the past debt. It also meant that the government did not have to borrow much, which in turn kept the interest rates low, encouraging both businesses and consumers to borrow and spend, and thus helping the Indian economy grow at a fast rate.

The subsidy bill for the year stood at Rs 43,516 crore or a little over 9% of the total government expenditure.

Cut to now. The CPI inflation for July 2012 was at 9.86%. The interest rate on most retail loans is greater than 10%. And the fiscal deficit has gone through the roof. The projected fiscal deficit for the year is Rs 5,13,590 crore or around 5.1% of the GDP. The primary deficit is at 1.9% of the GDP.

Even these numbers, as I showed in a recent piece will turn out to be way off the mark. (You can read the piece here). As economist Shankar Acharya wrote in the Business Standard “A few days back the Controller General of Accounts (CGA, not CAG!) informed us that the central government’s fiscal deficit for the first four months of 2012-13 had already exceeded half of the Budget’s target for the full year.”

The way things are going currently, the fiscal deficit might touch 7% of the GDP or its roundabout by the end of this year. This is a situation which hasn’t been experienced since 1990-91, just before India liberalised and opened up the economy.

In his speech as the Finance Minister of India in July 1991 Manmohan Singh had said “The crisis of the fiscal system is a cause for serious concern. The fiscal deficit of the Central Government…is estimated at more than 8 per cent of GDP in 1990-91, as compared with 6 per cent at the beginning of the 1980s and 4 per cent in the mid-1970s.”

So the question that arises is what went wrong between 2004 and 2012? The answer is that the subsidy budget of the government went through the roof. Things started changing in 2007-2008. The projected subsidy bill for the year was Rs 54,330 crore. By the end of the year the government had spent Rs 69,742 crore or 28% more. This was in preparation for the 2009 Lok Sabha elections.

The same thing happened the next year i.e. 2008-2009. The government budgeted Rs 71,431 crore as subsidies and ended up spending Rs 1,29,243 crore, a whopping 81% more. The subsidies were primarily on account of fertiliser, oil and food.

The budgeted subsidies for the current financial year (i.e. the period between April 1, 2012 and March 31, 2013) are at Rs 1,90,015 crore or around 12.7% of the total government expenditure. But as has been the case earlier the government will end up spending much more than this. Even after the Rs 5 increase in diesel price, the oil marketing companies (OMCs) will lose more than Rs 1 lakh crore on selling diesel this year. The total loss on account of selling diesel, kerosene and cooking gas at a loss is estimated to come to Rs 1,67,000 crore.

Just this will push up the subsidy bill close to Rs 3,00,000 crore. The government is expected to cross the budgeted amount for food and fertiliser subsidy as well. All in all it’s safe to say that subsidies will account for more than 20% of the government expenditure during the course of the year, leading to greater borrowing by the government and thus higher interest rates for everybody else.

The idea behind the subsidies (or inclusive growth as the government likes to call it) is to help the poor and ensure that they are not left out of the growth process. The question is where is the money to fund these subsidies going to come from? As Ila Patnaik writes in The Indian Express “Anyone looking at the rising subsidy bill, at the size of the welfare programmes, and contrasting it with the limited tax base, can only wonder why India will not have a fiscal crisis. A continuation of the present policies cannot but land the country into a huge problem. Either before a crisis or after it, there is little doubt that the current expenditure path has to change.”

The programme at the heart of the so called inclusive growth is the National Rural Employment Guarantee Act (NREGA), under which there is a legal guarantee of 100 days of employment during the course of the financial year to adults of any rural household. The daily wage is set at Rs 120 in 2009 prices, which means it is indexed for inflation. Now only if economic and social development was as easy as getting people to dig holes and fill them up.

Also as is usual with most such schemes in India there are huge leakages in this scheme as well. Estimates suggest that leakages are as high as 70%, which means only around Rs 30 of the Rs 100, reaches those it should, while the rest is being siphoned off. This is done by fudging muster rolls, which are essentially supposed to contain the number of days a labourer has worked and the wages he or she has been paid for it.

Also these subsidy and welfare programmes were initiated when the Indian economy was growing faster than 9%. Now the economic growth has slowed down to 5% levels. As Patnaik puts it “Implicit was also the argument that NREGA will be paid for by the high tax collection that the fast growing sectors of the economy would yield. Growth was to be made inclusive through a redistribution of incomes. This was the scenario when India was growing at 10 per cent and leaving some people behind. It was a scenario that might stand the test of time if India continued to grow at a long-run steady state of 10 per cent growth. This plan did not appear to evaluate the fiscal path of such a programme when growth halved.”

Slow growth also implies a slowdown in tax collections for the government, which might lead to the government needing to borrow more to finance the subsidies and welfare programmes.

A lot of the expenditure on account of subsidies could have been met if the government had been less corrupt and not sold off the assets of the nation at rock bottom prices. The loss on account of the telecom scandal was estimated to be at Rs 1.76 lakh crore. The loss on account of the coal blocks scandal was estimated to be at Rs 1.86lakh crore.

While these scams were happening all around him, Manmohan Singh chose to look the other way. As TN Ninan wrote in the Business Standard “Corruption silenced telecom, it froze orders for defence equipment, it flared up over gas, and now it might black out the mining and power sectors. Manmohan Singh’s fatal flaw — his willingness to tolerate corruption all around him while keeping his own hands clean — has led us into a cul de sac , with the country able to neither tolerate rampant corruption nor root it out.”

Singh has tried to re-establish his reformist credentials recently by announcing a spate of economic reforms over Friday and Saturday. But none of these reforms look to control the expenditure of the government and thus bring down the fiscal deficit. If the government continues down this path the future is doomed. As Ruchir Sharma writes in Breakout Nations “If the government continues down this path, India might meet the same path as Brazil in the late 1970s, when excessive government spending set off hyperinflation, ending the country’s economic boom.”

Higher expenditure also means inflation will continue to remain high. “NREGA pushed rural wage inflation up to 15% in 2011,” writes Sharma. The fear of high inflation continues, despite the reforms announced by the government. “The government undertook long anticipated measures towards fiscal consolidation by reducing fuel subsidies and selling stakes in public enterprises. Further, steps taken to increase foreign direct investment (FDI) should contribute to both greater capital inflows and, over the long run, higher productivity, particularly in the food supply chain. Importantly, however, for the moment, inflationary pressures, both at wholesale and retail levels, are still strong,” the Reserve Bank of India said in a statement today, keeping the repo rate (or the rate at which it lends to banks) constant at 8%. This despite the fact that there was great pressure on the central bank to cut the repo rate. It is unfair to expect the RBI to make up for the mistakes of the government.

The bottomline is that if the government has to get its act right it needs to reign in its expenditure. I started this piece with eggs let me end it with chickens. As economist Bibek Debroy wrote in the Economic Times “Since 2009, UPA-II has behaved like a headless chicken. It is still headless, but the chicken at least wants to cross the road. We still don’t know whether it will be run over or cross the road and lay an egg.”

And even if eggs are laid, we might still not end up with burnt bhurji rather than omelettes.

(The article originally appeared on www.firstpost.com. http://www.firstpost.com/politics/how-manmohans-omelette-came-out-as-scrambled-egg-458242.html)

(Vivek Kaul is a writer. He can be reached at [email protected])

Even with the diesel price hike, India is staring at a 7% fiscal deficit

Vivek Kaul

The Congress party led United Progressive Alliance(UPA) has been in the habit of shooting messengers who come with bad news. So here is some more bad news.

Almost half way through the financial year 2012-2013 (i.e. the period between April 1, 2012 and March 31, 2013), the fiscal deficit of the government is looking awful to say the least. Fiscal deficit is the difference between what the government earns and what it spends.

When the finance minister presents the annual budget there are a lot of assumptions that go into the projection of the fiscal deficit.

The overall fiscal deficit was projected to be at Rs 5,13,590 crore. The expenditure of the government for the year was expected to be at Rs 14,90,925 crore. In comparison the government expected to earn Rs 9,77,335 crore during the course of the year. The difference between the earnings of the government and its expenditure came to Rs 5,13,590 crore and this is the projected fiscal deficit. Hence, the government was spending 55% (Rs 5,13,590 crore expressed as a percentage of Rs 9,77,335 crore) more than it earned.

The expenditure part of the calculation includes subsidies on oil, fertiliser and food. The subsidy on oil was assumed to be at Rs 43,580 crore. This subsidy was to be used by the government to compensate oil marketing companies like Indian Oil, Bharat Petroleum and Hindustan Petroleum for selling diesel, kerosene and cooking gas, at a loss.

The government has more or less run out of the budgeted oil subsidies. It has already paid Rs 38,500 crore to OMCs, for selling diesel, kerosene and LPG at a loss during the last financial year. This amount was reimbursed only in the current financial year and hence has had to be adjusted against the oil subsidies budgeted for this year. This leaves only around Rs 5,080 crore with the government for compensating the OMCs for the losses this year.

And that’s just small change in comparison to the losses that OMCs are expected to face for selling diesel, kerosene and LPG. The oil minister Jaipal Reddy recently said that if the current situation continues the OMCs will end up with losses amounting to Rs 2,00,000 crore during the course of the year.

As economist Shankar Acharya wrote in the Business Standard on September 13“The real fiscal spoilsport is, of course, subsidies, especially those for diesel, LPG and kerosene, though those on fertiliser and foodgrain are also large. Data circulated by the petroleum ministry indicate under-recoveries by oil marketing companies (OMCs) of Rs 17/litre on diesel, Rs 33/litre on kerosene and Rs 347/cylinder on LPG.”

The OMCs need to be compensated for these losses by the government because if they are not compensated then they will go bankrupt. And if they go bankrupt then you, I and everybody else, won’t be able to buy petrol, diesel, kerosene and LPG, which would basically mean going back to the age of tongas and bullock carts. Clearly no one would want that.

So to deal with expected losses of Rs 2,00,000 crore the government has around Rs 5,080 crore of the budgeted amount remaining. This means that the government would have to come up with around Rs 1,95,000 crore from somewhere.

This is a large amount of money. The government has tried to curtail these losses by increasing the price of diesel by Rs 5 per litre and thus bringing down the loss on sale of diesel to Rs 12 per litre. This move is expected to save the government Rs 19,000 crore which means losses will now amount to Rs 1,76,000crore (Rs 1,95,000crore – Rs 19,000 crore) in total.

Since 2003-2004, the government has had a formula for sharing these losses. The upstream oil companies like ONGC and Oil India Ltd, which produce oil, are forced to share one third of the losses. But there have been instances when the formula has not been followed and the upstream companies have been forced to chip in with more than their fair share. In 2011-2012, the last financial year the government forced the upstream companies to compensate around 40% of the total losses.

If the government follows the same formula this year as well, it would mean that the upstream companies would have to compensate the OMCs to the tune of Rs 70,400crore (40% of Rs 1,76,000 crore). Now that is a huge amount, whether the upstream companies have the capacity to come up with that kind of money remains to be seen. But assuming that they do, it still means that the government would have to come up with Rs 1,05,600 crore (60% of Rs 1,76,000 crore) from somewhere. This would mean that the fiscal deficit would be pushed up to Rs 6,19,190 crore (Rs 5,13,590 crore + Rs 1,05,600 crore). If the upstream companies cannot bear 40% of the total loses the government will have to bear a greater proportion of the total losses, pushing the fiscal deficit up further.

Oil subsidies are not the only subsidies going around. The government is expected to overshoot its food subsidy target of Rs75,000 crore as well. The Economic Times had quoted a food ministry official on June 15, 2012, confirming that the food subsidy target will be overshot, after the government had approved the minimum support price (MSP) of rice to be increased by 16 per cent to Rs 1,250 per quintal to. “The under-provisioning of food subsidy in the current year is at Rs 31,750 crore. Now with increased MSP on paddy(i.e. rice), the total food subsidy deficit at the end of the current year will be about Rs 40,000 crore putting immense pressure on the food subsidy burden of the government,” said a food ministry official,” the Economic Times had reported.

If we add this Rs 40,000 crore to Rs 6,19,190 crore the deficit shoots up to Rs 6,59,190 crore. This is something that Acharya confirms in his column. “A few days back the Controller General of Accounts (CGA, not CAG!) informed us that the central government’s fiscal deficit for the first four months of 2012-13 had already exceeded half of the Budget’s target for the full year,” he writes.

What does this mean is that for the first four months of the year, the government’s fiscal deficit was greater than half of the fiscal deficit for the year. The targeted fiscal deficit for the year was Rs 5,13,590crore. Half of it would equal to Rs 2,56,795 crore. The government has already crossed this in the first four months. At the same rate it would end up with a fiscal deficit of Rs 7,70,385 crore (Rs 2,56,795 crore x 3) by the end of the year. This would work out to 50% more than the projected fiscal deficit of Rs 5,13,590 crore.

It would be preposterous on my part to project a fiscal deficit which is 50% more than the projected deficit. But as I had shown a little earlier a deficit of around Rs 6,60,000 crore is pretty much on the cards.

What does not help is the fact that things aren’t looking too good on the revenue side for the government. As Acharya puts it “More recently, there are ominous, if unsurprising, indications of a significant deceleration in direct tax collections up through August, especially from companies, with gross corporate tax revenues stagnant compared to April-August of the previous financial year. Despite finance ministry reassurances, tax collections for the year could fall significantly below Budget targets because of sluggish economic activity.”

So the government is not going to earn as much as it had expected to through taxes. The government also has set a disinvestment target of Rs30,000 crore. It hopes to earn this money by selling shares of public sector companies. But six months into the financial year there has been no activity on this front.

Taking these factors into account a fiscal deficit of Rs 7,00,000 crore can be expected. Fiscal deficit as we all know is expressed as a proportion of the gross domestic product (GDP). The projected fiscal deficit of Rs 5,13,590 crore works out to 5.1% of the GDP. The GDP in this case is assumed to be at Rs 101,59,884 crore.

With a fiscal deficit of Rs 7,00,000 crore, fiscal deficit as a proportion of GDP works out to 6.9% (Rs 7,00,000 crore expressed as a % of Rs 101,59,884 crore).

The GDP number of Rs 101,59,884 crore is also a projection. The assumption is that the GDP will grow by a nominal rate of 14% over the last financial year’s advance estimate of GDP at Rs 89,121,79 crore. The trouble is that the economy is slowing down and it is highly unlikely to grow at a nominal rate of 14%. The current whole sale price inflation is around 7%. The real rate of growth for the first six months of the calendar year (i.e. the period between January 1, 2012 and June 30, 2012) has been around 5.4%. If we add that to the inflation we are talking of a nominal growth of around 12.5%. At that rate the expected GDP for the year is likely to be around Rs 100,26,201crore (1.125 x Rs 89,121,79 crore).

Hence the fiscal deficit as a percentage of GDP will be around 7% (Rs 700,000 crore expressed as a percentage of Rs 100,26,201crore). A 7% fiscal deficit would give the Prime Minister Manmohan Singh a sense of déjà vu. In his speech as the Finance Minister of India in 1991 he had said “The crisis of the fiscal system is a cause for serious concern. The fiscal deficit of the Central Government…is estimated at more than 8 per cent of GDP in 1990-91, as compared with 6 per cent at the beginning of the 1980s and 4 per cent in the mid-1970s.”

One way out of this mess is to cut the losses due to the sales diesel, kerosene and on LPG. But that would mean a price increase of Rs 12/litre on diesel, Rs 33/litre on kerosene and Rs 347/cylinder on LPG. That of course is not going to happen. Also with the government having to borrow more to meet the increased fiscal deficit, the interest rates will continue to remain high.

India is staring at a huge economic problem. The question is whether the government is ready to recognise it. As Pratap Bhanu Mehta writes in The Indian Express “The central driver of good economics is recognising the problem.” The trouble is that the Congress led UPA government doesn’t want to recognise the problem, let alone tackle it.

(The article originally appeared on www.firstpost.com on September 14,2012. http://www.firstpost.com/economy/why-the-diesel-hike-will-not-even-dent-the-fiscal-deficit-455249.html)

(Vivek Kaul is a writer. He can be reached at [email protected])

Why oil prices won’t come down in the foreseeable future

Vivek Kaul

It is India’s Rs 2,00,000 crore problem. And it’s called crude oil.

With the global economy in general and the Chinese economy in particular slowing down, it was widely expected that the price of crude oil will also come down.

China has been devouring commodities at a very fast rate in order to build infrastructure. As Ruchir Sharma of Morgan Stanley writes in his recent book Breakout Nations “China has been devouring raw materials at a rate way out of line with the size of its economy…In the case of oil China accounts for only 10% of total demand but is responsible for nearly half of the growth in demand, so it is the critical factor in driving up prices.”

Even though the Chinese growth rate has slowed down considerably, the price of crude oil continues to remain high. According to the Petroleum Planning and Analysis Cell (PPAC) which comes under the Ministry of Petroleum and Natural Gas, the price of the Indian basket of crude oil was at $ 113.65 per barrel (bbl) on September 11. The more popular Brent Crude is at $115.44 per barrel as I write this.

The high price of crude oil has led to huge losses for the oil marketing companies in India as they continue to sell petrol, diesel, kerosene and cooking gas at a loss. The oil minister recently said that if the situation continues the companies will end up with losses amounting to Rs 2,00,000 crore during the course of the year.

So why do oil prices continue to remain high?

The immediate reason is the tension in the Middle East and the threat of war between Iran and Israel. Hillary Clinton, the US Secretary of State, recently said that the United States would not set any deadline for the ongoing negotiations with Iran. This hasn’t gone down terribly well with Israel. Reacting to this Benjamin Netanyahu, the Prime Minister of Israel said “the world tells Israel, wait, there’s still time, and I say, ‘Wait for what, wait until when? Those in the international community who refuse to put a red line before Iran don’t have the moral right to place a red light before Israel.” (Source: www.oilprice.com)

Iran does not recognize Israel as a nation. This has led to countries buying up more oil than they need and building stocks to take care of this geopolitical risk. “In the recent period, since the start of 2012, the increase in stocks has been substantial, i.e. 2 to 3 million barrels per day. These are probably precautionary stocks linked to geopolitical risks,” writes Patrick Artus of Flash Economics in a recent report titled Why is the oil price not falling?

At the same time the United States is pushing nations across the world to not source their oil from Iran, which is the second largest producer of oil within the Organisation of Petroleum Exporting Countries (Opec).

What also is happening is that Opec which is an oil cartel, has adjusted its production as per demand. Saudi Arabia which is the biggest producer of oil within OPEC has an active role to play in this. “This adjustment in the supply of oil mainly takes place via changes in Saudi Arabian production:this country keeps its production just above 10 million barrels/day to avoid the excess supply that would appear if it produced at full capacity (13 million barrels/day,” writes Artus.

If all this wasn’t enough gradually the realisation is setting in that some of the biggest oil producing regions in the world are beyond their peaks. As Puru Saxena, a Hong Kong based hedge fund manager writes in a column “it is important to realise that several oil producing regions are already past their peak flow rates and have entered an irreversible decline. For instance, it is no secret that the North Sea, Mexico, Indonesia and a host of other areas are past their prime.”

All eyes are hence now on the Opec nations. The twelve nations in the cartel currently claim to have around 81.3% of the world’s oil reserves. The trouble is that this has never been independently verified. As Kurt Cobb, the author of Prelude, a thriller based around oil puts it in a recent column on www.oilprice.com “Opec reserves are simply self-reported by each country. Essentially, Opec’s members are asking us to take their word for it. But should we?”

Saxena clearly doesn’t believe that Opec countries, including Saudi Arabia, have the kind of reserves they claim to. “Given the fact that the vast majority of Saudi Arabia’s super-giant oil fields are extremely old, one has to wonder whether the nation is capable of boosting production…We are of the view that Saudi Arabia has grossly overstated its oil reserves and it is extremely unlikely that the nation has 270 billion barrels of petroleum. After all, the Saudi reserves have never been audited and a recent report by WikiLeaks suggests that the Saudis have inflated their oil bounty by 40%,” he writes.

This is something that Cobb backs up with more data. “Another piece of evidence that casts doubt on Opec members’ reserve claims came to light in 2005. That year Petroleum Intelligence Weekly, an industry newsletter with worldwide reach, obtained internal documents from the state-owned Kuwait Oil Co. The documents revealed that Kuwaiti reserves were only half the official number, 48 billion barrels versus 99 billion,” he writes. “In 2004 Royal Dutch Shell had to lower its reserves number by 20 percent, a huge and costly blunder for such a sophisticated company. If Shell can bungle its reserves estimate, then how much more likely are OPEC countries which are subject to virtually no public scrutiny to bungle or perhaps manipulate theirs,” adds.

Given these reasons the world cannot produce more crude oil than it is currently producing. The production of oil has remained between 71-76million barrels per day since 2005. “When you take into account the ongoing depletion in the world’s existing oil fields, it becomes clear that the world is heading into an epic energy crunch,” feels Saxena.

In these circumstances where the feeling is that the world does not have as much oil as is claimed, the price of oil is likely to continue to remain high. India’s Rs 2,00,000crore problem can only get bigger.

The article originally appeared in the Daily News and Analysis (DNA) on September 14, 2012.

(Vivek Kaul is a writer. He can be reached at [email protected])