Vivek Kaul

One of my favourite Hollywood comedies is Mel Brooks’ Silent Movie made in 1976. As its name suggests, the film had no dialogue and the only audible word in the movie is spoken by Marcel Marceau, when he utters the word “No!” Rather ironically Marceau was one of the most famous mime artists of the era.

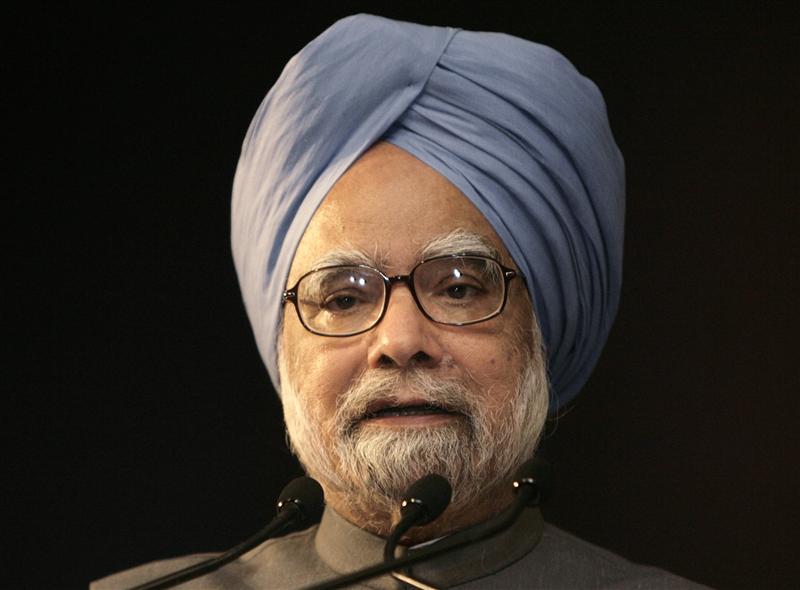

The Congress party led UPA in the last few years has been behaving in the opposite way.In the Congress movie every leader other than Prime Minister Manmohan Singh, the man at the top, had a dialogue. Singh chose to keep quiet rarely telling us what was going on inside his head, as his government moved from one scam to another.

But over the last two weeks he has suddenly found his voice, initiated a wave of reforms, from increasing the price of diesel by Rs 5 per litre to allowing foreign direct investment in the retail sector. “It will take courage and some risks but it should be our endeavour to ensure that it succeeds. The country deserves no less,” Singh said after the announcements were made.

He even addressed the nation and explained the rationale behind the decisions. The media went to town saying that Manmohan has got his mojo back. But the question is what has got our silent Prime Minister talking?

When Pranab Mukherjee presented the budget earlier this year he had projected a fiscal deficit of Rs 5,13,590 crore or 5.1% of the gross domestic product(GDP). Fiscal deficit is the difference between what the government earns and what it spends.

The projected fiscal deficit has gone all awry primarily because the price of oil has continued to remain high, despite a slowdown in the global economy. Currently, the price of the Indian basket of crude oil is at around $114.4 per barrel.

This wouldn’t have been a problem if the diesel, kerosene and cooking gas, would have been sold at their market price. But the Indian government hasn’t allowed that to happen over the years and has protected the consumers against the price rise. This means that the oil marketing companies (OMCs) Indian Oil, Bharat Petroleum and Hindustan Petroleum have had to sell diesel, kerosene and cooking gas at a loss.

The government needs to compensate these companies from the losses they incur, so that they don’t go bankrupt. These losses were close to touching Rs 1,90,000 crore, when the government decided to increase the price of diesel by Rs 5 per litre. Even after this increase the OMCs will lose over Rs 1,00,000 crore just on the sale of diesel this year. The total loss on diesel, kerosene and cooking gas is now estimated to be at Rs 1,67,000 crore. The OMCs are also losing around Rs 6 per litre on selling petrol, but the government doesn’t compensate them for this.

The government hadn’t budgeted for such huge losses on the oil front in the budget. The budgeted amount was a miniscule Rs 43,580 crore. Of this nearly Rs 38,500 crore was used to compensate the OMCs for losses made during the course of the lost financial year, leaving a little over Rs 5,000 crore to meet the losses for the current financial year.

The subsidies allocated for food and fertiliser are also likely to be not enough. In fact as per the Controller General of Accounts the fiscal deficit during the first four months of the year has already crossed half of the budgeted fiscal deficit of Rs 5,13,590 crore. This was a really worrying situation. More than that with tensions flaring up again in various countries in the Middle East, it is unlikely that the price of oil will come down in a hurry.

Given these reasons if the government had carried on in its current state there was a danger of the fiscal deficit crossing Rs 7,00,000 crore or 7% of the GDP. This is a situation which India has never had to face since the country first initiated and embraced economic reforms in July 1991. The fiscal deficit for the year 1990-1991 had stood at 8% of the GDP.

Reforms like allowing foreign investment in multi brand retailing will have an impact on economic growth over a very long period of time, if at all they do. Allowing foreign investors to pick up 49% stake in domestic airlines will also not have any immediate impact. But what is more important is the signals that these reforms send out to the market i.e. policy logjam that was holding economic growth back is over and the government is now in the mood for reforms.

As a result the rupee has appreciated against the dollar. One dollar was worth Rs 55.4 on September 14. Since then it has gained 3% to Rs 53.8. This will help in bringing the oil bill down. Oil is sold internationally in dollars. When one barrel costs $115 and one dollar is worth Rs 55.4, India pays Rs 6,371 per barrel. If one dollar is worth Rs 53.8, then India pays a lower Rs 6,187 per barrel. So an appreciating rupee brings down the oil bill, which in turn pushes down the fiscal deficit of the government.

The thirty share BSE Sensex has rallied by 2.9% to 18,542.3 points, from its close on September 13 to September 17. Nevertheless, even after these moves the actual fiscal deficit of the government will be substantially higher than the targeted Rs 5,13,590 crore. To bring that down the government needs to come up with more reforms so that the rupee continues to appreciate against the dollar and brings down the oil subsidy bill. The market rally also needs to continue, so that the government meets its disinvestment target of Rs 30,000 crore for the year. And on top of all this the government also needs to reign in the oil subsidy by gradually increasing prices of petrol, diesel, kerosene and cooking gas. Unless this happens, the government will continue to borrow more and this will keep interest rates high. Interest rates need to come down if businesses and consumers are to start borrowing again. This is necessary to revive economic growth, which has slowed down considerably.

If all this wasn’t enough we also need to hope that a certain Mrs G and Master G need to continue to understand that good economics also means good politics. If they switch off anytime now, Manmohan Singh is likely to go quiet again.

(A slightly different version of the article with a different headline appeared in the Asian Age/Deccan Chronicle on September 26, 2012. http://www.deccanchronicle.com/editorial/dc-comment/good-economics-good-politics-too-426)

(Vivek Kaul is a Mumbai based writer. He can be reached at [email protected])