Vivek Kaul

Around half way through Manu Joseph’s new book The Illicit Happiness of Other People, Ousep Chacko, one of the main characters in the book, says “Don’t hate me, son. There are people in this world who set out to make an omelette but end up with scrambled eggs. I am one of them.”

I just couldn’t help comparing this statement to Manmohan Singh, the current Prime Minister of the country. When he started out in 2004 he had all the economic ingredients that could be used to make a good omelette but what he has given us instead is burnt bhurji (the closest Indian representation of scrambled eggs and with due apologies to all the vegetarians out there).

When Manmohan Singh took over as the Prime Minister on May 22, 2004, things were looking good on the economic front. Consumer price index (CPI) inflation was at a rather benign 2.83%(Source: http://www.tradingeconomics.com/india/inflation-cpi) in May 2004. Interest rates were low.

The fiscal deficit projected by the government for 2004-2005(or the period between April 1, 2004 and March 31, 2005) was at 4.4% of the gross domestic product (GDP). Fiscal deficit is the difference between what the government earns and what it spends.

The interest payments that the government had to make on previous debt formed around 94% of the fiscal deficit. Interest payments stood at Rs 1,29,500 crore whereas the fiscal deficit was at Rs 1,37,407 crore. Thus the primary deficit or the difference between expenditure and income, after leaving out the interest payments, came to just 0.3% of the GDP.

What this meant was that the government was more or less meeting its expenditure from the income that it was earning during the course of the year. Thus the deficit was on account of the past debt. It also meant that the government did not have to borrow much, which in turn kept the interest rates low, encouraging both businesses and consumers to borrow and spend, and thus helping the Indian economy grow at a fast rate.

The subsidy bill for the year stood at Rs 43,516 crore or a little over 9% of the total government expenditure.

Cut to now. The CPI inflation for July 2012 was at 9.86%. The interest rate on most retail loans is greater than 10%. And the fiscal deficit has gone through the roof. The projected fiscal deficit for the year is Rs 5,13,590 crore or around 5.1% of the GDP. The primary deficit is at 1.9% of the GDP.

Even these numbers, as I showed in a recent piece will turn out to be way off the mark. (You can read the piece here). As economist Shankar Acharya wrote in the Business Standard “A few days back the Controller General of Accounts (CGA, not CAG!) informed us that the central government’s fiscal deficit for the first four months of 2012-13 had already exceeded half of the Budget’s target for the full year.”

The way things are going currently, the fiscal deficit might touch 7% of the GDP or its roundabout by the end of this year. This is a situation which hasn’t been experienced since 1990-91, just before India liberalised and opened up the economy.

In his speech as the Finance Minister of India in July 1991 Manmohan Singh had said “The crisis of the fiscal system is a cause for serious concern. The fiscal deficit of the Central Government…is estimated at more than 8 per cent of GDP in 1990-91, as compared with 6 per cent at the beginning of the 1980s and 4 per cent in the mid-1970s.”

So the question that arises is what went wrong between 2004 and 2012? The answer is that the subsidy budget of the government went through the roof. Things started changing in 2007-2008. The projected subsidy bill for the year was Rs 54,330 crore. By the end of the year the government had spent Rs 69,742 crore or 28% more. This was in preparation for the 2009 Lok Sabha elections.

The same thing happened the next year i.e. 2008-2009. The government budgeted Rs 71,431 crore as subsidies and ended up spending Rs 1,29,243 crore, a whopping 81% more. The subsidies were primarily on account of fertiliser, oil and food.

The budgeted subsidies for the current financial year (i.e. the period between April 1, 2012 and March 31, 2013) are at Rs 1,90,015 crore or around 12.7% of the total government expenditure. But as has been the case earlier the government will end up spending much more than this. Even after the Rs 5 increase in diesel price, the oil marketing companies (OMCs) will lose more than Rs 1 lakh crore on selling diesel this year. The total loss on account of selling diesel, kerosene and cooking gas at a loss is estimated to come to Rs 1,67,000 crore.

Just this will push up the subsidy bill close to Rs 3,00,000 crore. The government is expected to cross the budgeted amount for food and fertiliser subsidy as well. All in all it’s safe to say that subsidies will account for more than 20% of the government expenditure during the course of the year, leading to greater borrowing by the government and thus higher interest rates for everybody else.

The idea behind the subsidies (or inclusive growth as the government likes to call it) is to help the poor and ensure that they are not left out of the growth process. The question is where is the money to fund these subsidies going to come from? As Ila Patnaik writes in The Indian Express “Anyone looking at the rising subsidy bill, at the size of the welfare programmes, and contrasting it with the limited tax base, can only wonder why India will not have a fiscal crisis. A continuation of the present policies cannot but land the country into a huge problem. Either before a crisis or after it, there is little doubt that the current expenditure path has to change.”

The programme at the heart of the so called inclusive growth is the National Rural Employment Guarantee Act (NREGA), under which there is a legal guarantee of 100 days of employment during the course of the financial year to adults of any rural household. The daily wage is set at Rs 120 in 2009 prices, which means it is indexed for inflation. Now only if economic and social development was as easy as getting people to dig holes and fill them up.

Also as is usual with most such schemes in India there are huge leakages in this scheme as well. Estimates suggest that leakages are as high as 70%, which means only around Rs 30 of the Rs 100, reaches those it should, while the rest is being siphoned off. This is done by fudging muster rolls, which are essentially supposed to contain the number of days a labourer has worked and the wages he or she has been paid for it.

Also these subsidy and welfare programmes were initiated when the Indian economy was growing faster than 9%. Now the economic growth has slowed down to 5% levels. As Patnaik puts it “Implicit was also the argument that NREGA will be paid for by the high tax collection that the fast growing sectors of the economy would yield. Growth was to be made inclusive through a redistribution of incomes. This was the scenario when India was growing at 10 per cent and leaving some people behind. It was a scenario that might stand the test of time if India continued to grow at a long-run steady state of 10 per cent growth. This plan did not appear to evaluate the fiscal path of such a programme when growth halved.”

Slow growth also implies a slowdown in tax collections for the government, which might lead to the government needing to borrow more to finance the subsidies and welfare programmes.

A lot of the expenditure on account of subsidies could have been met if the government had been less corrupt and not sold off the assets of the nation at rock bottom prices. The loss on account of the telecom scandal was estimated to be at Rs 1.76 lakh crore. The loss on account of the coal blocks scandal was estimated to be at Rs 1.86lakh crore.

While these scams were happening all around him, Manmohan Singh chose to look the other way. As TN Ninan wrote in the Business Standard “Corruption silenced telecom, it froze orders for defence equipment, it flared up over gas, and now it might black out the mining and power sectors. Manmohan Singh’s fatal flaw — his willingness to tolerate corruption all around him while keeping his own hands clean — has led us into a cul de sac , with the country able to neither tolerate rampant corruption nor root it out.”

Singh has tried to re-establish his reformist credentials recently by announcing a spate of economic reforms over Friday and Saturday. But none of these reforms look to control the expenditure of the government and thus bring down the fiscal deficit. If the government continues down this path the future is doomed. As Ruchir Sharma writes in Breakout Nations “If the government continues down this path, India might meet the same path as Brazil in the late 1970s, when excessive government spending set off hyperinflation, ending the country’s economic boom.”

Higher expenditure also means inflation will continue to remain high. “NREGA pushed rural wage inflation up to 15% in 2011,” writes Sharma. The fear of high inflation continues, despite the reforms announced by the government. “The government undertook long anticipated measures towards fiscal consolidation by reducing fuel subsidies and selling stakes in public enterprises. Further, steps taken to increase foreign direct investment (FDI) should contribute to both greater capital inflows and, over the long run, higher productivity, particularly in the food supply chain. Importantly, however, for the moment, inflationary pressures, both at wholesale and retail levels, are still strong,” the Reserve Bank of India said in a statement today, keeping the repo rate (or the rate at which it lends to banks) constant at 8%. This despite the fact that there was great pressure on the central bank to cut the repo rate. It is unfair to expect the RBI to make up for the mistakes of the government.

The bottomline is that if the government has to get its act right it needs to reign in its expenditure. I started this piece with eggs let me end it with chickens. As economist Bibek Debroy wrote in the Economic Times “Since 2009, UPA-II has behaved like a headless chicken. It is still headless, but the chicken at least wants to cross the road. We still don’t know whether it will be run over or cross the road and lay an egg.”

And even if eggs are laid, we might still not end up with burnt bhurji rather than omelettes.

(The article originally appeared on www.firstpost.com. http://www.firstpost.com/politics/how-manmohans-omelette-came-out-as-scrambled-egg-458242.html)

(Vivek Kaul is a writer. He can be reached at [email protected])

Fiscal Deficit

Economics made easy

Vivek Kaul

Name of the book: Day to Day Economics

Author: Satish Y Deodhar

Pages: 214

Publisher: Random House India

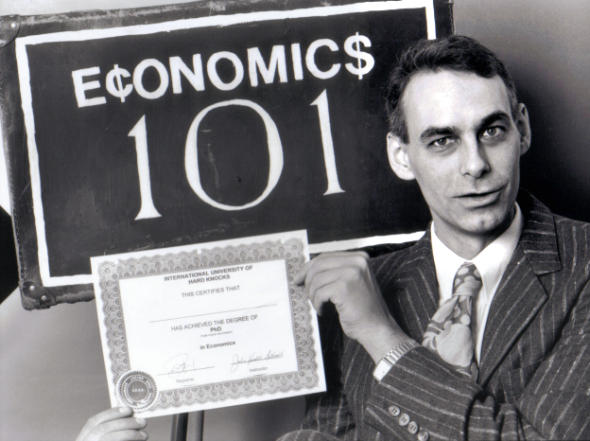

Steve Landsburg wrote The Armchair Economist – Economics and Everyday Life in 1993. The book was the first of its kind and was written in a very simple way to explain the subject of economics to anybody and everybody.

In the just released second edition of the book Landsburg explains his reasons behind writing the book. One day in 1991, he had walked into a medium sized book shop and realised that the shop had around 80 titles on quantum physics and the history of the universe. But it did not have a single book on economics that could be read by even those who did not have an academic background in the subject. This motivated him to write The Armchair Economist and two years later he had a bestseller ready.

The little story tells us a few things about the “dismal science” called economics. Economists over the years have found it very difficult to communicate in a language which everybody can understand. On the flip side people haven’t paid enough attention to the subject even though it impacts them more than other subjects.

But things can only be set right once economists start writing and communicating in a language which everyone can understand. Satish Y Deodhar’s Day to Day Economics attempts to set this situation right. The book explains the economic terms and concepts that get bandied around in newspapers and television channels, in a very simple lucid sort of way, making it accessible to everyone.

What makes the book even better is the fact that Deodhar’s links the economic concepts to political and other events that are happening around us. Too many teachers of economics in the past have taught economics as a theoretical subject full of maths in isolation of what is happening around us. As Deodhar puts it “It…matters whether or not economics is made interesting in the classroom”.

Deodhar, a professor at IIM Ahmedabad, discuses the concept of fiscal deficit and the current state of economic affairs in good detail. Fiscal deficit is the difference between what a government earns and what it spends. For anyone wanting to understand why their equated monthly installments (EMIs) have gone up over the last few years this book is a must read. At the heart of the problem facing the Indian economy is the fact that the government expenditure has gone up at a much faster rate than its revenue. Hence the government has had to borrow more to finance its increased expenditure leaving less on the table for other big borrowers like banks and housing finance companies.

This has meant higher interest rates and higher EMIs. While understanding this will not bring down your EMIs in anyway but you will surely know who is to be blamed for your spiraling EMIs. But more than that you will understand that once a government commits to a certain expenditure, it is very difficult to curtail it. As Deodhar points out “it is difficult to curtail government expenditure once the government is committed to them.” What this obviously means is that your higher EMIs are likely to continue.

The solution as Deodhar rightly points out is collection of more taxes. This can only happen when the Goods and Services Tax, which seeks to replace state and central sales tax, is introduced. Also its time to get rid of the amendment ridden Income Tax Act and replace it with the Direct Taxes Code.

Deodhar explains the concepts of banking and inflation in the same lucid way. That apart a few mistakes seem to have crept in the book. The Foreign Direct Investment allowed in the insurance sector in India is 26% and not 27% as the book points out. Also the book says that banks in India were first nationalized in 1967. That is incorrect. The banks were first nationalized in 1969.

Another point which falls flat is Deodhar’s link between interest rates and the rupee-dollar exchange rate. Deodhar says that when interest rates are high in India, it makes sense for foreigners to lend money in India. When this money comes to India the foreigners have to change their dollars into rupees. This pushes up the demand for rupees and it appreciates in value against the dollar. While theoretically this makes perfect sense, what is happening in India is exactly the opposite. The interest rates in India are high, despite that the rupee has fallen in value against the dollar. This is because India imports most of the oil it consumes. It needs dollars to buy the oil. Hence when the oil companies buy dollars and sell rupees to buy oil, rupees flood the market, leading to its value depreciating against the dollar. At the same time foreigners haven’t been bringing money into India because they are worried about the government’s burgeoning fiscal deficit.

What this clearly tells us is that economics is not a fixed science like physics. Any action can generate different kind of reactions and even stump the best economists. And that is why most economists try and look at various options while explaining things. This lack of clear answers can even frustrate the best of people at times. As the American President Harry Truman once demanded “Give me a one-handed economist. All my economists say, ‘on the one hand…on the other’”.

(The article originally appeared in the Asian Age on September 16, 2012. http://www.asianage.com/books/economics-made-easy-275)

(Vivek Kaul is a Mumbai based writer and can be reached at [email protected])

Even with the diesel price hike, India is staring at a 7% fiscal deficit

Vivek Kaul

The Congress party led United Progressive Alliance(UPA) has been in the habit of shooting messengers who come with bad news. So here is some more bad news.

Almost half way through the financial year 2012-2013 (i.e. the period between April 1, 2012 and March 31, 2013), the fiscal deficit of the government is looking awful to say the least. Fiscal deficit is the difference between what the government earns and what it spends.

When the finance minister presents the annual budget there are a lot of assumptions that go into the projection of the fiscal deficit.

The overall fiscal deficit was projected to be at Rs 5,13,590 crore. The expenditure of the government for the year was expected to be at Rs 14,90,925 crore. In comparison the government expected to earn Rs 9,77,335 crore during the course of the year. The difference between the earnings of the government and its expenditure came to Rs 5,13,590 crore and this is the projected fiscal deficit. Hence, the government was spending 55% (Rs 5,13,590 crore expressed as a percentage of Rs 9,77,335 crore) more than it earned.

The expenditure part of the calculation includes subsidies on oil, fertiliser and food. The subsidy on oil was assumed to be at Rs 43,580 crore. This subsidy was to be used by the government to compensate oil marketing companies like Indian Oil, Bharat Petroleum and Hindustan Petroleum for selling diesel, kerosene and cooking gas, at a loss.

The government has more or less run out of the budgeted oil subsidies. It has already paid Rs 38,500 crore to OMCs, for selling diesel, kerosene and LPG at a loss during the last financial year. This amount was reimbursed only in the current financial year and hence has had to be adjusted against the oil subsidies budgeted for this year. This leaves only around Rs 5,080 crore with the government for compensating the OMCs for the losses this year.

And that’s just small change in comparison to the losses that OMCs are expected to face for selling diesel, kerosene and LPG. The oil minister Jaipal Reddy recently said that if the current situation continues the OMCs will end up with losses amounting to Rs 2,00,000 crore during the course of the year.

As economist Shankar Acharya wrote in the Business Standard on September 13“The real fiscal spoilsport is, of course, subsidies, especially those for diesel, LPG and kerosene, though those on fertiliser and foodgrain are also large. Data circulated by the petroleum ministry indicate under-recoveries by oil marketing companies (OMCs) of Rs 17/litre on diesel, Rs 33/litre on kerosene and Rs 347/cylinder on LPG.”

The OMCs need to be compensated for these losses by the government because if they are not compensated then they will go bankrupt. And if they go bankrupt then you, I and everybody else, won’t be able to buy petrol, diesel, kerosene and LPG, which would basically mean going back to the age of tongas and bullock carts. Clearly no one would want that.

So to deal with expected losses of Rs 2,00,000 crore the government has around Rs 5,080 crore of the budgeted amount remaining. This means that the government would have to come up with around Rs 1,95,000 crore from somewhere.

This is a large amount of money. The government has tried to curtail these losses by increasing the price of diesel by Rs 5 per litre and thus bringing down the loss on sale of diesel to Rs 12 per litre. This move is expected to save the government Rs 19,000 crore which means losses will now amount to Rs 1,76,000crore (Rs 1,95,000crore – Rs 19,000 crore) in total.

Since 2003-2004, the government has had a formula for sharing these losses. The upstream oil companies like ONGC and Oil India Ltd, which produce oil, are forced to share one third of the losses. But there have been instances when the formula has not been followed and the upstream companies have been forced to chip in with more than their fair share. In 2011-2012, the last financial year the government forced the upstream companies to compensate around 40% of the total losses.

If the government follows the same formula this year as well, it would mean that the upstream companies would have to compensate the OMCs to the tune of Rs 70,400crore (40% of Rs 1,76,000 crore). Now that is a huge amount, whether the upstream companies have the capacity to come up with that kind of money remains to be seen. But assuming that they do, it still means that the government would have to come up with Rs 1,05,600 crore (60% of Rs 1,76,000 crore) from somewhere. This would mean that the fiscal deficit would be pushed up to Rs 6,19,190 crore (Rs 5,13,590 crore + Rs 1,05,600 crore). If the upstream companies cannot bear 40% of the total loses the government will have to bear a greater proportion of the total losses, pushing the fiscal deficit up further.

Oil subsidies are not the only subsidies going around. The government is expected to overshoot its food subsidy target of Rs75,000 crore as well. The Economic Times had quoted a food ministry official on June 15, 2012, confirming that the food subsidy target will be overshot, after the government had approved the minimum support price (MSP) of rice to be increased by 16 per cent to Rs 1,250 per quintal to. “The under-provisioning of food subsidy in the current year is at Rs 31,750 crore. Now with increased MSP on paddy(i.e. rice), the total food subsidy deficit at the end of the current year will be about Rs 40,000 crore putting immense pressure on the food subsidy burden of the government,” said a food ministry official,” the Economic Times had reported.

If we add this Rs 40,000 crore to Rs 6,19,190 crore the deficit shoots up to Rs 6,59,190 crore. This is something that Acharya confirms in his column. “A few days back the Controller General of Accounts (CGA, not CAG!) informed us that the central government’s fiscal deficit for the first four months of 2012-13 had already exceeded half of the Budget’s target for the full year,” he writes.

What does this mean is that for the first four months of the year, the government’s fiscal deficit was greater than half of the fiscal deficit for the year. The targeted fiscal deficit for the year was Rs 5,13,590crore. Half of it would equal to Rs 2,56,795 crore. The government has already crossed this in the first four months. At the same rate it would end up with a fiscal deficit of Rs 7,70,385 crore (Rs 2,56,795 crore x 3) by the end of the year. This would work out to 50% more than the projected fiscal deficit of Rs 5,13,590 crore.

It would be preposterous on my part to project a fiscal deficit which is 50% more than the projected deficit. But as I had shown a little earlier a deficit of around Rs 6,60,000 crore is pretty much on the cards.

What does not help is the fact that things aren’t looking too good on the revenue side for the government. As Acharya puts it “More recently, there are ominous, if unsurprising, indications of a significant deceleration in direct tax collections up through August, especially from companies, with gross corporate tax revenues stagnant compared to April-August of the previous financial year. Despite finance ministry reassurances, tax collections for the year could fall significantly below Budget targets because of sluggish economic activity.”

So the government is not going to earn as much as it had expected to through taxes. The government also has set a disinvestment target of Rs30,000 crore. It hopes to earn this money by selling shares of public sector companies. But six months into the financial year there has been no activity on this front.

Taking these factors into account a fiscal deficit of Rs 7,00,000 crore can be expected. Fiscal deficit as we all know is expressed as a proportion of the gross domestic product (GDP). The projected fiscal deficit of Rs 5,13,590 crore works out to 5.1% of the GDP. The GDP in this case is assumed to be at Rs 101,59,884 crore.

With a fiscal deficit of Rs 7,00,000 crore, fiscal deficit as a proportion of GDP works out to 6.9% (Rs 7,00,000 crore expressed as a % of Rs 101,59,884 crore).

The GDP number of Rs 101,59,884 crore is also a projection. The assumption is that the GDP will grow by a nominal rate of 14% over the last financial year’s advance estimate of GDP at Rs 89,121,79 crore. The trouble is that the economy is slowing down and it is highly unlikely to grow at a nominal rate of 14%. The current whole sale price inflation is around 7%. The real rate of growth for the first six months of the calendar year (i.e. the period between January 1, 2012 and June 30, 2012) has been around 5.4%. If we add that to the inflation we are talking of a nominal growth of around 12.5%. At that rate the expected GDP for the year is likely to be around Rs 100,26,201crore (1.125 x Rs 89,121,79 crore).

Hence the fiscal deficit as a percentage of GDP will be around 7% (Rs 700,000 crore expressed as a percentage of Rs 100,26,201crore). A 7% fiscal deficit would give the Prime Minister Manmohan Singh a sense of déjà vu. In his speech as the Finance Minister of India in 1991 he had said “The crisis of the fiscal system is a cause for serious concern. The fiscal deficit of the Central Government…is estimated at more than 8 per cent of GDP in 1990-91, as compared with 6 per cent at the beginning of the 1980s and 4 per cent in the mid-1970s.”

One way out of this mess is to cut the losses due to the sales diesel, kerosene and on LPG. But that would mean a price increase of Rs 12/litre on diesel, Rs 33/litre on kerosene and Rs 347/cylinder on LPG. That of course is not going to happen. Also with the government having to borrow more to meet the increased fiscal deficit, the interest rates will continue to remain high.

India is staring at a huge economic problem. The question is whether the government is ready to recognise it. As Pratap Bhanu Mehta writes in The Indian Express “The central driver of good economics is recognising the problem.” The trouble is that the Congress led UPA government doesn’t want to recognise the problem, let alone tackle it.

(The article originally appeared on www.firstpost.com on September 14,2012. http://www.firstpost.com/economy/why-the-diesel-hike-will-not-even-dent-the-fiscal-deficit-455249.html)

(Vivek Kaul is a writer. He can be reached at [email protected])

How Obama and Manmohan Singh will drive up the price of gold

Vivek Kaul

‘Miss deMaas,’ Van Veeteren decided, ‘if there’s anything I’ve learned in this job, it’s that there are more connections in the world than there are particles in the universe.’

He paused and allowed her green eyes to observe him.

‘The hard bit is finding the right ones,’ he added. – Chief Inspector Van Veeteren in Håkan Nesser’s The Mind’s Eye

I love reading police procedurals, a genre of crime fiction in which murders are investigated by police detectives. These detectives are smart but they are nowhere as smart as Agatha Christie’s Hercule Poirot or Sir Arthur Conan Doyle’s Sherlock Holmes. They look for clues and the right connections, to link them up and figure out who the murderer is.

And unlike Poirot or Holmes they take time to come to their conclusions. Often they are wrong and take time to get back on the right track. But what they don’t stop doing is thinking of connections.

Like Chief Inspector Van Veeteren, a fictional character created by Swedish writer Håkan Nesser, says above “there are more connections in the world than there are particles in the universe… The hard bit is finding the right ones.”

The murder is caught only when the right connections are made.

The same is true about gold as well. There are several connections that are responsible for the recent rapid rise in the price of the yellow metal. And these connections need to continue if the gold rally has to continue.

As I write this, gold is quoting at $1734 per ounce (1 ounce equals 31.1 grams). Gold is traded in dollar terms internationally.

It has given a return of 8.4% since the beginning of August and 5.2% since the beginning of this month in dollar terms. In rupee terms gold has done equally well and crossed an all time high of Rs 32,500 per ten grams.

So what is driving up the price of gold?

The Federal Reserve of United States (the American central bank like the Reserve Bank of India in India) is expected to announce the third round of money printing, technically referred to as quantitative easing (QE). The idea being that with more money in the economy, banks will lend, and consumers and businesses will borrow and spend that money. And this in turn will revive the slow American economy.

Ben Bernanke, the current Chairman of the Federal Reserve, has been resorting to what investment letter writer Gary Dorsch calls “open mouth operations” i.e. dropping hints that QE III is on its way, for a while now. The earlier two rounds of money printing by the Federal Reserve were referred as QE I and QE II. Hence, the expected third round is being referred to as QE III.

At its last meeting held on July 31-August 1, the Federal Open Market Committee (FOMC) led by Bernanke said in a statement “The Committee will closely monitor incoming information on economic and financial developments and will provide additional accommodation as needed to promote a stronger economic recovery and sustained improvement in labor market conditions in a context of price stability.” The phrase to mark here is additional accommodation which is a hint at another round of quantitative easing. Gold has rallied by more than 8% since then.

But that was more than a month back. Ben Bernanke has dropped more hints since then. In a speech titled Monetary Policy since the Onset of the Crisis made at the Federal Reserve Bank of Kansas City Economic Symposium, Jackson Hole, Wyoming, on August 31, 2012, Bernanke, said: “Taking due account of the uncertainties and limits of its policy tools, the Federal Reserve will provide additional policy accommodation as needed to promote a stronger economic recovery and sustained improvement in labor market conditions in a context of price stability.”

Central bank governors are known not to speak in language that everybody can understand. As Alan Greenspan, the Chairman of the Federal Reserve before Bernanke took over once famously said ““If you think you understood what I was saying, you weren’t listening.”

But the phrase to mark in Bernanke’s speech is “additional policy accommodation” which is essentially a euphemism for quantitative easing or more printing of dollars by the Federal Reserve.

The question that crops up here is that FOMC in its August 1 statement more or less said the same thing. Why didn’t that statement attract much interest? And why did Bernanke’s statement at Jackson Hole get everybody excited and has led to the yellow metal rising by more than 5% since the beginning of this month.

The answer lies in what Bernanke said in a speech at the same venue two years back. “We will continue to monitor economic developments closely and to evaluate whether additional monetary easing would be beneficial. In particular, the Committee is prepared to provide additional monetary accommodation through unconventional measures if it proves necessary, especially if the outlook were to deteriorate significantly,” he said.

The two statements have an uncanny similarity to them. In 2010 the phrase used was “additional monetary accommodation”. In 2012, the phrase used became “additional policy accommodation”.

Bernanke’s August 2010 statement was followed by the second round of quantitative easing or QE II as it was better known as. The Federal Reserve pumped in $600billion of new money into the economy by printing it. Drawing from this, the market is expecting that the Federal Reserve will resort to another round of money printing by the time November is here.

Any round of quantitative easing ensures that there are more dollars in the financial system than before. To protect themselves from this debasement, people buy another asset; that is, gold in this case, something which cannot be debased. During earlier days, paper money was backed by gold or silver. When governments printed more paper money than they had precious metal backing it, people simply turned up with their paper at the central bank and demanded it be converted into gold or silver. Now, whenever people see more and more of paper money, the smarter ones simply go out there and buy that gold. Also this lot of investors doesn’t wait for the QE to start. Any hint of QE is enough for them to start buying gold.

But why is the Fed just dropping hints and not doing some real QE?

The past two QEs have had the blessings of the American President Barack Obama. But what has held back Bernanke from printing money again is some direct criticism from Mitt Romney, the Republican candidate against the current President Barack Obama, for the forthcoming Presidential elections.

“I don’t think QE-2 was terribly effective. I think a QE-3 and other Fed stimulus is not going to help this economy…I think that is the wrong way to go. I think it also seeds the kind of potential for inflation down the road that would be harmful to the value of the dollar and harmful to the stability of our nation’s needs,” Romney told Fox News on August 23.

Paul Ryan, Romney’s running mate also echoed his views when he said “Sound money… We want to pursue a sound-money strategy so that we can get back the King Dollar.”

This has held back the Federal Reserve from resorting to QE III because come November and chances are that Bernanke will be working with Romney and Obama. Romney has made clear his views on Bernanke by saying that “I would want to select someone new and someone who shared my economic views.”

So what are the connections?

So gold is rising in dollar terms primarily because the market expects Ben Bernanke to resort to another round of money printing. But at the same time it is important that Barack Obama wins the Presidential elections scheduled on November 6, 2012.

Experts following the US elections have recently started to say that the elections are too close to call. As Minaz Merchant wrote in the Times of India “Obama’s steady 3% lead over Romney has evaporated in recent opinion polls… Ironically, one big demographic slice of America’s electorate could deny Obama a second term as president: white men. Up to an extraordinary 75% of American Caucasian males, the latest opinion polls confirm, are likely to vote against Obama… the Republican ace is the white male who makes up 35% of America’s population. If three out of four white men, cutting across Democratic and Republican party lines, vote for Mitt Romney, he starts with a huge electoral advantage, locking up over 25% of the total electorate.” (You can read the complete piece here)

If gold has to continue to go up it is important that Obama wins. And for that to happen it is important that a major portion of white American men vote for Obama. While Federal Reserve is an independent body, the Chairman is appointed by the President. Also, a combative Fed which goes against the government is rarity. So if Mitt Romney wins the elections on November 6, 2012, it is unlikely that Ben Bernanke will resort to another round of money printing unless Romney changes his mind by then. And that would mean no more rallies gold.

But even all this is not enough

All the connections explained above need to come together to ensure that gold rallies in dollar terms. But gold rallying in dollar terms doesn’t necessarily mean returns in rupee terms as well. For that to happen the Indian rupee has to continue to be weak against the dollar. As I write this one dollar is worth around Rs 55.5. At the same time an ounce of gold is worth $1734. As we know one ounce is worth 31.1grams. Hence, one ounce of gold in rupee terms costs Rs96,237 (Rs 1734 x Rs 55.5). This calculation for the ease of simplicity does not take into account the costs involved in converting currencies or taxes for that matter.

If one dollar was worth Rs 60, then one ounce of gold in rupee terms would have cost around Rs 1.04 lakh. If one dollar was worth Rs 50, then one ounce of gold in rupee terms would have been Rs 86,700. So the moral of the story is that other than the price of gold in dollar terms it is also important what the dollar rupee exchange rate is.

So the ideal situation for the Indian investor to make money by investing in gold is that the price of gold in dollar terms goes up, and at the same time the rupee either continues to be at the current levels against the dollar or depreciates further, and thus spruces up the overall return.

For this to happen Manmohan Singh has to keep screwing the Indian economy and ensure that foreign investors continue to stay away. If foreign investors decide to bring dollars into India then they will have to exchange these dollars for rupees. This will increase the demand for the rupee and ensure that it apprecaits against the dollar. This will bring down the returns that Indian investors can earn on gold. As we saw earlier at Rs60to a dollar one ounce of gold is worth Rs 1.04 lakh, but at Rs 50, it is worth Rs 86,700.

One way of keeping the foreign investors away is to ensure that the fiscal deficit of the Indian government keeps increasing. And that’s precisely what Singh and his government have been doing. At the time the budget was presented in mid March, the fiscal deficit was expected to be at 5.1% of GDP. Now it is expected to cross 6%. As the Times of India recently reported “The government is slowly reconciling to the prospect of ending the year with a fiscal deficit of over 6% of gross domestic project,higher than the 5.1% it has budgeted for, due to its inability to reduce subsidies, especially on fuel.

Sources said that internally there is acknowledgement that the fiscal deficit the difference between spending and tax and non-tax revenue and disinvestment receipts would be much higher than the calculations made by Pranab Mukherjee when he presented the Budget.” (You can read the complete story here).

To conclude

So for gold to continue to rise there are several connections that need to come together. Let me summarise them here:

1. Ben Bernanke needs to keep hinting at QE till November

2. Obama needs to win the American Presidential elections in November

3. For Obama to win the white American male needs to vote for him

4. If Obama wins,Bernanke has to announce and carry out QE III

5. With all this, the rupee needs to maintain its current level against the dollar or depreciate further.

6. And above all this, Manmohan Singh needs to keep thinking of newer ways of pulling the Indian economy down

(The article originally appeared on www.firstpost.com on September 11,2012. http://www.firstpost.com/economy/how-obama-and-manmohan-will-drive-up-the-price-of-gold-450440.html)

(Vivek Kaul is a writer and can be reached at [email protected])

Of 9% economic growth and Manmohan’s pipedreams

Vivek Kaul

Shashi Tharoor before he decided to become a politician was an excellent writer of fiction. It is rather sad that he hasn’t written any fiction since he became a politician. A few lines that he wrote in his book Riot: A Love Story I particularly like. “There is not a thing as the wrong place, or the wrong time. We are where we are at the only time we have. Perhaps it’s where we’re meant to be,” wrote Tharoor.

India’s slowing economic growth is a good case in point of Tharoor’s logic. It is where it is, despite what the politicians who run this country have to say, because that’s where it is meant to be.

The Prime Minister Manmohan Singh in his independence-day speech laid the blame for the slowing economic growth in India on account of problems with the global economy as well as bad monsoons within the country. As he said “You are aware that these days the global economy is passing through a difficult phase. The pace of economic growth has come down in all countries of the world. Our country has also been affected by these adverse external conditions. Also, there have been domestic developments which are hindering our economic growth. Last year our GDP grew by 6.5 percent. This year we hope to do a little better…While doing this, we must also control inflation. This would pose some difficulty because of a bad monsoon this year.”

So basically what Manmohan Singh was saying that I know the economic growth is slowing down, but don’t blame me or my government for it. Singh like most politicians when trying to explain their bad performance has resorted to what psychologists calls the fundamental attribution bias.

As Vivek Dehejia an economics professor at Carleton University in Ottawa, Canada, told me in a recent interview I did for the Daily News and Analysis (DNA) “Fundamentally attribution bias says that we are more likely to attribute to the other person a subjective basis for their behaviour and tend to neglect the situational factors. Looking at our own actions we look more at the situational factors and less at the idiosyncratic individual subjective factors.”

In simple English what this means is that when we are analyzing the performance of others we tend to look at the mistakes that they made rather than the situational factors. On the flip side when we are trying to explain our bad performance we tend to blame the situational factors more than the mistakes that we might have made.

So in Singh’s case he has blamed the global economy and the deficient monsoon for the slowing economic growth. He also blamed his coalition partners. “As far as creating an environment within the country for rapid economic growth is concerned, I believe that we are not being able to achieve this because of a lack of political consensus on many issues,” Singh said.

Each of these reasons highlighted by Singh is a genuine reason but these are not the only reasons because of which economic growth of India is slowing down. A major reason for the slowing down of economic growth is the high interest rates and high inflation that prevails. With interest rates being high it doesn’t make sense for businesses to borrow and expand. It also doesn’t make sense for you and me to take loans and buy homes, cars, motorcycles and other consumer durables.

The question that arises here is that why are banks charging high interest rates on their loans? The primary reason is that they are paying high interest rate on their deposits.

And why are they paying a high interest rate on their deposits? The answer lies in the fact that banks have been giving out more loans than raising deposits. Between December 30, 2011 and July 27, 2012, a period of nearly seven months, banks have given loans worth Rs 4,16,050 crore. During the same period the banks were able to raise deposits worth Rs 3,24,080 crore. This means an incremental credit deposit ratio of a whopping 128.4% i.e. for every Rs 100 raised as deposits, the banks have given out loans of Rs 128.4.

Thus banks have not been able to raise as much deposits as they are giving out loans. The loans are thus being financed out of deposits raised in the past. What this also means is that there is a scarcity of money that can be raised as deposits and hence banks have had to offer higher interest rates than normal to raise this money.

So the question that crops up next is that why there is a scarcity of money that can be raised as deposits? This as I have said more than few times in the past is because the expenditure of the government is much more than its earnings.

The fiscal deficit of the government or the difference between what it earns and what it spends has been going up, over the last few years. For the financial year 2007-2008 the fiscal deficit stood at Rs 1,26,912 crore. It went up to Rs 5,21,980 crore for financial year 2011-2012. In a time frame of five years the fiscal deficit has shot up by nearly 312%. During the same period the income earned by the government has gone up by only 36% to Rs 7,96,740 crore.

This difference is made up for by borrowing. When the borrowing needs of the government go through the roof it obviously leaves very little on the table for the banks and other private institutions to borrow, which in turn means that they have to offer higher interest rates to raise deposits. Once they offer higher interest rates on deposits, they have to charge higher interest rate on loans.

A higher interest rate scenario slows down economic growth as companies borrow less to expand their businesses and individuals also cut down on their loan financed purchases. This impacts businesses and thus slows down economic growth.

The huge increase in fiscal deficit has primarily happened because of the subsidy on food, fertilizer and petroleum. One of the programmes that benefits from the government subsidy is Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA). The scheme guarantees 100 days of work to adults in any rural household. While this is a great short term fix it really is not a long term solution. If creating economic growth was as simple as giving away money to people and asking them to dig holes, every country in the world would have practiced it by now.

As Raghuram Rajan, who is taking over as the next Chief Economic Advisor of the government of India, told me in an interview I did for DNA a couple of years back “The National Rural Employment Guarantee Scheme (NREGS, another name for MGNREGA), if appropriately done it is a short term insurance fix and reduces some of the pressure on the system, which is not a bad thing. But if it comes in the way of the creation of long term capabilities, and if we think NREGS is the answer to the problem of rural stagnation, we have a problem. It’s a short term necessity in some areas. But the longer term fix has to be to open up the rural areas, connect them, education, capacity building, that is the key.”

But the Manmohan Singh led United Progressive Alliance seems to be looking at the employment guarantee scheme as a long term solution rather than a short term fix. This has led to burgeoning wage inflation over the last few years in rural areas.

As Ruchir Sharma writes in Breakout Nations – In Pursuit of the Next Economic Miracles “The wages guaranteed by MGNREGA pushed rural wage inflation up to 15 percent in 2011”.

Also as more money in the hands of rural India chases the same number of goods it has led to increased price inflation as well. Consumer price inflation currently remains over 10%. The most recent wholesale price index inflation number fell to 6.87% for the month of July 2012, from 7.25% in June. But this experts believe is a short term phenomenon and inflation is expected to go up again in the months to come.

As Ruchir Sharma wrote in a column that appeared yesterday in The Times of India “For decades India’s place in the rankings of nations by inflation rates also held steady, somewhere between 78 and 98 out of 180. But over the past couple of years India’s inflation rate is so out of whack that its ranking has fallen to 151. No nation has ever managed to sustain rapid growth for several decades in the face of high inflation. It is no coincidence that India is increasingly an outlier on the fiscal front as well with the combined central and state government deficits now running four times higher than the emerging market average of 2%.” (You can read the complete column here).

So to get economic growth back on track India has to control inflation. The Reserve Bank of India (RBI) has been trying to control inflation by keeping the repo rate, or the rate at which it lends to banks, at a high level. One school of thought is that once the RBI starts cutting the repo rate, interest rates will fall and economic growth will bounce back.

That is specious argument at best. Interest rates are not high because RBI has been keeping the repo rate high. The repo rate at best acts as an indicator. Even if the RBI were to cut the repo rate the question is will it translate into interest rate on loans being cut by banks? I don’t see that happening unless the government clamps down on its borrowing. And that will only happen if it’s able to control the subsidies.

The fiscal deficit for the current financial year 2012-2013 has been estimated at Rs Rs Rs 5,13,590 crore. I wouldn’t be surprised if the number even touches Rs 600,000 crore. The oil subsidy for the year was set at Rs 43,580 crore. This has already been exhausted. Oil prices are on their way up and brent crude as I write this is around $115 per barrel. The government continues to force the oil marketing companies to sell diesel, LPG and kerosene at a loss. The diesel subsidy is likely to continue given that with the bad monsoon farmers are now likely to use diesel generators to pump water to irrigate their fields. With food inflation remaining high the food subsidy is also likely to go up.

The heart of India’s problem is the huge fiscal deficit of the government and its inability to control it. As Sharma points out in Breakout Nations “It was easy enough for India to increase spending in the midst of a global boom, but the spending has continued to rise in the post-crisis period…If the government continues down this path India, may meet the same fate as Brazil in the late 1970s, when excessive government spending set off hyperinflation and crowded out private investment, ending the country’s economic boom.”

These details Manmohan Singh couldn’t have mentioned in his speech. But he tried to project a positive picture by talking about the planning commission laying down measures to ensure a 9% rate of growth. The one measure that the government needs to start with is to cut down the fiscal deficit. And the probability of that happening is as much as my writing having more readers than that of Chetan Bhagat. Hence India’s economic growth is at a level where it is meant to be irrespective for all the explanations that Manmohan Singh gave us and the hope he tried to project in his independence-day speech.

But then you can’t stop people from dreaming in broad daylight. Even Manmohan Singh! As the great Mirza Ghalib who had a couplet for almost every situation in life once said “hui muddat ke ghalib mar gaya par yaad aata hai wo har ek baat par kehna ke yun hota to kya hota?”

(The article originally appeared on www.firstpost.com on August 16,2012. http://www.firstpost.com/economy/of-9-economic-growth-and-manmohans-pipedreams-419371.html)

Vivek Kaul is a writer and can be reached at [email protected]