Vivek Kaul

So P Chidambaram’s at it again, trying to bully the Reserve Bank of India (RBI) to cut interest rates. “In our view, the government and monetary authority must point in the same direction and walk in the same direction. As we take steps on the fiscal side, RBI should take steps on the monetary side,” the Union Finance Minister told the Economic Times.

Economic theory suggests that when interest rates are low, consumers and businesses tend to borrow more. When consumers borrow and spend money businesses benefit. When businesses benefit they tend to expand their operations by borrowing money. And this benefits the entire economy and it grows at a much faster rate.

But then economics is no science and so theory and practice do not always go together. If they did the world we live would be a much better place. As John Kenneth Galbraith points out in The Economics of Innocent Fraud: “If in recession the interest rate is lowered by the central bank, the member banks are counted on to pass the lower rate along to their customers, thus encouraging them to borrow. Producers will thus produce goods and services, buy the plant and machinery they can afford now and from which they can make money, and consumption paid for by cheaper loans will expand..The difficulty is that this highly plausible, wholly agreeable process exists only in well-established economic belief and not in real life… Business firms borrow when they can make money and not because interest rates are low.”

While India is not in a recession exactly, economic growth has slowed down considerably this year. And this has led to businesses not borrowing. As a story in theBusiness Standard points out “At a recent meeting with the Reserve Bank of India (RBI), 10 of the country’s top bankers said companies were still keeping expansion plans on hold, as business growth continued to be slow in an uncertain economic environment. Nine of 10 bankers who attended the meeting admitted their sanctioned loan pipeline was shrinking fast due to tepid demand.”

This is borne out even by RBI data. The incremental credit deposit ratio for scheduled commercial banks between March 30, 2012 and September7, 2012, stood at 14.4%. This meant that for every Rs 100 that bank raised as deposits during this period they only lent out Rs 14.4 as loans. Hence, businesses are not borrowing to expand neither are consumers borrowing to buy flats, cars, motorcycles and consumer durables.

One reason for this lack of borrowing is high interest rates. But just cutting interest rates won’t ensure that the borrowing will pick up. As Galbraith aptly puts it business firms borrow when they can make money. But that doesn’t seem to be the case right now. Take the case of the infrastructure sector which was one of the most hyped sectors in 2007. As Swaminathan Aiyar points out in the Times of India “The government claims India is a global leader in public-private partnerships in infrastructure. The private sector financed 36% of infrastructure in the 11th Plan (2007-12 ),and is expected to finance fully 50% in the 12th Plan. This is now a pie in the sky. Corporations that charged into this sector have suffered heavy losses. They expected a gold mine, but found only quicksand. They have been hit by financially disastrous time and cost overruns.”

Clearly these firms are not in a state to borrow. Several other business sectors are in a mess. Airlines are not going anywhere. The big Indian companies that got into organised retail have lost a lot of money. The telecom sector is bleeding. So just because interest rates are low it doesn’t automatically follow that businesses will borrow money.

“If you take a poll of the top 100 companies in the country, you will find them saying nothing has changed despite the reforms. Confidence will return only if things start happening on the ground,” a Chief Executive of a leading foreign bank in India was quoted as saying in the Business Standard.

Confidence on the ground can only come back once businesses start feeling that this business is committed to genuine economic reform, there is lesser corruption, more transparency, so and so forth. These things cannot happen overnight.

Consumers are also feeling the heat with salary increments having been low this year and the consumer price inflation remaining higher than 10%. Borrowing doesn’t exactly make sense in an environment like this, when just trying to make ends meet has become more and more difficult.

Given these reasons why has Chidambaram been after the RBI to try and get it to cut interest rates? The thing is that the finance minister is not so concerned about consumers and businesses, but what he is concerned about is the stock market.

With interest rates on fixed income investments like bank fixed deposits, corporate fixed deposits, debentures, etc, being close to 10%, there is very little incentive for the Indian investor to channelise his money into the stock market.

Since the beginning of the year the domestic institutional investors have taken out Rs 38,000.5 crore from the stock market. If the RBI does cut interest rates as Chidambaram wants it to, then investing in fixed income investments will become less lucrative and this might just get Indian investors interested in the stock market.

The lucky thing is that even though Indian investors have been selling out of the stock market, the foreign investors have been buying. Since the beginning of the year the foreign institutional investors have bought stocks worth Rs 72,065.2 crore. This has ensured that stock market has not fallen despite the Indian investors selling out.

If the RBI does cut interest rates and that leads Indian investors getting back into the stock market there might be several other positive things that can happen. If Indian investors turn net buyers and the stock market goes up, more foreign money will come in. This will push up the stock market even further up.

The other thing that will happen with the foreign money coming in is that the rupee will appreciate against the dollar. When foreigners bring dollars into India they have to sell those dollars and buy rupees. This increases the demand for the rupee and it gains value against the dollar.

An appreciating rupee will also spruce up returns for foreign investors. Let us say a foreign investor gets $1million to invest in Indian stocks when one dollar is worth Rs 55. He converts the dollars into rupees and invests Rs 5.5 crore ($1million x Rs 55) into the Indian market. He invests for a period of one year and makes a return of 10%. His investment is now worth Rs 6.05 crore. One dollar is now worth Rs 50. When he converts the investors ends up with $1.21million or a return of 21% in dollar terms. An appreciating rupee thus spruces up his returns. This prospect of making more money in dollar terms is likely to get more and more foreign investors into India, which will lead to the rupee appreciating further. So the cycle will feeds on itself.

In the month of September 2012, foreign investors have bought stocks worth Rs 20,807.8 crore. Correspondingly, the rupee has gained in value against the dollar. On September 1, 2012, one dollar was worth Rs 55.42. Currently it quotes at around Rs 52.8. This means that the rupee has appreciated against the dollar by 4.72%.

An immediate impact of the appreciating rupee is that it brings down the oil bill. Oil is sold internationally in dollars. Let us say the Indian basket of crude oil is selling at $108 per barrel (one barrel equals 159 litres). If one dollar is worth Rs 55.4 then India has to pay Rs 5983.2 for a barrel of oil. If one dollar is worth Rs 52.8, then India has to pay Rs 5702.4 per barrel. So as the rupee appreciates the oil bill comes down.

The oil marketing companies (OMCs) sell diesel, kerosene and cooking gas at a price which is lower than the cost price and thus incur huge losses. The government compensates the OMCs for these losses to prevent them from going bankrupt. This money is provided out of the annual budget of the government under the oil subsidy account. But as the rupee appreciates and the losses come down, the oil subsidy also comes down. This means that the expenditure of the government comes down as well, thus lowering the fiscal deficit. Fiscal deficit is the difference between what the government earns and what it spends.

This is how a rising stock market may lead to a lower fiscal deficit. But that’s just one part of the argument. A rising stock market will also allow the government to sell some of the shares that it owns in public sector enterprises to the general public. The targeted disinvestment for the year is Rs 30,000 crore. While that can be easily met the government has to exceed this target given that the government is unlikely to meet the fiscal deficit target of 5.1% of GDP as its subsidy bill keeps going up. The Kelkar Committee recently estimated that the fiscal deficit level can even reach 6.1% of the GDP.

For the government to exceed this target the stock markets need to continue to do well. It is a well known fact people buy stocks only when the stock markets have rallied for a while. As Akash Prakash writes in the Business Standard “The finance minister will have to do a lot more than raise Rs 40,000 crore from spectrum and Rs 30,000 crore from divestment. We will need to see movement on selling the SUUTI (Specified Undertaking of UTI) stakes, strategic assets like Hindustan Zinc, land with companies like VSNL, coal block auctions, etc. To enable the government to raise resources of the required magnitude, the capital markets have to remain healthy, both to absorb equity issuance and to enable companies to raise enough debt resources to participate in these asset auctions.”

Given this the stock market has a very important role to play in the scheme of things. Controlling the burgeoning fiscal deficit remains the top priority for the government. But it is easier said than done. “Given the difficulty in getting the coalition to accept the diesel hike and LPG-targeting measures, there are limitations as to how much the current subsidies and revenue expenditure can be compressed. We can see some further measures on fuel price hikes and maybe some movement on a nutrient-based subsidy on urea; but with elections only 15-18 months away, there are serious political costs to any subsidy cuts,” points out Prakash.

Over and above this with elections around the corner the government is also likely to announce more freebies. Money to finance this also needs to come from somewhere. As Prakash writes “There is also intense pressure on the government to roll out more freebies through the right to food, free medicines and so on. If expenditure compression is intensely difficult in the run-up to an election cycle, higher revenue is the only way to control the fiscal deficit.”

For the government to raise a higher revenue it is very important that more and more money keeps coming into the stock market. For this to happen interest rates need to fall. And that is something that D Subbarao the governor of RBI controls and not Chidambaram.

The article originally appeared on www.firstpost.com on October 1, 2012. http://www.firstpost.com/economy/why-fm-is-tickling-the-markets-its-his-only-chance-474908.html

Vivek Kaul is a writer. He can be reached at [email protected]

Fiscal Deficit

‘India grows at night while the government sleeps’

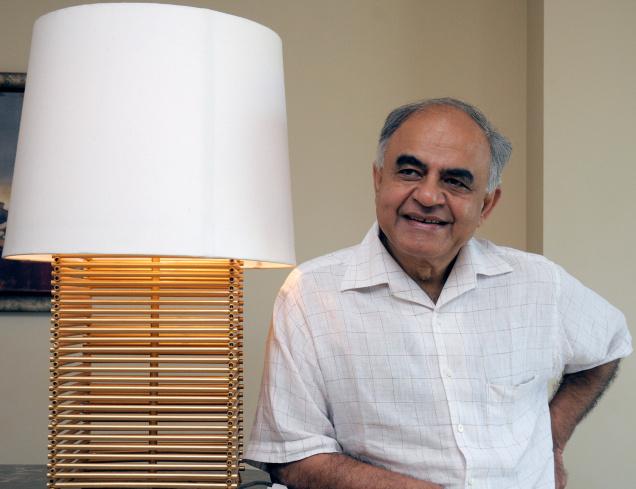

Gurcharan Das is an author and a public intellectual. He is the author of The Difficulty of Being Good: On the Subtle Art of Dharma which interrogates the epic, Mahabharata. His international bestseller, India Unbound, is a narrative account of India from Independence to the turn of the century. His latest book India Grows At Night – A Liberal Case For a Strong State (Penguin Allen Lane)has just come out. He was also formerly the CEO of Proctor & Gamble India. In this interview he speaks to Vivek Kaul on why Gurgaon made it and Faridabad didn’t, how the actions of Indira Gandhi are still hurting us, why he cannot vote for anyone in the 2014 Lok Sabha elections and why democracy has to start in your own backyard if it has to succeed.

Gurcharan Das is an author and a public intellectual. He is the author of The Difficulty of Being Good: On the Subtle Art of Dharma which interrogates the epic, Mahabharata. His international bestseller, India Unbound, is a narrative account of India from Independence to the turn of the century. His latest book India Grows At Night – A Liberal Case For a Strong State (Penguin Allen Lane)has just come out. He was also formerly the CEO of Proctor & Gamble India. In this interview he speaks to Vivek Kaul on why Gurgaon made it and Faridabad didn’t, how the actions of Indira Gandhi are still hurting us, why he cannot vote for anyone in the 2014 Lok Sabha elections and why democracy has to start in your own backyard if it has to succeed.

Excerpts:

What do you mean when you say India grows at night?

Essentially the full expression is India grows at night while the government sleeps. I thought that would be insulting to put in the title. So I left it at India Grows at Night. And I subtitled it a liberal case for a strong state. The basic idea is that India has risen from below. We are a bottom up success, unlike China which is a top down success. And because our success is from below, it is more heroic and also more enduring. But we should also grow during the day meaning we should reform our institutions of the state, so that they contribute much more to the growth of the country. We cannot have a story of private success and public failure in India.

Could you explain this through an example?

I start chapter one of the book with a contrast between Faridabad and Gurgaon. If you were living in Delhi in the seventies and eighties, the big story, the place you were going to invest was Faridabad. It had an active municipality. The state government wanted to make it into a showcase for the future. It had a direct line to Delhi. It had host of industries coming in. It had a very rich agriculture. It was the success story. So if you were an investor you would have put your money in Faridabad.

And what about Gurgaon?

In contrast there was this village called Gurgaon not connected to Delhi. No industries. It had rocky soil, so the agriculture was poor. Even the goats did not want to go there. So it was wilderness. And yet 25 years later look at the story. Gurgaon has become an engine of international growth. It is called the millennium city. It has thirty two million square feet of commercial space. It is the residence of all the major multinationals that have come into the country. It has seven golf courses. Every brand name, from BMW to Mercedes Benz, they are all there. And look at Faridabad (laughs)…

Faridabad missed the bus?

Faridabad still hasn’t got the first wave of modernisation that came to India after 1991. It escaped Faridabad. Only now it’s kind of waking up. And Gurgaon did not have a municipality until 2009. This contrast really is in a way the story of India grows at night. And the fact is that the people of Gurgaon deserve a lot of credit because they didn’t sit and wait around. If the police didn’t show up they had private security guards. They even dug bore-wells to make up for the water. The state electricity board did not provide electricity, so they had generators and backup. They used couriers instead of the Post Office. Basically they rose on their own.

So what is the point you are trying to make?

My point is that neither Faridabad nor Gurgaon is India’s model. Faridabad is a model where you have an excessive bureaucracy. Why did Faridabad not succeed? Because the politician and bureaucrats tried to squeeze everything out in the form of licenses. And Gurgaon’s disadvantage turned out to be its advantage. It had no government. So there was nobody to bribe. But at the end of the day Gurgaon would be better off, people would have happier if they had good sanitation, if they had a working transportation system, they had good roads, parks, power etc.

All that is missing…

All the things that you take for granted that you would get in a city, you shouldn’t have to provide them for yourself. This is the point. Neither model is right. And we need to reform the institutions of our state. And we need to create what I call a strong liberal state.

What’s a strong liberal state?

A strong liberal state has three pillars. One an executive that is not paralysed like Delhi is right now, where you have push and drag to get any action done. Second that action of the executive is bounded by the rule of law and third that action is accountable to the people. When I mean a strong state? I am not talking about Soviet Russia or Maoist China. I am not even talking about a benign authoritarian state like Singapore which is very tempting because it has got such high levels of governance. I am talking about classical liberal state the same kind of state that our founding fathers had in mind or the American founding fathers had in mind when they thought about the state. And so that is not easy to achieve.

Why do you say that?

It is not easy to achieve because some elements in these three pillars fight with each other. In other words you have an excessive drive for accountability then the executive gets weakened. I mean right now the Anna Hazare movement has so scared the bureaucrats that they won’t put a signature on a piece of paper. The Anna Hazare movement is a good thing because it awakened the middle class but it also weakened the executive. So, today more important than even economic reforms are institutional reforms i.e. the reform of the bureaucracy. If a person is promoted after twenty years regardless of his performance there are repercussions. If it doesn’t matter whether he is a rascal or outstanding, and both are treated the same, you won’t get high performance. You will get a demoralised bureaucracy. Those are the kind of reforms we need.

What are other such reforms?

Take the case of the judiciary, why should it take us 12 years to get a case settled when it takes two or three years anywhere else? You go to a police station to register an FIR, do you think they will do it? Either you have to bribe somebody or lagao some influence. You have this rising India amidst a very very ineffective state.

One of the things you write about in your book is the fact that India got democracy before it got capitalism. World over it’s been the other way around. How has that impacted our evolution as a country?

That also explains some of our problems. By getting democracy before capitalism, you had a populist wave. The politicians when they thought about going to elections started realising ke bhai we will tell people that I’ll give you four rupee kilo rice and get elected. In Punjab the politicians said we will give free electricity to the farmers and got elected. So you killed your finances through this populism. The states which did this really went bankrupt. Punjab and Andhra Pradesh which did these two things couldn’t pay their salaries to their bureaucrats.

And this started with Nehru’s socialism?

Nehru’s socialism created the illusion of a limitless society, that the state would do everything. Jo kuch hai, which we used to do for ourselves, through our families etc, we now expected the state to do. That was the message given by the socialists. The fact is that the state did not have the capacity. In the courts judges knew their jobs. It was a good judiciary. Even the police was very good but suddenly you expanded the mandate so that half the cases today are government cases. You haven’t been paid a refund. Or the government is taking your land or something and so you go to court. So the guilty in many cases is the state.

What you are suggesting is that the mandate of the state was expanded so much that it couldn’t cope with it?

And they did not expand the capacity. Suddenly you needed a tenfold increase in judges and a tenfold increase in bureaucrats. This is because the jobs you expected this people to do were so much greater. And you told people, especially workers and government servants, that you have rights. So a school teacher suddenly realised that he did not have to attend school, he could get away with it. The person who was his boss or her boss was too scared because of the union of the teachers. So one out of four teachers is absent from our schools. And nothing happens to that person. I am answering your question about how embracing democracy before capitalism hurt us. We became more aware of our rights. We tried to distribute the pie before the pie was baked. Before the chapati was created we started dividing it.

In fact there is a saying in Punjabi ke pind vasiya nahi te mangte pehle aa gaye (the village is still being built and the beggars have already arrived)…

Bilkul. Perfect. That’s an even a better saying. This has been one of the problems. In 1991 we did start building the economy base to support a democracy like ours. But these people fettered away some of the gains. Just see how much subsidy is being given on petroleum products. It is around Rs 1,80,000 crore. I mean you could transform your school system with that kind of money.

And the health system…

Yes even the health system.

How much do you think the socialism of Nehru and Indira Gandhi is holding us back?

The damage that Indira Gandhi did was far greater. Her license raj combined with the mai baap sarkar, this double whammy gave the illusion to the people that the state would do everything. Nehru had never talked about a mai baap sarkar. The second was the damage she did to our political institutions. We owe Nehru a great debt because he built those institutions. Our modern political democracy we owe it to him. But she did a lot of damage to those institutions. Could you elaborate on that little?

During the period she was the Prime Minister, I think she dismissed fifty nine elected governments in states. Now we hardly hear of this. This is partly a reaction to what she had done. She tried to change India’s culture and change our political system. A lot has been written about the emergency and so on. But the enduring damage we don’t realise. Before her, Chief Ministers were a little afraid when a secretary said no sir you can’t do this. And if you tried to do it, the secretary wouldn’t bend very often. Now they just transfer. Look at what Mayawati did. Also after Indira Gandhi the police became a handmaiden of the executive. The police lost its independence. Even the judiciary was damaged. She wanted committed judges. Fortunately the Supreme Court did not succumb to that rot.

“It is tempting to compare crisis-ridden Hastinapur with today’s flailing Indian state,” you write. Could you explain that in some detail?

Before this I wrote this book called The Difficulty of Being Good. I interrogated the Mahabharata in a modern contemporary way. And I realised that the Mahabharata is us, still. The great scholar Sukthankar, the editor of the critical edition of the Mahabharata had once said that the Mahabharata is us. And I had always wondered what he had meant. I realised reading the book that really it’s a story of India. And why I preferred the Mahabharata to the Ramayana is because in the Ramayana, the hero is perfect. The brother of the hero is perfect. The wife of the hero is perfect. Even the villain is perfect. Luckily I had done Sanskrit in College and so I went back to my roots. I went to study in Chicago.

And what did you realise after studying the Mahabharata?

Essentially the Mahabharata is about the corruption of the kshatriya institutions of that time. The way the rulers, the nobles behaved, it clearly upset the author of the Mahabharata or we should say authors, because it was continuously evolved over 400-500years. They were very upset and enraged as today young Indians are enraged by the government. They were enraged by the institutions of these kshatriyas. The sort of the big chested behaviour. The idea that you went to heaven if you died fighting on the battle field. That sort of notion. So most people think Mahabharata is about war, but actually it’s an anti war epic.

So what is the point you are trying to make?

In Mahabharata, Hastinapur is the capital of the kingdom of the Kauravas. The Pandavas have created a new capital at Indraprastha. The point is crisis ridden Hastinapur is somewhat like our crisis ridden institutions of today. People were impatient and they were enraged by what was going on and so they had to wage a war at Kurushetra. And I just hope that we don’t have to do that. We can reform the institutions before we reach that point. That’s the comparison to Kurushetra and Hastinapur that I spoke about.

You were a socialist once?

I was a socialist like all of us when we were in the 20s and 30s. But then we could see that Nehru’s path was leading us to a dead end. Certainly a part of India Unbound is a story of the personal humiliations that I experienced, and on top of that Indira Gandhi’s failures really converted me. When the reforms came in 1991 I had become a libertarian. I really celebrated the reforms. For me that was Diwali and so I began to believe that the story of India rising without the state was a sustainable story. And I began to believe that this was a heroic thing and a laissez faire state was the best state. Back then, in my view the state was a second order phenomenon. Now writing this book partly and looking back over twenty years, I have concluded that state is a first order phenomenon. So I have gone from being a socialist to a libertarian to what I would go back and say is a classical liberal, who really doesn’t believe that laissez faire is the answer, and who does believe that you need the state.

Can you elaborate on that?

You need a limited state and not a minimalist state as Nozick(Robert Nozick, an American political philosopher) would have said. But that limited state must perform. So I have come to realise that the success after 1991 has partly been because there were regulators in those sectors, which rose. The election commissioner, the RBI, the Sebi, these have all contributed. Or even the first TRAI(Telecom Regulatory Authority of India, the telecom regulator) under Justice Sodhi and Zutshi. That first TRAI sent the right signals. If we had left it to the Department of Telecom (DOT) and did not have any regulator things might have been different. DOT wanted to crush the new private companies. So what I am saying is that you need good regulators. You need government as a good umpire. You don’t need government to own Air India. But you need a good civil aviation regulator who will ensure a level playing field for everyone in the market.

You explain in some depth in your book as to why Indian political parties treat voters as victims. One can see that happening all the time and everywhere…

And it also explains why I cannot vote for anybody in 2014. Really as an Indian citizen I have been thinking who will I vote for? Every party treats voters as a victim. They are all parties of grievance. We don’t realise that one third of India is now middle class. This new middle class are tigers. They have just made it. They don’t want to be reminded that they are victims. They are looking for the state to further their rise. And they are looking for good roads, good schools and these things.

But nobody talks about development in India…

Yeah. BJP if you scratch them you know they are talking about 1000 years of Muslim oppression. Congress says you are victim of globalisation and liberalisation. So we will give you free power, free this and free that, NREGA etc. Dalit parties say you are a victim of oppression. OBC parties say you are a victim of upper caste oppression. Nobody is talking about the reform of the institution. Even the Anna Hazare movement was talking about only one Lokpal, which is fine, but it had to be couched in a bigger story.

You critique the Anna movement by saying that they have further undermined politicians and political life. Could you explain that in detail?

They have undermined the politics and political life. It is very easy to do that. When you attack politicians then you are also unwittingly attacking the institution of elections. The good thing is that it has put a fear in the minds of politicians. Whether the Anna Hazare movement fails or succeeds is no longer important. What is important is the legacy that it has woken up the middle class. That won’t go away easily. The question then for a young person today is that the Anna movement may have gone, but what can I do? The answer is start with your neighbourhood. Start with your ward and see what can be done. And that is the local democracy I am talking about. That’s where politics begins and that’s where habits of the heart created. I am so in favour of grass-root democracy, the fact that we should put the power downwards. Also even in the rhetoric of the Anna Hazare movement they talked about the gram sabha, the mohalla sabha, that’s where we get the habits of the heart.

What about Arvind Kejriwal’s decision to enter politics? How do you view that?

Before I get to that let me discuss something that I talk about in my book. In this book I hope for a formation of a new political party along the lines of the erstwhile Swatantra Party. But the agenda of this party is not just economic reform but institutional reform. At the Delhi launch of my book Arivnd Kerjiwal was there. TN Ninan, Chairman of the Business Standard newspaper,was moderating the discussion and he said since both of you are advocating a political party, why don’t you join hands. I said, I admire Kejriwal, but he has got all kinds of crazy people around him, who still think that reforms were a bad India. Also, they never talk about institutional reform. So I am not sure that we could be together. But I said were we would be together is that both of us are tapping into the new middle class, which is impatient, confident, assured and which wants to get rid of corruption. But I feel that we need the hard work of institutional reforms and that street protest is not the answer. I also said I am so glad that Kejriwal is now looking at politics because that is the right route to go.

One of the things that one frequently comes across in your book is that you are hopeful that the politics of India will change in the next few years as more and more people become middle class.

Yes.

But it doesn’t look like…

It doesn’t look like because politics has been left behind. But now they are realising. They have been shaken up because so many of them (the politicians) have gone to jail. Even the language is a little more cautious now.

So you see the kind of chaos that prevails right now will go away?

It is only out of chaos that something happens. As Nietzsche(Friedrich Wilhelm Nietzsche, a German philosopher) said that it is the chaos in the heart that gives birth to a dancing star. I see things positively even though we have been a weak state. But as they say, history is not destiny.

“The trickling down of power has made India more difficult to rule,” you write. Could you explain that in the context of the politics that is currently playing out?

It has made India more difficult to govern. But it remains a very important development because I am in favour of federalism. The best thing about FDI in multi brand retailing is that they have given the states the freedom to decide whether they want foreign investment or not. So imagine an FDI decision is now in the hands of the state. And I think that is wonderful because each state is like a country in India. The state of UP has 180 million people and I have no problem is with the trickling down of power. My problem is that we should be able to have an effective executive at the centre. Today we have a very weak Prime Minister. We need a stronger person in the role. We don’t want an Indira Gandhi, but we want a strong person who can be an institutional reformer.

You hope for the rise of a free market based party like the erstwhile Swatantra Party(a party formed by C Rajagopalachari and NG Ranga in 1959 to oppose the socialist policies of Nehru). Do you see really see that happening?

You have to be lucky to some extent and hope to get a young leader. I don’t know who it will be. But there will be somebody in their thirties and forties. Then the country will rally behind them. The way they rallied behind the Kejriwal, Anna Hazare movement. In one sense the last thing India needs is a another political party. But I also see that I cannot vote for any political party. I see that there is a wing of the Congress which does not like this free power and that entitlement culture and the corruption that is being bred in the Congress. There are people even in the BJP who have faith in the past, but they are not anti-Muslim necessarily. So I think they will come together for a secular political liberal party. Similarly there are people in the regional parties. And this is a good time for a liberal party. Swatantra Party was at the wrong time. They were too early. They were ahead of their time. So if we are lucky we will throw up a leader, but you can’t depend on that. But the hopeful thing is the rise of the middle class which will make the politics change.

(The interview originally appeared on www.firstpost.com. http://www.firstpost.com/india/how-india-grows-at-night-while-the-government-sleeps-469035.html)

Vivek Kaul is a writer. He can be reached at [email protected]

The Singh Talkies

Vivek Kaul

One of my favourite Hollywood comedies is Mel Brooks’ Silent Movie made in 1976. As its name suggests, the film had no dialogue and the only audible word in the movie is spoken by Marcel Marceau, when he utters the word “No!” Rather ironically Marceau was one of the most famous mime artists of the era.

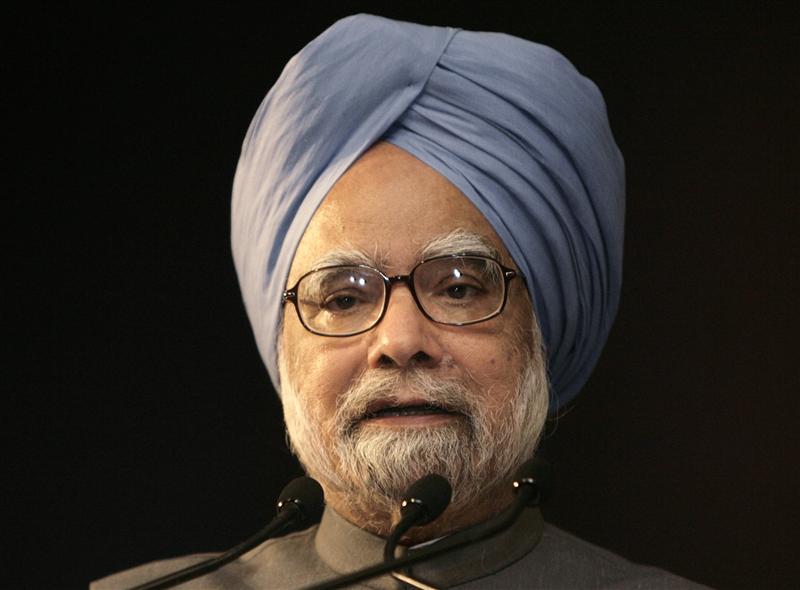

The Congress party led UPA in the last few years has been behaving in the opposite way.In the Congress movie every leader other than Prime Minister Manmohan Singh, the man at the top, had a dialogue. Singh chose to keep quiet rarely telling us what was going on inside his head, as his government moved from one scam to another.

But over the last two weeks he has suddenly found his voice, initiated a wave of reforms, from increasing the price of diesel by Rs 5 per litre to allowing foreign direct investment in the retail sector. “It will take courage and some risks but it should be our endeavour to ensure that it succeeds. The country deserves no less,” Singh said after the announcements were made.

He even addressed the nation and explained the rationale behind the decisions. The media went to town saying that Manmohan has got his mojo back. But the question is what has got our silent Prime Minister talking?

When Pranab Mukherjee presented the budget earlier this year he had projected a fiscal deficit of Rs 5,13,590 crore or 5.1% of the gross domestic product(GDP). Fiscal deficit is the difference between what the government earns and what it spends.

The projected fiscal deficit has gone all awry primarily because the price of oil has continued to remain high, despite a slowdown in the global economy. Currently, the price of the Indian basket of crude oil is at around $114.4 per barrel.

This wouldn’t have been a problem if the diesel, kerosene and cooking gas, would have been sold at their market price. But the Indian government hasn’t allowed that to happen over the years and has protected the consumers against the price rise. This means that the oil marketing companies (OMCs) Indian Oil, Bharat Petroleum and Hindustan Petroleum have had to sell diesel, kerosene and cooking gas at a loss.

The government needs to compensate these companies from the losses they incur, so that they don’t go bankrupt. These losses were close to touching Rs 1,90,000 crore, when the government decided to increase the price of diesel by Rs 5 per litre. Even after this increase the OMCs will lose over Rs 1,00,000 crore just on the sale of diesel this year. The total loss on diesel, kerosene and cooking gas is now estimated to be at Rs 1,67,000 crore. The OMCs are also losing around Rs 6 per litre on selling petrol, but the government doesn’t compensate them for this.

The government hadn’t budgeted for such huge losses on the oil front in the budget. The budgeted amount was a miniscule Rs 43,580 crore. Of this nearly Rs 38,500 crore was used to compensate the OMCs for losses made during the course of the lost financial year, leaving a little over Rs 5,000 crore to meet the losses for the current financial year.

The subsidies allocated for food and fertiliser are also likely to be not enough. In fact as per the Controller General of Accounts the fiscal deficit during the first four months of the year has already crossed half of the budgeted fiscal deficit of Rs 5,13,590 crore. This was a really worrying situation. More than that with tensions flaring up again in various countries in the Middle East, it is unlikely that the price of oil will come down in a hurry.

Given these reasons if the government had carried on in its current state there was a danger of the fiscal deficit crossing Rs 7,00,000 crore or 7% of the GDP. This is a situation which India has never had to face since the country first initiated and embraced economic reforms in July 1991. The fiscal deficit for the year 1990-1991 had stood at 8% of the GDP.

Reforms like allowing foreign investment in multi brand retailing will have an impact on economic growth over a very long period of time, if at all they do. Allowing foreign investors to pick up 49% stake in domestic airlines will also not have any immediate impact. But what is more important is the signals that these reforms send out to the market i.e. policy logjam that was holding economic growth back is over and the government is now in the mood for reforms.

As a result the rupee has appreciated against the dollar. One dollar was worth Rs 55.4 on September 14. Since then it has gained 3% to Rs 53.8. This will help in bringing the oil bill down. Oil is sold internationally in dollars. When one barrel costs $115 and one dollar is worth Rs 55.4, India pays Rs 6,371 per barrel. If one dollar is worth Rs 53.8, then India pays a lower Rs 6,187 per barrel. So an appreciating rupee brings down the oil bill, which in turn pushes down the fiscal deficit of the government.

The thirty share BSE Sensex has rallied by 2.9% to 18,542.3 points, from its close on September 13 to September 17. Nevertheless, even after these moves the actual fiscal deficit of the government will be substantially higher than the targeted Rs 5,13,590 crore. To bring that down the government needs to come up with more reforms so that the rupee continues to appreciate against the dollar and brings down the oil subsidy bill. The market rally also needs to continue, so that the government meets its disinvestment target of Rs 30,000 crore for the year. And on top of all this the government also needs to reign in the oil subsidy by gradually increasing prices of petrol, diesel, kerosene and cooking gas. Unless this happens, the government will continue to borrow more and this will keep interest rates high. Interest rates need to come down if businesses and consumers are to start borrowing again. This is necessary to revive economic growth, which has slowed down considerably.

If all this wasn’t enough we also need to hope that a certain Mrs G and Master G need to continue to understand that good economics also means good politics. If they switch off anytime now, Manmohan Singh is likely to go quiet again.

(A slightly different version of the article with a different headline appeared in the Asian Age/Deccan Chronicle on September 26, 2012. http://www.deccanchronicle.com/editorial/dc-comment/good-economics-good-politics-too-426)

(Vivek Kaul is a Mumbai based writer. He can be reached at [email protected])

Sonianomics will put India on the path to disaster

Vivek Kaul

Vivek Kaul

Sonia Gandhi must be having the last laugh, at least when it comes to economic reforms and their salability among Indian politicians. “Maine kaha tha, Mamata nahi manegi(I had told you Mamata will not agree),” she must be telling the Prime Minister Manmohan Singh these days. “Par aap zidd par add gaye(But you became rather obstinate about the entire thing),” she must have added.

Whether this government survives or not remains to be seen but economic reforms will now be put on the backburner, that’s for sure. Also, the Congress party led United Progressive Alliance(UPA) will start preparing for elections (early or not that doesn’t really matter). And given that Sonia Gandhi’s form of “giveaway everything for free” economics will come to the forefront again now.

The various Congress led governments, since India attained independence from the British in 1947, have always followed this form of economics. As Sunil Khilnani writes in The Idea of India “The state was enlarged, its ambitions inflated, and it was transformed from a distant, alien object into one that aspired to infiltrate the everyday lives of Indians, proclaiming itself responsible for everything they could desire: jobs, ration cards, educational places, security, cultural recognition.”

When someone is responsible for everything, the way it usually turns out is that he is not responsible for anything. A major reason for the economic and social mess that India is in today is because of the various Congress led government trying to be responsible for everything.

This is going to increase in the days to come with Sonia Gandhi’s pet projects of the right to food and universal health insurance being initiated. It need not be said that the projects will help spruce up the chances of the Congress party in the next Lok Sabha election.

These are populist giveaways which have existed all through history. As Gurucharan Das writes in his new book India Grows at Night “Populist giveaways have always been a great temptation. Roman politicians devised a plan in 140BCE to win votes of the poor by offering cheap food and entertainment – they called it ‘bread and circuses.’”

But even with that, the idea of right to food and health for all, are very noble measures and difficult to oppose for anybody who has his heart in the right place. Nevertheless, the larger question is where will the government get the money to finance these schemes from? As P J O’Rourke, an American political satirist, writes in Don’t Vote! It Just Encourages the Bastards “We’re giving until it hurts. That is, we’re giving until it hurts other people, since we’re giving more than we’ve got.”

The fiscal deficit target of Rs 5,13,590 crore or 5.1% of the gross domestic product(GDP), for 2012-2013 will be breached by a huge amount. Fiscal deficit is the difference between what the government earns and what it spends. This will happen primarily because of the subsidy bill going through the roof (as the following table shows).

| Subsides | Apr-July 2012 | Apr-July 2011 | Increase over last year | budget estimate | % of budget estimate |

| Oil | 28,630 | 20760 | 37.91% | 43580 | 65.70% |

| Fertilizer | 32220 | 19250 | 67.38% | 60974 | 52.84% |

| Food | 46400 | 37540 | 23.60% | 75000 | 61.87% |

| Source: Controller General of Accounts, Deutsche Bank. In rupees crore | |||||

As is clear from the table the subsidies on oil, fertilizer and food for the first four months of this have been much higher than the previous year. Also four months into the year the subsidies are already more than 50% of the amount targeted for the year. Like the food subsidy for the year has been targeted at Rs 75,000 crore. During the first four months subsidies worth Rs 46,400 crore have already been offered. Unless the government controls this, the spending over the remaining eight months of the year will definitely cross the targeted Rs 75,000 crore. This will increase the overall spending of the government and thus the overall fiscal deficit, which is in the process of reaching dangerous proportions.

As I have stated in the past at the current rate the fiscal deficit of the Indian government could easily surpass Rs 700,000 crore or 7% of the GDP. (you can read the complete argument here). Now add the right to food and universal health insurance to it and just imagine where the fiscal deficit will go. And that means the scenario of high interest rates and high inflation will continue in the days to come.

But that’s just one part of the argument. Those in favour of subsidies and a welfare state have often given the example of the greatest western democracies (particularly in Europe) which have run huge welfare states with the government taking care of its citizens from cradle to grave. An extreme example of such a welfare state is Greece.

Greece categorises certain jobs as arduous. For such jobs the retirement age is 55 for men and 50 for women. “As this is also the moment when the state begins to shovel out generous pensions, more than 600 Greek professions somehow managed to get themselves classified as arduous: hairdressers, radio announcers, musicians…” write John Mauldin and Jonathan Tepper write in Endgame – The End of the Debt Supercycle and How it Changes Everything.

But the Western democracies became welfare states only after almost 100 years of economic growth. “Western democracies had taken more than a hundred years of economic growth and capacity building to achieve the welfare state,” writes Das. And given this India is indulging in “premature welfarism”. “A nation with a per capita income of $1500 cannot protect its people from life’s risks as a nation with a per capita income of $15,000 could. It came at a cost of investment in infrastructure, governance and longer-term prosperity,” adds Das.

That’s one part of the argument. In order to finance these programmes the government will have to run huge fiscal deficits. This means that the government will have to borrow. Once it does that it will crowd out borrowing by the private sector and thus bring down the investment in infrastructure and hence longer term prosperity.

There is no example of a premature welfare state in the history of mankind rising its way to economic prosperity. An excellent example of a country that tried and failed is Brazil. India is making the same mistakes now that Brazil did in the late 1970s.

As Ruchir Sharma writes in Breakout Nations “Inspired by the popularity of employment guarantees, the government now plans to spend the same amount extending food subsidies to the poor. If the government continues down this path, India might meet the same fate as Brazil in the late 1970s, when excessive government spending set off hyperinflation and crossed out private investment, ending the country’s economic boom…the hyperinflation that started in the early 1980s and peaked in 1994, at the vertiginous annual rate of 2,100 percent. Prices rose so fast that cheques would lose 30 percent of their value by the time businesses could deposit them, and so inconsistently that at one point a small bottle of sunscreen lotion cost as much as a luxury hotel.”

Inflation in such a scenario happens on two accounts. First it happens because people have more money in their hands. And with this they chase the same number of goods, thus driving up prices. The second level of inflation sets in once the government starts printing money to finance all their fancy welfare schemes.

As far inflation is concerned things have already started heating up in India. As Das writes “The Reserve Bank warned that wages, which were indexed against inflation in the employment scheme (the national rural employment guarantee scheme), had already pushed rural wage inflation by 15 per cent in 2011. As a result, India might not gain manufacturing jobs when China moves up the income ladder.”

Other than inflation, giving away things for free has other kinds of problems as well. With states giving away power for free or rock bottom rates, the state electricity boards are virtually bankrupt. As Abheek Barman wrote in a recent column in the Economic Times “Most of the power is bought by state governments, through state electricity boards (SEBs). These boards are bankrupt. In 2007, all SEBs put together made losses of Rs 26,000 crore; by March last year, this jumped to a staggering Rs 93,000 crore. Just two SEBs, Uttar Pradesh and Jammu & Kashmir, account for nearly half this amount. To cover power purchase costs, the SEBs borrow money. Today, the total short-term debt of all the SEBs has soared to a mind-boggling 2,00,000 crore. Many states would buy as little electricity as possible, to avoid going deeper into the red.” (You can read the compete piece here). So the farmer has free electricity but then there is no electricity available most of the time.

Das writes something similar in India Grows at Night. “Punjab’s politicians gave away free electricity and water to farmers, and destroyed state’s finances as well as the soil (as farmers overpumped water); hence, Haryana supplanted Punjab as the national’s leader in per capita income.”

Other than this a lot of things given away for free by the government are siphoned off and do not reach those they are intended to. It would be foolish on my part to assume the politicians in this country (including Sonia Gandhi and of course Manmohan Singh) do not understand these things. But as Das writes “But neither the ‘do-gooders’ nor the Congress party was deterred by the massive corruption in the supply of diesel, kerosene, electricity and cooking gas as well as in ‘make work’ schemes and food distribution. Politicians felt there were still plenty of votes there.”

But these votes will come at the cost of economic progress. No country in history has got its citizens out of poverty by giving away things for free. Countries have progressed when they have created enough jobs for its citizens. And that has only happened when the right investments have been made over the years to build infrastructure, industry and human skill.

So the votes for the Congress will come at the cost of economic prosperity for the country. In the end let me quote a couplet written by Allama Iqbal: “Na samjhoge to mit jaoge ae hindustan waalo, tumhari daastan bhi na hogi daastano main” ( “If you don’t wake up, O Indians, you will be ruined and razed, Your very name shall vanish from the chroniclers’ page” – Translation by K C Kanda in Masterpieces of Patriotic Urdu Poetry: Text, Translation, and Transliteration).

The Prime Minister Manmohan Singh’s love for urdu poetry is well known. It is time he went back to this couplet of Allama Iqbal and tried to understand it in the terms of all the problems that will come along with the premature welfare state that his party has created and is now trying to spread it further.

The article originally appeared on September 20, 2012 on www.firstpost.com. http://www.firstpost.com/politics/sonianomics-will-put-india-on-the-path-to-disaster-462163.html

(Vivek Kaul is a writer. He can be reached at [email protected])

How Mamata is denting the rupee and bloating the oil bill

Vivek Kaul

A major reason for announcing the so called economic reforms that the Manmohan Singh UPA government did over the last weekend was to get India’s burgeoning oil subsidy bill which was expected to cross Rs 1,90,000 crore during the course of the year, under some control.

One move was the increase in diesel price by Rs 5 per litre and limiting the number of cooking gas cylinders that one could get at the subsidisedprice to six per year. This was a direct step to reduce the loss that the oil marketing companies (OMCs) face every time they sell diesel and cooking gas to the end consumer.

The other part of the reform game was about expectations management. The announcement of reforms like allowing foreign direct investment in multi-brand foreign retailing or the airline sector was not expected to have any direct impact anytime soon. But what it was expected to do was shore up the image of the government and tell the world at large that this government is committed to economic reform.

Now how does that help in controlling the burgeoning oil bill?

Oil is sold internationally in dollars. The price of the Indian basket of crude oil is currently quoting at around $115.3 per barrel of oil (one barrel equals around 159litres).

Before the reforms were announced one dollar was worth around Rs 55.4(on September 13, 2012 i.e.). So if an Indian OMC wanted to buy one barrel of oil it had to convert Rs 6387.2 into $115.3 dollars, and pay for the oil.

After the reforms were announced the rupee started increasing in value against the dollar. By September 17, one dollar was worth around Rs 53.7. Now if an Indian OMC wanted to buy one barrel of oil it had to convert Rs 6191.6 into $115.3 to pay for the oil.

Hence, as the rupee increases in value against the dollar, the Indian OMCs pay less for the oil the buy internationally. A major reason for the increase in value of the rupee was that on September 14 and September 17, the foreign institutional investors poured money into the stock market. They bought stocks worth Rs 5086 crore over the two day period. This meant dollars had to be sold and rupee had to be bought, thus increasing the demand for rupee and helping it gain in value against the dollar.

But this rupee rally was short lived and the dollar has gained some value against the rupee and is currently worth around Rs 54.

The question is why did this happen? Initially the market and the foreign investors bought the idea that the government was committed at ending the policy logjam and initiating various economic reforms. Hence the foreign investors invested money into the stock market, the stock market rallied and so did the rupee against the dollar.

But now the realisation is setting in that the reform process might be derailed even before it has been earnestly started. This was reflected in the amount of money the foreign investors brought into the stock market on September 18. The number was down to around Rs 1049.2 crore. In comparison they had invested more than Rs 5080 crore over the last two trading sessions.

Mamata Banerjee’s Trinamool Congress, a key constituent of the UPA government, has decided to withdraw support to the government. At the same time it has asked the government to withdraw a major part of the reforms it has already initiated by Friday. If the government does that the Trinamool Congress will reconsider its decision.

How the political scenario plays out remains to be seen. But if the government does bow to Mamata’s diktats then the economic repercussions of that decision will be huge. The government had hoped that the losses on account of selling, diesel, kerosene and cooking gas, could have been brought down to Rs 1,67,000 crore, from the earlier Rs 1,92,000 crore by increasing the price of diesel and limiting the consumption of subsidised cooking gas.

If the government goes back on these moves, the oil subsidy bill will go back to attaining a monstrous size. Also, what the calculation of Rs 1,67,000 crore did not take into account was the fact that rupee would gain in value against the dollar. And that would have further brought down the oil subsidy bill. In fact HSBC which had earlier forecast Rs 57 to a dollar by December 2012, revised its forecast to Rs 52 to a dollar on Monday. But by then the Mamata factor hadn’t come into play.

If the government bows to Mamata, the rupee will definitely start losing value against the dollar again. This will happen because the foreign investors will stay away from both the stock market as well as direct investment. In fact, the foreign direct investment during the period of April to June 2012 has been disastrous. It has fallen by 67% to $4.41billion in comparison to $13.44billion, during the same period in 2011. If the government goes back on the few reforms that it unleashed over the last weekend, foreign direct investment is likely to remain low.

One factor that can change things for India is the if the price of crude oil were to fall. But that looks unlikely. The immediate reason is the tension in the Middle East and the threat of war between Iran and Israel. Hillary Clinton, the US Secretary of State, recently said that the United States would not set any deadline for the ongoing negotiations with Iran. This hasn’t gone down terribly well with Israel. Reacting to this Benjamin Netanyahu, the Prime Minister of Israel said “the world tells Israel, wait, there’s still time, and I say, ‘Wait for what, wait until when? Those in the international community who refuse to put a red line before Iran don’t have the moral right to place a red light before Israel.” (Source: www.oilprice.com)

Iran does not recognise Israel as a nation. This has led to countries buying up more oil than they need and building stocks to take care of this geopolitical risk. “In the recent period, since the start of 2012, the increase in stocks has been substantial, i.e. 2 to 3 million barrels per day. These are probably precautionary stocks linked to geopolitical risks,” writes Patrick Artus of Flash Economics in a recent report titled Why is the oil price not falling?

At the same time the United States is pushing nations across the world to not source their oil from Iran, which is the second largest producer of oil within the Organisation of Petroleum Exporting Countries (Opec). This includes India as well.

With the rupee losing value against the dollar and the oil price remaining high the oil subsidy bill is likely to continue to remain high. And this means the trade deficit (the difference between exports and imports) is likely to remain high. The exports for the period between April and July 2012, stood at $97.64billion. The imports on the other hand were at $153.2billion. Of this, $53.81billion was spent on oil imports. If we take oil imports out of the equation the difference between India’s exports and imports is very low.

Now what does this impact the value of the rupee against the dollar? An exporter gets paid in dollars. When he brings those dollars back into the country he has to convert them into rupees. This means he has to buy rupees and sell dollars. This helps shore up the value of the rupee as the demand for rupee goes up.

In case of an importer the things work exactly the opposite way. An importer has to pay for the imports in terms of dollars. To do this, he has to buy dollars by paying in rupees. This increases the demand for the dollar and pushes up its value against the rupee.

As we see the difference between imports and exports for the first four months of the year has been around $55billion. This means that the demand for the dollar has been greater than the demand for the rupee.

One way to fill this gap would be if foreign investors would bring in money into the stock market as well as for direct investment. They would have had to convert the dollars they want to invest into rupees and that would have increased the demand for the rupee.

The foreign institutional investors have brought in around $3.86billion (at the current rate of $1 equals Rs 54) since the beginning of the year. The foreign direct investment for the first three months of the year has been at $4.41 billion.

So what this tells us that there is a huge gap between the demand for dollars and the supply of dollars. And precisely because of this the dollar has gained in value against the rupee. On April 2, 2012, at the beginning of the financial year, one dollar was worth around Rs 50.8. Now it’s worth Rs 54.

This situation is likely to continue. And I wouldn’t be surprised if rupee goes back to its earlier levels of Rs 56 to a dollar in the days to come. It might even cross those levels, if the government does bow to the diktats of Mamata.

This would mean that India would have to pay more for the oil that it buys in dollars. This in turn will push up the demand for dollars leading to a further fall in the value of the rupee against the dollar.

Since the government forces the OMCs to sell diesel, kerosene and cooking gas much below their cost to consumers, the losses will continue to mount. The current losses have been projected to be at Rs 1,67,000 crore. I won’t be surprised if they cross Rs 2,00,000 crore. The government has to compensate the OMCs for these losses in order to ensure that they don’t go bankrupt.

This also means that the government will cross its fiscal deficit target of Rs 5,13,590 crore. The fiscal deficit, which is the difference between what the government earns and what it spends, might well be on its way to touch Rs 7,00,000 crore or 7% of GDP. (For a detailed exposition of this argument click here). And that will be a disastrous situation to be in. Interest rates will continue to remain high. And so will inflation. To conclude, the traffic in Mumbai before the Ganesh Chaturthi festival gets really bad. Any five people can get together while taking the Ganesh statue to their homes, put on a loudspeaker, start dancing on the road and thus delay the entire traffic on the road for hours. Indian politics is getting more and more like that.

Reforms, like the traffic, may have to wait. Mamata’s revolt is single-handedly worsening the oil bill, thanks, in part, to the rupee’s worsening fortunes. By not raising prices now, the subsidy bill bloat further, and in due course we will be truly in the soup.

The article originally appeared on www.firstpost.com on September 20, 2012. http://www.firstpost.com/economy/how-mamata-is-denting-the-rupee-and-bloating-the-oil-bill-461919.html

Vivek Kaul is a writer and can be reached at [email protected]