Vivek Kaul

Yo Yo Honey Singh has an amazing sense of rhythm.

And every time he comes up with a new song, it keeps playing in my head over and over again, like an infinite loop. His latest song “char botal vodka kaam mera roz ka” is no exception to the rule.

Having said that, one has to also state up front that the lyrics of his songs should never be taken seriously and need to be treated with a pinch of salt. As the tagline of the old Hero Honda advertisement used to be “fill it, shut it, forget it”.

Yo Yo Honey Singh is a tad like that.

But what about the finance minister P Chidambaram? How seriously should he be taken on what he says? Or is he the new Yo Yo Honey Singh? In a recent interview to ET now, after presenting the interim budget, Chidambaram said “There is no doubt that growth is reviving. We clocked 4.4% in Q1 of the current year, 4.8% in Q2, 5.2% at the minimum in Q3 and Q4 taken together. It shows that growth is coming back at the rate of about 0.4% per quarter.”

What Chidambaram was essentially saying is that the economic growth as measured by the growth in gross domestic product(GDP), in the first quarter of the 2013-2014(i.e. the period between April 1 and June 30, 2013) came in at 4.4%. In the second quarter (i.e. the period between July 1 and September 30, 2013) it came in at 4.8%. He further said that the growth during the next two quarters of the year (i.e. the period between October and December 2013 and January and March 2014) would come in at 5.2%, when taken together. And hence, this shows an economic growth rate of 0.4% per quarter, he remarked. So, by that logic it would take around eight quarters or two years more, more for the economic growth to get back to 8%. Now only if things were as simple as that and everything in life moved in an arithmetic progression.

One needs to be rather ‘brave’ to make predictions on the basis of two data points. But that is what Chidambaram did. And now he has been proven wrong with the GDP growth numbers for the third quarter of 2013-2014(i.e. the period between October 1 and December 31, 2013) that were released on February 28, 2014.

During the period, the economic growth as measured by the GDP growth came in at 4.7%. This is nowhere near the 5.2% growth that Chidambaram had predicted around two weeks back. If one looks at the data in detail there are many worrying signs.

The manufacturing sector shrunk by 1.9% during the period (GDP at factor cost. At 2004-2005 prices). It had grown by 2.5% during September to December 2012. The sector had grown by 1% during July to September 2013. If India has to create jobs and move people from farms, the manufacturing sector needs to do well.

The agriculture sector grew by 3.6% during the period, after growing by 4.6% during July to September 2013. The agriculture sector contributed around 16.9% to the GDP ( GDP at factor cost. At 2004-2005 prices). But it employs around 45% of the Indian working population (Employment and Unemployment Survey 2011-12(68th round)). Given this, it is fairly straight forward that if India has to progress jobs need to be created, so that more people can moved out of agriculture, which currently suffers from over-employment.

And what for that to happen, the manufacturing sector needs to do well. In fact, the GDP data clearly shows that the manufacturing sector has barely grown over the last two years.

Other than the manufacturing sector, the mining sector has shrunk by 1.6% during the period. The construction sector, another sector which has the potential to generate ‘huge’ jobs, grew by only 0.6%, after growing by 1%, during September to December 2012. Financing, insurance, real estate and business services did reasonably well and grew by 12.5%, and thus pushed up the overall economic growth by 4.7%.

In fact, things are worrying even when looks at the GDP from the expenditure point of view. The personal final consumption expenditure formed 61.5% of the total expenditure during the period. In September to December 2012, the PFCE had formed around 62.7% of the total expenditure. What this clearly tells us is that PFCE is not rising as fast as other expenditure. In fact, during the period, the PFCE rose by just 2.6% to Rs 9,81,463 crore in comparison to September to December 2012.

Interestingly, during the period September to December 2012, the PFCE had grown by 5.1%. What this clearly tells us is that people are going slow on personal expenditure. The reason for that is high inflation which has led to more and more money being spent on meeting daily expenditure. Hence, people are postponing all other expenditure and that has had an impact on economic growth. One man’s expenditure is another man’s income, after all.

This scenario has been playing out pretty much over the last few years. But P Chidambaram has continued to be optimistic.

In November 2013, he remarked “The second quarter GDP growth rate indicates that the economy may be recovering and is on a growth trajectory again.” In December 2013, he remarked “We are going through a period of stress, but there is ground for optimism. We expect things to become better.” In late December 2013, he remarked “I am confident that the greenshoots that are visible here and there will multiply and that the economy will revive, there will be an upturn in the second half of this year.” In January 2014, he remarked “ I am confident that Indian economy will also get back step by step to the high growth path in three years.” And in February 2014, after presenting the interim budget, he said “we will get back to the high growth path.”

At almost every given opportunity Chidambaram has told us that the economy is recovering, there are green shoots and that the second half of the year will be better than the first half. The GDP grew by 4.4% during April to June 2013 and by 4.8% during July to September 2013. And it grew by 4.7% during October to December 2013. So where is the economic recovery that Chidambaram has been talking about? And where are the green shoots? To me, it appears to be more of the same happening.

Chidambaram has also predicted that “India is likely to achieve an economic growth of between 5-5.5 percent in this fiscal year.” But with the GDP growth being less than 5% during the first three quarters of the year, achieving even 5% growth will be difficult. Let’s not even talk about achieving 5.5% growth.

To conclude, Chidambaram’s statements on economic growth, like the lyrics of Yo Yo Honey Singh’s songs should not be taken seriously at all and be taken with a pinch of salt. While one doesn’t expect a minister of the ruling coalition to be totally negative on the economy, but at least some honesty on what is happening on the economic front, would be nice. Now only, if Chidambaram was listening.

Or, is he, like me, and a lot of other people, busy listening to Yo Yo Honey Singh?

Char botal vodka, kaam mera roz ka…

The article originally appeared on www.FirstBiz.com on March 1, 2014

(Vivek Kaul is a writer. He tweets @kaul_vivek)

P Chidambaram

Post interim budget, the threat of a downgrade remains

Vivek Kaul

Vivek Kaul

On February 28, 2013, the finance minister P Chidambaram, presented the budget for the financial year 2013-2014 (April 2013 to March 2014). In this, he projected a fiscal deficit of Rs 5,42,499 crore or 4.8% of the gross domestic product (GDP). Fiscal deficit is the difference between what a government earns and what it spends, expressed as a percentage of the GDP.

All through the year, Chidambaram maintained that come what may the government won’t cross the fiscal deficit of 4.8% of the GDP. In the end he stood by his promise, but only on paper. The fiscal deficit for 2013-2014 is now estimated to be at Rs 5,24,439 crore or 4.6% of the GDP.

It was important that the government did not cross the target of 4.8% of the GDP that it had set, given the threat of a downgrade from international rating agencies.

The rating agency Standard and Poor’s (S&P) currently rates India as BBB-. This is rating is the lowest rating in the investment grade. If India were to be downgraded, its rating would fall to BB or the first stage of the junk status.

This would mean that a lot of foreign investors would have to sell out of the Indian bond market as well as the Indian stock market,given that they are not allowed to invest in countries with a junk rating. This would lead to huge pressure on the rupee as foreign investors cashing out will convert their rupees into dollars.

In fact, in November 2013, S&P had maintained the “negative” outlook on India. This meant that there were chances of a downgrade, over the next 12 months. As the rating agency had said in a release “The central government’s budget balance[i.e. the fiscal deficit], however, tells only part of the Indian fiscal story. Using a broader measure of general government deficits, we project a 7.2% of GDP deficit for fiscal 2014, to which one should add 1-2 percentage points of GDP deficits for the unprofitable portions of the consolidated public sector, including state electricity boards and oil-marketing companies.”

Keeping this definition of fiscal deficit in mind, how has the finance minister P Chidambaram done? It is safe to say that the fiscal deficit of 4.6% of the GDP is at best a hogwash. In order to arrive at that number, the finance minister has under-budgeted for petroleum, food and fertilizer subsidies in a major way. Estimates suggest that payment of more than Rs 1,20,000 crore worth of subsidies has been postponed to the next year.

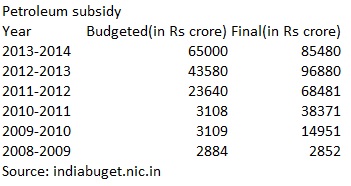

Take the case of petroleum subsidies. Chidambaram had budgeted Rs 65,000 crore towards it. The number has now been increased to Rs 85,480 crore. Of this amount, a substantial chunk has gone towards payments of petroleum subsidies that should have been paid in 2012-2013( April 2012 and March 2013) but were postponed to 2013-2014.

In fact, data released by the Ministry of Petroleum and Natural Gas in early February shows that the oil marketing companies have reported under-recoveries ofa total of Rs 1,00,632 crore during the first nine month of 2013-14 (April-December) on the sale of diesel, PDS Kerosene and cooking gas. Hence, the Rs 85,480 crore budgeted towards oil subsides is clearly not enough.

On the earnings side, Chidambaram has indulged in massive asset stripping to match his numbers. He has forced public sector banks, which are in a financially fragile state, to pay interim dividends of close to Rs 27,000 crore. ONGC and Oil India Ltd have been forced to pick up shares worth Rs 5,000 crore in the loss making Indian Oil Corporation, a company which no private investor wants to touch. And the government has also managed to get more than Rs 19,000 crore from Coal India, as dividend and dividend distribution tax.

Anyone who understands some basic accounting will tell you that using assets to pay for regular expenditure is never a great idea. Rating agencies like S&P obviously understand this. And that is why it had said in November 2013 that using broader measures, the fiscal deficit comes to greater than 7.2% of the GDP. In that sense, the deficit of the government is clearly greater than the 4.6% of the GDP that it has arrived at, once the accounting shenanigans are taken into account.

Given that, the threat of a downgrade remains. As S&P had said in November “we expect to review the rating on India after the next general elections when the new government has announced its policy agenda.” The agency plans to look at the fiscal policy of the next government as well, among other things. Given the mess the current fiscal policy is in, it will be very difficult for the next government to do much about it. The only way out is to slash government expenditure massively. And that is easier said than done.

The article originally appeared in the Daily News and Analysis (DNA) dated February 18, 2014

(Vivek Kaul is the author of Easy Money. He can be reached at [email protected])

Vote of account 2014: Is Chidu Mr Natwarlal of budgeting?

Vivek Kaul

Vivek Kaul

The finance minister P Chidambaram hasn’t crossed the “red line” of achieving a fiscal deficit target of 4.8% of the gross domestic product (GDP), that he had set for the government when he presented the last budget in February 2013. In fact, he has done even better and achieved a fiscal deficit of 4.6% of the GDP.

Fiscal deficit is the difference between what a government earns and what it spends, expressed as a percentage of the GDP. There are essentially three variables that are involved in calculating the number. The amount the government earns. The amount the government spends. These two numbers form the numerator and their difference is then expressed as a percentage of the GDP.

Hence, in order to achieve a targeted fiscal deficit, any of these three numbers can be manipulated. Chidambaram has worked on two of these three fronts to arrive at a fiscal deficit target of 4.6% of the GDP.

Let’s start on the expenditure front. The government expenditure is categorised into two kinds—planned and non planned. Planned expenditure is essentially money that goes towards creation of productive assets through schemes and programmes sponsored by the central government. Non-plan expenditure is an outcome of planned expenditure. For example, the government constructs a highway using money categorised as a planned expenditure. But the money that goes towards the maintenance of that highway is non-planned expenditure. Interest payments on debt, pensions, salaries, subsidies and maintenance expenditure are all non-plan expenditure.

As is obvious a lot of non-plan expenditure is largely regular expenditure that cannot be done away with. The government can at best delay paying subsidies. Hence, when expenditure needs to be cut, it is the asset creating planned expenditure which typically faces the axe and that is not good for the overall economy. If one looks at the numbers that is the direction they point towards.

The planned expenditure target of the government was at Rs 5,55,322 crore. The actual planned expenditure has come in at Rs 4,75,532 crore, which is close to Rs 80,000 crore or 14.4% lower. This as mentioned earlier is not a good sign.

If the government had incurred this expenditure the actual fiscal deficit would have come in at close to 5.3% of the GDP.

When it comes to non planned expenditure the target was at Rs 1,109,975 crore. It came in around 0.44% higher at Rs 1,114,902 crore. Most of the non-planned expenditure is regular in nature and hence, like planned expenditure, cannot be done away with. But there is one accounting trick that the government can resort to even on this front.

It can postpone the payment of petroleum, food and fertilizer subsidies to the next financial year. Let’s take the case of petroleum subsidies for one. Rs 65,000 crore had been allocated on this front. The actual amount spent by the government has come in at Rs 85,480 crore. Of this amount a major chunk has gone towards payment of under-recoveries from the financial year 2012-2013 (i.e. the period between April 2012 and March 2013).

Hence, the amount allocated is clearly not enough for the payment of petroleum subsidies. In fact, data from the Ministry of Petroleum and Natural Gas suggests that the oil marketing companies have reported under-recoveries of a total of Rs 1,00,632 crore during the first nine month of 2013-14 (April-December) on the sale of diesel, PDS Kerosene and cooking gas.

So clearly the amount of Rs 85,480 crore earmarked in the budget is not enough. This means that the payments that need to be made on this front have been postponed to the next year. A recent article in the Business Standard estimates that subsidies of around Rs 1,23,000 crore will be postponed to the next financial year.

These are subsidies on petroleum, food and fertilizer which should have been paid up by the government in this financial year, but will be postponed to the next financial year. The article points out that the government will need Rs 1,45,000 crore to pay up all the subsidies but is likely to sanction only around Rs 22,000 crore. This leaves a gap of Rs 1,23,000 crore which will be postponed to the next financial year, and will become a huge headache for the next government.

This essentially means that the government will not recognise expenditure when it incurs it, but only when it pays for that expenditure. This goes against the basic accounting principles, where an expenditure needs to be recognised during the period it is incurred.

Lets now look at what Chidambaram and the government have done on the government earnings front to boost that number. The government has indulged in massive asset stripping to boost its earnings. A recent estimate in the Mint newspaper suggests that since January 2014, public sector banks have announced interim dividends of Rs 27,474.4 crore.

These are banks in which the government had put in fresh capital of Rs 14,000 crore earlier in the year. So the government gives from one hand and takes away as much twice as more from another. Also, it is worth noting here that the public sector banks are currently on a very weak wicket. As Shekhar Gupta wrote in a recent column in The Indian Express “You read any of the recent data from the RBI, reputed market analysts and brokerages, economists, even from Uday Kotak on CNBC-TV18 this Thursday. You will know that the current stressed, restructured or non-performing loans in the Indian banking system amount to nearly 25 per cent of their total assets. Kotak put the aggregate at Rs 10 lakh crore out of total advances of Rs 40 lakh crore. Scared yet? He says the banks’ total write-offs over the next couple of years could be Rs 3.5-4 lakh crore. The total net worth of all banks now is about Rs 8 lakh crore. In other words, half their net worth will be wiped out.”

In trying to meet the fiscal deficit target, Chidambaram has further weakened the Indian banking system. And then there is the case of moving money from government owned companies to the government. Take the case of the Oil India Ltd and ONGC buying shares in Indian Oil Corporation worth Rs 5,000 crore, a company which is expected to lose a lot of money during the course of this financial year. Hence, no investor other than the government owned companies would have bought IOC stock.

Continuing with asset stripping, the 90% government owned Coal India Ltd, recently declared a record dividend in January of Rs 18,317.5 crore. Of this, the government will get Rs 16,485 crore, given that it owns 90% of the company. The government will also get Rs 3,100 crore, which Coal India will have to pay as dividend distribution tax. This money should actually have been used by Coal India to develop more coal mines so that India does not have to import coal, like it currently does, despite having massive coal reserves. But that of course, hasn’t happened.

The icing on the cake was the sale of telecom spectrum which made the government richer by more than Rs 61,000 crore.

It isn’t a good idea to meet regular expenditure by selling assets. How many people you know survived for long by selling their home, their car and other assets that they owned, to meet their daily expenditure? Ultimately to meet regular expenditure, regular income is needed. The sale of assets to meet current expenditure is not a great practice to follow. This is because assets once sold, cannot be re-sold.

If all these factors highlighted above are taken into account, there is no way the fiscal deficit would have come in at 4.6% of the GDP. The number is at best a joke that Chidambaram and his UPA colleagues have played on the citizens of this country.

The article originally appeared on www.firstpost.com on February 17, 2014.

(Vivek Kaul is a writer. He tweets @kaul_vivek)

How Chidambaram has screwed the next govt even before it takes over

Vivek Kaul

What we don’t achieve ourselves, we expect from others.

This is a statement I have oft used during family conversations in the context of the “unrealistic” expectations parents and grandparents have from their children and grandchildren.

But it is also true for the current Congress party led United Progressive Alliance (UPA) government. After spending much more than it earned for close to six years now, and managing to screw up the Indian economy left, right and centre, the Congress-led UPA government wants the government that takes over after the next Lok Sabha elections scheduled later this year, to cut down on the fiscal deficit.

The fiscal deficit target set for the financial year 2014-15 (i.e. the period between April 2014 and March 2015) is at 4.1 percent of the gross domestic product (GDP). Fiscal deficit is essentially the difference between what a government earns and what it spends expressed as a percentage of GDP.

The Congress led UPA government set a fiscal deficit target of Rs 1,33,287 crore or 2.5% of the GDP in the financial year 2008-09 (i.e. the period between April 2008 and March 2009). The actual number came in at Rs 3,36,992 crore or 6 percent of the GDP. And so started an era of fiscal profligacy.

The fiscal deficit target set for the financial year 2013-2014 (i.e. the period between April 2013 and March 2014) was set at Rs 5,42,499 crore or 4.8% of the GDP. But it is expected to come in at Rs 5,24,539 crore or 4.6% of the GDP.

This is primarily a result of accounting shenanigans as explained earlier and does not reflect the true state of the government accounts.

The fiscal deficit target set by the finance minister P Chidambaram for the next financial year is at Rs 5,28,631 crore or 4.1% of the GDP. Prima facie, the target is unachievable and there are several reasons for the same.

The petroleum subsidy allocated for 2014-15 stands at Rs 63,426.95 crore. In comparison, the petroleum subsidy for 2013-14 has come in at Rs 85,480 crore. This after, Rs 65,000 crore had been allocated towards it, at the beginning of the year.

Even a higher allocation of Rs 85,480 crore is not enough, given that the under-recoveries of the oil marketing companies for the first nine months of the year stand at Rs 1,00,632 crore during the first nine months of 2013-14 (April-December) on the sale of diesel, PDS Kerosene and cooking gas. The interesting bit here is that since 2009-10, the government has never been able to match the petroleum subsidy it allocated originally at the beginning of the year (as can be seen from the following table).

Take the case of 2012-13, when Rs 43,580 crore was allocated towards petroleum subsidy at the beginning of the year. The actual bill came in at close to Rs 96,880 crore, which was more than double. Given this, it is highly unlikely that Rs 63,426.95 crore will turn out to be enough.

This means greater expenditure for the government, and hence, a higher fiscal deficit, unless of course it balances the expenditure by cutting down asset creating planned expenditure. That is not the best strategy to follow, especially in a scenario of low economic growth which currently prevails.

Interestingly, even after making a higher allocation, a portion of subsidy payments is typically postponed to the next year. Estimates suggest that this year close to Rs 1,23,000 crore of subsidies have been postponed to the next year. The next finance minister would have to meet this expenditure.

If this expenditure has to be made and assuming that everything else stays equal, the fiscal deficit of the government would shoot to Rs 6,51,631 crore (Rs 5,28,631 crore + Rs 1,23,000 crore) or 5.1% of the GDP, against the currently assumed 4.1% of the GDP.

The only way the next finance minister would be able to meet the fiscal deficit target of 4.1% of the GDP, would be by following Chidambaram’s strategy of postponing expenditure, which is not the best way to go about it.

Another interesting point is the allocation of Rs 1,15,000 crore made towards food subsidies. Prima facie this does not seem to be enough to meet the commitments of the Food Security Act.

The government estimates suggest that food security will cost Rs 1,24,723 crore per year. But that is just one estimate. Andy Mukherjee, a columnist with Reuters, puts the cost at around $25 billion. The Commission for Agricultural Costs and Prices(CACP) of the Ministry of Agriculture in a research paper titled National Food Security Bill – Challenges and Options puts the cost of the food security scheme over a three year period at Rs 6,82,163 crore. During the first year (which 2014-15 more or less is) the cost to the government has been estimated at Rs 2,41,263 crore.

Economist Surjit Bhalla in a column in The Indian Express put the cost of the scheme at Rs 3,14,000 crore or around 3 percent of the gross domestic product (GDP). Ashok Kotwal, Milind Murugkar and Bharat Ramaswami challenge Bhalla’s calculation in a column in The Financial Express and write “the food subsidy bill should…come to around 1.35% of GDP.”

Even at 1.35 percent of the GDP, the cost of the food security scheme comes in at close to Rs 1,73,000 crore (1.35 percent of Rs 12,839,952 crore that Chidambaram has assumed as the GDP for 2014-2015).

All these numbers are more than the allocation of Rs 1,15,000 crore made by Chidambaram towards food subsidies. This means that there will be trouble for the next government in balancing the budget.

Of course, the new government that takes over after the Lok Sabha elections will present a fresh budget, in which it can junk all the calculations of the current budget (or to put it correctly, the vote of account). But even if the next government does that the expenditure commitments that the Congress-led UPA government has created are so huge, that it will be completely screwed on the finance front, even before it takes over.

This article originally appeared on www.FirstBiz.com on February 17, 2014

Vivek Kaul tweets @kaul_vivek

To meet fiscal deficit, Chidu does an Enron, junking all accounting principles

Vivek Kaul

Vivek Kaul

The Mint newspaper has a very interesting article today on the finance minister’s P Chidambaram’s latest move to use the Reserve Bank of India(RBI) to help meet the fiscal deficit target of 4.8% of the GDP, set at the beginning of this financial year. Fiscal deficit is the difference between what a government earns and what it spends.

As per this plan the finance ministry is talking to the RBI for an interim payment or transfer of the central bank’s income. The RBI follows an accounting year of July to June. Given that, it usually transfers its income to the central government in August every year. Last year, the central bank had handed over Rs 33,100 crore to the government and the year before last, it had handed over Rs 16,100 crore.

But the government does not want to wait till August this year. It wants the central bank to pay up immediately, in order to contain the burgeoning fiscal deficit. The trouble is that the RBI Act does not have a provision for transferring surplus before the accounting year ends.

The government is desperate for any revenue irrespective of where it comes from. The fiscal deficit for the nine month period between April and December 2013, stood at Rs 5,16,390 crore or 95.2% of the annual target of Rs 5,42,499 crore (or 4.8% of the GDP as estimated in the budget presented in February 2013).

For the first nine months of the financial year, the government has run an average fiscal deficit of Rs 57,377 crore (Rs 5,16,390 crore/12). But for the remaining three months, it has very little room.If the government has to match the numbers projected in the budget presented in February 2013, over the next three months it can run a fiscal deficit of only around Rs 26,109 crore (Rs 5,42,499 crore – Rs 5,16,390 crore). This means an average fiscal deficit of Rs 8,703 crore per month, which is a whopping 85% lower than the average fiscal deficit per month that the government has run between April and December 2013.

One way of controlling the fiscal deficit is slashing expenditure. This is not very easy to do given that salaries need to be paid, employee provident fund needs to be deposited, interest on government debt needs to be paid and the government debt maturing needs to be repaid.

But one trick that the finance ministry has come up with on this front is to postpone a lot of payments to the next financial year. An article in the Business Standard estimates that subsidies of around Rs 1,23,000 crore will be postponed to the next financial year. These are subsidies on oil, food and fertilizer which should have been paid up by the government in this financial year, but will be postponed to the next financial year. The article points out that the government will need Rs 1,45,000 crore to pay up all the subsidies but is likely to sanction only around Rs 22,000 crore. This leaves a gap of Rs 1,23,000 crore which will be postponed to the next financial year, and will become a huge headache for the next government.

This essentially means that the government will not recognise expenditure when it incurs it, but only when it pays for that expenditure. This goes against the basic accounting principles, where an expenditure needs to be recognised during the period it is incurred. If a private company where to do such a thing it would be accused of fraud. Interestingly, even last year a lot of subsidy payments had been postponed. The American company Enron used this strategy for years to over- declare profits. It used to recognise revenue expected from the future years without recognising the expenditure expected against that revenue, and thus over-declare its profit.

That’s how things stack up for the government on the expenditure side. On the income side, the government is indulging in massive asset stripping. Since January 2014, public sector banks have announced interim dividends of Rs 27,474.4 crore. Now what is the logic here? Earlier this year, the government had put in Rs 14,000 crore of fresh capital in these banks. So, the government gives ‘x’ rupees to public sector banks and then takes away 2’x’ rupees from them.

Then there is the very interesting case of the Oil India Ltd and ONGC buying shares in Indian Oil Corporation worth Rs 5,000 crore, a company which is expected to lose around Rs 75,000 crore this year. Hence, no investor in his right mind would have bought stock in this company.

Given that all these companies are owned by the government, this is essentially a complicated manoeuvre of moving cash from the books of these companies to the books of the government. The next time any UPA politician talks about corporate governance, the example of IOC should be brought to his notice.

And then there is Coal India Ltd. The world’s largest coal producer declared a record dividend in January. This dividend aggregated to Rs 18,317.5 crore. Of this, the government will get Rs 16,485 crore, given that it owns 90% of the company. The government will also get Rs 3,100 crore, which Coal India will have to pay as dividend distribution tax. This money should actually have been used by Coal India to develop more coal mines so that India does not have to import coal, like it currently does, despite having massive coal reserves. But that of course, hasn’t happened.

Also, there is another basic issue here. The sale of assets from the balance sheet to meet current expenditure is not a great practice to follow, given that assets once sold cannot be re-sold, but the expenditure will have to be incurred every year. Asset sales cannot be a permanent source of revenue.

The UPA government has brought India to a brink of a financial disaster. The next government which will take over after the Lok Sabha elections later this year, will have a huge financial hole to fill. As the old Hindi film dialogue goes “hum to doobenge sanam, tumko bhi le doobenge (I will drown for sure, but I will ensure that you drown as well).” The UPA clearly has worked along those lines.

The article originally appeared on www.FirstBiz.com on February 12, 2014

(Vivek Kaul is a writer. He tweets @kaul_vivek)