I should have written this column around a week back, nevertheless it’s still not too late to make the point that I want to make.

On August 24, 2015, the BSE Sensex fell by 1624.51 points or a whopping 5.94% to close at 25,741.56 points. This was the biggest drop that India’s premier stock market index had seen since January 7, 2009.

In all the hungama that followed around the Sensex fall another important story got buried. On the same day, the government was trying to sell 24.28 crore shares or 10% stake in the Indian Oil Corporation (IOC) at Rs 387 per share. The government was hoping to raise around Rs 9,400 crore through this disinvestment.

In the budget presented in February earlier this year, the government had set a disinvestment target of Rs 69,500 crore. Of this amount it hopes to raise Rs 28,500 crore through what it calls strategic disinvestment.

On a day when stock markets all over the world fell it was hardly surprising that there were almost no takers for the government’s share sale. The retail portion of the IOC disinvestment issue was subscribed only 0.18 times i.e. only about one-fifth of the shares that were offer.

The fact that the government had no idea of what was about to hit it, can be made out by the disinvestment secretary Aradhana Johri’s comment on August 21, 2015. She said that the stock market had an “excellent appetite” for the IOC offering. As it turned out, her definition of the stock market included only one investor. In the end, the Modi government, like the governments before it, had to call on the Life Insurance Corporation (LIC) of India to come to its rescue.

LIC picked up 20.87 crore shares or 8.59 per cent of IOC and thus bailed out the government. This would have cost LIC around Rs 8,087 crore. There are multiple points that need to be made here.

The government treats LIC as a sovereign wealth fund, which keeps coming to its rescue whenever required. But the money LIC has and manages is not the government’s money. The LIC manages the hard earned savings of the people of India and given that these savings need to be treated with a little more respect.

A filing made on the Bombay Stock Exchange website points out that LIC now owns 11.11% of IOC. SEBI rules do not allow mutual funds to own more than 10% of a company. This is to prevent concentration of risk on the overall investment portfolio. But this does not apply to LIC, given that it is an insurance company.

The question is why is the government allowing this concentration of risk in LIC’s investment portfolio to happen? Why are rules different for the private sector and the public sector? Ultimately like mutual funds, LIC is also basically managing money.

The LIC chairman SK Roy has said in the past that “every investment decision happens after due diligence.” What due diligence leads to an investment corporation (which LIC basically is) to buy a share at Rs 387, when the weighted average price of the stock during the course of the day was around Rs 380?

Roy told The Indian Express in an interview in July 2015: “If you see the OFS (offer for sale) of last 14 months, we have never got more than 50 per cent of the offered amount…So the question of bailing out doesn’t arise. A bailout happens when the entire 100 per cent is taken by us. There’s no data to support this.”

In the IOC disinvestment last week, LIC bought 20.87 crore shares of the 24.28 crore shares that were on sale. This amounts to 86% of the total shares that were being sold by the government. This makes it clear that the LIC bailed out the government and what Roy had claimed in July is no longer true. Further, Roy’s claim about following “due diligence” doesn’t really hold. Like previous LIC chairmen he also followed instructions from Delhi though he can’t admit to doing the same.

Also, if IOC is a good buy, why was LIC bringing down its stake in the company since June? As on June 30, 2015, LIC’s holding in IOC was 2.83%. Before the August 24 purchase, this holding was down to 2.52%. Hence, over a period of nearly seven weeks, LIC had sold a substantial stake in the company.

Also, as an LIC official told Business Standard on the condition of anonymity: “LIC is a long-term investor and we looked at the offer quality and subscribed for it. A call was made to us since as there was a crisis-like situation with the markets. We have not set aside any funds for disinvestment. We take a call based on the merit of every offer.” So, if IOC was such a good buy why had not LIC set aside any money for it?

Further, any ‘real’ disinvestment happens when shares are bought by the private sector (be it retail or institutional investors). But what seems to be happening with the Modi government’s disinvestment programme is that the LIC is taking over from the government. One arm of the government is being replaced by another government. This is nothing but a farce.

In fact, the disinvestment secretary Ardhana Johri made a good joke when she told PTI that the sale was “highly successful given the market conditions” and “with this the government has managed the best-ever first half disinvestment collections in seven years.” The government has managed to raise around Rs

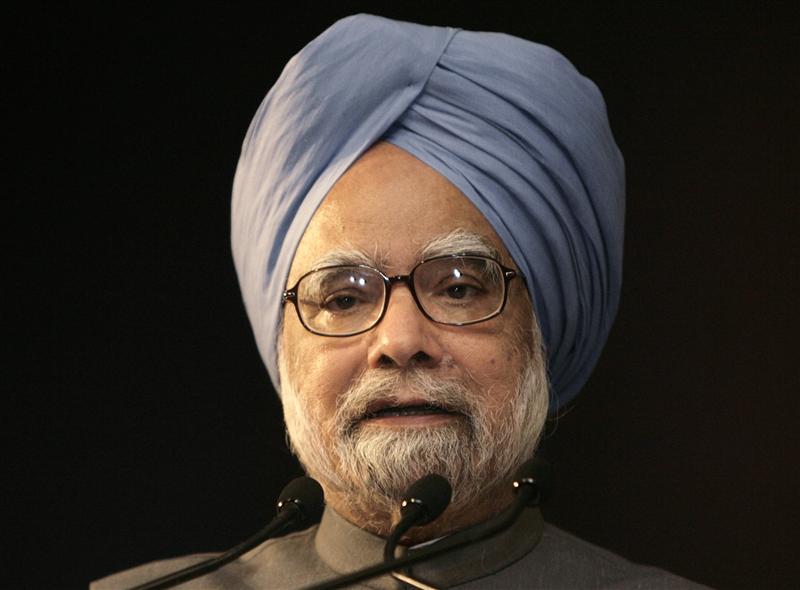

Hence, on this front the Modi government has been no different from the earlier Manmohan Singh government, which also used to get LIC to rescue its disinvestment share sales.

Also, what is the point of going through this elaborate farce anyway? If shares are to be bought by LIC, why does the insurance behemoth have to buy shares from the market? Why can’t the government allocate shares to LIC directly and at a discount, so that LIC investors can also gain, given that it is their hard earned money that is being put to such risk?

To conclude, the government also plans to raise Rs 28,500 crore through strategic disinvestment. This is essentially a euphemism for the government selling its stakes in loss making companies. Further, the Cabinet has already approved sales of shares of such companies’ worth around Rs 50,000 crore.

I sincerely hope that if the stock market investors do not buy these shares, LIC is not forced to take them on.

The column was originally published on The Daily Reckoning on Sep 1, 2015