Ravi Batra is an Indian American economist and a professor at the Southern Methodist University, in Dallas, Texas. Over the years Batra has made many predictions which have turned out right. He correctly predicted the fall of communism in USSR and at the same time said it would continue in China. He also predicted an enormous rise in wealth concentration in the United States that would generate poverty among its masses. These predictions were made way back in 1978 in his book The Downfall of Capitalism and Communism. These along with many of his political and economic predictions have come to be true over the years (for a complete list click here). Batra uses the Law of Social Cycle to make these predictions. On the basis of this law he now predicts the rise of the Team Anna political party. “Through long and painful fasting Anna Hazare has captured the attention of people, and finally decided to form a political party. Indians will indeed vote for him or the candidates he supports,” says Batra. Batra is the author of many bestselling books like The Crash of the Millennium, The Downfall of Capitalism and Communism, Greenspan’s Fraud and most recently The New Golden Age. In this interview he speaks to Vivek Kaul.

Excerpts:

What is the law of social cycle?

The law of social cycle was pioneered by my late teacher and mentor, Shri Prabhata Ranjan Sarkar. It can be explained in a variety of ways. Let’s start with a simple observation. A careful examination of every society reveals that there are three possible sources of political power –the army, popular ideas, or money.

Could you explain that through an example?

For instance, if we carefully explore the political landscape of our world, we find that in places like the United States, Western Europe, Canada, India, Australia and Japan, money rules society and super-materialism prevails. In places like Iran, the priesthood is dominant with control over religious ideas, whereas in Russia former intelligence officers such as the ex-KGB chief, Vladimir Putin among others, hold the reigns. In China, the communist party is supreme but the ultimate source of political power is the military, which established the party’s rule in a Marxist revolution in 1949. The Tiananmen Square massacre of 1989 clearly illustrates this point. When the Chinese government faced a serious challenge to its authority, it is the army that restored order in the country and crushed the opposition to the communist rule?

So what does this suggest?

This suggests that there are three main sources of political power—the military, human intellect, and, of course, money or wealth. Religion may also bring power, but priests dominate society by mastering scriptures and rituals. In other words, they also utilise their intellect to control and influence people. Thus, ultimately political power or societal dominance stems from three sources—physical strength or skills, human intellect or intellectual skills, and the hoarding of wealth. As a result, through the pages of history, we find that a society is sometimes dominated by warriors, sometimes by intellectuals (including priests), and sometimes by acquisitors who are experts in making money. However, the law of social cycle goes a lot further than merely describing the three classes of people.

Could you explain that?

It analyses the evolution of civilizations and states that a society evolves in terms of a cycle wherein a nation is first dominated by a group of warriors, then by a group of intellectuals, and finally by a group of wealthy acquisitors. Then towards the end of the age of the wealthy, there is so much corruption and crime that people get fed up and revolt against the elite or the rulers, who are overthrown in a social revolution. Since it takes a lot of courage to revolt against the authorities, the successful revolutionaries are the true warriors, who start another warrior age and bring an end to the corrupt rule of money. This way the social cycle begins anew and moves along in the same succession of warriors to intellectuals to acquisitors and then to the social revolution.

That’s very interesting…

Historically, the warrior era has been represented by the rule of the army, and the intellectual era by the supremacy of the priesthood or prime ministers. By contrast, the eras of acquisitors have occurred when feudal landlords or wealthy bankers and merchants were dominant. Thus warriors come to power with the help of physical might, intellectual with the help of ideas, and acquisitors with the help of money.

Since when has this cycle existed?

The social cycle has existed since the birth of human society and its validity can be proved by written history and the logic of social evolution. For instance, in India, around the times of Mahabharata, warriors dominated society; then came the rule of brahmans or intellectuals, followed by the Buddhist period, when capitalism and acquisitors were predominant; this era ended in the flames of a social revolution, when a great warrior named Chandragupta Maurya, put an end to the reign of a king named Dhananand, and started another age of warriors. What is interesting is that India’s overwhelmingly powerful caste system, wherein the brahman is placed atop the social hierarchy followed by kshyatriyas, vaishyas and shudras, was not able to thwart the law of social cycle. There were times when in practice, though not in theory, the brahman accepted the supremacy of people belonging to other castes. During the Buddhist period, for instance, the vaishyas were treated with great respect. They were called shreshthis, meaning “superiors.” In today’s acquisitive age, of course, we clearly see the priest eagerly and humbly accepting money from the rich regardless of their caste.

What happened after Chandragupta Maurya?

Reverting to the cycle, the Mauryan age of warriors was followed by another age of intellectuals in which the kings themselves claimed to be brahmans. The latter period was followed by feudalism, representing the age of acquisitors. Later, the feudal landlords, sometimes called rajas, were overthrown by an illustrious warrior, named Samudra Gupta, who thus organised another social revolution against the rule of acquisitors. Some historians have called the Gupta king the Napoleon of India, because he destroyed the armies of a large number of landowners and brought the wealthy under control.

And the age of Samudragupta was followed by?

The Gupta warrior era gave way to another intellectual era in the 9th century, when a renowned ascetic named Shankracharya revived brahmanism and uprooted Buddhism from the land of its birth. Priests and prime ministers dominated again, but their influence waned in a few hundred years and gave way to another round of feudalism, which was followed by yet another age of warriors, this time under the rule of Muslim invaders. Thus began the Muslim warrior era during the 14th century and continued as the Mughal empire in the 15th. Akbar the Great was the most illustrious emperor of this age, which lasted for a while and then gave way to another intellectual era, this time under the dominance of Muslim priests or Ulemas, who held sway over the Mughal king Aurangzeb. Around these times the great warrior Shivaji founded the Maratha Empire, which, after his death, came under the influence of brahmans known as Peshwas. At the same time, the northern Mughal Empire came under the sway of its wazirs or prime ministers. Thus this Mughal-Maratha period was the latest era of intellectuals, which was followed by yet another era of acquisitors, when the British took over around 1800. India has been in this age ever since. Indians will indeed vote for him or the candidates he supports

So what is the point that you are trying to make?

The main point is that no class remains in power forever, and that the acquisitive age always ends in a revolution. Such was the case in all civilizations. In fact new revolutions are already taking place in the world. Muslim society, where Saudi oil wealth is the main source of power, is also in the age of acquisitors, as is much of the planet. Rebellions have already occurred in the Islamic nations of Tunisia, Egypt, Libya and Yemen, and now Syria is facing the same fate. The Syrians have shown admirable resolve, and even though unarmed or heavily outgunned they are revolting against their ruler, President Assad.

What about the current state of affairs in India?

Courage is contagious and gradually inspires the masses to fight tyranny. The wave of courage that has dethroned many Muslim rulers is now budding in India under the guidance of Shri Anna Hazare and Baba Ram Dev. The movements they have started are still in the early stage but such movements are likely to grow and ultimately succeed in their mission to rid the nation of political corruption, because the age of acquisitors is about to end around the globe. Who could have imagined just a few years ago that Egypt’s Hosni Mubarak and Libya’s Colonel Kaddafi would be overthrown by their people?

Yes you are right…

A revolution doesn’t occur overnight, but when it starts it engulfs the nation in a mighty wave that crushes the ruler. It is initiated by small groups that have been opposing corruption for a long time, and for a while it faces public apathy and even opposition, but when the right moment comes it ignites the people to decimate the elite. The current decade is likely to be the decade of revolutions that will consume the ruling classes around the planet. The revolutionary wave began in the Muslim world and it is bound to spread in all areas where the acquisitors are dominant, because remember that courage is contagious. India gained independence in 1947 and so did many other countries within a few years. The point is that when a revolutionary wave begins in one area, it unleashes a flood that engulfs the neighbours. The moment has arrived to dethrone the corrupt acquisitors, and someone has to seize the moment to feed this flame. Anna Hazare and Ram Dev are doing it and they deserve the support of moralists around the world.

But how do you see the current rule of wealth being overthrown in India?

The rule of wealth in India will end through the electoral process, because people will vote for those who vow to end corruption. Through long and painful fasting Anna Hazare has captured the attention of people, and finally decided to form a political party. Indians will indeed vote for him or the candidates he supports. Although, some of his followers will be unhappy with his decision to enter the political fray, this is the right thing to do. As Mahatma Gandhi demonstrated, fasting alone is not enough to achieve a desired goal. You also have to offer a concrete and credible alternative. The social revolution against the acquisitors has started in Muslim society and is slowly gathering steam in India and the United States. By the end of this decade, if not sooner, the age of acquisitors will be a thing of the past, and those with courage to oppose the elite will start a new age of warriors, because courage is the chief hallmark of a person of warrior mentality. Today, an acquisitor’s democracy prevails in most nations; in the near future it will give way to a warrior’s democracy, where money will not be needed to win an election.

So how do you see this new age that you are predicting?

During the Buddhist period preceding Chandragupta’s ascension kings were elected in some areas of north India. That was an example of warrior’s democracy wherein a person’s martial skills, not wealth, brought him the high office. Similarly, in the future a candidate’s military background could be important in his rise to power. Whoever brings about the new warrior age will also give birth to a new golden age.

(The interview originally appeared on www.firstpost.com on August 7,2012. http://www.firstpost.com/economy/raghuram-rajans-advice-isnt-what-upa-may-want-to-hear-410694.html)

(Vivek Kaul is a writer and can be reached at [email protected])

Month: August 2012

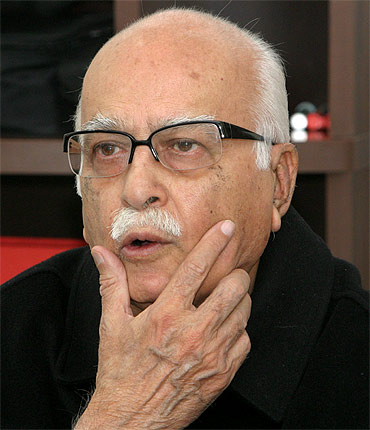

Media and the art of misreading LK Advani’s blogpost

Vivek Kaul

Vivek Kaul

Sunday evenings are normally difficult days for newspaper editors. There is not much happening politically. Businesses are shut and so is the government.

So unless there is a rail mishap somewhere or India happens to win bronze medal at the Olympics, bringing out the Monday edition is a major challenge in comparison to most other days.

Unless, someone like LK Advani happens to write a blog which smells of the foot in the mouth disease, and can be read between the lines.

Newspapers have gone to town highlighting that Advani has conceded to the possibility of a non BJP-non Congress government emerging after the 2014 Lok Sabha elections. “A non-Congress, non-BJP Prime Minister heading a government supported by one of these two principal parties is however feasible,” wrote Advani. This has become the headline point.

But the truth is a little more complicated than that. The word to mark in Advani’s statement is “however”. The context in which he uses the word however has been missed out by the newspapers while reporting on the blog.

Advani starts the blog with an informal chat he had had with two Senior Cabinet Ministers in the current United Progressive Alliance at a dinner hosted by the Prime Minister(PM) Manmohan Singh, for the outgoing President Pratibha Patil.

As he writes “In an informal chat with two senior Cabinet Ministers belonging to the Congress party before the formal dinner, I could clearly perceive an intense sense of concern weighing on the minds of both these Ministers. Their apprehensions were as follows: a) In the Sixteenth Elections to the Lok Sabha, neither the Congress nor the BJP may be able to forge an alliance which has a clear majority in the Lok Sabha. b) In 2013 or 2014, therefore, whenever the Lok Sabha elections take place, the Government likely to take shape can be that of the Third Front. This, according to the Congress Ministers would be extremely harmful not only for the stability of Indian politics but also for national interests.”

The blog then goes on to address the concerns of these Congress ministers. “My response to the anxiety voiced by these Congressmen was: I can understand your concern, but I do not share it. My own view is: i) The shape which national polity has acquired in the past two and a half decades makes it practically impossible for any government to be formed in New Delhi which does not have the support either of the Congress or of the BJP. A third Front Government, therefore, can be ruled out. ii) A non-Congress, non-BJP Prime Minister heading a government supported by one of these two principal parties is however feasible. This has happened in the past also. But, as the Prime Ministership of Ch. Charan Singh, Chandrashekharji, Deve Gowdaji and Inder Kumar ji Gujral (all supported by Congress) as also of Vishwanath Pratap Singhji (supported by BJP) have shown, such governments have never lasted long.”

Essentially Advani is saying three things in a very direct way. The first and foremost is that the Congress is worried after having been in power for nearly eight years at a stretch. The second thing is that he does not expect the third front to come to power, as a certain section of experts has been widely speculating. The third and the most important point is that no government in the country can be formed without the support of either the Congress or the BJP. Hence even if the Congress or the BJP do not form the government they will run the government. Given this, such a government is not expected to last long.

While Advani has said that a non-BJP non-Congress PM can emerge in the 2014 Lok Sabha election, he has also said that such a PM cannot last long as has been the case in the past. This is a very important point that has been missed out on by the media while reporting on the blog and thus creating an incomplete picture.

As expected the Congress leaders are shouting from the rooftops that Advani has already accepted defeat. “Advani has conceded defeat by saying that there can’t be a BJP prime minister in 2014. It means he has conceded defeat… After this blog, how will a BJP candidate win?” said ex journalist and now BCCI office bearer and Congress leader, Rajiv Shukla.

That feeling does not come out anywhere through a proper reading of the blog. In fact Advani clearly says that “it may be the first time when the Congress Party’s score sinks to just two digits, that is, less than one hundred!” Whether that happens or not remains to be seen, but the statement does make it clear that Advani hasn’t accepted defeat in any sort of way.

Shukla’s statement should also be seen in light of the fact that Advani attacked the Gandhi family in his blog. As he wrote “The party’s (the Congress party) miserable performance in Rae Bareilly, Amethi etc. which have long been regarded as pocket-boroughs of the first family, in the U.P. Assembly polls held recently and its dismal record in the Corporation elections of Uttar Pradesh where as against the BJP’s score of ten out of twelve Corporations, the Congress drew a big blank are clear indices of the party’s collapsing fortunes.”

The main job of any spokesperson of the Congress party is to keep the flag flying for the Gandhi family and that’s what Shukla was basically doing.

Another cocktail party theory going around is that Advani has basically used the blog to make a veiled attack at his own party, the Bhartiya Janta Party (BJP), and the senior leaders who are busy projecting Narendra Modi as the party’s Prime Ministerial candidate for the 2012 elections. The logic being that Narendra Modi cannot lead the BJP to a win in the Lok Sabha elections and so he (i.e. Advani) still remains the right candidate, his age notwithstanding.

Now that is something only Advani himself can throw light on and we can only make speculations on the same.

To conclude, let me throw in some lines from a popular reggae song called “Games People Play” first released in 1994 and sung by this group called Inner Circle. As the lines go:

All the games people play now,

Every night and every day now,

Never meaning what they say, yeah,

Never say what they mean.

Politicians are a tad like that.

(The article originally appeared on www.firstpost.com on August 6,2012. http://www.firstpost.com/politics/media-and-the-art-of-misreading-lk-advanis-blogpost-406759.html)

(Vivek Kaul is a writer and can be reached at [email protected])

The case against equity investing: In the long run we are all dead

Vivek Kaul

Stocks are for the long run is a phrase you would have heard often. But that’s not what William H Gross seems to believe anymore. “The cult of equity is dying. Like a once bright green aspen turning to subtle shades of yellow then red in the Colorado fall, investors’ impressions of “stocks for the long run” or any run have mellowed as well,” he wrote in his monthly investment outlook for August 2012.

Gross is the Managing Director of Pacific Investment Management Company (Pimco) and manages Pimco’s Total Return Fund. The Total Return Fund currently has assets under management of $263billion and is the biggest mutual fund in the world.

“An investor can periodically compare the return of stocks for the past 10, 20 and 30 years, and find that long-term Treasury bonds have been the higher returning and obviously “safer” investment than a diversified portfolio of equities,” wrote Gross. So what this clearly tells us is that the higher risk of investing in stocks is not always rewarded with excess return and sometimes it might just make sense to invest in dull and boring bonds which guarantee a given rate of return.

But that’s just one part of the evidence. In the really really long term stocks have done very well. As Gross points out “The long-term history of inflation adjusted returns from stocks shows a persistent but recently fading 6.6% real return (known as the Siegel constant) since 1912.” Hence $1 invested in 1912 would have turned to $500(inflation adjusted) hundred years later i.e. now in 2012. No wonder the Americans took onto investing in stocks like nobody else did. The prime reason for this was the premise that returns from equity beat that from bonds over the long run. Shankar Sharma, joint managing director and vice chairman of First Global explained this phenomenon to me in a recent interview I did for the Daily News and Analysis (DNA) in this way: “Rightly or wrongly, they (the Americans and the much of the Western world) have been given a lifestyle which was not sustainable, as we now know. But for the period it sustained it kind of bred a certain amount of risk taking because life was very secure. The economy was doing well. You had two cars in the garage. You had two cute little kids in the lawn. Good community life. Lot of eating places. You were bred to believe that life is going to be good so hence hey, take some risk with your capital. People were forced to invest in equities under the pretext that equities will beat bonds… They did for a while. Nevertheless, if you go back thirty years to 1982, when the last bull market in stocks started in the United States and look at returns since then, bonds have beaten equities. But who does all this Math?” (You can read the complete interview here)

What has changed now is the ability of Americans to take risk by investing in equity. “Americans are naturally more gullible to hype. But now western investors and individuals are now going to think like us. Last ten years have been bad for them and the next ten years look even worse. Their appetite for risk has further diminished because their picket fences, their houses all got mortgaged. Now they know that it was not an American dream, it was an American nightmare. So I cannot make a case for a broad bull market emerging anytime soon,” said Sharma.

And this seems phenomenon seems to be clearly evident in the numbers that are coming out. As the USA Today reported in mid May: “Stocks remain out of fashion…Retail investors have yanked more than $260 billion out of mutual funds that invest in US stocks since the end of 2008, says the Investment Company Institute, a fund trade group. In contrast, they have funneled more than $800 billion into funds that invest in less-volatile bonds. Investors’ chronic mistrust of stocks is reigniting fears that an entire generation is unlikely to stash large chunks of cash in the increasingly unpredictable market as they did in the past. “Investors have suffered a traumatic shock that has caused severe psychological damage and made them more risk-averse,” says Carmine Grigoli, chief investment strategist at Mizuho Securities USA.”

The phrase to mark here is “risk-averse”. As Sharma puts it “Investing in equity is a mindset. That when I am secure, I have got good visibility of my future, be it employment or business or taxes, when all those things are set, then I say okay, now I can take some risk in life.”

The question that concerns us in India is how will this change in mindset impact India? Before I come to that question let me deviate a little and discuss the concept of naturally occurring ponzi schemes.

A ponzi scheme essentially is a fraudulent investment scheme in which money being brought in by new investors is used to pay off the old investors. The people running the scheme typically promise very high returns to tempt prospective investors to invest money in the scheme. But this money is not invested anywhere to generate returns. The “promise” of high returns ensures that newer investors keep coming in. They money they bring in is used to pay off the older investors. The scheme keeps running till the money being brought in by the new investors is lesser than the money that needs to be paid off to the older ones. This is the point when the scheme collapses. Typically the people who run such schemes disappear with the money, before the scheme collapses.

In his book, Irrational Exuberance, Robert Schiller introduces the concept of Naturally Occurring Ponzi Schemes, which happen without the contrivance of a fraudulent manager. Such a scheme works on a price to price feedback theory. When prices go up creating successes for some investors, this may attract public attention, promote word of mouth enthusiasm and heighten expectations for further price increases. (Adapted from Shiller 2003). The stock market is the best example. Stories about stock markets going up spread very fast. Investors, in an optimistic mood, might want to buy stock and take the stock price further up. This leads to more investors entering the market, fuelling an even greater price rise and the cycle gets repeated over and over. As Shiller mentions, “When prices go up a number of times, investors are rewarded by price movements in these markets, just as they are in Ponzi Schemes.”

The point being that the real returns in the stock market are made when prospective investors are in the Ponzi scheme mode and are willing to invest. A major reason for the bull run in the stock market in India between 2003 and 2007 was the fact that foreign investors brought in a lot of money, thus driving up stock prices and generating returns for those who had already invested. But things have changed over the last five years.

Between April 2007 and July 2012, the foreign investors invested Rs 3,538,108.46 crore in Indian stocks. That clearly is a lot of money. But they also sold Rs 3,537,016.97 crore worth of Indian stocks. This means that the net investment of foreign investors in Indian stocks in the last five years and three months has been a miniscule Rs 1091.49crore.

During the same period the domestic institutional investors made investments worth Rs 1,571,084.73 crore. They sold stocks worth Rs 1,462,118.66 crore. Hence their net investment in stocks was Rs 108,938.27 crore. (Source: www.moneycontrol.com)

It is this net investment by Indian institutional investors which ensured that the BSE Sensex, India’s premier stock market index, has delivered an absolute return of 30% since April 2007. This means an average return of 5.1% per year. I need not tell you that you would have been better off doing a fixed deposit where the returns were more or less guaranteed. If you had taken on some risk by investing in a mutual fund scheme like Birla Sun Life MIP-II Savings 5 G, you would have managed to get a return of 10.35% per year, more than double that of the stock marekt. The scheme invests 95% of the money collected in debt and the remaining in stocks.

The point I am trying to make is that for the stock market in India to give good returns it is important that foreign investors bring money into India and stay invested in Indian stocks. With their attitudes towards investing in stocks changing whether they will continue to invest in India, remains to be seen.

The other way out is that Indian investors start investing more money in the stock market both directly and indirectly. I don’t see that happening due to two reasons. A lot of Indian investors over the last few years invested money in the Indian stock market indirectly through unit linked insurance plans(Ulips) sold (or rather mis-sold) by insurance companies.

They are now coming to the realization that they have been taken to the cleaners. Money invested five to seven years back is just about breaking even and they would have been much better off by simply letting their money lie idle in a savings bank account.

This is primarily because Ulips used the premium paid by investors to pay very high commissions to insurance agents and did not invest the full premium. So these investors who were taken for a royal ride are not going to come back to the stock market anytime soon.

While systematic investment plans( SIPs) offered by mutual funds have done a lot better than Ulips but the returns are nowhere in the region that would compensate for the increased risk of investing in stocks.

The other reason is a more fundamental reason that was explained to me by Shankar Sharma. “Emerging market investors are more risk averse than the developed world investors. We see too much of risk in our day to day lives and so we want security when it comes to our financial investing… But look across emerging markets, look at Brazil’s history, look at Russia’s history, look at India’s history, look at China’s history, do you think citizens of any of these countries can say I have had a great time for years now? That life has been nice and peaceful? I have a good house with a good job with two kids playing in the lawn with a picket fence? Sorry boss, this has never happened…. Indians have figured out that equities are a fashionable thing meant for the Nariman Points of the world.”

Given these reasons it is difficult to make a case for equities as a long term investment in India as well, though things may not turn to be as bad as they might turn out to be in America and other parts of the Western world.

In the end let me quote an economist who the world always goes back to, when they run out of everything else. As John Maynard Keynes once famously said “In the long run we are all dead”.

(The article originally appeared on www.firstpost.com on August 6,2012. http://www.firstpost.com/investing/the-case-against-equity-in-the-long-run-we-are-all-dead-406223.html)

(Disclosure: Despite the slightly negative take here, the writer continues to makes regular investments in the Indian stock market through systematic investment plans, though the amount of investments have come down over the last six months)

(Vivek Kaul is a writer and can be reached at [email protected])

Reform by stealth, the original sin of 1991, has come back to haunt us

India badly needs a second generation of economic reforms in the days and months to come. But that doesn’t seem to be happening. “What makes reforms more difficult now is what I call the original sin of 1991. What happened from 1991 and thereon was reform by stealth. There was never an attempt made to sort of articulate to the Indian voter why are we doing this? What is the sort of the intellectual or the real rationale for this? Why is it that we must open up?” says Vivek Dehejia an economics professor at Carleton University in Ottawa,Canada. He is also a regular economic commentator on India for the New York Times India Ink. In this interview he speaks to Vivek Kaul.

How do you see overall Indian economy right now?

The way I would put it Vivek is, if I take a long term view, a generational view, I am pretty optimistic. The fundamentals of savings and investments are strong.

What about a more short term view?

If you take a shorter view of between six months to a year or even two years ahead, then everything that we have been reading about in the news is worrisome. The foreign direct investment is drying up. The savings rate seems to have been dropping. The economic growth we know has dropped. The next fiscal year we would lucky if we get 6.5% economic growth.

How do we account for the failure of this particular government to deliver sort of crucially needed second generation economic reforms?

The India story is a glass half empty or a glass half full. If you look at the media’s treatment of the India story, particularly international media they tend to overshoot. So two years ago we were being overhyped. I remember that the Economist had a famous cover where they said that India will overtake China’s growth rate in the next couple of years. They made that bold prediction. And then about a year later they were saying that India is a disaster. What has happened to the India story? The international media tends to overshoot. And then they overdo it in the negative direction as well. A balanced view would say that original hype was excessive. We cannot do nor would we want to do what China is doing. With our democratic system, our pluralistic democracy, the India that we have, we cannot marshal resources like the way the Chinese do, or like the way Singapore did.

Could you discuss that in detail?

If you take a step back, historically, many of the East Asian growth miracles, the Latin American growth miracles, were done under brutal dictatorial regimes. I mean whether it was Pinochet’s Chile, whether it was Taiwan or Singapore or Hong Kong, they all did it under authoritarian regimes. So the India story is unique. We are the only large emerging economy to have emerged as a fully fledged democracy the moment we were born as a post colonial state and that is an incredibly daring thing to do. At the time when the Constituent Assembly was figuring out what are we going to do now post independence a lot of conservative voices were saying don’t go in for full fledged democracy where every person man or a woman gets a vote because you will descend down into pluralism and identity based politics and so on. Of course to some extent it’s true. A country with a large number of poor people which is a fully fledged democracy, the centre of gravity politically is going to be towards redistribution and not towards growth. So any government has to reckon with the fact that where are your votes. In other words the market for votes and the market for economic reform do not always correlate.

You talk about authoritarian regimes and growth going together…

This is one of the oldest debates in social sciences. It is a very unsettled and a very controversial one. For any theory you can give on one side of it there is an equally compelling argument on the other side. So the orthodox view in political science particularly more than economics was put forward by Samuel Huntington. The view was that you need to have some sort of political control, you cannot have a free for all, and get marshalling of resources and savings rate and investment rate, that high growth demands.

So Huntington was supportive of the Chinese model of growth?

Yes. Huntington famously was supportive of the Chinese model and suggested that was what you had to do at an early stage of economic development. But there are equally compelling arguments on the other side as well. The idea is that democracy gives a safety valve for a discontent or unhappiness or for popular expression to disapproval of whatever the government or the regime in power is doing. We read about the growing number of mysterious incidents in China where you can infer that people are rioting. But we are not exactly sure because the Chinese system also does not allow for a free media. Also let’s not forget that China has had growing inequalities of income and growth, and massive corruption scandals. The point being that China too for its much wanted economic efficiency also has kinds of problems which are not much different from the once we face.

That’s an interesting point you make…

Here again another theory or another idea which can help us interpret what is going on. When you have a period of rapid economic growth and structural transformation of an economy, you are almost invariably going to have massive corruption. It is almost impossible to imagine that you have this huge amount of growth taking place in a relatively weak regulatory environment where there isn’t going to be an opportunity for corruption. It doesn’t mean that it is okay or it doesn’t mean that one condones it, but if you look throughout history it’s always been the case that in the first phase of rapid growth and rapid transformation there has been corruption, rising inequalities and so on.

Can you give us an example?

The famous example is the so called American gilded age. In the United States after the end of the Civil War (in the 1860s) came the era of the Robber Barons. These people who are now household names the Vanderbilts, the Rockefellers, the Carnegies, the Mellons, were basically Robber Barons. They were called that of course because how they operated was pretty shady even according to the rules of that time.

Why are the second generation of reforms not happening?

What makes reforms more difficult now is what I call the original sin of 1991. We had a first phase of the economic reforms in 1991 where we swept away the worst excesses of the license permit raj. We opened up the product markets. But what happened from 1991 and thereon was reform by stealth. Reform by the stroke of the pen reform and reform in a mode of crisis, where there was never an attempt made to sort of articulate to the Indian voter why are we doing this? What is the sort of the intellectual or the real rationale for this? Why is it that we must open up? It wasn’t good enough to say that look we are in a crisis. Our gold reserves have been mortgaged. Our foreign exchange reserves are dwindling. Again India’s is hardly unique on this. Wherever you look whether it is Latin America or Eastern Europe, it generally takes an economic crisis to usher in a period of major economic reform.

So the original sin is still haunting us?

The original sin has come back to haunt us because the intellectual basis of further reform is not even on anyone’s agenda. Discussions and debates on reform are more focused on issues like the FDI is falling, the rupee is falling, the current account deficit is going up etc. Those are all symptoms of a problem. The two bursts of reform that we had first were first under Rao/Manmohan Singh and then under NDA. If a case had been made to build a constituency for economic reform, then I think we would have been in a different political economy than we are now. But the fact that didn’t happen and things were going well, the economy was growing, that led to a situation where everybody said let’s carry on. But now we don’t have that luxury. Now whichever government whoever comes to power in 2014 is going to have to make some tough decisions that their electoral base, isn’t going to like necessarily. So how are they going to make their case?

So are you suggesting that the next generation of reforms in India will happen only if there is an economic crisis?

I don’t want to say that. Again that could be one interpretation from the arguments I am making of the history. It will require a change in the political equilibrium and certainly a crisis is one thing that can do that. But a more benign way the same thing can happen that without a crisis is the realization of the political actors that look I can make economic reform and economic growth electorally a winning policy for me. But India is a land of so many paradoxes. A norm of the democratic political theory in the rich countries i.e. the US, Canada, Great Britain etc, is that other things being equal, the richer you are, the more educated you are, the more likely you are to vote. In India it is the opposite. The urban middle class is the more disengaged politically. They feel cynical. They feel powerless. Until they become more politically engaged that change in the equilibrium cannot happen.

What about the rural voter?

The rural voter at least in the short run might benefit from a NREGA and will say that you are giving me money and I will keep voting for you. We have all heard people say they are uneducated and they are ignorant, no it’s not like that. He is in a very liquidity constrained situation. He is looking to the next crop, the next harvest, the next I got to pay my bills. If someone gave him 100 days of employment and gives him a subsidy, he will take it.

How do explain the dichotomy between Manmohan Singh’s so called reformist credentials and his failure to carry out economic reforms?

One of the misconceptions that crops up when we look at poor economic performance or failure to carry out economic reform is what cognitive psychologists call fundamental attribution bias. Fundamentally attribution bias says that we are more likely to attribute to the other person a subjective basis for their behaviour and tend to neglect the situational factors. Looking at our own actions we look more at the situational factors and less at the idiosyncratic individual subjective factors. So what am I trying to say? What I am saying is that it has become almost a refrain to say that Dr Manmohan Singh should be an economic reformer. He was at least the instrument if not the architect of the 1991 reforms. There are speculations being in made in what you can call the Delhi and Mumbai cocktail party circuit, about whether he is really a reformer? Was it Narsimha Rao who was really the real architect of the reform? Is he a frustrated reformer? What does he really want to do? What’s going on his head? That in my view is a fundamental attribution bias because we are attributing to him or whoever is around him a subjective basis for the inaction and the policy paralysis of the government.

So the government more than the individual at the helm of it is to be blamed?

Traditionally the electoral base of the Congress party has been the rural voter, the minority voters and so on, people who are at the lower end of the economic spectrum. So they are the beneficiaries just roughly speaking of the redistributive policies. Political scientists have a fancy name for it. They call it the median voter theorem. What does it mean? It means that all political parties will tend to gravitate towards the preferred policy of the guy in the middle, the median voter.

Was Narsimha Rao who was really the real architect of the reform?

Narsimha Rao must be given a lot of credit for taking what was then a very bold decision. He was at the top of a very weak government as you know. And he gave the political backing to Manmohan Singh to push this first wave of reforms more than that would have been necessary just to avert a foreign exchange crisis. And then he paid a price for it electorally in the next election. This again the intangible element in the political economy that short of a crisis it often takes someone of stature to really take that long term generation view. IT means that you are not just looking at narrow electoral calculus but you are looking beyond the next election. That’s what seems to be missing right now. Among all the political parties right now, one doesn’t seem to see that vision of look at this is where we want to be in a generation and here is our roadmap of how we are going to get there.

Going back to Manmohan Singh you called him an overachiever recently, after the Time magazine called him an “underachiever”. What was the logic there?

The traditional view and certainly that was widely in the West at least till very recently has been that it was Manmohan Singh who was the architect of the India’s economic reforms. But then how do you explain the inaction in the last five, six, seven years? The revisionist perspective would say no in fact the real reformer was Narsimha Rao to begin with. The real political weight behind the reform was his. And Manmohan Singh that any good technocratic economist should have been able to do which is to implement a series of reforms that we all knew about. My teacher Jagdish Bhagwati had been writing about it for years. In that sense maybe Manmohan Singh was given too much credit in the first instance for implementing a set of reforms. If you look at his career since then he has never really been a politically savvy actor. We have this peculiar situation in India since 2004 where the Prime Minister sits in the Rajya Sabha, the upper house. That kind of thing is not barred by our constitution but I don’t think that the framers of the constitution envisaged this would be a long term situation. It is a little like the British prime minister sitting in the House of Lords. I mean that practice disappeared in the nineteenth century. He has not shown from the evidence that we can see any ability to get a political base of his own to be a counterweight to the more redistributive tendencies of the Nehru Gandhi dynasty. And that’s the sense that in somewhat cheeky way I was using the term overachiever.

Do you think he is just keeping the seat warm for Rahul Gandhi?

It increasingly appears to be that way. If that is true then it suggests that we shouldn’t really expect much to happen in the next two years.

Does the fiscal deficit of India worry you?

If you look at some shorter to medium term challenges, then things like fiscal deficit and the current account deficit are things to worry about. Again other things like the weak rupee, the weak FDI data, things that people tend to fixate at, but those at best are symptoms of a deeper structural problem. The deeper concern is the kind of reform that will require a major legislative agenda such as labour law reform for example to unlock our manufacturing sector. And managing the huge demographic dividend that we are going to get in the form of 300-400 million young people. They will have to be educated.

But is there a demographic dividend?

That’s the question. Will it become a demographic nightmare? Can you imagine the social chaos if you have all these kids just wandering around, not educated enough to get a job, what are they going to do? It’s a recipe for social disaster. That according to me is going to be real litmus test. If we are able to navigate that then I don’t see why we won’t be on track to again go back to 8- 9% economic growth. I want to remain optimistic at the end of the day.

(The interview originally appeared in the Daily News and Analysis on August 6,2012. http://www.dnaindia.com/money/interview_reform-by-stealth-the-originalsin-of-1991-has-come-back-to-haunt-us_1724348)

(Interviewer Kaul is a writer and can be reached at [email protected])

What Team Anna can learn from Nirma, Sony, Apple and Ford

Vivek Kaul

The decision by Team Anna to form a political party has become the butt of jokes on the internet. A Facebook friend suggested that they name their party, the Char Anna Party and someone else suggested the name Kejriwal Liberal Party for Democracy (KLPD).

The jokes are clearly in a bad taste and reflect the level of cynicism that has seeped into us. Let me paraphrase lines written by my favourite economist John Kenneth Galbraith (borrowed from his book The Affluent Society) to capture this cynicism. “When Indians see someone agitating for change they enquire almost automatically: “What is there for him?” They suspect that the moral crusades of reformers, do-gooders, liberal politicians, and public servants, all their noble protestations notwithstanding are based ultimately on self interest. “What,” they enquire, “is their gimmick?””

The cynicism comes largely from the way things have evolved in the sixty five years of independence where the political parties have taken us for a royal ride. Given this the skepticism that prevails at the decision of Team Anna to form a political party isn’t surprising. Take the case of Justice Markandey Katju, who asked CNN-IBN “Which caste will this political party represent? Because unless you represent one caste, you won’t get votes…Whether you are honest or meritorious nobody bothers. People see your caste or religion. You may thump your chest and say you are very honest but you will get no votes.”

Former Supreme Court justice N. Santosh Hegde said “Personally, am not in favour of Annaji floating a political party and contesting elections, which is an expensive affair and requires huge resources in terms of funds and cadres.”

Some other experts and observers have expressed their pessimism at the chances of success of the political party being launched by Team Anna. Questions are being raised. Where will they get the money to fight elections from? How will they choose their candidates? What if Team Anna candidates win elections and start behaving like other politicians?

All valid questions. But I remain optimistic despite the fact that things look bleak at this moment for Team Anna’s political party.

I look at Team Anna’s political party as a disruptive innovation. Clayton Christensen, a professor of strategy at the Harvard Business School is the man who coined this phrase. He defines it as “These are innovations that transform an existing market or create a new one by introducing simplicity, convenience, accessibility and affordability. It is initially formed in a narrow foothold market that appears unattractive or inconsequential to industry incumbents.”

An excellent example of a home grown disruptive innovation is Nirma detergent. Karsanbhai Patel, who used to work as a chemist in the Geology & Mining Department of the Gujarat government, introduced Nirma detergent in 1969.

He first started selling it at Rs 3.50 per kg. At that point of time Hindustan Lever Ltd’s (now Hindustan Unilever) Surf retailed for Rs 15 per kg. The lowest-priced detergent used to sell at Rs 13.50 per kg. The price point at which Nirma sold made it accessible to consumers, who till then really couldn’t afford the luxury of washing their clothes using a detergent and had to use soap instead.

If Karsanbhai Patel had thought at the very beginning that Hindustan Lever would crush his small detergent, he would have never gotten around launching it. The same applies to Team Anna’s political party as well. They will never know what lies in store for them unless they get around launching the party and running it for the next few years.

Getting back to Nirma, the logical question to ask is who should have introduced a product like Nirma? The answer is Hindustan Lever, the company which through the launch of Surf detergent, pioneered the concept of bucket wash in India. But they did not. Even after the launch of Nirma, for a very long time they continued to ignore Nirma, primarily because the price point at which Nirma sold was too low for Hindustan Lever to even think about. And by the time the MBAs at Hindustan Lever woke up, Nirma had already established itself as a pan-India brand. But, to their credit they were able to launch the ‘Wheel’ brand, which competed with Nirma directly.

At times the biggest players in the market are immune to the opportunity that is waiting to be exploited. A great example is that of Kodak which invented the digital camera but did not commercialize it for a very long time thinking that the digital camera would eat into its photo film business. The company recently filed for bankruptcy.

Ted Turner’s CNN was the first 24-hour news channel. Who should have really seen the opportunity? The BBC. But they remained blind to the opportunity and handed over a big market to CNN on a platter.

Along similar lines, maybe there is an opportunity for a political party in India which fields honest candidates who work towards eradicating corruption and does not work along narrow caste or regional lines. Maybe the Indian voter now wants to go beyond voting along the lines of caste or region. Maybe he did not have an option until now. And now that he has an option he might just want to exercise it.

While there is a huge maybe but the thing is we will never know the answers unless Team Anna’s political party gets around to fighting a few elections.

The other thing that works to the advantage of disruptive innovators is the fact that the major players in the market ignore them initially and do not take them as a big enough force that deserves attention.

A great example is the Apple personal computer. As Clayton Christensen told me in an interview I carried out for the Daily News and Analysis (DNA) a few years back “Apple made a wise decision and first sold the personal computer as a toy for children. Children had been non-consumers of computers and did not care that the product was not as good as the existing mainframe and minicomputers. Over time Apple and the other PC companies improved the PC so it could handle more complicated tasks. And ultimately the PC has transformed the market by allowing many people to benefit from its simplicity, affordability, and convenience relative to the minicomputer.”

Before the personal computer was introduced, the biggest computer available was called the minicomputer. “But minicomputers cost well over $200,000, and required an engineering degree to operate. The leading minicomputer company was Digital Equipment Corporation (DEC), which during the 1970s and 1980s, was one of the most admired companies in the world economy,” write Clayton Christensen, Michael B Horn and Curtis W Johnson in Disrupting Class —How Disruptive Innovation Will Change the Way the World Learns.

But even then DEC did not realise the importance of the personal computer. “None of DEC’s customers could even use a personal computer for the first 10 years it was on the market because it wasn’t good enough for the problems they needed to solve. That meant that more carefully DEC listened to its best customers, the less signal they got that the personal computer mattered — because in fact it didn’t — to those customers,” the authors explain.

That DEC could generate a gross profit of $112,500 when selling a minicomputer and $300,000 while selling the much bigger ‘mainframe’ also didn’t help. In comparison, the $800 margin on the personal computer looked quite pale.

Another example is Sony. “In 1955, Sony introduced the first battery-powered, pocket transistor radio. In comparison with the big RCA tabletop radios, the Sony pocket radio was tiny and static laced. But Sony chose to sell to its transistor radio to non-consumers – teenagers who could not afford big tabletop radio. It allowed teenagers to listen to music out of earshot of their parents because it was portable. And although the reception and fidelity weren’t great, it was far better than their alternative, which was no radio at all,” write Christensen, Horn and Johnson. Sony went onto to come up with other great disruptive innovations like the Walkman and the CDMan. But did not see the rise of MP3 players.

The point is that incumbents are so clued in to their business that it is very difficult for them to see the rise of a new category.

So what is the learning here for Team Anna? The learning is that their political party may not take the nation by storm all at once. They might appeal only to a section of the voters initially, probably the urban middle class, like Apple PCs had appealed to children and Sony radios to teenagers. So the Team Anna political party is likely to start off with a limited appeal and if that is the case the bigger political parties will not give them much weight initially. Chances are if they stay true to their cause their popularity might gradually go up over the years, as has been the case with disruptive innovators in business. The fact that political parties might ignore them might turn out to be their biggest strength in the years to come.

Any disruption does not come as an immediate shift. As the authors write, “Disruption rarely arrives as an abrupt shift in reality; for a decade, the personal computer did not affect DEC’s growth or profits.” Similarly, the Team Anna political party isn’t going to take India by storm overnight. It will need time.

Business is littered with examples of companies that did not spot a new opportunity that they should have and allowed smaller entrepreneurial starts up to grow big. The only minicomputer company that successfully made the transition to being a personal computer company was IBM. “They set up a separate organisation in Florida, the mission of which was to create and sell a personal computer as successfully as possible. This organisation had to figure out its own sales channel, it had its own engineers, and it was unencumbered by the existing organization,” said Christensen.

But even IBM wasn’t convinced about the personal computer and that is why it handed over the rights of the operating system to Microsoft on a platter. Even disruptive innovators get disrupted. Microsoft did not see the rise of email and it’s still trying to correct that mistake through the launch of Outlook.com. It didn’t see the rise of search engines either. Nokia did not see the rise of smart phones. Google did not see the rise of social media. And Facebook will not see the rise of something else.

Team Anna is a disruptive innovation which can disrupt the model of the existing political parties in India. There are three things that can happen with this disruptive innovation. The Team Anna political party tries for a few years and doesn’t go anywhere. That doesn’t harm us in anyway. The Team Anna political party fights elections and is able to build a major presence in the country and stays true to its cause. That benefits all of us. The Team Anna political party fights elections and its candidates win. But these candidates and the party turn out to be as corrupt as the other political parties that are already there. While this will be disappointing but then one more corrupt political party is not going to make things more difficult for the citizens of this country in anyway. We are used to it by now.

Given these reasons the Team Anna political party deserves a chance and should not be viewed with the cynicism and skepticism which seems to be cropping up.

(The article originally appeared on www.firstpost.com on August 4,2012. http://www.firstpost.com/politics/what-team-anna-can-learn-from-nirma-sony-apple-and-ford-404843.html)

(Vivek Kaul is a writer and can be reached at [email protected])