Vivek Kaul

The Congress party led United Progressive Alliance(UPA) has been in the habit of shooting messengers who come with bad news. So here is some more bad news.

Almost half way through the financial year 2012-2013 (i.e. the period between April 1, 2012 and March 31, 2013), the fiscal deficit of the government is looking awful to say the least. Fiscal deficit is the difference between what the government earns and what it spends.

When the finance minister presents the annual budget there are a lot of assumptions that go into the projection of the fiscal deficit.

The overall fiscal deficit was projected to be at Rs 5,13,590 crore. The expenditure of the government for the year was expected to be at Rs 14,90,925 crore. In comparison the government expected to earn Rs 9,77,335 crore during the course of the year. The difference between the earnings of the government and its expenditure came to Rs 5,13,590 crore and this is the projected fiscal deficit. Hence, the government was spending 55% (Rs 5,13,590 crore expressed as a percentage of Rs 9,77,335 crore) more than it earned.

The expenditure part of the calculation includes subsidies on oil, fertiliser and food. The subsidy on oil was assumed to be at Rs 43,580 crore. This subsidy was to be used by the government to compensate oil marketing companies like Indian Oil, Bharat Petroleum and Hindustan Petroleum for selling diesel, kerosene and cooking gas, at a loss.

The government has more or less run out of the budgeted oil subsidies. It has already paid Rs 38,500 crore to OMCs, for selling diesel, kerosene and LPG at a loss during the last financial year. This amount was reimbursed only in the current financial year and hence has had to be adjusted against the oil subsidies budgeted for this year. This leaves only around Rs 5,080 crore with the government for compensating the OMCs for the losses this year.

And that’s just small change in comparison to the losses that OMCs are expected to face for selling diesel, kerosene and LPG. The oil minister Jaipal Reddy recently said that if the current situation continues the OMCs will end up with losses amounting to Rs 2,00,000 crore during the course of the year.

As economist Shankar Acharya wrote in the Business Standard on September 13“The real fiscal spoilsport is, of course, subsidies, especially those for diesel, LPG and kerosene, though those on fertiliser and foodgrain are also large. Data circulated by the petroleum ministry indicate under-recoveries by oil marketing companies (OMCs) of Rs 17/litre on diesel, Rs 33/litre on kerosene and Rs 347/cylinder on LPG.”

The OMCs need to be compensated for these losses by the government because if they are not compensated then they will go bankrupt. And if they go bankrupt then you, I and everybody else, won’t be able to buy petrol, diesel, kerosene and LPG, which would basically mean going back to the age of tongas and bullock carts. Clearly no one would want that.

So to deal with expected losses of Rs 2,00,000 crore the government has around Rs 5,080 crore of the budgeted amount remaining. This means that the government would have to come up with around Rs 1,95,000 crore from somewhere.

This is a large amount of money. The government has tried to curtail these losses by increasing the price of diesel by Rs 5 per litre and thus bringing down the loss on sale of diesel to Rs 12 per litre. This move is expected to save the government Rs 19,000 crore which means losses will now amount to Rs 1,76,000crore (Rs 1,95,000crore – Rs 19,000 crore) in total.

Since 2003-2004, the government has had a formula for sharing these losses. The upstream oil companies like ONGC and Oil India Ltd, which produce oil, are forced to share one third of the losses. But there have been instances when the formula has not been followed and the upstream companies have been forced to chip in with more than their fair share. In 2011-2012, the last financial year the government forced the upstream companies to compensate around 40% of the total losses.

If the government follows the same formula this year as well, it would mean that the upstream companies would have to compensate the OMCs to the tune of Rs 70,400crore (40% of Rs 1,76,000 crore). Now that is a huge amount, whether the upstream companies have the capacity to come up with that kind of money remains to be seen. But assuming that they do, it still means that the government would have to come up with Rs 1,05,600 crore (60% of Rs 1,76,000 crore) from somewhere. This would mean that the fiscal deficit would be pushed up to Rs 6,19,190 crore (Rs 5,13,590 crore + Rs 1,05,600 crore). If the upstream companies cannot bear 40% of the total loses the government will have to bear a greater proportion of the total losses, pushing the fiscal deficit up further.

Oil subsidies are not the only subsidies going around. The government is expected to overshoot its food subsidy target of Rs75,000 crore as well. The Economic Times had quoted a food ministry official on June 15, 2012, confirming that the food subsidy target will be overshot, after the government had approved the minimum support price (MSP) of rice to be increased by 16 per cent to Rs 1,250 per quintal to. “The under-provisioning of food subsidy in the current year is at Rs 31,750 crore. Now with increased MSP on paddy(i.e. rice), the total food subsidy deficit at the end of the current year will be about Rs 40,000 crore putting immense pressure on the food subsidy burden of the government,” said a food ministry official,” the Economic Times had reported.

If we add this Rs 40,000 crore to Rs 6,19,190 crore the deficit shoots up to Rs 6,59,190 crore. This is something that Acharya confirms in his column. “A few days back the Controller General of Accounts (CGA, not CAG!) informed us that the central government’s fiscal deficit for the first four months of 2012-13 had already exceeded half of the Budget’s target for the full year,” he writes.

What does this mean is that for the first four months of the year, the government’s fiscal deficit was greater than half of the fiscal deficit for the year. The targeted fiscal deficit for the year was Rs 5,13,590crore. Half of it would equal to Rs 2,56,795 crore. The government has already crossed this in the first four months. At the same rate it would end up with a fiscal deficit of Rs 7,70,385 crore (Rs 2,56,795 crore x 3) by the end of the year. This would work out to 50% more than the projected fiscal deficit of Rs 5,13,590 crore.

It would be preposterous on my part to project a fiscal deficit which is 50% more than the projected deficit. But as I had shown a little earlier a deficit of around Rs 6,60,000 crore is pretty much on the cards.

What does not help is the fact that things aren’t looking too good on the revenue side for the government. As Acharya puts it “More recently, there are ominous, if unsurprising, indications of a significant deceleration in direct tax collections up through August, especially from companies, with gross corporate tax revenues stagnant compared to April-August of the previous financial year. Despite finance ministry reassurances, tax collections for the year could fall significantly below Budget targets because of sluggish economic activity.”

So the government is not going to earn as much as it had expected to through taxes. The government also has set a disinvestment target of Rs30,000 crore. It hopes to earn this money by selling shares of public sector companies. But six months into the financial year there has been no activity on this front.

Taking these factors into account a fiscal deficit of Rs 7,00,000 crore can be expected. Fiscal deficit as we all know is expressed as a proportion of the gross domestic product (GDP). The projected fiscal deficit of Rs 5,13,590 crore works out to 5.1% of the GDP. The GDP in this case is assumed to be at Rs 101,59,884 crore.

With a fiscal deficit of Rs 7,00,000 crore, fiscal deficit as a proportion of GDP works out to 6.9% (Rs 7,00,000 crore expressed as a % of Rs 101,59,884 crore).

The GDP number of Rs 101,59,884 crore is also a projection. The assumption is that the GDP will grow by a nominal rate of 14% over the last financial year’s advance estimate of GDP at Rs 89,121,79 crore. The trouble is that the economy is slowing down and it is highly unlikely to grow at a nominal rate of 14%. The current whole sale price inflation is around 7%. The real rate of growth for the first six months of the calendar year (i.e. the period between January 1, 2012 and June 30, 2012) has been around 5.4%. If we add that to the inflation we are talking of a nominal growth of around 12.5%. At that rate the expected GDP for the year is likely to be around Rs 100,26,201crore (1.125 x Rs 89,121,79 crore).

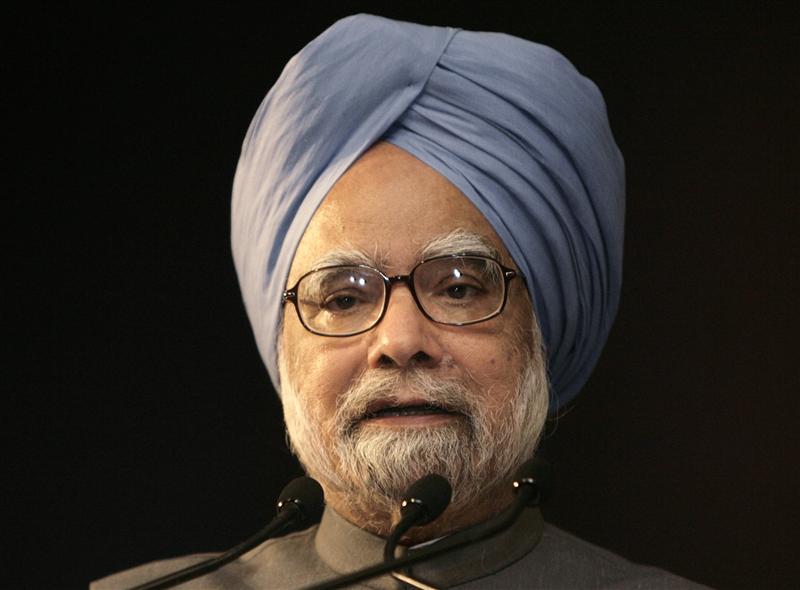

Hence the fiscal deficit as a percentage of GDP will be around 7% (Rs 700,000 crore expressed as a percentage of Rs 100,26,201crore). A 7% fiscal deficit would give the Prime Minister Manmohan Singh a sense of déjà vu. In his speech as the Finance Minister of India in 1991 he had said “The crisis of the fiscal system is a cause for serious concern. The fiscal deficit of the Central Government…is estimated at more than 8 per cent of GDP in 1990-91, as compared with 6 per cent at the beginning of the 1980s and 4 per cent in the mid-1970s.”

One way out of this mess is to cut the losses due to the sales diesel, kerosene and on LPG. But that would mean a price increase of Rs 12/litre on diesel, Rs 33/litre on kerosene and Rs 347/cylinder on LPG. That of course is not going to happen. Also with the government having to borrow more to meet the increased fiscal deficit, the interest rates will continue to remain high.

India is staring at a huge economic problem. The question is whether the government is ready to recognise it. As Pratap Bhanu Mehta writes in The Indian Express “The central driver of good economics is recognising the problem.” The trouble is that the Congress led UPA government doesn’t want to recognise the problem, let alone tackle it.

(The article originally appeared on www.firstpost.com on September 14,2012. http://www.firstpost.com/economy/why-the-diesel-hike-will-not-even-dent-the-fiscal-deficit-455249.html)

(Vivek Kaul is a writer. He can be reached at [email protected])

Manmohan Singh

Mute Manmohan watches as “Coalgate” engulfs Congress from all sides

Vivek Kaul

The Great Fire of Rome started on July 19, 64AD, and burnt for six days. There are several varying accounts of it in history. One of the accounts suggests that Nero the king of Rome watched the fire destroy the city, from one of Rome’s many hills, while singing and playing the lyre, a stringed musical instrument.

India these days has its own Nero, Prime Minister Manmohan Singh. As the Congress led United Progressive Alliance (UPA) government gets engulfed in the coal-gate scam, Manmohan Singh has largely been a silent spectator watching from the stands and seeing his government being engulfed by the coal fire.

And this is not the first time. Manmohan Singh has largely been a bystander at the helm of what is turning out to be probably the most corrupt government that India has ever seen. As TN Ninan, one of the most respected business editors in the country, recently wrote in the Business Standard “Corruption silenced telecom, it froze orders for defence equipment, it flared up over gas, and now it might black out the mining and power sectors. Manmohan Singh’s fatal flaw — his willingness to tolerate corruption all around him while keeping his own hands clean — has led us into a cul de sac , with the country able to neither tolerate rampant corruption nor root it out.”

Manmohan Singh like Nero before him has been watching as institutionalised corruption burns India. The biggest of these scams has been termed “coal-gate” by the Indian media. The Comptroller and the Auditor General (CAG) of India put the losses on account of this scam at a whopping Rs 1,86,000 crore.

The background

The Planning Commission of India had estimated that the raw demand for coal in the year 2011-2012 will be at around 696 million tonnes. Of this 554 million tonnes was expected to be produced in the country by Coal India, Singareni Collieries and a host of other small companies. The remaining was expected to be met through imports.

Production of coal in 2011-2012 in million tonnes

Company Target Achievement

Coal India 447 436

Singareni Collieries 51 52

Others 56 52

Total 554 540

Source: Provisional Coal Statistics 2011-2012, Coal Controller Organisation, Ministry of Coal

As can be seen from the table above the actual production of coal at 540 million tonnes was a little less than the target. This was an increase of 1.3% over the previous year. Also since the actual demand for coal was significantly higher than the actual production, India had to import a lot of coal during the course of the year. Estimates made by the Coal Controller Organisation suggest that the country imported around 99million tonnes of coal in 2011-2012. The Planning Commission had expected around 137million tonnes to be imported in the year. So the Coal Controller’s estimate for coal imports is significantly lower than that. Also the increasing iport of coal is not a one off trend.

Coal Imports In Million tonnes In Rupees crore

1999-2000 19.7 3548

2000-2001 20.9 4053

2001-2002 20.5 4536

2002-2003 23.3 5028

2003-2004 21.7 5009

2004-2005 29 10266

2005-2006 38.6 14910

2006-2007 43.1 16689

2007-2008 49.8 20738

2008-2009 59 41341

2009-2010 73.3 39180

2010-2011 68.9 41550

2011-2012 98.9 45723*

*from April-Oct 2011

Source: Provisional Coal Statistics 2011-2012, Coal Control Organisation, Ministry of Coal

As the above table suggests India has been importing more and more coal since the turn of the century. A major reason for this has been the inability of the government owned Coal India, which is the largest producer of coal in the country, to increase production at a faster rate. Between 2004-2005 and 2011-2012 the company managed to increase its production by just 65million tonnes to 436million tonnes, an absolute increase of around 17.5%. The import of coal went up by a massive 241% to around 99 million tonnes, during the same period.

In fact, to its credit, the government of India realised the inability of the country to produce enough coal in the early 1990s. The Coal Mines (Nationalisation) Act 1973 was amended with effect from June 9, 1973, to allow the government to give away coal blocks for free for captive use of coal. The Economic Survey for 1994-95 points out the reason behind the decision: “In order to encourage private sector investment in the coal sector, the Coal Mines (Nationalisation) Act, 1973 was amended with effect from June 9, 1993 for operation of captive coal mines by companies engaged in the production of iron and steel, power generation and washing of coal in the private sector.”

The total coal production in the country in 1993-94 stood at 246.04million tonnes having grown by 3.3% from 1992-93. The government understood that the production was not going to increase at a faster rate anytime soon because the newer projects were having time delays and cost overruns. As the 1994-95 economic survey put it “As on December 31,1994, out of 71 projects under implementation in the coal sector, 22 projects are bedeviled by time and cost over-runs. On an average, the time overrun per project is about 38months.There is urgent need to improve project implementation in the coal sector”.

The last few years

The idea of giving away coal blocks for free was to encourage investment in coal by companies which were dependant on coal as an input. This included companies producing power, iron and steel and cement. Since the government couldn’t produce enough coal to meet their needs, the companies would be allowed to produce coal to meet their own needs by giving them coal blocks for free.

While the policy to give away coal blocks has been in place since 1993, it didn’t really take off till the mid 2000s. Between 1993 and 2003, the government gave away 39 coal blocks free to private companies as well as government owned companies. 20 out of the 39 blocks were allocated in 2003.

In the year 2004, the government gave away four blocks. But these were big blocks with the total geological reserves of coal amounting to 2143.5million tonnes. After this the floodgates really opened up and between 2005 and 2009, 149 coal blocks were given away for free.

Year Number of mines Geological Reserves (in million tonns)

2004 4 2143.5

2005 21 3174.3

2006 47 14424.8

2007 45 10585.8

2008 21 3423.5

2009 15 6549.2

153 40301.1

Source: Provisional Coal Statistics 2011-2012, Coal Control Organisation, Ministry of Coal

The above table makes for a very interesting reading. Between 2004 and 2009, the government of India gave away 153 coal blocks with geological reserves amounting to a little more than 40billion tonnes for free. Estimates made by the Geological Survey of India suggest that India has 293.5billon tonnes of coal reserves. This implies that the government gave away 13.7% of India’s coal reserves for free in a period of just five years.

The Congress led United Progressive Alliance was in power for most of this period with Manmohan Singh having been sworn in as the Prime Minister in May 2004. Interestingly, things reached their peak between 2006 and 2009, when the Prime Minister was also the Minister for Coal. During this period 128 coal blocks with geological reserves amounting to around 35billion tonnes were given away for free. But giving away the coal blocks for free did not solve any problem. As per the report prepared the Comptroller and Auditor General of India, as on March 31, 2011, eighty six of these blocks were supposed to produce around 73million tonnes of coal. Only 28 blocks have started production and their total production has been around 34.6million tonnes, as on March 31,2011.

The CAG and the losses

As is clearly explained above the Manmohan Singh led UPA government gave away around 14% of nation’s coal reserves away for free. Nevertheless, several senior leaders of the Congress party have told the nation that there have been no losses on account of the coal blocks being given away for free, primarily because very little coal was being produced from these blocks.

P Chidamabaram, the finance minister recently said “If coal is not mined, where is the loss? The loss will only occur if coal is sold at a certain price or undervalued.” Digvijaya Singh, a senior Congress leader targeted Vinod Rai, the Comptroller and Auditor General. Singh told The Indian Express that “the way the CAG is going, it is clear he(i.e. Vinod Rai) has political ambitions like TN Chaturvedi (a former CAG who later joined the BJP). He has been giving notional and fictional figures that have no relevance to facts. How has he computed these figures? He is talking through his hat.”

This is sheer nonsense to say the least and anyone who understands how CAG arrived at the loss number of Rs 1,86,000 crore wouldn’t say so.

The CAG reasonably assumed that the coal mined from the coal blocks given away for free could have been sold at a certain price in the market. Since the government gave away the blocks for free it lost that opportunity. This lost opportunity is what CAG has tried to quantify in terms of a number.

While calculating the loss the CAG did not take into account the coal blocks given to the government companies. Only blocks given to private companies were taken into account. Further only open cast mines were included in calculating the loss. Underground mines were not taken into account.

Also, the total coal available in a block is referred to as geological reserve. Due to several reasons including those of safely, the entire geological reserve cannot be mined. The portion that can be mined is referred to as extractable reserve. The extractable reserves for the blocks (after ignoring the blocks owned by government companies and underground mines) came to 6282.5million tonnes. This is equivalent to more than 14 times the annual production of Coal India Ltd.

The government could have sold this coal at a certain price. Also mining this coal would have involved a certain cost. The CAG first calculated the average sale price for all grades of coal sold by Coal India in 2010-2011. This came to Rs 1028.42 per tonne. Then it calculated the average cost of production for all grades of coal for the same period. This came at Rs 583.01. Other than this there was a financing cost of Rs 150 per tonne which was taken into account, as advised by the Ministry of Coal. Hence a benefit of Rs 295.41 per tonne of coal was arrived at (Rs 1028.42 – Rs 583.01 – Rs 150). The losses were thus estimated to be at Rs 1,85,591.33 crore (Rs 295.41 x 6282.5million tonnes) or around Rs 1.86lakh crore, by the CAG.

Chidambaram and Singh were basically trying to confuse us by mixing two issues here. One is the fact that the government gave away the blocks for free. And another is the inability of the companies who got these blocks to start mining coal. Just because these companies haven’t been able to mine coal doesn’t mean that the government of India did not face a loss by giving away the mines for free.

What are the problems with the CAG’s loss calculation?

The problem with CAG’s loss calculation is that it doesn’t take into account the time value of money. The government wouldn’t have been able to sell all the coal all at once. It would have only been able to do so over a period of time. The CAG doesn’t take this into account. Ideally, it should have assumed that the government earns this revenue over a certain number of years and then discounted those revenues to arrive at a present value for the losses.

This goes against the government. But there are several assumptions that favour the government. The coal blocks given away free to government companies aren’t taken into account. The transaction of handing over a coal block was between two arms of the government. The ministry of coal and a government owned public sector company (like NTPC). In the past when such transactions have happened the profit earned from such transactions have been recognised. A very good example is when the government forces the Life Insurance Corporation (LIC) of India to buy shares of public sector companies to meet its disinvestment target. One arm of the government (LIC) is buying shares of another arm of the government (for eg: ONGC). And the money received by the government is recognised as revenue in the annual financial statement. So when revenues for transactions between two arms of the government are recognised so should losses. Around half of the coal blocks were given to government owned companies.

Also, the price at which Coal India sells coal to companies it has an agreement with, is the lowest in the market. It is not linked to the international price of coal. The price of coal that is auctioned by Coal India is much higher than its normal price. As the CAG points out in its report on the ultra mega power project, the average price of coal sold by Coal India through e-auction in 2010-2011 was Rs 1782 per tonne. The average price of imported coal in November 2009 was Rs 2874 per tonne (calculated by the CAG based on NTPC data). The CAG did not take into account these prices. It took into account the lowest price of Rs 1028.42 per tonne, which was the average Coal India price.

Let’s run some numbers to try and understand what kind of losses CAG could have come up with if it wanted to. At a price of Rs 1,782, the profit per tonne would have been Rs 1050 (Rs 1782-Rs 583.01- Rs 150). If this number had been used the losses would have amounted to Rs6.6lakh crore.

At a price of Rs 2874 per tonne, the profit per tonne would have been Rs 2142(Rs 2874 – Rs 583.01 – Rs 150). If this number had been used the losses would have been Rs 13.5lakh crore. This number is a little more than the Rs 13.18 lakh crore expenditure that the government of India incurred in 2011-2012.

So there are weaknesses in the CAG’s calculation of the losses on account of coal blocks being given away free. But these weaknesses work in both the directions. The bottomline though is that the country has suffered a big loss, though the quantum of the loss is debatable.

To conclude

News reports suggest that several Congress politicians have benefitted from the coal blocks being given away for free. The companies which got coal blocks haven’t been able to produce coal. The government hasn’t been able to invoke the bank guarantees of the companies for the delay in producing coal. This is because of a flaw in the allocation letters. As the Business Standard reports “There is a technical flaw in the format of the allocation letters. As per the letters, the government can invoke the bank guarantee clause only in cases of less production, and not nil production.” Some companies have started selling power in the open market. This power is being produced from the coal they mined out of the coal blocks they got free from the government.

The situation has all the facets of turning into a big mess like the previous scams under the Congress led UPA regime. And like the previous scams, it is likely to be swept under the carpet as well. Despite all this, the Prime Minister Manmohan Singh will continue to be a mute spectator to all this, keeping the chair warm till Rahul Gandhi is ready to take over. I would be glad to be proven otherwise.

(The article originally appeared in The Seasonal Magazine on September 12,2012. http://www.seasonalmagazine.com/2012/09/mute-manmohan-watches-as-coalgate.html)

(Vivek Kaul is a writer and can be reached at [email protected])

How Obama and Manmohan Singh will drive up the price of gold

Vivek Kaul

‘Miss deMaas,’ Van Veeteren decided, ‘if there’s anything I’ve learned in this job, it’s that there are more connections in the world than there are particles in the universe.’

He paused and allowed her green eyes to observe him.

‘The hard bit is finding the right ones,’ he added. – Chief Inspector Van Veeteren in Håkan Nesser’s The Mind’s Eye

I love reading police procedurals, a genre of crime fiction in which murders are investigated by police detectives. These detectives are smart but they are nowhere as smart as Agatha Christie’s Hercule Poirot or Sir Arthur Conan Doyle’s Sherlock Holmes. They look for clues and the right connections, to link them up and figure out who the murderer is.

And unlike Poirot or Holmes they take time to come to their conclusions. Often they are wrong and take time to get back on the right track. But what they don’t stop doing is thinking of connections.

Like Chief Inspector Van Veeteren, a fictional character created by Swedish writer Håkan Nesser, says above “there are more connections in the world than there are particles in the universe… The hard bit is finding the right ones.”

The murder is caught only when the right connections are made.

The same is true about gold as well. There are several connections that are responsible for the recent rapid rise in the price of the yellow metal. And these connections need to continue if the gold rally has to continue.

As I write this, gold is quoting at $1734 per ounce (1 ounce equals 31.1 grams). Gold is traded in dollar terms internationally.

It has given a return of 8.4% since the beginning of August and 5.2% since the beginning of this month in dollar terms. In rupee terms gold has done equally well and crossed an all time high of Rs 32,500 per ten grams.

So what is driving up the price of gold?

The Federal Reserve of United States (the American central bank like the Reserve Bank of India in India) is expected to announce the third round of money printing, technically referred to as quantitative easing (QE). The idea being that with more money in the economy, banks will lend, and consumers and businesses will borrow and spend that money. And this in turn will revive the slow American economy.

Ben Bernanke, the current Chairman of the Federal Reserve, has been resorting to what investment letter writer Gary Dorsch calls “open mouth operations” i.e. dropping hints that QE III is on its way, for a while now. The earlier two rounds of money printing by the Federal Reserve were referred as QE I and QE II. Hence, the expected third round is being referred to as QE III.

At its last meeting held on July 31-August 1, the Federal Open Market Committee (FOMC) led by Bernanke said in a statement “The Committee will closely monitor incoming information on economic and financial developments and will provide additional accommodation as needed to promote a stronger economic recovery and sustained improvement in labor market conditions in a context of price stability.” The phrase to mark here is additional accommodation which is a hint at another round of quantitative easing. Gold has rallied by more than 8% since then.

But that was more than a month back. Ben Bernanke has dropped more hints since then. In a speech titled Monetary Policy since the Onset of the Crisis made at the Federal Reserve Bank of Kansas City Economic Symposium, Jackson Hole, Wyoming, on August 31, 2012, Bernanke, said: “Taking due account of the uncertainties and limits of its policy tools, the Federal Reserve will provide additional policy accommodation as needed to promote a stronger economic recovery and sustained improvement in labor market conditions in a context of price stability.”

Central bank governors are known not to speak in language that everybody can understand. As Alan Greenspan, the Chairman of the Federal Reserve before Bernanke took over once famously said ““If you think you understood what I was saying, you weren’t listening.”

But the phrase to mark in Bernanke’s speech is “additional policy accommodation” which is essentially a euphemism for quantitative easing or more printing of dollars by the Federal Reserve.

The question that crops up here is that FOMC in its August 1 statement more or less said the same thing. Why didn’t that statement attract much interest? And why did Bernanke’s statement at Jackson Hole get everybody excited and has led to the yellow metal rising by more than 5% since the beginning of this month.

The answer lies in what Bernanke said in a speech at the same venue two years back. “We will continue to monitor economic developments closely and to evaluate whether additional monetary easing would be beneficial. In particular, the Committee is prepared to provide additional monetary accommodation through unconventional measures if it proves necessary, especially if the outlook were to deteriorate significantly,” he said.

The two statements have an uncanny similarity to them. In 2010 the phrase used was “additional monetary accommodation”. In 2012, the phrase used became “additional policy accommodation”.

Bernanke’s August 2010 statement was followed by the second round of quantitative easing or QE II as it was better known as. The Federal Reserve pumped in $600billion of new money into the economy by printing it. Drawing from this, the market is expecting that the Federal Reserve will resort to another round of money printing by the time November is here.

Any round of quantitative easing ensures that there are more dollars in the financial system than before. To protect themselves from this debasement, people buy another asset; that is, gold in this case, something which cannot be debased. During earlier days, paper money was backed by gold or silver. When governments printed more paper money than they had precious metal backing it, people simply turned up with their paper at the central bank and demanded it be converted into gold or silver. Now, whenever people see more and more of paper money, the smarter ones simply go out there and buy that gold. Also this lot of investors doesn’t wait for the QE to start. Any hint of QE is enough for them to start buying gold.

But why is the Fed just dropping hints and not doing some real QE?

The past two QEs have had the blessings of the American President Barack Obama. But what has held back Bernanke from printing money again is some direct criticism from Mitt Romney, the Republican candidate against the current President Barack Obama, for the forthcoming Presidential elections.

“I don’t think QE-2 was terribly effective. I think a QE-3 and other Fed stimulus is not going to help this economy…I think that is the wrong way to go. I think it also seeds the kind of potential for inflation down the road that would be harmful to the value of the dollar and harmful to the stability of our nation’s needs,” Romney told Fox News on August 23.

Paul Ryan, Romney’s running mate also echoed his views when he said “Sound money… We want to pursue a sound-money strategy so that we can get back the King Dollar.”

This has held back the Federal Reserve from resorting to QE III because come November and chances are that Bernanke will be working with Romney and Obama. Romney has made clear his views on Bernanke by saying that “I would want to select someone new and someone who shared my economic views.”

So what are the connections?

So gold is rising in dollar terms primarily because the market expects Ben Bernanke to resort to another round of money printing. But at the same time it is important that Barack Obama wins the Presidential elections scheduled on November 6, 2012.

Experts following the US elections have recently started to say that the elections are too close to call. As Minaz Merchant wrote in the Times of India “Obama’s steady 3% lead over Romney has evaporated in recent opinion polls… Ironically, one big demographic slice of America’s electorate could deny Obama a second term as president: white men. Up to an extraordinary 75% of American Caucasian males, the latest opinion polls confirm, are likely to vote against Obama… the Republican ace is the white male who makes up 35% of America’s population. If three out of four white men, cutting across Democratic and Republican party lines, vote for Mitt Romney, he starts with a huge electoral advantage, locking up over 25% of the total electorate.” (You can read the complete piece here)

If gold has to continue to go up it is important that Obama wins. And for that to happen it is important that a major portion of white American men vote for Obama. While Federal Reserve is an independent body, the Chairman is appointed by the President. Also, a combative Fed which goes against the government is rarity. So if Mitt Romney wins the elections on November 6, 2012, it is unlikely that Ben Bernanke will resort to another round of money printing unless Romney changes his mind by then. And that would mean no more rallies gold.

But even all this is not enough

All the connections explained above need to come together to ensure that gold rallies in dollar terms. But gold rallying in dollar terms doesn’t necessarily mean returns in rupee terms as well. For that to happen the Indian rupee has to continue to be weak against the dollar. As I write this one dollar is worth around Rs 55.5. At the same time an ounce of gold is worth $1734. As we know one ounce is worth 31.1grams. Hence, one ounce of gold in rupee terms costs Rs96,237 (Rs 1734 x Rs 55.5). This calculation for the ease of simplicity does not take into account the costs involved in converting currencies or taxes for that matter.

If one dollar was worth Rs 60, then one ounce of gold in rupee terms would have cost around Rs 1.04 lakh. If one dollar was worth Rs 50, then one ounce of gold in rupee terms would have been Rs 86,700. So the moral of the story is that other than the price of gold in dollar terms it is also important what the dollar rupee exchange rate is.

So the ideal situation for the Indian investor to make money by investing in gold is that the price of gold in dollar terms goes up, and at the same time the rupee either continues to be at the current levels against the dollar or depreciates further, and thus spruces up the overall return.

For this to happen Manmohan Singh has to keep screwing the Indian economy and ensure that foreign investors continue to stay away. If foreign investors decide to bring dollars into India then they will have to exchange these dollars for rupees. This will increase the demand for the rupee and ensure that it apprecaits against the dollar. This will bring down the returns that Indian investors can earn on gold. As we saw earlier at Rs60to a dollar one ounce of gold is worth Rs 1.04 lakh, but at Rs 50, it is worth Rs 86,700.

One way of keeping the foreign investors away is to ensure that the fiscal deficit of the Indian government keeps increasing. And that’s precisely what Singh and his government have been doing. At the time the budget was presented in mid March, the fiscal deficit was expected to be at 5.1% of GDP. Now it is expected to cross 6%. As the Times of India recently reported “The government is slowly reconciling to the prospect of ending the year with a fiscal deficit of over 6% of gross domestic project,higher than the 5.1% it has budgeted for, due to its inability to reduce subsidies, especially on fuel.

Sources said that internally there is acknowledgement that the fiscal deficit the difference between spending and tax and non-tax revenue and disinvestment receipts would be much higher than the calculations made by Pranab Mukherjee when he presented the Budget.” (You can read the complete story here).

To conclude

So for gold to continue to rise there are several connections that need to come together. Let me summarise them here:

1. Ben Bernanke needs to keep hinting at QE till November

2. Obama needs to win the American Presidential elections in November

3. For Obama to win the white American male needs to vote for him

4. If Obama wins,Bernanke has to announce and carry out QE III

5. With all this, the rupee needs to maintain its current level against the dollar or depreciate further.

6. And above all this, Manmohan Singh needs to keep thinking of newer ways of pulling the Indian economy down

(The article originally appeared on www.firstpost.com on September 11,2012. http://www.firstpost.com/economy/how-obama-and-manmohan-will-drive-up-the-price-of-gold-450440.html)

(Vivek Kaul is a writer and can be reached at [email protected])

All you wanted to know about the COAL SCAM but didn't know where to ask…

Vivek Kaul

What is the basic issue?

Between 1993 and 2011, the government of India gave away 206 coal blocks for free to government and private companies.

So if these blocks were being given away free from 1993, why so much commotion now?

The Comptroller and Regulator General(CAG) in a recent report estimated that the losses due to the policy of the government giving out coal blocks for free, amounted to Rs 1.86lakh crore.

Why is the Congress led UPA government being blamed if the policy started in 1993?

Estimates made by stock brokerage CLSA suggest that only 41 out of the 206 blocks given away for free, were allocated before the end of 2003. This means that 165 blocks were allocated between 2004 and 2011. The Congress led UPA government has been in power since May 2004. This amounts to nearly 14% Hence, a major number of coal blocks were given away free during the UPA rule.

And how is Prime Minister(PM) Manmohan Singh involved in all this?

The PM also happened to be the coal minister between 2006 and 2009. During this period 134 coal blocks were given away for free. Estimates made by Nomura Equity Research suggest that between 2006 and 2009 the coal blocks given away for free had geological reserves of around 40 billion tonnes. India has around 286billion tonnes of geological reserves of coal. This means that around 14% of total geological reserves of coal was given away free during the period Manmohan Singh was the coal minister.

What was the purported reason for giving the coal blocks for free?

This was done in order to increase the total coal production in the country. The government owned Coal India Ltd which accounts for 80% of the total coal production in the country hasn’t been able to produce enough to meet the growing energy needs of the country. Between April 1, 2004 and March 31, 2012, the production of coal by Coal India has increased by just 65million tonnes to 436million tonnes. This means a growth of a mere 2.3% per year on an average.

What is the reasoning behind CAG coming up with the Rs 1.86lakh crore number?

The CAG reasonably assumed that the coal mined from the coal blocks given away for free could have been sold at a certain price in the market. Since the government gave away the blocks for free it lost that opportunity. This lost opportunity is what CAG has tried to quantify in terms of a number.

So what were the assumptions that the CAG worked with?

While calculating the loss the CAG did not take into account the coal blocks given to the government companies. Only blocks given to private companies were taken into account. Further only open cast mines were included in calculating the loss. Underground mines were not taken into account.

How were the numbers worked out?

The total coal available in a block is referred to as geological reserve. Due to several reasons including those of safely, the entire geological reserve cannot be mined. The portion that can be mined is referred to as extractable reserve. The extractable reserves for the blocks (after ignoring the blocks owned by government companies and underground mines) came to 6282.5million tonnes. This is equivalent to more than 14 times the annual production of Coal India Ltd. And this is the amount of coal the government would have been able to sell if it had not given the blocks away for free to private companies.

But that’s just coal in tonnes, how did CAG arrive at a loss of Rs 1.86 lakh crore?

The government gave away 6282.5million tonnes of coal for free. It could have sold it at a certain price. Also mining this coal would have involved a certain cost. The CAG first calculated the average sale price for all grades of coal sold by Coal India in 2010-2011. This came to Rs 1028.42 per tonne. Then it calculated the average cost of production for all grades of coal for the same period. This came at Rs 583.01. Other than this there was a financing cost of Rs 150 per tonne which was taken into account, as advised by the Ministry of Coal. Hence a benefit of Rs 295.41 per tonne of coal was arrived at (Rs 1028.42 – Rs 583.01 – Rs 150).

The losses were thus estimated to be at Rs 1,85,591.33 crore (Rs 295.41 x 6282.5million tonnes) or around Rs 1.86lakh crore, by the CAG.

But isn’t Rs 1.86 lakh crore a very big number?

Yes it is a very big number. But still a conservative estimate. The CAG does not take into account the losses on account of blocks given away free to government companies. As I had mentioned on an earlier occasion in this newspaper, the transaction of handing over a coal block was between two arms of the government. The ministry of coal and a government owned public sector company (like NTPC). In the past when such transactions have happened revenue earned from such transactions have been recognized. A very good example is when the government forces the Life Insurance Corporation (LIC) of India to buy shares of public sector companies to meet its disinvestment target. One arm of the government (LIC) is buying shares of another arm of the government (for eg: ONGC). And the money received by the government is recognized as revenue in the annual financial statement. So when revenues for transactions between two arms of the government are recognized so should losses. Hence, the entire idea of the CAG not taking losses on account of coal blocks given to pubic sector companies does not make sense. If they had recognised these losses as well, losses would have been greater than Rs 1.86lakh crore.

So this number could have been bigger?

Yes. The other point to remember here is that the CAG had assumed extractable reserves of a conservative 73% in case of mines were mine plans were not available. Typically extractable reserves are around 80-95% of geological reserves. The CAG has also been very conservative in calculating the benefit per tonne of coal by taking the average price of coal sold by Coal India Ltd. This price is typically the lowest in the market. Coal from other sources is very expensive. Coal India also sells coal through an e-auction. The price of coal sold through this route is higher than the normal Coal India price. As the CAG has pointed out in its performance audit of ultra-mega power projects, the average e-auction price for Coal India coal was Rs 1782 per tonne in 2010-2011. Imported coal sells at an even higher price. The landed cost of imported coal was Rs 2874 per tonne (based on NTPC data for November 2009), reports CAG. If these prices had been taken into account or a weighted average price would have been created using these prices as well as the average Coal India price of Rs 1028.42 per tonne, the loss number would have been higher than Rs 1.86lakh crore.

If all this is true, so what was that Chidambaram said about zero losses?

The union Finance Minister P Chidambaram wanted us to believe that almost all companies which have been given free coal blocks have not started to mine coal till date. Hence there are no losses. This is like saying that I gave away my house for free, but since the person I gave it away to is not able to sell it, hence I did not face any losses.

What about the argument that coal is a natural resource and hence should not be auctioned?

People who have come up with this argument also need to realize that coal like air is not an unlimited natural resource. So air need not be priced because it is unlimited, but coal needs to be priced because it is limited. And if that had not been the case the government would be giving away all the coal that Coal India produces for free.

(The article originally appeared in the Daily News and Analysis on September 3,2012. http://www.dnaindia.com/india/report_all-you-wanted-to-know-about-the-coal-scam_1735936))

Vivek Kaul is a writer and can be reached at [email protected]

Canaries and coal mines

Vivek Kaul

Music has got its share of one hit wonders. Delhi born singer and musician Peter Saerdest fits that category. His most famous claim to fame being the 1969 hit “where do you go to (my lovely)”.

The song is about a fictional girl called Marie Clare. There is a paragraph in the song which brings out the unhappiness in her life. Here is how it goes:

But where do you go to my lovely

When you’re alone in your bed

Tell me the thoughts that surround you

I want to look inside your head, yes i do.

Now this is a question that I have been wanting to ask the Prime Minister (PM) Manmohan Singh as the country moves from one scam to another. What are the thoughts that go inside his head? The forever quiet PM finally obliged us when he issued a statement on the coal gate scam and put the blame on his predecessors and the Comptroller and Auditor General(CAG) of India, for coming up with a loss number of Rs 1.86 lakh crore.

The policy of the government allocating coal blocks for free was introduced in 1993, and so it was not right to blame the Congress led United Progressive Alliance (UPA) felt the Prime Minister. Fair point, one must say.

But as the numbers calculated by the international stock brokerage CLSA show a major part of the coal blocks were given away for free only after the Congress led UPA came to power in May 2004. Of the 100 coal blocks given away free to government companies between 1993 and 2011, 83blocks were handed over after 2003. The same stands true for private sector companies where 82 out of the 106 blocks were allocated after 2003.

So while it might be true that UPA did not start the policy but what Manmohan Singh cannot deny is that they went around implementing it with a vengeance. The geological reserves of the coal blocks given away for free amounted to around 41billion tonnes. The total geological reserves of coal in India amount to around 286billion tonnes which means 14% of it was given away for free.

Hence, the question that the PM still needs to answer is that why was there a sudden increase in the allocation of blocks between 2004 and 2009, and especially during his tenure as the coal minister between 2006 and 2009?

The answer might most probably lies in the price of coal which started to shoot up around the time UPA first came to power. Prices shot up from around $30-40 per tonne to around $190 per tonne internationally in mid 2008. The conclusion that one can draw from this is that before 2004 it was cheap to just buy coal off the market. But after that things changed and it made more sense for companies to have direct access to coal.

The PM in his statement has also claimed that the loss number of Rs 1.86 lakh crore arrived at by the CAG can be questioned on a number of technical points.

The CAG has calculated the loss number based on certain assumptions. It has only taken into account mines given to private sector companies for free. Those allotted to government companies have been ignored. Underground mines have also not been taken into consideration.

So these assumptions work in favour of the government. If the government blocks had also been taken into account the loss number would have dramatically shot up. It need not be said that the PM does not talk about this anywhere in his statement.

The extractable reserves of these private sector coal blocks come to 6282.5million tonnes of coal. This is the amount of coal that the CAG feels could have been mined and sold and has been given away for free. The average benefit per tonne of this coal was estimated to be at Rs 295.41.

As Abhishek Tyagi and Rajesh Panjwani of CLSA write in a report dated August 21, 2012,”The average benefit per tonne has been arrived at by first, taking the difference between the average sale price (Rs1028.42) per tonne for all grades of CIL(Coal India Ltd) coal for 2010-11 and the average cost of production (Rs583.01) per tonne for all grades of CIL coal for 2010-11. Secondly, as advised by the Ministry of Coal vide letter dated 15 March 2012 a further allowance of Rs150 per tonne has been made for financing cost. Accordingly the average benefit of Rs295.41 per tonne has been applied to the extractable reserve of 6282.5 million tonne calculated as above.”

Using this method CAG arrived at the loss figure of Rs 1,85,591.33 crore (Rs 295.41 x 6282.5million tonnes) or around Rs 1.86 lakh crore. Analysts who track coal believe that assuming a profit of Rs 295.41 per tonne is a fairly conservative estimate.

In fact as has been reported elsewhere, if the e-auction prices of coal would have been considered, the losses would have been at Rs 11.2lakh crore. And if the calculations had been done using the imported coal prices the losses would amount to Rs 18lakh crore. These are huge numbers. The total expenditure of the government of India for the year 2011-2012 was estimated to be at around Rs 13.2lakh crore.

Another bogey that has been raised by the sympathizers of the Congress party (not by the PM) is that coal is a natural resource and hence cannot be “auctioned” or sold at a market price. What they forget to tell us is that coal is a limited natural resource and hence it needs to be priced correctly and not given away for free. If that was not the case why does the government price products like petrol, diesel, telecom spectrum etc? These products are also either natural resources or derivatives of natural resources. Why does Coal India Ltd sell coal at a certain price? Why not give it away for free?

By giving away coal blocks for free the nation has faced huge losses. Whether its Rs 1.86 lakh crore or Rs 18 lakh crore is a matter of conjecture, but that does not take away the fact that losses have been huge. Given this, the PM and the Congress party, are just trying to practice the old adage: “if you can’t convince them, confuse them”.

(The article originally appeared on Asian Age/Deccan Chronicle on September 2,2012. http://www.deccanchronicle.com/editorial/dc-comment/canaries-coal-951)

(Vivek Kaul is a Mumbai based writer. He can be reached at [email protected])