In the press conference that followed the monetary policy on December 7, 2016, R Gandhi, one of the deputy governors of the Reserve Bank of India(RBI), said: “We reiterate that there is adequate supply of notes and hoarding of notes helps nobody’s cause.”

The impression that the RBI is trying to create is that all is well and that it is the hoarders are responsible for the mess that prevails on the cash front, all through the country. But is that really the case?

In a press release dated December 8, 2016, the RBI said: “During the period from November 10, 2016 and December 7, 2016, banks have reported that banknotes worth Rs 4,27,684 crore have been issued to public either over the counter or through ATMs.”

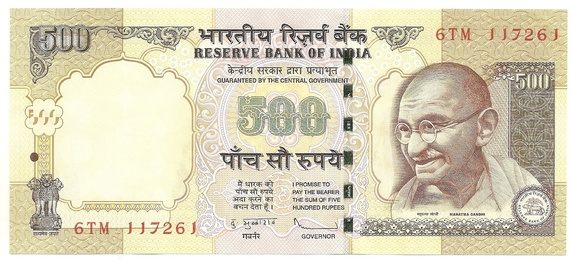

The total value of the Rs 500 and the Rs 1,000 demonetised notes amount to Rs 15.44 lakh crore. Hence, the notes replaced amount to close to 27.7 per cent of the demonetised notes. Before the notes had been demonetised the total value of currency stood at Rs 17.87 lakh crore. This basically means that around 23.9 per cent of the currency that was in circulation before demonetisation has been replaced.

Hence, around one-fourth of the currency is back in circulation. The question is why doesn’t it feel like one-fourth? Why does it continue to be difficult to carry out cash transactions? The answer is straightforward.

To replace the Rs 500 and Rs 1,000 demonetised notes, the government printed the Rs 2,000 note, first. This means that there is no note between Rs 100 and Rs 2,000. Hence, every time one tries to spend the Rs 2,000 note, it is tough going because the other party simply doesn’t have enough change going around.

This, despite the fact that the RBI has supplied: “lower denomination of the notes, that is Rs 100, Rs 50, Rs 20 and Rs 10… over its counters,” as well. In fact, it has supplied 19.1 billion pieces of denomination of these notes over the last one month. As deputy governor Gandhi put it “This is more than what the Reserve Bank had supplied to the public in the whole of the last three years.”

While the RBI said that a total of 19.1 billion pieces of notes of small denomination were printed, it doesn’t provide us with a breakdown of numbers. It doesn’t tell us how many Rs 100 notes were printed, how many Rs 50 notes were printed and so on. Hence, there is no way of finding out the total value of these notes that had been printed.

Nevertheless, it is safe to say that the total value of the lower denomination notes printed and pumped into the economy, would essentially amount to around 5-6 per cent of the total currency in circulation before demonetisation. Hence, the bulk of the notes printed have been Rs 2,000 notes. Given this, there isn’t enough change going around, which means even those who have Rs 2,000 notes are finding it very difficult to use it.

What this means is that the 23.9 per cent figure of the total amount of currency replaced in comparison to the currency in circulation before November 8, 2016, when demonetisation was carried out, is overstated to that extent.

There is another problem with the Rs 2,000 note. There is a huge rumour going around that it has been launched as a stop-gap arrangement and is likely to be demonetised soon. This rumour perhaps comes from what was mentioned in the press release accompanying the demonetisation decision. As the press release said: “High denomination notes are known to facilitate generation of black money… Infusion of Rs 2,000/- bank notes will be monitored and regulated by RBI.” It is well worth remembering that the original motive of demonetisation was to tackle black money and fake notes.

How will the situation play out in the days to come? Will things improve by the end of this month as the prime minister has repeatedly told the nation? As Urjit Patel said during the course of the monetary policy press conference: “What we have done over the last two weeks is recalibrated our production towards the 500 and the 100.” This is going to improve the situation a little, given that as more 500s hit the market, the chances of the 2000s being accepted will also go up, as more change becomes available.

Having said that it will take some time for the situation to get back to normal. With 500s and 100s being printed the rate of currency replacement will slow down. It takes four 500 rupee notes to replace the currency that one 2000 rupee could.

Further, it is worth remembering here that the capacity of the printing presses supplying RBI with notes is around 300 crore notes per month. This, when the presses work 24 hours a day and for the full month.

The total number of 500 rupee notes demonetised stand at 1716.5 crore. At 300 crore notes a month, it will easily take five to six months to replace the total lot. Even if all the notes are not printed, given the push towards cashless, it will be a while before there is enough cash going around in the economy.

Hence, the point is that people are not hoarding cash. There simply isn’t enough cash going around. But what about all the raids all across the country and the cash being found during these operations? Isn’t that hoarding cash? Yes. Nevertheless, these seizures at best amount to a few hundred crore, which is a minuscule part of the overall currency that has been printed and pumped into the economy. At times, one does get excited looking at absolute numbers, but to put things in a proper perspective, it always makes sense to look at percentages.

To conclude, currency or cash is not the only form of money going around. There are other forms as well. Nevertheless, for a country where 98 per cent of the consumer transactions happen in cash, cash remains the major form of money. How difficult it is to understand this basic fact?

The column originally appeared on Equitymaster on December 12, 2016