Vivek Kaul

Vivek Kaul

Do financial markets have bubbles? Like most things in economics, the answer to what seems like a rather straightforward question, is yes and no. It depends on which economist you are talking to.

Eugene Fama and Robert Shiller are two of the three economists(the third being Peter Hansen) who have won the Nobel Prize in Economics this year.

When it comes to the bubble question Fama feels there are no bubbles. Shiller, on the other hand, has done some of his best work in economics around financial market bubbles. In fact, he was one of the few economists, who predicted both the dotcom bubble as well as the real estate bubble. Ironically enough, both of them have won the Nobel Prize in the same year.

Eugene Fama, who teaches at the University of Chicago, came up with the efficient market hypothesis(EMH), sometime in the 1960s. A lot of financial theory that followed was built around EMH.

Benoit Mandelbrot, a mathematician who did some pioneering work in economics, was Fama’s thesis advisor. As Mandelbrot (along with Richard Hudson) writes in The (Mis) Behavior of Markets – A Fractal View of Risk, Ruin and Reward “It (i.e. EMH) became the intellectual bedrock on which orthodox financial theory sits.”

So what is the EMH? As Mandelbrot and Hudson write “At its heart: In an ideal market, security prices fully reflect all relevant information…Given that, the price at any particular moment must be the “right” one.”

And how is that possible? How can the price of a financial security( lets say a stock or a bond) at any point of time incorporate all the information?

Mark Buchanan explains this through a small thought experiment in his book Forecast – What Physics, Meteorology and Natural Sciences Can Teach Us About Economics “Let’s do a thought experiment, which I’ll call the 5 percent problem. Suppose that on Tuesday morning everyone knew for sure that the markets would recover, stocks gaining 5 percent(on average) in a big rally in the final half hour at the end of the day. Everyone in the market would expect this rise, and lots of people on that morning would be eager to pay up to 5 percent more than current values to buy stock, as they would profit by selling at the day’s very end. Knowledge of the coming afternoon rise would make the market rise immediately in the morning, violating the assumption we made to start this thought experiment; the prediction of a late rally would be totally wrong.” Hence, information about the market rising by 5% towards its close, would be incorporated into the price of the stocks immediately.

Mandelbrot and Hudson give another similar example to explain EMH. “Suppose a clever chart-reader thinks he has spotted a pattern in old price records – say, every January, stocks prices tend to rise. Can he get rich on that information by buying in December and selling in January? Answer: No. If the market is big and efficient then others will spot the trend, too, or at least spot his trading on it. Soon, as more traders anticipate the January rally, more people are buying in December – and then, to beat the trend for a December rally, in November. Eventually, the whole phenomenon is spread out over so many months that it ceases to be noticeable. The trend has vanished, killed by its very discovery,” write Mandelbrot and Hudson.

And this happens primarily because the market is made up of many investors, who are all working towards spotting a trend and trading on it. As Buchanan explains in Forecast “In this view, a market is a vast crowd of investors with diverse interests and skills all working hard to gather information on every kind of manufacturing company, bank, nation, technology, raw material, and so on. They use that information to make best investments they can, jumping on any new information that might affect prices as it comes along, and using that information to profit. They sell currently valued stocks, bonds, or other instruments, and buy undervalued ones. These very actions act to drive the prices back toward their proper, realistic, or “intrinsic” values.”

Given this financial markets are correctly priced all the time. Robert Shiller summarises this argument best in Irrational Exuberance. As he writes “The efficient markets theory asserts that all financial prices accurately reflect all public information at all times. In other words, financial assets are always priced correctly, given what is publicly known, at all times.”

And if financial assets are correctly priced, there is no question of any speculative bubbles occurring. As John Cassidy writes in How Markets Fail – The Logic of Economic Calamities “During the 1960s and ’70s, a group of economists, many of them associated with the University of Chicago, promoted the counter-intuitive idea…that speculative bubbles don’t exist. The efficient market hypothesis…states that financial markets always generate the correct prices, taking into account all of the available information…In short financial prices are tied to economic fundamentals: they don’t reflect any undue pessimism..If markets rise above the levels justified by fundamentals, well informed speculators step in and sell until prices return to their correct levels. If prices fall below their true values, speculators step in buy.”

This ensures that all the available information is priced in. Hence, at any point of time, the market price is the correct price. And given that where is the question of any bubbles popping up? As Fama put it in a 2010 interview, “I don’t even know what a bubble means. These words have become popular. I don’t think they have any meaning.”

Robert Lucas, another University of Chicago economist who won the Nobel prize in 1995, reflected Fama’s sentiment when he said “The main lesson we should take away from the EMH for policy-making purposes is the futility of trying to deal with crises and recessions by finding central bankers and regulators who can identify and puncture bubbles. If these people exist, we will not be able to afford them.”

And this is the view that came to dominate much of the prevailing economic establishment since the 1960s. It is surprising that economists have had so much confidence in a theory for which the evidence is at best sketchy. Raj Patel makes this point in The Value of Nothing “The problem with efficient market hypothesis is that it doesn’t work. If it were true, there’d be no incentive to invest in research because the market would, by magic, have beaten you to it. Economists Sanford Grossman and Joseph Stiglitz demonstrated this in 1980, and hundreds of subsequent studies have pointed out quite how unrealistic the hypothesis is, some of the most influential were written by Eugene Fama himself.”

Also, if EMH were true, prices of financial assets would be right all the time, which is clearly not the case. As Buchanan writes “In November 2010, the New York Times reported on a dozen “mini flash crashes” in which individual stocks plunged in value over a few seconds recovering shortly thereafter. In one episode, for example, stock of Progress Energy – a company with eleven thousand employees – dropped 90 percent in few seconds. There was no news released about the business prospects of Progress Energy either before or after the event…On May 13(2011), Enstar, an insurer, fell from roughly $100 a share to $0 a share, then zoomed back to $100 in just a few seconds.”

Shiller gives the example of eToys and Toys “R” Us, two companies which were into selling toys. As he writes “Consider, for example, eToys a firm established in 1997 to sell toys over the Internet. Shortly after its initial public offering in 1999, eToys’ stock value was $8 billion, exceeding the $6 billion value of the long established “brick and mortar” retailer Toys “R” Us. And yet in fiscal 1999 eToys’ sales were $30 million, while the sales of Toys “R” Us were $11.2 billion, almost 400 times larger. And eToys’ profits were a negative $28.6 million, while the profits of Toys “R” Us were a positive $376 million.”

So a company with no profits had a greater market capitalization in comparison to a company making substantial profits. Now as per the EMH this should have never happened. Investors would have sold the eToys’ stock and driven down its price. But that did not happen, at least for a few years. And the stock price of eToys went from strength to strength.

But despite the weak evidence in support of EMH, the prevailing economic thinking since the 1960s has been that market prices of financial assets reflect the fundamentals, and hence, there was no chance of bubbles popping up. And even if bubbles did pop up, now and then, there was no chance of identifying them in advance. Alan Greenspan, the Chairman of the Federal Reserve of United States between 1987 and 2006, believed that a central bank could not spot a bubble, but could hope to mitigate its fallout, once it burst.

This led to him letting the dotcom bubble run. A few years later he let the real estate bubble run as well. He was just following the economic theory that has dominated over the last few decades. As Patel writes “ Despite ample economic evidence to suggest it was false, the idea of efficient markets ran riot through governments. Alan Greenspan was not the only person to find the hypothesis a convenient untruth. By pushing regulators to behave as if the hypothesis were true, traders could make their titanic bets…Governments enabled the finance sector’s binge by promising to be there to pick up the pieces, and they were as good as their word.”

In the end, Greenspan did find out that the model did not work and that bubbles did occur, now and then. As he admitted to before a committee of the House of Representatives in October 2008, “I found a flaw in the model that I perceived is the critical functioning structure that defines how the world works, so to speak…I had been going for 40 years or more with very considerable evidence that it was working exceptionally well.”

So Eugene Fama’s EMH doesn’t really work and has caused the world a lot of harm.

Now compare this to Robert Shiller who in the first edition of Irrational Exuberance, which released some time before the dotcom bubble burst, compared the stock market to a Ponzi scheme. As he wrote “Ponzi schemes do arise from time to time without the contrivance of a fraudulent manager. Even if there is no manipulator fabricating false stories and deliberately deceiving investors in the aggregate stock market, tales about the market are everywhere. When prices go up a number of times, investors are rewarded sequentially by price movements in these markets just as they are in Ponzi schemes. There are still many people (indeed, the stock brokerage and mutual fund industries as a whole) who benefit from telling stories that suggest that the markets will go up further. There is no reason for these stories to be fraudulent; they need to only emphasise the positive news and give less emphasis to the negative.”

Hence, financial markets at times degenerate into Ponzi schemes, where prices are going up simply because prices are going up. These bubbles can keep running for a while, just as the dotcom bubble in the US and the real estate bubble all over the developed world, did. When these bubbles burst, they caused huge economic problems, as we have seen over the last few years.

The trouble is that the dazzle of efficient market hypothesis has blinded economists so much that they cannot spot bubbles anymore. Hence, it is important that economists junk the efficient market hypothesis, and start looking at a world where bubbles are possible and keep popping up all the time. Else, we will have more trouble ahead.

The article originally appeared on www.firstpost.com on October 15, 2013

(Vivek Kaul is a writer. He tweets @kaul_vivek)

Month: October 2013

Inflation at 8 month high is a sure spoiler to FM’s ‘all is well’ party

Vivek Kaul

Vivek Kaul

All is well, again.

Or so the government of India has been trying to tell us over the last few weeks.

But some spoilers have come in lately.

The wholesale price inflation (WPI) for the month of September 2013 has come in at an eight month high of 6.46%. It was at 6.1% in August and 5.85% in July.

A massive increase in food prices has been a major driver of wholesale price inflation. Onion prices rose by a massive 323% in September in comparison to the same period last year. Vegetable prices went up by 89.37%. Fruits were up at 13.54%. And all in all food prices were up by 18.4% in comparison to the same period last year.

Half of the expenditure of an average household in India is on food. In case of the poor it is 60% (NSSO 2011). Given this, the massive rise in food prices, hits what the Congress led UPA calls the aam aadmi, the most.

In this scenario it is more than likely that the aam aadmi has been cutting down on expenditure on non essential items like consumer durables, in order to ensure that he has enough money in his pocket to pay for food.

Hence, it is not surprising the index for industrial production, a measure of the industrial activity in the country, rose by just 0.6% in August 2013, after rising by 2.8% in July.

As Sonal Varma of Nomura writes in a research note dated October 11, 2013 “consumer durables output growth remained in the negative, possibly due to a sharper slowdown in white goods production.” Consumer durables output fell by 7.6% in August 2013. This after falling by 8.9% in July.

What this tells us clearly is that as people are spending more money on food, they are postponing other expenditure. This postponement of consumption is reflected in companies not increasing the production of goods, which in turn is reflected in the overall index of industrial production rising at a very slow pace and the consumer durables output falling by a whopping 7.6% in August 2013.

The government of India wants to tackle this by increasing the capital of public sector banks in the hope that they give out loans to people to buy consumer durables and two wheelers at lower interest rates. (Why that is a bad idea is explained here).

But the trouble is that people are not in the mood to buy stuff because they do not feel confident enough of their job prospects in the days to come. As Varma put it in a note dated October 3, 2011 “The job market and income growth – the key drivers of consumption – remain lacklustre.”

Over and above that there is high food inflation to contend with.

One reason that the inflation will continue to remain high is the fact that the government of India has been running a high fiscal deficit. In the first five months of the year (i.e. the period between April-August 2013) the fiscal deficit stood at 8.7% of the GDP. The government is targeting a fiscal deficit of 4.8% of the GDP during the course of the financial year. Fiscal deficit is the difference between what a government earns and what it spends.

As economist Shankar Acharya put it in a recent column in the Business Standard “In the first five months of 2013-14, the Centre’s fiscal deficit ratio has been running at a whopping 8.7 per cent of GDP. Bringing it down to 4.8 per cent in the remaining seven months looks impossibly difficult, without recourse to seriously creative accounting ploys. In any case, it is worth pointing out that a deficit that stays high through most of the year imposes the associated costs of higher inflation, higher interest rates, more crowding out of private investment.”

With the government running a higher fiscal deficit it needs to borrow more money to finance the deficit. This means that the private sector will have lesser money to borrow(i.e. it will be crowded out by the government) and hence, will have to offer higher interest rates to borrow money. Hence, the interest rates will continue to remain high.

Also, a higher fiscal deficit means increased government spending in some areas of the economy. This leads to more money chasing the same amount of goods and services and hence, higher prices i.e. inflation.

When interest rates as well as inflation remain high, people are likely to concentrate on consuming things that they need the most, like food and avoiding other expenditure. This will have an impact on economic growth. Hence, the only way to revive economic growth is to weed out inflation. And that’s easier said than done.

This recent confidence of the government has come from the fact that the rupee which had almost touched 70 to a dollar, is now quoting at around 61.2 to a dollar.

This has happened because the government has taken steps to squeeze out gold import totally. In the month of September the gold imports fell to around $0.8 billion. In August, the gold imports were at $0.65 million.

Gold is bought and sold internationally in dollars. Hence, any gold importer needs dollars to buy gold. To buy these dollars the importer needs to sell rupees. And this pushes the value of the rupee down against the dollar.

But with the government making it very difficult to buy gold, the importers are not buying dollars and selling rupees. And this has helped the rupee to recover partially, given that the demand for dollars in the official foreign exchange market has gone down.

Of course these numbers do not include the gold that is now being smuggled into India. While there is no specific data available for this, there is enough anecdotal evidence going around. As Dan Smith and Anubhuti Sahay of Standard Chartered write in a report titled Gold – India’s government gets tough “Pakistan temporarily suspended a duty-free gold import arrangement in August, when gold imports doubled. According to media reports, much of this was crossing the border into India. Dubai has seen a steady pick-up in the number of passengers being arrested at airports for smuggling. Nepal has seen an eight-fold rise in smuggling – 69kg of smuggled gold was seized by customs in the first half of this year, versus 18kg for the whole of 2012.”

This does not reflect in the official numbers and there are other social consequences of smuggling. It is worth remembering that Dawood Ibrahim started out primarily as a gold smuggler, until he moved onto other bigger things.

The other factor that has helped control the value of the rupee against the dollar is the fact that oil companies are buying dollars directly from the Reserve Bank of India and not from the market. Hence, the two major buyers of dollars in the foreign exchange market have been taken out of the equation totally. This has skewed the equation in favour of the rupee.

Of course this cannot continue forever. Some demand for gold is likely to return in the months of October and November, because of the marriage season as well as Diwali. The other decision that has helped the rupee is the fact that the Federal Reserve of United States has decided to continue printing money.

While it is widely expected that the Federal Reserve will continue to print money in the months to come, this is something that is not under the control of the Indian government. Also, it is worth remembering that given the high fiscal deficit, the threat of India being downgraded to “junk” status by an international rating agency remains very high. If this were to happen, many investors will exit India in a hurry, putting pressure on the rupee, and undoing all the work that has been done to get it back to a level of 61 against the dollar.

In short, the macroeconomic conditions of India continue to remain weak, despite the government trying to project otherwise.

The article originally appeared on www.firstpost.com on October 14, 2013

(Vivek Kaul is a writer. He tweets @kaul_vivek)

What media missed out on in Rahul Gandhi's “escape-velocity” speech

Vivek Kaul

Nitpicking is not a good habit I am told.

But there are times when the opportunity is too good to resist.

Rahul Gandhi in a recent speech which has become famous as the “escape velocity” speech said “To Jupiter ki escape velocity kya hoti hai? Agar koi Jupiter pe khada hai aur Jupiter ki kheech se nikalna ho to use 60 km/sec ki acceleration chahiye. (So what is the escape velocity of Jupiter? If you are standing on Jupiter you need to go at 60 km/sec).”

Rahul had defined escape velocity a little earlier in his speech. “Escape velocity matlab agar aap ne dharti se space mein jana hai… agar aap hamari dharti pe hai to 11.2 km per second aap ki velocity honi padegi. (There is a concept of escape velocity if you want to go into space from Earth… your velocity has to be 11.2 km/sec).”

There is a very basic flaw in this small lecture on escape velocity. Acceleration and velocity are two different concepts. As Rahul said “Agar koi Jupiter pe khada hai aur Jupiter ki kheech se nikalna ho to use 60 km/sec ki acceleration chahiye.”

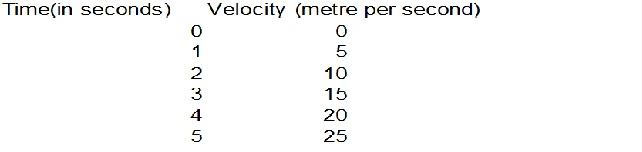

The word to be used here was velocity and not acceleration. Acceleration, as anyone who has studied basic eight standard physics will tell you, is the rate of change of velocity per unit of time. Lets consider the following table which shows the velocity of a moving object:

As we can see clearly from the above table, the velocity is constantly going up at the rate of 5 metre per second, in each second of time. Hence, the object has an acceleration of 5 metre per second squared (m/s2).

So that is the difference between velocity and acceleration. They are two different words, with two different meanings, which cannot be used interchangeably.

So that was the nitpicking bit.

The “escape velocity” comment has been a subject of lot of ridicule since it was first made. But there was a bigger joke in Rahul Gandhi’s speech, which people haven’t latched onto. He recounted a story that his late grandmother Indira Gandhi had told him about how she had cheered a team playing an ice hockey match against Germany, which was then ruled by Adolf Hitler. As Rahul said “It was a match between Germany and some other team. The other team was being thrashed and the crowds were cheering….My grandmother (Indira Gandhi) felt very bad and got up to cheer the weak team, but was shouted at. She sat down out of fear.” (As reported in The Time of India)

“The whole stadium (full of Germans) shouted against her. She sat down in fear but decided that never again in her life she will ever sit down in fear… If somebody is doing anything wrong never sit down,” Rahul said (As reported in The Telegraph). This it seems had an impact on Indira Gandhi and she resolved never again to be cowed down, while doing what she thought was right.

This is the bigger joke in the speech. Indira Gandhi only did those things that ensured that she continued to be in power. She destroyed the democratic institutions in this country. The lack of governance today in India is because of all that she did when she was the Prime Minister. As Gurucharan Das told me in an interview last year “The damage that Indira Gandhi did was far greater. Her license raj combined with the mai baap sarkar, this double whammy gave the illusion to the people that the state would do everything…The second was the damage she did to our political institutions…During the period she was the Prime Minister, I think she dismissed fifty nine elected governments in states…She tried to change India’s culture and change our political system. A lot has been written about the emergency and so on. But the enduring damage we don’t realise. Before her, Chief Ministers were a little afraid when a secretary said no sir you can’t do this. And if you tried to do it, the secretary wouldn’t bend very often. Now they just transfer…Also after Indira Gandhi the police became a handmaiden of the executive. The police lost its independence. Even the judiciary was damaged. She wanted committed judges.”

Other than destroying the democratic institutions of this country she turned the Congress party, into a party which thrives on chamchas and chamchagiri. Historian and writer Ramachandra Guha explains this in an essay titled A Short History of Congress Chamchagiri which is a part of his book Patriots and Partisans.“Most Indians are too young to know this, but the truth is that until about 1969 the Congress was more or less a democratic party,” writes Guha.

Indira Gandhi had been planning to settle in Great Britain. After Nehru died in May 1964, she was invited to join the cabinet as the minister of information and broadcasting by Lal Bahadur Shastri who took over as the next prime minister.

“When Shastri died in January 1966, Mrs Gandhi was, to her own surprise, catapulted into the post of the prime minister. There were other and better candidates for the job, but the Congress bosses (notably K Kamraj) thought that they could more easily control a lady they thought to be a gungi gudiya (dumb doll),“ writes Guha.

But she was not a gungi gudia and made all the right moves to consolidate her power and finally split the Congress party in 1969 and what was a essentially a decentralised and democratic party till that point of time became an extension of the whims, fancies and insecurities of a single individual.

Thus started an era of chamchas and chamchagiri in the Congress. Dev Kant Baruah who was the President of the Congress Party between 1975 and 1977 went to the extent of saying “Indira is India and India is Indira”. What was loyalty to the party earlier became loyalty to the individual and the family.

Also, Indira Gandhi took total control over the system effectively overriding democracy and imposing emergency on June 26, 1975. During this period she also formed a mini government within the government. This effort was led by her PN Haksar, her civil service secretary.

As veteran journalist Kuldip Nayar recounts in Emergency Retold “Haksar…organised the system in such a way that everything would revolve around the prime minister’s secretariat. Not even a deputy secretary was appointed without its concurrence. He set up a mini government…Haksar’s main contribution was that he politicized the setup, in the sense that for the first time in the country’s post independence history, government machinery came to be used for political purposes, if need be for Congress party purposes.”

The prime minister’s office is currently run by Pulok Chatterjee, who was earlier the officer on special duty to Sonia Gandhi.

Getting back to the emergency, Indira’s mini government had total control over how the system worked. A famous cartoon made by Abu showed President Fakhruddin Ali Ahmed in his bath during the emergency signing ordinances and saying “if there are any more ordinances just ask them to wait.”

Indira Gandhi also ensured that the Congress party effectively became a family run concern. As Guha writes in the essay Verdicts on Nehru “Mrs Gandhi converted the Indian National Congress into a family business. She first bought in her son Sanjay, and after his death, his brother Rajiv. In each case, it was made clear that the son would succeed Mrs Gandhi as head of Congress and head of government.”

Once the model was established firmly in the Congress party, it spread to most other political parties. “Indira Gandhi’s embrace of the dynastic principle for the Congress served as a ready model for other parties to emulate…The DMK was once the proud party of Dravidian nationalism and social reform; it is now the private property of M Karunanidhi and his children…Likewise, for all his professed commitment to Maharashtrian pride and Hindu nationalism Shiv Sena leader, Bal Thackeray could look no further than his son. The Samajwadi Party and Rashtriya Janta Dal claimed to stand for ‘social justice’, but the leadership of Mulayam’s party passed onto his son and in Lalu’s party to his wife,” writes Guha.

In doing what she did Indira Gandhi basically destroyed Indian democracy. Indeed, if she had not done what she did, Rahul Gandhi would not be the vice-president of the Congress party. He would at best be a middle level manager of a private sector company (as Guha puts it). Rahul Gandhi is honest enough to realise this. In October 2008, while addressing girl students at a resort near Jim Corbett National Park, Rahul Gandhi referred to “politics” as a closed system in India. “If I had not come from my family, I wouldn’t be here. You can enter the system either through family or friends or money. Without family, friends or money, you cannot enter the system. My father was in politics. My grandmother and great grandfather were in politics. So, it was easy for me to enter politics. This is a problem. I am a symptom of this problem.”

Hence, it is not surprising Rahul is inspired by what his grandmother, Indira Gandhi, told him. If it was not for her, he would be largely irrelevant today. He would pop up in the media once in a while, as a subject of stories on what are the descendants of Indira Gandhi doing today. Meanwhile, Rahul’s “bigger” joke, I talked about initially, is really on us, the citizens of this country.

(Vivek Kaul is the author of Easy Money. He tweets @kaul_vivek)

The ghost of Keynes

Vivek Kaul

Franklin D Roosevelt became the President of the United States in 1933, at the height of the Great Depression. Known for his no nonsense manner of speaking, Roosevelt is said to have remarked that “any government, like any family, can, for a year, spend a little more than it earns. But you know and I know that a continuation of that habit means the poorhouse.”

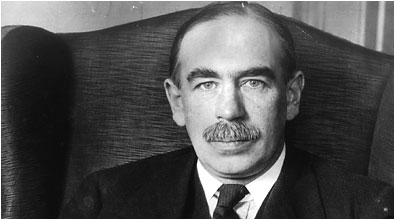

Those were the days when it was believed that governments should be balancing their budgets i.e. their income should be equal to their expenditure. Also, John Maynard Keynes, the most influential economist of the 20th century hadn’t gotten around to writing his magnum opus, The General Theory of Employment, Interest and Money, till then. The book would be published in 1936.

In this book, Keynes introduced a concept called the “paradox of thrift”.

As Paul Samuelson, the first American to win a Nobel Prize in economics, wrote in an early edition of his bestselling textbook “It is a paradox because in kindergarten we are all taught that thrift is always a good thing….And now comes a new generation of alleged financial experts who seem to be telling us…that the old virtues may be modern sins.”

What Keynes said was that when it comes to thrift or saving, the economics of an individual differed from the economics of the system as a whole. An individual saving more by cutting down on expenditure made tremendous sense. But when a society as a whole starts to save more then there is a problem. This is primarily because what is expenditure for one person is an income for someone else. Hence, when expenditures start to go down, incomes start to go down as well. In this way the aggregate demand of a society as a whole falls, impeding economic growth.

Keynes used the “paradox of thrift” to explain the Great Depression. He felt that cutting interest rates to low levels would not tempt either consumers or businesses to borrow and spend. Cutting taxes, so as people have more to spend was one way out. But the best way out of a depression was the government spending more money, and becoming the “spender of the last resort”. Also, it did not matter if the government ended up running a fiscal deficit in doing so. Fiscal deficit is the difference between what a government earns and what it spends.

After the stock market crash in late October 1929 which started the Great Depression, people’s perception of the future changed and this led them to cutting down on their expenditure. In 1930, consumer durable expenditure in America fell by over 20% and residential housing expenditure fell by 40%. This continued for the next two years and the economy contracted, leading to huge unemployment.

As per Keynes, the way out of this situation was for someone to spend more. The citizens and the businesses were not willing to spend more given the state of the economy. So, the only way out of this situation was for the government to spend more on public works and other programmes. This would act as a stimulus and thus cure the recession.

In fact in his book Keynes even went to the extent of saying “If the Treasury(i.e. The government) were to fill old bottles with banknotes, bury them at suitable depths in disused coalmines which are then filled up to the surface with town rubbish, and leave it to private enterprise on well-tried principles of laissez-faire to dig the notes up again…there need be no more unemployment and, with the help of the repercussions, the real income of the community, and its capital wealth also, would probably become a good deal greater than it actually is. It would, indeed, be more sensible to build houses and the like; but if there are political and practical difficulties in the way of this, the above would be better than nothing.”

In the later years this became famous as the “dig holes and fill them up” argument. During the time Keynes was expounding on his theory, it was already being practiced by Adolf Hitler, who had put 100,000 construction workers for the construction of Autobahn, a nationally coordinated motorway system in Germany, which was supposed to have no speed limits. Italy and Japan had also worked along similar lines.

Very soon Britain would end up doing what Keynes had been recommending. Great Britain had more or less done away with both its army and air force after the First World War. But the rise of Hitler led to a situation where massive defence capabilities had to be built in a very short period of time.

The Prime Minister Neville Chamberlain was in no position to raise taxes to finance the defence expenditure. What he did was instead borrow money from the public and by the time the Second World War started in 1939, the British fiscal deficit was already projected to be around £1billion.

The deficit spending which started to happen, even before the Second World War started, led to the British economy booming specially in south of England where ports and bases were being expanded and ammunition factories were being built.

This evidence left very little doubt in the minds of politicians, budding economists and people around the world that the economy worked like Keynes said it did. Keynesianism became the economic philosophy of the world for the next few decades.

Lest we come to the conclusion that Keynes was an advocate of government’s running fiscal deficits all the time, it needs to be clarified that his stated position was far from that. What Keynes believed in was that on an average the government budget should be balanced. This meant that during years of prosperity the governments should run budget surpluses. But when the environment was recessionary and things were not looking good, governments should spend more than what they earn and even run a fiscal deficit.

The politicians over the decades just took one part of Keynes’ argument and ran with it. The belief in running deficits in bad times became permanently etched in their minds. Meanwhile, they forgot that Keynes had also wanted them to run surpluses during good times.

So, the politicians ran deficits in good times and bigger deficits in bad times. This meant more and more borrowing. And that’s how the Western world ended up with all the debt, which has brought the world to the brink of an economic disaster. The way the ideas of Keynes have evovled, has cost the world dearly.

Keynes, of course, understood the power (or danger) of economic ideas and he wrote in The General Theory that “The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist.”

Now, only if he knew that a lot of practical men(read politicians) in the years to come would become the slaves of his ‘distorted’ ideas. The ghost of Keynes is still haunting us.

This column originally appeared in the Wealth Insight Magazine edition dated October 1, 2013

(Vivek Kaul is the author of Easy Money. He tweets @kaul_vivek)

10 things you should know about the American debt ceiling

Vivek Kaul

Vivek Kaul

The American government is staring at a big problem ahead. Come October 17, and it will hit the debt ceiling set by the American Congress. If this happens it will have global implications. Given that, it is important to understand what the debt ceiling really means and how it can impact the whole world.

So what is the debt ceiling?

The American government, like almost every government in the world, spends more than what it earns. The difference between what it spends and what it earns is met through borrowing money. There is an overall limit to the amount the American government can borrow. This limit is currently set at $16.69 trillion.

So what will actually happen on October 17?

The American Treasury Secretary Jack Lew (equivalent of the finance minister in India) has said that on October 17, the Treasury department will run out of the extraordinary measures it had put in place to ensure that the government doesn’t cross the debt ceiling of $16.69 trillion. Since May 2013, Lew has taken a number of extraordinary measures, like delaying pension fund payments, to ensure that the government expenditure remains under control and hence, the government does not cross the debt ceiling.

So the American government will run out of money on October 17?

The answer to this question is not very clear. Lew has said that as on October 17, the government “

“will be left to meet our country’s commitments at that time with only approximately $30bn.” And this amount will not be enough to meet expenditures of the government, which on certain days can be as high as $60 billion. He has not clarified the exact expected expenditure of the American government as on October 17. Hence, we don’t know if the American government will run out of money on October 17.

So when will the American government actually run out of money?

There are various estimates going around on this. Most analysts agree that the government won’t run out of money on October 18, and will keep chugging along for a brief while. The Bipartisan Policy Center expects this date to be anywhere between October 22 and November 1. As it points out “Updated data on Treasury cash flows through the first week of October show that the range for the Bipartisan Policy Center’s (BPC) X Date – the date on which the United States will be unable to meet all of its financial obligations in full and on time – has narrowed to between October 22 and November 1.”

Economists at JP Morgan have come up with a more precise date of October 24th. As an article on Time.com points out “They (i.e. the economists at JP Morgan) write that it is “extremely unlikely” the Treasury will be able to make it’s payments more than a few days after the 24th, and that the Treasury would most certainly have to default on some payments by November 1st, when large outlays for Social Security, Medicare, retirement benefits for military and civil services workers, and interest payments are due.”

So what will be the impact of this?

The expenditure of the American government will be greater than its income. Until now it has been able to borrow money to finance the gap. It won’t be able to borrow anymore. Given that, it will have to cut down on its expenditure.

AsEric Posner writes on Slate.com “If the debt ceiling is not raised, and the executive branch stops borrowing, the government will need to cut spending by about 15 to 20 percent—or almost 40 percent of spending on everything (yes, Medicare and defense) other than the interest on the debt.”

The impact of the cut in expenditure will be immediate. As Henry J Aaron writes in The New York Times “A decision to cut spending enough to avoid borrowing would instantaneously slash outlays by approximately $600 billion a year. Cutting payments to veterans, Social Security benefits and interest on the national debt by half would just about do the job. But such cuts would not only illegally betray promises to veterans, the elderly and disabled and bondholders.”

Other than having economic consequences, this cut in expenditure will also have social consequences. As Mark Blyth writes in Austerity – The History of a Dangerous Idea in a slightly different context but still applicabl in this case, “Seventy-two percent of the working population(in America) live paycheck to paycheck, have few if any savings, and would have trouble raising $2000 at short notice. There are, as far as we can tell, about 70 million handguns in the United States. So what would happen if…no paychecks were being paid out?”

Hence, cutting expenditure can have dramatic social and economic consequences.

So why is the American government doing nothing about this?

As must be clear by now the consequences of the American government hitting the debt ceiling and not being able to meet its expenditure, will be disastrous. Given this, why hasn’t the government done something about it? Why haven’t they increased the debt ceiling?

The answer lies in the fact that the two houses of the American Congress are currently in a logjam. The House of Representatives is dominated by the Republican Party and the Senate is dominated by the Democratic Party. And both the parties are refusing to talk to each other. The Republicans believe that fiscal profligacy of the American government has gone on for too long and needs to be reined in.

In fact, many Republican Congressmen are not concerned about the debt ceiling at all. As Senator Richard Burr recently said “I’m not as concerned as the president is on the debt ceiling, because the only people buying our bonds right now is the Federal Reserve. So it’s like scaring ourselves.”

So are Republicans right on only the Federal Reserve buying government bonds?

This statement has been true in the recent past. The Federal Reserve of United States, the American central bank has been printing money to buy American government bonds. This helps the government finance its fiscal deficit. Fiscal deficit is the difference between between what a government earns and what it spends.

But Burr’s statement does not take into account the fact that foreign countries hold nearly $5.6 trillion of American government bonds. In comparison, the treasury holds bonds worth $1.93 trillion. These bonds were issued by the American government to borrow money to finance its fiscal deficit.

Interest on these bonds needs to be paid. Also, maturing bonds needs to be repaid. The American government has reached a stage, where it pays the interest on bonds as well as repays maturing bonds, by raising money by selling new bonds and taking on more debt. Any decision to stop paying interest on bonds or default on maturing bonds, will lead to a global financial crisis. As Posner writes “ If he(i.e Obama) stops interest payments, the United States will default. This will not only raise interest payments—costing taxpayers hundreds of billions of dollars—but could spark a financial panic like the meltdown of 2008.”

The US government bonds are the ultimate risk free asset. If the government defaults on interest payments and/or principal repayment, then investors all over the world are going to exit all kinds of financial markets. No wonder China which holds more than a trillion dollars of American government bonds is worried. The Chinese Vice Finance Minister Zhu Guangyao recently said “We naturally are paying attention to financial deadlock in the U.S. and reasonably demand that the U.S. guarantee the safety of Chinese investment there.”

So that brings us back to the question why aren’t Republicans and Democrats talking?

This basically boils down to the fact that Republican Congressmen seem to be confident that the government is in a position to work its way around the debt ceiling. As Senator Orrin Hatch recently said “I think the administration could work on who gets paid and who doesn’t in a way that would pull us through.”

It is easy to ask the government to prioritize payments, but anything done around those lines could have serious legal implications. It needs to be pointed out that there are no legal provisions to decide which expenditure should be cut first. “There is no clear legal basis for deciding what programs to cut. Defense contractors, or Medicare payments to doctors? Education grants, or the F.B.I.? Endless litigation would follow. No matter how the cuts might be distributed, they would, if sustained for more than a very brief period, kill the economic recovery and cause unemployment to return quickly to double digits,” Aaron points out in The New York Times.

The politicians on both the sides are also taking it easy because the markets haven’t reacted to this lack of communication between the two political parties on the debt ceiling. As Senator Hatch put it “I don’t think the markets have been spooked so far, and I personally believe that if they realized there was a legitimate attempt to make the government work, they would be less likely [to be spooked].”

So why haven’t the markets reacted?

The debt ceiling has been in place since 1939. And since then the American Congress has raised it numerous times to allow the government to borrow more. As an article in the Christian Science Monitor points out “An overall cap on federal debt has been in place since 1939, and Congress has raised it numerous times since then. The Treasury Department counts 78 times since 1960.”

What has happened 78 times is also likely to happen one more time.

This explains why the various financial markets in America and around the world continue to remain stable and are not taking into account the possibility of another crisis. As Bill Gross manager of the world’s biggest bond fund, told Bloomberg Television “The odds of a default are “a million-to-one” as the Treasury Department will be able to take other measures to ensure it is servicing the country’s debt.”

Hence, the market is currently expecting the Republicans and the Democrats to sit down and solve the problem before October 17.

So will the markets continue to remain stable?

That’s a tricky question to answer. The closer we get to October 17 without any solution in sight, the more the stability of the markets will be threatened. In fact, if the American stock market falls it might even get the Republicans and the Democrats to start talking. As John Cassidy of The New Yorker magazines writes on his blog “If the market fell by, say, three or four hundred points for three days in a row, and then lurched down another eight hundred points, or even a thousand points, the effect would be salutary. How can I say that? Tens of millions of Americans would grow alarmed about their 401k plans. On Wall Street, there would be margin calls, liquidity runs, and other disturbing developments that inevitably accompany market breaks. Rumors would start to spread about the health of various financial institutions. You don’t have to subscribe to a tail-wags-the-dog view of finance and politics to believe that this would lead to a rapid change of thinking, and of behaviour, in Washington.”

This will get the two sides talking on the debt ceiling for sure.

The article originally appeared on www.firstpost.com on October 9, 2013

(Vivek Kaul is a writer. He tweets @kaul_vivek)