Vivek Kaul

The Dow Jones Industrial Average (DJIA), America’s premier stock market index, has been quoting at all-time-high levels. On 7 March 2013, it closed at 14,329.49 points. This has happened in an environment where the American economy and corporate profitability has been down in the dumps.

The Indian stock markets too are less than 10 percent away from their all-time peaks even though the economy will barely grow at 5 percent this year.

All the easy money created by the Federal Reserve is landing up in the stock market. So the stock market is going up because there is too much money chasing stocks. ReutersIn this scenario, should one dump stocks or buy them?

The short answer is simple: as long as the other markets are doing fine, we will do fine too. The Indian market’s performance is more closely linked to the fortunes of other stock markets than to Indian economic performance.

So watch the world and then invest in the Sensex or Nifty. You can’t normally go wrong on this.

Let’s see how the connection between the real economy and the stock market has broken down after the Lehman crisis.

The accompanying chart below proves a part of the point I am trying to make. It tells us that the total liabilities of the American government are huge and currently stand at 541 percent of GDP. The American GDP is around $15 trillion. Hence the total liability of the American government comes to around $81 trillion (541 percent of $15 trillion).

Source: Global Strategy Weekly, Cross Asset Research, Societe Generate, March 7, 2013

The total liability of any government includes not only the debt that it currently owes to others but also amounts that it will have to pay out in the days to come and is currently not budgeting for.

Allow me to explain. As economist Laurence Kotlikoff wrote in a column in July last year, “The 78 million-strong baby boom generation is starting to retire in droves. On average, each retiring boomer can expect to receive roughly $35,000, adjusted for inflation, in Social Security, Medicare, and Medicaid benefits. Multiply $35,000 by 78 million pairs of outstretched hands and you get close to $3 trillion per year in costs.”

The $3trillion per year that the American government needs to pay its citizens in the years to come will not come out of thin air. In order to pay out that money, the government needs to start investing that money now. And that is not happening. Hence, this potential liability in the years to come is said to be unfunded. But it’s a liability nonetheless. It is an amount that the American government will owe to its citizens. Hence, it needs to be included while calculating the overall liability of the American government.

So the total liabilities of the American government come to around $81 trillion. The annual world GDP is around $60 trillion. This should give you, dear reader, some sense of the enormity of the number that we are talking about.

And that’s just one part of the American economic story. In the three months ending December 2012, the American GDP shrank by 0.1 percent. The “U3” measure of unemployment in January 2013 stood at 7.9 percent of the labour force. There are various ways in which the Bureau of Labour Standards in the United States measures unemployment. This ranges from U1 to U6. The official rate of unemployment is the U3, which is the proportion of the civilian labour force that is unemployed but actively seeking employment.

U6 is the broadest definition of unemployment and includes workers who want to work full-time but are working part-time because there are no full-time jobs available. It also includes “discouraged workers”, or people who have stopped looking for work because economic conditions make them believe that no work is available for them. This number for January, 2013, stood at 14.4 percent.

The business conditions are also deteriorating. As Michael Lombardi of Profit Confidential recently wrote, “As for business conditions, they appear bright only if you look at the stock market. In reality, they are deteriorating in the US economy. For the first quarter of 2013, the expectations of corporate earnings of companies in the S&P 500 have turned negative. Corporate earnings were negative in the third quarter of 2012, too.”

The average American consumer is not doing well either. “Consumer spending, hands down the biggest contributor of economic growth in the US economy, looks to be tumbling. In January, the disposable income of households in the US economy, after taking into consideration inflation and taxes, dropped four percent—the biggest single-month drop in 20 years!,” writes Lombardi.

Consumption makes up for nearly 70 percent of the American GDP. And when the American consumer is in the mess that he is where is the question of economic growth returning?

So why is the stock market rallying then? A stock market ultimately needs to reflect the prevailing business and economic conditions, which is clearly not the case currently.

The answer lies in all the money that is being printed by the Federal Reserve of the United States, the American central bank. Currently, the Federal Reserve prints $85 billion every month, in a bid to keep long-term interest rates on hold and get the American consumer to borrow again. The size of its balance-sheet has touched nearly $3 trillion. It was at around $800 billion at the start of the financial crisis in September 2008.

As Lombardi puts it, “When trillions of dollars in paper money are created out of thin air and interest rates are simultaneously reduced to zero, where else would investors put their money?”

All the easy money created by the Federal Reserve is landing up in the stock market.

So the stock market is going up because there is too much money chasing stocks. The broader point is that the stock markets have little to do with the overall state of economy and business.

This is something that Aswath Damodaran, valuation guru, and professor at the Columbia University in New York, seemed to agree with, when I asked him in a recent interview about how strong is the link between economic growth and stock markets? “It is getting weaker and weaker every year,” he had replied.

This holds even in the context of the stock market in India. The economy which was growing at more than 8 percent per year is now barely growing at 5 percent per year. Inflation is high at 10 percent. Borrowing rates are higher than that. When it comes to fiscal deficit we are placed 148 out of the 150 emerging markets in the world. This means only two countries have a higher fiscal deficit as a percentage of their GDP, in comparison to India. Our inflation rank is around 118-119 out of the 150 emerging markets.

More and more Indian corporates are investing abroad rather than in India (Source: This discussion featuring Morgan Stanley’s Ruchir Sharma and the Chief Economic Advisor to the government Raghuram Rajan on NDTV). But despite all these negatives, the BSE Sensex, India’s premier stock market index, is only a few percentage points away from its all-time high level.

Sharma, Managing Director and head of the Emerging Markets Equity team at Morgan Stanley Investment Management, had a very interesting point to make. He used thefollowing slide to show how closely the Indian stock market was related to the other emerging markets of the world.

India’s premier stock market index, is only a few percentage points away from its all-time high level.

As he put it, “It has a correlation of more than 0.9. It is the most highly correlated stock market in the entire world with the emerging market averages.”

So we might like to think that we are different but we are not. “We love to make local noises about how will the market react pre-budget/post-budget and so on, but the big picture is this. What drives a stock market in the short term, medium term and long term is how the other stock markets are doing,” said Sharma. So if the other stock markets are going up, so does the stock market in India and vice versa.

In fact, one can even broaden the argument here. The state of the American stock market also has a huge impact on how the other stock markets around the world perform. So as long as the Federal Reserve keeps printing money, the Dow will keep doing well. And this in turn will have a positive impact on other markets around the world.

To conclude let me quote Lombardi of Profit Confidential again “I believe the longer the Federal Reserve continues with its quantitative easing and easy monetary policy, the bigger the eventual problem is going to be. Consider this: what happens to the Dow Jones Industrial Average when the Fed stops printing paper money, stops purchasing US bonds, and starts to raise interest rates? The opposite of a rising stock market is what happens.”

But the moral is this: when the world booms, India too booms. Keep your fingers crossed if the boom is lowered some time in the future.

The article originally appeared on www.firstpost.com on March 8, 2013.

Vivek Kaul is a writer. He tweets @kaul_vivek

Month: March 2013

A marketer's dream – what does a woman really want on women’s day

Vivek Kaul

Vivek Kaul

What follows is a conversation that every marketing guy working for big business would love to hear on women’s day.

“So how do we celebrate today?” she asked him, as soon as he got up.

“Celebrate?” he asked, wondering if he had forgotten her birthday, her mother’s birthday, their monthly anniversary, the day they had first met or something else, all over again.

“Don’t tell me you have forgotten it again this year,” she said. “No V, not again.”

“Let’s go out for dinner to your favourite restaurant,” he said, trying to rescue the situation. “I’ll call them and make a reservation for a cosy candle lit dinner.”

“That would be nice,” she said. “But the occasion demands more than that baby.”

This set him thinking. “It can’t be Valentine’s day today,” he wondered. “Because that was only last month.”

“And why is she calling me baby? Must be something really special today? Maybe the day we first met. Or the day we first kissed. Anyway, doesn’t really matter as long as I pamper her!”

“Jaan let’s go for a long drive after dinner. I’ll take you for a spin around the lake. You used to love that so much when we first started dating,” he said, hoping that this time he had hit the bull’s eye.

“Nah. I am tired of going there.”

“So lets then go visit your mother,” he said. “We haven’t met her in a while.”

“No yaar. Going to meet her in the evening is a disaster. First she will torture us is with the pravachan of Dhartiphod baba. And then she will make us watch the soap opera Bade Ache Lagte Hain on television.”

“So?”

“Arre. I find that very boring. I can still stand Dhartiphod baba but watching that soap opera gives me a bout of nausea.”

“Then what do you want to do?”he asked. “I have run out of ideas.”

“Let’s go shopping,” she responded immediately.

“Shopping. But why?”he asked. “We had gone shopping only last week. You made me go around that mall atleast twenty times.”

“So we can’t go shopping again?”

“Of course, we can baby,” he said. “But you bought all the clothes you wanted to.”

“Yes I did. But its not clothes that I want to buy.”

“You also have at least 52 pairs of sandals, each for one week of the year!”

“Yes I have. But I don’t want to buy sandals.”

“You just bought the latest iPhone last month.”

“Yes, I don’t feel like buying any gadgets.”

“Your mother anyway gives you six sarees a year which you never wear,” he said. “And you keep converting those sarees into salwar suits.”

“Who wants to buy Sarees when Ma orders them directly from Kanjeevaram,” she replied.

“Oh then why do you want to go shopping?” he asked desperately.

“Because I want to buy something else.”

“Something else?” he asked. “Do you want to buy more wall hangings, paintings, chimes, sofa covers, bed covers, bed sheets? What?”

“Nah!” she exclaimed. “I am done with all that for now.”

“Then?”

“I want something that is not very showy.”

“And what is that?”

“Something that is transparent.”

“Get to the point baby.”

“Something that looks sophisticated on me.”

“Acha.”

“And something that is going to cost you a lot of money.”

“Oh!”

“I want a diamond.”

“A diamond? Why?”

“Because a diamond is a woman’s best friend!”

“That’s just a marketing pitch baby. I am your best friend.”

“Really? Are you? Then why don’t you make me happy and buy me a diamond.”

“Hmmm. What other option do I have?” he said smiling and cursing his fate.

“Yippie,” she jumped, and gave him a big tight hug.

“But now that I am spending such a huge amount of money, at least tell me what is the ocassion?” he asked.

“I knew,” she said. “You wouldn’t remember.”

“So what is it?”

“It’s women’s day!”

“Come on. For me, every day is women’s day,” he protested.

“Is it?”

“Yes. I mean, why just celebrate it one day in 365 days,” he remarked.

“So does that mean you will give me a diamond every day of the year?” she said, having the last laugh.

(Vivek Kaul is a writer. He tweets @kaul_vivek)

Dear PM, those who live in glass houses don't throw stones at others

The nation came to the realisation yesterday that the Prime Minister Manmohan Singh actually has a voice. And then we all came to the conclusion that just because he decided to speak, he spoke well. One commentator even went onto christen the event as “Manmohan on steroids”.

The part that the media loved the most was when Singh told the Parliament ‘Jo garajte hain, woh baraste nahi(Thunderous clouds do not bring showers)’, a clichéd statement which was supposed to put the Bhartiya Janata Party (BJP), the main opposition party, in its place.

As far as clichés go, I would take this opportunity, to bring to your notice, dear readers, a dialogue written by Akhtar-Ul-Iman and delivered with great panache by Raj Kumar in the Yash Chopra directed Waqt. The line goes like this: “Chinoi Seth…jinke apne ghar sheeshe ke hon, wo dusron par pathar nahi feka karte (Chinoi Seth…those who live in glass houses don’t throw stones at others).”

Now Singh may not have time to sit through a movie which runs into 206 minutes, given that he is the Prime Minister of the nation, and probably has decisions to make and things to do. But he would be well-advised to watch this 18-second YouTube clip and hopefully come to the realisation that those who live in glass houses, like Singh and his government, do not throw stones at others.

In fact, Singh’s speech to the Parliament yesterday was riddled with many inconsistent and wrong claims. It is a real surprise that the BJP has not caught onto rubbishing the arguments presented by Singh. Let us examine a few claims made by Singh:

Even BIMARU states have also done much better in UPA period than previous period: BIMARU is an acronym used for the states of Bihar, Madhya Pradesh, Rajasthan and Uttar Pradesh. These are states which have lagged in economic growth for a long period of time. There has been a recent spurt in their economic growth and this claims Singh has been because of the UPA government.

Three out of the four states (except Rajasthan) have had a non Congress-non UPA government for the entire duration of the UPA rule in Delhi. Rajasthan has had a Congress government since December 2008.

So trying to claim that the growth in these states has been only because of the UPA government is misleading to say the least. The argument is along similar lines where Congress politicians and some experts have tried to claim over and over again that Bihar has grown faster than Gujarat. Yes it has in percentage terms. But what they forget to tell us is that Gujarat is growing on a much higher base, meaning the absolute growth in Gujarat is higher. In fact, it is three times higher than that of Bihar (The entire argument is explained here).

If we look at the MSP across various commodities, they have increased by 50 to 200% since 2004-05: The government offers a minimum support price on various commodities including rice and wheat. At this price, the Food Corporation of India (FCI), or a state agency acting on its behalf, purchase primarily rice and wheat, grown by Indian farmers. The theory behind setting the MSP is that the farmer will have some idea the price he would get when he sells his produce after harvest. What it has led to is that more and more farmers are selling to the government because they have an assured buyer at an assured price. The government now has nearly Rs 60,000 crore of rice and wheat in excess of what it needs to maintain a buffer stock. While the government is hoarding onto more rice and wheat than it needs, there is a shortage of wheat and rice in the open market pushing up their prices and in turn food inflation and consumer price inflation. It has also pushed up food subsidies and fiscal deficit. Fiscal deficit is the difference between what the government earns and what it spends. And if the government continues with this policy there are likely to be other negative consequences as well. (The entire argument is explained here)

The current slowdown in industrial growth is a concern: This was the most tepid statement in the entire speech. Is it just a concern? Some of the biggest Indian industrialists have gone on record to say that they would rather invest abroad than in India. As Kumar Manglam Birla recently said in an interview “Country risk for India just now is pretty elevated and chances are that for deployment of capital, you would look to see if there is an asset overseas rather than in India…We are in 36 countries around the world. We haven’t seen such uncertainty and lack of transparency in policy anywhere.” The Birlas have known to be very close to the Congress party for a very long time.

And numbers bear this story. Indian corporates are investing abroad rather than India. In 2001-2002 this number was less than 1% of the gross domestic product (GDP) and currently it stands at 6% of the GDP (Source: This discussion featuring Morgan Stanley’s Ruchir Sharma and the Chief Economic Advisor to the government Raghuram Rajan on the news channel NDTV). So the situation is clearly more than just a concern. If Indian industrialists don’t want to invest in India who else will? Is it time to say good bye to industrial growth? Maybe the Prime Minister has an answer for that.

The economic growth has slowed down in 2012-13, because of the difficult global situation: This is something which the finance minister P Chidambaram also alluded to in his budget speech. What it tells us is that there is very little acknowledgement of mistakes that have been made by this government led by Manmohan Singh over the years.

When India was growing at growth rates of 8% and greater, there was a lot of chest thumping by various constituents of the government, that look we are growing at such a high rate. Now that we are not growing at the same speed its because of a difficult global situation.

Ruchir Sharma in a post budget discussion on the news channel NDTV made a very interesting point. India has consistently been at around 24-26th position among 150 emerging market countries when it comes to economic growth over the last three decades.

We thought we were growing at a very fast rate over the last few years, but so was everyone else. As Sharma put it “The last decade we thought we had moved to a higher normal and it was all about us. Every single emerging market in the world boomed and the rising tide lifted all boats including us.”

But now that we are not growing as fast as we were it is because the global economy has slowed down. Sharma nicely summarised this disconnect when he said “When the downturn happens it is about the global economy. When we do well its about us.” India currently has fallen to the 40th position when it comes to economic growth.

Will bring the country back to 8% growth rate: This is kite flying of the worst kind. As Sharma of Morgan Stanley told NDTV “I see people in government today including the Prime Minister talking about 8% GDP growth rate as if that is the level we should be. There is nothing to suggest that is our potential.”

Singh said that the government was committed to achieving a 8% growth rate for the period of the 12th five year plan period of 2012-2017. In the first year of this plan i.e. the financial year 2012-2013 (the period between April 1, 2012 and March 31, 2013), the Indian economy is expected to grow at around 5%(numbers projected by the Central Statistical Organisation).

What that means is that if the 8% target is to be achieved, the economy has to consistently grow at 9% per year for the remaining four years of the plan. And India has never experienced such consistent high growth ever in the past.

Given that Singh’s statement needs to be taken with a pinch of salt. It is essentially rhetoric of the worst kind. As Nate Silver writes in The Signal and the Noise “Sometimes economic forecasts have expressively political purposes too. It turns out that economic forecasts produced by the White House , for instance, have historically been among the least accurate of all, regardless of whether it’s a Democrat or Republican in charge. When it comes to economic forecasting, however, the stakes are higher than for political punditry. As Robert Lucas pointed out, the line between economic forecasting and economic policy is very blurry: a bad forecast can make the real economy worse.” Singh’s 8% growth statement needs to be viewed along similar lines.

There were many things that Singh did not talk about. Among 150 emerging markets, the fiscal deficit of the Indian government is currently at the 148th number. When it comes to inflation, India is currently at the 118-119th position. The current account deficit (which Singh did talk about) will touch an all time high during the course of the financial year 2012-2013. Interest rates have stubbornly refused to come down. And so on.

To conclude, Manmohan Singh was in poetic mood yesterday. “Humko hai unse wafa ki umeed, jo nahi jaante wafa kya hai (We hope for loyalty from those who do not know the meaning of the word),” the prime minister said quoting the Urdu poet Mirza Ghalib, while taking pot-shots at the BJP.

It’s time the BJP got back to him with what are the most famous lines of the poet Akbar Allahabadi.

“Hum aah bhi karte hain to ho jaate hain badnam,

wo qatl bhi karte hain to charcha nahi hota.”

(badnam = infamous. Qatl = murder. Charcha = discussion)

This article originally appeared on www.firstpsost.com on March 7, 2013, with a different headline.

(Vivek Kaul is a writer. He tweets @kaul_vivek)

The secret of Raul Ghandi's girlfriend is out

Vivek Kaul

(This is a work of fiction)

It was late evening in Lutyens Delhi and winter was gradually giving away to the long hot summer. Madam was sitting in her verandah and was listening to an old Kishore Kumar song.

“Zaroorat hai zaroorat hai zaroot hai,” went the lines. “Ek shirmati ki, kalawati ki, seva kare jo pati ki.”

The CD player had been set on a high volume. This woke up Raul, who was having his daily afternoon siesta.

“Ma, you don’t have to play it so loud,” Raul baba said as he barged into the room. “You know I sleep very late at night.”

“I was hoping you’d take the hint beta,” said Madam, who other being Raul’s mother was also the chief of the Con-Regress party.

“Ma, you know what?” said Raul. “As I told journalists the other day I am like a parachute.”

“So?”

“A parachute can land anywhere. It needs a lot of training to land it at the same place all the time.”

“So?”

“Well if I get married, the parachute will have to land at the same place all the time. And I am still not trained enough to do that, still finding my feet around.”

“Oh,” said Madam. “I really didn’t see it that way.”

“You like Kishore Kumar songs. I like Amit Kumar, his son’s voice more,” said Rahul, taking the conversation on a totally different track.

“Amit Kumar? Where did he come from?”

“Let me play to you my favourite Amit Kumar song,” said Rahul, putting on a CD.

“Jab se hui hai shaadi aansu baha ra hoon,” went the lines. “Aafat gale padi hai usko nibha raha hoon.”

“Ha ha ha. Naught boy,” said Madam, trying to rough up Raul’s hair.

“Ma, I am man now. A 42 year old man,” said Raul. “And the difference between the father and the son can be seen in the songs that they sang. Kishore Kumar married four times. Amit married just once and that too very late in life.”

“Yes,” said Madam. “I am only bothered about you beta. I am fine as long as you marry, even if its late in life. But how late can it really get? You’ll turn 43 in June. Hope you don’t get too late because the show needs to go on beta.”

As soon as Madam had finished asking her question, Raul’s mobile phone started to ring. “Shayad meri shadi ka khayal dil main aaya hai is liye mummy ne teri mujhe chai pe bulaya hai,” went the ring tone.

“Excuse me,” said Raul and disappeared into his room.

Madam followed him and put her ears close to Raul’s door trying to overhear the conversation. And she could easily hear Raul’s side of the conversation.

“Haan jaan bolo!”

“No baby!”

“I love you baby. But in politics we have to keep saying things.”

“You want me to repeat what I told the journalists the other day?”

“I feel we should all be detached from power. Only then we can contribute to the society better. You people ask me about my marriage plans. Sometimes, I think, if I marry and have children, I would want my children to take my position. Sometimes, I feel that status quo is better.”

“You thought that was funny?”

“Thank you. Thank you. I came up with that impromptu. It went with my broader philosophy also. I never mean what I say and I never say what I mean.”

“But why don’t you want any children?”

“My show must go on baby! Please understand. Or Bob’s children will take over. The bugger is even throwing a party tonight.”

Madam kept hearing Raul’s side of the conversation till the bunch of keys she was holding in her left hand fell and alerted Raul.

“Okay, I will call you at night,” he blurted out, cut the call and rushed out of the room.

“So?” asked Madam.

“Guess you figured it out.”

“Who’s she?”

“My girlfriend.”

“When are you marrying her?”

“I don’t know. She says, she likes me, but is not sure if she loves me.”

“Oh!”

“And you know that parachute line. I actually borrowed it from her. She said it first.”

“These parachutes seem to be ruining my life,” said Madam.

“Okay. Tell me when she is ready,” said Madam, going back to listening to songs.

This time it was another Kishore Kumar number that was playing.

“Barah mahine line maari phir bhi laga na number, January main shuru kiya tha aa gaya December, mera phir laga na number!” went the lines.

(This is a work of fiction)

The article originally appeared on www.theunrealtimes.com on March 6, 2013

(Vivek Kaul is a writer. He tweets at @kaul_vivek)

UPA-nomics: How to hoard grain and let food prices soar

Vivek Kaul

Over the last few days my mother and her sister have been complaining about how the price of the 10 kg bag of rice that they buy has gone up by 17% in just over a couple of month’s time.

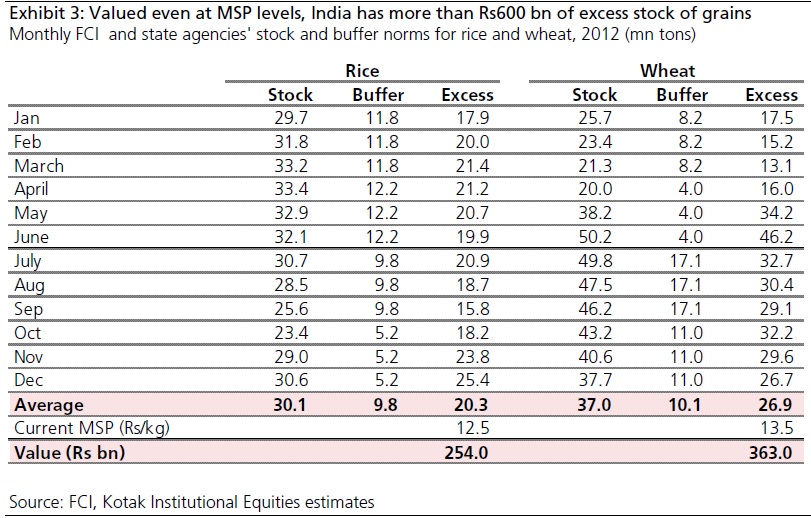

Now contrast this with what Akhilesh Tilotia of Kotak Institutional Equities Research writes in the GameChanger Perspectives report titled Putting the mountain of grains to use (Released on March 5, 2013). “India can raise more than Rs60,000 crore if it prunes its inventory of food grains: an excess 20 million tons of rice and 26 million tons of wheat (without accounting for procurements to be made this year),” writes Tilotia. (The table shows the numbers in detail).

As the above table shows the government currently has an excess rice stock worth around Rs 25,400 crore and an excess wheat stock worth Rs 36,300 crore, or more than Rs 60,000 crore in total. These numbers have been arrived at by taking into account the MSP of rice at Rs 12.5 per kg and the MSP of wheat at Rs 13.5 per kg and multiplying them with the excess stocks. What the table also tells us is that the government currently has an excess rice stock of nearly 2 times the buffer and an excess wheat stock of nearly 2.7 times the buffer.

The government sets a minimum support price(MSP) for wheat and rice. Every year the Food Corporation of India (FCI), or a state agency acting on its behalf, purchases rice and wheat at MSPs set by the government. The “supposed” idea behind setting the MSP much and that too much in advance is to give the farmer some idea of how much he should expect to earn when he sells his produce a few months later. FCI typically purchases around 15-20 percent of India’s wheat output and 12-15 percent of its rice output, estimates suggest.

At least this is how things are supposed to work in theory. But most government motives have unintended consequences. With an assured price more rice and wheat lands up with the government than it distributes through the public distribution system. Also with FCI obligated to purchase what the farmers bring in, its godowns overflow and at times the wheat and rice are dumped in the open, leading to rodents feasting on the crop.

On the other hand the way things currently are it helps the farmer as he has an assured buyer in the government for his produce. But what it also does is it pushes up prices of rice and wheat everywhere else, as more of it lands up in the godowns of FCI and not in the open market.

The procurement also adds to the food subsidy. The government pays for all the rice and wheat that the farmer brings to it and then lets a lot of it rot. The government currently has nearly 67 million tonnes of rice and wheat in stock. Of this nearly 47 million tonnes is excess.

Tilotia expects the rice and wheat stock of the government to go up to 100 million tonnes by the time this harvest season gets over. As he writes “After the current harvest season, Indian granaries will stock about 100 million tonnes of wheat and rice…A high inventory comes with a heavy carrying cost, which the FCI estimates at Rs6.12 per kg for year-end September 2014: At 100 million tons, this will cost India Rs 60,000 crore a year (forming most of its food subsidy bill).”

A higher food subsidy bill adds to the fiscal deficit and which as writers Firstpost regularly keeps discussing has huge consequences of its own. Fiscal deficit is the difference between what a government spends and what it earns.

In fact, the United States of America had a similar policy in place in the aftermath of The Great Depression which started in 1929, on a number of agri-commodities like wheat, tobacco, cotton etc. The government offered a support price to farmers. This support price had unintended consequences over the years, especially in case of wheat.

As Bruce Gardner writes in the research paper “The Political Economy of U.S.Export Subsidies for Wheat” (quoted by Tilotia) “The traditional means of price support is a governmental agreement, through its Commodity Credit Corporation (CCC), to buy wheat at the support price. This programme periodically led to governmental acquisition of large stocks which were costly to store and for which markets did not exist at the support price level.”

As is happening in India right now the American government ended up buying more and more wheat, of which it had no use for, especially at the price it was paying for it. The farmers had an assured buyer in the government and they went around producing more wheat than before.

This resulted in excess stocks with the American government. Over the years this excess wheat was exported at a subsidised rates. As Gardner writes “The subsidy ranged from 5 to 30 percent of the price of wheat, depending on world and U.S. market conditions in each year.” A lot of wheat was also donated under the Agricultural Trade and Development Act of 1954 ( better known as P.L. 480) of which India was a huge beneficiary in the late 50s and early 60s till Lal Bahadur Shastri initiated the agricultural revolution.

Gradually the wheat acreage, or the area over which wheat was planted, was also reduced in the United States. This meant that the farmers had to keep their land idle and not plant wheat on it. “Acreage allotments…were reintroduced in 1954 and reduced planted acreage by about 18 million acres (from 79 million in 1953 to an average of 61 million in 1954-56). Each producer had to stay under the farm’s allotment in order to be eligible for price support loans. In 1956 the Soil Bank program was introduced. It paid wheat growers about $20 per acre (roughly market rental rates) to idle an average of 12 million more acres (20 percent of preprogram acreage) in 1956-58,” writes Gardner.

India seems to be heading on the same path if the current policies don’t change. As Tilotia writes “India’s inventory is concentrated in the north-western states of Punjab and Haryana, which store 36 million tons of its 66 million tons of stock. Given the large procurement expected from these states again this year (though Madhya Pradesh may better Haryana in wheat procurement this year, especially given state elections), this imbalance can worsen.”

Interestingly, the government can use this excess inventory of rice and wheat to control inflation and at the same time bring down its fiscal deficit. The government currently has rice and wheat worth in excess of Rs 60,000 crore. On the other hand it also has a disinvestment target of Rs 54,000 crore for the next financial year (i.e. the period between April 1, 2013 and March 31, 2014). The government hopes to earn this amount by selling stakes it holds in public sector units to the public.

Along similar lines the government can try selling the excess rice and wheat that it currently holds in the open market. This will help control food inflation with the excess government stock hitting the market. Food forms around 43% of the consumer price inflation number and so if food inflation comes down, the consumer price inflation is also likely to come down.

The challenge of course in doing this is two fold. The first being moving grains from Punjab, Haryana where more than half the inventory lies. The second is to ensure that the market prices of rice and wheat don’t collapse.

Also the current MSP system is not working. If the idea is to pay the citizens of this country to improve their living standards, the government may be better off paying them in cash, rather than paying them in this roundabout manner that creates inflation. This is simply because the current system drives up the price of food for everyone else and it doesn’t necessarily always benefit the farmers. The middleman continue to make the most money.

As Tilotia puts it “If such a payment indeed needs to be made, there is no point in raising prices for all in the system by adding it to the price of the grain: Simply pay the farmer whatever support you want to pay him/her. India is reaching a situation where, by using UID it would be able to send payments to farmers directly. Maybe it is time to re-couple wheat and rice prices with global prices – that can meaningfully reduce inflation in India.”

The article originally appeared on www.firstpost.com on March 6,2013.

(Vivek Kaul is a writer. He tweets @kaul_vivek)