It is that time of the year when media houses go around writing about the best of the year that was. Given this, I thought it would be an appropriate time to put out a list of what I think are the best nonfiction books that I read in 2014. The list is biased to the extent of what I read, which are basically books in the area of finance and economics. Also, some of the titles were released earlier and I only happened to read them in 2014. The books are listed out in a random order. So here we go.

Saving Capitalism from the Capitalists by Raghuram Rajan and Luigi Zingales: I had read this book when it was first published in 2003. At that point of time I was basically trying to figure out what to do with my life, having finished an MBA in information systems in 2002 and at the same time having realized that the MBA degree was one big con job. In 2014, the book was published again with a new afterword. I read it again and appreciated the book much more than I had done in 2003. The book is a great read for anyone who believes in the idea of free markets. It tells you loud and clear that the incumbent capitalists are the greatest enemies of the free market. The book also helped me understand why so many big businesses in India manage to default on their bank loans without the industrialists having to face the consequences of the same.

After the Music Stopped by Alan S Blinder: This book was published in 2013, but I happened to read it only this year. The best books on historical events are written many years after the event has happened. Take the case of what I think is the best book on the Great Depression—The Great Crash 1929, written by John Kenneth Galbraith. The book was first published in the mid 1950s almost quarter of a century after the Depression started. One possible explanation for this is the fact that writing many years later, the author can leave out all the noise and concentrate on the most important issues. Over the last six years many books have been written on the financial crisis, but After the Music Stopped, in my opinion is perhaps the best book on it. It summarises the economic, the political as well as the legal angles of the financial crisis very well. If you are looking for a ready reckoner on the financial crisis, this has to be your go to book. Capital in the Twenty-First Century by Thomas Piketty: This was by far the bestselling title in economics during the course of this year, having been the number one book on Amazon.com for a while. It is very rare for an economics book running into 700 pages to be number one on Amazon. In this book the core argument offered by Piketty, who is a French economist, is that capitalism has led to greater inequality among people over the years. Piketty offers a lot of data from the developed countries to make his point. The book did not go down well with the American economists, and after it appeared many of them tried to discredit it by trying to find mistakes in the data and methodology used by Piketty. Who is right and who is wrong is too long a debate to get into here. Nevertheless, Piketty’s book remains a must read for the fantastically lucid way in which its written and the several original ideas that it offers. The Dollar Trap by Eswar S. Prasad: The United States is in a huge financial mess. Nevertheless, dollar remains the go to currency of the world at large. Whenever there is a whiff of a crisis anywhere in the world, money is pulled out and moves to the dollar. Ironically, even when the rating agency Standard and Poor’s cut the rating of the debt issued by the United States government from AAA to AA+, money moved into the US dollar. Prasad explains this “exorbitant privilege” of the dollar and the reasons behind it. While the US may not be in a great financial shape, but the world at large still has faith in the dollar. Prasad summarizes the situation well when he says: “It is possible that we are on a sandpile that is just a few grains away from collapse. The dollar trap might one day end in a dollar crash. For all its logical allure, however, this scenario is not easy to lay out in a convincing way.” The book is a great read for anyone trying to understand one of the most fundamental disconnects of the times that we live in. Flashboys by Michael Lewis: No one quite writes about finance like the way Lewis does. From his first book Liars Poker to the latest Flashboys, each one of his books on Wall Street and its ways has been a bestseller. One reason for the same is the fact that Lewis started as a Wall Street insider in the investment bank Salomon Brothers (which has since gone bust) and has managed to maintain his contacts since then. Flashboys is essentially a story of the people and systems that make up algorithmic trading that has taken Wall Street by storm. A majority of the trades on Wall Street are not driven by humans any more. They are driven by computers with a lot of processing power. And that is the fascinating story of Flashboys. If you are the kind who likes reading thrillers over weekends, this is just the right book for you.

Business Adventures by John Brooks: I first discovered Brooks in the process of writing and researching my books. Someone suggested that I should be reading Brooks’ version of the Great Depression called Once in Golconda: A True Drama of Wall Street 1920-1938. The book was a fantastic read and made me realize that Wall Street had a Michael Lewis even before the real Michael Lewis appeared on the scene. Early this year, Bill Gates wrote a blog on one of Brooks’ other books called Business Adventures. He called it the best business book that he and Warren Buffett had ever read. This blog pushed the book to the top of the Amazon charts. It was re-issued after this. The book is a collection of twelve long articles that Brooks wrote about the American businesses, government as well as Wall Street, for the New Yorker magazine. And it has tremendous lessons for almost everyone connected with business and finance.

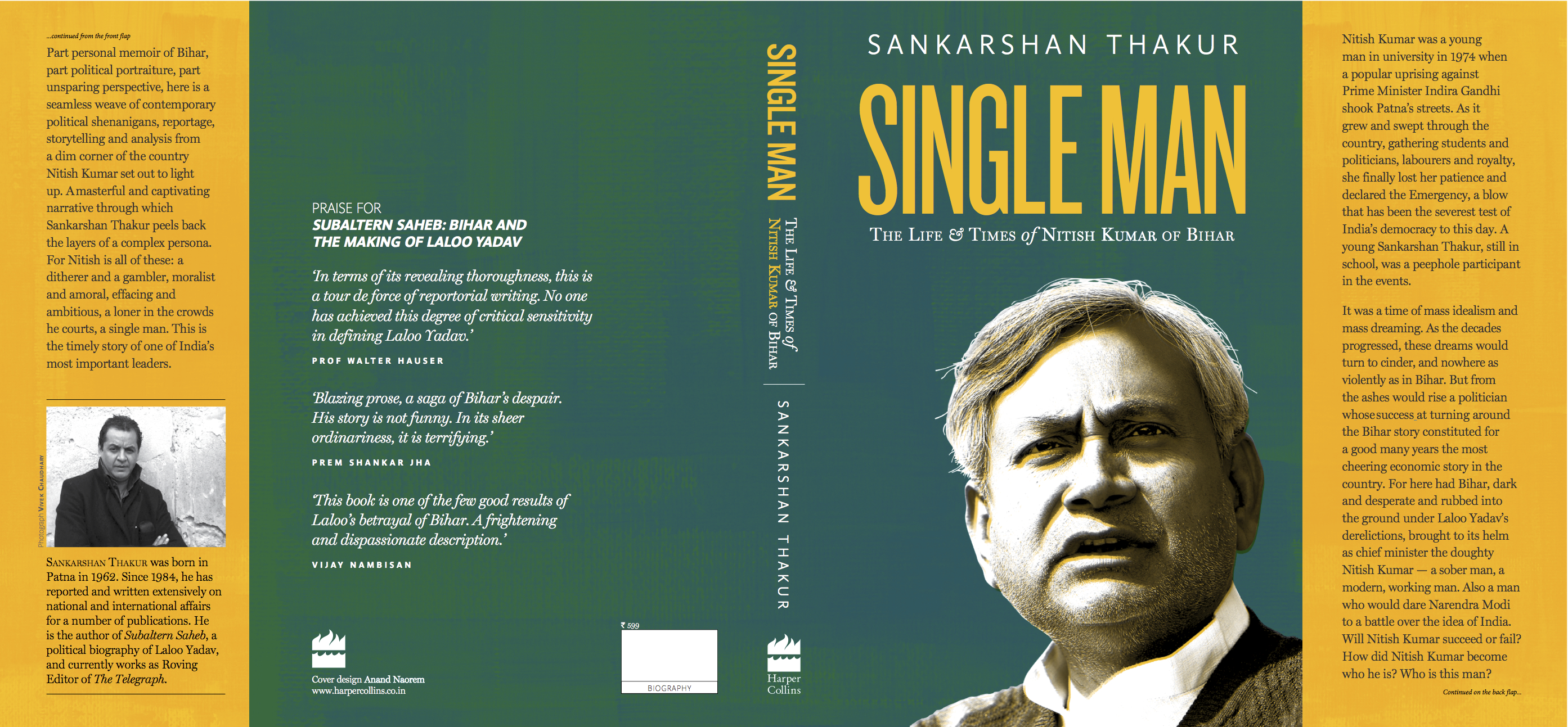

Single Man—The Life & Times of Nitish Kumar of Bihar by Sankarshan Thakur: This book is the joker in the pack. In a list full of books on economics and finance, here is a book on politics. Having been born in erstwhile Bihar, I have always been interested in the politics of Bihar. And there is no better writer on Bihar in English than Thakur, who works as a roving editor for The Telegraph newspaper. Thakur chronicles the rather turbulent life of Nitish Kumar, starting a little before the Emergency, and goes on to chronicle the life of the Bihari politician over the next four decades. As he does that he also goes into the history of Bihar over that period. Unlike a lot of other biography writers, Thakur also goes into Kumar’s unhappy personal life. The book is an excellent model for how to write a biography of an Indian politician. What we normally get to read are either hagiographies or out and out criticism (as is the case with so many books on Narendra Modi which swing at both ends). There is rarely a biography of an Indian politician which takes the middle path. If I had to choose just one book to read this year, then Single Man would have to be it. And this would be more for Thakur’s andaz-e-bayan(the way he tells the story) than Kumar’s story per se. How Not to Be Wrong—The Hidden Maths of Everyday Life by Jordan Ellenberg: This is another joker in the pack. I absolutely love to read good books on Mathematics. Ellenberg in this book goes around explaining the practical aspects of Maths in everyday life. He explains in great detail how media often uses Maths incorrectly to draw wrong conclusions. He also tries to answer some really interesting questions: How early should you get to the airport? What’s the best way to get rich playing a lottery? And does Facebook know you are terrorist? If you are feeling a little adventurous and want to go a little out of your comfort zone, this is just the right book for you.

The End of Normal by James Galbraith: I am reading this book currently and am around half way through it. James Galbraith is the son of John Kenneth Galbraith, who I feel was one of the most lucid writers on economics that the twentieth century saw. Galbraith junior writes in the same lucid way as his father did. Since the financial crisis broke out, economists and politicians have tried to tell the world at large that “all is going to be well,” and that the financial crisis was just caused by bad policy and bad people. Galbraith challenges this world view and offers four reasons against it: the rising cost of real resources, the futility of military power, the labour saving consequences of the digital revolution and the breakdown of law and ethics in the financial sector. Long story short: The global economy will not see acche din(good days) any time soon. Hormegeddon—How Too Much Of a Good Thing Leads to Disaster by Bill Bonner: The regular readers of The Daily Reckoning would know by now that this has been one of favourite books of the year, given the number of times I have already quoted from it in my columns. I have been a big fan of Bonner’s writing since I first met him in late 2008. In this book Bonner goes about explaining how too much of a good thing in public policy, economics and businesses, leads to disaster or what he calls FUBAR (f***ed up beyond all recognition). Bonner offers many examples from history to make his point—from Napoleon’s decision to invade Russia to the outbreak of the Second World War to America’s War on Terror. He then goes on to show that these disasters cannot be prevented by well-informed people with good intentions because they are the ones who cause them in the first place.

So that was my list of what I thought were the ten best books that I read this year. Happy reading. The India edition of The Daily Reckoning will be taking a year end break and will be back early next year on January 3. Here is wishing you a Merry Christmas and a Happy New Year. Meanwhile you can continue reading the international edition of The Daily Reckoning authored by Bill Bonner. The article originally appeared on www.equitymaster.com as a part of The Daily Reckoning, on Dec 24, 2014