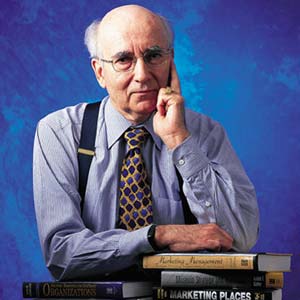

He is 81 and still going strong. His text book on marketing: Marketing Management is now in its thirteenth edition and still remains an essential read for anyone who hopes to get an MBA degree. He’s often called the father of marketing; something he regards as a compliment, while at the same time ceding the title of the “grandfather of marketing” to management thinker Peter Drucker. Meet Philip Kotler, the S.C. Johnson & Son Distinguished Professor of International Marketing at the Northwestern University Kellogg Graduate School of Management in Chicago. He has been hailed by Management Centre Europe as “the world’s foremost expert on the strategic practice of marketing.” In this freewheeling interview he talks to Vivek Kaul.

Excerpts:

Historically, the vast majority of marketing campaigns have been designed to appeal to our personal needs, lusts, greed or insecurities. To what extent do marketers exploit our human tendencies toward addiction?

Professional marketers see customers as carrying on both mental and emotional processes as they consider purchasing anything. Marketers need to choose the emotional appeal(s) that are relevant to the particular product or service. For a toothpaste, the appeal might be better breath, whiter teeth, or fewer cavities. Or going further, the appeal might be looking sexier, or having longer term dental health. Each competitor must make a choice. In a campaign to get people to stop smoking, one can use a negative appeal (cancer, lung disease, kidney failure) or a positive appeal (better sports performance, living longer for your family). I have advocated using an anti-smoking appeal showing a father who puts out his cigarette when his child comes into view so as not to pass on this bad habit to his children (this is a love appeal). Human emotions range widely and the choice of an appeal is a careful decision that is conditioned by competitors’ appeals and other data. It might seem to the layman that ads often use sex, power, or ego appeals but we could cite many campaigns that use appeals that are less base.

Lately companies have been cutting their marketing budgets, given the troubled times that we are in. Do you think it is a wise move to cut the marketing budget?

That is a panic response and often inappropriate. If competitors decide to cut their marketing budgets, the remaining firm should consider keeping or even increasing its marketing budget. I would go further and sat that a well-heeled firm might even consider buying out some weaker firms during a recession. In normal times, a company finds it hard to move its market share. In recession times, a well-endowed firm can power up its market share. Much depends on the quality of the firm’s products and services. A market leader should consider adding more value rather than cutting its marketing budget. The leader will probably have to alter its messages and media but it doesn’t follow that it needs to cut its marketing budget.

The economist Milton Friedman famously said: “There is one and only one social responsibility of business – to use its resources and engage in activities designed to increase its profits”. What are your thoughts on the social responsibility of marketing?

Milton Friedman was my professor at the University of Chicago and we all admired his brilliance. He was a great believer in leaving businesses unencumbered by regulations and he wanted the leave the business owners to decide what they wanted to do with their profits. I took exception to this view.

Why was that?

Businesses are social organizations that can do great good or great harm. We don’t have to be reminded of the environmental damage companies did by dumping waste into water and pollutants into the air. We don’t have to be reminded of Enron and Madoff and other crooks and pyramid builders. We need appropriate regulations for the competitive system to work. I would argue that companies should go beyond their worship of shareholders who often don’t care about the company and jump in and out of owning its stock. The theory of maximizing “shareholder value” has done great harm to businesses. I have argued that smart companies must focus on the other stakeholders first – customers, employees, suppliers and distributor—and make sure that these stakeholders are all rewarded appropriately and that they work together as a winning team. Satisfying the stakeholders is the best way to maximize the long run profitability of the company. I would propose that as education levels rise in a country, more buyers will expect more from companies and base their brand choices partly on which companies have practiced a caring attitude toward the environment and society. Those companies that operate on the triple bottom line — people, planning and profits – will outperform those who only pursue profit.

A major point in your new book Good Works: ! Marketing and Corporate Initiatives that Build a Better World…and the Bottom Line, is that over the last decade there has been tremendous growth in the number of marketing and corporate initiatives that appeal to our desire to help others or tackle social or environmental problems. Why has this sudden change come about? Can you share some examples with us?

Let’s recognise that societies are facing a growing number of difficult problems – world hunger and poverty, local wars, pollution, environment damage, and faulty education and health systems. Solutions are badly needed. Solutions can only come from the three sectors found in any economy: businesses, NGOs, and government. Today, the governments in most countries are in no condition to solve these problems, given their debt levels and their political impasses. The NGOs have as their purpose to help solve these social problems but are even with less funds available in these recessed times. Business is the only agent of change with the means of doing something to improve the sad state of affairs. The public is increasingly interested in which companies are willing to help make a difference in some of these problems. Consider what Wal-Mart is doing now to reduce air pollution. It is not only ordering the most fuel efficient delivery trucks but now asking its suppliers to change to more efficient trucks or else not be accepted as a supplier. Timberland, the maker of shoes and clothing, does a thorough job of waste reduction and of choosing only suppliers who have good environmental practices. The message is that companies have the capacity to be proactive in making the world a better place for all of us.

What do think are the biggest challenges facing marketing today?

Marketing used to be pretty straight forward. Hire able salespeople and brand managers and a top advertising agency and the team will attract many triers and buyers. Marketers didn’t have much input into the product: their job was to get the product sold. Today the picture is radically different. The social media revolution has diminished the power of advertising and requires new skills in the marketing group to successfully use Facebook, You Tube, Linked in, and Twitter. Buyers are now all-knowing thanks to Google and their Facebook friends and they can get excellent information on different brands and their worth. Companies have to make a basic decision: Should the marketing department basically remain a communication group (one P – Promotion), or a 4P group (Product, Price, Place and Promotion)? I am in favor of giving marketing more power to participate in the product development process, and pricing, and place (distribution decisions).

Could you elaborate on that?

I would go further. The ideal marketing department would be headed by someone with the mindset of Steve Jobs. The Chief Marketing Officer (CMO) would be responsible for identifying the best opportunities for the business for the next five years, calibrating the profitability of the different opportunities, and participating with the other senior officers to make the right choices. The marketing group should know more about what is happening in the marketplace and what is likely to happen over the next few years and therefore be in a position to visualise where the business should be going. I remember that some years ago, GE asked its appliance marketing group to anticipate what will be the size and activities in kitchens in the next five years. The marketers came up with a great number of new ideas, many of which GE Appliance implemented. So the basic choice is whether marketing should remain largely a “service” department dishing out communications or it should be a proactive marketing group helping the company identify its best future opportunities. I sometimes say that a company should have two marketing departments: a large one that is busy selling what the company is making , and a smaller marketing group trying to figure out what the company ought to be making the in the coming years.

What is social marketing? Can you share some examples with us?

In July 1971, Professor Gerald Zaltman and I published “Social Marketing: An Approach to Planned Social Change” in the Journal of Marketing. The question was: “could you sell a cause the way we sell soap.” At the time, there was a lot of interest in how we could help people avert unwanted pregnancies, stop smoking, and say no to drugs. We could imagine creating ads that would change certain beliefs and behaviours. We could imagine making new products and services that would provide solutions in these problem areas. We could imagine distribution arrangements that would reduce the accessibility of unsalutory products or increase the availability of better substitute products and services. We could imagine using price to encourage or discourage certain behaviors. All four Ps would work on these social questions as they have worked in the commercial market.

And things have changed since then?

Since that time, social marketing has become another branch of marketing. There are over 2,000 social marketers operating in the world and addressing social causes of poverty and hunger, health, environment, education, littering, literacy and others. Social marketers don’t stop with advertising: they use a planning framework that applies the ideas of segmentation, targeting and positioning and the 4Ps to craft a workable social marketing plan. Dozens of social marketing examples are described in the 4th edition of Social Marketing that Nancy Lee and I published. There is now a hotline where social marketers interested in working on some social problem can put it out to other social marketers to learn of previous work and results in the same problem area. I believe that social marketing methodology has been a major contributor to the decline of smoking, the practice of birth control, the improvement of the environment, the providing of more health facilities and practitioners in poor countries, and rising rates of literacy.

Your basic training is as an economist. How did you move on to marketing?

Marketing is economics, even if many trained economists don’t recognise or read marketing and ignore the one hundred years of marketing writing. As I majored in economics at the University of Chicago (M.A.) and M.I.T. (Ph.D), I was impressed with the high level of theory but disappointed at the neglect of the real actions taking place in the marketplace. Classical economists didn’t say much about several key forces affecting demand such as sales force, advertising, sales promotion, and public relations. Economists focused mainly on price and how it affects demand and supply. They didn’t say much about distribution and the roles played by wholesalers, jobbers, retailers, agents, brokers and other transactional and facilitating forces. In fact, the first marketing books written around 1910 were written primarily by economists who wanted to bring the role of Promotion and Place into the understanding of markets. Even when economists discussed price, they rarely described how price is set separately by manufacturers, wholesalers, and retailers as price setting moves down the value chain.

So how did you move onto teaching marketing?

When I joined the Kellogg School of Management at Northwestern University, I was given a choice to teach either economics (macro or micro) or marketing. I chose marketing because it brought in all these additional forces that affect demand and supply. Earlier I was in a Ford Foundation program with Jerry McCarthy who was writing his textbook on Basic Marketing and proposing a 4P framework: Product, Price, Place, and Promotion. He was influenced by his professor of marketing at Northwestern University, Richard Clewett who taught Product, Price, Promotion and Distribution (which Jerry renamed Place to get the alliteration of 4Ps). Remember that the 4Ps are demand-shaping forces and should be part of basic economic theory. The interesting development today is that classical economics is undergoing the challenge of a different school of thought, namely behavioural economics. Behavioral economics drops the assumption that producers, middlemen and consumers always make rational decisions. At best there is “bounded rationality” and “satisficing” behavior rather than rational profit maximization. What is most interesting is that “behavioural economics” is just another name for “marketing” and what marketing has been researching for 100 years.

How do you manage to write about marketing from almost every angle?

I recognised early that marketing is a pervasive human activity that goes beyond just trying to sell goods and sales. What is courtship, after all, if not a marketing exercise? What is fundraising, if not a marketing exercise? What about building a stronger brand for your city, if not a marketing exercise? Every celebrity and many professionals are engaged in building and marketing their brand. This led me to want to bridge marketing theory and practice to other things than goods and services. I started to research and write on place marketing, person marketing, cultural areas marketing (museums and performing arts), cause marketing (i.e., social marketing), religious institution marketing, and so on.

(The interview originally appeared in the Daily News and Analysis on August 27,2012. http://www.dnaindia.com/analysis/interview_theory-of-maximising-shareholder-value-has-done-great-harm-to-businesses_1733089))

(Interviewer Kaul is a writer and can be reached at [email protected])

Wal-Mart

Should India fear Wal-Mart – the bully of Bentonville?

Vivek Kaul

Does the American president Barack Obama have the foot-in-the-mouth disease or is India just overreacting? In an interview to PTI Obama said “In too many sectors, such as retail, India limits or prohibits the foreign investment that is necessary to create jobs in both our countries, and which is necessary for India to continue to grow.” He also cited concerns over the deteriorating investment climate in India and endorsed another ‘wave’ of economic reforms.

Predictably this has led to a series of terse reactions from across the political spectrum in India. Indian politicians have gotten together and asked Obama to mind his own business. “If Obama wants FDI in retail and India does not want, then it won’t come just because he is demanding it,” said former finance minister and senior BJP leader Yashwant Sinha. The left parties were equally critical of Obama’s statement.

Veerapa Moily, the minister for corporate affairs said “Certain international lobbies like Vodafone are spreading this kind of a story and Obama was not properly informed about the things that are happening, particularly when India’s economic fundamentals are strong.” Moily clearly wasn’t joking. The corporates were also quick to criticise Obama’s statement.

But for a moment let’s keep aside the fact that India does not need any advice from the President of the biggest economy in the world and try and understand Obama’s statement in a little more detail.

What did Obama essentially mean by what he said? He was basically pitching for Wal-Mart, the biggest retailer in the world, to be allowed to do business in India. Wal-Mart is headquartered out of Bentonville in the American state of Arkansas. It currently has a marginal presence in India through a joint venture with Bharti.

Such is the fear of Wal-Mart entering India and destroying other businesses both small and large, that politicians from across the political spectrum have used it as an excuse for not allowing foreign direct investment in the retail sector in India. This fear comes from the Wal-Mart experience in the United States.

As Anthony Bianco writes in The Bully of Bentonville – How the High Cost of Wal-Mart’s Everyday Low Prices is Hurting America “It (Wal-Mart) grows by wrestling businesses away from other retailers large and small. In hundreds of towns and cities, Wal-Mart’s entry put ailing …shopping districts into intensive care and then ripped out the life-support-system.”

But that’s just one part of the story. The question to ask here is, whether what is true for America is also true for the rest of the world? And the answer is no.

Pankaj Ghemawat, who has the distinction of becoming the youngest full professor at the Harvard Business School, in his book Redefining Global Strategy, points out a very interesting story. “When CEO Lee Scott (who was the CEO of Wal-Mart from 2000 to 2009) was asked a few years ago about why he thought Wal-Mart could expand successfully overseas, his response was that naysayers had also questioned the company’s ability to move successfully from its home state of Arkansas to Alabama…such trivialisation of international differences greases the rails for competing exactly the same way overseas at home. This has turned out to be a recipe for losing money in markets very different from the United States: as the former head of the company’s German operations, now shut down, plaintively observed, “We didn’t realise that pillowcases are a different size in Germany.””

Given this the countries that Wal-Mart has achieved success in are countries which are the closest to the United States. As Ghemawat writes “Unsurprisingly, the foreign markets in which Wal-Mart has achieved profitability-Canada, Mexico and the United Kingdom are the ones culturally, administratively and geographically closest to the United States.”

Wal-Mart and other big retailers have had a tough time in emerging markets. As Rajiv Lal, a professor at the Harvard Business School told me in an interview I did for the Daily News and Analysis(DNA) “There is not even a single emerging market that I know where a foreign entrant is the number one retailer. In Brazil it is Pão de Açúcar, in China you have the local Beijing Bailian. In most markets even when there are foreign entrants the dominant retailer in the organised sector is still the local retailer.”

And there are several reasons for the same. The local retailers are very price competitive. “If Wal-Mart is operating in Brazil there is nothing that Wal-Mart can do in Brazil that the local Brazilian guy cannot do. If you want to procure supplies from China, you can procure supplies from China as much as Wal-Mart can procure supplies,” said Lal.

Also the local guys understand the market better. This is because they have a better understanding of the customers. “On top of that they have local merchants that they know they can source from and Wal-Mart may not,” said Lal.

The other big fear about the likes of Wal-Mart being allowed into India is that it will destroy the business of the local kirana store. This is a highly specious argument at best because it is not easy to compete with kirana stores. As Lal explained to me “Just because you are a big guy with a lot of money, it doesn’t mean that you can compete. Kirana stores have a lot of benefits that established retailers don’t have. First of all location. What rents do they pay versus what established companies have to pay? Employees, same story. On the consumer side they can deliver services, in terms of somebody calls them and asks can you deliver six eggs? The guy runs and delivers six eggs. That’s not something that the big established firms can provide.”

A Wal-Mart in the US is typically established outside the city where rents are low. But such a strategy may not work in India. “It’s not easy to open a 150,000 square feet store in India. That kind of space is not available. They can’t open these stores 50 miles away from where the population lives. People in India don’t have the conveyance to go and buy bulk goods, bring it and store it. They don’t have the conveyance and they don’t have the big houses. So it doesn’t work,” explained Lal.

The kirana stores also provide goods on interest free credit to their customers something that no big retailer can afford to do. Also as the economy grows the chances are that the kirana stores will grow faster than big retailers. “So think about in five years, where will organised retailing be as a market share. Maybe it’s less than 1% now, and maybe it will become 3% or 5% of total retailing. It will not be more than that. In five years organised retail grows from one percent to five percent, the economy would have grown by another 50 percent. If they grow from one to five percent and the economy grows by 50%, virtually it means that the number of kirana stores and mom and pop stores are actually growing. They are not reducing by any means,” said Lal.

Allowing foreign investment in the retail sector is also expected to bring down food inflation. As Satish Y Deodhar writes in Day to Day Economics “Allowing private players – including multi-brand retailers who bring in foreign direct investment – to deal in retail and wholesale markets will reduce trader margins. An empirical study on domestic and imported apples sold in India shows that there are a number of middlemen in the farm-to-finger supply chain: out of the final rupee spent by a consumer on apples, about 50 percent goes for trader margins…More competition through private players will reduce the margins for the middlemen and lower the prices for consumers.”

Allowing foreign retailers into India is thus likely to bring down food inflation. Also as explained earlier the kirana store has not much to fear from the likes of Wal-Mart and other foreign retailers. But the same cannot be said about the companies which are the organised retail sector. Wal-Mart does take time to get its act right, but eventually it does. As Lal put it “The people who should be more afraid should be people who are in the organised retailing sector and not the mom and pop stores.”

And that’s where the real story about all the opposition in allowing foreign retailers entering the country, might lie.

(The article originally appeared on www.firstpost.com on July 16,2012. http://www.firstpost.com/business/should-india-fear-wal-mart-the-bully-of-bentonville-378330.html)

(Vivek Kaul is a writer and can be reached at [email protected])

How the new Peter Principle caused Kingfisher’s downfall

Vivek Kaul

A few years back I had booked a ticket on an early morning Kingfisher flight from Mumbai to Ranchi, or so I had thought. I came to realize I was on Kingfisher Red and not the full service Kingfisher only once I was inside the aircraft.

Sometime later I came to realize that several people I knew had had a similar experience. They had booked flights thinking they were on the Kingfisher full service, only to realize later that they were on Kingfisher Red.

The airline clarified that it was not their mistake but the mistake of the websites that did not make a distinction between Kingfisher Red and Kingfisher First.

But the question that cropped up in my mind was that why would Kingfisher, a premium-upmarket brand, want to dilute its positioning by associating itself with Kingfisher Red, which was essentially a low-cost airline.

Vijay Mallya, started Kingfisher Airlines in 2005. A few years later he tried to get into the low cost airline business, which was the flavour of the season back then, by taking over Deccan Aviation which ran Air Deccan, a low cost airline. He rebranded it as Kingfisher Red. By doing this he diluted the premier positioning that Kingfisher Airlines had acquired in the minds of the consumer.

To explain this a little differently, let us take the example of Hindustan Unilever Ltd (HUL). It sells the Lifebuoy which is targeted at the lower end of the market and goes with the line tandurusti ki raksha karta hai Lifebuoy. The company also sells Lux which is targeted at the upper end of the market and comes with the tagline filmi sitaron ka saundarya sabun.

Of course, the positioning of Lifebuoy and Lux is totally different. And HUL tries to make this very very clear in the minds of the consumer. First of all, both the products have different names. Second the pricing is very different. And third, the advertisements of both the products emphasize on the “different” positioning over and over again.

Now Mallya running a low cost airline under the premium brand name of Kingfisher would be like HUL selling Lux soap under the name of Lifebuoy premium.

And it’s not just about the brand name and the positioning in the mind of the consumer. The philosophy required to run a premium brand is totally different in comparison to the philosophy required to run a low cost brand. Hence, Mallya buying Air Deccan was mistake. And then changing its name to Kingfisher Red was an even bigger mistake.

So in the end this did not work and Mallya decided to close down Kingfisher Red. He explained it by saying that “We are doing away with Kingfisher Red, we do not want to compete in the low-cost segment. We cannot continue to fly and make losses, but we have to be judicious to give choice to our customers.”

Kingfisher might have just survived if it had not made the mistake of buying Kingfisher Red. World-over several airlines have tried running a full-service and a low cost airline at the same time and made a mess of it. A company cannot run a low cost airline and a full service career at the same time. The basic philosophy required in running these two kind of careers is completely different from one another.

But the bigger question is what was Vijay Mallya trying to do by running a liquor business, a real estate business and an airline at the same time? This was other than spending substantial time on his expensive hobbies of trying to run a cricket and an FI team, and cheaper ones like commenting regularly on Twitter.

There isn’t really any link among the businesses Mallya runs. Some people have tried to explain that the airline was just surrogate advertising for the beer of the same name. But then there are cheaper ways of advertising than running an airline and losing thousands of crores doing it.

Businesses over the years have become more complicated. And just because a company has been good at one particular business doesn’t mean it will be good at another totally unrelated business.

Mallya is not the only one realizing this basic fact. The period between 2002 and 2008 was an era of easy money. Businesses could borrow money very easily to expand as well as get into new business. And this is what finally got businessmen like Mallya into trouble.

The British economist John Kay calls this the new Peter’s Principle. The original Peter’s Principle essentially states that every person rises to his or her level of incompetence in a hierarchy. Simply put, as a person keeps getting promoted he is bound to appointed to a job, he is not good at. The same is the case with companies which keep buying and diversifying into different businesses, until they land up in a business they don’t really understand. And that drives them down.

Mallya was a victim of the new Peter’s Principle, his non related diversification into the airline business cost him dearly. The lack of focus has hurt Mallya’s core alcohol business as well and United Spirits is no longer India’s most profitable alcohol company. That tag now belongs to the Indian division of the French giant Pernod Ricard.

An era of easy money got Indian entrepreneurs including Mallya to get into all kinds of things which they did not understand and had no clue about. Kishore Biyani brought the retail revolution to India, having been inspired by Sam Walton who started Wal-Mart. His retail businesses were doing decently well till he decided to get into a wide variety of businesses from launching an insurance company to even selling mobile phone connections. When times were good he accumulated a lot of debt in trying to grow fast. Now he is in trouble in trying to service the debt and rumors are flying thick and fast that he is planning to sell Big Bazaar, his equivalent of Wal-Mart. This after he sold controlling stake in the cloths retailer, Pantaloons.

Let’s take the case of DLF, the biggest real estate company in the country. It tried getting into the insurance and mutual fund business. It had to sell its stake in the mutual fund business and if news reports are to be believed it is trying to lower its stake in the insurance venture. It also tried unsuccessfully to get into the luxury hotel business and failed. Hotel Leela tried to get into the up-market apartments space and failed.

Reliance Energy (the erstwhile BSES) was turned into Reliance Infra and now is into all kinds of things. It is building one section of the Mumbai Metro, the completion of which keeps getting postponed. It is also supposed to build the remaining portion of the sealink in Mumbai.

The days when businesses like Tata and Birla used to do everything under the sun are long over. In fact, those were the days of license quota raj with very little competition. Hence companies could get into a new space as long as they got a license for it.

An interesting example is that of the Ambassador. The car had the same engine as of the original Morris Oxford which was made in 1944. The same engine was a part of the Ambassador car sold in India till 1982. The technology did not change for nearly four decades.

Given this lack of change, the businessmen could focus on multiple businesses at the same time. That is not possible anymore with technology and consumer needs and wants changing at a very fast pace. Even focused companies like Nokia missed out on the smart phone revolution in India.

Look at the newer businesses some of the big-older companies have got into over the years. The retail business of Ambanis hasn’t gone anywhere. Same is true with that of the retail business of the Aditya Birla group. The telecom business of the Tatas has lost a lot of money over the years. Though, they finally seem to be getting it right.

Hence it’s becoming more and more essential for businesses to focus on what they know best. And when it comes to airlines its time Mallya read what Warren Buffett told his shareholders a few years back.

“Now let’s move to the gruesome. The worst sort of business is one that grows rapidly, requires significant capital to engender the growth, and then earns little or no money. Think airlines. Here a durable competitive advantage has proven elusive ever since the days of the Wright Brothers. Indeed, if a farsighted capitalist had been present at Kitty Hawk, he would have done his successors a huge favor by shooting Orville down. The airline industry’s demand for capital ever since that first flight has been insatiable. Investors have poured money into a bottomless pit, attracted by growth when they should have been repelled by it. And I, to my shame, participated in this foolishness when I had Berkshire buy U.S. Air preferred stock in 1989. As the ink was drying on our check, the company went into a tailspin, and before long our preferred dividend was no longer being paid. But we then got very lucky. In one of the recurrent, but always misguided, bursts of optimism for airlines, we were actually able to sell our shares in 1998 for a hefty gain. In the decade following our sale, the company went bankrupt.”

The bigger sucker saved Buffett. But Mallya may not have any such luck

(The article originally appeared on www.firstpost.com on July 5,2012. http://www.firstpost.com/business/how-the-new-peter-principle-caused-kingfishers-downfall-368549.html)

(Vivek Kaul is a writer and can be reached at [email protected])