Vivek Kaul

Ushinawareta Nijūnen or the period of two lost decades for Japan(from 1990 to 2010) might finally be coming to an end. Or so it seems.

And Japan has to thank Abenomics unleashed by its current Prime Minister Shinzo Abe for it. Abe has more or less bullied the Bank of Japan, the Japanese central bank, to go on an unlimited money printing spree, until it manages to create an inflation of 2%.

The Japanese money supply is set to double over a two year period. And all this ‘new’ money that is being pumped into the financial system, will chase an almost similar number of goods and services, and thus drive up their prices. Or so the hope is.

The target is to create an inflation of 2% and get people spending money again. When prices are rising or are expected to rise, people tend to buy stuff, because they don’t want to pay a higher price later (This of course is true to a certain level of inflation and doesn’t hold in the Indian case where retail inflation is greater than 10%). As people go out and shop, it helps businesses and in turn the overall economy.

In an environment where prices are stagnant or falling, as has been the case with Japan for a while now, people tend to postpone purchases in the hope of getting a better deal. The situation where prices are falling is referred to as deflation.

In 2012, the average inflation in Japan was 0%, which meant that prices neither rose nor they fell. In fact, in each of the three years for the period between 2009 and 2011, prices fell on the whole. This has led people to postpone their consumption and hence had a severe impact on Japanese economics growth. To break this “deflationary trap”, Shinzo Abe and the Bank of Japan have decided to go on an almost unlimited money printing spree.

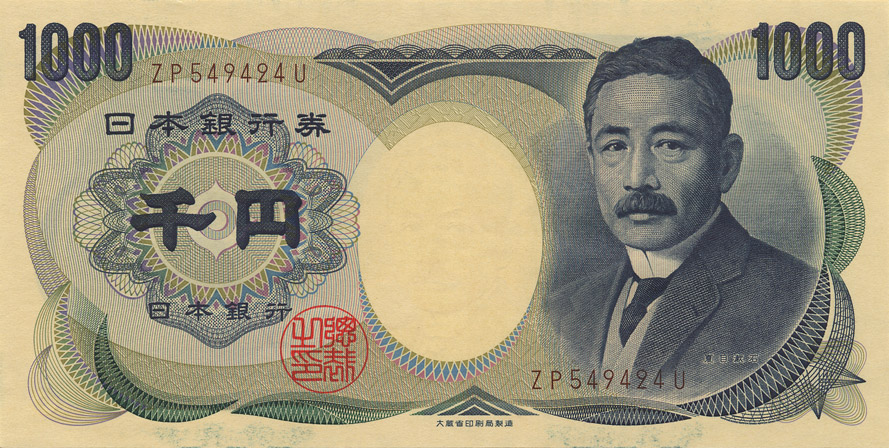

A major impact of this policy has been on the Japanese currency ‘yen’. As more yen are created out of thin air, the currency has weakened considerably against other major currencies. One dollar was worth around 78 yen, on October 1, 2012. Yesterday, yen weakened beyond 100 to a dollar for the first time in four years. As I write this one dollar is worth around 101.1 yen.

This weakening of the yen has helped Japanese businesses which have a major international presence spruce up their profits. As the news agency Bloomberg reports “The weaker yen helped Mazda, Japan’s fifth-largest car company, post a profit of 34 billion yen for the fiscal year that ended March 31, compared with a loss of 107.7 billion yen the previous year. A one-yen change against the dollar, euro, Canadian dollar and Australian dollar has a 9.1 percent impact on Mazda’s operating profit…That compares with 4.7 percent at Fuji Heavy Industries Ltd, which makes Subaru cars, and 3.1 percent at Toyota.”

When yen was at 78 to a dollar, a Japanese company making a profit of $1 million internationally would have made a profit of 78 million yen. Now with the yen at 101 to a dollar, the same company will make a profit of 101 million yen, which is almost 29.5% more.

This increase in profit it is hoped will also encourage Japanese companies to pay their employees more. Albert Edwards of Societe Generale writing in a report titled Thoughts on Asia will a yen slide trigger an EM currency crisis? 1997 redux dated April 17, 2013, cites a survey which suggests that Japanese companies may be short on labour. “This suggests that Prime Minister Abe will indeed get his way on a rapid return of wage inflation to boost consumption,” writes Edwards.

And this boost in consumption will get the Japanese economy going again. So does that mean Japan will live happily ever after? Not quite.

As the Japanese central bank prints more and more yen, the returns from Japanese government bonds are expected to go up. As Edwards writes “if the market really believes that it is committed to the 2% inflation target (and I certainly do), then Japanese bond yields(returns) will quickly attempt a move above 2%.” In early April the return on a ten year Japanese government bond was at 0.45% per year. Since then it has risen to around 0.69% per year.

And this can lead to a major crisis in Japan. If returns on existing bonds go up, the government will have to offer a higher rate of interest on the new bonds that it issues to make them interesting enough for investors.

As Satyajit Das writes in a research paper titled The Setting Sun – Japan’s Financial Miasma “Higher interest rates will increase the stress on government finances. Even at current low interest rates, Japan spends around 25-30% of its tax revenues on interest payments. At borrowing costs of 2.50% to 3.50% per annum, two to three times current rates, Japan’s interest payments will be an unsustainable proportion of tax receipts.”

Now that’s just one part of it. If the government has to spend more of the money than it earns towards interest payments that means there will be less left for meeting other expenditure. So it will either have to borrow more or ask the Bank of Japan to print more money to finance its expenditure, given that there is a limit to the amount of money that can be borrowed. Either option doesn’t sound good. Das estimates that Japan’s gross government debt will reach around 250-300% of its gross domestic product by 2015, a very high level indeed.

Also as things stand as of now it looks like the Bank of Japan will have to finance a major part of Japanese government expenditure in the years to come by printing money. As Dylan Grice wrote in an October 2010, Societe Generale report titled Nikkei 63,000,000? A cheap way to buy Japanese inflation risk “Japan’s tax revenues currently don’t even cover debt service and social security, persistent and growing fiscal burdens. Therefore, once the Bank of Japan is forced into monetisation of government deficits, even if only with the initial intention of stabilising government finances in the short term, it will prove difficult to stop. When it becomes the largest holder and most regular buyer of Japanese government bonds, Japan will be on its inflationary trajectory.” And this is not an inflation of 2% that we are talking about.

The yen weakening against other international currencies is making Japanese exports more competitive. A Japanese exporter with sales of a million dollars in early October, would have made 78 million yen (when one dollar was worth 78 yen). Now the same exporter would make 101 million yen.

The weakening yen allows Japanese exporters to cut their prices in dollar terms and become more price competitive. If a price cut of 20% is made, then sales will come down to $800,000 but in yen terms the sales will be at 80.8 million yen ($800,000 x 101). This will be higher than before. Also a cut in price might help Japanese exporters to increase total volumes of sales.

The trouble of course is that this will hit other major exporters like South Korea, Taiwan and Germany. As Michael J Casey points out in a column on Wall Street Journal website “Japan might be a hobbled economy but it is still the third largest in the world, accounting for almost one-tenth of world gross domestic product. So when the Bank of Japan prints as much yen as this, it provokes a worldwide adjustment in relative prices. Electronics producers in South Korea, Taiwan and, to an increasing degree, China, automatically face a price disadvantage versus their Japanese competitors, for example.”

Also interest rates on American and Japanese bonds are currently at very low levels. And this has sent investors looking for return to other parts of the world. Take the case of New Zealand. Foreign money has been flooding into the country. When foreign money comes into a country it needs to be exchanged for the local currency (the New Zealand dollar in case of New Zealand). This leads to a situation where the demand for the local currency increases, leading to its appreciation.

One New Zealand dollar was worth around 64.6 yen on October 1, 2012. It is currently worth around 84.4 yen. An appreciation in the value of a country’s currency hurts its exports. On Wednesday (May 8, 2013), the Reserve Bank of New Zealand, decided that it will intervene in the foreign exchange market to weaken the New Zealand dollar.

How does any central bank weaken its currency? When a huge amount of foreign money comes in, it increases the demand for local currency. The central bank at that point floods the foreign exchange market with its own currency, to ensure that there is enough of it going around. This ensures that the local currency does not appreciate. If the central bank floods the market with more local currency than the demand is, it ensures that the local currency loses value against the foreign money that is coming in.

The question is where does the central bank get this money from? It simply prints it.

The thing to remember is that if Japan can print money to cheapen its currency so can other countries like New Zealand. It is not rocket science. Its what Americans call a no brainer. In fact, yen started appreciating against the dollar once the Federal Reserve of United States, the American central bank, started printing money to revive economic growth. And this has also been responsible for Japan starting to print money. As Casey points out “Together, the U.S. Federal Reserve and the Bank of Japan will print the equivalent of $155 billion every month for an indefinite period.” This will spill over to more countries printing money to hold the value of their currency or even cheapen it.

The currency war which is currently on between countries as they print money to cheapen their currencies will only get worse in the days and months and years to come. Australia is expected to join this war very soon. Countries are also trying to control the flood of foreign money by cutting interest rates. The Australian central bank cut interest rates on Tuesday (i.e. May 7, 2013). The Bank of Korea, the South Korean central bank also cut interest rates on Thursday (i.e. May 9,2013). China has put measures in place to curb foreign inflows.

As Greg Canvan writes in The Daily Reckoning Australia “So as the US dollar moves above 100 yen for the first time in four years…Get ready for an escalation in the currency wars.”

To conclude, it is important to remember what H L Mencken, an American writer, once said “For every complex problem there is an answer that is clear, simple, and wrong.” If only creating economic growth was just about printing more money…

The article originally appeared on www.firstpost.com on May 11, 2013

(Vivek Kaul is a writer. He tweets @kaul_vivek)

Satyajit Das

‘Warren Buffett does not practice what he preaches’

Satyajit Das is an internationally renowned derivatives expert. His works include the best-selling Traders, Guns & Money: Knowns and Unknowns in the Dazzling World of Derivatives. His latest book Extreme Money – Masters of the Universe and the Cult of Risk deals with the messy details of the 2008 financial crisis, the lessons from which have still not been learnt, feels Das. As he puts it, “We keep repeating the same mistakes over and over…The only lesson of history after all is that no one learns the lessons of history.”

In this freewheeling interview with Vivek Kaul, he talks about how investing is never going to be the same again, why financial TV is pornography, and that Warren Buffett does not practice what he preaches. The interview will be published in two parts. This is the first part.

Why do you call “financial TV” pornography?

Pornography is formulaic, explicit subject matter is depicted to sexually excite the viewer. Financial TV shares the characteristics of pornography — sleaze, intrusiveness and a desire to titillate and shock. It is a 24/7 Joycean stream of consciousness, a financial noise machine with the inevitability and repetition of all sexual congress. No one seriously relies on financial TV for deep insight. If it is on TV, then it’s already happened. It’s entertainment. Attractive men and women cater to all possible proclivities in the audience. It’s like wall paper or eye candy – pleasant but not essential. In dealing rooms, generally you don’t even have the sound on, so it is like pornography in another sense – dialogue is superfluous. The only time financial TV is interesting is when I am invited on to offer my money making insights – buy low, sell high etc.

Whatever his record as an investor, there are differences between Buffett’s pronouncements about the standard of conduct he requires of others and that he follows. Getty Images

You say that investment genius was always little more than a short memory and a rising market? You write that the assumed sophistication of finance and financiers is overrated. Why do you say that?

Investing is like captaining a cricket side – 90 percent luck and 10 percent skill, in the words of former Australian Test captain Richie Benaud. But as he said, don’t try it without the 10 percent! The last 30 years were an exceptional period of investment history which provided high returns for reasons which are unique to that period. The best investment strategy would have been to buy stock or real estate and leverage it up. Then go to sleep or play golf for 25 years. You would have been a rich man.

When people make money, they theorise too much about it – hence all the books about trading success. The latest fad is about explaining the trader’s personality via his biology. Some research suggests that male traders perform better when they have elevated testosterone levels. As prices increase and decrease, traders experience chemical changes. Euphoria caused by boosted testosterone levels from successful trades drives higher risk taking. Losses or reversals increase levels of the defensive steroid cortisone leading to risk-aversion. The experimental data is thin.

Could you elaborate on that?

If correct, you could take steps on banks and fund managers to manage risk. You could artificially manipulate the biology of traders and investment managers to improve performance. It is not hard to imagine a future where traders will need to have their supplements –uppers and downers (in the old parlance) — at hand to improve trading, similar to the experience of competitive sports where drugs have become relatively commonplace to improve performance. It is also not hard to imagine internal risk mangers and regulators insisting on regular monitoring of hormone levels as part of the compliance regime, with attendant cheating.

Isn’t that far fetched?

This is not far-fetched. Already, organisations are adopting unusual initiatives to gain a critical edge. A trader at Steve Cohen’s SAC Capital was allegedly forced by his boss to take female hormones and wear articles of women’s clothing at work, leading to a sexual relationship between the men, one of whom was married. The bizarre behaviour was to eliminate the trader’s aggressive male attitude, making him a more obedient and detail-oriented trader. How can you take an industry which actually does this seriously!

In this freewheeling interview with Vivek Kaul, he talks about how investing is never going to be the same again, why financial TV is pornography, and that Warren Buffett does not practice what he preaches. The interview will be published in two parts. This is the first part.

Why do you call “financial TV” pornography?

Pornography is formulaic, explicit subject matter is depicted to sexually excite the viewer. Financial TV shares the characteristics of pornography — sleaze, intrusiveness and a desire to titillate and shock. It is a 24/7 Joycean stream of consciousness, a financial noise machine with the inevitability and repetition of all sexual congress. No one seriously relies on financial TV for deep insight. If it is on TV, then it’s already happened. It’s entertainment. Attractive men and women cater to all possible proclivities in the audience. It’s like wall paper or eye candy – pleasant but not essential. In dealing rooms, generally you don’t even have the sound on, so it is like pornography in another sense – dialogue is superfluous. The only time financial TV is interesting is when I am invited on to offer my money making insights – buy low, sell high etc.

Whatever his record as an investor, there are differences between Buffett’s pronouncements about the standard of conduct he requires of others and that he follows. Getty Images

You say that investment genius was always little more than a short memory and a rising market? You write that the assumed sophistication of finance and financiers is overrated. Why do you say that?

Investing is like captaining a cricket side – 90 percent luck and 10 percent skill, in the words of former Australian Test captain Richie Benaud. But as he said, don’t try it without the 10 percent! The last 30 years were an exceptional period of investment history which provided high returns for reasons which are unique to that period. The best investment strategy would have been to buy stock or real estate and leverage it up. Then go to sleep or play golf for 25 years. You would have been a rich man.

When people make money, they theorise too much about it – hence all the books about trading success. The latest fad is about explaining the trader’s personality via his biology. Some research suggests that male traders perform better when they have elevated testosterone levels. As prices increase and decrease, traders experience chemical changes. Euphoria caused by boosted testosterone levels from successful trades drives higher risk taking. Losses or reversals increase levels of the defensive steroid cortisone leading to risk-aversion. The experimental data is thin.

Could you elaborate on that?

If correct, you could take steps on banks and fund managers to manage risk. You could artificially manipulate the biology of traders and investment managers to improve performance. It is not hard to imagine a future where traders will need to have their supplements –uppers and downers (in the old parlance) — at hand to improve trading, similar to the experience of competitive sports where drugs have become relatively commonplace to improve performance. It is also not hard to imagine internal risk mangers and regulators insisting on regular monitoring of hormone levels as part of the compliance regime, with attendant cheating.

Isn’t that far fetched?

This is not far-fetched. Already, organisations are adopting unusual initiatives to gain a critical edge. A trader at Steve Cohen’s SAC Capital was allegedly forced by his boss to take female hormones and wear articles of women’s clothing at work, leading to a sexual relationship between the men, one of whom was married. The bizarre behaviour was to eliminate the trader’s aggressive male attitude, making him a more obedient and detail-oriented trader. How can you take an industry which actually does this seriously!

Does Warren Buffett practice what he preaches?

Talking about Warren Buffett is like discussing the existence of God. He is either great or he is not (the minority view). I am an atheist. Whatever his record as an investor, there are differences between Buffett’s pronouncements about the standard of conduct he requires of others and that he follows. While he dispenses finely crafted criticism of derivatives as weapons of mass destruction, Berkshire Hathaway (Buffett’s holding company) makes extensive use of derivatives and invested in Salomon Brothers and General Reinsurance, both participants in derivative markets.

During the crisis, Buffett, a significant investor in Moody’s, was silent about the problems surrounding rating agencies. Having uncharacteristically declined an invitation to appear in June 2010, Buffett testified before the Financial Crisis Inquiry Commission under subpoena. Buffett emphasised that he knew little about the rating process other than its profit margins. He had never visited Moody’s offices, not even knowing where they were located. He also defended Moody’s not acknowledging any failure or complicity of the agencies in creating the bubble. When Goldman Sachs was indicted for alleged violations in structuring and selling CDOs (collateralised debt obligations, a kind of security backed by loans and bonds), Buffett, a major investor in Goldman, defended the firm, its actions and its CEO.

Satyajit Das.

Could you tell us a little more about this?

Critics have frequently pointed out anomalies in the firm’s corporate practices. Berkshire Hathaway’s dual-class share arrangement gives Buffett voting control whilst owning 34 percent of the equity. Until a decade ago, Berkshire Hathaway’s seven-person board of directors consisted of mainly insiders such as Buffett’s son. The new ‘independent’ directors include Bill Gates, a close friend of Buffett, and his regular bridge partner, as well as co-investor in the Gates Foundation. Critics also pointed to that fact Buffett’s partner Charlie Munger’s family owned a 3 percent stake in BYD, the Chinese electric battery maker, before Berkshire bought a stake in 2008.

As to his record as an investor, there are a number of interesting aspects. Firstly, what is the right benchmark to measure his performance against – it can’t be the broad market index. Secondly, the source of his investment success is not that complicated. His main source of investment capital is the premium income from his insurance businesses (cash received today against a promise to honour a future contingent claim). This provides him with effective economic leverage (at low interest cost) to buy low beta assets. The strategy worked well but whether it will continue to work is more difficult. The past, as they say, is “another country”.

In your book Extreme Money you write “Archimedes said, “Give me a lever long enough and a fulcrum on which to place it, and I shall move the world.” You paraphrase it to write “give me enough debt and I shall make you all the money in the world”. Can you elaborate?

Borrowing amplifies economic growth. Debt allows society to borrow from the future. It accelerates consumption and investment spending, as borrowed money is used to purchase something today against the promise of paying back the borrowing in the future. Spending that would have taken place normally over a period of years is accelerated because of the availability of cheap borrowing. In this way, debt generates economic growth. In financial markets, debt and leverage amplify returns.

Could you explain this through an example?

Assume an investor uses $20 of its own money – equity – and borrows $80 (80 percent of the value) to purchase an asset for $100. If the asset increases in value by 10 percent to $110, then the investor’s equity increases on paper to $30 ($110 minus the fixed amount of debt of $80). If the investor maintains its leverage at 5 times then it can buy $150 of assets (funded by $30 of equity and $120 of debt). If the investor can now leverage 6 times then it can buy $180 of assets (funded by $30 of equity and $150 of debt). The investor still only has his original $20 investment in cash, unless he sells the asset to realise paper gains, which can vanish.

But now, this $20 supports even more debt, as much as $160 (the $180 of assets that the investor can buy if it leverages six times less its original investment). The real leverage is around nine times, which means an 11 percent fall in the value of the asset purchased can wipe out the investor’s wealth entirely. Where the supply of assets does not increase as quickly as the supply of debt, the price increases allow the process to continue. In the period to 2007, the use of leverage, in different ways, to make money was rampant. Unfortunately, it was never real money. Of course, when prices start to fall the entire process operates in reverse.

The interview was originally published on www.firstpost.com on October 2o, 2012. http://www.firstpost.com/economy/warren-buffet-does-not-practice-what-he-preaches-496581.html

Vivek Kaul is a writer. He can be reached at [email protected]

Talking about Warren Buffett is like discussing the existence of God. He is either great or he is not (the minority view). I am an atheist. Whatever his record as an investor, there are differences between Buffett’s pronouncements about the standard of conduct he requires of others and that he follows. While he dispenses finely crafted criticism of derivatives as weapons of mass destruction, Berkshire Hathaway (Buffett’s holding company) makes extensive use of derivatives and invested in Salomon Brothers and General Reinsurance, both participants in derivative markets.

During the crisis, Buffett, a significant investor in Moody’s, was silent about the problems surrounding rating agencies. Having uncharacteristically declined an invitation to appear in June 2010, Buffett testified before the Financial Crisis Inquiry Commission under subpoena. Buffett emphasised that he knew little about the rating process other than its profit margins. He had never visited Moody’s offices, not even knowing where they were located. He also defended Moody’s not acknowledging any failure or complicity of the agencies in creating the bubble. When Goldman Sachs was indicted for alleged violations in structuring and selling CDOs (collateralised debt obligations, a kind of security backed by loans and bonds), Buffett, a major investor in Goldman, defended the firm, its actions and its CEO.

Satyajit Das.

Could you tell us a little more about this?

Critics have frequently pointed out anomalies in the firm’s corporate practices. Berkshire Hathaway’s dual-class share arrangement gives Buffett voting control whilst owning 34 percent of the equity. Until a decade ago, Berkshire Hathaway’s seven-person board of directors consisted of mainly insiders such as Buffett’s son. The new ‘independent’ directors include Bill Gates, a close friend of Buffett, and his regular bridge partner, as well as co-investor in the Gates Foundation. Critics also pointed to that fact Buffett’s partner Charlie Munger’s family owned a 3 percent stake in BYD, the Chinese electric battery maker, before Berkshire bought a stake in 2008.

As to his record as an investor, there are a number of interesting aspects. Firstly, what is the right benchmark to measure his performance against – it can’t be the broad market index. Secondly, the source of his investment success is not that complicated. His main source of investment capital is the premium income from his insurance businesses (cash received today against a promise to honour a future contingent claim). This provides him with effective economic leverage (at low interest cost) to buy low beta assets. The strategy worked well but whether it will continue to work is more difficult. The past, as they say, is “another country”.

In your book Extreme Money you write “Archimedes said, “Give me a lever long enough and a fulcrum on which to place it, and I shall move the world.” You paraphrase it to write “give me enough debt and I shall make you all the money in the world”. Can you elaborate?

Borrowing amplifies economic growth. Debt allows society to borrow from the future. It accelerates consumption and investment spending, as borrowed money is used to purchase something today against the promise of paying back the borrowing in the future. Spending that would have taken place normally over a period of years is accelerated because of the availability of cheap borrowing. In this way, debt generates economic growth. In financial markets, debt and leverage amplify returns.

Could you explain this through an example?

Assume an investor uses $20 of its own money – equity – and borrows $80 (80 percent of the value) to purchase an asset for $100. If the asset increases in value by 10 percent to $110, then the investor’s equity increases on paper to $30 ($110 minus the fixed amount of debt of $80). If the investor maintains its leverage at 5 times then it can buy $150 of assets (funded by $30 of equity and $120 of debt). If the investor can now leverage 6 times then it can buy $180 of assets (funded by $30 of equity and $150 of debt). The investor still only has his original $20 investment in cash, unless he sells the asset to realise paper gains, which can vanish.

But now, this $20 supports even more debt, as much as $160 (the $180 of assets that the investor can buy if it leverages six times less its original investment). The real leverage is around nine times, which means an 11 percent fall in the value of the asset purchased can wipe out the investor’s wealth entirely. Where the supply of assets does not increase as quickly as the supply of debt, the price increases allow the process to continue. In the period to 2007, the use of leverage, in different ways, to make money was rampant. Unfortunately, it was never real money. Of course, when prices start to fall the entire process operates in reverse.

The interview was originally published on www.firstpost.com on October 2o, 2012. http://www.firstpost.com/economy/warren-buffet-does-not-practice-what-he-preaches-496581.html

Vivek Kaul is a writer. He can be reached at [email protected]