Vivek Kaul

One of my favourite Hollywood comedies is Mel Brooks’ Silent Movie made in 1976. As its name suggests, the film had no dialogue and the only audible word in the movie is spoken by Marcel Marceau, when he utters the word “No!” Rather ironically Marceau was one of the most famous mime artists of the era.

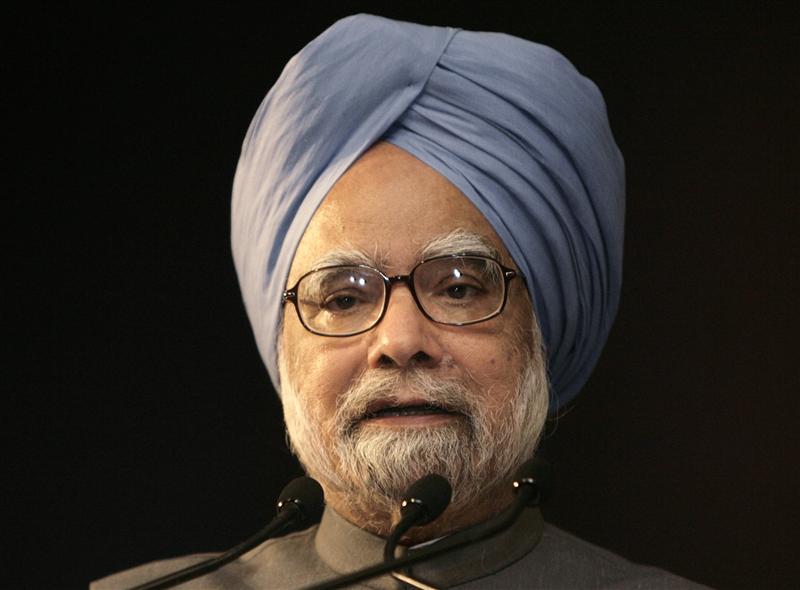

The Congress party led UPA in the last few years has been behaving in the opposite way.In the Congress movie every leader other than Prime Minister Manmohan Singh, the man at the top, had a dialogue. Singh chose to keep quiet rarely telling us what was going on inside his head, as his government moved from one scam to another.

But over the last two weeks he has suddenly found his voice, initiated a wave of reforms, from increasing the price of diesel by Rs 5 per litre to allowing foreign direct investment in the retail sector. “It will take courage and some risks but it should be our endeavour to ensure that it succeeds. The country deserves no less,” Singh said after the announcements were made.

He even addressed the nation and explained the rationale behind the decisions. The media went to town saying that Manmohan has got his mojo back. But the question is what has got our silent Prime Minister talking?

When Pranab Mukherjee presented the budget earlier this year he had projected a fiscal deficit of Rs 5,13,590 crore or 5.1% of the gross domestic product(GDP). Fiscal deficit is the difference between what the government earns and what it spends.

The projected fiscal deficit has gone all awry primarily because the price of oil has continued to remain high, despite a slowdown in the global economy. Currently, the price of the Indian basket of crude oil is at around $114.4 per barrel.

This wouldn’t have been a problem if the diesel, kerosene and cooking gas, would have been sold at their market price. But the Indian government hasn’t allowed that to happen over the years and has protected the consumers against the price rise. This means that the oil marketing companies (OMCs) Indian Oil, Bharat Petroleum and Hindustan Petroleum have had to sell diesel, kerosene and cooking gas at a loss.

The government needs to compensate these companies from the losses they incur, so that they don’t go bankrupt. These losses were close to touching Rs 1,90,000 crore, when the government decided to increase the price of diesel by Rs 5 per litre. Even after this increase the OMCs will lose over Rs 1,00,000 crore just on the sale of diesel this year. The total loss on diesel, kerosene and cooking gas is now estimated to be at Rs 1,67,000 crore. The OMCs are also losing around Rs 6 per litre on selling petrol, but the government doesn’t compensate them for this.

The government hadn’t budgeted for such huge losses on the oil front in the budget. The budgeted amount was a miniscule Rs 43,580 crore. Of this nearly Rs 38,500 crore was used to compensate the OMCs for losses made during the course of the lost financial year, leaving a little over Rs 5,000 crore to meet the losses for the current financial year.

The subsidies allocated for food and fertiliser are also likely to be not enough. In fact as per the Controller General of Accounts the fiscal deficit during the first four months of the year has already crossed half of the budgeted fiscal deficit of Rs 5,13,590 crore. This was a really worrying situation. More than that with tensions flaring up again in various countries in the Middle East, it is unlikely that the price of oil will come down in a hurry.

Given these reasons if the government had carried on in its current state there was a danger of the fiscal deficit crossing Rs 7,00,000 crore or 7% of the GDP. This is a situation which India has never had to face since the country first initiated and embraced economic reforms in July 1991. The fiscal deficit for the year 1990-1991 had stood at 8% of the GDP.

Reforms like allowing foreign investment in multi brand retailing will have an impact on economic growth over a very long period of time, if at all they do. Allowing foreign investors to pick up 49% stake in domestic airlines will also not have any immediate impact. But what is more important is the signals that these reforms send out to the market i.e. policy logjam that was holding economic growth back is over and the government is now in the mood for reforms.

As a result the rupee has appreciated against the dollar. One dollar was worth Rs 55.4 on September 14. Since then it has gained 3% to Rs 53.8. This will help in bringing the oil bill down. Oil is sold internationally in dollars. When one barrel costs $115 and one dollar is worth Rs 55.4, India pays Rs 6,371 per barrel. If one dollar is worth Rs 53.8, then India pays a lower Rs 6,187 per barrel. So an appreciating rupee brings down the oil bill, which in turn pushes down the fiscal deficit of the government.

The thirty share BSE Sensex has rallied by 2.9% to 18,542.3 points, from its close on September 13 to September 17. Nevertheless, even after these moves the actual fiscal deficit of the government will be substantially higher than the targeted Rs 5,13,590 crore. To bring that down the government needs to come up with more reforms so that the rupee continues to appreciate against the dollar and brings down the oil subsidy bill. The market rally also needs to continue, so that the government meets its disinvestment target of Rs 30,000 crore for the year. And on top of all this the government also needs to reign in the oil subsidy by gradually increasing prices of petrol, diesel, kerosene and cooking gas. Unless this happens, the government will continue to borrow more and this will keep interest rates high. Interest rates need to come down if businesses and consumers are to start borrowing again. This is necessary to revive economic growth, which has slowed down considerably.

If all this wasn’t enough we also need to hope that a certain Mrs G and Master G need to continue to understand that good economics also means good politics. If they switch off anytime now, Manmohan Singh is likely to go quiet again.

(A slightly different version of the article with a different headline appeared in the Asian Age/Deccan Chronicle on September 26, 2012. http://www.deccanchronicle.com/editorial/dc-comment/good-economics-good-politics-too-426)

(Vivek Kaul is a Mumbai based writer. He can be reached at [email protected])

Oil Marketing Companies

How Mamata is denting the rupee and bloating the oil bill

Vivek Kaul

A major reason for announcing the so called economic reforms that the Manmohan Singh UPA government did over the last weekend was to get India’s burgeoning oil subsidy bill which was expected to cross Rs 1,90,000 crore during the course of the year, under some control.

One move was the increase in diesel price by Rs 5 per litre and limiting the number of cooking gas cylinders that one could get at the subsidisedprice to six per year. This was a direct step to reduce the loss that the oil marketing companies (OMCs) face every time they sell diesel and cooking gas to the end consumer.

The other part of the reform game was about expectations management. The announcement of reforms like allowing foreign direct investment in multi-brand foreign retailing or the airline sector was not expected to have any direct impact anytime soon. But what it was expected to do was shore up the image of the government and tell the world at large that this government is committed to economic reform.

Now how does that help in controlling the burgeoning oil bill?

Oil is sold internationally in dollars. The price of the Indian basket of crude oil is currently quoting at around $115.3 per barrel of oil (one barrel equals around 159litres).

Before the reforms were announced one dollar was worth around Rs 55.4(on September 13, 2012 i.e.). So if an Indian OMC wanted to buy one barrel of oil it had to convert Rs 6387.2 into $115.3 dollars, and pay for the oil.

After the reforms were announced the rupee started increasing in value against the dollar. By September 17, one dollar was worth around Rs 53.7. Now if an Indian OMC wanted to buy one barrel of oil it had to convert Rs 6191.6 into $115.3 to pay for the oil.

Hence, as the rupee increases in value against the dollar, the Indian OMCs pay less for the oil the buy internationally. A major reason for the increase in value of the rupee was that on September 14 and September 17, the foreign institutional investors poured money into the stock market. They bought stocks worth Rs 5086 crore over the two day period. This meant dollars had to be sold and rupee had to be bought, thus increasing the demand for rupee and helping it gain in value against the dollar.

But this rupee rally was short lived and the dollar has gained some value against the rupee and is currently worth around Rs 54.

The question is why did this happen? Initially the market and the foreign investors bought the idea that the government was committed at ending the policy logjam and initiating various economic reforms. Hence the foreign investors invested money into the stock market, the stock market rallied and so did the rupee against the dollar.

But now the realisation is setting in that the reform process might be derailed even before it has been earnestly started. This was reflected in the amount of money the foreign investors brought into the stock market on September 18. The number was down to around Rs 1049.2 crore. In comparison they had invested more than Rs 5080 crore over the last two trading sessions.

Mamata Banerjee’s Trinamool Congress, a key constituent of the UPA government, has decided to withdraw support to the government. At the same time it has asked the government to withdraw a major part of the reforms it has already initiated by Friday. If the government does that the Trinamool Congress will reconsider its decision.

How the political scenario plays out remains to be seen. But if the government does bow to Mamata’s diktats then the economic repercussions of that decision will be huge. The government had hoped that the losses on account of selling, diesel, kerosene and cooking gas, could have been brought down to Rs 1,67,000 crore, from the earlier Rs 1,92,000 crore by increasing the price of diesel and limiting the consumption of subsidised cooking gas.

If the government goes back on these moves, the oil subsidy bill will go back to attaining a monstrous size. Also, what the calculation of Rs 1,67,000 crore did not take into account was the fact that rupee would gain in value against the dollar. And that would have further brought down the oil subsidy bill. In fact HSBC which had earlier forecast Rs 57 to a dollar by December 2012, revised its forecast to Rs 52 to a dollar on Monday. But by then the Mamata factor hadn’t come into play.

If the government bows to Mamata, the rupee will definitely start losing value against the dollar again. This will happen because the foreign investors will stay away from both the stock market as well as direct investment. In fact, the foreign direct investment during the period of April to June 2012 has been disastrous. It has fallen by 67% to $4.41billion in comparison to $13.44billion, during the same period in 2011. If the government goes back on the few reforms that it unleashed over the last weekend, foreign direct investment is likely to remain low.

One factor that can change things for India is the if the price of crude oil were to fall. But that looks unlikely. The immediate reason is the tension in the Middle East and the threat of war between Iran and Israel. Hillary Clinton, the US Secretary of State, recently said that the United States would not set any deadline for the ongoing negotiations with Iran. This hasn’t gone down terribly well with Israel. Reacting to this Benjamin Netanyahu, the Prime Minister of Israel said “the world tells Israel, wait, there’s still time, and I say, ‘Wait for what, wait until when? Those in the international community who refuse to put a red line before Iran don’t have the moral right to place a red light before Israel.” (Source: www.oilprice.com)

Iran does not recognise Israel as a nation. This has led to countries buying up more oil than they need and building stocks to take care of this geopolitical risk. “In the recent period, since the start of 2012, the increase in stocks has been substantial, i.e. 2 to 3 million barrels per day. These are probably precautionary stocks linked to geopolitical risks,” writes Patrick Artus of Flash Economics in a recent report titled Why is the oil price not falling?

At the same time the United States is pushing nations across the world to not source their oil from Iran, which is the second largest producer of oil within the Organisation of Petroleum Exporting Countries (Opec). This includes India as well.

With the rupee losing value against the dollar and the oil price remaining high the oil subsidy bill is likely to continue to remain high. And this means the trade deficit (the difference between exports and imports) is likely to remain high. The exports for the period between April and July 2012, stood at $97.64billion. The imports on the other hand were at $153.2billion. Of this, $53.81billion was spent on oil imports. If we take oil imports out of the equation the difference between India’s exports and imports is very low.

Now what does this impact the value of the rupee against the dollar? An exporter gets paid in dollars. When he brings those dollars back into the country he has to convert them into rupees. This means he has to buy rupees and sell dollars. This helps shore up the value of the rupee as the demand for rupee goes up.

In case of an importer the things work exactly the opposite way. An importer has to pay for the imports in terms of dollars. To do this, he has to buy dollars by paying in rupees. This increases the demand for the dollar and pushes up its value against the rupee.

As we see the difference between imports and exports for the first four months of the year has been around $55billion. This means that the demand for the dollar has been greater than the demand for the rupee.

One way to fill this gap would be if foreign investors would bring in money into the stock market as well as for direct investment. They would have had to convert the dollars they want to invest into rupees and that would have increased the demand for the rupee.

The foreign institutional investors have brought in around $3.86billion (at the current rate of $1 equals Rs 54) since the beginning of the year. The foreign direct investment for the first three months of the year has been at $4.41 billion.

So what this tells us that there is a huge gap between the demand for dollars and the supply of dollars. And precisely because of this the dollar has gained in value against the rupee. On April 2, 2012, at the beginning of the financial year, one dollar was worth around Rs 50.8. Now it’s worth Rs 54.

This situation is likely to continue. And I wouldn’t be surprised if rupee goes back to its earlier levels of Rs 56 to a dollar in the days to come. It might even cross those levels, if the government does bow to the diktats of Mamata.

This would mean that India would have to pay more for the oil that it buys in dollars. This in turn will push up the demand for dollars leading to a further fall in the value of the rupee against the dollar.

Since the government forces the OMCs to sell diesel, kerosene and cooking gas much below their cost to consumers, the losses will continue to mount. The current losses have been projected to be at Rs 1,67,000 crore. I won’t be surprised if they cross Rs 2,00,000 crore. The government has to compensate the OMCs for these losses in order to ensure that they don’t go bankrupt.

This also means that the government will cross its fiscal deficit target of Rs 5,13,590 crore. The fiscal deficit, which is the difference between what the government earns and what it spends, might well be on its way to touch Rs 7,00,000 crore or 7% of GDP. (For a detailed exposition of this argument click here). And that will be a disastrous situation to be in. Interest rates will continue to remain high. And so will inflation. To conclude, the traffic in Mumbai before the Ganesh Chaturthi festival gets really bad. Any five people can get together while taking the Ganesh statue to their homes, put on a loudspeaker, start dancing on the road and thus delay the entire traffic on the road for hours. Indian politics is getting more and more like that.

Reforms, like the traffic, may have to wait. Mamata’s revolt is single-handedly worsening the oil bill, thanks, in part, to the rupee’s worsening fortunes. By not raising prices now, the subsidy bill bloat further, and in due course we will be truly in the soup.

The article originally appeared on www.firstpost.com on September 20, 2012. http://www.firstpost.com/economy/how-mamata-is-denting-the-rupee-and-bloating-the-oil-bill-461919.html

Vivek Kaul is a writer and can be reached at [email protected]

Even with the diesel price hike, India is staring at a 7% fiscal deficit

Vivek Kaul

The Congress party led United Progressive Alliance(UPA) has been in the habit of shooting messengers who come with bad news. So here is some more bad news.

Almost half way through the financial year 2012-2013 (i.e. the period between April 1, 2012 and March 31, 2013), the fiscal deficit of the government is looking awful to say the least. Fiscal deficit is the difference between what the government earns and what it spends.

When the finance minister presents the annual budget there are a lot of assumptions that go into the projection of the fiscal deficit.

The overall fiscal deficit was projected to be at Rs 5,13,590 crore. The expenditure of the government for the year was expected to be at Rs 14,90,925 crore. In comparison the government expected to earn Rs 9,77,335 crore during the course of the year. The difference between the earnings of the government and its expenditure came to Rs 5,13,590 crore and this is the projected fiscal deficit. Hence, the government was spending 55% (Rs 5,13,590 crore expressed as a percentage of Rs 9,77,335 crore) more than it earned.

The expenditure part of the calculation includes subsidies on oil, fertiliser and food. The subsidy on oil was assumed to be at Rs 43,580 crore. This subsidy was to be used by the government to compensate oil marketing companies like Indian Oil, Bharat Petroleum and Hindustan Petroleum for selling diesel, kerosene and cooking gas, at a loss.

The government has more or less run out of the budgeted oil subsidies. It has already paid Rs 38,500 crore to OMCs, for selling diesel, kerosene and LPG at a loss during the last financial year. This amount was reimbursed only in the current financial year and hence has had to be adjusted against the oil subsidies budgeted for this year. This leaves only around Rs 5,080 crore with the government for compensating the OMCs for the losses this year.

And that’s just small change in comparison to the losses that OMCs are expected to face for selling diesel, kerosene and LPG. The oil minister Jaipal Reddy recently said that if the current situation continues the OMCs will end up with losses amounting to Rs 2,00,000 crore during the course of the year.

As economist Shankar Acharya wrote in the Business Standard on September 13“The real fiscal spoilsport is, of course, subsidies, especially those for diesel, LPG and kerosene, though those on fertiliser and foodgrain are also large. Data circulated by the petroleum ministry indicate under-recoveries by oil marketing companies (OMCs) of Rs 17/litre on diesel, Rs 33/litre on kerosene and Rs 347/cylinder on LPG.”

The OMCs need to be compensated for these losses by the government because if they are not compensated then they will go bankrupt. And if they go bankrupt then you, I and everybody else, won’t be able to buy petrol, diesel, kerosene and LPG, which would basically mean going back to the age of tongas and bullock carts. Clearly no one would want that.

So to deal with expected losses of Rs 2,00,000 crore the government has around Rs 5,080 crore of the budgeted amount remaining. This means that the government would have to come up with around Rs 1,95,000 crore from somewhere.

This is a large amount of money. The government has tried to curtail these losses by increasing the price of diesel by Rs 5 per litre and thus bringing down the loss on sale of diesel to Rs 12 per litre. This move is expected to save the government Rs 19,000 crore which means losses will now amount to Rs 1,76,000crore (Rs 1,95,000crore – Rs 19,000 crore) in total.

Since 2003-2004, the government has had a formula for sharing these losses. The upstream oil companies like ONGC and Oil India Ltd, which produce oil, are forced to share one third of the losses. But there have been instances when the formula has not been followed and the upstream companies have been forced to chip in with more than their fair share. In 2011-2012, the last financial year the government forced the upstream companies to compensate around 40% of the total losses.

If the government follows the same formula this year as well, it would mean that the upstream companies would have to compensate the OMCs to the tune of Rs 70,400crore (40% of Rs 1,76,000 crore). Now that is a huge amount, whether the upstream companies have the capacity to come up with that kind of money remains to be seen. But assuming that they do, it still means that the government would have to come up with Rs 1,05,600 crore (60% of Rs 1,76,000 crore) from somewhere. This would mean that the fiscal deficit would be pushed up to Rs 6,19,190 crore (Rs 5,13,590 crore + Rs 1,05,600 crore). If the upstream companies cannot bear 40% of the total loses the government will have to bear a greater proportion of the total losses, pushing the fiscal deficit up further.

Oil subsidies are not the only subsidies going around. The government is expected to overshoot its food subsidy target of Rs75,000 crore as well. The Economic Times had quoted a food ministry official on June 15, 2012, confirming that the food subsidy target will be overshot, after the government had approved the minimum support price (MSP) of rice to be increased by 16 per cent to Rs 1,250 per quintal to. “The under-provisioning of food subsidy in the current year is at Rs 31,750 crore. Now with increased MSP on paddy(i.e. rice), the total food subsidy deficit at the end of the current year will be about Rs 40,000 crore putting immense pressure on the food subsidy burden of the government,” said a food ministry official,” the Economic Times had reported.

If we add this Rs 40,000 crore to Rs 6,19,190 crore the deficit shoots up to Rs 6,59,190 crore. This is something that Acharya confirms in his column. “A few days back the Controller General of Accounts (CGA, not CAG!) informed us that the central government’s fiscal deficit for the first four months of 2012-13 had already exceeded half of the Budget’s target for the full year,” he writes.

What does this mean is that for the first four months of the year, the government’s fiscal deficit was greater than half of the fiscal deficit for the year. The targeted fiscal deficit for the year was Rs 5,13,590crore. Half of it would equal to Rs 2,56,795 crore. The government has already crossed this in the first four months. At the same rate it would end up with a fiscal deficit of Rs 7,70,385 crore (Rs 2,56,795 crore x 3) by the end of the year. This would work out to 50% more than the projected fiscal deficit of Rs 5,13,590 crore.

It would be preposterous on my part to project a fiscal deficit which is 50% more than the projected deficit. But as I had shown a little earlier a deficit of around Rs 6,60,000 crore is pretty much on the cards.

What does not help is the fact that things aren’t looking too good on the revenue side for the government. As Acharya puts it “More recently, there are ominous, if unsurprising, indications of a significant deceleration in direct tax collections up through August, especially from companies, with gross corporate tax revenues stagnant compared to April-August of the previous financial year. Despite finance ministry reassurances, tax collections for the year could fall significantly below Budget targets because of sluggish economic activity.”

So the government is not going to earn as much as it had expected to through taxes. The government also has set a disinvestment target of Rs30,000 crore. It hopes to earn this money by selling shares of public sector companies. But six months into the financial year there has been no activity on this front.

Taking these factors into account a fiscal deficit of Rs 7,00,000 crore can be expected. Fiscal deficit as we all know is expressed as a proportion of the gross domestic product (GDP). The projected fiscal deficit of Rs 5,13,590 crore works out to 5.1% of the GDP. The GDP in this case is assumed to be at Rs 101,59,884 crore.

With a fiscal deficit of Rs 7,00,000 crore, fiscal deficit as a proportion of GDP works out to 6.9% (Rs 7,00,000 crore expressed as a % of Rs 101,59,884 crore).

The GDP number of Rs 101,59,884 crore is also a projection. The assumption is that the GDP will grow by a nominal rate of 14% over the last financial year’s advance estimate of GDP at Rs 89,121,79 crore. The trouble is that the economy is slowing down and it is highly unlikely to grow at a nominal rate of 14%. The current whole sale price inflation is around 7%. The real rate of growth for the first six months of the calendar year (i.e. the period between January 1, 2012 and June 30, 2012) has been around 5.4%. If we add that to the inflation we are talking of a nominal growth of around 12.5%. At that rate the expected GDP for the year is likely to be around Rs 100,26,201crore (1.125 x Rs 89,121,79 crore).

Hence the fiscal deficit as a percentage of GDP will be around 7% (Rs 700,000 crore expressed as a percentage of Rs 100,26,201crore). A 7% fiscal deficit would give the Prime Minister Manmohan Singh a sense of déjà vu. In his speech as the Finance Minister of India in 1991 he had said “The crisis of the fiscal system is a cause for serious concern. The fiscal deficit of the Central Government…is estimated at more than 8 per cent of GDP in 1990-91, as compared with 6 per cent at the beginning of the 1980s and 4 per cent in the mid-1970s.”

One way out of this mess is to cut the losses due to the sales diesel, kerosene and on LPG. But that would mean a price increase of Rs 12/litre on diesel, Rs 33/litre on kerosene and Rs 347/cylinder on LPG. That of course is not going to happen. Also with the government having to borrow more to meet the increased fiscal deficit, the interest rates will continue to remain high.

India is staring at a huge economic problem. The question is whether the government is ready to recognise it. As Pratap Bhanu Mehta writes in The Indian Express “The central driver of good economics is recognising the problem.” The trouble is that the Congress led UPA government doesn’t want to recognise the problem, let alone tackle it.

(The article originally appeared on www.firstpost.com on September 14,2012. http://www.firstpost.com/economy/why-the-diesel-hike-will-not-even-dent-the-fiscal-deficit-455249.html)

(Vivek Kaul is a writer. He can be reached at [email protected])

Post-WPI, Subbarao’s music may be more Baba Sehgal than Ilaiyaraaja

As I sit down to write this it is a rather cloudy, dull and insipid morning in Mumbai. An old Tamil number Vaa Vennila composed by the music maestro Ilaiyaraaja and sung by S P Balasubrahmanyam and S Janaki, is playing in the background. I happened to discover this song a few days back, quite by chance, and it has been playing nonstop on my laptop since then. It’s the most melodious composition that I have heard in a long-long time.

Dear Reader, before you start breaking your head over why am I talking about an old Ilaiyaraaja number, when the headline clearly tells you that I should be talking about other things, allow me to explain.

For a music director to be able to create melody a lot of things need to come together. First and foremost the tune has to be good. On top of that the musicians have to be able to flesh out the tune in a way that the music director had originally envisaged it. The lyrics need to make sense. The singers need to get the right emotion into the song and of course not be out of tune. The director of the movie needs to have the ability to recognize a good song when he hears one and not fiddle around with it. And so on.

The point I am trying to make is that “melody” cannot be created in isolation. A lot of things need to come together to create a melodious song and to have an individual born and brought in erstwhile Bihar of Kashmiri Pandit parents, who does not speak a word of Tamil (and not much Kashmiri either), humming it nearly 26 years after it was first released.

What is true about Ilaiyaraaja’s ability to create melody is also true about the ability of Duvvuri Subbarao, the governor of the Reserve Bank of India(RBI), to influence the Indian economy and take it in the direction where everyone wants him to.

The inflation number

The wholesale price index (WPI) inflation number for the month of June 2012 was released sometime back. The inflation has fallen to 7.25% against 7.55% in the month of May. The number has come in much lower than what the analysts and the economists were expecting it to be.

This is likely to lead to calls for the Reserve Bank of India (RBI) RBI to cut the repo rate.

The first quarter review of the monetary policy of the RBI is scheduled on July 31,2012. Industrialists, economists and analysts would want the RBI to cut the repo rate on this day. The repo rate is the interest rate at which RBI lends to the banks.

The first quarter review of the monetary policy is scheduled on July 31,2012. Industrialists, economists and analysts want the RBI to cut the repo rate on this day. The repo rate is the interest rate at which RBI lends to the banks.

So what is the idea behind this? When the RBI cuts the repo rate it is trying to send out a signal to that it expects the interest rates to come down in the months to come. If the banks think that the signal by the RBI is credible enough then they lower the interest rate they pay on their deposits. They also lower the interest rates they charge on their long term loans like home loans, car loans and loans to businesses. With people as well as businesses borrowing and spending more it is expected that the slowing economic growth will be revived.

That’s how things are expected to work in theory. But economic theory and practice do not always go together. The trouble is that even if the RBI cut the repo rate right now, the credibility of the signal would be under doubt, and banks wouldn’t cut interest rates. This is primarily because like Ilaiyaaraja, Subbarao and the RBI also do not work in isolation.

More loans than deposits

The incremental credit deposit ratio of the banks in the six month period between December 30,2011 and June 29,2012, has been 108%. What this means that during this period for every Rs 100 that banks have borrowed by raising deposits, they have loaned out Rs 108. Hence, banks have not been able to match their deposits to loans. They have been funding their loans out of deposits they had raised in periods previous to the six month period considered here. Given the shortage of deposits that banks are facing it doesn’t make sense for them to cut the interest rates on their deposits, even if the RBI were to go ahead and cut the repo rate. And if they can’t cut interest rates on their deposits there is no way the banks are going to cut interest rates on their loans. But why are banks facing a shortage of deposits?

The oil subsidy for this year is already over

The budget for the year 2012-2013 had made a provision of Rs 43,580 crore for oil subsidies. This provision is made to compensate the oil marketing companies (OMCs) Indian Oil Corporation, Bharat Petroleum and Hindustan Petroleum, for selling diesel, kerosene and LPG at a loss. Four months into the financial year the government has already run out of this money. The government has compensated the OMCs to the extent of Rs 38,500 crore for products at a loss in the last financial year (i.e. the period between April 1, 2011 and March 31,2012). This payment was made in this financial year and hence has been adjusted against the Rs 43,580 crore provisioned against oil subsidies in the budget for the current financial year.

The OMCs continue to sell these products at a loss. In the month of April 2012 they lost around Rs 17,000 crore by selling diesel, kerosene and LPG at a loss. In the last financial year the government compensated 60% of this loss. The remaining loss the government forced the oil producing companies like ONGC and Oil India Ltd, to compensate. So using the rate of 60%, the government would have to compensate around Rs 10,200 crore for the losses faced by the OMCs in the month of April. Add this to the Rs 38,500 crore of payment that has already been made, we end up with Rs 48,700crore. This is more than the Rs 43,580 crore that had been budgeted for.

The OMCs continue to lose money

The losses made by OMCs have come down since the beginning of the year. In April, the OMCs were losing Rs 563crore per day. A recent estimate made by ICICI Securities puts the number at Rs 355crore per day. At this rate the companies will lose around Rs 130,000 crore by the end of the year. Even if oil prices were to continue to fall the companies will continue losing substantial amount of money.

All this will mean an increase in expenditure for the government as it would have to compensate these companies to help them continue their operations and prevent them from going bust. An increase in expenditure would mean an increase in the fiscal deficit. Fiscal deficit is the difference between what the government spends and what it earns. The fiscal deficit for the current year has been budgeted to be at Rs 5,13,590 crore. It is highly unlikely that the government will be able to meet this target, given the continued losses faced by the OMCs.

Further borrowing from the government would mean that the pool of savings from which banks and other financial institutions can borrow will come down. This means that to banks will have to continue offering higher interest rates on their fixed deposits and hence keep charging higher interest rates on their loans.

High inflation

The consumer price index (CPI) inflation for the month of May stood at 10.36%, higher than the 10.26% in April. This is likely to go up even further in the days to come. The WPI inflation coming for the month of June has come in at xx%. And this is likely to push the CPI also in the days to come. CPI inflation will be pushed further given that the government increased the minimum support price on khareef crops from anywhere between 15-53% sometime back. These are crops which are typically sown around this time of the year for harvesting after the rains (i.e. September-October). The MSP for paddy (rice) has been increased from Rs 1,080 per quintal to Rs 1,250 per quintal. Other major products like bajra, ragi, jowar, soybean, urad, cotton etc, have seen similar increases. Also, after dramatically increasing prices for khareef crops, the government will have to follow up the same for rabi crops like wheat. Rabi crops are planted in the autumn season and harvested in winter. This will further fuel food inflation. Food constitutes around 50% of the consumer price index in India. In this scenario of higher inflation it will be very difficult for the RBI to cut the repo rate. And even if it does cut interest rates it is not going to be of any help as has been explained above.

To conclude

The way out of this mess is rather simple. Oil subsidies need to be cut down. That is the only way the government can hope to control its fiscal deficit. If things keep going the way they are I wouldn’t be surprised if the fiscal deficit of the government even touches the vicinity of Rs 6,00,000 crore against the budgeted Rs 5,13,590 crore.

Only once the government gives enough indications that it is serious about controlling the fiscal deficit, will the market start taking the interest rate policy of the RBI seriously. Before that even if the RBI were to cut interest rates it wouldn’t have an impact.

For Duvvuri Subbarao to make melody like Ilaiyaraaja does a lot of things which are not under his control need to come together. Ilaiyaraaja has control over the people he works with. He can tell his musicians what to play. He can ask his singers to sing in a certain way. He can ask his lyric writer to write a certain kind of song. And so on. Subbarao does not have the same control over the other players in the economy.

So in the meanwhile it is safe to say that try he might as much to make melody like Ilaiyaraaja, chances are he is likely to come up a song Baba Sehgal once made. It was called “Main Bhi Maddona”. For those who have heard the song will know that melody has never been “murdered” more.

(The article originally appeared on www.firstpost.com on July 16,2012. http://www.firstpost.com/economy/post-wpi-subbaraos-music-may-be-more-baba-sehgal-than-ilaiyaraaja-378448.html)

Vivek Kaul is a writer and can be reached at [email protected]

Of fiscal deficit, Manmohan Singh and a prayer to god

Vivek Kaul

India is country that lives on hope, gods and pipedreams. The Prime Minister Manmohan Singh is no different when it comes to this. In a recent interview after taking over as the finance minister of the country he said he was focusing on controlling the fiscal deficit through a series of measures that the officials were working on.

He did not explain what these measures were. But with things as they stand now, it is next to impossible for the government to control the fiscal deficit and the PM can just hope for the best.

Fiscal deficit is the difference between what the government earns and spends. For the financial year 2012-2013 (from April 1, 2012 to March 31, 2013) this number is expected to be at Rs 5,13,590 crore. The government finances the deficit by borrowing money or taking on debt as it is technically referred to as.

There are several reasons why the fiscal deficit is likely to turn out to be higher than the projected number. Let’s start with oil subsidies. Oil subsidies for the year have been budgeted at Rs 43,580crore. The government has more or less run out of this money. It has paid Rs 38,500 crore to oil marketing companies (OMCs) like Indian Oil Corporation, Bharat Petroleum and Hindustan Petroleum for selling diesel, kerosene and LPG, at a loss during the last financial year. This payment was made only in the current financial year and hence has had to be adjusted against the oil subsidies budgeted for the current financial year.

This leaves only around Rs 5080 crore (Rs 43,580 crore – Rs 38,500crore) with the government for compensating the OMCs for the losses for the remaining part of the year.

International oil prices have come down since the beginning of April. Back then the OMCs were losing around Rs 563crore per day. A recent estimate made at the beginning of July by ICICI Securities puts this loss at Rs 355crore a day. Oil prices have fallen further by around 8% since this estimate was made. Adjusting for that the oil companies continue to lose around Rs 325crore per day or around Rs 10,000 crore per month. Hence the Rs 5080 crore that the government has remaining in its oil subsidy account would be over in a period of 15 days, at the current rate of losses.

Oil prices have fallen by 32% to $85 per barrel since the beginning of April. It’s is unlikely that the price will continue to fall given that at some stage the oil cartel, Organization of Petroleum Exporting Countries (OPEC), will intervene and start cutting production to push up prices. Also, the threat of confrontation between Iran and the United States has been on for a while. Even a whiff of a crisis can push up oil prices. Iran is the second largest producer of oil in OPEC after Saudi Arabia. It has been trying to sell oil in currencies other than the US dollar for the past few years, much to the annoyance of the US.

So if the OMCs continue to lose money at the current rate, the projected losses for the year will be over Rs 120,000 crore. In 2011-2012 the government compensated around 60% of the losses. It got oil producing companies like ONGC and Oil India Ltd to pay the OMCs for the remaining losses. If the same ratio is followed in this financial year as well, it would mean an extra burden of around Rs 72,000 crore for the government (60% of Rs 1,20,000 crore). The fiscal deficit would go up by a similar amount.

Oil subsidies are the not the government’s only problem. On June 14, 2012, the government had approved the minimum support price (MSP) of rice to be increased by 16% from Rs 1250 per quintal from Rs 1080 per quintal. The Food Corporation of India buys rice from the farmers at the MSP. The food subsidy for the current financial year has been set at Rs 75,000 crore. Experts believe that this number is terribly under-provisioned given the various programmes of the government. Also with a significant increase in the MSP of rice the food subsidy is expected to cost the government around Rs 40,000 crore more from its current estimates. Even this number is likely to be beaten because after increasing the MSP of rice significantly, a similar price increase would have to be made for wheat during the coming months.

What does not help is that interest payments on all the money that the government has previously borrowed, comes to Rs 3,19,759 crore. Other than paying interest the government also needs to repay the past debt that is maturing. This amount comes to Rs 1,24,302 crore. Hence the cost of total debt servicing comes to Rs 4,44,061 crore or around 87% of the projected fiscal deficit of Rs 5,13,590 crore for the year. There is nothing that Manmohan Singh and the government can do to control this.

If all these problems were not enough the monsoon till now has been 23% deficient. This impacts the purchasing power of “rural” India and means lower sales of cars, bikes, white goods and fast moving consumer products in rural India, leading to a lower collection of indirect tax for the government. Lower taxes can drive up the fiscal deficit further.

So what is the way out? The subsidy on various oil products needs to be brought down. That’s the only solution that Manmohan Singh led government has to this problem. But the question is will they bite the bullet and make some tough decisions? From the past record it can be safely said, the answer is no. Given these reasons hoping to control the fiscal deficit remains a distant pipe dream.

Hence it’s time for Manmohan Singh to do what most Indians do when they are stretched and stressed. Pray to god. And hope for the best.

(The article originally appeared in the Asian Age/Deccan Chronicle on July 16,2012. http://www.deccanchronicle.com/editorial/dc-comment/fiscal-deficit-and-prayer-god-905)

(Vivek Kaul is a writer and can be reached at [email protected])