Vivek Kaul

Milton Friedman was the most famous economist of the second half of the twentieth century. He believed that inflation is a monetary phenomenon. As he wrote in Money Mischief – Episodes in Monetary History: “The recognition that substantial inflation is always and everywhere a monetary phenomenon is only the beginning of an understanding of the cause and cure of inflation.”

This line of thinking has influenced many economists over the years ‘particularly’ those who work and teach at the University of Chicago, where Friedman was based for 31 years between 1946 and 1977.

Raghuram Rajan, who teaches at the University of Chicago and is scheduled to takeover as the next governor of the Reserve Bank of India (RBI), is one such economist. In fact Rajan has clearly pointed out in his earlier writings that RBI should simply concentrate on managing inflation.

As Rajan wrote in a 2008 article (along with Eswar Prasad) “The RBI already has a medium-term inflation objective of 5 per cent…But the central bank is also held responsible, in political and public circles, for a stable exchange rate. The RBI has gamely taken on this additional objective but with essentially one instrument, the interest rate, at its disposal, it performs a high-wire balancing act.”

And given this the RBI ends up being neither here nor there. As Rajan put it “What is wrong with this? Simple that by trying to do too many things at once, the RBI risks doing none of them well.”

Hence, Rajan felt that the RBI should ‘just’focus on controlling inflation. As he wrote in the 2008 Report of the Committee on Financial Sector Reforms “The RBI can best serve the cause of growth by focusing on controlling inflation and intervening in currency markets only to limit excessive volatility…an exchange rate that reflects fundamentals tends not to move sharply, and serves the cause of stability.”

The trouble is that the RBI has moved on from a single minded focus on inflation, since the days of Bimal Jalan and tends to follow what experts refer to as the ‘multiple indicator approach’. The central bank now looks at a range of indicators from inflation to capital flows and even the exchange rate. Though at times the objectives the RBI is trying to achieve, are at odds.

This is what is happening currently. The RBI is trying to control inflation, accelerate economic growth and stabilise the value of the rupee, all at the same time. Something which is not possible. Rajan understands this well enough. “The RBI’s objective could be restated as low inflation, and growth consistent with the economy’s potential. They amount to essentially the same thing! But it would let the RBI off the hook for targeting the exchange rate. And that is the key point,” Rajan wrote in the 2008 article cited earlier.

Rajan’s writing suggests that he believes in letting the currency finding its right value. This puts him at odds with the current RBI policy of defending the rupee at around 60-61 to a dollar. If he allows the rupee to fall and find its right value against the dollar, it would make him terribly unpopular with the political class. Also, do nothing might be a good theoretical strategy, but an RBI governor needs to be seen doing something to defend the rupee.

A weaker rupee would mean higher oil prices for one. These higher prices would have to be passed onto the consumers in the form of higher price of petrol, diesel, cooking gas etc. With the Lok Sabha elections due in mid 2014, this would be politically disastrous for the Congress led UPA.

Also it is worth remembering that there is not much a central bank governor can do about high consumer price inflation in India, given that most of it has come about from increased government expenditure, which more than doubled(gone up by 133%) to Rs 16,65,297 crore between 2007-2008 and 2013-2014. In fact, inflation might only go up once the food security scheme is on full swing.

In short, a tough test lies ahead for Raghuram Rajan. But given his impeccable credentials he might just be the best man for the job. As Turkish-American economist Dani Rodrik put it“In Rajan, India gets a superb economist as its central bank governor.”

Rajan himself realises the challenges he has to face and the fact that there are no “magic wands” to cure India’s economic problems. He also realises the limited power of a central banker. As he wrote in an October 2012 column for Project Syndicate “Central bankers nowadays enjoy the popularity of rock stars, and deservedly so…But they must be able to admit when they are out of bullets. After all, the transformation from hero to zero can be swift.”

The article originally appeared in the Daily News and Analysis on August 8,2013

(Vivek Kaul is a writer. He can be reached at [email protected])

Milton Friedman

Why the new bear market theory in gold is all wrong

Vivek Kaul

Vivek Kaul

An old theory about bull markets is that every bull market has a theory behind it. This was true about the bull market in gold which started in 2002 and ran for almost ten years till late 2011. The price of gold during this period went up from around $280 per ounce (one troy ounce equals 31.1 grams) in January 2002 to around $1895 per ounce in September 2011.

The gold bull market had essentially two theories driving it, at different points of time. Between 2002 and September 2008, gold rallied because there was the fear of the American financial system collapsing, as the American citizens went piling on debt to buy new homes, only to sell them after a short period of time.

The American financial system came close to collapse. And some time later it was revealed that Europe was heading towards a similar and a bigger mess. Central banks around the world tried to stem the rot by printing truck loads of money. This money was first used to save the various financial institutions and banks which were on the verge of collapse.

After the governments had managed to save the financial institutions from collapsing, the next lot of money printing was carried out to revive their respective economies. The hope was that by pumping more and more money into the economy, the governments would be able to ensure that there was ample money supply in the economy.

This would ensure low interest rates, leading to people borrowing and spending more, and banks lending more. This spending would lead to people buying more homes, automobiles, consumer goods and so on, helping businesses make more money and thus help revive the overall economy. Low interest rates would also help people to re-finance their homes loans, leading to lower equated monthly instalments(EMIs). The money thus saved would be spend on other things and thus add to economic growth.

The danger here was that all this excess money floating around could chase the same number of goods and services, and lead to very high inflation, as had happened in the past. To hedge against this risk, investors started moving their money into gold.

The investment in gold comes with the belief that gold retains its purchasing power over long periods of time. As Nick Barisheff President and CEO of Bullion Management Group Inc and the author of$10,000 Gold: Why Golds Inevitable Rise Is the Investor’s Safe Haventold Firstpost in a recent interview “It took 66 ounces of gold to buy a compact car in 1971. Today it would take about 10 ounces. We can see the same ratio with houses…Today you can buy 3 average size houses for the same amount of gold you would have needed to buy 1 house in 1971 even though the prices of houses have risen significantly in dollar terms since then. That’s how gold serves as a hedge against inflation and maintains its purchasing power.”

With investors buying gold to hedge the risk of high inflation, the price of the yellow metal went up from $780 per ounce in mid September 2008 to around $1895 per ounce in early September 2011, which meant an absolute return of 143% over a three year period.

The price of gold has fallen since September 2011, and as I write this it quotes at around $1410 per ounce. With this fall, we now have a new theory being bandied around. And its now being said that gold rallied all these years on a misunderstanding.

As per this new theory, those investing in gold have got it all wrong. The fundamental argument about investing in gold is that excess money printing leads to high inflation and to hedge against that inflation investors buy god. But this time around the argument doesn’t really hold, we are now being told. This is because the world is in the midst of a balance sheet recession.

The term balance sheet recession has been coined by the Japanese economist Richard Koo. He feels the situation in the United States and almost all of Europe is very similar to as it was in Japan when the stock market bubble as well as the real estate bubble burst in 1990.

In a balance sheet recession a large portion of the individuals who had taken on loans to be a part of a bubble (real estate in case of America as well as Europe and real estate as well stock market in case of Japan), start saving more to repay their loans. When this happens they are not spending as much as they were in the past. This means incomes of businesses come down, which slows down economic growth as well.

Governments try to revive this economic growth by printing and pumping more money into the economy. This is done in the hope that interest rates will remain low, and encourage people to borrow and spend more. This spending will in turn create economic growth. The trouble is that people are in the saving mode and no mood to borrow and spend.

This also means that all this money that has been printed continues to remain in the vaults of banks. And when that happens, the situation where more and more money chases the same amount of goods and services, leading to higher prices and inflation, doesn’t really come around.

And when there is no high inflation there is no point in buying an asset as useless as gold is.

Hence, there is a fundamental flaw in the reason why people have been buying gold. This is one of the new bear market theories in gold, being bandied around.

There are multiple problems with this approach. First and foremost, the theory has come around only after the price of gold has fallen. Over and above that governments all around the world have been printing money in the hope of maintaining low interest rates and people borrowing and spending more. They have also been printing money in the hope of creating some inflation. When prices are rising or are expected to rise, there is a greater chance of people getting out in the market and buying stuff, so that they don’t have to pay more in the days and months to come.

But this hasn’t really worked because there is a balance sheet recession on. Central banks and governments have tried to solve this by printing even more money. But inflation hasn’t shown up in the official numbers as yet.

As Jeff Nielson, Editor of www.bullionbullscanada.com puts it “The premise is that you can print infinite quantities of paper; but as long as you hive-off that money-printing from the “broader economy” there (supposedly) will be no inflationary impact.”

So governments can print all the money that they want but there will be no inflation, as long as the money is lying in bank vaults. The question is that if money is to lie in banks vaults only and not lent out, then why print it in the first place?

Also, just because people are not borrowing doesn’t mean all the money being printed is not being put to use. As Nielson explains “What is meant by hiving-off this money-printing? Giving every penny to bankers, and letting them gamble with it in their (private, unregulated) derivatives casino, or hold government bonds for the interest arbitrage.”

So bankers and financial institutions are borrowing this money at close to 0% interest rates and speculating in different kinds of investments and markets around the world. This also explains to a large extent why stock markets around the world have been doing stupendously well, even though the global economy has been stagnating. It has also led to bankers and financial institutions buying government bonds, and thus helping governments borrow money at close to 0% interest rate. All this obviously isn’t reflected in the official inflation numbers.

The other trouble is the way in which official inflation numbers are calculated. The consumer price index which measures inflation is looked at as a definitive measure by economists. But there are problems with the way it is constructed. As a recent report titled Gold Investor: Risk Management and Capital Preservation released by the World Gold Council points out “The weights that different goods and services have in the aforementioned indices do not always correspond to what a household may experience. For example, tuition has been one of the fastest growing expenses for US households but represents only 3% of CPI (consumer price index). In practice, tuition costs correspond to more than 10% of the annual income even for upper-middle American households – and a higher percentage of their consumption.”

An August 2012 World Bank report said between June 2012 to July 2012, corn and wheat prices had risen by 25%. While soybean prices had increased by 17%. During this period inflation in the United States was close to 0%. This led Nielson to quip that “total inflation was supposedly at absolute-zero among the obese U.S. population. Did nobody eat that month…?”

Famed investor Jim Rogers summarised this best in an interview when he said “if you shop in the U.S., you know that there is inflation – whether it’s taxis or tolls or insurance or education or entertainment or food. I mean, the price of everything is going up. It’s only the U.S. Government that says prices aren’t going up…Go and try to buy something. Go see that there is inflation in the U.S. just as there is everywhere else.”

Then there are also methodological changes that have been made to the consumer price index and the way it measures inflation over the years, which in practice do not always reflect the full erosion of the purchasing power of money. If inflation in the United States was still measured as it was in the 1980s, it would be now close to 10% instead of the official 2%.

So yes there is a lot of inflation, it is just that it is not showing up in the government numbers (This link gives a detailed argument). Nielson makes another fundamental point. He says “For me the perversity of the mainstream media acknowledging all the money-printing but refusing to acknowledge currency-dilution is even more fundamental. All of these people are reporting on markets. If a company dilutes its share structure through excessive printing of shares; all of these same analysts would immediately recommend fleeing that company because of “dilution.””

But the same analysts don’t do that when governments print money. “Fiat currencies(i.e. Paper money) are literally nothing but the equivalent of “shares” in our overall economy. Yet when our currencies are diluted (through exponentially increasing money-printing) the concept of “dilution” is — supposedly — impossible for any of these analysts to comprehend,” says Nielson.

As economist Milton Friedman (who was no gold bug) wrote in Money Mischief – Episodes in Monetary History: “Inflation occurs when the quantity of money rises appreciably more rapidly than output, and the more rapid the rise in the quantity of money per unit of output, the greater the rate of inflation. There is probably no other proposition in economics that is as well established as this one.”

To conclude, its worth remembering that just because money printing by government hasn’t produced official inflation till date, doesn’t mean that there will be no high inflation in the time to come. We simply don’t know. And that is something worth remembering.

(The article originally appeared on www.firstpost.com on June 4, 2013)

(Vivek Kaul is a writer. He tweets @kaul_vivek)

It is Sonia who needs to read Rajan’s Economic Survey

Vivek Kaul

Raghuram Govind Rajan, the chief economic advisor to the government of India, likes to talk straight and call a spade a spade. He was the first economist of some standing to take on Alan Greenspan’s economic policies at a public forum. In a conference in 2005, Rajan said “The bottom line is that banks are certainly not any less risky than the past despite their better capitalization, and may well be riskier. Moreover, banks now bear only the tip of the iceberg of financial sector risks…the interbank market could freeze up, and one could well have a full-blown financial crisis.”

This was during the time when the United States of America was in the middle of a real estate bubble. Everyone was having a good time. And no one wanted to spoil the party.

Alan Greenspan hadn’t achieved the ignominy that he now has, and was revered as god, at least in economic circles. Hence, any criticism of the American economy was seen as criticism of Greenspan himself. Given this, Rajan came in for heavy criticism for what he said. But we all know who turned out to be right in the end.

Recalling the occasion Rajan later wrote in his book Fault Lines “I exaggerate only a bit when I say I felt like an early Christian who had wandered into a convention of half-starved lions. As I walked away from the podium after being roundly criticised by a number of luminaries (with a few notable exceptions), I felt some unease. It was not caused by the criticism itself…Rather it was because the critics seemed to be ignoring what going on before their eyes.”

What this tells us is that Rajan doesn’t hesitate in pointing out what is going on before his eyes, even though it might be politically incorrect to do so. This clearly comes out in the Economic Survey for the year 2012-2013. A part of the summary to the first chapter State of the Economy and Prospects reads “With the subsidies bill, particularly that of petroleum products, increasing, the danger that fiscal targets would be breached substantially became very real in the current year. The situation warranted urgent steps to reduce government spending so as to contain inflation.”

The last sentence of the above paragraph makes for a very interesting reading. This is probably the first occasion where a government functionary has conceded that it is the increased government spending during the second term of the UPA that has led to a high inflationary scenario. This is not surprising given that Rajan holds a full time job teaching at the University of Chicago.

Rajan’s thinking is in line with what the late Milton Friedman, a doyen of the University of Chicago, had been talking about since the early 1960s. As Friedman writes in Money Mischief – Episodes in Monetary History: “The recognition that substantial inflation is always and everywhere a monetary phenomenon is only the beginning of an understanding of the cause and cure of inflation…Inflation occurs when the quantity of money rises appreciably more rapidly than output, and the more rapid the rise in the quantity of money per unit of output, the greater the rate of inflation. There is probably no other proposition in economics that is as well established as this one.”

And that is what has happened in India with the government spending more and more money over the last five years. This money has chased the same number of goods and services and thus led to higher prices i.e. inflation.

Rajan has never been a great fan of subsidies and he looks at them as a short term necessity. In an interview I did with him after the release of his book Fault Lines, for the Daily News and Analysis(DNA), I had asked him whether India could afford to be a welfare state, to which he had replied “Not at the level that politicians want it to.”

In another interview that I had done with him in late 2008, for the same newspaper, he had said “There is a real concern in India that government in India is not doing enough of what it should be doing…I don’t agree that we should overspend and run large deficits but I think we should bite the bullet and cut back on subsidies where we can for the larger good of the public investment into agriculture, roads etc.”

This kind of thinking that Rajan is known for clearly comes out in the Economic Survey. The subsidy bill (oil, food and fertilizer primarily) for the current financial year 2012-2013 (i.e. the period between April 1, 2012 and March 31, 2013) is estimated to be at Rs 1,90,015 crore. This has to come down. As the Economic Survey points out “Controlling the expenditure on subsidies will be crucial. Domestic prices of petroleum products, particularly diesel and liquefied petroleum gas (LPG) need to be raised in line with the prices prevailing in international markets. A beginning has already been made with the decision in September 2012 to raise the price of diesel and again in January 2013 to allow oil marketing companies to increase prices in small increments at regular intervals.”

The question is that will this be enough. The amount budgeted for oil subsidies during the course of this financial year was Rs 43,580 crore. These subsidies are given to oil marketing companies because they sell diesel, cooking gas and kerosene at a loss.

The amount budgeted against oil subsidies will not be enough to meet the actual losses. As the Chapter 3 of the Economic Survey points out “The Indian basket crude oil was $107.52 per bbl (April-December) in 2012 and even with the pass through effected in the course of the year, under-recoveries of OMCs surged and were estimated at Rs1,24,854 crore during April-December 2012-13.”

So for the first nine months of the year the oil subsidy bill was more than Rs 81,000 crore off the target. By the end of the financial year this might well touch Rs 1,00,000 crore. This of course will need some clever accounting to hide. Chances are that the finance minister P Chidambaram might move this payment that will have to be made to the oil marketing companies to the next financial year.

Hence it becomes even more important to cut these subsidies in the years to come. As Rajan writes “The crucial lesson that emerges from the fiscal outcome in 2011-12 and 2012-13 is that in times of heightened uncertainties, there is need for continued risk assessment through close monitoring and for taking appropriate measures for achieving better fiscal marksmanship. Openended commitments such as uncapped subsidies are particularly problematic for fiscal credibility because they expose fiscal marksmanship to the vagaries of prices.”

The phrase to mark over here is that ‘open ended commitments such as uncapped subsidies are particularly problematic‘. This is something that Sonia Gandhi, president of the Congress party, and Chairman of UPA wouldn’t want to hear. This specially during a time when Lok Sabha elections are due in a little over a year’s time and this budget is the last occasion which the government can use to continue bribing the Indian public through subsidies.

It will be interesting to see whether the finance minister P Chidambaram takes any of the suggestions put forward by Rajan and his team, when he presents the annual budget tomorrow. Or will this Economic Survey, like many before it, be also confined to the dustbins of history?

The piece originally appeared on www.firstpost.com on February 27, 2013

(Vivek Kaul is a writer. He tweets at @kaul_vivek )

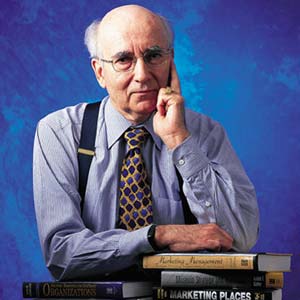

‘The theory of maximizing “shareholder value” has done great harm to businesses’

He is 81 and still going strong. His text book on marketing: Marketing Management is now in its thirteenth edition and still remains an essential read for anyone who hopes to get an MBA degree. He’s often called the father of marketing; something he regards as a compliment, while at the same time ceding the title of the “grandfather of marketing” to management thinker Peter Drucker. Meet Philip Kotler, the S.C. Johnson & Son Distinguished Professor of International Marketing at the Northwestern University Kellogg Graduate School of Management in Chicago. He has been hailed by Management Centre Europe as “the world’s foremost expert on the strategic practice of marketing.” In this freewheeling interview he talks to Vivek Kaul.

Excerpts:

Historically, the vast majority of marketing campaigns have been designed to appeal to our personal needs, lusts, greed or insecurities. To what extent do marketers exploit our human tendencies toward addiction?

Professional marketers see customers as carrying on both mental and emotional processes as they consider purchasing anything. Marketers need to choose the emotional appeal(s) that are relevant to the particular product or service. For a toothpaste, the appeal might be better breath, whiter teeth, or fewer cavities. Or going further, the appeal might be looking sexier, or having longer term dental health. Each competitor must make a choice. In a campaign to get people to stop smoking, one can use a negative appeal (cancer, lung disease, kidney failure) or a positive appeal (better sports performance, living longer for your family). I have advocated using an anti-smoking appeal showing a father who puts out his cigarette when his child comes into view so as not to pass on this bad habit to his children (this is a love appeal). Human emotions range widely and the choice of an appeal is a careful decision that is conditioned by competitors’ appeals and other data. It might seem to the layman that ads often use sex, power, or ego appeals but we could cite many campaigns that use appeals that are less base.

Lately companies have been cutting their marketing budgets, given the troubled times that we are in. Do you think it is a wise move to cut the marketing budget?

That is a panic response and often inappropriate. If competitors decide to cut their marketing budgets, the remaining firm should consider keeping or even increasing its marketing budget. I would go further and sat that a well-heeled firm might even consider buying out some weaker firms during a recession. In normal times, a company finds it hard to move its market share. In recession times, a well-endowed firm can power up its market share. Much depends on the quality of the firm’s products and services. A market leader should consider adding more value rather than cutting its marketing budget. The leader will probably have to alter its messages and media but it doesn’t follow that it needs to cut its marketing budget.

The economist Milton Friedman famously said: “There is one and only one social responsibility of business – to use its resources and engage in activities designed to increase its profits”. What are your thoughts on the social responsibility of marketing?

Milton Friedman was my professor at the University of Chicago and we all admired his brilliance. He was a great believer in leaving businesses unencumbered by regulations and he wanted the leave the business owners to decide what they wanted to do with their profits. I took exception to this view.

Why was that?

Businesses are social organizations that can do great good or great harm. We don’t have to be reminded of the environmental damage companies did by dumping waste into water and pollutants into the air. We don’t have to be reminded of Enron and Madoff and other crooks and pyramid builders. We need appropriate regulations for the competitive system to work. I would argue that companies should go beyond their worship of shareholders who often don’t care about the company and jump in and out of owning its stock. The theory of maximizing “shareholder value” has done great harm to businesses. I have argued that smart companies must focus on the other stakeholders first – customers, employees, suppliers and distributor—and make sure that these stakeholders are all rewarded appropriately and that they work together as a winning team. Satisfying the stakeholders is the best way to maximize the long run profitability of the company. I would propose that as education levels rise in a country, more buyers will expect more from companies and base their brand choices partly on which companies have practiced a caring attitude toward the environment and society. Those companies that operate on the triple bottom line — people, planning and profits – will outperform those who only pursue profit.

A major point in your new book Good Works: ! Marketing and Corporate Initiatives that Build a Better World…and the Bottom Line, is that over the last decade there has been tremendous growth in the number of marketing and corporate initiatives that appeal to our desire to help others or tackle social or environmental problems. Why has this sudden change come about? Can you share some examples with us?

Let’s recognise that societies are facing a growing number of difficult problems – world hunger and poverty, local wars, pollution, environment damage, and faulty education and health systems. Solutions are badly needed. Solutions can only come from the three sectors found in any economy: businesses, NGOs, and government. Today, the governments in most countries are in no condition to solve these problems, given their debt levels and their political impasses. The NGOs have as their purpose to help solve these social problems but are even with less funds available in these recessed times. Business is the only agent of change with the means of doing something to improve the sad state of affairs. The public is increasingly interested in which companies are willing to help make a difference in some of these problems. Consider what Wal-Mart is doing now to reduce air pollution. It is not only ordering the most fuel efficient delivery trucks but now asking its suppliers to change to more efficient trucks or else not be accepted as a supplier. Timberland, the maker of shoes and clothing, does a thorough job of waste reduction and of choosing only suppliers who have good environmental practices. The message is that companies have the capacity to be proactive in making the world a better place for all of us.

What do think are the biggest challenges facing marketing today?

Marketing used to be pretty straight forward. Hire able salespeople and brand managers and a top advertising agency and the team will attract many triers and buyers. Marketers didn’t have much input into the product: their job was to get the product sold. Today the picture is radically different. The social media revolution has diminished the power of advertising and requires new skills in the marketing group to successfully use Facebook, You Tube, Linked in, and Twitter. Buyers are now all-knowing thanks to Google and their Facebook friends and they can get excellent information on different brands and their worth. Companies have to make a basic decision: Should the marketing department basically remain a communication group (one P – Promotion), or a 4P group (Product, Price, Place and Promotion)? I am in favor of giving marketing more power to participate in the product development process, and pricing, and place (distribution decisions).

Could you elaborate on that?

I would go further. The ideal marketing department would be headed by someone with the mindset of Steve Jobs. The Chief Marketing Officer (CMO) would be responsible for identifying the best opportunities for the business for the next five years, calibrating the profitability of the different opportunities, and participating with the other senior officers to make the right choices. The marketing group should know more about what is happening in the marketplace and what is likely to happen over the next few years and therefore be in a position to visualise where the business should be going. I remember that some years ago, GE asked its appliance marketing group to anticipate what will be the size and activities in kitchens in the next five years. The marketers came up with a great number of new ideas, many of which GE Appliance implemented. So the basic choice is whether marketing should remain largely a “service” department dishing out communications or it should be a proactive marketing group helping the company identify its best future opportunities. I sometimes say that a company should have two marketing departments: a large one that is busy selling what the company is making , and a smaller marketing group trying to figure out what the company ought to be making the in the coming years.

What is social marketing? Can you share some examples with us?

In July 1971, Professor Gerald Zaltman and I published “Social Marketing: An Approach to Planned Social Change” in the Journal of Marketing. The question was: “could you sell a cause the way we sell soap.” At the time, there was a lot of interest in how we could help people avert unwanted pregnancies, stop smoking, and say no to drugs. We could imagine creating ads that would change certain beliefs and behaviours. We could imagine making new products and services that would provide solutions in these problem areas. We could imagine distribution arrangements that would reduce the accessibility of unsalutory products or increase the availability of better substitute products and services. We could imagine using price to encourage or discourage certain behaviors. All four Ps would work on these social questions as they have worked in the commercial market.

And things have changed since then?

Since that time, social marketing has become another branch of marketing. There are over 2,000 social marketers operating in the world and addressing social causes of poverty and hunger, health, environment, education, littering, literacy and others. Social marketers don’t stop with advertising: they use a planning framework that applies the ideas of segmentation, targeting and positioning and the 4Ps to craft a workable social marketing plan. Dozens of social marketing examples are described in the 4th edition of Social Marketing that Nancy Lee and I published. There is now a hotline where social marketers interested in working on some social problem can put it out to other social marketers to learn of previous work and results in the same problem area. I believe that social marketing methodology has been a major contributor to the decline of smoking, the practice of birth control, the improvement of the environment, the providing of more health facilities and practitioners in poor countries, and rising rates of literacy.

Your basic training is as an economist. How did you move on to marketing?

Marketing is economics, even if many trained economists don’t recognise or read marketing and ignore the one hundred years of marketing writing. As I majored in economics at the University of Chicago (M.A.) and M.I.T. (Ph.D), I was impressed with the high level of theory but disappointed at the neglect of the real actions taking place in the marketplace. Classical economists didn’t say much about several key forces affecting demand such as sales force, advertising, sales promotion, and public relations. Economists focused mainly on price and how it affects demand and supply. They didn’t say much about distribution and the roles played by wholesalers, jobbers, retailers, agents, brokers and other transactional and facilitating forces. In fact, the first marketing books written around 1910 were written primarily by economists who wanted to bring the role of Promotion and Place into the understanding of markets. Even when economists discussed price, they rarely described how price is set separately by manufacturers, wholesalers, and retailers as price setting moves down the value chain.

So how did you move onto teaching marketing?

When I joined the Kellogg School of Management at Northwestern University, I was given a choice to teach either economics (macro or micro) or marketing. I chose marketing because it brought in all these additional forces that affect demand and supply. Earlier I was in a Ford Foundation program with Jerry McCarthy who was writing his textbook on Basic Marketing and proposing a 4P framework: Product, Price, Place, and Promotion. He was influenced by his professor of marketing at Northwestern University, Richard Clewett who taught Product, Price, Promotion and Distribution (which Jerry renamed Place to get the alliteration of 4Ps). Remember that the 4Ps are demand-shaping forces and should be part of basic economic theory. The interesting development today is that classical economics is undergoing the challenge of a different school of thought, namely behavioural economics. Behavioral economics drops the assumption that producers, middlemen and consumers always make rational decisions. At best there is “bounded rationality” and “satisficing” behavior rather than rational profit maximization. What is most interesting is that “behavioural economics” is just another name for “marketing” and what marketing has been researching for 100 years.

How do you manage to write about marketing from almost every angle?

I recognised early that marketing is a pervasive human activity that goes beyond just trying to sell goods and sales. What is courtship, after all, if not a marketing exercise? What is fundraising, if not a marketing exercise? What about building a stronger brand for your city, if not a marketing exercise? Every celebrity and many professionals are engaged in building and marketing their brand. This led me to want to bridge marketing theory and practice to other things than goods and services. I started to research and write on place marketing, person marketing, cultural areas marketing (museums and performing arts), cause marketing (i.e., social marketing), religious institution marketing, and so on.

(The interview originally appeared in the Daily News and Analysis on August 27,2012. http://www.dnaindia.com/analysis/interview_theory-of-maximising-shareholder-value-has-done-great-harm-to-businesses_1733089))

(Interviewer Kaul is a writer and can be reached at [email protected])