Vivek Kaul

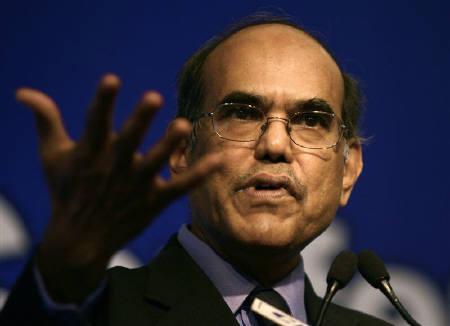

Duvvuri Subbarao, the current governor of the Reserve Bank of India must be a troubled man these days, professionally that is. The gross domestic product (GDP) growth has fallen to 5.3% for the period of January to March 2012. And now he is expected to come to the rescue of the Indian economy by cutting interest rates, so that people and businesses can easily borrow more, and we all can live happily ever after.

Cows would fly, only if it was as simple as that!

The mid quarter review of the monetary policy is scheduled for June 18,2012. On that day the Subbarao led Reserve Bank of India(RBI) is expected to cut the repo rate by at least 50 basis points (one basis point is one hundredth of a percentage). The repo rate is the rate at which banks borrow from the RBI.

Repo rate is a short term interest rate and by cutting this interest rate the RBI tries to manage the other interest rates in the economy, including long term interest rates like the rate at which the bond market lends to the government, the interest offered by banks on their fixed deposits, and the interest charged by banks on long term loans like home loans, and loans to businesses.

But the fact of the matter is it really has no control on these interest rates in the current state of things. To understand why, let us deviate a little.

Greenspan and Clinton

Alan Greenspan and Bill Clinton came from the opposite ends of the political spectrum. Greenspan had been a lifelong Republican whereas Clinton was a Democrat. Unlike India where there are a large number of political parties, America has basically two parties, the Republican Party and the Democratic Party. Greenspan was the Chairman of the Federal Reserve of United States, the American central bank, from 1987 to 2006.

But despite coming from the opposite ends of the political spectrum they got along fabulously well. In fact, when Clinton became the President of America in early 1993, Greenspan approached him with what Americans call a “proposition”.

Greenspan told Clinton that since 1980 the rate of inflation had fallen from a high of around 15% to the current 4%. But during the same period the interest rate on home loans had fallen only by 400 basis points from 13% to 9%. Despite the fact that the Federal Funds Rate (the American equivalent of the Indian repo rate) stood at a low 3%.

Why was the difference between the Federal Funds rate which was a short term interest rate and the home loan interest rate, which was a long term interest rate, so huge?

High fiscal deficit

The difference in interest rates was primarily because of the high fiscal deficit that the government of United States was incurring. Fiscal deficit is the difference between what the government earns and what it spends in a particular year.

When Clinton took over as President on January 20, 1993, the American government had just run a record fiscal deficit amounting to $290.3billion or 4.7% of the GDP for 1992. And this had led to high long term interest rates even though the Federal Reserve had set the short term Federal Funds rate at 3%.

The government was borrowing long term to fund its fiscal deficit. And since its borrowing needs were high because of the large fiscal deficit it needed to offer a higher rate of interest to attract lenders. When the government borrowed more it crowded private borrowing, meaning, there was lesser pool of “savings” for the private borrowers to borrow from.

Hence, banks and other financial institutions which needed to borrow in order to give out home loans had to offer an even higher rate of interest than the government to attract lenders. Even otherwise, the private sector has to offer a higher rate of interest than the government, because lending to the government is deemed to be the safest form of lending. Due to these reasons the difference in short term interest rates and long term interest rates in the US was high. So the repo rate was at 3% and the home loan rate was at 9%.

The proposition

Greenspan was rightly of the opinion that a high fiscal deficit was holding economic growth back. This was the argument he made to President Clinton when he first met him. As Greenspan writes in his autobiography The Age of Turbulence – Adventures in a New World “Long term interest rates were still stubbornly high. They were acting as a brake on economic activity by driving up costs of home mortgages (the American term for home loans) and bond issuance.”

Other than the government which issues bonds to finance its fiscal deficit, companies also issue bonds to raise debt to meet the needs of their business. If interest rates are high companies normally tend to put expansion plans on hold because high interest rates may not make the plan financially viable.

Greenspan’s proposition to Clinton was that if the Wall Street got enough of a hint that the government was serious about bringing down the fiscal deficit, long term interest rates would start to fall . This would be good for the overall economy because at lower interest rates people would borrow more to buy houses and as well as everything else that needs to be bought to make a house a “home”.

As Greenspan writes “Improve investors’ expectations, I told Clinton, and long-term rates could fall, galvanizing the demand for new homes and the appliances, furnishings, and the gamut of consumer items associated with home ownership. Stock values too, would rise, as bonds became less attractive and investors shifted into equities.”

The US Congressional and Budget Office(CBO), a US government agency which provides economic data to the US Congress (the American parliament) to help better decision making, upped its projection of the fiscal deficit at that point of time. It said that the fiscal deficit is likely to reach $360billion a year by 1997. This data point put out by the US CBO helped buttress Greenspan’s point further and Clinton decided to do something about the fiscal deficit.

The Clinton plan

Clinton put out a plan which would cut the deficit by $500billion over a period of four years through a combination of higher tax rates as well as lower spending by the government. The fiscal deficit of the United States of America which had been growing steadily for years, started to fall from 1993. In 1993, it was down by 12% to $255billion. By 1997, the fiscal deficit was down to $21billion. In Clinton’s second term as President, the deficit turned into a surplus, something that had not happened since 1971. Between 1998 and 2001, the US government earned a surplus of $559.4billiondollars.

A lower fiscal deficit led to lower long term interest rates and good economic growth. The United States of America grew at an average rate of 3.9% between 1993 and 2000. In the eight years prior to that the country had grown at an average rate of 2.9% per year. So the US grew at a much faster rate on a higher base because the fiscal deficit was turned into a fiscal surplus.

This was also the period of the dotcom bubble but the fiscal surplus was clearly not the reason for it.

The moral of the story

As we clearly see from the above example, at times there is not much that a central bank can do on the interest rate front, especially when the government is running a high fiscal deficit. As I have often said over the past one month the fiscal deficit of the government of India has increased by 312% between 2007 and 2012. During the same period its income has increased by only 36%. The fiscal deficit target for the current financial year is at Rs Rs 5,13,590 crore, a little lower from the last year’s target. But as we have seen in the past this government has a tendency to miss its fiscal deficit targets regularly. So the government will have to borrow to finance its fiscal deficit and that means an environment in which long term interest rates will remain high.

In fact, some banks have quietly raised the interest rates they charge to their existing home loan borrowers, after the Subbarao led RBI last cut the repo rate by 50 basis points on April 17, 2012.

The interest being charged to some of the existing home loan borrowers has even crossed 14.5%, a difference of more than 6% between a long term interest rate and the repo rate, as was the case in America.

India has another problem which America did not in the early 1990s, high inflation. The consumer price inflation was at 10.36% for the month of April 2012. Urban inflation was at 11.1% whereas rural inflation was just below 10% at 9.86%. If Subbarao goes about cutting the repo rate in a rapid manner, he runs the danger of inciting further inflation.

So the only way out of this mess is to cut subsidies. Cut fuel subsidies. Cut fertilizer subsidies. This of course would mean higher prices in the short term, particularly if diesel prices are raised. An increase in the price of diesel will immediately lead to higher inflation, given that diesel is the major transport fuel, and any increase in its price is passed onto the consumers. The government thus has to make a choice whether it wants high interest rates for the long term or high inflation for the short term. It need not be said it will be a politically difficult decision to make.

Over the longer term it also needs to figure out how to bring more Indians under the tax ambit and lower the portion of the “black” economy in the overall economy. (You can read this in detail here: It’s not Greece: Cong policies responsible for rupee crashhttp://www.firstpost.com/economy/dont-blame-greece-cong-policies-responsible-for-rupees-crash-318280.html)

And there is nothing that RBI can do on any of these fronts. The predicament of the RBI was best explained in a recent column titled Seeking Divine Intervention, written by Rajeev Malik, an economist at CLSA. He said: “There are three institutions that keep India running: the Supreme Court, the Election Commission and the Reserve Bank of India (RBI). To be sure, most of the economic mess in India has the government behind it. And often the RBI is called in as a vacuum cleaner. But even the world’s best vacuum cleaner cannot be successfully used to clean up a garbage dump.”

(The article originally appeared at www.firstpost.com on June 4,2012. http://www.firstpost.com/economy/no-subbarao-wont-be-able-to-clean-upas-garbage-dump-331114.html)

(Vivek Kaul is a writer and can be reached at [email protected])

India

Sonia’s UPA is taking us to new ‘Hindu’ rate of growth

Vivek Kaul

Raj Krishna, a professor at the Delhi School of Economics, came up with the term “Hindu rate of growth” to refer to Indian economy’s sluggish gross domestic product (GDP) growth of 3.5% per year between the 1950s and the 1980s. The phrase has been much used and abused since then.

A misinterpretation that is often made is that Krishna used the term to infer that India grew slowly because it was a nation dominated by Hindus. In fact he never meant anything like that. Krishna was a believer in free markets and wasn’t a big fan of the socialistic model of development put forward by Jawahar Lal Nehru and the Congress party.

In fact he realised over the years looking at the slow economic growth of India that the Nehruvian model of socialism wasn’t really working. This was visible in the India’s secular or long term economic growth rate which averaged around 3.5% during those days.

The word to mark here is “secular”. The word in its common every day usage refers to something that is not specifically related to a particular religion. Like our country India. One of the fundamental rights Indians have is the right to freedom of religion which allows us to practice and propagate any religion.

But the world “secular” has another meaning. It also means a long term trend. Hence when economists like Krishna talk about the secular rate of growth they are talking about the rate at which a country like India has grown year on year, over an extended period of time. And this secular rate of growth in India’s case was 3.5%. This could hardly be called a rate of growth for a country like India which was growing from a very low base and needed to grow at a much faster pace to pull its millions out of poverty.

So Krishna came up with the word “Hindu” which was the direct opposite of the word “secular” to take a dig at Jawahar Lal Nehru and his model of development. Nehru was a big believer in secularism. Hence by using the word “Hindu” Krishna was essentially taking a dig on Nehru and his brand of economic development, and not Hindus.

The policies of socialism and the license quota raj followed by Nehru, his daughter Indira Gandhi and grandson Rajiv ensured that India grew at a very slow rate of growth. While India was growing at a sub 4% rate of growth, South Korea grew at 9%, Taiwan at 8% and Indonesia at 6%. These were countries which were more or less at a similar point where India was in the late 1940s.

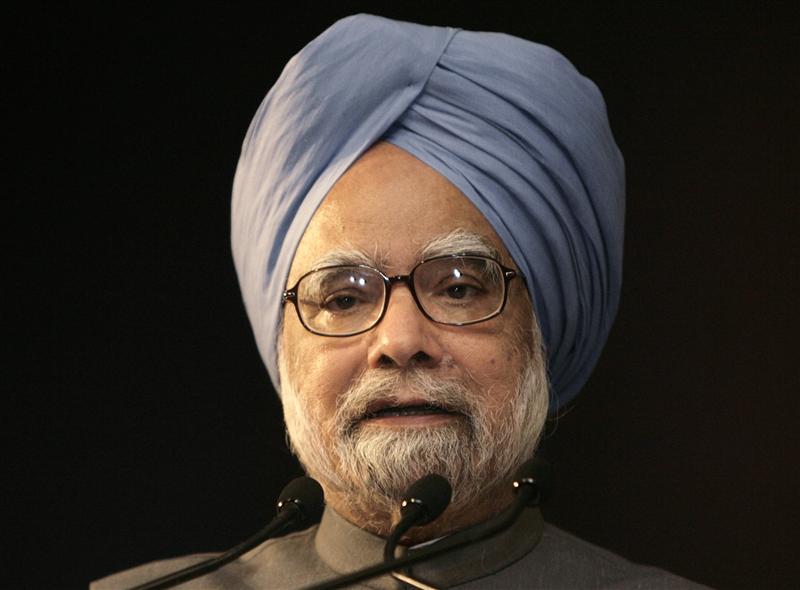

The Indian economic revolution stared in late July 1991, when a certain Manmohan Singh, with the blessings of PV Narsimha Rao, initiated the economic reform process. The country since then has largely grown at the rates of 7-8% per year, even crossing 9% over the last few years.

Over the years this economic growth has largely been taken for granted by the Congress led UPA politicians, bureaucrats and others in decision making positions. Come what may, we will grow by at least 9%. When the growth slipped below 9%, the attitude was that whatever happens we will grow by 8%. When it slipped further, we can’t go below 7% was what those in decision making positions constantly said. On a recent TV show Montek Singh Ahulwalia, the Deputy Chairman of the Planning Commission, kept insisting that a 7% economic growth rate was a given. Turns out it’s not.

The latest GDP growth rate, which is a measure of economic growth, for the period of January to March 2012 has fallen to 5.3%. I wonder, what is the new number, Mr Ahulwalia and his ilk will come up with now. “Come what may we will grow at least by 4%!” is something not worth saying on a public forum.

But chances are that’s where we are headed. As Ruchir Sharma writes in his recent book Breakout Nations – In Pursuit of the Next Economic Miracles “India is already showing some of the warning signs of failed growth stories, including early-onset of confidence.”

The history of economic growth

Sharma’s basic point is that economic growth should never be taken for granted. History has proven otherwise. Only six countries which are classified as emerging markets by the western world have grown at the rate of 5% or more over the last forty years. These countries are Malaysia, Singapore, South Korea, Taiwan, Thailand and Hong Kong. Of these two, Hong Kong and Taiwan are city states with a very small area and population. Hence only four emerging market countries have grown at a rate of 5% or more over the last forty years. Only two of these countries i.e. Taiwan and South Korea have managed to grow at 5% or more for the last fifty years.

“In many ways “mortality rate” of countries is as high as that of stocks. Only four companies – Procter & gamble, General Electric, AT&T, and DuPont- have survived on the Dow Jones index of the top-thirty U.S. industrial stocks since the 1960s. Few front-runners stay in the lead for a decade, much less many decades,” writes Sharma.

The history of economic growth is filled with examples of countries which have flattered to deceive. In the 1950s and 1960s, India and China, the two biggest emerging markets now, were struggling to grow. The bet then was on Iraq, Iran and Yemen. In the 1960s, the bet was Philippines, Burma and Sri Lanka to become the next East Asian tigers. But that as we all know that never really happened.

India is going the Brazil way

Brazil was to the world what China is to it now in the 1960s and the 1970s. It was one of the fastest growing economies in the world. But in the seventies it invested in what Sharma calls a “premature construction of a welfare state”, rather than build road and other infrastructure important to create a viable and modern industrial economy. What followed was excessive government spending and regular bouts of hyperinflation, destroying economic growth.

India is in a similar situation now. Over the last five years the Congress party led United Progressive Alliance is trying to gain ground which it has lost to a score of regional parties. And for that it has been very aggressively giving out “freebies” to the population. The development of infrastructure like roads, bridges, ports, airports, education etc, has all taken a backseat.

But the distribution of “freebies” has led to a burgeoning fiscal deficit. Fiscal deficit is the difference between what a government earns and what it spends.

For the financial year 2007-2008 the fiscal deficit stood at Rs 1,26,912 crore against Rs 5,21,980 crore for the current financial year. In a time frame of five years the fiscal deficit has shot up by nearly 312%. During the same period the income earned by the government has gone up by only 36% to Rs 7,96,740 crore. The huge increase in fiscal deficit has primarily happened because of the subsidy on food, fertilizer and petroleum.

This has meant that the government has had to borrow more and this in turn has pushed up interest rates leading to higher EMIs. It has also led to businesses postponing expansion because higher interest rates mean that projects may not be financially viable. It has also led to people borrowing lesser to buy homes, cars and other things, leading to a further slowdown in a lot of sectors. And with the government borrowing so much there is no way the interest rate can come down.

As Sharma points out: “It was easy enough for India to increase spending in the midst of a global boom, but the spending has continued to rise in the post-crisis period…If the government continues down this path India, may meet the same fate as Brazil in the late 1970s, when excessive government spending set off hyperinflation and crowded out private investment, ending the country’s economic boom.”

Where are the big ticket reforms?

India reaped a lot of benefits because of the reforms of 1991. But it’s been 21 years since then. A new set of reforms is needed. Countries which have constantly grown over the years have shown to be very reform oriented. “In countries like South Korea, China and Taiwan, they consistently had a plan which was about how do you keep reforming. How do you keep opening up the economy? How do you keep liberalizing the economy in terms of how you grow and how you make use of every crisis as an opportunity?” says Sharma.

India has hardly seen any economic reform in the recent past. The Direct Taxes Code was initiated a few years back has still not seen the light of day, but even if it does see the light of day, it’s not going to be of much use. In its original form it was a treat to read with almost anyone with a basic understanding of English being able to read and understand it. The most recent version has gone back to being the “Greek” that the current Income Tax Act is.

It has been proven the world over that simpler tax systems lead to greater tax revenues. Then the question is why have such complicated income tax rules? The only people who benefit are CAs and the Indian Revenue Service officers.

Opening up the retail sector for foreign direct investment has not gone anywhere for a long time. This is a sector which is extremely labour intensive and can create a lot of employment.

What about opening up the aviation sector to foreigners instead of pumping more and more money into Air India? As Warren Buffett wrote in a letter to shareholders of Berkshire Hathaway, the company whose chairman he is, a few years back “The worst sort of business is one that grows rapidly, requires significant capital to engender the growth, and then earns little or no money. Think airlines. Here a durable competitive advantage has proven elusive ever since the days of the Wright Brothers. Indeed, if a farsighted capitalist had been present at Kitty Hawk, he would have done his successors a huge favor by shooting Orville down…The airline industry’s demand for capital ever since that first flight has been insatiable. Investors have poured money into a bottomless pit, attracted by growth when they should have been repelled by it.”

If foreigners want to burn their money running airlines in India why should we have a problem with it?

The insurance sector is bleeding and needs more foreign money, but there is a cap of 26% on foreign investment in an insurance company. Again this limit needs to go up. The sector very labour intensive and has potential to create employment. The same is true about the print media in India.

The list of pending economic reforms is endless. But in short India needs much more economic reform in the days to come if we hope to grow at the rates of growth we were growing.

To conclude

Raj Krishna was a far sighted economist. He knew that the Nehruvian brand of socialism was not working. It never has. It never did. And it never will. But somehow the Congress party’s fascination for it continues. And in continuance of that, the party is now distributing money to the citizens of India through the various so called “social-sector” schemes. If economic growth could be created by just distributing money to everyone, then India would have been a developed nation by now. But that’s not how economic growth is created. The distribution of money creates is higher inflation which leads to higher interest rates and in turn lower economic growth. Also India is hardly in a position to become a welfare state. The government just doesn’t earn enough to support the kind of money it’s been spending and plans to spend.

Its time the mandarins who run the Congress party and effectively the country realize that. Or rate of growth of India’s economy (measured by the growth in GDP) will continue to fall. And soon it will be time to welcome the new “Hindu” rate of economic growth. And how much shall that be? Let’s say around 3.5%.

(The article originally appeared at www.firstpost.com on June 1,2012. http://www.firstpost.com/politics/sonias-upa-is-taking-us-to-new-hindu-rate-of-growth-328428.html)

(Vivek Kaul is a writer and can be reached at [email protected])

Higher Oil Prices or Higher EMIs? Take your pick

Vivek Kaul

The petrol prices were raised by Rs 6.28 per litre yesterday. With taxes the total comes to Rs 7.54 per litre. Let’s try and understand what impact this increase in prices will have.

The primary beneficiary of this increase will be the oil marketing companies like Indian Oil, Bharat Petroleum and Hindustan Petroleum. The companies had been losing Rs 6.28 per litre of petrol they sold. Since December, when prices were last raised the companies had lost $830million in total. With the increase in prices the companies will not lose money when they sell petrol.

The increase in price will have no impact on the fiscal deficit of the government. The fiscal deficit is the difference between what the government spends and what it earns. The government does not subsidize the oil marketing companies for the losses they make on selling petrol.

It subsidizes them for losses made on selling diesel, kerosene and LPG, below cost.

The losses on account of this currently run at Rs 512 crore a day. The loss last year to these companies because of selling diesel, kerosene and LPG below cost was at Rs 138,541crore. They were compensated for this loss by the government. Out of this the government got the oil and gas producing companies like ONGC, Oil India Ltd and GAIL to pick up a tab of Rs 55,000 crore. The remaining Rs 83,000 odd crore came from the coffers of the government.

What is interesting that when the budget was presented in March, the oil subsidy bill for the year 2011-2012 (from April 1, 2011 to March 31,2012) was expected to be at around Rs 68,500 crore. The final number was Rs 14,500 crore higher.

The losses for this financial year (from April 1, 2012 to March 31,2012) are expected to be at Rs Rs. 193,880 crore. If the losses are divided between the government and the oil and gas producing companies in the same ratio as last year, then the government will have to compensate the oil marketing companies with around Rs 1,14,000 crore. The remaining money will come from the oil and gas producing companies.

The trouble is in two fronts. It will pull down the earnings of the oil and gas producing companies. But that’s the smaller problem. The bigger problem is it will push up the fiscal deficit. If we look at the assumptions made in the budget for the current financial year, the oil subsidies have been assumed at Rs Rs 43,580 crore. If the government has to compensate the oil marketing companies to the extent of Rs 1,14,000 crore, it means that the fiscal deficit will be pushed up by around Rs 70,000 crore more (Rs 1,14,000crore minus Rs 43,580 crore), assuming all other expenses remain the same.

A higher fiscal deficit would mean that the government would have to borrow more. A higher government borrowing will ‘crowd-out’ the private borrowing and push interest rates higher. This would mean higher equated monthly installments(EMIs) for people who have loans to pay off or are even thinking of borrowing.

The only way of bringing down the interest rates is to bring down the fiscal deficit. The fiscal deficit target for the financial year 2012-2013 has been set at Rs 5,13,590 crore. The government raises this money from the financial system by issuing bonds which pay interest and mature at various points of time. Of this amount that the government will raise, it will spend Rs 3,19,759 crore to pay interest on the debt that it already has. Rs 1,24,302 crore will be spent to payback the debt that was raised in the previous years and matures during the course of the year 2012-2013. Hence a total of Rs 4,44,061 crore or a whopping 86.5% of the fiscal deficit will be spent in paying interest on and paying off previously issued debt. This is an expenditure that cannot be done away with.

The other major expenditure for the government during the course of the year are subsidies. The total cost of subsidies during the course of this year has been estimated to be at Rs Rs 1,90,015 crore. The subsidies are basically of three kinds: oil, food and petroleum. The food subsidy is at Rs 75,000 crore. This is a favourite with Sonia Gandhi and hence cannot be lowered. And more than that there is a humanitarian angle to it as well.

The fertizlier subsidies have been estimated at Rs 60,974 crore. This is a political hot potato and any attempts to cut this in the pst have been unsuccessful and have had to be rolled back. There are other subsidies amounting to Rs 10,461 crore which are minuscule in comparison to the numbers we are talking about.

This leaves us with oil subsidies which have been estimated to be at Rs 43,580 crore. This as we see will be overshot by a huge level, if oil prices continue to be current levels. Even if prices fall a little, the subsidy will not come down by much. .

Hence if the government has to even maintain its deficit (forget bringing it down) the only way out currently is to increase the price of diesel, LPG and kerosene. Diesel is a transport fuel and an increase in its price will push prices inflation in the short term. But maintain the fiscal deficit will at least keep interest rates at their current levels and not push them up from their already high levels.

If the government continues to subsidize diesel, LPG and kerosene, interest rates are bound to go up because it will have to borrow more. This will mean higher EMIs for sure. It would also mean businesses postponing expansion because higher interest rates would mean that projects may not be financially viable. It would also mean people borrowing lesser to buy homes, cars and other things, leading to a further slowdown in a lot of sectors. In turn it would mean lower economic growth.

That’s the choice the government has to make. Does it want the citizens of this country to pay higher fuel and gas prices? Or does it want them to pay higher EMIs? There is no way of providing both.

(The article originally appeared at www.rediff.com on May 24,2012. http://www.rediff.com/business/slide-show/slide-show-1-special-higher-oil-prices-or-higher-emis-take-your-pick/20120524.htm)

(Vivek Kaul is a writer and can be reached at [email protected])

Petrol bomb is a dud: If only Dr Singh had listened…

Vivek Kaul

The Congress led United Progressive Alliance (UPA) government finally acted hoping to halt the fall of the falling rupee, by raising petrol prices by Rs 6.28 per litre, before taxes. Let us try and understand what will be the implications of this move.

Some relief for oil companies:

The oil companies like Indian Oil Company (IOC), Bharat Petroleum (BP) and Hindustan Petroleum(HP) had been selling oil at a loss of Rs 6.28 per litre since the last hike in December. That loss will now be eliminated with this increase in prices. The oil companies have lost $830million on selling petrol at below its cost since the prices were last hiked in December last year. If the increase in price stays and is not withdrawn the oil companies will not face any further losses on selling petrol, unless the price of oil goes up and the increase is not passed on to the consumers.

No impact on fiscal deficit:

The government compensates the oil marketing companies like Indian Oil, BP and HP, for selling diesel, LPG gas and kerosene at a loss. Petrol losses are not reimbursed by the government. Hence the move will have no impact on the projected fiscal deficit of Rs 5,13,590 crore. The losses on selling diesel, LPG and kerosene at below cost are much higher at Rs 512 crore a day. For this the companies are compensated for by the government. The companies had lost Rs 138,541 crore during the last financial year i.e.2011-2012 (Between April 1,2011 and March 31,2012).

Of this the government had borne around Rs 83,000 crore and the remaining Rs 55,000 crore came from government owned oil and gas producing companies like ONGC, Oil India Ltd and GAIL.

When the finance minister Pranab Mukherjee presented the budget in March, the oil subsidies for the year 2011-2012 had been expected to be at Rs Rs 68,481 crore. The final bill has turned out to be at around Rs 83,000 crore, this after the oil producing companies owned by the government, were forced to pick up around 40% of the bill.

For the current year the expected losses of the oil companies on selling kerosene, LPG and diesel at below cost is expected to be around Rs 190,000 crore. In the budget, the oil subsidy for the year 2012-2013, has been assumed to be at Rs 43,580 crore. If the government picks up 60% of this bill like it did in the last financial year, it works out to around Rs 114,000 crore. This is around Rs 70,000 crore more than the oil subsidy that the government has budgeted for.

Interest rates will continue to remain high

The difference between what the government earns and what it spends is referred to as the fiscal deficit. The government finances this difference by borrowing. As stated above, the fiscal deficit for the year 2012-2013 is expected to be at Rs 5,13,590 crore. This, when we assume Rs 43,580crore as oil subsidy. But the way things currently are, the government might end up paying Rs 70,000 crore more for oil subsidy, unless the oil prices crash. The amount of Rs 70,000 crore will have to be borrowed from financial markets. This extra borrowing will “crowd-out” the private borrowers in the market even further leading to higher interest rates. At the retail level, this means two things. One EMIs will keep going up. And two, with interest rates being high, investors will prefer to invest in fixed income instruments like fixed deposits, corporate bonds and fixed maturity plans from mutual funds. This in other terms will mean that the money will stay away from the stock market.

The trade deficit

One dollar is worth around Rs 56 now, the reason being that India imports more than it exports. When the difference between exports and imports is negative, the situation is referred to as a trade deficit. This trade deficit is largely on two accounts. We import 80% of our oil requirements and at the same time we have a great fascination for gold. During the last financial year India imported $150billion worth of oil and $60billion worth of gold. This meant that India ran up a huge trade deficit of $185billion during the course of the last financial year. The trend has continued in this financial year. The imports for the month of April 2012 were at $37.9billion, nearly 54.7% more than the exports which stood at $24.5billion.

These imports have to be paid for in dollars. When payments are to be made importers buy dollars and sell rupees. When this happens, the foreign exchange market has an excess supply of rupees and a short fall of dollars. This leads to the rupee losing value against the dollar. In case our exports matched our imports, then exporters who brought in dollars would be converting them into rupees, and thus there would be a balance in the market. Importers would be buying dollars and selling rupees. And exporters would be selling dollars and buying rupees. But that isn’t happening in a balanced way.

What has also not helped is the fact that foreign institutional investors(FIIs) have been selling out of the stock as well as the bond market. Since April 1, the FIIs have sold around $758 million worth of stocks and bonds. When the FIIs repatriate this money they sell rupees and buy dollars, this puts further pressure on the rupee. The impact from this is marginal because $758 million over a period of more than 50 days is not a huge amount.

When it comes to foreign investors, a falling rupee feeds on itself. Lets us try and understand this through an example. When the dollar was worth Rs 50, a foreign investor wanting to repatriate Rs 50 crore would have got $10million. If he wants to repatriate the same amount now he would get only $8.33million. So the fear of the rupee falling further gets foreign investors to sell out, which in turn pushes the rupee down even further.

What could have helped is dollars coming into India through the foreign direct investment route, where multinational companies bring money into India to establish businesses here. But for that the government will have to open up sectors like retail, print media and insurance (from the current 26% cap) more. That hasn’t happened and the way the government is operating currently, it is unlikely to happen.

The Reserve Bank of India does intervene at times to stem the fall of the rupee. This it does by selling dollars and buying rupee to ensure that there is adequate supply of dollars in the market and the excess supply of rupee is sucked out. But the RBI does not have an unlimited supply of dollars and hence cannot keep intervening indefinitely.

What about the trade deficit?

The trade deficit might come down a little if the increase in price of petrol leads to people consuming less petrol. This in turn would mean lesser import of oil and hence a slightly lower trade deficit. A lower trade deficit would mean lesser pressure on the rupee. But the fact of the matter is that even if the consumption of petrol comes down, its overall impact on the import of oil would not be that much. For the trade deficit to come down the government has to increase prices of kerosene, LPG and diesel. That would have a major impact on the oil imports and thus would push down the demand for the dollar. It would also mean a lower fiscal deficit, which in turn will lead to lower interest rates. Lower interest rates might lead to businesses looking to expand and people borrowing and spending that money, leading to a better economic growth rate. It might also motivate Multi National Companies (MNCs) to increase their investments in India, bringing in more dollars and thus lightening the pressure on the rupee. In the short run an increase in the prices of diesel particularly will lead higher inflation because transportation costs will increase.

Freeing the price

The government had last increased the price of petrol in December before this. For nearly five months it did not do anything and now has gone ahead and increased the price by Rs 6.28 per litre, which after taxes works out to around Rs 7.54 per litre. It need not be said that such a stupendous increase at one go makes it very difficult for the consumers to handle. If a normal market (like it is with vegetables where prices change everyday) was allowed to operate, the price of oil would have risen gradually from December to May and the consumers would have adjusted their consumption of petrol at the same pace. By raising the price suddenly the last person on the mind of the government is the aam aadmi, a term which the UPAwallahs do not stop using time and again.

The other option of course is to continue subsidize diesel, LPG and kerosene. As a known stock bull said on television show a couple of months back, even Saudi Arabia doesn’t sell kerosene at the price at which we do. And that is why a lot of kerosene gets smuggled into neighbouring countries and is used to adulterate diesel and petrol.

If the subsidies continue it is likely that the consumption of the various oil products will not fall. And that in turn would mean oil imports would remain at their current level, meaning that the trade deficit will continue to remain high. It will also mean a higher fiscal deficit and hence high interest rates. The economic growth will remain stagnant, keeping foreign businesses looking to invest in India away.

Manmohan Singh as the finance minister started India’s reform process. On July 24, 1991, he backed his “then” revolutionary proposals of opening up India’s economy by paraphrasing Victor Hugo: “No power on Earth can stop an idea whose time has come.”

Good economics is also good politics. That is an idea whose time has come. Now only if Mr Singh were listening. Or should we say be allowed to listen..

(The article originally appeared at www.firstpost.com on May 24,2012. http://www.firstpost.com/economy/petrol-bomb-is-a-dud-if-only-dr-singh-had-listened-319594.html)

(Vivek Kaul is a writer and can be reached at [email protected])

It’s not Greece: Cong policies responsible for rupee crash

Vivek Kaul

All is well in India under the rule of the “Gandhi” family. That’s what the Finance Minister Pranab Mukjerjee has been telling us. And the rupee’s fall against the dollar is primarily because of problems in Greece. And Spain. And Europe. And other parts of the world. As I write this one dollar is worth around Rs 55 (actually Rs 54.965 to be precise, but we can ignore a few decimal points). The rupee has fallen around 22% in value against the dollar in the last one year.

The larger view among analysts and experts who track the foreign exchange market is that a dollar will soon be worth Rs 60. And by then there might be problems in some other part of the world and the rupee’s fall might be blamed on the problems there. As a late professor of mine used to say, with a wry smile on his face “Since we are all born on this mother earth, there is some sort of symbiosis between us.”

So let’s try and understand why the underlying logic to the rupee’s fall against the dollar is not as simple as it is made out to be.

Dollar is the safe haven

As economic problems have come to the fore in Europe (As I have highlighted in If PIIGS have to fly they will have to exit the Euro http://www.firstpost.com/world/if-piigs-have-to-fly-they-will-need-to-exit-the-euro-314589.html) the large institutional investors have moved out of the Euro into the dollar. A year back one dollar was worth €0.71, now it’s worth €0.78. So the dollar has gained against the Euro, no doubt.

But the argument being made is that this is global trend and that dollar has gained in value against lot of other major currencies. Is that true? A year back one dollar was worth 0.88 Swiss Francs, now it is worth 0.93 Swiss Francs. So it has gained in value against the Swiss currency.

What about the British pound? A year back the dollar was worth £0.62, now it’s worth £0.63. Hence the dollar has barely moved against the pound. A dollar was worth around 82 Japanese yen around a year back. Now it’s worth around 79.5yen. It has lost value against the Japanese yen. The dollar has gained in value against the Brazilian Real. It was worth around 1.63real a year back. It is now worth over 2 real. So yes, the dollar has gained in value against the other currencies but not against all currencies.

What is ironic is that the world at large is considering dollar to be a safe haven and moving money into it, by buying bonds issued by the American government. The debt of the US government is now around $14.6trillion, which is almost equal to the US gross domestic product of $15trillion. But since everyone considers it to be a safe haven it has become a safe haven.

But let’s get back to the point at hand. So, not all currencies have lost value against the dollar and those that have lost value, have lost it in varying degrees. This tells us that there are other individual issues at play as well when it comes to currencies losing value against the dollar.

What is happening in India?

The Indian government has been spending much more money than it has been earning over the last few years. In other words the fiscal deficit of the government has been on its way up. For the financial year 2007-2008 (i.e. the period between April 1,2007 and March 31, 2008) the fiscal deficit stood at Rs 1,26,912 crore. This shot up to Rs 5,21,980 crore for the financial year 2011-2012. In a time frame of five years the fiscal deficit has shot up by nearly 312%. During the same period the income earned by the government has gone up by only 36% to Rs 7,96,740 crore. The fiscal deficit targeted for the current financial year 2012-2013(i.e. between April 1, 2012 and March 31,2013) is a little lower at Rs 5,13,590 crore. The huge increase in fiscal deficit has primarily happened because of the subsidy on food, fertilizer and petroleum.

The tendency to overshoot

Also it is highly likely that the government might overshoot its fiscal deficit target like it did last year. In his budget speech last year Pranab Mukherjee had set the fiscal deficit target for the financial year 2011-2012, at 4.6% of GDP. He missed his target by a huge margin when the real number came in at 5.9% of GDP. The major reason for this was the fact that Mukherjee had underestimated the level of subsidies that the government would have to bear. He had estimated the subsidies at Rs 1,43,750 crore but they ended up costing the government 50.5% more at Rs 2,16,297 crore.

Generally all the three subsidies of food, fertilizer and petroleum are underestimated, but the estimates on the oil subsidies are way off the mark. For the year 2011-2012, oil subsidies were assumed to be at Rs 23,640crore. They came in at Rs 68,481 crore. This has been the case in the past as well. In 2010-2011 (i.e. the period between April 1, 2010 and March 31, 2011) he had estimated the oil subsidies to be at Rs 3108 crore. They finally came in 20 times higher at Rs 62,301 crore. Same was the case in the year 2009-2010 (i.e. the period between April 1, 2009 and March 31, 2010). The estimate was Rs 3109 crore. The real bill came in nearly eight times higher at Rs 25,257 crore (direct subsidies + oil bonds issued to the oil companies).

The increasing fiscal deficit

The fiscal deficit has gone up over the years primarily because an increase in expenditure has not been matched with an increase in revenue. Revenue for the government means various forms of taxes and other forms of revenue like selling stakes in public sector enterprises.

The fact of the matter is that Indians do not like to pay income tax or any other kind of tax. This a throw back from the days of the high income tax rate in the 60s, 70s and the 80s, when a series of Finance Ministers (from C D Deshmukh to Yashwantrao Chavan and bureaucrats like Manmohan Singh) implemented high income tax rates in the hope that taxing the “rich” would solve all of India’s problems.

In the early 1970s the highest marginal rate of tax was 97%. The story goes that JRD Tata sold some property every year to pay taxes (income tax plus wealth tax) which worked out to be more than his yearly income. Of course everybody was not like the great JRD, and because of the high tax rates implemented by various Congress governments over the years, a major part of the Indian economy became black. Dealings were carried out in cash. Transactions were made but they were never recorded, because if they were recorded tax would have to be paid on them.

A series of exemptions were granted to corporate India as well, and companies like Reliance Industries did not pay any income tax for years. As a result of this India and Indians did not and do not like paying tax.

Various lobbies have also emerged which have ensured that those that they represent are not taxed. As Professor Amartya Sen wrote in a column in The Hindu earlier this year “It is worth asking why there is hardly any media discussion about other revenue-involving problems, such as the exemption of diamond and gold from customs duty, which, according to the Ministry of Finance, involves a loss of a much larger amount of revenue (Rs.50,000 crore per year)”.

As he further points out “The total “revenue forgone” under different headings, presented in the Ministry document, an annual publication, is placed at the staggering figure of Rs.511,000 crore per year. This is, of course, a big overestimation of revenue that can be actually obtained (or saved), since many of the revenues allegedly forgone would be difficult to capture — and so I am not accepting that rosy evaluation.”

But even with the overestimation the fact of the matter is that a lot of tax that can be collected from those who can pay is not being collected, and that of course means a higher fiscal deficit.

The twin deficit hypothesis

The hypothesis basically states that as the fiscal deficit of the country goes up its trade deficit (i.e. the difference between its exports and imports) also goes up. Hence when a government of a country spends more than what it earns, the country also ends up importing more than exporting.

But why is that? The fiscal deficit goes up because the increase in expenditure is not matched by an increase in taxes. This leaves people with a greater amount of money in their hands. Some portion of this money is used towards buying goods and services, which might be imported from abroad. This leads to greater imports and thus a higher trade deficit. The situation in India is similar. The government of India has been spending more than it has been earning without matching the increase in income with higher taxes, which in turn has led to increasing incomes and that to some extent has been responsible for an increase in Indian imports. But that could have hardly been responsible for the trade deficit of $185billion that India ran in 2011-2012. The imports for the month of April 2012 were at $37.9billion, nearly 54.7% more than the exports which stood at $24.5billion. So the trend has continued even in this financial year.

The golden oil shock

India exports a major part of its oil needs. On top of that it is obsessed with gold. Last year we imported 1000 tonnes of it. Very little of both these commodities priced in dollars is dug up in India. So we have to import them.

This pushes up our imports and makes them greater than our exports. These imports have to be paid for in dollar. When payments are to be made importers buy dollars and sell rupees. When this happens, the foreign exchange market has an excess supply of rupees and a short fall of dollars. This leads to rupee losing value against the dollar. In case our exports matched our imports, then exporters who brought in dollars would be converting them into rupees, and thus there would be a balance in the market. Importers would be buying dollars and selling rupees. And exporters would be selling dollars and buying rupees. But that isn’t happening in a balanced way.

This to some extent explains the current rupee dollar rate of $1 = Rs 55. The Reserve Bank of India does intervene at times to stem the fall of the rupee. This it does by selling dollars and buying rupee. But the RBI does not have an unlimited supply of dollars and hence cannot keep intervening indefinitely.

As mentioned earlier the major part of the trade deficit is because of the fact that we need to import oil. Oil prices have been high for the last few years, though recently they have fallen. Oil is sold in dollars. Hence when India needs to buy oil it needs to pay in dollars. But with the rupee constantly losing value against the dollar, it means that Indian companies have to more per barrel of oil in rupees.

The government of India does not pass on a major part of the increase in the price of oil to the end consumer and hence subsidizes the prices of diesel, LPG, kerosene etc. This means that the oil companies have to sell these products at a loss to the consumer. The government in turn compensates these companies for the loss. This leads to the expenditure of the government going up and hence it incurs a higher fiscal deficit.

No passing the buck

If the government had not subsidized prices of oil products and passed them onto the end consumer, their consumption would have come down. With prices of oil products not rising as much as they should people have not adjusted their consumption accordingly. An increase in price typically leads to a fall in demand. If the increased price of oil had been passed onto the end consumer, the demand for oil would have come down. This would have meant that a fewer number of dollars would have been required to pay for the oil being imported, in turn leading to a lower trade deficit and hence lesser pressure on the rupee-dollar rate.

So let me summarise the argument I am making. The higher fiscal deficit in the form of subsidies has pushed up the trade deficit which in turn has led to rupee losing value against the dollar. The solution is to get consumers to pay the “right” price. With this the fiscal deficit can be brought down to some extent. If these products are priced correctly, their consumption is likely to come down as well in the near future, given that their prices will go up. Lower consumption is likely to lead to lower imports and thus a lower trade deficit. A lower trade deficit would also mean that the fall of the rupee against the dollar may stop. This in turn would mean a lower price for the oil we import in rupee terms and that in turn help overall economic growth. A lower fiscal deficit will lead to lower government borrowing and hence lesser “crowding out” and so lower interest rates, which might get corporates and individuals interested in borrowing again.

The long term solution

What has been suggested above is a short term solution, which given the way the Congress led UPA government operates is unlikely to be implemented. The main problem is that while it’s quite a noble idea to provide subsidies in the form of food, fertilizer, kerosene etc to the India’s poor, it has to be matched with an increase in taxes. An increase in income taxes rates isn’t going to help much because only a minuscule portion of India pays income tax (basically the salaried class).

What is needed is to get larger number of people to pay tax to pay for all the subsidies that are doled out. This can be done by simplifying the income tax act. This was tried when the government tried to come up with the Direct Taxes Code(DTC), which was very simple and straightforward and had done away with most exemptions. In its original form the DTC was a pleasure to read. But of course if it had been implemented scores of people who do not pay income tax would have to pay income tax. In its current form the DTC is another version of Income Tax Act.

Another way is to target specific communities of people who do not pay income tax even though they earn a huge amount of money, but all in “black”. For starters the targeting property dealers that line up almost every street in Delhi might be a good idea. Once, people see that the government is serious about collecting taxes, they are more likely to pay up than not. And there is no better way than starting with the capital.

(The article originally appeared at www.firstpost.com on May 23,2012. http://www.firstpost.com/economy/dont-blame-greece-cong-policies-responsible-for-rupees-crash-318280.html)

(Vivek Kaul is a writer and he can be reached at [email protected])