The government has a certain theory on gold as per which buying gold is harmful for the Indian economy. Allow me to elaborate starting with something that P Chidambaram, the union finance minister, recently said “I…appeal to the people to moderate the demand for gold.”

India produces very little of the gold it consumes and hence imports almost all of it. Gold is bought and sold internationally in dollars. When someone from India buys gold internationally, Indian rupees are sold and dollars are bought. These dollars are then used to buy gold.

So buying gold pushes up demand for dollars. This leads to the dollar appreciating or the rupee depreciating. A depreciating rupee makes India’s other imports, including our biggest import i.e. oil, more expensive.

This pushes up the trade deficit (the difference between exports and imports) as well as our fiscal deficit (the difference between what the government earns and what it spends).

The fiscal deficit goes up because as the rupee depreciates the oil marketing companies(OMCs) pay more for the oil that they buy internationally. This increase is not totally passed onto the Indian consumer. The government in turn compensates the OMCs for selling kerosene, cooking gas and diesel, at a loss. Hence, the expenditure of the government goes up and so does the fiscal deficit. A higher fiscal deficit means greater borrowing by the government, which crowds out private sector borrowing and pushes up interest rates. Higher interest rates in turn slow down the economy.

This is the government’s theory on gold and has been used to in the recent past to hike the import duty on gold to 6%. But what the theory doesn’t tells us is why do Indians buy gold in the first place? The most common answer is that Indians buy gold because we are fascinated by it. But that is really insulting our native wisdom.

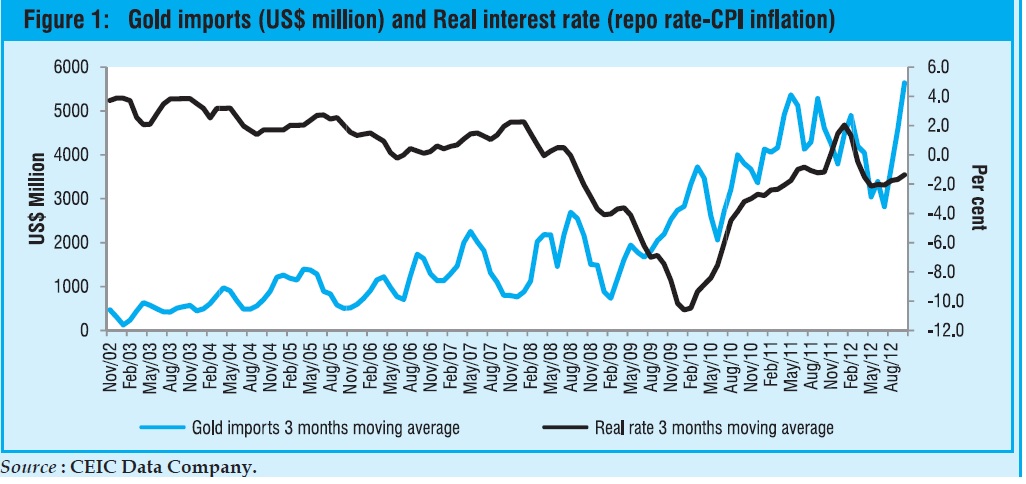

World over gold is bought as a hedge against inflation. This is something that the latest economic survey authored under aegis of Raghuram Rajan, the Chief Economic Advisor to the government, recognises. So when inflation is high, the real returns on fixed income investments like fixed deposits and banks is low. As the Economic Survey puts it “High inflation reduces the return on other financial instruments. This is reflected in the negative correlation between rising(gold) imports and falling real rates.”(as can be seen from the accompanying table at the start)

In simple English, people buy gold when inflation is high and the real return from fixed income investments is low. That has precisely what has happened in India over the last few years. “The overarching motive underlying the gold rush is high inflation…High inflation may be causing anxious investors to shun fixed income investments such as deposits and even turn to gold as an inflation hedge,” the Survey points out.

High inflation in India has been the creation of all the subsidies that have been doled out by the UPA government. As the Economic Survey puts it “With the subsidies bill, particularly that of petroleum products, increasing, the danger that fiscal targets would be breached substantially became very real in the current year. The situation warranted urgent steps to reduce government spending so as to contain inflation.”

Inflation thus is a creation of all the subsidies being doled out, says the Economic Survey. And to stop Indians from buying gold, inflation needs to be controlled. “The rising demand for gold is only a “symptom” of more fundamental problems in the economy. Curbing inflation, expanding financial inclusion, offering new products such as inflation indexed bonds, and improving saver access to financial products are all of paramount importance,” the Survey points out. So if Indians are buying gold despite its high price and imposition of import duty, they are not be blamed.

A shorter version of this piece appeared in the Daily News and Analysis on February 28, 2013

(Vivek Kaul is a writer. He tweets @kaul_vivek)

Dollar

How Mamata is denting the rupee and bloating the oil bill

Vivek Kaul

A major reason for announcing the so called economic reforms that the Manmohan Singh UPA government did over the last weekend was to get India’s burgeoning oil subsidy bill which was expected to cross Rs 1,90,000 crore during the course of the year, under some control.

One move was the increase in diesel price by Rs 5 per litre and limiting the number of cooking gas cylinders that one could get at the subsidisedprice to six per year. This was a direct step to reduce the loss that the oil marketing companies (OMCs) face every time they sell diesel and cooking gas to the end consumer.

The other part of the reform game was about expectations management. The announcement of reforms like allowing foreign direct investment in multi-brand foreign retailing or the airline sector was not expected to have any direct impact anytime soon. But what it was expected to do was shore up the image of the government and tell the world at large that this government is committed to economic reform.

Now how does that help in controlling the burgeoning oil bill?

Oil is sold internationally in dollars. The price of the Indian basket of crude oil is currently quoting at around $115.3 per barrel of oil (one barrel equals around 159litres).

Before the reforms were announced one dollar was worth around Rs 55.4(on September 13, 2012 i.e.). So if an Indian OMC wanted to buy one barrel of oil it had to convert Rs 6387.2 into $115.3 dollars, and pay for the oil.

After the reforms were announced the rupee started increasing in value against the dollar. By September 17, one dollar was worth around Rs 53.7. Now if an Indian OMC wanted to buy one barrel of oil it had to convert Rs 6191.6 into $115.3 to pay for the oil.

Hence, as the rupee increases in value against the dollar, the Indian OMCs pay less for the oil the buy internationally. A major reason for the increase in value of the rupee was that on September 14 and September 17, the foreign institutional investors poured money into the stock market. They bought stocks worth Rs 5086 crore over the two day period. This meant dollars had to be sold and rupee had to be bought, thus increasing the demand for rupee and helping it gain in value against the dollar.

But this rupee rally was short lived and the dollar has gained some value against the rupee and is currently worth around Rs 54.

The question is why did this happen? Initially the market and the foreign investors bought the idea that the government was committed at ending the policy logjam and initiating various economic reforms. Hence the foreign investors invested money into the stock market, the stock market rallied and so did the rupee against the dollar.

But now the realisation is setting in that the reform process might be derailed even before it has been earnestly started. This was reflected in the amount of money the foreign investors brought into the stock market on September 18. The number was down to around Rs 1049.2 crore. In comparison they had invested more than Rs 5080 crore over the last two trading sessions.

Mamata Banerjee’s Trinamool Congress, a key constituent of the UPA government, has decided to withdraw support to the government. At the same time it has asked the government to withdraw a major part of the reforms it has already initiated by Friday. If the government does that the Trinamool Congress will reconsider its decision.

How the political scenario plays out remains to be seen. But if the government does bow to Mamata’s diktats then the economic repercussions of that decision will be huge. The government had hoped that the losses on account of selling, diesel, kerosene and cooking gas, could have been brought down to Rs 1,67,000 crore, from the earlier Rs 1,92,000 crore by increasing the price of diesel and limiting the consumption of subsidised cooking gas.

If the government goes back on these moves, the oil subsidy bill will go back to attaining a monstrous size. Also, what the calculation of Rs 1,67,000 crore did not take into account was the fact that rupee would gain in value against the dollar. And that would have further brought down the oil subsidy bill. In fact HSBC which had earlier forecast Rs 57 to a dollar by December 2012, revised its forecast to Rs 52 to a dollar on Monday. But by then the Mamata factor hadn’t come into play.

If the government bows to Mamata, the rupee will definitely start losing value against the dollar again. This will happen because the foreign investors will stay away from both the stock market as well as direct investment. In fact, the foreign direct investment during the period of April to June 2012 has been disastrous. It has fallen by 67% to $4.41billion in comparison to $13.44billion, during the same period in 2011. If the government goes back on the few reforms that it unleashed over the last weekend, foreign direct investment is likely to remain low.

One factor that can change things for India is the if the price of crude oil were to fall. But that looks unlikely. The immediate reason is the tension in the Middle East and the threat of war between Iran and Israel. Hillary Clinton, the US Secretary of State, recently said that the United States would not set any deadline for the ongoing negotiations with Iran. This hasn’t gone down terribly well with Israel. Reacting to this Benjamin Netanyahu, the Prime Minister of Israel said “the world tells Israel, wait, there’s still time, and I say, ‘Wait for what, wait until when? Those in the international community who refuse to put a red line before Iran don’t have the moral right to place a red light before Israel.” (Source: www.oilprice.com)

Iran does not recognise Israel as a nation. This has led to countries buying up more oil than they need and building stocks to take care of this geopolitical risk. “In the recent period, since the start of 2012, the increase in stocks has been substantial, i.e. 2 to 3 million barrels per day. These are probably precautionary stocks linked to geopolitical risks,” writes Patrick Artus of Flash Economics in a recent report titled Why is the oil price not falling?

At the same time the United States is pushing nations across the world to not source their oil from Iran, which is the second largest producer of oil within the Organisation of Petroleum Exporting Countries (Opec). This includes India as well.

With the rupee losing value against the dollar and the oil price remaining high the oil subsidy bill is likely to continue to remain high. And this means the trade deficit (the difference between exports and imports) is likely to remain high. The exports for the period between April and July 2012, stood at $97.64billion. The imports on the other hand were at $153.2billion. Of this, $53.81billion was spent on oil imports. If we take oil imports out of the equation the difference between India’s exports and imports is very low.

Now what does this impact the value of the rupee against the dollar? An exporter gets paid in dollars. When he brings those dollars back into the country he has to convert them into rupees. This means he has to buy rupees and sell dollars. This helps shore up the value of the rupee as the demand for rupee goes up.

In case of an importer the things work exactly the opposite way. An importer has to pay for the imports in terms of dollars. To do this, he has to buy dollars by paying in rupees. This increases the demand for the dollar and pushes up its value against the rupee.

As we see the difference between imports and exports for the first four months of the year has been around $55billion. This means that the demand for the dollar has been greater than the demand for the rupee.

One way to fill this gap would be if foreign investors would bring in money into the stock market as well as for direct investment. They would have had to convert the dollars they want to invest into rupees and that would have increased the demand for the rupee.

The foreign institutional investors have brought in around $3.86billion (at the current rate of $1 equals Rs 54) since the beginning of the year. The foreign direct investment for the first three months of the year has been at $4.41 billion.

So what this tells us that there is a huge gap between the demand for dollars and the supply of dollars. And precisely because of this the dollar has gained in value against the rupee. On April 2, 2012, at the beginning of the financial year, one dollar was worth around Rs 50.8. Now it’s worth Rs 54.

This situation is likely to continue. And I wouldn’t be surprised if rupee goes back to its earlier levels of Rs 56 to a dollar in the days to come. It might even cross those levels, if the government does bow to the diktats of Mamata.

This would mean that India would have to pay more for the oil that it buys in dollars. This in turn will push up the demand for dollars leading to a further fall in the value of the rupee against the dollar.

Since the government forces the OMCs to sell diesel, kerosene and cooking gas much below their cost to consumers, the losses will continue to mount. The current losses have been projected to be at Rs 1,67,000 crore. I won’t be surprised if they cross Rs 2,00,000 crore. The government has to compensate the OMCs for these losses in order to ensure that they don’t go bankrupt.

This also means that the government will cross its fiscal deficit target of Rs 5,13,590 crore. The fiscal deficit, which is the difference between what the government earns and what it spends, might well be on its way to touch Rs 7,00,000 crore or 7% of GDP. (For a detailed exposition of this argument click here). And that will be a disastrous situation to be in. Interest rates will continue to remain high. And so will inflation. To conclude, the traffic in Mumbai before the Ganesh Chaturthi festival gets really bad. Any five people can get together while taking the Ganesh statue to their homes, put on a loudspeaker, start dancing on the road and thus delay the entire traffic on the road for hours. Indian politics is getting more and more like that.

Reforms, like the traffic, may have to wait. Mamata’s revolt is single-handedly worsening the oil bill, thanks, in part, to the rupee’s worsening fortunes. By not raising prices now, the subsidy bill bloat further, and in due course we will be truly in the soup.

The article originally appeared on www.firstpost.com on September 20, 2012. http://www.firstpost.com/economy/how-mamata-is-denting-the-rupee-and-bloating-the-oil-bill-461919.html

Vivek Kaul is a writer and can be reached at [email protected]

How Manmohan’s omelette came out as scrambled egg

Vivek Kaul

Around half way through Manu Joseph’s new book The Illicit Happiness of Other People, Ousep Chacko, one of the main characters in the book, says “Don’t hate me, son. There are people in this world who set out to make an omelette but end up with scrambled eggs. I am one of them.”

I just couldn’t help comparing this statement to Manmohan Singh, the current Prime Minister of the country. When he started out in 2004 he had all the economic ingredients that could be used to make a good omelette but what he has given us instead is burnt bhurji (the closest Indian representation of scrambled eggs and with due apologies to all the vegetarians out there).

When Manmohan Singh took over as the Prime Minister on May 22, 2004, things were looking good on the economic front. Consumer price index (CPI) inflation was at a rather benign 2.83%(Source: http://www.tradingeconomics.com/india/inflation-cpi) in May 2004. Interest rates were low.

The fiscal deficit projected by the government for 2004-2005(or the period between April 1, 2004 and March 31, 2005) was at 4.4% of the gross domestic product (GDP). Fiscal deficit is the difference between what the government earns and what it spends.

The interest payments that the government had to make on previous debt formed around 94% of the fiscal deficit. Interest payments stood at Rs 1,29,500 crore whereas the fiscal deficit was at Rs 1,37,407 crore. Thus the primary deficit or the difference between expenditure and income, after leaving out the interest payments, came to just 0.3% of the GDP.

What this meant was that the government was more or less meeting its expenditure from the income that it was earning during the course of the year. Thus the deficit was on account of the past debt. It also meant that the government did not have to borrow much, which in turn kept the interest rates low, encouraging both businesses and consumers to borrow and spend, and thus helping the Indian economy grow at a fast rate.

The subsidy bill for the year stood at Rs 43,516 crore or a little over 9% of the total government expenditure.

Cut to now. The CPI inflation for July 2012 was at 9.86%. The interest rate on most retail loans is greater than 10%. And the fiscal deficit has gone through the roof. The projected fiscal deficit for the year is Rs 5,13,590 crore or around 5.1% of the GDP. The primary deficit is at 1.9% of the GDP.

Even these numbers, as I showed in a recent piece will turn out to be way off the mark. (You can read the piece here). As economist Shankar Acharya wrote in the Business Standard “A few days back the Controller General of Accounts (CGA, not CAG!) informed us that the central government’s fiscal deficit for the first four months of 2012-13 had already exceeded half of the Budget’s target for the full year.”

The way things are going currently, the fiscal deficit might touch 7% of the GDP or its roundabout by the end of this year. This is a situation which hasn’t been experienced since 1990-91, just before India liberalised and opened up the economy.

In his speech as the Finance Minister of India in July 1991 Manmohan Singh had said “The crisis of the fiscal system is a cause for serious concern. The fiscal deficit of the Central Government…is estimated at more than 8 per cent of GDP in 1990-91, as compared with 6 per cent at the beginning of the 1980s and 4 per cent in the mid-1970s.”

So the question that arises is what went wrong between 2004 and 2012? The answer is that the subsidy budget of the government went through the roof. Things started changing in 2007-2008. The projected subsidy bill for the year was Rs 54,330 crore. By the end of the year the government had spent Rs 69,742 crore or 28% more. This was in preparation for the 2009 Lok Sabha elections.

The same thing happened the next year i.e. 2008-2009. The government budgeted Rs 71,431 crore as subsidies and ended up spending Rs 1,29,243 crore, a whopping 81% more. The subsidies were primarily on account of fertiliser, oil and food.

The budgeted subsidies for the current financial year (i.e. the period between April 1, 2012 and March 31, 2013) are at Rs 1,90,015 crore or around 12.7% of the total government expenditure. But as has been the case earlier the government will end up spending much more than this. Even after the Rs 5 increase in diesel price, the oil marketing companies (OMCs) will lose more than Rs 1 lakh crore on selling diesel this year. The total loss on account of selling diesel, kerosene and cooking gas at a loss is estimated to come to Rs 1,67,000 crore.

Just this will push up the subsidy bill close to Rs 3,00,000 crore. The government is expected to cross the budgeted amount for food and fertiliser subsidy as well. All in all it’s safe to say that subsidies will account for more than 20% of the government expenditure during the course of the year, leading to greater borrowing by the government and thus higher interest rates for everybody else.

The idea behind the subsidies (or inclusive growth as the government likes to call it) is to help the poor and ensure that they are not left out of the growth process. The question is where is the money to fund these subsidies going to come from? As Ila Patnaik writes in The Indian Express “Anyone looking at the rising subsidy bill, at the size of the welfare programmes, and contrasting it with the limited tax base, can only wonder why India will not have a fiscal crisis. A continuation of the present policies cannot but land the country into a huge problem. Either before a crisis or after it, there is little doubt that the current expenditure path has to change.”

The programme at the heart of the so called inclusive growth is the National Rural Employment Guarantee Act (NREGA), under which there is a legal guarantee of 100 days of employment during the course of the financial year to adults of any rural household. The daily wage is set at Rs 120 in 2009 prices, which means it is indexed for inflation. Now only if economic and social development was as easy as getting people to dig holes and fill them up.

Also as is usual with most such schemes in India there are huge leakages in this scheme as well. Estimates suggest that leakages are as high as 70%, which means only around Rs 30 of the Rs 100, reaches those it should, while the rest is being siphoned off. This is done by fudging muster rolls, which are essentially supposed to contain the number of days a labourer has worked and the wages he or she has been paid for it.

Also these subsidy and welfare programmes were initiated when the Indian economy was growing faster than 9%. Now the economic growth has slowed down to 5% levels. As Patnaik puts it “Implicit was also the argument that NREGA will be paid for by the high tax collection that the fast growing sectors of the economy would yield. Growth was to be made inclusive through a redistribution of incomes. This was the scenario when India was growing at 10 per cent and leaving some people behind. It was a scenario that might stand the test of time if India continued to grow at a long-run steady state of 10 per cent growth. This plan did not appear to evaluate the fiscal path of such a programme when growth halved.”

Slow growth also implies a slowdown in tax collections for the government, which might lead to the government needing to borrow more to finance the subsidies and welfare programmes.

A lot of the expenditure on account of subsidies could have been met if the government had been less corrupt and not sold off the assets of the nation at rock bottom prices. The loss on account of the telecom scandal was estimated to be at Rs 1.76 lakh crore. The loss on account of the coal blocks scandal was estimated to be at Rs 1.86lakh crore.

While these scams were happening all around him, Manmohan Singh chose to look the other way. As TN Ninan wrote in the Business Standard “Corruption silenced telecom, it froze orders for defence equipment, it flared up over gas, and now it might black out the mining and power sectors. Manmohan Singh’s fatal flaw — his willingness to tolerate corruption all around him while keeping his own hands clean — has led us into a cul de sac , with the country able to neither tolerate rampant corruption nor root it out.”

Singh has tried to re-establish his reformist credentials recently by announcing a spate of economic reforms over Friday and Saturday. But none of these reforms look to control the expenditure of the government and thus bring down the fiscal deficit. If the government continues down this path the future is doomed. As Ruchir Sharma writes in Breakout Nations “If the government continues down this path, India might meet the same path as Brazil in the late 1970s, when excessive government spending set off hyperinflation, ending the country’s economic boom.”

Higher expenditure also means inflation will continue to remain high. “NREGA pushed rural wage inflation up to 15% in 2011,” writes Sharma. The fear of high inflation continues, despite the reforms announced by the government. “The government undertook long anticipated measures towards fiscal consolidation by reducing fuel subsidies and selling stakes in public enterprises. Further, steps taken to increase foreign direct investment (FDI) should contribute to both greater capital inflows and, over the long run, higher productivity, particularly in the food supply chain. Importantly, however, for the moment, inflationary pressures, both at wholesale and retail levels, are still strong,” the Reserve Bank of India said in a statement today, keeping the repo rate (or the rate at which it lends to banks) constant at 8%. This despite the fact that there was great pressure on the central bank to cut the repo rate. It is unfair to expect the RBI to make up for the mistakes of the government.

The bottomline is that if the government has to get its act right it needs to reign in its expenditure. I started this piece with eggs let me end it with chickens. As economist Bibek Debroy wrote in the Economic Times “Since 2009, UPA-II has behaved like a headless chicken. It is still headless, but the chicken at least wants to cross the road. We still don’t know whether it will be run over or cross the road and lay an egg.”

And even if eggs are laid, we might still not end up with burnt bhurji rather than omelettes.

(The article originally appeared on www.firstpost.com. http://www.firstpost.com/politics/how-manmohans-omelette-came-out-as-scrambled-egg-458242.html)

(Vivek Kaul is a writer. He can be reached at [email protected])

Why you should be nice to your mom – and buy some gold

Vivek Kaul

So let me start this piece by admitting Ben Bernanke, the Chairman of the Federal Reserve of United States (the American central bank) has proven me wrong.

I was wrong when I recently said that the Federal Reserve would not initiate a third round of quantitative easing (QE), before the November 6 presidential elections in the United States. (you can read about it here).

Bernanke announced late last night that the Federal Reserve would buy mortgage backed securities worth $40billion every month. This will continue till the job scenario in the United States improves substantially. The Federal Reserve will print money to buy the mortgage back securities.

I concluded that the Federal Reserve wouldn’t announce any QE till November 6, primarily on account of the fact that Mitt Romney, the Republican nominee for the Presidential elections, has been against any sort of QE to revive the economy.

“I don’t think QE-II was terribly effective. I think a QE-III and other Fed stimulus is not going to help this economy…I think that is the wrong way to go. I think it also seeds the kind of potential for inflation down the road that would be harmful to the value of the dollar and harmful to the stability of our nation’s needs,” Romney told Fox News on 23 August. This had held back the Federal Reserve from initiating QE III.

But from the looks of it Bernanke doesn’t feel that Romney has a chance at winning and that he is more likely than not going to continue working with Barack Obama, the current American President.

This round of quantitative easing is going to help Obama and hurt Romney. Let me explain. The theory behind quantitative easing is that when the Federal Reserve buys mortgage backed securities (in this case) by printing dollars, it pumps in more money into the economy. With more money in the economy, banks and financial institutions it is felt will lend that money and businesses and consumers will borrow. This will mean that spending by both businesses and consumers will start to up. Once that happens the economic scenario will start improving, which will lead to more jobs being created.

But as I said this is the theoretical part. And theory and practice do not always go together. Both American businesses and consumers have been shying away from borrowing. Hence, all this money floating around has found its way into stock and commodity markets around the world.

As more money enters the stock market, stock prices go up and this creates the “wealth effect”. People who invest money in the market feel richer and then they tend to spend part of the accumulated wealth. This, in turn, helps economic growth.

As Gary Dorsch, an investment newsletter writer, said in a recent column, “Historical observation reveals that the direction of the stock market has a notable influence over consumer confidence and spending levels. In particular, the top 20% of wealthiest Americans account for 40% of the spending in the US economy, so the Fed hopes that by inflating the value of the stock market, wealthier Americans would decide to spend more. It’s the Fed’s version of “trickle down” economics, otherwise known as the “wealth effect.””

When this happens, the economy is likely to grow faster and hence, people are more likely to vote for the incumbent President. As Dorsch explains “Incumbent presidents are always hard to beat. The powers of the presidency go a long way…In the 1972 election year, when Nixon pressured Arthur Burns, then the Fed chairman, to expand the money supply with the aim of reducing unemployment, and boosting the economy in order to insure Nixon’s re-election.”

Bernanke is looking to do the same, even though he has denied it completely. “We have tried very, very hard, and I think we’ve been successful, at the Federal Reserve to be non-partisan and apolitical…We make our decisions based entirely on the state of the economy,” the Financial Times quoted Bernanke as saying. Given this, Romney has been a vocal critic of quantitative easing knowing that another round of money printing will clearly benefit Obama.

Other than Obama and the stock markets, the other big beneficiary of QE III will be gold. The yellow metal has gone up by around 2.2% to $1768 per ounce, since the announcement for QE III was made. In fact the expectation of QE III has been on since the beginning of September after Ben Bernanke dropped hints in a speech. Gold has risen by 7.3% since the beginning of this month.

This is primarily because any round of quantitative easing ensures that there are more dollars in the financial system than before. The threat is that the greater number of dollars will chase the same number of goods and services. This will lead to an increase in their prices. But this hasn’t happened till now. Nevertheless that hasn’t stopped investors from buying gold to protect themselves from this debasement of money. Gold cannot be debased. Unlike paper money it cannot be created out of thin air.

During earlier days, paper money was backed by gold or silver. When governments printed more paper money than the precious metals backing it, people simply turned up with their paper at the central bank and government mints, and demanded that paper money be converted into gold or silver. Now, whenever people see more and more of paper money being printed, the smarter ones simply go out and buy that gold. Hence, bad money (that is, paper money) is driving out good money (that is, gold) away from the market.

But that’s just one part of the story. The governments and central banks around the world, led by the Federal Reserve of United States and the European Central Bank, are likely to continue printing more money, in the hope that people spend this money and this revives economic growth. This in turn increases the threat of inflation which would mean that the price of gold is likely to keep going up. “Gold tends to benefit from easy-money policies as investors utilize the precious metal as a hedge against potential inflation that could ultimately result from the Fed’s policies,” Steven Russolillo, wrote on WSJ Blogs.

Market watchers have also started to believe that the Federal Reserve is now only bothered about economic growth and has abandoned the goal of keeping inflation under control. Growth and inflation control are typically the twin goals of any central bank.

“They are emphasizing the growth mandate, and that means they don’t care about inflation other than giving lip service to it,” Axel Merk, chief investment officer at Merk Funds, told Reuters. “The price of gold will do very well in the years to come,”he added.

Something that Jeffrey Sherman, commodities portfolio manager of DoubleLine Capital, agrees with. “The Fed’s inflationary behavior should be bearish for the dollar in the long run and drive investors to seek protection via the gold market,” he told Reuters.

Also unlike previous two rounds of money printing there are no upper limits on this QE, although at $40billion a month it’s much smaller in size. QE II, the second round of money printing, was $600billion in size.

Something that can bring down the returns on gold in rupee terms is the appreciation of the rupee against the dollar. Yesterday the rupee appreciated against the dollar by nearly 2%. This is happening primarily because the UPA government has suddenly turned reformist. (To understand the complete relationship between rupee, dollar and gold, read this).

In the end let me quote William Bonner & Addison Wiggin, the authors of Empire of Debt — The Rise of an Epic Financial Crisis. As they say “There is never a good time to die. Nor is there a good time for a crash or a slump. Still, death happens. Be prepared. Say something nice to your mother. Offer a bum a drink. And buy gold.”

So be nice to your mother and buy gold.

Disclosure: This writer has investments in gold through the mutual fund route.

(The article originally appeared on www.firstpost.com on September 15,2012. http://www.firstpost.com/investing/why-you-should-be-nice-to-your-mom-and-buy-some-gold-456915.html)

(Vivek Kaul is a writer. He can be reached at [email protected])

An SSC pass understands that inflation today has nothing to do with RBI

Vivek Kaul

The attempts of the Reserve Bank of India (RBI) to control inflation have been a non-starter. “Growth, particularly in the last two or three years, has been worth its weight in gold. In a global economic boom, an economic growth of 8%, 7% or 9% doesn’t really matter. But when the world is slowing down, in fact growth in large parts of the world has turned negative, to kill that growth by raising the interest rate is inhuman. It is almost like a sin. And the RBI killed it under the very lofty ideal that we will tame inflation by killing growth,” said Shankar Sharma, vice-chairman & joint managing director, First Global, in an interview to DNA Money.

“If you have got a matriculation degree, you will understand that India’s inflation has got nothing to do with RBI’s policies. Your inflation is largely international commodity price driven. Your local interest rate policies have got nothing to do with that. We have seen that inflation has remained stubbornly high no matter what Mint Street has done. You should have understood this one commonsensical thing,” he added.

Given this, Sharma feels that there is no way out for the RBI but to cut the repo rate in the days to come. Repo rate is the rate at which RBI lends money to the banks. “I do not rule out a 150 basis points cut in the repo rate this year. Manmohan Singh might have just put in the ears of Subbarao that it’s about time that you woke up and smelt the coffee. You have no control over inflation. But you have control over growth, at least peripherally,” said Sharma.

Growth is the only antidote to inflation, feels Sharma. “If your nominal growth is 15%, you will get 10-20% salary and wage hikes. Then you have more purchasing power left in the hands of the consumer to deal with increased price of dal or milk or chicken. If the wage hikes don’t happen, you are leaving less purchasing power in the hands of people. And wage hikes won’t happen if you have killed economic growth,” explained Sharma.

And getting economic growth started again will be very difficult. As Sharma put it “The laws of physics say that you have to put in a lot of effort to get a stalled car going, yaar. But if it was going at a moderate pace, to accelerate is not a big issue. We have killed that whole momentum. And remember that 5-6%, economic growth, in my view, is a disastrous situation for a country like India. You can’t say we are still growing.”

By keeping interest rates high the RBI has managed to slowdown credit growth of banks and thus made borrowing easy for the government of India, which has been borrowing big time to finance its fiscal deficit. Fiscal deficit is the difference between what the government earns and it spends. “There are not many competing borrowers from the same pool of money that the government borrows from. So far, indications are that the government will be able to get what it wants without disturbing the overall borrowing environment substantially. In a strange sort of way the government’s ability to borrow has been enhanced by the RBI’s policy of killing growth. I always say that India has 33 crore Gods and Goddesses. They find a way to solve our problems,” said Sharma.

Sharma also sees the rupee appreciating against the dollar, a prediction he made at the beginning of the year and which hasn’t worked out till now. But his optimism still remains. “I still maintain that by the end of the year you are going to see a vastly stronger rupee. I believe it will be Rs 44-45 against the dollar. Or if you are going to say that is too optimistic may be Rs 47-48. But I don’t think it’s going to be Rs 60-65 or anything like that.”

A major reason for Sharma’s optimism is a fall in oil prices and Indians buying lesser gold.

“At the beginning of the year our view that oil prices will be sharply lower. That time we were trading at around $105-110 per barrel. Our view was that this year we would see oil prices of around $65-75. So we almost got to $77 per barrel (Nymex). We have bounced back a bit. But that’s okay. Our view still remains that you will see oil prices being vastly lower this year and next year as well, which is again great news for India,” said Sharma. Also with gold prices touching all time highs in rupee terms gold imports have taken a beating.

“You should be seeing a much stronger rupee by the end of the year. Imagine what that does to the equity market. That has a big, big effect because then foreign investors sitting in the sidelines start to play catch-up,” concluded Sharma.

(The article originally appeared in the Daily News and Analysis on July 31,2012. http://www.dnaindia.com/money/report_an-ssc-pass-understands-that-inflation-today-has-nothing-to-do-with-rbi_1721962)

(Vivek Kaul is a writer and can be reached at [email protected])