In theory there is no difference between theory and practice. In practice there is.

– Yogi Berra

A question I am often asked is why are the stock markets around the world still rallying despite the Federal Reserve of United States going slow on printing money. In a statement released yesterday the Fed decided to cut down further on money printing.

It will now print $15 billion per month instead of the earlier $25 billion. This was the seventh consecutive cut of $10 billion. Since December 2012, the Federal Reserve had been printing $85 billion per month. This money was pumped into the financial system by buying mortgage backed securities and government bonds. The idea was that by increasing the amount of money in the financial system, long term interest rates could be driven lower. The hope was that at lower interest rates, people would borrow and spend more.

From January 2014, the Federal Reserve decided to buy bonds worth $75 billion a month, instead of the earlier $85 billion. This meant that the Fed would be printing $75 billion a month instead of the earlier $85 billion. This cut in money printing came to be referred to as “tapering”, which means getting progressively smaller. Since then the amount of money being printed by the Federal Reserve has been tapered to $15 billion per month. At this pace the Federal Reserve should be done at dusted with its money printing by next month i.e. October 2014.

A lot of this printed money instead of being lent out to consumers has found its way around into stock markets and other financial markets around the world. The Dow Jones Industrial Average, America’s premier stock market index, has rallied more than 30% since October, 2012. This when the American economy hasn’t been in the best of shape.

The FTSE 100, the premier stock market index in the United Kindgom, has given a return of 15% during the same period. The Nikkei 225, the premier stock market index of Japan has rallied by 53% during the same period. Closer to home, the BSE Sensex has rallied by around 43% during the same period.

Stock markets around the world have given fabulous returns, despite the global economy being down in the dumps. The era of easy money unleashed by the Federal Reserve has obviously helped.

Nevertheless, the question is with the Fed clearly signalling that the easy money era is now coming to an end, why are stock markets still holding strong? One reason is the fact that even though the Fed might be winding down its money market operations, other central banks are still continuing with it.

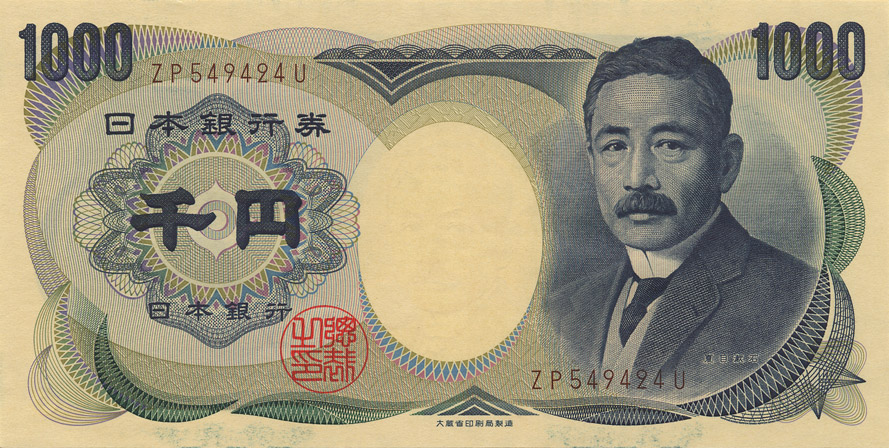

The Bank of Japan, the Japanese central bank is printing around ¥5-trillion per month and is expected to do so till March 2015. The European Central Bank is also preparing to print €500-billion to €1-trillion over the next few years. What this means is that interest rates in large parts of the Western world will continue to remain low. Hence, big institutional investors can borrow from these financial markets and invest the money in stock markets around the world.

The second and more important reason is that the Federal Reserve does not plan to shrink its balance sheet any time soon. Before the financial crisis started in September 2008, the size of the Federal Reserve balance sheet stood at $925.7 billion. Since then it has ballooned and as on August 27, 2014, it stood at $4.42 trillion.

The size of the Fed balance sheet has exploded by close to 378% over the last six years. This has happened primarily because the Fed has printed money and pumped it into the financial system by buying bonds, in the hope of keeping interest rates low and getting people to borrow and spend.

Janet Yellen, the current Chairperson of the Federal Reserve made it very clear yesterday that the Fed was in no hurry to withdraw this money from the financial system. It could take to the “end of the decade” to shrink the Fed’s huge balance sheet “to the lowest levels consistent with the efficient and effective implementation of policy.”

What this essentially means is that the money that the Fed has printed and pumped into the financial system by buying bonds, will not be suddenly withdrawn from the financial system. When a bond matures, the institution which has issued the bond, repays the money invested to the institution that has invested in it.

If the investor happens to be the Federal Reserve, the maturing proceeds are paid to it. This leads to the amount of money in the financial system going down, and could lead to interest rates going up, as money becomes dearer.

This is something that the Fed does not want, in order to ensure that individuals continue borrow and spend money, and this, in turn, leads to economic growth. Hence, the Fed will use the money that comes back to on maturity, to buy more bonds and in that way ensure that total amount of money floating in the financial system does not go down.

This means that long term interest rates will continue to remain low. Hence, investors can continue to borrow money at low interest rates and invest that money in different parts of the world.

Yellen also clarified that short-term interest rates are also not going to go up any time soon. As she said “economic conditions may for some time warrant keeping the target federal funds rate below levels the committee views as normal in the longer run.”The federal funds rate is the interest rate that banks charge each other to borrow funds overnight, in order to maintain their reserve requirement at the Federal Reserve. This interest rate acts as a benchmark for short-term loans.

Given these reasons, the stock markets around the world will continue to rally, at least in the near term, as the era of easy money will continue. These rallies will happen, despite global growth being down in the dumps and the fact that the global economy is still to recover from the financial crisis that started just about six years and three days back, when the investment bank Lehman Brothers went bust on September 15, 2008.

To conclude, Ben Hunt who writes the Epsilon Theory newsletter put it best in a recent newsletter dated September 8, 2014, and titled The Ministry of Markets: “No one doubts the omnipotence of central banks. No one doubts that market outcomes are fully determined by central bank policy. No one doubts that central banks are large and in charge. No one doubts that central banks can and will inflate financial asset prices. And everyone hates it.”

The article appeared originally on www.FirstBiz.com on Sep 18, 2014

(Vivek Kaul is the author of the Easy Money trilogy. He tweets @kaul_vivek)