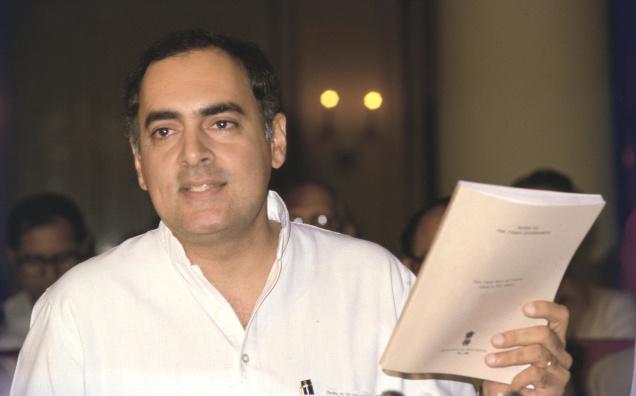

Vivek Kaul

Oil prices have been falling for a while now. The price of the Indian basket of crude oil as on December 10, 2014, stood at $63.16 per barrel. At the beginning of this financial year, as on April 1, 2014, the price had stood at $104.56 per barrel. Hence, prices have fallen by close to 40% since then.

Analysts expect that oil prices will continue to remain low in 2015. In a report titled 2015: It Likely Gets Worse Before It Gets Better analysts at Morgan Stanley give three possible scenarios for the price of oil. In the worst possible scenario they expect the price of oil to touch $43 per barrel in the second quarter of 2015 (i.e. the period between April and June 2015).

As the Morgan Stanley analysts write: “ With OPEC on the sidelines, oil prices face their greatest threat since 2009…Without intervention, physical markets and prices will face serious pressure, with 2Q15[April to June 2015] likely marking the peak period of dislocation.”

As I have explained on previous occasions the Saudi Arabia led Organization of the Petroleum Exporting Countries(OPEC) is interested in driving down the price of oil to ensure that shale oil firms operating in the United States and Canada become unviable. This is why OPEC hasn’t cut oil production majorly in recent months, even though oil prices have fallen dramatically.

The conventional thinking is that a fall in oil prices will benefit India tremendously. A major reason for the same is that India imports nearly four fifths of the oil that it consumes. Hence, a fall in oil prices will mean that there will be lower oil imports and this will mean a lower trade deficit (i.e. the difference between imports and exports).

Further, lower oil prices will also mean lower inflation and a lower fiscal deficit for the government. Fiscal deficit is the difference between what a government earns and what it spends. In the years gone by, the government did not allow the oil marketing companies to sell diesel, cooking gas and kerosene oil, at a price that was viable for them. The government compensated these companies for a part of the under-recoveries.

This led to the government expenditure shooting up which pushed up the fiscal deficit. While this sounds good in theory, things are not as straightforward as they are made out to be. Neelkanth Mishra and Ravi Shankar of Credit Suisse discredit this argument in their recent research report titled 2015 Outlook: Growth at any price?

Let’s look at these points one by one. The government had budged Rs 63,426.95 crore as oil subsidy for this financial year. This as always has been the case in the past was a very optimistic assumption, given that a significant part of the oil subsidies for the last financial year were unpaid. The oil subsidies that had not been paid for during the course of the last financial year amounted to Rs 35,000 crore. This has been paid from this year’s budget. Given this, despite a dramatic fall in oil prices there isn’t going to be a huge impact on the fiscal deficit. If oil prices continue to remain low during the course of the next financial year (April 2015 to March 2016) it will benefit the government on the fiscal deficit front, feel the Credit Suisse analysts.

What about inflation? Petrol and diesel together make up for around 2% of the consumer price index. Over and above this, the government has raised the excise duty on petrol and diesel twice in the recent past. This has reduced the “passthrough to consumer prices”. Hence, consumers haven’t benefited as much as they should have.

Further, “LPG[domestic cooking gas] and kerosene, which have higher weights[in the consumer price index],are still subsidised, so the fall in crude will not directly impact retail prices,” write Mishra and Shankar.

Now let’s look at the trade deficit or the difference between imports and exports. Oil imports in the month of October 2014 fell by 19% to $15.2 billion in comparison to the same period last year. Despite this, the overall trade deficit for the month rose to $13.3 billion from $10.6 billion a year ago.

Why is that the case? With global growth slowing down, exports slowed down by 5% to $26 billion. Further, India seems to have rediscovered its appetite for gold with gold imports rising by 280% to $4.17 billion from $1.09 billion in October 2013.

So, despite falling oil prices India may not gain much immediately. Also, falling oil prices mean lower incomes for oil exporting countries and this will slow down their consumer demand, which will have an impact on Indian exports.

Professor Eswar Prasad of Cornell University explained this in an interview to CNBC. As he said: “Right now if oil goes to USD 65 or even slightly lower it is not a big negative but it does imply that there is going to be a lot of weakness in external demand and countries in Latin America like Venezuela which already have a very difficult situation, emerging markets like Russia and of course the Middle Eastern countries plus some of the European economies like the UK and Norway that rely on oil exports to a significant extent are going to be facing fairly difficult situations. This will affect their budgets and their current account balances which in turn will affect their consumption demand. So, softness in consumption demand is ultimately not good for anybody in the world including India.”

Neelkanth Mishra of Credit Suisse also made a similar point in an interview to The Economic Times. Mishra’s argument was that if oil exporting countries earn lower, their sovereign wealth funds will invest a lower amount of money in other countries, including India.

As he said: “Further, capital flows get impacted, too — if you look at the sources of funds that invest in India, it’s primarily the sovereign wealth funds (SWFs), the pension funds and the insurance funds. If Norway, Saudi Arabia, Abu Dhabi, Qatar, or Kuwait are not going to see the kind of surpluses that they used to then they will have less capital to send out, which will mean that capital flows into India will not be as strong as they were.”

Norway, Abu Dhabi and Saudi Arabia run the three biggest sovereign wealth funds in the world.

To conclude, what these points clearly tell us is that a fall in oil prices will not benefit India as much as it is being made out to be.

The article originally appeared on www.FirstBiz.com on Dec 11, 2014

(Vivek Kaul is the author of the Easy Money trilogy. He tweets @kaul_vivek)