Vivek Kaul

“Every action has an equal and opposite reaction,” states Newton’s Third Law of Motion. The law holds in political and economic space as well, the only difference being that sometimes the gap between the action and the reaction can be as long as two decades.

The Coal Mines (Nationalisation) Act 1973 was amended with effect from June 9,1973. The Economic Survey for 1994-95 points out the reason behind the decision. “In order to encourage private sector investment in the coal sector, the Coal Mines (Nationalisation) Act, 1973 was amended with effect from June 9, 1993 for operation of captive coal mines by companies engaged in the production of iron and steel, power generation and washing of coal in the private sector,” the survey points out.

The reason for the change was simple. The government owned Coal India Ltd wasn’t producing enough coal to meet the growing energy needs of the country. The total coal production in the country in 1993-94 stood at 246.04million tonnes having grown by 3.3% from the last financial year.

What also did not help was the fact that there were huge time and cost escalations on the newer projects to mine coal. As the 1994-95 economic survey put it “As on December 31,1994, out of 71 projects under implementation in the coal sector, 22 projects are bedeviled by time and cost over-runs. On an average, the time overrun per project is about 38months.There is urgent need to improve project implementation in the coal sector”.

This change made nearly two decades ago allowed the government to give away coal blocks free to both government owned as well as private sector companies. The repercussions of this move are being felt now with the Comptroller and Auditor General(CAG) of India coming out with a report and putting the losses of giving out coal mines for free at Rs 1,86,000 crore. It also has led to a political deadlock in the functioning of the Parliament.

So what happened in between 1993 and 2011?

Between 1993 and 2003, the government wasn’t in any hurry to give away mines free. In a period of over ten years, the government gave away around 41 blocks (17 to private sector companies and 24 to government owned companies) for free. Even 2004 was a slow year with only 5 blocks being given away for free.

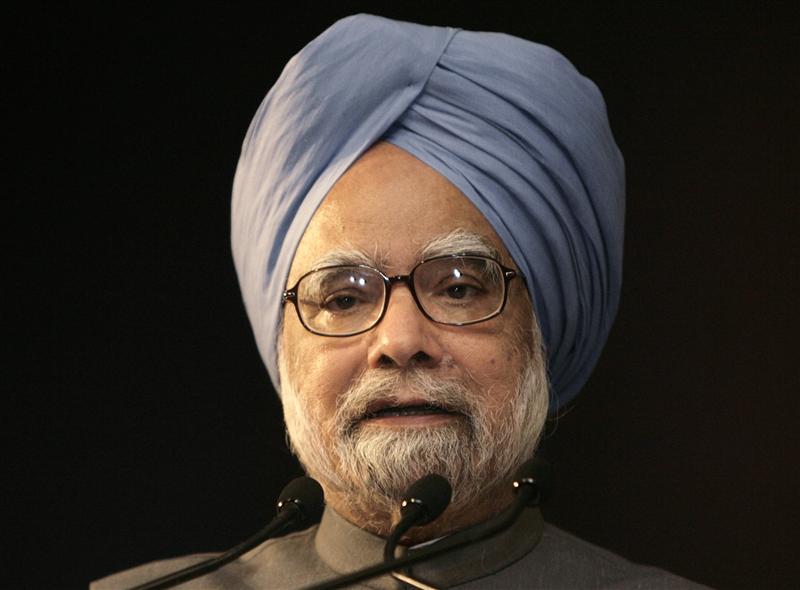

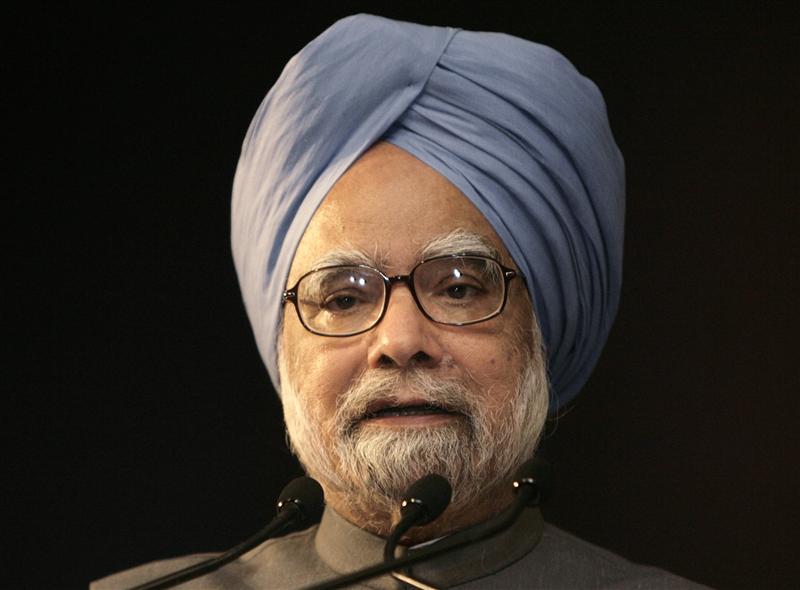

But come 2005 and the government was suddenly in a hurry to give away blocks for free. Twenty four blocks were given away during the course of the year. This continued over the next few years. Between 2006 and 2009 a total number of 145 coal blocks were handed for free to private sector companies, government companies and ultra mega power projects. The total geological reserves of these coal blocks amounted to around 40.9billion tonnes. As the CAG report points out the total geological reserves of coal in India, as on April 1, 2011, were at around 285.9billion tonnes. Hence, 14.3% of the total coal reserves in the country were given away by the government for free. For most of this period between 2006 and 2009, the Prime Minister Manmohan Singh doubled up as the coal minister as well.

Why was there a sudden increase in giveaways post 2005?

Data from ministry of coal shows that the total production of coal in India in 2005-2006 stood at 437.3million tonnes. As pointed out earlier the production in 1993-1994 was 246.04million tonnes. Hence over a period of 12 years, the coal production had grown at the rate of 4.9% per year on an average. Of the 437.3million tonnes produced in 2005-2006, Coal India Ltd produced around 348million tonnes or around 80% of the total produce.

The trouble was that the economy was growing at a much faster rate than the rate of coal production. Hence the total coal demand could not be satisfied by the coal being produced by Coal India and other few government owned companies.

This meant coal had to be imported. The amount of coal imported doubled from 19.7 million tonnes in 1999-2000 to 38.6million tonnes in 2005-2006. In 1999-2000 these imports cost Rs 3,548 crore. In 2005-2006, the coal imports cost Rs 14,910 crore. Hence, even though the amount of coal that the country imported had doubled, the total amount paid for it had gone up by 4.2 times.

This was primarily because the price of coal started to shoot up from mid 2003 onwards. The price was a little over $20 per metric tonne of coal at that point of time. It shot up to around $40 per metric tonne in mid 2005 and kept rising after that. Prices shot up to around $190 per tonne internationally in mid 2008. As can be seen from the following table, the import of coal kept going up over the years, but the money paid for it went up at a much faster rate.

The conclusion that one can draw from this is that before 2004 it was cheap for a company to import coal because international coal prices were low. But after that things changed and it made more sense for companies to have direct access to coal.

Coal Imports In Million tonnes In Rupees crore

1999-2000 19.7 3548

2000-2001 20.9 4053

2001-2002 20.5 4536

2002-2003 23.3 5028

2003-2004 21.7 5009

2004-2005 29 10266

2005-2006 38.6 14910

2006-2007 43.1 16689

2007-2008 49.8 20738

2008-2009 59 41341

2009-2010 67.8 NA

Source: Provisional Coal Statistics 2009-2010, Coal Control Organisation, Ministry of Coal

Coal India has not been able to expand production fast enough to meet this growing need for coal in India. Between 2004 and March 31, 2012, the production of coal has increased by just 65million tonnes to 436million tonnes. This means an increase in production at the rate of 2.3% per year on an average, over the last seven years.

Year Production (in million tonnes)

2011-2012 436

2010-2011 431

2009-2010 415

2008-2009 400

2007-2008 372

2005-2006 348

2004-2005 371

Average 396

Source: Coal India Ltd

Hence there was a need to look beyond Coal India. This in a way explains why the government gave away 145 coal blocks free between 2006 and 2009. But all this was of not much use.

The government’s decision to give away coal blocks free in the hope of increasing coal production hasn’t gone anywhere. As per the CAG report, as on March 31, 2011, eighty six of these blocks were supposed to produce around 73million tonnes of coal. Only 28 blocks have started production and their total production has been around 34.6million tonnes, as on March 31,2011.

Why expanding coal production is very difficult?

The root of the decision to give away coal blocks for free has been the inability of Coal India to expand production at the rate which meets the growing coal demands of the country. There are several reasons for the same. These reasons will apply equally even to the private sector companies and government companies which have got coal blocks for free but have been unable to produce coal.

A large part of the coal reserves in India are in the naxal dominated areas of Chattisgarh, Jharkhand, West Bengal, Odisha and Maharashtra. So operating in these regions isn’t really easy. Over and above this, a lot of reserves are in forest areas. Mining in these areas needs clearance from the state governments and that is not easy to come. The overall environmental clearance comes from the Ministry of Environment and Forests and in this day and age of environmental activism, this clearance also takes time.

But the biggest problem for Coal India has been land acquisition. There are several reasons for the same. Over the years the government of India has forcibly acquired land for a lot of its projects and paid peanuts in return to the landholders. In some cases in the state of Jharkhand, money has still not been paid to original landholders even decades after the land was acquired to set up a big public sector unit.

There is a very little attempt made to rehabilitate the people whose land is being acquired. This writer has seen homes that were built by the Central Coalfields Ltd (a 100% subsidiary of Coal India which is headquartered in Ranchi and operates coal mines in the state of Jharkhand) for people whose land was acquired to mine coal and they were unlivable to say the least. Due to these reasons people don’t want to part with their land.

Also acquisition of land requires coordination with the local District Commissioners (DCs). The DCs are usually so overburdened with work that land acquisition isn’t really a top of agenda for them. Over the years the issue has become so politicised that bureaucrats like to stay away. The state governments are not interested because by forcibly acquiring land they are likely to lose votes.

On occasions even when the land is acquired the government can re-allocate the land for some other use like building a railway line. So the main thing to get the coal production going in this country is to have a proper land acquisition process. People whose land is acquired need to be properly compensated and rehabilitated. They should be willing to part with their land.

To conclude

Several suggestions have been made for setting the prevailing situation right. Commentators have asked for setting up of another government owned coal company. Several others have asked for auctioning of the coal blocks and allowing private sector companies to operate freely to mine coal.

All these are good suggestions in their own right but they won’t work unless the land acquisition process is cleaned up. If that does not happen coal production in India cannot be increased fast enough to meet all the emerging demand. And that is the main learning that the government needs to take from what is being called Coalgate.

(The article originally appeared in The Pioneer on September 9,2012. http://www.dailypioneer.com/sunday-edition/sundayagenda/cover-story-agenda/93154-the-dirty-business.html)

(Vivek Kaul is a Mumbai based writer and can be reached at [email protected])

CAG

All you wanted to know about the COAL SCAM but didn't know where to ask…

Vivek Kaul

What is the basic issue?

Between 1993 and 2011, the government of India gave away 206 coal blocks for free to government and private companies.

So if these blocks were being given away free from 1993, why so much commotion now?

The Comptroller and Regulator General(CAG) in a recent report estimated that the losses due to the policy of the government giving out coal blocks for free, amounted to Rs 1.86lakh crore.

Why is the Congress led UPA government being blamed if the policy started in 1993?

Estimates made by stock brokerage CLSA suggest that only 41 out of the 206 blocks given away for free, were allocated before the end of 2003. This means that 165 blocks were allocated between 2004 and 2011. The Congress led UPA government has been in power since May 2004. This amounts to nearly 14% Hence, a major number of coal blocks were given away free during the UPA rule.

And how is Prime Minister(PM) Manmohan Singh involved in all this?

The PM also happened to be the coal minister between 2006 and 2009. During this period 134 coal blocks were given away for free. Estimates made by Nomura Equity Research suggest that between 2006 and 2009 the coal blocks given away for free had geological reserves of around 40 billion tonnes. India has around 286billion tonnes of geological reserves of coal. This means that around 14% of total geological reserves of coal was given away free during the period Manmohan Singh was the coal minister.

What was the purported reason for giving the coal blocks for free?

This was done in order to increase the total coal production in the country. The government owned Coal India Ltd which accounts for 80% of the total coal production in the country hasn’t been able to produce enough to meet the growing energy needs of the country. Between April 1, 2004 and March 31, 2012, the production of coal by Coal India has increased by just 65million tonnes to 436million tonnes. This means a growth of a mere 2.3% per year on an average.

What is the reasoning behind CAG coming up with the Rs 1.86lakh crore number?

The CAG reasonably assumed that the coal mined from the coal blocks given away for free could have been sold at a certain price in the market. Since the government gave away the blocks for free it lost that opportunity. This lost opportunity is what CAG has tried to quantify in terms of a number.

So what were the assumptions that the CAG worked with?

While calculating the loss the CAG did not take into account the coal blocks given to the government companies. Only blocks given to private companies were taken into account. Further only open cast mines were included in calculating the loss. Underground mines were not taken into account.

How were the numbers worked out?

The total coal available in a block is referred to as geological reserve. Due to several reasons including those of safely, the entire geological reserve cannot be mined. The portion that can be mined is referred to as extractable reserve. The extractable reserves for the blocks (after ignoring the blocks owned by government companies and underground mines) came to 6282.5million tonnes. This is equivalent to more than 14 times the annual production of Coal India Ltd. And this is the amount of coal the government would have been able to sell if it had not given the blocks away for free to private companies.

But that’s just coal in tonnes, how did CAG arrive at a loss of Rs 1.86 lakh crore?

The government gave away 6282.5million tonnes of coal for free. It could have sold it at a certain price. Also mining this coal would have involved a certain cost. The CAG first calculated the average sale price for all grades of coal sold by Coal India in 2010-2011. This came to Rs 1028.42 per tonne. Then it calculated the average cost of production for all grades of coal for the same period. This came at Rs 583.01. Other than this there was a financing cost of Rs 150 per tonne which was taken into account, as advised by the Ministry of Coal. Hence a benefit of Rs 295.41 per tonne of coal was arrived at (Rs 1028.42 – Rs 583.01 – Rs 150).

The losses were thus estimated to be at Rs 1,85,591.33 crore (Rs 295.41 x 6282.5million tonnes) or around Rs 1.86lakh crore, by the CAG.

But isn’t Rs 1.86 lakh crore a very big number?

Yes it is a very big number. But still a conservative estimate. The CAG does not take into account the losses on account of blocks given away free to government companies. As I had mentioned on an earlier occasion in this newspaper, the transaction of handing over a coal block was between two arms of the government. The ministry of coal and a government owned public sector company (like NTPC). In the past when such transactions have happened revenue earned from such transactions have been recognized. A very good example is when the government forces the Life Insurance Corporation (LIC) of India to buy shares of public sector companies to meet its disinvestment target. One arm of the government (LIC) is buying shares of another arm of the government (for eg: ONGC). And the money received by the government is recognized as revenue in the annual financial statement. So when revenues for transactions between two arms of the government are recognized so should losses. Hence, the entire idea of the CAG not taking losses on account of coal blocks given to pubic sector companies does not make sense. If they had recognised these losses as well, losses would have been greater than Rs 1.86lakh crore.

So this number could have been bigger?

Yes. The other point to remember here is that the CAG had assumed extractable reserves of a conservative 73% in case of mines were mine plans were not available. Typically extractable reserves are around 80-95% of geological reserves. The CAG has also been very conservative in calculating the benefit per tonne of coal by taking the average price of coal sold by Coal India Ltd. This price is typically the lowest in the market. Coal from other sources is very expensive. Coal India also sells coal through an e-auction. The price of coal sold through this route is higher than the normal Coal India price. As the CAG has pointed out in its performance audit of ultra-mega power projects, the average e-auction price for Coal India coal was Rs 1782 per tonne in 2010-2011. Imported coal sells at an even higher price. The landed cost of imported coal was Rs 2874 per tonne (based on NTPC data for November 2009), reports CAG. If these prices had been taken into account or a weighted average price would have been created using these prices as well as the average Coal India price of Rs 1028.42 per tonne, the loss number would have been higher than Rs 1.86lakh crore.

If all this is true, so what was that Chidambaram said about zero losses?

The union Finance Minister P Chidambaram wanted us to believe that almost all companies which have been given free coal blocks have not started to mine coal till date. Hence there are no losses. This is like saying that I gave away my house for free, but since the person I gave it away to is not able to sell it, hence I did not face any losses.

What about the argument that coal is a natural resource and hence should not be auctioned?

People who have come up with this argument also need to realize that coal like air is not an unlimited natural resource. So air need not be priced because it is unlimited, but coal needs to be priced because it is limited. And if that had not been the case the government would be giving away all the coal that Coal India produces for free.

(The article originally appeared in the Daily News and Analysis on September 3,2012. http://www.dnaindia.com/india/report_all-you-wanted-to-know-about-the-coal-scam_1735936))

Vivek Kaul is a writer and can be reached at [email protected]

Canaries and coal mines

Vivek Kaul

Music has got its share of one hit wonders. Delhi born singer and musician Peter Saerdest fits that category. His most famous claim to fame being the 1969 hit “where do you go to (my lovely)”.

The song is about a fictional girl called Marie Clare. There is a paragraph in the song which brings out the unhappiness in her life. Here is how it goes:

But where do you go to my lovely

When you’re alone in your bed

Tell me the thoughts that surround you

I want to look inside your head, yes i do.

Now this is a question that I have been wanting to ask the Prime Minister (PM) Manmohan Singh as the country moves from one scam to another. What are the thoughts that go inside his head? The forever quiet PM finally obliged us when he issued a statement on the coal gate scam and put the blame on his predecessors and the Comptroller and Auditor General(CAG) of India, for coming up with a loss number of Rs 1.86 lakh crore.

The policy of the government allocating coal blocks for free was introduced in 1993, and so it was not right to blame the Congress led United Progressive Alliance (UPA) felt the Prime Minister. Fair point, one must say.

But as the numbers calculated by the international stock brokerage CLSA show a major part of the coal blocks were given away for free only after the Congress led UPA came to power in May 2004. Of the 100 coal blocks given away free to government companies between 1993 and 2011, 83blocks were handed over after 2003. The same stands true for private sector companies where 82 out of the 106 blocks were allocated after 2003.

So while it might be true that UPA did not start the policy but what Manmohan Singh cannot deny is that they went around implementing it with a vengeance. The geological reserves of the coal blocks given away for free amounted to around 41billion tonnes. The total geological reserves of coal in India amount to around 286billion tonnes which means 14% of it was given away for free.

Hence, the question that the PM still needs to answer is that why was there a sudden increase in the allocation of blocks between 2004 and 2009, and especially during his tenure as the coal minister between 2006 and 2009?

The answer might most probably lies in the price of coal which started to shoot up around the time UPA first came to power. Prices shot up from around $30-40 per tonne to around $190 per tonne internationally in mid 2008. The conclusion that one can draw from this is that before 2004 it was cheap to just buy coal off the market. But after that things changed and it made more sense for companies to have direct access to coal.

The PM in his statement has also claimed that the loss number of Rs 1.86 lakh crore arrived at by the CAG can be questioned on a number of technical points.

The CAG has calculated the loss number based on certain assumptions. It has only taken into account mines given to private sector companies for free. Those allotted to government companies have been ignored. Underground mines have also not been taken into consideration.

So these assumptions work in favour of the government. If the government blocks had also been taken into account the loss number would have dramatically shot up. It need not be said that the PM does not talk about this anywhere in his statement.

The extractable reserves of these private sector coal blocks come to 6282.5million tonnes of coal. This is the amount of coal that the CAG feels could have been mined and sold and has been given away for free. The average benefit per tonne of this coal was estimated to be at Rs 295.41.

As Abhishek Tyagi and Rajesh Panjwani of CLSA write in a report dated August 21, 2012,”The average benefit per tonne has been arrived at by first, taking the difference between the average sale price (Rs1028.42) per tonne for all grades of CIL(Coal India Ltd) coal for 2010-11 and the average cost of production (Rs583.01) per tonne for all grades of CIL coal for 2010-11. Secondly, as advised by the Ministry of Coal vide letter dated 15 March 2012 a further allowance of Rs150 per tonne has been made for financing cost. Accordingly the average benefit of Rs295.41 per tonne has been applied to the extractable reserve of 6282.5 million tonne calculated as above.”

Using this method CAG arrived at the loss figure of Rs 1,85,591.33 crore (Rs 295.41 x 6282.5million tonnes) or around Rs 1.86 lakh crore. Analysts who track coal believe that assuming a profit of Rs 295.41 per tonne is a fairly conservative estimate.

In fact as has been reported elsewhere, if the e-auction prices of coal would have been considered, the losses would have been at Rs 11.2lakh crore. And if the calculations had been done using the imported coal prices the losses would amount to Rs 18lakh crore. These are huge numbers. The total expenditure of the government of India for the year 2011-2012 was estimated to be at around Rs 13.2lakh crore.

Another bogey that has been raised by the sympathizers of the Congress party (not by the PM) is that coal is a natural resource and hence cannot be “auctioned” or sold at a market price. What they forget to tell us is that coal is a limited natural resource and hence it needs to be priced correctly and not given away for free. If that was not the case why does the government price products like petrol, diesel, telecom spectrum etc? These products are also either natural resources or derivatives of natural resources. Why does Coal India Ltd sell coal at a certain price? Why not give it away for free?

By giving away coal blocks for free the nation has faced huge losses. Whether its Rs 1.86 lakh crore or Rs 18 lakh crore is a matter of conjecture, but that does not take away the fact that losses have been huge. Given this, the PM and the Congress party, are just trying to practice the old adage: “if you can’t convince them, confuse them”.

(The article originally appeared on Asian Age/Deccan Chronicle on September 2,2012. http://www.deccanchronicle.com/editorial/dc-comment/canaries-coal-951)

(Vivek Kaul is a Mumbai based writer. He can be reached at [email protected])

CAG was over-conservative in its Rs 1,86,000 cr loss number

Vivek Kaul

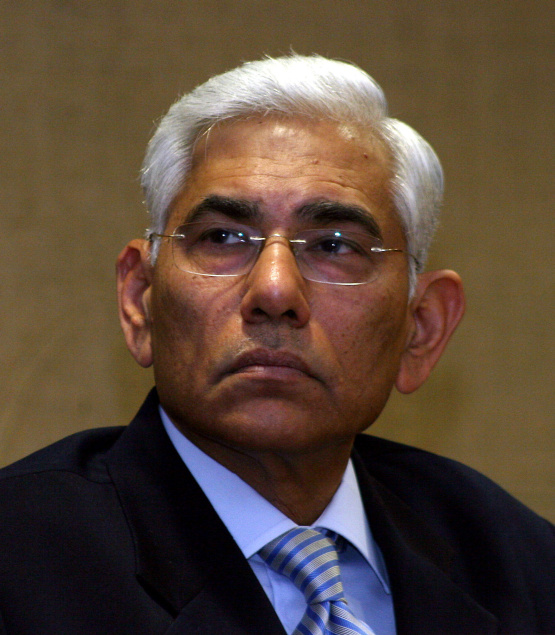

The Congress party seems to be hell bent on discrediting Vinod Rai, the Comptroller and Auditor General(CAG) of India, who has put the estimate of the losses on account of coal-gate at Rs 1.86 lakh crore.

The latest Congress politician to join the “pull Rai down” bandwagon is Digvijaya Singh.

Singh told The Indian Express that “the way the CAG is going, it is clear he(i.e. Vinod Rai) has political ambitions like TN Chaturvedi (a former CAG who later joined the BJP). He has been giving notional and fictional figures that have no relevance to facts. How has he computed these figures? He is talking through his hat.”

Let’s try and understand why what Singh said is nonsense of the highest order and anyone who has read the CAG report wouldn’t say anything that was as remarkably stupid as this. But before I do that let me just summarise the coalgate issue first.

Between 1993 and 2011, the government of India gave away 206 coal blocks for free to government and private sector companies. The idea being that Coal India Ltd wasn’t producing enough coal to meet the growing energy needs of the nation. So free coal blocks were given away so that other companies could produce coal to meet their own coal needs.

Of these blocks given away for free, 165 blocks were given away free between 2004 and 2011. The Congress led United Progressive Alliance(UPA) has been in power since May 2004. Hence, 80% of the coal blocks have been given away for free during the reign of the Congress led UPA government.

This explains to a large extent why the Congress leaders are trying to discredit the CAG. Before Digvijaya Singh, the Prime Minister Manmohan Singh broke his silence for once, and said that the CAG report could be questioned on a number of technical points. The finance minister P Chidambaram said there had been no losses because of free coal blocks allocations and then denied making the statement a little later.

The CAG report on the coalgate scam explains in great detail the method they have used to arrive at a loss figure of Rs 1.86 lakh crore. Hence Singh’s question “how has he computed these figures?” is sheer rhetoric and nothing else.

As is the case with any estimate the CAG made a number of assumptions (for those who have a problem with this, even the government’s annual budget is an estimate which is replaced by a revised estimate a year later, and the actual number two years later). The CAG started with the assumption that the coal mined out of the coal blocks has been given away for free. This coal could be sold at a certain price. Since the government gave away the blocks for free, it let go of that opportunity. And this loss to the nation, the CAG has tried to quantify in terms of rupees, in its report.

There were other assumptions that were made as well. Only the coal blocks given out to private companies were taken into account while calculating losses. Blocks given to government companies were ignored. Personally, I would have liked CAG to take the government companies into account as well while calculating the losses, because a loss is a loss at the end of the day. Also, transactions happen between various sections of the government all the time and the money earned on account of these transactions is taken into account. So should the losses. Out of the 165 blocks allocated since 2004, 83, or around half were allocated to government owned companies.

The amount of coal in a block is referred to as the geological reserve. The portion that can be mined is referred to as the extractable reserve. The CAG calculated extractable reserves of the private coal blocks to be around 6282.5million tonnes. This is the amount of coal that could have been sold.

The second part of the calculation was arriving at a price at which this coal could have been sold. For this the CAG looked at the prices at which Coal India, which produces 80% of India’s coal, sells its various grades of coal. Using these prices it arrived at an average price of Rs 1028.42 per tonne of coal. Obviously there is a cost involved in producing this coal as well. The average cost of production came to Rs 583.01 per tonne. Other than this a financing cost of Rs 150 per tonne was also taken into account.

This meant a profit of Rs 295.41 per tonne of coal (Rs 1028.42 – Rs 583.01 – Rs 150). Hence the government had lost Rs295.41 for every tonne of coal that it gave away for free. Hence, the losses were estimated to be at Rs 1,85,591.33 crore (Rs 295.41 x 6282.5 million tonnes).

This brings me back to Digvijaya Singh. “He has been giving notional and fictional figures that have no relevance to facts,” a part of his statement said. The numbers are not fictional at all. They are backed by hardcore data. If you don’t use the numbers of Coal India, a company which produces 80% of the coal in India, whose numbers do you use? That is a question that Singh should answer.

Also, the price at which Coal India sells coal to companies it has an agreement with, is the lowest in the market. It is not linked to the international price of coal. The price of coal that is auctioned by Coal India is much higher than its normal price. As the CAG points out in its report on the ultra mega power project, the average price of coal sold by Coal India through e-auction in 2010-2011 was Rs 1782 per tonne. The average price of imported coal in November 2009 was Rs 2874 per tonne (calculated by the CAG based on NTPC data). The CAG did not take into account these prices. It took into account the lowest price of Rs 1028.42 per tonne, which was the average Coal India price.

Let’s run some numbers to try and understand what kind of losses CAG could have come up with if it wanted to. At a price of Rs 1,782, the profit per tonne would have been Rs 1050 (Rs 1782-Rs 583.01- Rs 150). If this number had been used the losses would have amounted to Rs6.6lakh crore.

At a price of Rs 2874 per tonne, the profit per tonne would have been Rs 2142(Rs 2874 – Rs 583.01 – Rs 150). If this number had been used the losses would have been Rs 13.5lakh crore. This number is a little more than the Rs 13.18 lakh crore expenditure that the government of India incurred in 2011-2012.

Even a weighted average price of these three prices would have implied a loss of Rs 7.3lakh crore. And this when the coal blocks given to government companies haven’t been taken into account at all.

So the point is that the CAG like a good accountant has worked with very conservative estimates and come up with a loss of Rs1.86 lakh crore. It could have easily come up with substantially bigger numbers as I just showed.

Now coming to the final charge of Vinod Rai having political ambitions. “The way the CAG is going, it is clear he(i.e. Vinod Rai) has political ambitions like TN Chaturvedi (a former CAG who later joined the BJP),” said Singh. Well just because one former CAG joined politics does not mean that every other CAG will follow him.

Singh should well remember the old English adage: “one swallow does not a summer make”.

(The article originally appeared on www.firstpost.com on September 1,2012. http://www.firstpost.com/business/cag-was-over-conservative-in-its-rs-186000-cr-loss-number-439355.html)

(Vivek Kaul is a writer and can be reached at [email protected])

Why Manmohan Singh was better off being silent

Vivek Kaul

So the Prime Minister (PM) Manmohan Singh has finally spoken. But there are multiple reasons why his defence of the free allocation of coal blocks to the private sector and public sector companies is rather weak.

“The policy of allocation of coal blocks to private parties…was not a new policy introduced by the UPA (United Progressive Alliance). The policy has existed since 1993,” the PM said in a statement to the Parliament yesterday.

But what the statement does not tell us is that of the 192 coal blocks allocated between 1993 and 2009, only 39 blocks were allocated to private and public sector companies between 1993 and 2003.

The remaining 153 blocks or around 80% of the blocks were allocated between 2004 and 2009. Manmohan Singh has been PM since May 22, 2004. What makes things even more interesting is the fact that 128 coal blocks were given away between 2006 and 2009. Manmohan Singh was the coal minister for most of this period.

Hence, the defence of Manmohan Singh that they were following only past policy falls flat. Given this, giving away coal blocks for free is clearly UPA policy. Also, we need to remember that even in 1993, when the policy was first initiated a Congress party led government was in power.

The PM further says that “According to the assumptions and computations made by the CAG, there is a financial gain of about Rs. 1.86 lakh crore to private parties. The observations of the CAG are clearly disputable.”

What is interesting is that in its draft report which was leaked earlier in March this year, the Comptroler and Auditor General(CAG) of India had put the losses due to the free giveaway of coal blocks at Rs 10,67,000 crore, which was equal to around 81% of the expenditure of the government of India in 2011-2012.

Since then the number has been revised to a much lower Rs 1,86,000 crore. The CAG has arrived at this number using certain assumptions.

The CAG did not consider the coal blocks given to public sector companies while calculating losses. The transaction of handing over a coal block was between two arms of the government. The ministry of coal and a government owned public sector company (like NTPC). In the past when such transactions have happened revenue from such transactions have been recognized.

A very good example is when the government forces the Life Insurance Corporation (LIC) of India to forcefully buy shares of public sector companies to meet its disinvestment target. One arm of the government (LIC) is buying shares of another arm of the government (for eg: ONGC). And the money received by the government is recognized as revenue in the annual financial statement.

So when revenues from such transactions are recognized so should losses. Hence, the entire idea of the CAG not taking losses on account of coal blocks given to pubic sector companies does not make sense. If they had recognized these losses as well, losses would have been greater than Rs 1.86lakh crore. So this is one assumption that works in favour of the government. The losses on account of underground mines were also not taken into account.

The coal that is available in a block is referred to as geological reserve. But the entire coal cannot be mined due to various reasons including those of safety. The part that can be mined is referred to as extractable reserve. The extractable reserves of these blocks (after ignoring the public sector companies and the underground mines) came to around 6282.5 million tonnes. The average benefit per tonne was estimated to be at Rs 295.41.

As Abhishek Tyagi and Rajesh Panjwani of CLSA write in a report dated August 21, 2012,”The average benefit per tonne has been arrived at by first, taking the difference between the average sale price (Rs1028.42) per tonne for all grades of CIL(Coal India Ltd) coal for 2010-11 and the average cost of production (Rs583.01) per tonne for all grades of CIL coal for 2010-11. Secondly, as advised by the Ministry of Coal vide letter dated 15 March 2012 a further allowance of Rs150 per tonne has been made for financing cost. Accordingly the average benefit of Rs295.41 per tonne has been applied to the extractable reserve of 6282.5 million tonne calculated as above.”

Using this is a very conservative method CAG arrived at the loss figure of Rs 1,85,591.33 crore (Rs 295.41 x 6282.5million tonnes).

Manmohan Singh in his statement has contested this. In his statement the PM said “Firstly, computation of extractable reserves based on averages would not be correct. Secondly, the cost of production of coal varies significantly from mine to mine even for CIL due to varying geo-mining conditions, method of extraction, surface features, number of settlements, availability of infrastructure etc.”

As the conditions vary the profit per tonne of coal varies. To take this into account the CAG has calculated the average benefit per tonne and that takes into account the different conditions that the PM is referring to. So his two statements in a way contradict each other. Averages will have been to be taken into consideration to account for varying conditions. And that’s what the CAG has done.

The PM’s statement further says “Thirdly, CIL has been generally mining coal in areas with

better infrastructure and more favourable mining conditions, whereas the coal blocks offered for captive mining are generally located in areas with more difficult geological conditions.”

Let’s try and understand why this statement also does not make much sense. As The Economic Times recently reported, in November 2008, the Madhya Pradesh State Mining Corporation (MPSMC) auctioned six mines. In this auction the winning bids ranged from a royalty of Rs 700-2100 per tonne.

In comparison the CAG has estimated a profit of only Rs 295.41 per tonne from the coal blocks it has considered to calculate the loss figure. Also the mines auctioned in Madhya Pradesh were underground mines and the extraction cost in these mines is greater than open cast mines. The profit of Rs 295.41was arrived at by the CAG by considering only open cast mines were costs of extraction are lower than that of underground mines.

The fourth point that the PM’s statement makes is that “Fourthly, a part of the gains would in any case get appropriated by the government through taxation and under the MMDR Bill, presently being considered by the parliament, 26% of the profits earned on coal mining operations would have to be made available for local area development.”

Fair point. But this will happen only as and when the bill is passed. And CAG needs to work with the laws and regulations currently in place.

A major reason put forward by Manmohan Singh for not putting in place an auction process is that “major coal and lignite bearing states like West Bengal, Chhattisgarh, Jharkhand, Orissa and Rajasthan that were ruled by opposition parties, were strongly opposed to a switch over to the process of competitive bidding as they felt that it would increase the cost of coal, adversely impact value addition and development of industries in their areas.”

That still doesn’t explain why the coal blocks should have been given away for free. The only thing that it does explain is that maybe the opposition parties also played a small part in the coal-gate scam.

To conclude Manmohan Singh might have been better off staying quiet. His statement has raised more questions than provided answers. As he said yesterday “Hazaaron jawabon se acchi hai meri khamoshi, na jaane kitne sawaalon ka aabru rakhe”.For once he should have practiced what he preached.

(The article originally appeared in the Daily News and Analysis on August 29,2012. http://www.dnaindia.com/analysis/column_why-manmohan-singh-was-better-off-being-silent_1734007))

(Vivek Kaul is a writer and can be reached at [email protected])