The BSE Sensex closed at 28,177 points on November 17, up by around half a percent from its last close. Its been good going for the Sensex, having rallied by 33.3% since the beginning of this year. This probably led to a reader asking me on Twitter whether the stock market rally was for real or would the bubble burst soon?

These are essentially two questions here. First, whether the current rally is a bubble? Second, how long will it last? These are not easy questions to answer. Also, instead of trying to figure out whether the current rally is a bubble or not, I will stick to answering the second question, that is, how long will the current rally last.

As I have written on a few occasions in the past, the current rally is being driven by foreign institutional investors (FIIs). The domestic institutional investors(DIIs) have had very little role to play in it. The FIIs have made a net investment of a little over Rs 68,000 crore since the beginning of the year. During the same period the DIIs have made net sales of Rs 32,468 crore.

This data makes it very clear who has been driving the market up. Given this, instead of trying to figure out whether the current market is a bubble or not, it makes more sense to figure out whether the FIIs will keep bringing in fresh money into the Indian stock market.

The foreign investors have been borrowing money at very low interest rates and investing it in financial markets all around the world. They have been able to do that because Western central banks have been printing money to maintain low interest rates.

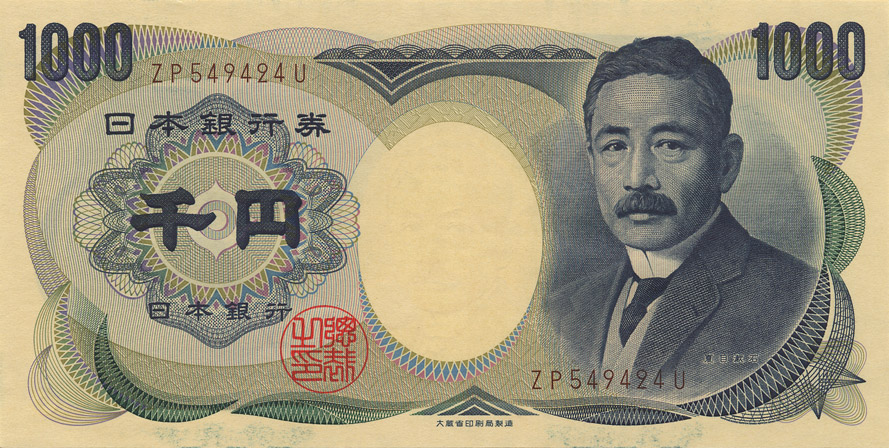

The Federal Reserve of the United States (the American central bank) recently decided to stop printing money and almost at the same time, the Bank of Japan decided to increase it. The Japanese central bank will now print around 80 trillion yen per year. The central bank had been printing around 60-70 trillion yen since April 2013, when it got into the money printing party, big time.

Like other central banks it pumped this money into the financial system by buying bonds. Interestingly, the size of the balance sheet of the Bank of Japan stood at around 164.8 trillion yen in March 2013. Since then, it has increased dramatically and as of October 2014 stood at 286.8 trillion yen.

The Bank of Japan hopes that by printing money it will manage to create some inflation. Once people see the price of goods and services going up, they will go out and shop, in the hope of getting a better deal. Also, with all the money printed and pumped into the financial system, interest rates will continue to remain low. And at low interest rates people were more likely to borrow and spend. Once people start to shop, it will lead to economic growth. Japan has had very little economic growth over the last two decades.

The trouble is that the Japanese aren’t falling for this oft tried central bank formula. And there is a clear reason for it. James Rickards in his book The Death of Money explains the point using what Eisuke Sakakibara, a former deputy finance minister of Japan, said in a speech on May 31, 2013, in South Korea.

As Rickards writes “Sakakibara…pointed out that Japanese people are wealthy and have prospered personally despite decades of low nominal growth. He made the often-overlooked point that because of Japan’s declining population, real GDP per capita will grow faster than aggregate GDP. …Combined with the accumulated wealth of the Japanese people, this condition can result in well-to-do-society even in the face of nominal growth that would cause central bankers to flood the economy with money.”

The question to ask here is will the Japanese continue to print money? The answer is yes. The Japanese politicians are desperate to create some inflation and the central bank has decided to get into bed with them. Also, more than that the Japanese government spends much more than it earns and needs to be bailed out by the Bank of Japan.

As analyst John Mauldin wrote in a recent column titled The Last Argument of Central Banks “According to my friend Nouriel Roubini, in 2013 Japan’s total tax revenue fell to a 24-year low. Corporate tax receipts fell to a 50-year low. Japan now spends more than 200 yen for every 100 yen of tax revenue it receives. It is likely Japan will run an 8% fiscal deficit to GDP this year, but the Bank of Japan is currently monetizing at a rate of over 15% of GDP, thereby theoretically reducing the level of debt owed by government institutions other than the central bank.”

Fiscal deficit is the difference between what a government earns and what it spends.

What Mauldin basically means is that a part of the debt raised by the Japanese government is being repaid through the Bank of Japan printing money and lending it to the government. With all this money continuing to float around in the financial system, interest rates in Japan will continue to remain low.

This will allow large financial institutions to borrow money at low interest rates in Japan and invest it in financial markets all over the world, including India.

The European Central Bank (ECB) also seems to be in the mood to start quantitative easing (QE, i.e. printing money to buy bonds). As Mohamed A. El-Erian, Chief Economic Adviser at Allianz wrote in a recent column “In fact, ECB President Mario Draghi signaled a willingness to expand his institution’s balance sheet by a massive €1 trillion ($1.25 trillion).”

While the United States might have decided to stop printing money, Japan and the Euro Zone, want to take a shot at it. Interestingly, chances are that the United States might go back to money printing in the years to come. As Niels C. Jensen writes in The Absolute Return Letter for November 2014 “If my growth expectations are about correct, QE is far from over – at least not in some parts of the world, and it is even possible that the Fed[the Federal Reserve of the United States] will come creeping back after having distanced itself from QE recently.”

The Federal Reserve of the United States has been financing the American fiscal deficit by printing money and buying treasury bonds issued by the government. In mid September 2008, around the time the financial crisis started, the Fed held treasury bonds worth $479.8 billion dollars. Since then, the number has shot up dramatically and as on October 29, 2014, it stood at $2.46 trillion dollars.

The fiscal deficit of the United States government shot up in the aftermath of the financial crisis. It was financed by more than a little help from the Federal Reserve. Nevertheless, the fiscal deficit has now been brought down. As Mauldin points out “The 2014 government deficit will be only 2.8% of GDP (it last saw that level in April 2005), the first time in a long time it has been below nominal GDP.”

The bad news is that the fiscal deficit will start rising again in 2016. “It is projected to fall again next year before rising in 2016. For the United States, this represents a reprieve, allowing us some time to deal with potential future problems before government spending rises to a proportion of income that is impossible to manage without severe economic repercussions. Government spending on mandated social programs will rise more than 50%, from $2.1 trillion this year to $3.6 trillion in 2024, potentially blowing the deficit out of control,” writes Mauldin.

The Federal Reserve might have to start printing money again in order to finance the government fiscal deficit.

Moral of the story: There are enough reasons for the Western nations to continue printing money and ensuring low interest rates. This means, FIIs can continue to borrow money at low interest rates and invest it in financial markets all over the world, including India.

The easy money party hasn’t ended. The only condition here is that the current government should not create a negative environment like the previous one did.

To conclude, the difficult thing to predict is, until when will this easy money party continue. I don’t have any clue about it. Do you, dear reader?

The article originally appeared on www.equitymaster.com on Nov 18, 2014