In the Diary dated December 13, 2016, I had tried to answer a question: The question was what portion of black money is held in the form of cash.

In order to answer the question I had reproduced some data out of the White Paper on Black Money published by the Manmohan Singh government in May 2012. This data was reproduced in the form of two tables. The tables had data from the search and seizure operations carried out by the income tax department. They are reproduced below:

Table 1: Value of assets seized (in Rs. Crore)

| Year | Cash | Jewellery | Other assets | Total Undisclosed Income Admitted (in Rs Crore) |

|---|---|---|---|---|

| 2006-07 | 187.48 | 99.19 | 77.96 | 3,612.89 |

| 2007-08 | 206.35 | 128.07 | 93.39 | 4,160.58 |

| 2008-09 | 339.86 | 122.18 | 88.19 | 4,613.06 |

| 2009-10 | 300.97 | 132.20 | 530.33 | 8,101.35 |

| 2010-11 | 440.28 | 184.15 | 150.55 | 10,649.16 |

| 2011-12 | 499.91 | 271.40 | 134.30 | 9,289.43 |

Source: White Paper on Black MoneyThe cash seized at the time the search and seizure operations were carried out by the income tax department, was a small portion of the total undisclosed income. This becomes clear from Table 2.

Table 2:

| Year | Cash | Total Undisclosed Income Admitted (in Rs Crore) | Proportion of cash in total undisclosed wealth |

|---|---|---|---|

| 2006-07 | 187.48 | 3,612.89 | 5.2% |

| 2007-08 | 206.35 | 4,160.58 | 5.0% |

| 2008-09 | 339.86 | 4,613.06 | 7.4% |

| 2009-10 | 300.97 | 8,101.35 | 3.7% |

| 2010-11 | 440.28 | 10,649.16 | 4.1% |

| 2011-12 | 499.91 | 9,289.43 | 5.4% |

| Total | 1,974.85 | 40,426.47 | 4.9% |

Source: Author calculations based on White Paper on Black MoneySo what do the tables tell us? They tell us that a very small portion of black money is held in the form of cash. People tend to hold their black money in the form of assets other than cash. And given this, what was the point of carrying out the demonetisation exercise which tried to tackle black money held in the form of cash, is a question worth asking.

As the ministry of finance press release on demonetisation said: “Use of high denomination notes for storage of unaccounted wealth has been evident from cash recoveries made by law enforcement agencies from time to time. High denomination notes are known to facilitate generation of black money.” By demonetising the notes of Rs 500 and Rs 1,000, the idea perhaps was to ensure that a lot of black money is deposited into banks. And after that the government would find ways of recovering it.

So far so good. By now, you must be wondering dear reader, as to why am I repeating things which I have already pointed out earlier, perhaps multiple times. What is the current context? Well, over the weekend I happened to read a recently published book titled Demonetisation and Black Money written by C Rammanohar Reddy.

On Page 61 of the book Reddy has a table which is more or less similar to the Table 1 earlier in the Diary. The point he is trying to make is the same as the point I made earlier, i.e., very little of black money is held in the form of cash. Hence, Reddy goes on to say: “Thus, prima facie, cash is not a dominant component of the aggregate stock of black money or of the total value of transactions in the black economy.”

If cash is not a dominant component of the black money i.e. people don’t hold a significant portion of their black money in the form of cash, then attacking it through demonetisation does not seem to make any sense. But Reddy does not totally agree with this and offers two reasons on why attacking the cash component of the economy through demonetisation can be justified. As he writes: “First, because cash is one instrument which is used for both transactions and investment-more for the former than for the latter—an attack on ‘black cash’, as it were, could have a disruptive effect on the market value of the stocks in the black economy.”

Honestly, this is the first well argued point that I have come across in support of demonetisation. What does it mean in simple English? People who have black money do not hoard it in the form of cash, that is a given. Despite that transactions in the black economy are carried out in the form of cash.

Take the case of a home that has been bought using both white money and black money. When it is sold, the payment will be sought both in white money in the form of a cheque, and black money in the form of cash. Hence, as Reddy puts it: “The availability of a buyer with cash becomes critical for effecting the transaction… Cash, is not a dominant part of the black economy, [but] it lends liquidity to the transactions in the black economy“. If you take cash out of the system, you make it difficult for those who transact in the black economy to continue transacting. And to that extent, there was some justification for demonetisation.

As I said earlier Reddy had offered two reasons in favour of attacking the cash component. Here is the second reason. As he writes: “Second, attacking cash may be the most effective way of communicating the government’s determination to deal with the black economy. So any attempts to disable its use may send the appropriate signals to the holders of unaccounted wealth and to people at large.” This is also a relevant point. It is easier for a government to attack cash than it attack hoards of black wealth held in the form of gold and real estate. That would be significantly tougher.

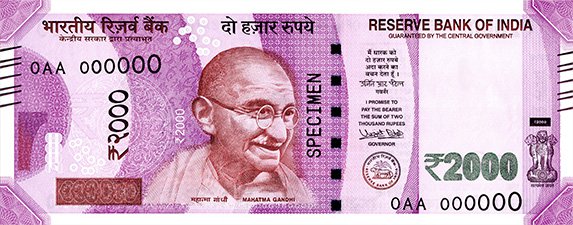

These are two very good reasons offered in favour of demonetisation carried out by the Narendra Modi government on November 8, 2016. Having said that along with demonetisation the government did something which has entirely opposite of what it was trying to achieve. It introduced a Rs 2,000 note replacing the Rs 1,000 note.

As mentioned earlier, while cash is not used to store black money, it is used to carry out transactions in the black economy. Also, higher the denomination of the paper money, easier it is carry out transactions in the black economy. It also makes it easier to store black money in the form of cash.

As Reddy writes: “It may have been a strange decision to take to introduce a new currency of even higher denomination, given that one of the objectives of the entire exercise was to remove high denomination notes from circulation.”

One reason for introducing a Rs 2,000, a note of higher denomination than Rs 500 and Rs 1,000 notes which were demonetised, lies in the fact that it accelerated the process of remonetisation i.e. the process of printing notes and pumping them into the financial system. It takes one Rs 2,000 note to replace two Rs 1,000 notes or four Rs 500 notes. Hence, the process of remonetisation works faster.

Having said that, it goes against the entire idea of demonetising in the first place. A Rs 2,000 note makes it even more easier to carry out transactions in black than a Rs 1,000 note, given that fewer notes are needed. It also makes it easier to store black money in the form of cash due to the same reason.

Hence, it is important that the government withdraw the Rs 2,000 note. It needs to do this gradually over a period of time. The Rs 1,000 note needs to be re-introduced. The moment a Rs 2,000 note comes back to a bank, it needs to be replaced by two Rs 1,000 notes. A date also needs to be set by which the Rs 2,000 notes need to deposited back into the banks.

Again, it is important that the mess that was created in the aftermath of demonetisation be avoided. This can be done by having a last date which is a couple of years down the line. The RBI has carried out phased withdrawal of currency in the past, which is precisely what can be done in this case as well.

The column originally appeared in Equitymaster on April 1, 2017