Vivek Kaul

Raghuram Govind Rajan will take over as the governor of the Reserve Bank of India(RBI) on September 4, 2013. There are great expectations from him to turnaround the faltering Indian economy. His appointment has been welcomed by the media, business leaders as well as politicians. It is one of those rare occasions where almost everyone seems to be happy about the appointment.

But will Rajan be able to deliver? Will he able to control inflation, stop the rupee from falling further against the dollar and at same time engineer economic growth, as he is expected to. Or to ask a more pointed question, can any central banker really make a huge difference?

Before I get around to answering that question, let me deviate a little.

Inflation targeting has been a favourite policy of central banks all over the world. This strategy essentially involves a central bank estimating and projecting an inflation target and then using interest rates and other monetary tools to steer the economy towards the projected inflation target.

But recent analysis suggests that inflation targeting might have been one of the major reasons behind the current financial crisis. Stephen D King, Group Chief Economist of HSBC makes this point in his new book When the Money Runs Out. As he writes “the pursuit of inflation-targetting…may have contributed to the West’s financial downfall.”

He gives the example of United Kingdom to make his point. “Take, for example, inflation targeting in the UK. In the early years of the new millennium, inflation had a tendency to drop too low, thanks to the deflationary effects on manufactured goods prices of low-cost producers in China and elsewhere in the emerging world. To keep inflation close to target, the Bank of England loosened monetary policy with the intention of delivering higher ‘domestically generated’ inflation. In other words, credit conditions domestically became excessive loose…The inflation target was hit only by allowing domestic imbalances to arise: too much consumption, too much consumer indebtedness, too much leverage within the financial system and too little policy-making wisdom.”

In simple English what this basically means is that the Bank of England, the British central bank, kept interest rates too low for a very long time, so that people borrowed and spent money. This was done in the hope that prices would rise and the inflation target would thus be met.

With interest rates being low banks were falling over one another to lend money to anyone who was willing to borrow. And this gradually led to a fall in lending standards. People who did not have the ability to repay were also being given loans. As King writes “With the UK financial system now awash with liquidity, lending increased rapidly both within the financial system and to other parts of the economy that, frankly, didn’t need any refreshing. In particular, the property sector boomed thanks to an abundance of credit and a gradual reduction in lending standards.”

The Western central banks were focussed on just maintaining the inflation target that they had set. In fact, the ‘inflation only’ focus was a result of how economic theory had evolved over the years. As Felix Martin writes in the fascinating book Money – The Unauthorised Biography “The sole monetary ill that had been permitted into the New Keynesian theory was high or volatile inflation, which was deemed to retard the growth of GDP. The appropriate policy objective, therefore, was low and stable inflation, or ‘monetary stability’…On such grounds, the Bank of England was granted its independence and given a mandate to target inflation in 1997, and the European Central Bank was founded as an independent, inflation-targeting central bank in 1998.”

But this focus on ‘low inflation’ or ‘monetary stability’ as economists like to call it, turned out to be a very narrow policy objective. As Martin writes “The single minded pursuit of low and stable inflation not only drew attention away from the other monetary and financial factors that were to bring the global economy to its knees in 2008 – it exacerbated them…Disconcerting signs of impending disaster in the pre-crisis economy – booming housing prices, a drastic underpricing of liquidity in asset markets, the emergence of shadow banking system, the declines in lending standards, bank capital, and the liquidity ratios – were not given the priority they merited, because, unlike low and stable inflation, they were simply not identified as being relevant.”

And this ‘lack of focus’ led to a big real estate bubbles in large parts of the Western world, which was followed by biggest ‘macroeconomic’ crash in history.

Since then, central banks around the world have tried to concentrate on factors other than inflation as well. But it is not easy for a central bank, if I might use that phrase, to be all over the place.

Raghuram Rajan understands this very well. As he wrote in a 2008 article (along with Eswar Prasad) “The RBI already has a medium-term inflation objective of 5 per cent…But the central bank is also held responsible, in political and public circles, for a stable exchange rate. The RBI has gamely taken on this additional objective but with essentially one instrument, the interest rate, at its disposal, it performs a high-wire balancing act.”

Focus on multiple things makes the RBI run the risk of not doing any of them well. “What is wrong with this? Simple that by trying to do too many things at once, the RBI risks doing none of them well,” wrote Rajan and Prasad.

Hence it made sense for the RBI to concentrate on one thing instead of being all over the place. As Rajan wrote in the 2008 Report of the Committeeon Financial Sector Reforms “ The RBI can best serve the cause of growth by focusing on controlling inflation, and intervening in currency markets only to limit excessive volatility. This focus can also best serve the cause of inclusion because the poorer sections are least hedged against inflation.”

Rajan might have revised his beliefs in the last five years. But as we have seen over the period, the strategy of central banks being all over the place hasn’t really worked either. Given this, we shouldn’t have very high expectations from what Rajan will be able to do as the governor of the RBI, even though he maybe the best man for the job.

To conclude, it is worth remembering what Sunil Gavaskar said in 1994, after he was appointed the manager of a floundering Indian cricket team. “Results can’t be produced overnight. I’m not instant coffee,” said the cricket legend.

Rajan probably realises this more than anyone else. As he wrote recently in his globally syndicated column “The bottom line is that if there is one myth that recent developments have exploded it is probably the one that sees central bankers as technocrats, hovering independently over the politics and ideologies of their time. Their feet, too, have touched the ground.”

This article originally appeared in the Wealth Insight Magazine for September 2013

(Vivek Kaul is the author of the soon to be published Easy Money. He tweets @kaul_vivek)

Wealth Insight

The Complexity of Money

Vivek Kaul

Over the last two weeks I have come to realise that people share a very complex relationship with money. A friend of mine who makes more than Rs 50 lakh a year, owns two homes, a couple of cars, and holidays abroad in exotic locations ever year, has constantly been cribbing about the 10% increment he got after the yearly performance appraisal.

“So were you expecting more?” I asked him. “Not really. The company hasn’t been in a great shape, so even 10% is very good. The average increments this year have only been around 6-7%,” he replied.

“So then what is the issue?” I asked.

“Well you know,” he said, such and such person, “who I tend to compete with got an increment of 11%.” This difference of 1%(actually I should be saying 100 basis points, but that sounds too technical) had been bothering him no end.

I tried telling him that his salary was nearly 50% more than the other person he was talking about. “So in absolute terms your increment is greater than his,” I explained.

“Yeah. But it would have been better if I made more in percentage terms as well,” my friend replied.

What this little story tells us is that people share a complex relationship with money. How else do you explain what my friend earning more than Rs 50 lakh per year was going through? There is no doubt that money motivates. An experiment carried out in 1953, showed just that. As Margaret Heffernan writes in Wilful Blindness – Why We Ignore the Obvious At Our Peril “Patients were asked to hang on horizontal bars for as long as they could; most could take it for about 45 seconds. When subjected to power of suggestion and even, in some cases, hypnosis, they could stretch to about 75 seconds. But when offered a five dollar bill the patients managed to hang from the bar for 110 seconds.”

So money does motivate people to work longer. And in many organisations that is equivalent to working harder. But as Heffernan puts it “money has a more complex influence on people than just making them work longer.”

Experiments carried out by behavioural psychologist Dan Ariely suggest that the less appreciated we feel our work is, the more money we want to do it. Ariely gave research participants a piece of paper that was filled with random letters. The participant were divided into three groups, and had to find pairs of identical letters on the sheets of paper given to them and mark them out.

While returning their papers, the the participants in the first group wrote their names on the sheets of paper and handed it back to the experimenter. He took the sheet, looked it over, said “Uh huh” and put it in a pile.

The participants in the second group did not write their names on the sheets of paper. The experimenter took their sheets without looking at them and without saying anything. He placed them in a pile. The sheets handed over by the participants of the third group were immediately shredded, as soon as they handed them over.

In order to be a part of another round of the experiment, those in the third group whose sheets were shredded wanted twice the amount of money in comparison to those in the first group, whose sheets were simply put in a pile. Those in the second group whose work was saved but ignored wanted as much as participants of the third group whose sheets were shredded.

As Ariely put in a blog on www.ted.com “Ignoring the performance of people is almost as bad as shredding their effort before their eyes.” And when that happens people want to be paid more.

The next question that crops up is that does paying people more money make them work smarter?This question is of utmost importance given the fact that some of the highest paid people in the world brought it to the verge of economic collapse a few years back in late 2008.

Ariely and a group of researchers tested this out in an experiment they carried out in India (to control the costs involved in running the experiment). In this experiment, research participants were asked to play memory games and assemble puzzles while they were throwing tennis balls at a target. One third of the participants were promised one day’s pay, if they performed well. Another one third were promised two weeks pay. And the final third were promised five months pay (the real reason behind conducting the experiment in India), if they did well.

The results were surprising. Those who were promised a day’s pay and two weeks pay as a financial reward, performed equally well. But those who were offered five months pay, performed the worst.

Ariely explained this surprising finding in an article he wrote for The New York Times. Very high financial rewards act as a double edged sword, Ariely wrote. “They provide motivation to work well, but they also cause stress and preoccupation with the reward that can actually hurt performance.”

Of course this in no way means that people don’t want to paid more, even though the prospect of earning more money starts hurting their performance beyond a point. Also, more money doesn’t always make people happier.

Research carried out by economist Angus Deaton and psychologist Daniel Kahneman (who won the Noble Prize in economics) in 2010 found that more money makes people happier upto an income of $75,000 per year. As Kahneman writes in Thinking, Fast and Slow “The satiation level beyond which experienced well being no longer increases was a household income of $75,000 in high cost areas (it could be less in areas where the cost of living is lower). The average increase of experienced well-being associated with incomes beyond that level was precisely zero…Higher income brings with it higher satisfaction, well beyond the point at which it ceases to have any positive effect on experience.”

So earning more money is not always directly proportional to greater happiness. But then why does money continue to bother people (as we saw in my friend’s case) so much? Nassim Nicholas Taleb perhaps has an explanation for it in Anti Fragile “The worst side of wealth is the social association it forces on its victims, as people with big houses tend to end up socialising with other people with big houses.”

Beyond a point the need for more money is an essential part of being seen at the top of the rat race. More money is also equated with higher intelligence and leads to greater respect from the society at large. As John Kenneth Galbraith, one economist who thoroughly deserved a Nobel prize, but never never got it, put it in A Short History of Financial Euphoria: “Individuals and institutions are captured by the wondrous satisfaction from accruing wealth. The associated illusion of insight is protected, in turn, by the oft-noted public impression that intelligence, one’s own and that of others, marches in close step with the possession of money.” Hence, money after a point becomes a measure of intelligence and success and that creates problems of its own.

The article originally appeared in the Wealth Insight magazine dated August 1, 2013

(Vivek Kaul is a writer. He tweets @kaul_vivek)

The psychology of discounts

Vivek Kaul

Vivek Kaul

The power discounts have over consumer spending became apparent to me on a recent visit to Delhi. An aunt of mine decided to travel nearly twenty five kilometres in a DTC (Delhi Transport Corporation) bus to have lunch in a restaurant in Connaught Place, which was offering a 20% discount. And this was a time when the heat in Delhi was killing, with the temperature being greater than 40 degrees Celsius.

After coming back to Mumbai I heard about a high end lifestyle brand putting its goods on sale. And women queued up for it from 6.30am in the morning, despite the heavy rains.

That’s the power the words discount and sale have on the human mind. They can really get people out there to shop, despite the rains and the heat.

In fact Eric Anderson and Duncan Simester carried out an experiment to test whether just labelling something to be “on sale” lead to higher sales. Jonah Berger discusses this experiment in his book Contagious – Why Things Catch on. As he writes “Anderson and Simester, created two different versions of the catalogue and mailed each to more than fifty thousand people. In one version some of the products(let’s call them dresses) were marked with signs that said “Pre-Season SALE.” In other version the dresses were not marked as on sale.”

The results were very interesting. The items on which a sale sign had been marked, saw the demand go up by more than 50%. “The prices of the dresses (i.e. the items marked to be on sale) were the same in both versions of the catalogue. So using the word ‘sale’ beside a price increased sales even though the price itself stayed the same.”

While just mention of the world ‘sale’ is likely to increase sales, the trick is not to overuse it. As Anderson and Simester point out in a research paper titled The Role of Sale Signs “if customers’ price expectations are sensitive to the number of products that have sale signs, this strategy is not without cost. Using additional sale signs may reduce demand for other products that already have sale signs.” Also, if a product is always on sale then there is a problem because people can’t compare it with anything.

Despite these negatives, the fact is that everyone wants a good deal. In fact such is people’s fascination for getting a good deal that in some cases they are even willing to pay more. Berger carried out a small experiment in which a barbecue grill is on sale. Originally priced at $350, now its being sold at $250, a saving of $100. He ran this ‘deal’ through 100 people and 75% of the people said that they would buy the grill.

There was another scenario in which the same grill was on sale but at a different store. Originally it had been priced at $255 and was now selling at $240. Berger ran this ‘deal’ through 100 people and only 22% of the people said they would buy the grill.

And this is what made things really interesting. “Both stores were selling the same grill. So if anything, people should have been more likely to say they would buy it at the store where the price was lower….More people said they would purchase the grill in scenario A (the first scenario where a $350 grill was being sold for $250), even though they would have to pay a higher price ($250 rather than $240) to get it,” writes Berger.

Discount and sales offers play tricks on the human mind leading it to make irrational decisions, which are exploited by marketers. Akshay Rao of the University of Minnesota carried out a research on discounts and offering something extra for the same price, which he published in a paper titled When More Is Less: The Impact of Base Value Neglect on Consumer Preferences for Bonus Packs over Price Discounts.

In this paper Rao came to the conclusion that “shoppers prefer getting something extra free to getting something cheaper.”He explains this through an example of coffee beans. On a normal day, 100 coffee beans are being sold for Rs 100. One day, a discount of 33% is on offer. This means 100 coffee beans are sold for Rs 67.

Another day, a 50% extra offer is on. This means 150 coffee beans can now be bought for Rs 100. But what this also means is that 100 coffee beans can be bought for Rs 67. So a 33% discount offer and a 50% extra offer are economically equivalent. There is no difference between them, at least theoretically.

But real life turned out to be different from theory as usual. Rao and his team carried out an experiment and found that they managed to increase sales of a consumer packed good by over 70% in a retail store, when they used the extra/free bonus pack format in comparison to offering a discount on the product. Rao attributes this to the fact that the human mind is not good at performing arithmetic with complex forms such as logarithms, fractions, probability and percentages.

So if you have ever wondered why everyone from biscuit companies to mobile phone operators wants to give out something extra, rather than offer a discount, you now know why.

The inability to handle basic maths leads to marketers exploiting it in other ways as well. One such way is to express discount in a way where it seems larger than it actually is. As Berger writes “Twenty percent off on that $25 shirt seems like a better deal than $5 off. For high-priced big-ticket-items, framing price reductions in dollar terms (rather than percentage terms) makes them seem like a better offer. The laptop seems like a better deal when it is $200 off rather than 10 percent off.”

Whether marketers express discount in absolute terms or in percentage terms depends on the rule of 100. If the price of a product is less than $100 (or Rs 100 or any other currency) the percentage discount will seem bigger. Vice versa is true, if the price of a product is higher than $100. “For a $30 shirt…even a $3 discount is still a relatively small number. But percentage wise (10 percent), that same discount looks much bigger…Take a $750 vacation package or the $2,000 laptop. While a 10 percent discount may seem like a relatively small number, it immediately seems much bigger when translated into dollars ($75 or $200),” writes Berger.

The interesting thing is that the rule of 100 doesn’t seem to have caught on in India as yet. This could be a killer application for discount websites, which still focus on expressing discounts in percentage terms. As I write this the Bangla version of Amish’s The Immortals of Melhua is selling for Rs 130, a 33% discount on a price of Rs 195, on one of the discount websites. Now wouldn’t Rs 65 off have sounded so much more better?

While marketers are quick to latch on to these tricks, in this case they seem to have missed out on something rather obvious. Rest assured this anomaly will be corrected in the days to come.

The article originally appeared in the Wealth Insight magazine dated July 1, 2013

(Vivek Kaul is a writer. He tweets @kaul_vivek)

The Flipside of Business Books

Vivek Kaul

Vivek Kaul

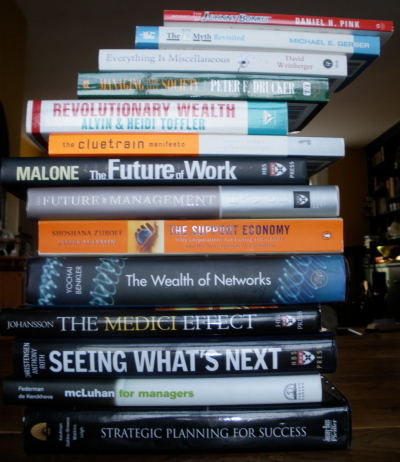

There is a certain formula to writing a business book which explains the reasons behind the success of a particular company and the learnings other ‘lesser mortals’ can draw from it. It involves the authors choosing examples of companies that have been successful over a period of time, studying them in great detail and then explaining the reasons behind their success.

These reasons then become the ‘list of things to do’ for other managers and business leaders looking to build successful companies. The trouble is that companies that are studied as bellwethers of success often become very mediocre after the book has been published.

There are four major problems with this approach of trying to figure out what makes a company successful. The first problem is what is referred to as survivorship bias. The authors studying success only look at companies which have been successful and not at the companies which might have failed doing the same things that successful companies did.

Take the case of the VHS versus Betamax battle for the video standard, between Sony and Matsushita, both Japanese companies. Sony decided to concentrate on video quality whereas Matsushita decided to concentrate on longer recording time, which ultimately became the key differentiator between the two standards.

So was Sony wrong in concentrating on quality of the video rather than the playing time? Not at all. This was totally in line with Sony’s positioning as a company which makes high end quality products. Even though Sony failed in this case by doing what it thought was the right thing to do, there are many companies which have become iconic companies by concentrating on the quality of the product rather than its price or other features.

The second problem with this approach is that authors are looking at something that has already happened and trying to fit a story around it. As Phil Rosenzweig writes in The Halo Effect…and the Eight Other Business Delusions that Deceive Managers “We want explanations. We want the world around us to make sense…We prefer explanations that are definitive and offer clear implications.”

These explanations create an illusion that success in the world of business is orderly and predictable. As Nobel Prize winning economist Daniel Kahneman writes in Thinking, Fast and Slow “The illusion that one has understood the past feeds the further illusion that one can predict and control the future. These illusions are comforting. They reduce the anxiety that we would experience if we allowed ourselves to fully acknowledge uncertainties of existence… Many business books are tailor-made to satisfy this need.”

Among the many definitive explanations for success that have been offered one of the most popular is that a company should stick to its core and do what it does best. But then there are examples of many companies which do really well by looking beyond their core. “During the 1980s, General Electric, America’s largest industrial company associated with light bulbs, refrigerators, airplane engines, and plastics, sold some of its traditional businesses – home appliances and television and went in a big way into financial services,” writes Rosenzweig. And GE did very well in its new business. So going beyond its core helped GE to reinvent itself even though a lot of business books recommended doing exactly the opposite.

The third problem with the way authors approach business books is that they never really take into account the element of luck. Tonnes of books have been written about around the success of Google, one of the most innovative companies of our times. But none of them really talk about the early streak of luck that Google had. As Duncan J Watts writes in Everything is Obvious – Once You Know the Answer, “In the late 1990s the founders of Google, Sergey Brin and Larry Page, tried to sell their company for $1.6 million.” The story goes that the buyer thought that Brin and Page were asking for too high a price and decided not to go ahead with the deal.

Microsoft had a similar lucky streak. The story goes that when IBM first approached Bill Gates to supply an operating system for IBM’s new PC, Gates referred them to this guy called Gary Kildall, who ran a company called Digital Research. Kildall and IBM couldn’t strike a deal, and so IBM went back to Gates. And this changed the game totally for Gates.

As Michael Mauboussin writes in The Success Equation: Untangling Skill and Luck in Business, Sports, and Investing “IBM struck a deal with Gates for a lookalike of Kildall’s product, CP/M-86, that Gates had acquired. Once it was tweaked for the IBM PC, Microsoft renamed it PC-DOS and shipped it. After some wrangling by Kildall, IBM did agree to ship CP/M-86 as an alternative operating system. IBM also set the prices for products. No operating system was included with the IBM PC, and everyone who bought a PC had to purchase an operating system. PC-DOS cost $40. CP/M-86 cost $240. Guess which won.”

What really got Microsoft and Gates going was the fact that Gates had kept the right to license PC-DOS to other companies. And when other companies started manufacturing PCs, Gates was there selling them his operating system. “The fact is, Kildall played his cards much differently than Gates did, and hence did well but enjoyed financial success vastly more modest than Gates. But it’s tantalising to consider the possibility that with a few tweaks, Kildall could have been Gates,” writes Mauboussin.

The fourth problem with most management books is that they overestimate the role of a CEO in the success of companies. While there is no denying that CEOs do influence performance of companies, but their impact is much lower than most business books tend to suggest.

As Kahneman points out “A very generous estimate of the correlation between the success of the firm and the quality of its CEO might be as high as 0.3, indicating 30% overlap.” Also the books never take into account whether business leaders are taking on too much risk. “A few lucky gambles can crown a reckless leader with a halo of prescience and boldness,” writes Kahneman.

The trouble is if the authors don’t make heroes out of CEOs there books won’t sell. “It is difficult to imagine people lining up at airport bookstores to buy a book that enthusiastically describes the practises of business leaders who, on average, do somewhat better than chance. Consumers have a hunger for a clear message about the determinants of success and failure in business, and they need stories that offer a sense of understanding, however illusory,” writes Kahneman.

And that’s the story of business books. There are no magic formulas as the books try to tell us over and over again. As Rosenzweig best puts it “There’s no magic formula, no way to crack the code, no genie in the bottle holding the secrets to success. The answer to the question What really works? Is simple: Nothing really works, at least not all the time.”

The article originally appeared in the Wealth Insight magazine in the edition dated June 10, 2013

(Vivek Kaul is a writer. He tweets @kaul_vivek)