Vivek Kaul

Vivek Kaul

“Now we know better. If we learn from experience, history need not repeat itself,” wrote economists George Akerlof and Paul Romer, in a research paper titled Looting: The Economic Underworld of Bankruptcy for Profit.

But that doesn’t seem to be the case with the Federal Reserve of United States, which seems to be making the same mistakes that led to the financial crisis in the first place. Take its decision to continue printing money, in order to revive the American economy.

In a press conference to explain the logic behind the decision, Ben Bernanke, the Chairman of the Federal Reserve of United States, said “we should be very reluctant to raise rates if inflation remains persistently below target, and that’s one of the reasons that I think we can be very patient in raising the federal funds rate since we have not seen any inflation pressure.”

The Federal Reserve of United States prints $85 billion every month. It puts this money into the financial system by buying bonds. With all this money going around interest rates continue to remain low. And at low interest rates the hope is that people will borrow and spend more money.

As people spend more money, a greater amount of money will chase the same number of goods, and this will lead to inflation. Once a reasonable amount of inflation or expectations of inflation set in, people will start altering their spending plans. They will buy things sooner rather than later, given that with inflation things will become more expensive in the days to come. This will help businesses and thus revive economic growth.

The Federal Reserve has an inflation target of 2%. Inflation remains well below this level. As Michael S. Derby writes in the Wall Street Journal “As of the most recent reading in July, the Fed’s favoured inflation gauge, the personal consumption expenditures price index, was up 1.4% from a year ago.”

So, given that inflation is lower than the Fed target, interest rates need to continue to be low, and hence, money printing needs to continue. That is what Bernanke was basically saying.

Inflation targeting has been a favourite policy of central banks all over the world. This strategy essentially involves a central bank estimating and projecting an inflation target and then using interest rates and other monetary tools to steer the economy towards the projected inflation target. The trouble here is that inflation-targeting by the Federal Reserve and other central banks around the world had led to the real estate bubble a few years back. The current financial crisis is the end result of that bubble.

Stephen D King, Group Chief Economist of HSBC makes this point When the Money Runs Out. As he writes “the pursuit of inflation-targetting…may have contributed to the West’s financial downfall.”

King writes about the United Kingdom to make his point. “Take, for example, inflation targeting in the UK. In the early years of the new millennium, inflation had a tendency to drop too low, thanks to the deflationary effects on manufactured goods prices of low-cost producers in China and elsewhere in the emerging world. To keep inflation close to target, the Bank of England loosened monetary policy with the intention of delivering higher ‘domestically generated’ inflation. In other words, credit conditions domestically became excessive loose…The inflation target was hit only by allowing domestic imbalances to arise: too much consumption, too much consumer indebtedness, too much leverage within the financial system and too little policy-making wisdom.”

What this means is that the Bank of England(as well as other central banks like the Federal Reserve) kept interest rates too low for too long because inflation was at very low levels. Low interest rates did not lead to inflation, with people borrowing and spending more, primarily because of low cost producers in China and other parts of the emerging world.

Niall Ferguson makes this point in The Ascent of Money – A Financial History of the World in the context of the United States. As he writes “Chinese imports kept down US inflation. Chinese savings kept down US interest rates. Chinese labour kept down US wage costs. As a result, it was remarkably cheap to borrow money and remarkably profitable to run a corporation.”

The same stood true for the United Kingdom and large parts of the Western World. With interest rates being low banks were falling over one another to lend money to anyone who was willing to borrow. And this gradually led to a fall in lending standards.

People who did not have the ability to repay were also being given loans. As King writes “With the UK financial system now awash with liquidity, lending increased rapidly both within the financial system and to other parts of the economy that, frankly, didn’t need any refreshing. In particular, the property sector boomed thanks to an abundance of credit and a gradual reduction in lending standards.” What followed was a big bubble, which finally burst and its aftermath is still being felt more than five years later.

As newsletter write Gary Dorsch writes in a recent column “Asset bubbles often arise when consumer prices are low, which is a problem for central banks who solely target inflation and thereby overlook the risks of bubbles, while appearing to be doing a good job.”

A lot of the money printed by the Federal Reserve over the last few years has landed up in all parts of the world, from the stock markets in the United States to the property market in Africa, and driven prices to very high levels. At low interest rates it has been easy for speculators to borrow and invest money, wherever they think they can make some returns.

Given this argument, it was believed that the Federal Reserve will go slow on money printing in the time to come and hence, allow interest rates to rise (This writer had also argued something along similar lines). But, alas, that doesn’t seem to be the case.

As Claudio Borio and Philip Lowe wrote in the BIS working paper titled Asset prices, financial and monetary stability: exploring the nexus (the same paper that Dorsch talks about) “lowering rates or providing ample liquidity when problems materialise but not raising rates as imbalances build up, can be rather insidious in the longer run.”

Once these new round of bubbles start to burst, there will be more economic pain. The Irish author Samuel Beckett explained this tendency to not learn from one’s mistakes beautifully. As he wrote “Ever tried. Ever failed. No matter. Try Again. Fail again. Fail better.”

The Federal Reserve seems to be working along those lines.

The article originally appeared on www.firstpost.com on September 20, 2013

(Vivek Kaul is a writer. He tweets @kaul_vivek)

Investing

What we can learn from Chidambaram's turkey problem

“The rupee depreciation of June, July was quite unexpected,” said finance minister P Chidambaram on August 1, 2013.

What does Chidambaram mean here? He probably means that the government was caught unaware on the depreciation of the rupee against the dollar over the last two months. They were not prepared for it.

And if the government had realised that the rupee would lose value against the dollar as fast as it has, then it would have done a few things to control it, like it is trying to do now.

When one looks at the economic reasons behind the rupee’s fall against the dollar they were as valid then, as they are now. The current account deficit for the period of 12 months ending March 31, 2013, had stood at 4.8% of the GDP or $87.8 billion. The current account deficit is the difference between total value of imports and the sum of the total value of its exports and net foreign remittances.

During the period of twelve months ending December 31, 2012, the current account deficit of India had stood at $93 billion. In absolute terms this was only second to the United States.

As Amay Hattangadi and Swanand Kelkar of Morgan Stanley Investment Management point out in a report titled Don’t Take Your Eye of the Ball “At $93billion, India’s current account deficit in 2012 was second only to the US in absolute terms, and higher than the UK, Canada and France.”

A high current account deficit meant that India’s demand for dollars to pay for imports should have been higher than the supply. The dollars that India earned through exports and the dollars that were being remitted into India were not enough to pay for the imports.

Hence, this meant that the rupee should have lost value against the dollar. But that did not happen because foreign investors kept bringing dollars into to invest in stocks and bonds in India. At the same time Indian corporates were borrowing in dollars abroad and kept bringing that money back to India. The Non Resident Indians were also bringing dollars into India and converting them into rupees to invest in bank deposits in India because interest rates on offer in India were higher.

All this effectively ensured that there was a good supply of dollars. This in turn meant that the rupee did not lose value against the dollar, even though the current account deficit had gone through the roof.

But a high current account deficit should have been warning enough for the government that rupee could snap against the dollar, at any point of time. The dollars coming in through foreign investors in bonds and stocks and NRIs deposits, could go back at any point of time. Also, money being borrowed by the Indian companies in dollars, would have to be repaid. And this would add to the demand for dollars.

Hence, steps should have been taken to control the high current account deficit by controlling imports. And at the same time steps should have been taken to ensure that dollars kept flowing into India. The government got active on this front only after the rupee started to lose value against the dollar since the end of May, 2013.

But why did the government and the finance minister not figure out what sounds a tad obvious with the benefit of hindsight? As I have explained here, here, here,here and here, most of the factors that have led to the rupee depreciating against the dollar, did not appear overnight. They have been work-in-process for a while now.

So why did Chidambaram find the rapid depreciation of the rupee against the dollar “unexpected”? The basic reason for this is the fact that between January and May rupee moved against the dollar in the range of 54-55. It was only towards the end of May that the rupee started rapidly losing value against the dollar.

Chidambaram and others who had thought that the rupee will continue to hold strong against the dollar had become of what Nassim Nicholas Taleb calls the turkey problem. As Taleb writes in his latest book Anti Fragile “A turkey is fed for a thousand days by a butcher; every day confirms to its staff of analysts that butchers love turkeys “with increased statistical confidence.” The butcher will keep feeding the turkey until a few days before thanksgiving. Then comes that day when it is really not a very good idea to be a turkey. So, with the butcher surprising it, the turkey will have a revision of belief—right when its confidence in the statement that the butcher loves turkeys is maximal … the key here is such a surprise will be a Black Swan event; but just for the turkey, not for the butcher.”

Chidambaram expected the trend ‘of a stable rupee’ to continue. What was true for the first five months of the year was expected to be true for the remaining part of the year as well. But sadly things did not turn out like that, and the rupee like Taleb’s turkey got butchered.

By May end, foreign investors were falling over one another to withdraw money from the Indian bond market. When they sold out on bonds, they were paid in rupees. Once they started converting these rupees into dollars, the demand for dollars went up. As a result the rupee rapidly lost value against the dollar, and only then did the government wake up.

As Taleb writes “We can also see from the turkey story the mother of all harmful mistakes: mistaking absence of evidence (of harm) for evidence of absence, a mistake that tends to prevail in intellectual circles.”

Just because something is not happening at the present time, people tend to assume that it will never happen. Or as Taleb puts it, an absence of evidence becomes an evidence of absence. Chidambaram was a victim of this as well.

There is a bigger lesson to learn here. People expect any trend to continue ad infinitum. For example, before the financial crisis broke out in late 2008, Americans expected that housing prices will keep increasing for the years to come. In a survey of home buyers carried out in Los Angeles in 2005, the prevailing belief was that prices will keep growing at the rate of 22% every year over the next 10 years. This meant that a house which cost a million dollars in 2005 would cost around $7.3million by 2015. This faith came from the fact that housing prices had not fallen in the recent past and everyone expected that trend to continue.

The same phenomenon was visible during the dotcom bubble of the 1990s. Every one expected the prices of dotcom companies which barely made any profits, to keep increasing forever. The great investor Warren Buffett stayed away from dotcom stocks and was written off for a while when the prices of dotcom stocks rose at a much faster pace than the value of investments that he had made. But we all know who had the last laugh in the end.

The Japanese stock market and real estate bubble of the 1980s was also expected to continue forever. A similar thing has happened with gold investors this year. Just because gold prices had rallied for more than 10 years at a stretch, investors assumed that the rally will continue even in 2013. But it did not.

Hence, it is important to remember that just because a negative event hasn’t happened in the recent past, that doesn’t mean it will never happen in the time to come. In India, currently there is a great belief that real estate prices will continue to go up forever. Is that the next ‘big’ turkey waiting to be slaughtered?

The article originally appeared on www.firstpost.com with a different headline on August 2, 2013

(Vivek Kaul is a writer. He tweets @kaul_vivek)

Why RBI killed the debt fund

Vivek Kaul

Vivek Kaul

The Reserve Bank of India(RBI) is doing everything that it can do to stop the rupee from falling against the dollar. Yesterday it announced further measures on that front.

Each bank will now be allowed to borrow only upto 0.5% of its deposits from the RBI at the repo rate. Repo rate is the interest rate at which RBI lends to banks in the short term and it currently stands at 7.25%.

Sometime back the RBI had put an overall limit of Rs 75,000 crore, on the amount of money that banks could borrow from it, at the repo rate. This facility of banks borrowing from the RBI at the repo rate is referred to as the liquidity adjustment facility.

The limit of Rs 75,000 crore worked out to around 1% of total deposits of all banks. Now the borrowing limit has been set at an individual bank level. And each bank cannot borrow more than 0.5% of its deposits from the RBI at the repo rate. This move by the RBI is expected bring down the total quantum of funds available to all banks to Rs 37,000 crore, reports The Economic Times.

In another move the RBI tweaked the amount of money that banks need to maintain as a cash reserve ratio(CRR) on a daily basis. Banks currently need to maintain a CRR of 4% i.e. for every Rs 100 of deposits that the banks have, Rs 4 needs to set aside with the RBI.

Currently the banks need to maintain an average CRR of 4% over a reporting fortnight. On a daily basis this number may vary and can even dip under 4% on some days. So the banks need not maintain a CRR of Rs 4 with the RBI for every Rs 100 of deposits they have, on every day.

They are allowed to maintain a CRR of as low as Rs 2.80 (i.e. 70% of 4%) for every Rs 100 of deposits they have. Of course, this means that on other days, the banks will have to maintain a higher CRR, so as to average 4% over the reporting fortnight.

This gives the banks some amount of flexibility. Money put aside to maintain the CRR does not earn any interest. Hence, if on any given day if the bank is short of funds, it can always run down its CRR instead of borrowing money.

But the RBI has now taken away that flexibility. Effective from July 27, 2013, banks will be required to maintain a minimum daily CRR balance of 99 per cent of the requirement. This means that on any given day the banks need to maintain a CRR of Rs 3.96 (99% of 4%) for every Rs 100 of deposits they have. This number could have earlier fallen to Rs 2.80 for every Rs 100 of deposits. The Economic Times reports that this move is expected to suck out Rs 90,000 crore from the financial system.

With so much money being sucked out of the financial system the idea is to make rupee scarce and hence help increase its value against the dollar. As I write this the rupee is worth 59.24 to a dollar. It had closed at 59.76 to a dollar yesterday. So RBI’s moves have had some impact in the short term, or the chances are that the rupee might have crossed 60 to a dollar again today.

But there are side effects to this as well. Banks can now borrow only a limited amount of money from the RBI under the liquidity adjustment facility at the repo rate of 7.25%. If they have to borrow money beyond that they need to borrow it at the marginal standing facility rate which is at 10.25%. This is three hundred basis points(one basis point is equal to one hundredth of a percentage) higher than the repo rate at 10.25%. Given that, the banks can borrow only a limited amount of money from the RBI at the repo rate. Hence, the marginal standing facility rate has effectively become the repo rate.

As Pratip Chaudhuri, chairman of State Bank of India told Business Standard “Effectively, the repo rate becomes the marginal standing facility rate, and we have to adjust to this new rate regime. The steps show the central bank wants to stabilise the rupee.”

All this suggests an environment of “tight liquidity” in the Indian financial system. What this also means is that instead of borrowing from the RBI at a significantly higher 10.25%, the banks may sell out on the government bonds they have invested in, whenever they need hard cash.

When many banks and financial institutions sell bonds at the same time, bond prices fall. When bond prices fall, the return or yield, for those who bought the bonds at lower prices, goes up. This is because the amount of interest that is paid on these bonds by the government continues to be the same.

And that is precisely what happened today. The return on the 10 year Indian government bond has risen by a whopping 33 basis points to 8.5%. Returns on other bonds have also jumped.

Debt mutual funds which invest in various kinds of bonds have been severely impacted by the recent moves of the RBI. Since bond prices have fallen, debt mutual funds which invest in these bonds have faced significant losses.

In fact, the data for the kind of losses that debt mutual funds will face today, will only become available by late evening. But their performance has been disastrous over the last one month. And things should be no different today.

Many debt funds have lost as much as 5% over the last one month. And these are funds which give investors a return of 8-10% over a period of one year. So RBI has effectively killed the debt fund investors in India.

But then there was nothing else that it could really do. The RBI has been trying to manage one side of the rupee dollar equation. It has been trying to make rupee scarce by sucking it out of the financial system.

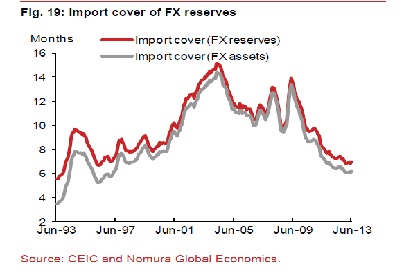

The other thing that it could possibly do is to sell dollars and buy rupees. This will lead to there being enough dollars in the market and thus the rupee will not lose value against the dollar. The trouble is that the RBI has only so many dollars and it cannot create them out of thin air (which it can do with rupees). As the following graph tells us very clearly, India does not have enough foreign exchange reserves in comparison to its imports.

The ratio of foreign exchange reserves divided by imports is a little over six. What this means is that India’s total foreign exchange reserves as of now are good enough to pay for imports of around a little over six months. This is a precarious situation to be in and was only last seen in the 1990s, as is clear from the graph.

The government may be clamping down on gold imports but there are other imports it really doesn’t have much control on. “The commodity intensity of imports is high,” write analysts of Nomura Financial Advisory and Securities in a report titled India: Turbulent Times Ahead. This is because India imports a lot of coal, oil, gas, fertilizer and edible oil. And there is no way that the government can clamp down on the import of these commodities, which are an everyday necessity. Given this, India will continue to need a lot of dollars to import these commodities.

Hence, RBI is not in a situation to sell dollars to control the value of the rupee. So, it has had to resort to taking steps that make the rupee scarce in the financial system.

The trouble is that this has severe negative repercussions on other fronts. Debt fund investors are now reeling under heavy losses. Also, the return on the 10 year bonds has gone up. This means that other borrowers will have to pay higher interest on their loans. Lending to the government is deemed to be the safest form of lending. Given this, returns on other loans need to be higher than the return on lending to the government, to compensate for the greater amount of risk. And this means higher interest rates.

The finance minister P Chidambaram has been calling for lower interest rates to revive economic growth. But he is not going to get them any time soon. The mess is getting messier.

The article originally appeared on www.firstpost.com on July 24, 2013

(Vivek Kaul is a writer. He tweets @kaul_vivek)

The Almighty Dollar and the Fallen Rupee

“I am not an economist. I am an old bond trader,” said Drew Brick, who leads the Market Strategy desk for RBS in the Asia-Pacific region, when Forbes India caught up with him for breakfast on a recent visit to India. “We trade the noise,” he added emphatically.

Right now, the noise is about what US Fed Chairman Ben Bernanke said or didn’t say about his bond-buying. And this is why one needed to know what the “old bond trader” had to say about why the rupee was falling against the dollar. “What is happening now is really not a function of anything really specific to India, although India has an inclination to have problems,” explained Brick. Finance Minister P Chidambaram should welcome at least the first part of his statement, since he has been defending the “fundamentals” of the economy to anybody who would listen.

The foreign exchange market hasn’t been one of them, for it has been cocking a more attentive ear to what Bernanke had to say. And on June 19, he said that the Fed would go slow on its money printing operations in the days to come as the US economy started reviving. “If the incoming data are broadly consistent with this forecast…it would be appropriate to moderate the monthly pace of purchases later this year…And if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around mid-year,” Bernanke said at a press conference that followed the meeting of the Federal Open Market Committee (FOMC).

That statement impacted the bond markets most—and the carry trade. The carry trade is about investors who borrow in low-yield currencies to invest in assets in other markets, presumably with higher yields. Bernanke’s statement signalled that bond yields may go up, and that meant carry-trades would have to be unwound. Brick confirmed this: “We are seeing the unwinding of a lot of carry trades that have been taking place across the globe in the chase for yield.”

Brick, who bears a striking resemblance to Hollywood actor Richard Gere, had worked with BNP Paribas, Morgan Stanley and legendary bond kings Pimco before he joined RBS last year. He explained why the dollar is holding up even though US growth isn’t exactly something to write home about. “Some people think that the United States is the least dirty shirt in the drawer. And it has got growth, though not a very high trajectory of growth,” said Brick.

It is this minor revival that is creating problems for carry trade investors who have borrowed and invested money across the world on the assumption that US interest rates will rule close to zero in the foreseeable future.

The return of economic growth in the US has pushed up 10-year treasury bond yields. The yield, which stood at 1.63 percent in the beginning of May, has since risen to 2.5-2.6 percent.

Said Brick: “A bond works by a simple method. It measures three fundamental variables. What are they? Everybody who trades bonds thinks about where is growth going? Where is inflation going? And what is the risk premium?”

And what do we get if we apply this formula to calculate the yield on 10-year US treasuries? Explained Brick: “If the 10-year yield today is around 2.2 percent [it was so, on the day the interview was conducted], what would you say the US nominal growth is? Around 2 percent. What do you think inflation is? Around 1 percent. What do you think the risk premium is in the market place? Clearly it’s risen a little, so maybe it is 30 basis points.” (100 basis points make 1 percent).

This gives us a 3.3 percent yield on 10-year US treasuries. “And when the 10-year treasury is trading at a yield of 2.2 percent, what do you do as a trader? You sell that freakin’ thing. And that’s the risk,” said Brick.

When lots of bonds are sold at the same time, the price of the bond falls and thus the yield, or the return, goes up. And that is precisely what has been happening with 10-year US treasuries, with the yield shooting up by nearly 60 basis points from 1.63 percent in early May to nearly 2.2 percent on June 18, 2013. After Bernanke’s press conference on June 19, the yield shot up dramatically. On June 24, it stood at nearly 2.6 percent.

“The 10-year US treasury is extremely important,” said Brick. This is because it sets the benchmark for interest rates on all other kinds of loans in the United States, from interest rates charged by banks on home loans and home equity loans to interest at which carry trade investors can borrow money. More important for the rupee’s health, when the 10-year US treasury yield goes up, carry trades become less attractive. “The days of quantitative easing-sponsored carry trading are about to be pared, perhaps significantly. Remember, as volume rises, the cost of carry rises and so, too, does market illiquidity,” said Brick.

This is why investors have been selling a lot of the assets they have invested in and repatriating the money back to the United States. The Indian debt market has been hit by this selling and foreign institutional investors (FIIs) have pulled out nearly $5 billion since late May. In fact, stock markets all over the world also fell in the aftermath of Bernanke announcing that he will go slow with his money printing operations in the days to come.

The Federal Reserve has been printing $85 billion every month. It uses $40 billion to buy mortgage-backed securities, and $45 billion to buy long-term American government bonds. By doing so, it has been pumping money into the financial system and keeping interest rates low in order to spur growth.

But the growth did not come. Said Brick: “The truth is that central banks are running up their monetary bases but they are not necessarily getting any bang for the buck in terms of the turnover of the cash that they are creating into the system.”

Bernanke did not say he was going to withdraw all kinds of quantitative easing, or even that he would start withdrawing the easy money. That would require him to sell all the bonds he bought. The market though is getting ready for that to happen. “The market is already trading this. Forward pricing in the markets is already adjusting for this,” said Brick.

Low interest rates in the US after the 2008 Lehman crisis led Asians to borrow a lot in cheap dollars. “All across Asia, non-financial corporations, and even households to a small extent, have been taking out huge amounts of dollar funding,” said Brick. And this may cause some major problems in the days to come. “Right now we are seeing an unwinding of the dollar carry trade but at some point the dollar is going to turn and then the servicing cost of that debt is going to be all the more tricky. Every crisis that I have ever read through, and I am an old man, has always been born on the back of rising rate cycles that move higher with the dollar in tow. This makes the financing cost of debt in emerging markets more expensive. That’s across the board. That’s probably true here in India as well,” he added.

Brick suspects that there are problems lurking in the woodwork. “Corporates are relatively sanguine with a weaker rupee. But where are the cockroaches in the system? Where has the dollar funding been taken on offshore? Have Indians thought about what it means to have a rupee possibly at 65 to a dollar? And what would that possibly mean for the financing cost of banks that have almost certainly been taking on relatively cheap quantitative easing-sponsored cash in their offshore operations to be able to finance lending?”

If the rupee gets to 65 to a dollar, our oil bill will go for a toss. And will gold have a rally in rupee terms, assuming that its price stays stable in dollar terms? “Gold is a zero interest, infinite maturity, inflation-linked bond. That’s all gold is,” Brick responded. The supposed end of quantitative easing in the United States has taken some sheen off the yellow metal. “But it’s possible that we may have another move higher. The selloff has been rather pronounced. But it’s not the core issue here. Gold is a symptom of the larger issue,” said Brick.

Brick also feels that the bond market in the United States might be getting a little ahead of itself.

He reminded us about March 2012, when the 10-year US treasury yield had moved up to 2.4 percent. “Then, Ben Bernanke showed up on the tapes 10 straight trading days, running it back down [i.e. the yield]. My guess is that something like that will occur this time. The market is way ahead of itself.”

The broader point is that if yields rise at a fast pace, they will push up interest rates on loans. This will slow down some of the economic growth that seems to be returning to the United States. And that situation may not be allowed to play out.

So where does that leave Asia? “If quantitative easing gets tapered off as a consequence of relatively strong growth, then quite frankly Asian equities probably will hold in pretty well,” explained Brick.

And then came the but. “But if treasuries sell off massively as a consequence of technical reasons and a marketplace getting well ahead of itself, and dollar funding and interest rates get higher, then equities will get wasted out.”

“What is another scenario? I can give you millions of scenarios. But the truth is we don’t know in the opening stages, the first minutes of a three-hour movie, how it is going to play out. It’s going to be like a Bergman movie. I don’t know how it is going to play out but it is going to be weird at times,” Brick said.

Weird it will be, for “even the end-point of tapering [of Fed bond purchases] leaves the Federal Reserve with a still-gargantuan 25 percent-of-US-GDP balance-sheet. Pressures will sustain, even with reprieves,” Brick concluded.

The interview originally appeared in the Forbes India magazine edition dated July 26, 2013

Saradha Redux: Why Rose Valley is a Ponzi scheme

Vivek Kaul

Vivek Kaul

The Securities and Exchange Board of India(Sebi) in a significant order yesterday directed Rose Valley Hotels and Entertainments Limited (RVHEL) and its directors to stop raising deposits through any of its existing investment schemes. The Sebi also directed RVHEL and its directors not to launch any new schemes, not to dispose of any of the properties or alienate any of the assets of the schemes and not to divert any funds raised from public at large which are kept in bank account(s) and/or in the custody of the company.

RVHEL had launched the Rose Valley Holiday Membership Plan (HMP) sometime in 2010. Under this plan investors could book a holiday package through the payment of monthly instalments. On completion of tenure investors could avail the facilities i.e. room accommodation and other services at one of the RVHEL’s hotels. He or she also had the option to opt for a maturity payment along with interest.

The Rose Valley group started sometime in the mid 1990s and has close to 31 registered companies. It claims to have presence in areas from residential townships to film to media and entertainment.

But a careful study of its operations suggests that it is nothing more than a Ponzi scheme. A Ponzi scheme is a fraudulent investment scheme in which the illusion of high returns is created by taking money being brought in by new investors and passing it on to old investors whose investments are falling due and need to be redeemed.

While every Ponzi scheme is different from another in its details, there are certain key characteristics that almost all Ponzi schemes tend to have. And Rose Valley is no exception to this.

The instrument in which the scheme will invest appears to be a genuine investment opportunity but at the same time it is obscure enough, to prevent any scrutiny by the investors: The website of Rose Valley India claims to be in many businesses like residential townships, commercial complexes, shopping malls, hotels & resorts, amusement parks, garments, IT, Media & Entertainment, Healthcare, Education, Social Welfare, Housing finance, Travels, Films & Fashions.

This told the prospective investors that the company was in various businesses and these businesses were supposedly making money. But there are several questions that crop up here. How did one promoter have the expertise to manage such a diverse line of businesses? We live in a day and age where its not possible for a single entrepreneur to run multiple unconnected businesses profitably.

Vijay Mallya thought running an airline, a cricket team and an FI team was just the same as selling alcohol. DLF thought running hotels, generating wind power, selling insurance and mutual funds would be a cake walk after they had created India’s biggest real estate company. Deccan Chronicle saw great synergy in selling newspapers and running a cricket team and a chain of bookshops. Hotel Leela thought running a business park would be similar to running a hotel. Kishore Biyani thought that once he got people inside his Big Bazaars and Pantaloon shops, he could sell them anything from mobile phone connections to life and general insurance. Bharti Telecom thought that mutual funds, insurance and retail were similar to running a successful telecom business. But in sometime all of them realised that they had a problem.

Of course there are groups like Birlas, Tatas and the Ambanis which are present in multiple businesses. But they are more of an exception that proves the rule.

Rose Valley wasn’t making any money from its multiple businesses either. As a recent report in The Financial Express points out “The Serious Fraud Investigation Office (SFIO) probing Rose Valley Hotels & Entertainment is looking into a web of intra-group transactions including Rs 207-crore loans to promoter Gautam Kundu in 2011-12, sources said. The company reported a loss of Rs 468 crore on revenues of Rs 24 crore in the same year.” On a slightly different note, Kundu travels in a Rolls-Royce Phantom.

Let me repeat this again. The company made a loss of Rs 468 crore on revenues of Rs 24 crore. What this clearly means is that the company wasn’t running any business at all. It was just creating an illusion of having several businesses, so that investors kept coming to it. Meanwhile, it was simply rotating money, using the money being brought in by the newer investors to pay off the older investors. This conclusion can be drawn from the fact that its real businesses weren’t making any money. So the money to pay off the older investors whose investments were up for redemption could only have come from newer investors.

There is other evidence that points to the fact that the company did not have much of a business model. As a January 2011 piece published on www.moneylife.in points out “Under its ‘Ashirvad’ scheme, Rose Valley mobilised Rs1,207 crore by selling 508,792 plots, but handed over only 9,045 plots. While the company claims to have a land bank in several upcoming and industrial areas of West Bengal, the question is, how did they get access to all those vast stretches of land that are traditionally used for agriculture?”

The rate of return promised is high and is fixed at the time the investor enters the scheme: The Sebi order against Rose Valley Hotels and Entertainments clearly points out that returns on various investment schemes varied from anywhere between 11.2% to 17.65%. At its upper the return is significantly higher than the rate of return from other fixed income investments like bank fixed deposits and post office deposits.

The certificate issued for investing in the Holiday Membership Plan said that the money is being invested for booking a room in one of the hotels of Rose Valley, but at the time of maturity the money would be returned against cancellation. This meant that the investors into the Holiday Membership plan could cancel it on maturity and be paid a bulk amount which would include the money invested into the scheme and the interest that had accumulated on it. As the Sebi order points out “However, such investor may also cancel the HMP(Holiday Membership Plan) booking upon maturity or completion of tenure for monthly installments, in lieu of maturity payment for non-utilization of the facilities i.e. the equivalent accumulated credit value under the HMP inclusive of annualized interest.”

An investor who had paid Rs 500 per month for 60 months would get Rs 48,000 if he cancelled at maturity, meaning a return of 17.65% per year. The Sebi order quotes an interim order passed by a sub divisional magistrate in West Tripura. As the Sebi order points out “As per the Interim Order passed by the SDM, West Tripura, RVHEL is alleged to have taken “recourse to unilateral and spontaneous cancellation of bookings of hotels in a routine manner so as to make returns.””

What this tells us is that Rose Valley wasn’t really interested in running the holiday membership plan. It couldn’t possibly have built all the hotel rooms that it had promised to build under the Holiday Membership Plan and hence encouraged investors to opt for a bulk payment on maturity.

Brand building is an inherent part of a Ponzi Scheme: Rose Valley spent a lot of money in building its brand. The company was one of the main sponsors for the IPL team Kolkata Knight Riders (KKR). KKR players wore jerseys with the Rose Valley logo. Rose Valley had a two year sponsorship deal with KKR. For this it paid Rs 5.5 crore during the first year and Rs 6.05 crore during the second year. The deal has now ended. Gautam Kundu, chairman, Rose Valley Group, recently told The Times of India “Our contract was for two years. Now it’s for me to decide whether I shall renew it or not. The decision to invest in KKR will also be mine, entirely.”

This deal helped Rose Valley build more credibility among prospective investors in West Bengal where it is primarily based out of. As Ashok Mitra, a retired clerk with the state government told New York Times India Ink “I saw Shah Rukh Khan(one of the owners of KKR) and invested 75,000 rupees…I did not worry because he was vouching for the company.”A report that appeared in The Indian Express in May 2013 quoted a source as saying “The company joined hands with KKR because they wanted to build their image and extend their reach. With 254 branches across the country, the association with the KKR provided them the right platform.”

Rose Valley has significant presence in the media. It owns newspapers as well as television channels. It also used other newspapers to build its brand. As the Moneylife article cited earlier points out “Rose Valley has been a big advertiser with Ananda Bazar Patrika (ABP) group. ABP has gone out of its way to promote them and celebrate their “entrepreneurship”.”

The most important part of a Ponzi Scheme is assuring the investor that their investment is safe: This is the most tricky part about running a Ponzi scheme. Unless the investor feels assured that his money will be safe he won’t invest it in the scheme. Rose Valley was a corporate agent of the Life Insurance Corporation(LIC) of India between 2002 and 2011. It is said that Rose Valley used this route to raise money for its own investment schemes. Given this, the confidence that people have in LIC which is backed by the government of India would have rubbed onto Rose Valley as well.

Interestingly, the Insurance Regulatory and Development Authority(Irda), the insurance regulator, cancelled Rose Valley’s license in early 2012.

To conclude, it is important to know that on March 14, 2013, Sachin Pilot, the Union Minister of State for Corporate Affairs, presented a long list of companies across the country against which complaints had been received for running Ponzi schemes. This list had 14 companies belonging to the Rose Valley group.

The article originally appeared on www.firstpost.com on July 11, 2013

(Vivek Kaul is a writer. He tweets @kaul_vivek)