Vivek Kaul

Vidhu Vinod Chopra the producer of the superhit 3 Idiots made a movie called 1942:A Love Story which was released in 1994. The movie had soulful songs and could have been a big comeback for the great R D Burman. But alas that never happened. Pancham da died of a heart attack before the movie was released.

The movie set during the days of the British Raj starts as a love story between the hero Anil Kapoor and the heroine Manisha Koirala, who keep singing all the beautiful songs composed by Burman in the first half of the movie. But throughout the first half all the characters other than the hero and the heroine keep saying this one line “shubhankar da aa rahe hain”, building the expectations of the audience for his arrival.

Shubhankar da (played by Jackie Shoff) finally arrives around 30 seconds before the interval. Until that moment the movie was a love story. Then on it becomes a movie on the freedom struggle, which in this day and age would have been called a political thriller.

As was the case in the movie, there comes a time in life of individuals as well businesses when the story has to change. The past has to be dumped and made insignificant and a new story needs to emerge.

This is something that Mamata Banerjee, rabble rouser par excellence and the only angry young man in the country with the days of Bachchan long gone, needs to realize. She built her career and life around trying to throw out the Left Parties out of West Bengal and finally after more than two decades of hard work and sheer persistence she succeeded.

If ever there was an example of an individual not giving up and finally succeeding she was it. But after becoming the Chief Minister of West Bengal what is her story? She still seems to be working on the same story of rabble rousing against the Left everywhere all the time, and holding them responsible for everything that is happening in the state of West Bengal. From rapes of women to lack of governance!

The irony of course is that she is the government now. Her level of paranoia against the Left is reaching extreme proportions now. Most recently she called the students of Jadhavpur University CPI-M cadres. As she said “They are the CPI-M cadres. I am not going to reply. I will give reply to questions from common people. I am sorry to say you belong to CPI-M. You are SFI (Student Federation of India, the student wing of CPI-M) cadres. We know all of you.”

While Bengal may be full of CPI-M cadres this is like stretching it a little too much. It is time that Mamata Banerjee changed her anti-left story.

There are a few things that Banerjee can learn from businesses from around the world which experience this phenomenon time and again. Some learn and adapt, others don’t and for some others by the time they realise that things have changed, it’s already too late.

Take the case of Nokia, the largest mobile phone manufacturer in the world. The company started in 1865 as a groundwood pulp mill. It gradually became an industrial conglomerate and among other things produced paper products, tyres, footwear, communication cables and consumer electronics.

In the early 1990s the company realised that its story had to change. It decided to concentrate on the telecommunication business. It gradually sold out a host of its other businesses. The change of story helped the company become the largest mobile phone manufacturer in the world.

But the company missed out on the smart phone revolution completely. By the time it changed its story and started concentrating on smart phones, other companies had already moved in and captured the market. A host of smaller companies from Micromax to Karbon Mobiles and many more are giving Nokia a run for its money in the Indian market.

Why did this happen? For the simple reason, like Mamata, the company remained attached to its earlier story.

There are other such examples as well. When it came to reliable trustworthy news there wasn’t a bigger brand than the British Broadcasting Corporation(BBC). The company did not see the story changing and the rise of 24hour news channels. CNN grabbed the opportunity and broadcast the Gulf War live into homes. Sony is another great example. The company changed the entire music business with the launch of the Walkman. But failed to see the story changing and handed over the mp 3 player market to the likes of Apple, on a platter.

Bharti Beetel which revolutionised land line phones in India by launching push button phones failed to see the story changing and remained stuck to selling push button phones, when more and more consumers were moving to mobile phones. Ironically, its sister company Airtel became the biggest mobile phone company in India.

The company has recently started selling mobile phones. Now imagine, during the days when Airtel was a growing company, Bharti could have sold its own mobile phones (under the Beetel brand) to consumers who bought an Airtel connection and thus could have been one of the biggest mobile phone companies in India.

Those who do see the story changing and change their stories accordingly benefit from it. An oft quoted example is that of Nirma and Wheel. The Nirma detergent started selling at Rs 3.50 per kg at a time when Hindustan Lever’s (now Hindustan Unilever) Surf used to sell for around Rs 15 per kg. The low price of Nirma made it accessible to consumers, who till then really couldn’t afford the luxury of washing clothes using a detergent and had to use soap instead.

To Hindustan Lever’s credit they did not remain stuck in their past, realised that the story had to change, and thus went ahead and launched their Nirma killer “Wheel” detergent, which eventually beat the sales of Nirma.

The moral of the story from all these examples from Surf to Nokia to Sony to Bharti is simple. At times in lives of individuals as well as companies the story that had worked previously needs to be dumped. It is time for Mamata to come up with a new story. She is no longer in the opposition when blaming the Left for every problem in the state of West Bengal was her story. Now she is where the Left was earlier.

If she doesn’t change her story and come up with a new one, her innings as a Chief Minister is going to be a short lived on. The people of West Bengal need to know what does the new Mamata stand for?

(The article originally appeared on www.firstpost.com on May 19,2012. http://www.firstpost.com/politics/what-mamata-can-learn-from-surf-bbc-sony-and-nokia-314738.html)

(Vivek Kaul is a writer and can be reached at [email protected])

Analysis

Why rupee is on a freefall …

Vivek Kaul

Vivek Kaul

“Free Fallin!” is an old American country song sung by Tom Petty and the Heartbreakers. The rupee surely is now on a free “heartbreaking” fall. The last that I looked at the numbers, the dollar was worth around Rs 54.7, the lowest level ever for it has ever reached against the dollar. It is well on its way to touching Rs 55 against the dollar. Some analysts have even predicted that it will soon touch Rs 60 against the dollar.

So what is making the rupee fall? There are several interlinked reasons for the same. Let me offer a few here.

Trade deficit

India ran a trade deficit of nearly $185billion in the financial year 2011-2012 (i.e. between April 1, 2011 and March 31,2012). Trade deficit refers to a situation where a country imports more than it exports. So in the last financial year India’s import of goods and services was $185billion more than its exports.

This trend has continued in the current financial year as well. The Indian imports for the month of April 2012 were at $37.9billion, almost 55% more than its exports at $24.5bilion.

Imports have to be paid for in dollars because that is the international currency that everybody accepts. They cannot be paid for in rupees. Now when payments have to be made in dollars, the importers sell rupees and buy dollars. When this happens the foreign exchange market suddenly has an excess supply of rupees and a short fall of dollars. This leads to rupee losing value against the dollar. This is the basic reason why rupee has been losing value against the dollar because we have been importing much more than we have been exporting. In case our exports matched our imports, then exporters who brought in dollars would be converting them into rupees, and thus there would be a balance in the market. Importers would be buying dollars and selling rupees. And exporters would be selling dollars and buying rupees. But that isn’t happening in a balanced way.

The RBI intervention

The Reserve Bank of India (RBI) tries to stem the fall of the rupee at times. It does this by selling dollars and buying rupees to ensure that there is an adequate supply of dollars in the market and at the same time any excess supply of rupees is sucked out. This is done in order to ensure that the rupee either maintains or gains value against the dollar. But the RBI cannot do this indefinitely for the simple reason that it has a limited amount of dollars. The RBI can print rupees and create them out of thin air, but it cannot do the same with the dollar.

But that still doesn’t answer the basic question of why does India import more than it exports.

Why does India run a trade deficit?

India runs a trade deficit on two accounts. One is that it has to import oil to meet a major portion of its domestic needs. And the second is the fact that Indians have a huge fascination for gold. Last year India imported around 1000 tonnes of gold. So we do not produce enough of the oil that we use and the gold that we buy. This in turn means that we have to import this from abroad. Both oil and gold are internationally sold in dollars. The price of both oil and gold has been going up for a while (though very recently it has been falling). This means more and more dollars have to be paid for importing them. This, as explained above, leads to a glut of rupees and an increased demand for the dollars, thus pushing down the value of the rupee against the dollar.

On April 1, 2011, one dollar was worth Rs 44.44. Between then and March 31, 2012, India ran a trade deficit of $185billion. And it has continued that in the month of April 2012 as well. This has led to one dollar being currently worth Rs 54.7.

Subsidies

What has also happened is that the government of India has not allowed the oil companies to pass on the increased cost of oil to the end consumer. Hence products like kerosene, diesel and LPG continued to be subsidized. The government in turn pays the oil companies for the losses leading to an increased fiscal deficit. But more than that with prices not rising as much as they should people have not adjusted their consumption accordingly. An increase in price typically leads to a fall in demand. If the increased price of oil had been passed onto the end consumer, the demand for oil would have come down. This would have meant that a fewer number of dollars would have been required to pay for the oil being imported, in turn leading to a lower trade deficit and hence lesser pressure on the rupee-dollar rate.

To conclude

When imports are more than exports what it means is that the country is paying more dollars for the imports than it is earning from the exports. This difference obviously comes from the foreign exchange reserves that India has accumulated over the years. But that clearly isn’t healthy given our imports are more than 50% of our exports and there is a limited supply of foreign exchange reserves.

So the market is now worried about this and is further pushing down the value of the rupee. The only way to control the fall of the rupee for the government is show the market that it serious about cutting down the trade deficit. And this can only be done by pricing the various oil products like diesel and kerosene, correctly. This in turn will lead to a lower demand for these products and help bring down the trade deficit. It will also push down the fiscal deficit, given that the subsidy burden of the government will be eliminated or come down. On the flip side an increase in the price of oil products will lead to increased inflation, at least in the short term.

In the end the only way to stem the fall of the rupee against the dollar is to eliminate and if not that, at least bring down, oil subsidy. Will that happen? Will the allies of the Congress led United Progressive Alliance government allow that to happen?

I remain pessimistic.

(This post originally appeared on Rediff.com on May 18,2012. http://www.rediff.com/business/slide-show/slide-show-1-column-why-the-rupee-is-on-a-freefall/20120518.htm)

(Vivek Kaul is a writer and can be reached at [email protected])

Yesterday, once more! Is the world economy going the Japan way?

Vivek Kaul

Vivek Kaul

High risk means high returns.

Or does it?

Not always.

When more risk does not mean more return

The ten year bond issued by the United States (US) government currently gives a return of around 1.8% per year. Bonds are financial securities issued by governments to finance their fiscal deficits i.e. the difference between what they earn and what they spend.

Returns on similar bonds issued by the government of United Kingdom (UK) are at1.9% per year.

Nearly five years back in July 2007 before the start of the financial crisis the return on the US bonds was at 5.1% per year. The return on British bonds was at 5.5% per year.

The return on German bonds back then was around 4.6% per year. Now it stands at 1.44% per year.

Since the start of the financial crisis governments all over the world have been running huge fiscal deficits in order to try and create some economic growth. They have been financing these deficits through increasing borrowing.

In 2007, the deficit of the US government stood at $160billon. This difference was met through borrowing. The accumulated debt of the US government at that point of time was $5.035trillion.

In 2012, the deficit of the US government is expected to be at $1.327trillion or around 8.3times more than the deficit in 2007. The accumulated debt of the US government is also around three times more now and has crossed $14trillion.

The situation in the United Kingdom is similar. In 2007 the fiscal deficit was at £9.7billion. The projected deficit for 2012 is around 9.3times more at £90billion. The government debt as a percentage of gross domestic product (GDP) has gone up from around 37% of GDP to around 67% of GDP.

The same trend seems to be happening throughout the countries of Western Europe as well. Hence we can conclude that it is more risky to lend to the governments of United States, United Kingdom and countries like Germany and France in Western Europe. Though to give Germany the due credit it doesn’t run fiscal deficits as large as US or UK for that matter. Its fiscal deficit in 2010 had stood at €100billion but was cut to around €25.8billion in 2011.

Even though the riskiness of lending to these countries has gone up, the investors have been demanding lower returns from the governments of these countries. Why is that?

The answer might very well lie in what happened in Japan in the late 1980s.

The Japan story

The Japanese central bank started running a low interest policy to help exports from the mid 1980s. This other than helping exports fuelled massive bubbles in both the stock market as well as the real estate market. The Nikkei 225, Japan’s premier stock market index, returned 237% from the start of 1985 to December 29,1989, the day it peaked at a level of 38,916 points. The real estate prices also shot through the roof. As Paul Krugman points out in The Return of Depression Economics “Land, never cheap in crowded Japan, had become incredibly expensive…the land underneath the square mile of Tokyo’s Imperial Palace was worth more than the entire state of California.”

This was the mother of all bubbles.

Yasushi Mieno took over as the 26th governor of the Bank of Japan, the Japanese central bank, on December 17, 1989. Eight days later on December 25, 1989, he shocked the market by raising the interest rate. And more than that, he publicly declared that he wanted the land prices to fall by 20%, which he later upped to 30%. Mieno didn’t stop and kept raising interest rates.

The stock market crashed. And by October 1990 it was down nearly 40%. Since then the stock market has largely been on its way down. And it currently quotes at 8,900 points down 77% from the peak.

The real estate prices also fell but not at the same fast rate as the stock market. As Ruchir Sharma writes in Breakout Nations – In Pursuit of the Next Economic Miracle “ “The greatest bubble in human history” burst in 1990 with no pain at all, like falling off Everest without breaking a bone. At its peak Japan accounted for 40 percent of the property value of the planet, but instead of collapsing, the price of real estate slowly declined at a 7% annual rate for two decades, ultimately falling by a total of about 80%. There was never a major round of foreclosures or bankruptcies, as the government kept bailing out debtors, ruining its own finances.”

The GDP growth rate collapsed from 3.32% in 1991 to -0.14% in 1999. In the next ten years i.e. between 2000 and 2009, the GDP growth rate never went beyond 2.74% and was at -5.37% in 2009.

The balance sheet depression

Japan has been in what economist Richard Koo calls a balance sheet recession. What this means in simple English is that after bubbles burst, specially real estate bubbles, the private sector companies as well as individuals and families who had speculated on the bubble end up with a lot of excessive debt and an asset (like land or stocks) which is losing value. The excessive debt has to repaid. Given this individuals and companies try to save, in order to repay the debt. But what is good for the individual is not always good for the overall economy.

The paradox of thrift

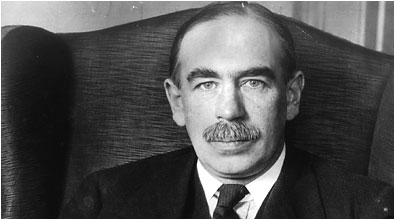

John Maynard Keynes unarguably the greatest economist of the twentieth century called this the paradox of thrift. What Keynes said was that when it comes to thrift or saving, the economics of an individual differs from the economics of the system as a whole.

If one person saves more then saving makes tremendous sense for him. But as more and more people start doing the same thing there is a problem. This is primarily because what is expenditure for one person is an income for someone else. Hence, when everybody spends less, businesses see a fall in revenue. This means lower aggregate demand and hence slower or even no growth for the overall economy.

The Japanese savings rate at the time when the bubble popped was around 0%. After this the Japanese started to save more and the savings rate of the Japanese private sector and households increased. It reached around 16% of the GDP in the year 2000.

All this money was being used to pay off the excess debt that had been accumulated. This meant slower growth for Japan. The government in turn tried to pump economic growth by spending more and more money. For this it took on more debt and now the Japanese government debt to GDP ratio is around 240%.

Ironically as the government debt went up the return on the government debt kept coming down. As Martin Wolf of Financial Times points out in a recent column “At the end of 1990, when its “bubble economy” went pop, the Japanese government’s 10-year bond was yielding 6.7 per cent…But yields on 10-year Japanese government bonds (JGBs) fell to close to 2 per cent in 1997 and then, with sizeable fluctuations, to troughs of 0.8 per cent in 1998, 0.4 per cent in 2003 and, recently, to 0.9 per cent. In short, the worse the Japanese government’s present and prospective debt position has become, the lower the interest rates on JGBs has also become.” (All returns per year)

The reason for this in retrospect is very straightforward. As the Japanese individuals and companies were saving more they did not want to risk their savings in either the stock market which had been continuously falling or the real estate market which was also falling, though at a slower rate. Hence a major part of the savings went into JGBs which they thought were safer. Given that there was great demand for JGBs the Japanese government could get away with offering lower returns on its bonds, even though over the years they became riskier.

The Japan Way

Richard Koo believes that what happened in Japan over the last twenty years is now happening in the US, UK and parts of Europe. Individuals in these countries are saving more to pay off their excess debts. An average American in the month of March 2012 saved 3.8% of his disposable income in March 2012. Before the crisis the American savings rate had become negative. . The same stands true for Great Britain where savings of household were -3% at the time the crisis struck. They have since gone up to 3% of GDP. The corporate sector was saving 3% of GDP is now saving 5% of GDP. Same stands true for Spain, Ireland and Portugal where savings were in negative territory (i.e. the people were borrowing and spending) before the crisis struck, and are now going up. In the case of Ireland the savings have gone up from -10% of GDP to around 5% of the GDP since the crisis struck.

Hence companies and individuals across countries are saving more to pay off the excess debt they had accumulated. This in turn has meant that they are spending lesser money than they used to. This has led to slower economic growth. A large part of these savings is going into government bonds keeping returns low. Retail investors have taken out nearly $260billion out of equity mutual funds in the United States since 2008, even though the stock market has doubled in the last three years. At the same time they have invested nearly $800billion in bond funds, which give very low returns.

ZIRP – Zero interest rate policy

The governments of these countries have cut interest rates to almost 0% levels and are also borrowing and spending more money. That as was the case in Japan has resulted in some economic growth, but nowhere as much as they had expected. Even though governments want their citizens and companies to borrow and spend money in order to revive economic growth, they are in no mood to do that.

The citizens would rather pay off their existing debt than take on new debt. And the companies need to feel that the economic opportunity is good enough to invest, which it clearly isn’t. That explains to a large level why US companies are sitting on more than $2trillion of cash.

The banks are also not willing to take on the risk of lending at such low interest rates, as was the case in Japan. What has also not helped is the case of continuously bailing out the financial sector like was the case in Japan. Hence real estate prices in countries like Spain still need to fall by 35% to come back at normal levels.

Slow growth

All in all most of the Western world is headed towards the Japan way, which means slow economic growth in the years to come. As Sharma writes “Over the next decade, growth in the United States, Europe and Japan is likely to slow…owing to the large debt overhang”. This will impact exports out of countries like China, South Korea, Japan, Taiwan, India etc. The Chinese exports for the month of April 2012 grew at 4.9% in comparison to 8.9% during the same period last year. This in turn has pushed down imports. Imports grew at a negligible 0.33% against the expected 11%.

A slowdown in Chinese imports immediately means lower prices for commodities. As Sharma puts it “It’s my conviction that the China-commodity connection will fall apart soon. China has been devouring raw materials at a rate way out of line with the size of its economy… Since 1990, China’s share of global demand for commodities ranging from aluminum to zinc has skyrockected from the low single digits to 40,50,60 % – even though China accounts for only 10% of total global output.” .

Over a longer term slower growth in the Western World will also means slower and lower stock markets. As the old Chinese curse goes “may you live in interesting times”. The interesting times are upon us.

(This post originally appeared on Firstpost.com on May 17,2012. http://www.firstpost.com/economy/japan-disease-is-spreading-high-risk-and-low-returns-311952.html)

(Vivek Kaul is a writer and can be reached at [email protected])

LIC money: Is it for investors’ benefit, or Rahul's election?

Vivek Kaul

“We’re slowly learning that fact. And we’re very, very pissed off.”

—Lines from the movie Fight Club

The government’s piggybank is in trouble. Well not major trouble. But yes some trouble.

The global credit rating agency Moody’s on Monday downgraded the Life Insurance Corporation (LIC) of India from a Baa2 rating to Baa3 rating. This is the lowest investment grade rating given by Moody’s. The top 10 ratings given by Moody’s fall in the investment grade category.

Moody’s has downgraded LIC due to three reasons: a) for picking up stake in the divestment of stocks like ONGC, when no one else was willing, to help the government reduce its fiscal deficit. b) for picking up stakes in a lot of public sector banks. c) having excessive exposure to bonds issued by the government of India to finance its fiscal deficit.

While the downgrade will have no impact on the way India’s largest insurer operates within India, it does raise a few basic issues which need to be discussed threadbare.

From Africa with Love

The wives of certain African dictators before going on a shopping trip to Europe used to visit the central bank of their country in order to stuff their wallets with dollars. The African dictators and their extended families used the money lying with the central banks of their countries as their personal piggybank. Whenever they required money they used to simply dip into the reserves at the central bank.

While the government of India has not fallen to a similar level there is no doubt that it treats LIC like a piggybank, rushing to it whenever it needs the money.

So why does the government use LIC as its piggybank? The answer is very simple. It spends more than what it earns. The difference between what the government earns and what it spends is referred to as the fiscal deficit.

In the year 2007-2008 (i.e. between April 1, 2007 and March 31,2008) the fiscal deficit of the government of India stood at Rs 1,26,912 crore. Fiscal deficit is the difference between what the government earns and what it spends. For the year 2011-2012 (i.e. between April 1, 2011 and March 31, 2012) the fiscal deficit is expected to be Rs 5,21,980 crore.

Hence the fiscal deficit has increased by a whopping 312% between 2007 and 2012. During the same period the income earned by the government has gone up by only 36% to Rs 7,96,740 crore. The expenses of the government have risen more than eight and half times faster than its revenues.

What is interesting is that the fiscal deficit numbers would have been much higher had the government not got LIC to buy shares of public sector companies it was selling to bring down the fiscal deficit.

Estimates made by the Business Standard Research Bureau in early March showed that LIC had invested around Rs 12,400 crore out of the total Rs 45,000 crore that the government had collected through the divestment of shares in seven public sector units since 2009. The value of these shares in March was around Rs 9,379 crore. Since early March the BSE Sensex has fallen 7.4%, which means that the LIC investment would have lost further value.

Over and above this the government also forced LIC to pick up 90% of the 5% follow-on offer from the ONGC in early March this year. This after the stock market did not show any interest in buying the shares of the oil major. The money raised through this divestment of shares went towards lowering the fiscal deficit of the government of India.

News reports also suggest that LIC was buying shares of ONGC in the months before the public issue of the insurance major hit the stock market, in an effort to bid up its price. Between December and March before the public offer, the government first got LIC to buy shares of ONGC and bid up the price of the stock from around Rs 260 in late December to Rs 293 by the end of February. After LIC had bid up the price of ONGC, the government then asked it to buy 90% of the shares on sale in the follow on public offer.

This is a unique investment philosophy where institutional investor managing money for the small retail investor, first bid up the price of the stock by buying small chunks of it, and then bought a large chunk at a higher price. Stock market gurus keep repeating the investment philosophy of “buy low-sell high” to make money in the stock market. The government likes LIC to follow precisely the opposite investment philosophy of “buying high”.

Estimates made by Business Standard suggest that LIC in total bought ONGC shares worth Rs 15,000 crore. The stock is since down more than 10%.

The bank bang

LIC again came to the rescue of the cash starved government during the first three months of this year, when it was force to buy shares of several government owned banks which needed more capital. It is now sitting on losses from these investments.

Take the case of Viajya Bank. It issued shares to LIC at a price of Rs 64.27 per share. Since then the price of the stock has fallen nearly 19%.

The same is case with Dena Bank. The stock price is down by almost 10% since allocation of shares to LIC. The share price of Indian Overseas Bank is down by almost 19.7% since it sold shares to LIC to boost its equity capital. While the broader stock market has also fallen during the period it hasn’t fallen as much as the stock prices of these shares have.

There are more than a few issues that crop up here. This special allotment of shares to LIC to raise capital has pushed up the ownership of LIC in many banks beyond the 10% mandated by the Insurance Regulatory and Development Authority of India, the insurance regulator. As any investment professional will tell you that having excessive exposure one particular company or sector isn’t a good strategy, especially when managing money for the retail investor, which is what LIC primarily does. What is interesting is that the government is breaking its own laws and thus not setting a great precedent for the private sector.

If LIC hadn’t picked up the shares of these banks, the fiscal deficit of the government would have gone up further. The third issue here is why should the government run so many banks? The government of India runs twenty six banks (20 public sector banks + State Bank of India and its five subsidiaries).

While given that banking is a sensitive sector and some government presence is required, but that doesn’t mean that the government has to run 26 banks. It is time to privatise some of these banks.

Gentlemen prefer bonds

As of December 31, 2011, the ratio of government securities to adjusted shareholders’ equity in LIC was 764%. This is understandable given that the subsidy heavy budget of the Congress led UPA government has seen its fiscal deficit balloon by 312% over the last five years. Again basic investment philosophy tells us that having a large exposure to one investment isn’t really a great idea, even if it’s a government.

The Rahul factor

But the most basic issue here is the fact that the government is using the small savings of the average Indian who buys LIC policies to make loss making investments. This is simply not done.

LIC has turned into the behemoth that it has over the years by offering high commissions to its agents over the years. It sells very little of “term insurance”, the real insurance. What it basically sells are investment policies with very high expenses which are used to pay high commissions to it’s the agents. The high commissions in turn ensure that these agents continue to hard-sell LIC’s extremely high cost investment policies to normal gullible Indians. The premium keeps coming in and the government keeps using LIC as a piggybank.

The high front-loading of commissions is allowed by The Insurance Act, 1938. The commission for the first can be a maximum of 40 per cent of the premium. In years two and three, the caps are 7.5 per cent, and 5 per cent thereafter. These are the maximum caps and serve as a ceiling rather than a floor.

The Committee on Investor Protection and Awareness led by D Swarup, the then Chairman of Pension Fund Regulatory and Development Authority, had proposed in September 2009 to do away with commissions across financial products. “All retail financial products should go no-load by April 2011,” the committee had proposed in its reports.

The National Pension Scheme(NPS) was already on a no commission structure. And so were mutual funds since August 1, 2009. But LIC and the other insurance companies were allowed to pay high commissions to their agents. “Because there are almost three million small agents who will have to adjust to a new way of earning money, it is suggested that immediately the upfront commissions embedded in the premium paid be cut to no more than 15 per cent of the premium. This should fall to 7 per cent in 2010 and become nil by April 2011,” the committee had further proposed.

Not surprisingly the government quietly buried this groundbreaking report.

While insurance commissions have come down on unit linked insurance plans, the traditional insurance policies in which LIC remains a market leader continue to pay high commissions to their agents. These traditional insurance policies typically invest in debt (read government bonds which are issued to finance the fiscal deficit).

This is primarily because the Congress led UPA government needs the premium collected by LIC to run LIC like a piggybank. The piggybank money can and is being used to run subsidies in the hope that the beneficiaries vote for Rahul Gandhi in 2014.

Is the objective of LIC to generate returns and ensure the safety of the hard earned money of crores of it’s investors? Or is it to let the UPA government run it like a piggybank in the hope that Rahul baba becomes the Prime Minister?

The country is waiting for an answer.

(This post originally appeared on Firstpost.com on May 15,2012. http://www.firstpost.com/politics/lic-money-is-it-for-investors-benefit-or-rahul-election-309545.html)

(Vivek Kaul is a writer and can be reached at [email protected])

How the bastardisation of Keynes is still haunting us

Vivek Kaul

“So how does it feel to be an educated unemployed?” she asked.

“Shikshit berozgar sounds much better,” I retorted. “Plus you are making a pot load of money anyway.”

“Ah. Where has the male ego gone?”

“Well, as long as you keep the money coming, ego can take a backseat.”

“On the subject of money I was reading somewhere about some Western economists recommending negative interest rates,” she said.

“ The idea is to charge people who let their money lying idle in a bank account,” I explained.

“Charge?”

“Yes. Say if you keep $1000 in your bank account and the negative interest rate is 2%, then at the end of the year your account will have $980 ($1000 – 2% of $1000).”

“Oh. But why?”

“So that instead of letting the money lay idle in the bank account people take it out and spend it.”

“And how will that help?”

“Well when people spend the money the demand for goods and services will go up. This in turn will mean more profits for businesses, which in turn may recruit more people and decrease unemployment.”

“Interesting. Where does this idea come from?”

“It comes from the concept of paradox of thrift which was first explained by John Maynard Keynes, an economist whose thinking had the most influence on economists and politicians of the twentieth century.”

“But why call it a paradox? Isn’t being thrifty or saving money a good thing?”

“Keynes thought that when it comes to saving what makes sense for an individual may not work for the economy. If an individual saves more he cuts down on his expenditure. If one person does this, it makes sense for him because he saves more money. But more people doing it creates a problem.”

“What problem?”

“What is expenditure for one person is income for someone else. When you buy your fancy makeup, a lot of people earn money. The shop you buy it from. The company that makes the brand you buy and so on. When you don’t the entire chain earns lesser.”

“Ah. Never thought about it that way.”

“So as everybody spends less, businesses see a fall in revenue. To stay competitive they start firing people, which leads to a further cut in spending. The unemployed obviously spend less. But so do others in the fear that they might be fired as well.”

“And all this is not good for the economy,” she said. “But how is it linked to negative interest rates?”

“Since the financial crisis started in 2008, people in Europe, America and even Japan, are not spending money. Hence the idea of negative interest rates has been put forward. People would rather spend the money than see its value go down.”

“But is that what Keynes suggested?”

“No. What Keynes had said was that consumers and firms would be unwilling to spend money in an environment where jobs are falling and demand is falling or is flat or growing at a very slow rate. So the government should become the “spender of the last resort” by coming up with a stimulus package.”

“Hmmm.”

“Keynes also said during recessions the government should not be trying to balance its budget i.e. match its income with expenditure. The logic being that taxes collected would anyway fall during a recession, if the government tried to match this with a cut in expenditure, it would squeeze the economy even more.”

“So Keynes advocated that governments run fiscal deficits,” she concluded.

“Not at all. Keynes believed that on an average the government budget should be balanced. This meant that during years of prosperity the governments should run budget surpluses i.e. earn more than what they spend. But when the economy wasn’t doing well governments should spend more than what they earn and hence run a fiscal deficit.”

“Okay. So the money saved during the good time could be spent during the bad times.”

“Yes. Keynes came up with this theory in his book The General Theory of Employment, Interest and Money in 1936. This book had ideas based on the study of the Great Depression. During those days it was not fashionable for governments to run fiscal deficits as it is today. As Franklin Roosevelt, the then President of America put it “Any government, like any family, can, for a year, spend a little more than it earns. But you know and I know that a continuation of that habit means the poorhouse.” But then attitudes changed.”

“How was that?”

“As governments around the world got ready to fight the Second World War they spent a lot of money in getting ready for it, which meant they ended with fiscal deficits. Economies around the world which were still in the doldrums because of the Great Depression, suddenly started rebounding,” I explained.

“And so the star of Keynes shone?”

“Yes. But the politicians over the decades just took one part of Keynes’ advice and ran with it. The belief in running deficits in bad times became permanently etched in their minds. In the meanwhile they forgot that Keynes had also wanted them to be running surpluses during good times. So they ran deficits in good times and bigger deficits in bad times. This meant more and more borrowing. And this how the Western world has ended up with all the debt which has brought the whole world to the brink of a huge economic disaster.”

“But what about negative interest rates?” she asked. “Will they help?”

“Not really.”

“Why?”

“See the thing is other than government debts increasing in the Western world, the debt of individuals has also gone up over the years. So right now they by not spending they are saving money so that they can repay their debts.”

“Hmmm. But do you see negative interest rates coming in?”

“On the face of it I don’t think that will happen,” I replied. “But then you never know. Politicians have bastardised Keynes in the past. They can do it again.”

“How sure are you of this?” she asked.

“Let me answer your question with a couplet written by Javed Akhtar “main khud bhi sochta hoon ye kya mera haal hai, jiska jawab chahiye wo kya sawal hai.”

(The interview was originally published on May 14,2012, in the Daily News and Analysis (DNA). http://www.dnaindia.com/analysis/column_how-the-bastardisation-of-keynes-is-still-haunting-us_1688370).

(Vivek Kaul is a writer and can be reached at [email protected])