The inspiration to write this piece came from a news report which appeared in the Mumbai edition of the Daily News and Analysis (DNA) a few days back. Before I get into that I would like to recount something, which I am really not proud of.

One of my bigger mistakes(I am still debating if it was my biggest mistake) in life was to do an MBA (actually a post graduate diploma in management(PGDM), but calling it an MBA is a simpler way to talk about it). By the time three-fourths of the course got over, I came to the conclusion that I was wasting my time and this is not what I wanted to do with my life. Nevertheless, it was too late to pull out. I completed the course, got the diploma and a job, and then quit my job, to try and figure out what to do with my life.

At this point of time I was in Delhi. My days used to be spent either watching new Hindi films or reading books at the four storied Crossword Book Shop at South Extension, which has since shut-down. To be honest I was never more happy with my life. The only problem was I had no money. And I did not want to ask my father for any more money, given that he had already spent quite a lot on my MBA.

But I had just become too addicted to books and movies by then. I was reading one book on an average per day and also buying them to ensure that Crossword does not throw me out. The money to buy books and watch movies came from my student credit card. Those were the days(I guess it still happens) where if you managed to get through a good business school, one of the first things you would end up with is a credit card from a foreign bank. The banks wanted to catch the future moneybags, young.

I knew that this wouldn’t last forever. Nevertheless, I continued using my credit card, having made up my mind to default on the outstanding payment. My confidence came from the fact that the residential address that I had given to the bank had changed because my parents had moved to a different city. Hence, the chances of collection agents landing up were slim.

This personal bubble did not last forever. And soon a lawyer representing the bank sent a legal notice threatening to initiate criminal or civil proceedings (he did not specify which) to my old residential address, unless a certain amount of money was paid to settle the debt I had accumulated.

A concerned neighbour decided to accept the notice and call up my father and inform him about it. My father then decided to settle the amount with the lawyer and that was where it ended.

The one result of this entire experience has been that I have never had a credit card. The only time I applied for a credit card from a new generation private sector bank, my application was rejected, given that my name would have been on the defaulter databases that banks now use. Also, I haven’t gotten around to taking any loans from banks either. In that sense, I have almost no credit history other than the credit card default.

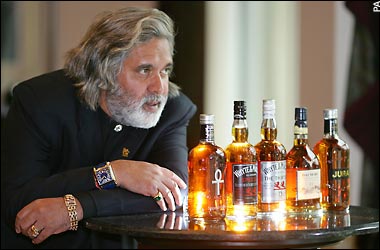

Now you must be wondering why have I been going on and on about my credit card default. I just remembered the entire experience after reading a news report in the Daily News and Analysis about Vijay Mallya, one of the biggest defaulters of this day and age.

This news report suggests that of the Rs 7,000 crore that various banks had lent to Kingfisher Airlines, they can now recover only Rs 6 crore. As the report points out: “The State Bank of India (SBI), the major lender to Mallya’s airline, till now has managed to recover only Rs 155 crore out of the Rs 1,623 crore due from it. dna has learnt from official SBI sources that the value of Kingfisher Airlines pledged to the bank has now plummeted from Rs 4,000 crore to Rs 6 crore! SBI is unable to find a single buyer for the ‘Kingfisher’ trademarks.”

Some of the other assets that the company offered as a collateral to banks are now stuck in litigation. This includes the Kingfisher House in Andheri, Mumbai and the Kingfisher Villa in Goa. As a recent report in The Financial Express said: “Bankers’ attempts to take possession of Kingfisher Villa in Goa have been thwarted by United Spirits (USL), which claims it has been a tenant since 2005 and, therefore, has the first right to buy the property.”

The banks waited for too long in the hope that Mallya will repay. And now they are not in a position to recover any of the money that they had lent. As Raghuram Rajan, governor of the Reserve Bank of India(RBI) had said in a speech in November 2014: “The longer the delay in dealing with the borrower’s financial distress, the greater the loss in enterprise value.”

Further, banks gave loans to Mallya even when their board members protested. As the DNA reports: “CBI sources reveal that IDBI had extended loans to Kingfisher despite being warned by some board members not to do so.”

Mallya exemplifies in the best possible manner what has gone wrong with the Indian banking system. Public sector banks have lent a lot of money to crony capitalists who are now no longer in a position to return that money. But they are in a position to hire the best possible lawyers to ensure that when banks move in to recover the money they had lent, the process gets endlessly delayed in the courts.

This has led banks to go after small and medium enterprises which are unable to repay their loans, with a vengeance. These enterprises are not in a position to hire expensive lawyers ike Mallya is. As Rajan put it in his speech: “[The] full force is felt by the small entrepreneur who does not have the wherewithal to hire expensive lawyers or move the courts, even while the influential promoter once again escapes its rigour. The small entrepreneur’s assets are repossessed quickly and sold, extinguishing many a promising business that could do with a little support from bankers.”

The case of banks going after small and medium enterprises is similar to my case. When it comes to recovering their loans, the banks go with full force behind people who are not in a position to hire expensive lawyers and do not have the wherewithal to get stuck with the legal system. The bigger defaulters they just let go. As George Orwell wrote in the Animal Farm: “All animals are equal, but some animals are more equal than others.”

The column originally appeared on www.equitymaster.com as a part of The Daily Reckoning on Feb 18, 2015