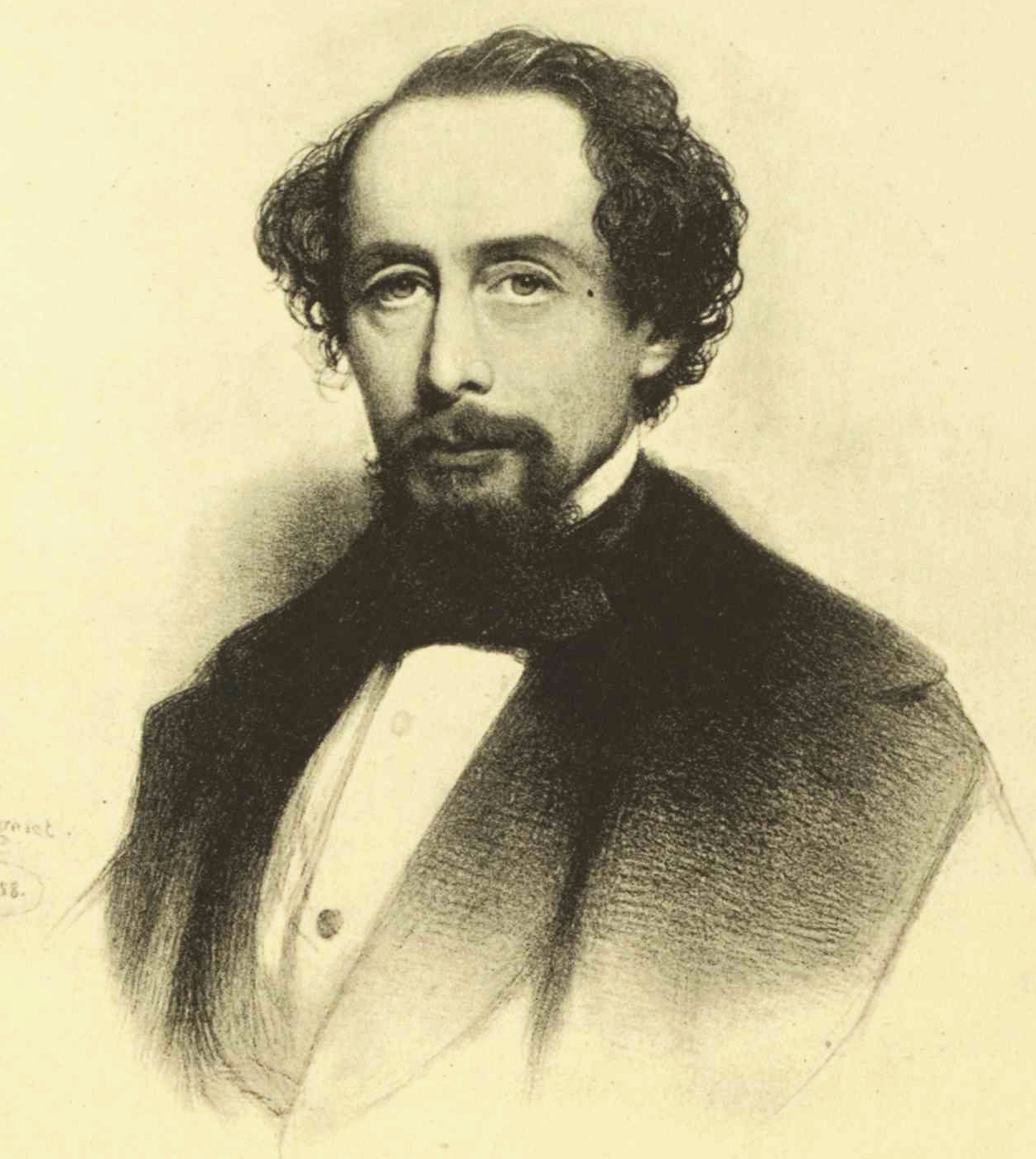

The writing of very few writers survives across generations. Charles Dickens is one of them. In his book David Copperfield one of the characters Mr Micawber says: “Annual income twenty pounds, annual expenditure nineteen nineteen six, result happiness. Annual income twenty pounds, annual expenditure twenty pounds ought and six, result misery.”

The writing of very few writers survives across generations. Charles Dickens is one of them. In his book David Copperfield one of the characters Mr Micawber says: “Annual income twenty pounds, annual expenditure nineteen nineteen six, result happiness. Annual income twenty pounds, annual expenditure twenty pounds ought and six, result misery.”

This is something that Indian politicians should be reading and imbibing. If reading Dickens is something that they don’t like, they can try listening to the song aamdani atthani kharcha rupaiya o bhaiyya na poocho na poocho haal natija than than gopal. This song is from the 1968 movie Teen Bahuraniyan. Given that most of the Indian politicians are “old,” they will definitely relate better to this song from the time when they were young, than to Dickens.

The moral in both what Dickens and Anand Bakshi (who was the lyricist for the aamdani atthani kharcha rupaiya song) wrote is that when you spend more than you earn there is trouble ahead. This basic lesson is something that the Indian government (and most other governments around the world) has not understood over the last ten years.

The government has constantly spent more than it has earned and run a fiscal deficit. Indeed, the situation continues to remain worrying on this front, even during the course of this financial year. Data released by the Comptroller General of Accounts(CGA) shows that during the first six months of 2014-2015(i.e. the period between April 1, 2014 and March 31, 2015), the government ran a fiscal deficit of Rs 4,38,826 crore or around 83% of the targeted fiscal deficit of Rs 5,31,177 crore, set at the time of the budget. The number was at 76% during the course of the last financial year.

One reason for this is the fact that the expenditure of the government is front loaded whereas its income is not. Hence, six months into the financial year, the fiscal deficit is not equal to 50% of the annual target.

Between April and September 2014 the total income of the government has risen by only 6.6% in comparison to the same period last financial year. The targeted growth in income in the budget is at 12.6%.So, the income has not grown as fast as it is supposed to grow. On the expenditure front things look a tad better. Between April and September 2014, the total expenditure has risen by 6.6%. The targeted growth in expenditure is at 7.8%.

In fact, with oil prices coming down the oil under-recoveries suffered by the oil marketing companies will come down. For a very long period of time oil marketing companies were selling diesel at a price at which they did not recover their cost of producing it. Cooking gas and kerosene continue to be sold at a price below their cost of production.

The government compensates these companies for their under-recoveries. This pushes up the expenditure of the government and hence, its fiscal deficit.

Kaushik Das and Taumir Baig economists at Deutsche Bank Research expect the under-recoveries for this financial year to be at Rs 85,300 crore against around Rs 1,40,000 crore, during the last financial year. This calculation was made in early October and oil prices have fallen further since then. As seems likely oil prices will continue to remain low in the short run and this will help the government contain its expenditure towards oil under-recoveries.

Nevertheless, before you uncork that bubbly, there are some other points that need to be considered. Around Rs 50,000 crore of food subsidies remain unpaid. In case of fertilizer subsidies pending bills amount to Rs 38,000 crore. This should largely neutralize the gains on account of oil prices falling. The previous finance minister P Chidambaram had pushed the payment of more than Rs 1,00,000 crore of subsidies into the current financial year, in order to ensure that he met his budget targets.

Also, there are other long term concerns on the fiscal front. The public sector banks are in a mess. They will need regular infusions of capital from the government, if they need to continue to function. This is a ticking time bomb which no one seems to be talking about. In fact, the Report of The Committee to Review Governance of Boards of Banks in India (better known as the PJ Nayak committee) released in May 2014, goes into the substantial detail regarding this issue. It estimates that between January 2014 and March 2018 “public sector banks would need Rs. 5.87 lakh crores of tier-I capital.”

The report further points out that “assuming that the Government puts in 60 per cent (though it will be challenging to raise the remaining 40 per cent from the capital markets), the Government would need to invest over Rs. 3.50 lakh crores.”

Where is this money going to come from? In fact, there has been very little activity on this front from the government during this financial year. As and when the government allocates money towards this, its expenditure will go up again. The other option is to let the private sector take over some of these banks. But that is a political minefield and also the money required for the capital infusion is not small change exactly.

Another long term issue on the fiscal front are the recommendations of the seventh finance commission which will come into force in 2016. As happened in the case of the sixth finance commission, the salaries of government employees will go up again. This will lead to a greater expenditure for the government and in turn, a higher fiscal deficit.

Immediately after the seventh finance commission recommendations are implemented, state government employees all across the country will ask for hikes as well. The state governments, as has been the case in the past, will be happy to oblige, even though they don’t have the money for it. This will mean that the total government borrowing (states + centre) will shoot up and crowd out the private sector borrowing and push up interest rates, which have only recently started to fall. These are issues that the government needs to tackle if it hopes that interest rates continue to fall.

In fact, during the course of the last financial year, the fiscal deficit crossed its annual target in January 2014. Something similar will happen this year. Nevertheless, by the time March 2015 comes, the government would have managed to bring back the fiscal deficit to the targeted level. This is because tax collections shoot up during the last three months of the year. Further, the government will go in for disinvestment of its holdings in public sector companies at that point of time. This year the government has targeted an income of Rs 58,400 crore through the disinvestment of shares. This seems to have become standard practice over the years. But the danger here is that shares once sold cannot be resold. But the expenditure they are financing is more or less permanent.

To conclude, it is important that the government looks at increasing its income, if it hopes to finance its ever burgeoning expenditure efficiently. In other words, it has to follow the advise of both Charles Dickens and Anand Bakshi.

In order to that the government has to look at increasing the number of income tax payers for one. Currently, only 3.5 crore individuals out of a population of 120 crore pay the income tax. A quick implementation of goods and services tax regime will also help. Hence, the government needs to tackle the black money economy in India seriously. The question is will get around to doing that?

The article originally appeared on www.equitymaster.com on Nov 7, 2014