Vivek Kaul

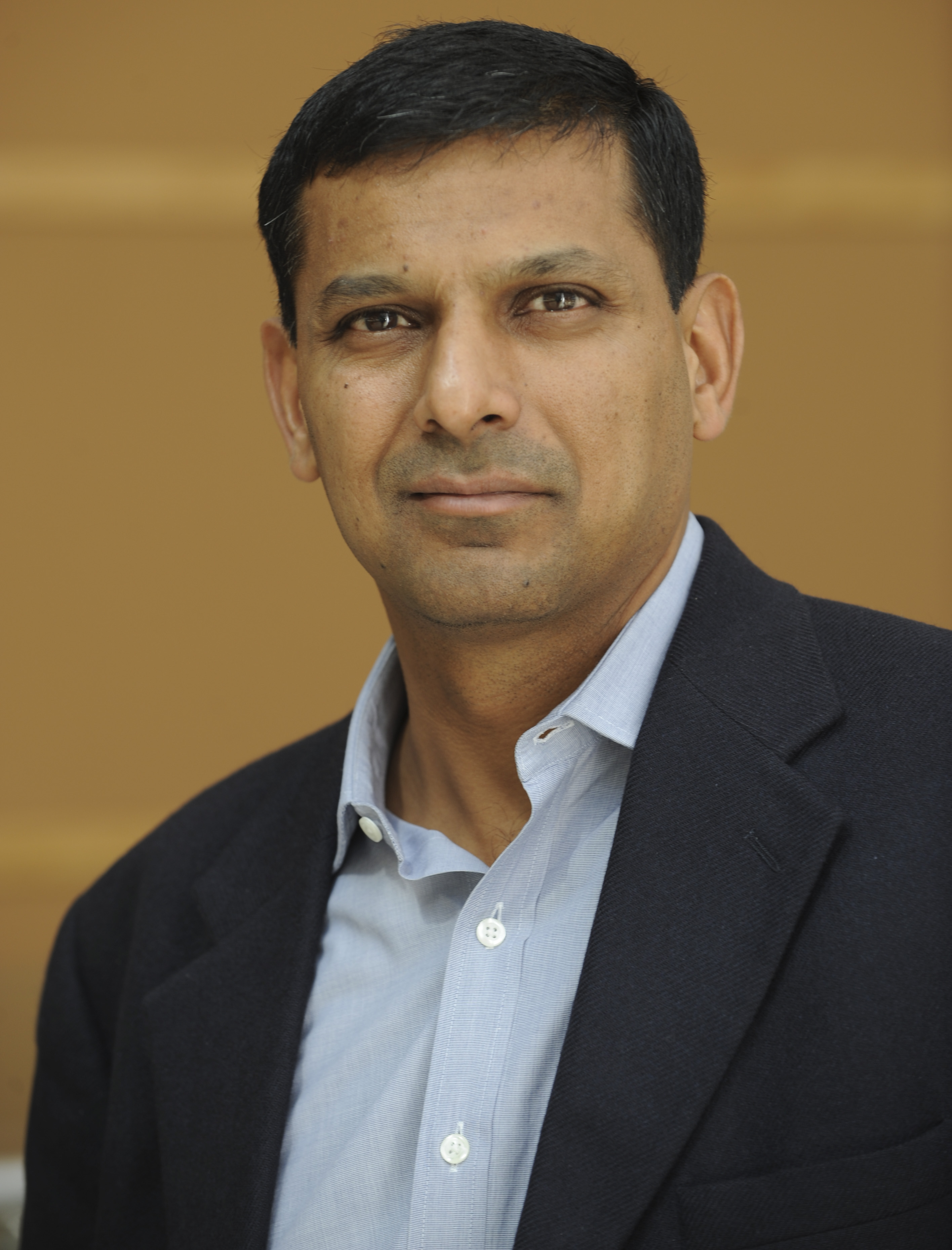

Raghuram Govind Rajan will take over as the governor of the Reserve Bank of India(RBI) on September 4, 2013. There are great expectations from him to turnaround the faltering Indian economy. His appointment has been welcomed by the media, business leaders as well as politicians. It is one of those rare occasions where almost everyone seems to be happy about the appointment.

But will Rajan be able to deliver? Will he able to control inflation, stop the rupee from falling further against the dollar and at same time engineer economic growth, as he is expected to. Or to ask a more pointed question, can any central banker really make a huge difference?

Before I get around to answering that question, let me deviate a little.

Inflation targeting has been a favourite policy of central banks all over the world. This strategy essentially involves a central bank estimating and projecting an inflation target and then using interest rates and other monetary tools to steer the economy towards the projected inflation target.

But recent analysis suggests that inflation targeting might have been one of the major reasons behind the current financial crisis. Stephen D King, Group Chief Economist of HSBC makes this point in his new book When the Money Runs Out. As he writes “the pursuit of inflation-targetting…may have contributed to the West’s financial downfall.”

He gives the example of United Kingdom to make his point. “Take, for example, inflation targeting in the UK. In the early years of the new millennium, inflation had a tendency to drop too low, thanks to the deflationary effects on manufactured goods prices of low-cost producers in China and elsewhere in the emerging world. To keep inflation close to target, the Bank of England loosened monetary policy with the intention of delivering higher ‘domestically generated’ inflation. In other words, credit conditions domestically became excessive loose…The inflation target was hit only by allowing domestic imbalances to arise: too much consumption, too much consumer indebtedness, too much leverage within the financial system and too little policy-making wisdom.”

In simple English what this basically means is that the Bank of England, the British central bank, kept interest rates too low for a very long time, so that people borrowed and spent money. This was done in the hope that prices would rise and the inflation target would thus be met.

With interest rates being low banks were falling over one another to lend money to anyone who was willing to borrow. And this gradually led to a fall in lending standards. People who did not have the ability to repay were also being given loans. As King writes “With the UK financial system now awash with liquidity, lending increased rapidly both within the financial system and to other parts of the economy that, frankly, didn’t need any refreshing. In particular, the property sector boomed thanks to an abundance of credit and a gradual reduction in lending standards.”

The Western central banks were focussed on just maintaining the inflation target that they had set. In fact, the ‘inflation only’ focus was a result of how economic theory had evolved over the years. As Felix Martin writes in the fascinating book Money – The Unauthorised Biography “The sole monetary ill that had been permitted into the New Keynesian theory was high or volatile inflation, which was deemed to retard the growth of GDP. The appropriate policy objective, therefore, was low and stable inflation, or ‘monetary stability’…On such grounds, the Bank of England was granted its independence and given a mandate to target inflation in 1997, and the European Central Bank was founded as an independent, inflation-targeting central bank in 1998.”

But this focus on ‘low inflation’ or ‘monetary stability’ as economists like to call it, turned out to be a very narrow policy objective. As Martin writes “The single minded pursuit of low and stable inflation not only drew attention away from the other monetary and financial factors that were to bring the global economy to its knees in 2008 – it exacerbated them…Disconcerting signs of impending disaster in the pre-crisis economy – booming housing prices, a drastic underpricing of liquidity in asset markets, the emergence of shadow banking system, the declines in lending standards, bank capital, and the liquidity ratios – were not given the priority they merited, because, unlike low and stable inflation, they were simply not identified as being relevant.”

And this ‘lack of focus’ led to a big real estate bubbles in large parts of the Western world, which was followed by biggest ‘macroeconomic’ crash in history.

Since then, central banks around the world have tried to concentrate on factors other than inflation as well. But it is not easy for a central bank, if I might use that phrase, to be all over the place.

Raghuram Rajan understands this very well. As he wrote in a 2008 article (along with Eswar Prasad) “The RBI already has a medium-term inflation objective of 5 per cent…But the central bank is also held responsible, in political and public circles, for a stable exchange rate. The RBI has gamely taken on this additional objective but with essentially one instrument, the interest rate, at its disposal, it performs a high-wire balancing act.”

Focus on multiple things makes the RBI run the risk of not doing any of them well. “What is wrong with this? Simple that by trying to do too many things at once, the RBI risks doing none of them well,” wrote Rajan and Prasad.

Hence it made sense for the RBI to concentrate on one thing instead of being all over the place. As Rajan wrote in the 2008 Report of the Committeeon Financial Sector Reforms “ The RBI can best serve the cause of growth by focusing on controlling inflation, and intervening in currency markets only to limit excessive volatility. This focus can also best serve the cause of inclusion because the poorer sections are least hedged against inflation.”

Rajan might have revised his beliefs in the last five years. But as we have seen over the period, the strategy of central banks being all over the place hasn’t really worked either. Given this, we shouldn’t have very high expectations from what Rajan will be able to do as the governor of the RBI, even though he maybe the best man for the job.

To conclude, it is worth remembering what Sunil Gavaskar said in 1994, after he was appointed the manager of a floundering Indian cricket team. “Results can’t be produced overnight. I’m not instant coffee,” said the cricket legend.

Rajan probably realises this more than anyone else. As he wrote recently in his globally syndicated column “The bottom line is that if there is one myth that recent developments have exploded it is probably the one that sees central bankers as technocrats, hovering independently over the politics and ideologies of their time. Their feet, too, have touched the ground.”

This article originally appeared in the Wealth Insight Magazine for September 2013

(Vivek Kaul is the author of the soon to be published Easy Money. He tweets @kaul_vivek)