The government has a certain theory on gold as per which buying gold is harmful for the Indian economy. Allow me to elaborate starting with something that P Chidambaram, the union finance minister, recently said “I…appeal to the people to moderate the demand for gold.”

India produces very little of the gold it consumes and hence imports almost all of it. Gold is bought and sold internationally in dollars. When someone from India buys gold internationally, Indian rupees are sold and dollars are bought. These dollars are then used to buy gold.

So buying gold pushes up demand for dollars. This leads to the dollar appreciating or the rupee depreciating. A depreciating rupee makes India’s other imports, including our biggest import i.e. oil, more expensive.

This pushes up the trade deficit (the difference between exports and imports) as well as our fiscal deficit (the difference between what the government earns and what it spends).

The fiscal deficit goes up because as the rupee depreciates the oil marketing companies(OMCs) pay more for the oil that they buy internationally. This increase is not totally passed onto the Indian consumer. The government in turn compensates the OMCs for selling kerosene, cooking gas and diesel, at a loss. Hence, the expenditure of the government goes up and so does the fiscal deficit. A higher fiscal deficit means greater borrowing by the government, which crowds out private sector borrowing and pushes up interest rates. Higher interest rates in turn slow down the economy.

This is the government’s theory on gold and has been used to in the recent past to hike the import duty on gold to 6%. But what the theory doesn’t tells us is why do Indians buy gold in the first place? The most common answer is that Indians buy gold because we are fascinated by it. But that is really insulting our native wisdom.

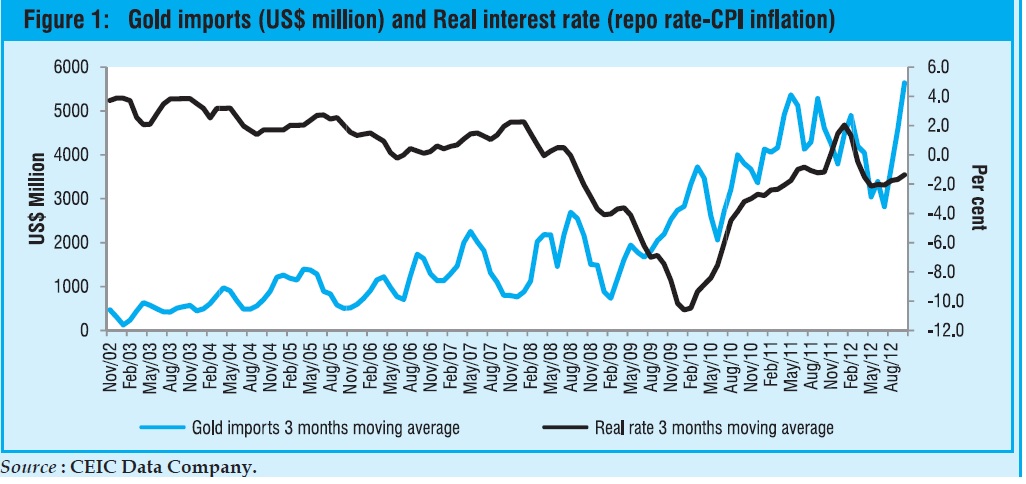

World over gold is bought as a hedge against inflation. This is something that the latest economic survey authored under aegis of Raghuram Rajan, the Chief Economic Advisor to the government, recognises. So when inflation is high, the real returns on fixed income investments like fixed deposits and banks is low. As the Economic Survey puts it “High inflation reduces the return on other financial instruments. This is reflected in the negative correlation between rising(gold) imports and falling real rates.”(as can be seen from the accompanying table at the start)

In simple English, people buy gold when inflation is high and the real return from fixed income investments is low. That has precisely what has happened in India over the last few years. “The overarching motive underlying the gold rush is high inflation…High inflation may be causing anxious investors to shun fixed income investments such as deposits and even turn to gold as an inflation hedge,” the Survey points out.

High inflation in India has been the creation of all the subsidies that have been doled out by the UPA government. As the Economic Survey puts it “With the subsidies bill, particularly that of petroleum products, increasing, the danger that fiscal targets would be breached substantially became very real in the current year. The situation warranted urgent steps to reduce government spending so as to contain inflation.”

Inflation thus is a creation of all the subsidies being doled out, says the Economic Survey. And to stop Indians from buying gold, inflation needs to be controlled. “The rising demand for gold is only a “symptom” of more fundamental problems in the economy. Curbing inflation, expanding financial inclusion, offering new products such as inflation indexed bonds, and improving saver access to financial products are all of paramount importance,” the Survey points out. So if Indians are buying gold despite its high price and imposition of import duty, they are not be blamed.

A shorter version of this piece appeared in the Daily News and Analysis on February 28, 2013

(Vivek Kaul is a writer. He tweets @kaul_vivek)