Vivek Kaul

When Manmohan Singh speaks he puts us to sleep.

When Barack Obama speaks the world listens. In his speech to accept the nomination to run for his second term as President, Obama touched all the right chords. The speech had the right amount of nostalgia, advise, self marketing and hope built into it.

His vision of future, as is the case with anyone asking for votes in a democracy, was optimistic, without getting into the specifics. The American dream is still on, despite the difficulties the country has faced over the last five years due to the financial crisis. That was the takeaway, one got from Obama’s speech.

“But as I stand here tonight, I have never been more hopeful about America. Not because I think I have all the answers. Not because I’m naïve about the magnitude of our challenges. I’m hopeful because of you,” said Obama

While hope is a good thing to have but then at times to hope we need to ignore the mess that we are in, in order to have some hope. And that precisely is my problem with Obama’s speech. There was a lot that he should have said, but did not.

The biggest problem in America today is not unemployment or slow economic growth but the unfunded liabilities like pensions, social security and medical care benefits that the government has promised to the citizens. .

As economist Laurence Kotlikoff wrote in a recent column “The 78 million-strong baby boom generation is starting to retire in droves. On average, each retiring boomer can expect to receive roughly $35,000, adjusted for inflation, in Social Security, Medicare, and Medicaid benefits. Multiply $35,000 by 78 million pairs of outstretched hands and you get close to $3 trillion per year in costs. This is not a partisan issue. The dirty little secret that neither President Obama nor Mitt Romney is telling you is that our kids, who are being stuck with the bill, can’t afford it.”

The three trillion dollars that Kotlikoff is talking about is a lot of money. The current American yearly GDP is $15trillion. Hence, the costs Kotlikoff is talking about amount to nearly 20% of the annual American GDP. And it is unfunded.

Before we go further let’s try and understand what unfunded liabilities are. Let us say I plan to retire 10 years from now. I feel that Rs 16 lakh per year should be enough for me to sail through the year. But to earn that Rs16 lakh I would need to build a corpus of Rs 2 crore in 10 years time, and assuming that I am able to earn an interest of 8% on this corpus, 10 years from now (8% of Rs 2crore works out to Rs 16 akh).

In order to build a corpus of Rs 2 crore in 10 years time I will have to start saving and investing money regularly from now. If I don’t I will be in trouble ten years from now. Either I won’t be able to retire or if I retire I will have to borrow to meet my expenses.

The same logic at a very basic level works for governments as well. The government gives a pension to people when they retire. If a certain number of people are expected to retire ten years from now, then they would have to be paid a certain amount of pension. While estimating the exact amount is difficult, estimates can be made. But what we know for sure is that money is to be saved now so that citizens can be paid pensions later.

If governments don’t invest the right amount from now on, which a lot of them don’t including the US government, they will have to pay these citizens by borrowing money later. And if pensions and other commitments made to the citizens cannot be funded through the investments already made, they are said to be ‘unfunded’.

Mitch Feierstein in his book Ponzi Power – How Politicians and Bankers Stole Your Future writes “Using proper accounting methods…the true value of the state and municipal pension liability is at $5.2trilion. When you deduct the $1.94trillion of pension assets that have already been set aside, you get a net liability of $3.26trillion.”

Other than this the US government already has an existing debt of around $15trillion. Feierstein also points out that the social security programme of the US government is underfunded to the extent of $18.8trillion. The underfunding in Medicare, the health insurance programme, amounts to around $38.5trillion. So if you add all of this up the number comes to greater than $75 trillion and that is what Feierstein feels the US government owes to other governments and its own citizens.

And that’s just one estimate and a very conservative one. Kotlikoff’s estimate is scarier. As he wrote in a recent column “I recently calculated the fiscal gap…The fiscal gap measures the present value difference between all projected future federal expenditures (including servicing official debt) and all projected future taxes. The fiscal gap is thus the true measure of our government’s total indebtedness and the true measure of fiscal sustainability. How big is the fiscal gap? Brace yourself. It’s $222 trillion large!… In short, our government is totally broke. And it’s not broke in 30 years or in 20 years or in 10 years. It’s broke today.”

So how large is $222trillion? The annual GDP of the whole world is around $60trillion. The GDP of the United States of America is around $15trillion.

So what is the way out of this? “Here’s one way to wrap your head around our $222 trillion fiscal hole: closing it via tax hikes would require an immediate and permanent 64 percent increase in all federal taxes. Alternatively, the government could cut all transfer payments, e.g., Social Security benefits, and discretionary federal expenditures, e.g., defense expenditures, by 40 percent. Waiting to raise taxes or cut spending makes these figures worse,” writes Kotlikoff.

Another way out for the American government is to print money to meet its expenses (something which is it is already doing). As Kotlikoff puts it another column “The first possibility is massive benefit cuts visited on the baby boomers in retirement. The second is astronomical tax increases that leave the young with little incentive to work and save. And the third is the government simply printing vast quantities of money to cover its bills. Most likely we will see combination of all three responses with dramatic increases in poverty, tax, interest rates and consumer prices. This is an awful, downhill road to follow, but it’s the one we are on. And bond traders will kick us miles down our road once they wake up and realize the U.S. is in worse fiscal shape than Greece.”

If America has to get out of this hole, the American way of life has to change. And that as Obama’s speech clearly points out is unlikely to happen.

(The article originally appeared on www.firstpost.com on September 8,2012. http://www.firstpost.com/world/the-truth-obama-didnt-tell-his-party-the-us-is-broke-448686.html)

(Vivek Kaul is a writer. He can be reached at [email protected])

Month: September 2012

Why gold is not running up as fast as it can…

Vivek Kaul

Gold is on a roll. Again!

The price of the yellow metal has risen 8.5% since August 1 and is currently quoting at $1,735 per ounce (one ounce equals 31.1gram). In fact, just since August 31, the price of gold has risen by around $87, or 5.2%.

Still, the price is nowhere near how high it could go. All thanks to the US Presidential elections, as we will see here.

Today, it is widely expected that the US Federal Reserve (Fed), the American central bank, will soon carry out another round of quantitative easing (QE) — that’s the big reason for the spurt.

QE is a technical term that refers to the Fed printing dollars and pumping them into the American economy.

“Taking due account of the uncertainties and limits of its policy tools, the Federal Reserve will provide additional policy accommodation as needed to promote a stronger economic recovery and sustained improvement in labour market conditions in a context of price stability,” Ben Bernanke, the current Fed chairman, said in a speech titled Monetary Policy since the Onset of the Crisis at the Federal Reserve Bank of Kansas City Economic Symposium, Jackson Hole, Wyoming, on August 31.

Fed chairmen are not known to speak in simple English. What Bernanke said is, therefore, being seen as Fedspeak for another round of easing.

Interestingly, in a speech he made at the same venue two years earlier, on August 27, 2010, Bernanke had said, “We will continue to monitor economic developments closely and to evaluate whether additional monetary easing would be beneficial. In particular, the committee (Federal Open Market Committee, or FOMC) is prepared to provide additional monetary accommodation through unconventional measures if it proves necessary, especially if the outlook were to deteriorate significantly.”

The two statements bear an uncanny similarity to each other. Bernanke’s August 2010 statement was followed by the second round of quantitative easing, in which the Federal Reserve pumped in $600 billion of new money into the economy.

QE2, as it came to be known as, started in November 2010.

Between August 2010 and beginning of November 2010, gold prices went up by around 9% to around $1,350 per ounce. QE2 went on till June 2011, and by then gold had touched $1,530 an ounce.

No wonder the market is now expecting another round of easing — QE3 if you please.

To be sure, the Fed has been hinting at another round of QE for a while now. At its last meeting, held on July 31 and August 1, the FOMC said in a statement, “The Committee will closely monitor incoming information on economic and financial developments and will provide additional accommodation as needed to promote a stronger economic recovery and sustained improvement in labour market conditions in a context of price stability.”

Mark the phrase “additional accommodation”, which is a hint at another round of easing.

Gold has rallied 8.5% since then.

But these hints haven’t been followed by any concrete action, primarily on account of the fact Mitt Romney, the Republican candidate against the current US President, Barack Obama, has been highly critical of the Fed’s quantitative easing policies.

“I don’t think QE2 was terribly effective. I think a QE3 and other Fed stimulus is not going to help this economy… I think that is the wrong way to go. I think it also seeds the kind of potential for inflation down the road that would be harmful to the value of the dollar and harmful to the stability of our nation’s needs,” Romney told Fox News on August 23.

Paul Ryan, Romney’s running mate, echoed his views, when he said, “Sound money… We want to pursue a sound-money strategy so that we can get back the King Dollar.”

The theory behind quantitative easing is that with more money in the economy, banks and financial institutions will lend that money and businesses and consumers will borrow. But both American businesses and consumers have been shying away from borrowing. Hence, all this money floating around has found its way into stock markets around the world.

As more money enters the stock market, stock prices go up and this creates the “wealth effect”. People who invest money in the market feel richer and then they tend to spend part of the accumulated wealth. This, in turn, helps economic growth.

As Gary Dorsch, an investment newsletter writer, said in a recent column, “Historical observation reveals that the direction of the stock market has a notable influence over consumer confidence and spending levels. In particular, the top 20% of wealthiest Americans account for 40% of the spending in the US economy, so the Fed hopes that by inflating the value of the stock market, wealthier Americans would decide to spend more. It’s the Fed’s version of “trickle down” economics, otherwise known as the “wealth effect.””

That suggests the economy is likely to grow faster and hence, people aremore likely to vote for the incumbent President.

Given this, Romney has been a vocal critic of quantitative easing, knowing that another round of money printing will clearly benefit Obama.

But Bernanke is unlikely to start another round of quantitative easing before November 6, the day the Presidential elections are scheduled, because he might end up with Romney as his boss.

Currently, most opinion polls put Obama ahead in the race. But the election is still two months away, a long time in politics.

Romney has made clear his views on Bernanke by saying, “I would want to select someone new and someone who shared my economic views.”

This has held back the price of gold from rising any faster.

As such, any round of quantitative easing ensures that there are more dollars in the financial system than before. And to protect themselves from this debasement, people buy another asset — gold — something that cannot be debased.

During earlier days, paper money was backed by gold or silver. When governments printed more paper money than they had precious metal backing it, people simply turned up with their paper at the central bank and demanded it be converted into gold or silver.

Now, whenever people see more and more of paper money, the smarter ones simply go out there and buy that gold.

So, all eyes will now be on Bernanke and what he does in the days to come. From the way he has been going, there will surely be some hints towards QE3 in the next FOMC meeting, scheduled for September 12-13.

(The article originally appeared in the Daily News and Analysis on September 8,2012. http://www.dnaindia.com/money/column_why-golds-not-running-up-as-fast-as-it-can_1738192))

Vivek Kaul is a writer and can be reached at [email protected]

What happens when Mentally Agitated Teachers Harass Students (M.A.T.H.S)

Vivek Kaul

It ain’t what you don’t know that counts. It’s what you know that ain’t so – Will Rogers

The year was 1986. I was in the fourth standard. My maths teacher Mrs. Leila Abraham (popularly known as Mrs Cherian because her husband’s name was Cherian Abraham) had just asked us to get an Amul or a Cadbury chocolate for the next day’s class. She wanted to teach fractions through a bar of chocolate.

The idea was exciting enough to motivate a few students to blackmail their parents to get what she had asked for. Over the next few days she taught fractions to the class by breaking the bar into half, three fourths, one fourths and so on. Even the dullest students picked up the concept very quickly.

As my interest in the subject grew, the quality of teachers who taught me went rapidly downhill. The ordeal ended when I graduated with a BSc in Mathematics from St Xavier’s College, Ranchi.

The quality of teaching was so bad that before the last class in the third year started I wrote this on the blackboard: Mentally (M) Agitated (A) Teachers (T) Harassing (H) Students (S). An English professor in the college who was also the best quiz master going around in Ranchi had come up with this expansion for M.A.T.H.S.

Professor Pankaj Chattoraj who taught us co-ordinate geometry among other things, was supposed to take the last class. He was the best of the six professors who taught us. So the joke wasn’t really on him. He took it in a good spirit made a few more jokes, taught what he had to and left.

I have no numbers or research to back this but I feel that Maths ends up being taught by the worst teachers. The impact of bad teaching of Mathematics is clearly seen when people have to apply Maths.

Let me share a few examples which I have come across over the last few years.

Justice Markandey Katju in a recent column in The Hindu titled Professor, teach thyself wrote: “When I was a judge of Allahabad High Court I had a case relating to a service matter of a mathematics lecturer in a university in Uttar Pradesh. Since the teacher was present in court I asked him how much one divided by zero is equal to. He replied, “Infinity.” I told him that his answer was incorrect, and it was evident that he was not even fit to be a teacher in an intermediate college. I wondered how had he become a university lecturer (In mathematics it is impermissible to divide by zero. Hence anything divided by zero is known as an indeterminate number, not infinity).”

Rather ironically the teacher Katju castigated was right. Any non zero number divided by zero is infinity. But when zero is divided you get what is known as an indeterminate. The following example should explain things a little better:

A2 = A2

A2- A2= A2- A2

A(A-A)= (A-A)(A+A)

[A(A-A)/(A-A)] = (A+A)

A=A+A

A=2A

1=2

In the fourth step of the equation we are dividing (A-A) by (A-A) and that allows us to come to the fifth step i.e. A=A+A and which finally leads to 1=2.

Now it need not be said that one cannot be equal to two. When we divide zero by zero we can prove anything. Hence dividing 0 by 0 (which is what A-A is) is not allowed in Mathematics.

So I guess Justice Katju’s Maths teachers did not teach him the right thing here. Justice Katju’s being wrong did not harm anyone and was more confined to the realms of what we can call an esoteric argument. But there are occasions when a lack of basic understanding of maths can lead to totally wrong interpretations.

Recently ABP news (formerly Star News) ran a report with a headline “Mahangai ghati kya aapko pata chala kya?”.This was in response to the consumer price inflation falling to 9.86% in July against 9.93% in June. The report went onto show that how the prices of vegetables and a lot of other goods had gone up. So it then questioned that how was the government claiming that prices are down?

This again shows the lack of basic understanding of Maths. When inflation comes down no government can claim that prices are coming down. What they can only claim is that the rate of increase in prices is coming down. Let me explain this through an example.

If the price a product increases from Rs 10 to Rs 12, we say inflation is 20% ((Rs 2/Rs 10) x 100%). Let us say the next month the cost of the product goes up to Rs 13. What is the month on month inflation now? The inflation is 8.33% ((Re 1/ Rs 12) x 100%). Now the inflation has fallen from 20% to around 8.33%. Does that mean that price has fallen? No it hasn’t. What has fallen is the rate of increase in price, not the price.

This is something very basic which a lot of people don’t seem to understand. On more than one occasion in the past I have been asked by fairly senior colleagues in the media “But why aren’t prices falling, if inflation is falling?”.

Another common mistake that people make is that they add or subtract percentages. Take the case of what Jerry Rao (an alumnus of IIM Ahmedabad, founder of the IT company Mphasis Corporation, and the former head of consumer banking of Citibank in India) wrote in a column in the Indian Express on October 6,2008.

“If stock market wealth drops by 50 per cent in six months, we get concerned. We conveniently forget that it went up by 200 per cent over the previous two years. At the end of 30 months we are still 150 per cent ahead.” (Read the full article here)

At the end of 30 months we are not 150% ahead but 50% ahead. Let us say an individual invests Rs 100. A 200% gain on this would mean that Rs 100 invested initially has grown to Rs 300 ( Rs 100 + 200% of Rs 100). A 50% fall would mean Rs 300 has fallen to Rs 150 (Rs 300 – 50% of Rs 300). This in turn means that we are 50% (((Rs 150 – Rs 100)/Rs 100) x 100%) ahead and not 150% ahead, as was written.

So what this means in simple English is that a 50% loss can wipe off a 100% gain. Let us say an investor buys a stock at Rs 50. The stock does well and runs up to a price of Rs 100. What was the gain? The gain was Rs 50 (Rs 100- Rs 50). What was the gain in percentage terms? 100%. ((Rs 50/Rs 50) x 100%).

After achieving its peak, the stock started to fall and is back at Rs 50. What is the loss from the peak? Of course Rs 50 (Rs 100- Rs 50). But what is the loss in percentage terms? 50% ((Rs 50/Rs 100) x 100%).

The point I was trying to make was that a 50% loss can wipe off a 100% gain. Or to flip it around, a 100% gain would be needed to wipe off a 50% loss.

But the example that clearly takes the cake was when a former colleague remarked that sales of a company that she was tracking had fallen by 110%. Anyone who understands percentages wouldn’t make a remark like that. Anything cannot fall more than 100% (Unless we are talking about things like temperature which can become negative. Then the concept of percentage becomes meaningless). Let me elaborate. Let us say a product sells 700 units in a month. In the next month no units are sold. What does this mean? It means sales are down by 700 units or 100%.

On the flip side when it comes to gains, they can be unlimited. A product sells one unit in a month and in the next month it sells 71 units or 70 units more than the previous month. Or a gain of 7000%.

Now, theoretically, there is no upper limit to the number of units that the product can sell. And so there is no upper limit to the gains can that can be expressed in percentages.

These are a few examples of lack of basic understanding of Maths that came to my mind on this teachers’ day. The bigger question is why is there such lack of basic mathematics? My theory on this is that it all boils down to the way teachers teach mathematics in schools. The entire emphasis is on solving a problem, rather than trying to explain to students why we are trying to solve a problem, and then getting into the nitty gritty. In colleges, it gets even worse.

So it’s time we stopped respecting our Maths teachers and re-title them as Mentally Agitated Teachers Harassing Students.

(The article originally appeared on www.firstpost.com on September 5,2012, with a different headline. http://www.firstpost.com/living/what-your-maths-teacher-didnt-teach-you-at-school-444727.html)

(Vivek Kaul is a writer and can be reached at [email protected]. After eleven years in school and eight years in college, from all that he was taught the only thing he partly remembers is some elementary mathematics)

Obama, Salman Khan, QE-3: Why we have to wait for 6 Nov

Vivek Kaul

Richard Nixon, who was the President of the United States between January 1969 and August 1974, appointed Arthur C Burns as the Chairman of the Federal Reserve of United States (the American central bank) on January 30,1970. “I respect his (i.e. Burns) independence. However, I hope that independently he will conclude that my views are the ones that should be followed,” Nixon said on the occasion.

Burns did not disappoint Nixon and when it was election time in 1972. Since the start of 1972, Burns ran an easy money policy and pumped more money into the financial system by simply printing it. The American money supply went by 10.6% in 1972.

The idea was that with the increased money in the financial system, interest rates would be low, and this would encourage consumers and businesses to borrow more. Consumers and businesses borrowing and spending more would lead to the economy doing well. And this would ensure the re-election of Nixon who was seeking a second term in 1972. That was the idea. And it worked. Nixon won the second term with some help from Burns.

As investment newsletter writer Gary Dorsch wrote in a column earlier this year “Incumbent presidents are always hard to beat. The powers of the presidency go a long way….Nixon pressured Arthur Burns, then the Fed chairman, to expand the money supply with the aim of reducing unemployment, and boosting the economy in order to insure Nixon’s re-election…Nixon imposed wage and price controls to constrain inflation, and won the election in a landslide.” (you can read the complete column here)

History is expected to repeat itself

Something similar has been expected from the current Federal Reserve Chairman Ben Bernanke. It has been widely expected that Bernanke will unleash the third round of money printing to revive the moribund American economy. Bernanke has already carried out two rounds of money printing before this to revive the American economy. This policy has been technically referred to as quantitative easing (QE), with the two earlier rounds of it being referred to as QE I and QE II.

The original idea was that with more money in the economy, banks will lend, and consumers and businesses will borrow and this in turn would revive the economy. But the American consumer had already borrowed too much in the run up to the financial crisis, which started in September 2008, when the investment bank Lehman Brothers went bust. The consumer credit outstanding peaked in 2008 and stood at $2.6trillion. The American consumer had already borrowed too much to buy homes and a lot of other stuff, and he was in no mood to borrow more.

The wealth effect

The other thing that happened because of the easy money policy of the American government was that it allowed the big institutional investors to borrow at very low interest rates and invest that money in the stock market. This pushed stock prices up leading to more investors coming into the market.

As Maggie Mahar puts it in Bull! : A History of the Boom, 1982-1999: What drove the Breakneck Market–and What Every Investor Needs to Know About Financial Cycles: “In the normal course of things, higher prices dampen desire. When lamb becomes too dear, consumers eat chicken; when the price of gasoline soars, people take fewer vacations. Conversely, lower prices usually whet our interest: colour TVs, VCRs, and cell phones became more popular as they became more affordable. But when a stock market soars, investors do not behave like consumers. They are consumed by stocks. Equities seem to appeal to the perversity of human desire. The more costly the prize, the greater the allure.”

As more money enters the stock market, stock prices go up. This leads to what economists call the “wealth effect”. The stock market investors feel richer because of the stock prices going up. And because they feel richer they tend to spend some of their accumulated wealth on buying goods and services. As more money is spent, businesses do well and so in turn does the economy.

As Gary Dorsch writes “Historical observation reveals that the direction of the stock market has a notable influence over consumer confidence and spending levels. In particular, the top-20% of wealthiest Americans account for 40% of the spending in the US-economy, so the Fed hopes that by inflating the value of the stock market, wealthier Americans would decide to spend more. It’s the Fed’s version of “trickle down” economics, otherwise known as the “wealth effect.”

Why Bernanke won’t launch QE III soon

Given these reasons it was widely expected that Ben Bernanke would start another round of money printing or QE III this year to help Obama’s reelection campaign. Bernanke has been resorting to what Dorsch calls “open mouth operations” i.e. dropping hints that QE III is on its way. In August he had said that the Federal Reserve “will provide additional policy accommodation as needed to promote a stronger economic recovery.” This was basically a complicated way of saying that if required the Federal Reserve wouldn’t back down from printing more money and pumping it into the economy.

But even though Bernanke has been hinting about QE III for a while he hasn’t gone around doing anything concrete about it. The reason for this is the fact that Mitt Romney, the Republican candidate against the incumbent President Barack Obama has gone to town criticizing the Fed’s past QE policies. He has also warned the Federal Reserve to stay neutral before the November 6 elections, says Dorsch. As Romney told Fox News on August 23 “I don’t think QE-2 was terribly effective. I think a QE-3 and other Fed stimulus is not going to help this economy…I think that is the wrong way to go. I think it also seeds the kind of potential for inflation down the road that would be harmful to the value of the dollar and harmful to the stability of our nation’s needs.”

Romney even indicated that he would prefer someone other than Bernanke as the Chairman of the Federal Reserve. “I would want to select someone new and someone who shared my economic views…I want someone to provide monetary stability that leads to a strong dollar and confidence that America is not going to go down the road that other nations have gone down, to their peril.” With more and more dollars being printed, the future of the dollar as an international currency is looking more and more bleak.

Romney’s running mate Paul Ryan also echoed his views when he said “Sound money… We want to pursue a sound-money strategy so that we can get back the King Dollar.”

Given this it is highly unlikely that Ben Bernanke will unleash QE III before November 6, the date of the Presidential elections. And whether he does it after that depends on who wins.

Of Obama and Salman Khan

As far as pollsters are concerned Obama seems to have the upper hand as of now. But at the same time the average American is not happy with the overall state of the American economy. “According to pollsters, two thirds of Americans think the US-economy is still stuck in the Great Recession, and is headed in the wrong direction. Only 31% say it is moving in the right direction – the lowest number since December 2011. The dire outlook is explained by a recent analysis by the US Census Bureau and Sentier Research LLC, indicating that US-household incomes actually declined more in the 3-year expansion that started in June 2009 than during the longest recession since the Great Depression,” writes Dorsch.

But despite this Americans don’t hold Obama responsible for the mess they are in. As Dorsch points out “Although, Americans are increasingly pessimistic about the future, many voters don’t seem to be holding it against Democrat Obama. Instead, the embattled president is getting some slack because he inherited a very tough situation. In fact, Obama’s strongest base supporters are among also suffering the highest jobless rates and highest poverty rates in the country.”

Obama’s support is similar to the support film actor Salman Khan receives in India. As Manoj

Manoj Desai, owner of G7 theatres in Mumbai, recently told The Indian Express “Even when the fans are disappointed with his film, they never blame him. You will often hear them say, bhai se galat karwaya iss picture main. (They made Bhai do the wrong things in this movie)”

What’s in it for us?

Indian stock market investors should thus be hoping that Barack Obama wins the November 6 elections. That is likely to lead to another round of quantitative easing. As had happened in previous cases a portion of that matter will be borrowed by big Wall Street firms and make its way into stock markets round the world including India.

(The article originally appeared on www.firstpost.com on September 5,2012. http://www.firstpost.com/world/obama-salman-khan-qe-3-why-we-have-to-wait-for-6-nov-444474.html)

(Vivek Kaul is a Mumbai based writer and can be reached at [email protected])

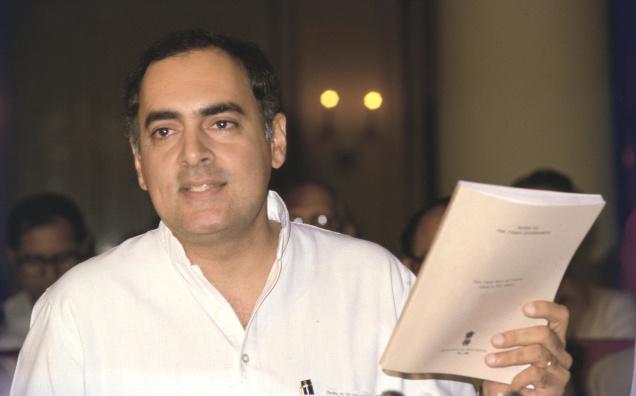

One Bofors got Rajiv. But will UPA’s bag of scams hurt Cong?

Vivek Kaul

It was May 22, 1991. My summer holidays were on. And I was at my grandfather’s duplex flat in South Delhi. I had woken up very late. It must have been around 10.30am. As soon as I came down to the lower level, an uncle who has since become an Art of Living guru, told me that Rajiv Gandhi had been killed late last night( he didn’t use the word assassinated, that I remember very clearly).

Given his penchant for practical jokes, I thought that he was pulling a fast one on me, early in the morning. Those were the days before cable television became a part of our everyday lives, and so I picked up the Hindustan Times newspaper, my grandfather used to subscribe to, in order to verify whether he was really speaking the truth.

And as it turned out my uncle wasn’t lying. He wasn’t playing a practical joke. Rajiv Gandhi had been assassinated by a human bomb at 10.10pm on May 21. “Bofors killed him,” was a random remark I heard during the course of that day. But since summer holidays were on I had better things to think about than Bofors and how it killed Rajiv Gandhi.

This entire incident came back to me while reading an excerpt of an upcoming book titled Decoding Rahul Gandhi written by Aarthi Ramachandran. As she writes “Sonia writes in Rajiv that Rahul would telephone from America, “consumed with anxiety” about his father’s security arrangements. She says Rajiv’s specialised security cover was withdrawn after he became leader of the opposition and it was replaced with a force not trained for this specific task. Rahul, who had gone to the US in June 1990 to start his undergraduate studies at Harvard University, insisted on coming back to India at the end of March 1991 for his Easter break. He accompanied his father on a tour of Bihar and was “appalled to witness the lack of elementary security around his father”. Sonia says that before going back to the US, Rahul had told her that if something was not done about it, he knew he would soon come home for his father’s funeral.”

Something did happen to Rajiv Gandhi a couple of months later and Rahul had to comeback from Harvard for the funeral.

Rajiv Gandhi had taken over as the Prime Minister of India after the assassination of his mother Indira by her bodyguards. Riding on his honest image and sympathy for his mother the Congress party got around half the votes polled and more than 400 seats of the total 515 seats in the Lok Sabha.

In 1987, the Bofors scandal came into light and tarred the honest image of Rajiv Gandhi. Bofors AB, a Swedish company, had supposedly paid kickbacks to top Indian politicians of around Rs64 crore to swing around a $285million contracts for Howitzer field guns in its favour.

The impact of this on the Congress party was huge. It lost the 1989 election to an alliance of Janta Dal and Bhartiya Janta Party. Rajiv Gandhi had to become the leader of opposition. His security was downgraded and he was assassinated two years later. So in a way Bofors killed Rajiv Gandhi.

But if one takes into account the size of the scam at Rs 64 crore it was hardly anything in size to the scams that have come into light over the last few years. The coal scam. The telecom scam. The commonwealth games scam. The Adarsh Housing Society scam. The Devas Antrix scam. And so on.

Each one of these scams has been monstrous in proportion to the Rs 64 crore Bofors scam. There has been a surfeit of scams coming to light since in the second tenure of the Congress led United Progressive Alliance started. These scams would have been on for a while but they have been coming to light only over the last couple of years.

The Canadian American Economist John Kenneth Galbraith has an explanation for this phenomenon in his book The Great Crash 1929. “At any given time there exists an inventory of undisclosed embezzlement. This inventory – it should perhaps be called the bezzle – amounts at any moment to many millions of dollars. In good times people are relaxed ,trusting, and money is plentiful. … Under these circumstances the rate of embezzlement grows, the rate of discovery falls o , and the bezzle increases rapidly. In depression all this is reversed. … Just as the (stock market boom) accelerated the rate of growth (of embezzlement), so the crash enormously advanced the rate of discovery.”

In an Indian context the economy and the stock market were booming between 2004 and 2008. 2009 was a bad year. Things recovered a bit in 2010. And have been looking bleak since the middle of 2011. And it is since then when all these scams have been coming to light. Galbraith’s explanation clearly works here. When things were good the scams were being created and as things turned around, all the scams have been coming to light.

But the bigger question here is will the people of this country remember about all these scams (and more that may be highlighted in the days to come) by the time the 2014 Lok Sabha elections come around? One Bofors scandal running into a few million dollars was enough to put Rajiv Gandhi out of power and even take his life in the end. But will all these billion dollar scandals carry enough weight in the days to come? Or will they just become background noise, leading to people not bothering about them, while deciding who to vote for in 2014?

As Umberto Eco (an Italian author) and Jean Claude Carriere (a french scriptwriter) write in This is Not the End of the Book: “But an abundance of witnesses isn’t necessarily enough. We witnessed the violence inflicted on Tibetan monks by the Chinese police. It provoked international outrage. But if your screens kept showing monks being beaten by police for months on end, even the most concerned and active audience would lose interest. There is therefore a level below which, news pieces do not penetrate and above which they become nothing but background noise.”

Isn’t India going through the same situation right now when it comes to scams? There is a race on among various sections of the media to highlight more and more scams (and rightly so). News channels talk about scams all day long. The front pages of newspapers are full of it. And so is the social media. So will a surfeit of scams make us immune to them?

I don’t have hard and fast answers to the questions that I have raised here. But I do have this lurking feeling that all this scam talk everywhere might just end up benefitting the Congress led UPA government, rather than hurting it. Or to put it in a better way it might not hurt the Congress led UPA as much as it should.

(The article originally appeared on www.firstpost.com on September 4,2012. http://www.firstpost.com/india/one-bofors-got-rajiv-but-will-upas-bag-of-scams-hurt-cong-443064.html)

(Vivek Kaul is a writer and can be reached at [email protected])