Vivek Kaul

It was October 1990. I was thirteen. In a pre cable TV, multiplexes and mall era, just about the only thing that got a teenager in a small town excited, was the twice a week Chitrahar on Wednesdays and Fridays, broadcast by Delhi Doordarshan.

Unless of course there was a cricket match on! But cricket was not played as often as it is today. And not everything was broadcast on the state owned Doordarshan.

Hence it was very exciting when Lal Krishna Advani arrived late one night to stay “overnight” in the guest house in the colony I lived in. Advani, during those days, was going around the country as a part of what he and the Bhartiya Janata Party (BJP) called the rath yatra.

Early next morning, before he was supposed to leave, a small crowd which included me had gathered in front of the guest house. He came out and was requested to speak a few words. I don’t remember anything of what he said except the last line, which was “saugandh Ram ki khaate hain, mandir wohin banayenge”.

He was out of the place in five minutes. But the crowd that had gathered continued to mingle around. Some were happy at having seen him. Some were amazed to know that his rath wasn’t actually one. Some women spoke about the glow Advani ji had on his face. And some others were worried. “Mandir banega ki nahi?” they asked.

I pretty much had the same feeling as everyone else, but what I was most happy about was the fact that I would be a minor celebrity in the school next day, having seen Advani when none of my classmates had.

Advani was arrested a few days later before the rath yatra could enter Uttar Pradesh. As he writes in his autobiography My Country My Life “My yatra was scheduled to enter Deoria in Uttar Pradesh on 24 October. However, as I had anticipated, it was stopped at Samastipur in Bihar on 23 October and I was arrested by the Janata Dal government in the state then headed by Laloo Prasad Yadav (sic). I was taken to an inspection bungalow of the irrigation department at a place called Massanjore near Dumka on the Bihar-Bengal border (Dumka now comes under the state of Jharkhand).”

We all know what happened in the aftermath of the rath yatra. But as I grew older, I kept asking myself, why did Advani say what he did? Why was it so important to build a temple there? Didn’t the country have bigger issues which needed to be sorted out first? And so on.

Political party as a brand

All my questions were answered the day I realised that every political party is a brand and a brand needs to stand for something. It needs a story that can be told to people, so that people can go buy the brand by supporting it and by voting for it.

In the aftermath of Indira Gandhi’s assassination in 1984, the Congress Party had swept the Lok Sabha elections, with the BJP winning only two seats. Given the sorry performance the party needed to stand for something in the minds of the Indian voter.

Brand BJP was built on the war cry of “saugandh Ram ki khaate hain mandir wohin banayenge”. This ensured that the party was able to increase the number of seats in the Lok Sabha from 2 in 1984, to 88 in 1989 and 118 in 1991.

The party espoused for causes like making temples in Ayodhya, Kashi and Mathura. It talked about banning cow slaughter, having a uniform civil code, and doing away with the Article 370, that gives special status to the state of Jammu and Kashmir. All this was music to the ears of voters across Northern and Western India and the party catapulted from being a political front of the Rashtriya Swayamsevak Sangh (RSS) to having an identity of its own.

BJP’s story was that it stood for the cause of Hindus and Hindutva. And it was not the only political party that came with a story attached to it. Almost every political party that has risen in India in the last three to four decades has had a story attached to it.

The Kanshi Ram story

Kanshi Ram launched the Dalit Soshit Samaj Sangharsh Samiti or DS4 as it was more popularly called, with the war cry “Thakur, Brahmin, Bania Chhod, Baki Sab Hain DS4.” This left no doubt in anybody’s mind that Kanshi Ram and DS4 stood for everyone who wasn’t an upper caste.

Kanshi Ram probably realised the power of the slogan he had hit upon. He came up with another slogan along similar lines when he launched the Bahujan Samaj Party(BSP). “Tilak Tarazu aur Talwaar, inko maaro joote chaar” was the rallying cry of the BSP (with Tilak, Tarazu and Talwar being the representation of the Brahman, Bania and Thakur castes, the upper castes).

Or let’s take the case of Left Front in West Bengal. The front which comprised of various communist parties stood for what the Sonia Gandhi led UPA calls the aam aadmi. It positioned itself as being pro-poor and anti big business. When the Left Front first came to power, share croppers where handed over land after taking it over from wealthy landlords. Teak trees were planted in front of homes by Left Front members where a girl child was born, so that the tree could be cut when she was of marriageable age and money for the wedding expenses could be raised.

In the late seventies and early eighties the Left brand also stood for “trade unions” which bargained hard in the interest of the workers. This over the years ensured that most industrialists shut shop and left for other parts of the country. But this didn’t really have any impact on the voter base of the Left Front which remained committed because what the Front was doing was in line with the story it had sold to the voters.

Why the story is important

The story that a political party sells to its voters is very important and it should hold for a very long period of time. Take the case of Janata Dal which was formed by the merger of the various factions of the erstwhile Janata Party, which were the Lok Dal, Congress (S) and the VP Singh led Jan Morcha.

The story that the party successfully sold to the voters was that it would introduced 27.5% reservation for other backward classes (OBCs) in government jobs, as had been proposed by the Mandal Commission.

The story was lapped by the votes and the party won 142 seats in the 1989 Lok Sabha elections.

Despite student protests erupting all across the country, starting with Rajiv Goswami burning himself in front of Deshbandu College in New Delhi, reservations were introduced. No political party could be seen going against this legislation.

The trouble was once Mandal Commission became a reality what did the Janata Dal stand for in the mind of the voter? Nothing. This soon led to the regional satraps forming their own parties like the Mulayam Singh Yadav led Samajwadi Party in Uttar Pradesh, Lalu Prasad Yadav led Rashtriya Janata Dal in Bihar and the Nitish Kumar-George Fernandes led Samta Party also in Bihar.

The end of Janata Dal led to the coining of one of the most memorable though underrated slogans in Indian politics: “Thakur buddhi, Yadav bal, jhandu ho gaya Janta Dal.” (where thakur was in reference to VP Singh who was a rajput).

Hence a political party needs to stand for something in the mind of the voter. If it doesn’t it meets the fate of a party like Janata Dal.

If it ain’t broke don’t fix it

Buddhadeb Bhattacharya became the Chief Minister of West Bengal in 2000, taking over after Jyoti Basu had been the Chief Minister for 23years. Bhattacharya tried to get big business to come back to Kolkata, so that jobs could be created.

But the trouble was Bengal was not a state used to the ways of professional business. If BPOs had to set shop then they had to work every day their foreign clients were working. So was the case with IT companies. But in a state where bandhs were way of life, how would that be possible?

Buddha Babu asked his party carder not to disturb BPO employees on their way to work on “bandh” days. This was the first dint to the Left brand. Then the heavy industry companies wanted to set shop, given that labour in Bengal was cheaper than other parts of the country and the government was ready to welcome them.

This was where all the trouble started. Almost all land in Bengal is agriculture land. And every time an industrialist wants to set shop it leads to some farmers being put out of job. Things escalated when the party carder in Nandigram resorted to violence against farmers who were protesting. The same was the case with Singur, where the Tata Nano plant was supposed to come up.

When a communist party (or rather parties) start beating up farmers, it need not be said that it does do any good to the identity and brand and the story they have carefully cultivated over the years.

This in no way means that industrialization is not important or should not have been pursued by the Left Front government, but it was definitely not done in the way it was. This of course went totally against the anti industry image that the Left Front carried in the minds of people. The same Left Front whose trade unions went cholbe na cholbe na against industries and industrialists was now catering to their demands, felt people of the state. Communists had become capitalists. The practitioners of all that Karl Marx had espoused for were now vouching for the principles of Adam Smith.

There was clearly a branding problem. The gap was filled by Mamata Banerjee who now stands for everything that the Left Front had stood for, warts and all.

India shining

The year was 2004 and I was travelling in a local bus in Hyderabad, excited about the new mobile phone I had bought. The phone suddenly buzzed and it was a Delhi number, the first call on my new mobile. I picked up the call and heard the voice on the other end say “main Atal Bihari Vajpayee bol raha hoon”.

It took me a few seconds to realize that it was an automated call in the voice of the Prime Minister of the country asking the voters to vote for the BJP led National Democratic Alliance (NDA) in the upcoming Lok Sabha elections.

The party had decided to abandon its soft-Hindutva branding and decided to go in for what it thought was a more mass market campaign of “India shining”.

The party lost the elections and has been in opposition ever since.

What BJP can learn from Coca Cola

Donald R Keough, a former president of the Coca-Cola Company, in his book The Ten Commandments for Business Failure elaborates on what happens when the story associated with a brand is changed.

A slew of research and consultants told the top brass at Coca-Cola that people were looking for more sweetness in the product. This led to the launch the ‘New Coke’.

What followed was a disaster that went totally against what the consultants had predicted. People did not like the tinkering. And some of them started to hoard old coke, before the stocks ran out..

One day an old woman called a Coke call centre. Here is how Keough recounts this touching story.

. “It was an eighty-five year woman who convinced me we had to do something more than stay course. She had called the company in tears from a retirement home in Covina, California. I happened to be visiting the call centre and took the call. “You’ve taken away my Coke,” she sobbed. “When was the last time you had Coke?” I asked. “Oh, I don’t know. About twenty, twenty-five years ago.” “Then why are you so upset?” I asked. “Young man, you are playing around with my youth and you should stop it right now. Don’t you have any idea what Coke means to me?”

This made the top brass at Coke realise that they are not dealing with a taste or a marketing issue, but the idea or the story behind Coca-Cola. It was the “real-thing” and the consumers did not want any fiddling around with it. Immediately a decision was made to bring back the old Coke as “Coca-Cola Classic”.

To conclude

As marketing guru Seth Godin writes in All Marketers are Liars “Great stories happen fast. They engage the consumer the moment the story clicks into place. First impressions are more powerful than we give them credit for.”

Given this getting rid of first impressions in the minds of the voter is very difficult. This does not apply for the Congress Party, which has been around for so long that it doesn’t really stand for anything and hence can change forms like a chameleon.

So if the BJP has to pose any sort of challenge to the Congress led United Progressive Alliance (UPA) in the next Lok Sabha elections it needs to go back to what it has always stood for in the mind of the voter: Hindutva. Like Coca Cola, it has to go back to stand for what it used to in the mind of the voter.

What it needs to decide on is the degree of Hindutva? Does it want to follow the hard line approach that it did in the late 1980s and the early 1990s with slogans like “ye to kewal jhaanki hai, kaashi mathura baaki hai” or does it want to follow the soft Hindutva strategy that it did when Atal Bihari Vajpayee was at his peak.

Given this, there is no one better than leader than Narendra Modi who can project the attributes of the pro Hindutva line. The trouble of course with Modi is that he comes across as a hardliner. Hence it’s important for Modi and the BJP that the spin-doctors of the party get to work immediately trying to soften up his image, so that his acceptability goes up across sections he is not currently popular with.

(The article originally appeared at www.firstpost.com on June 6,2012. http://www.firstpost.com/politics/political-brands-what-the-bjp-can-learn-from-coca-cola-333964.html)

(Vivek Kaul is a writer and can be reached at [email protected])

Month: June 2012

People should listen to market experts for entertainment, not elucidation.

Michael J. Mauboussin is Chief Investment Strategist at Legg Mason Capital Management in the United States. He is also the author of bestselling books on investing like Think Twice: Harnessing the Power of Counterintuition and More Than You Know: Finding Financial Wisdom in Unconventional Places. His latest book The Success Equation: Untangling Skill and Luck in Business, Sports, and Investing is due later this year. In this interview he speaks to Vivek Kaul on the various aspects of luck, skill and randomness and the impact they have on business, life and investing.

Excerpts:

How do you define luck?

The way I think about it, luck has three features. It happens to a person or organization; can be good or bad; and it is reasonable to believe that another outcome was possible. By this definition, if you win the lottery you are lucky, but if you are born to a wealthy family you are not lucky—because it is not reasonable to believe that any other outcome was possible—but rather fortunate.

How is randomness different from luck?

I like to distinguish, too, between randomness and luck. I like to think of randomness as something that works at a system level and luck on a lower level. So, for example, if you gather a large group of people and ask them to guess the results of five coin tosses, randomness tells you that some in the group will get them all correct. But if you get them all correct, you are lucky.

And what is skill?

For skill, the dictionary says the “ability to use one’s knowledge effectively and readily in execution or performance.” I think that’s a good definition. The key is that when there is little luck involved, skill can be honed through deliberate practice. When there’s an element of luck, skill is best considered as a process.

You have often spoken about the paradox of skill. What is that?

The paradox of skill says that as competitors in a field become more skillful, luck becomes more important in determining results. The key to this idea is what happens when skill improves in a field. There are two effects. First, the absolute level of ability rises. And second, the variance of ability declines.

Could you give us an example?

One famous example of this is batting average in the sport of baseball. Batting average is the ratio of hits to at-bats. It’s somewhat related to the same term in cricket. In 1941, a player named Ted Williams hit .406 for a season, a feat that no other player has been able to match in 70 years. The reason, it turns out, is not that no players today are as good as Williams was in his day—they are undoubtedly much better. The reason is that the variance in skill has gone down. Because the league draws from a deeper pool of talent, including great players from around the world, and because training techniques are vastly improved and more uniform, the difference between the best players and the average players within the pro ranks has narrowed. Even if you assume that luck hasn’t changed, the variance in batting averages should have come down. And that’s exactly what we see. The paradox of skill makes a very specific prediction. In realms where there is no luck, you should see absolute performance improve and relative performance shrink. That’s exactly what we see.

Any other example?

Take Olympic marathon times as an example. Men today run the race about 26 minutes faster than they did 80 years ago. But in 1932, the time difference between the man who won and the man who came in 20th was close to 40 minutes. Today that difference is well under 10 minutes.

What is the application to investing?

The application to investing is straightforward. As the market is filled with participants who are smart and have access to information and computing power, the variance of skill will decline. That means that stock price changes will be random—a random walk down Wall Street, as Burton Malkiel wrote—and those investors who beat the market can chalk up their success to luck. And the evidence shows that the variance in mutual fund returns has shrunk over the past 60 years, just as the paradox of skill would suggest. I want to be clear that I believe that differential skill in investing remains, and that I don’t believe that all results are from randomness. But there’s little doubt that markets are highly competitive and that the basic sketch of the paradox of skill applies.

How do you determine in the success of something be it a song, book or a business for that matter, how much of it is luck, how much of it is skill?

This is a fascinating question. In some fields, including sports and facets of business, we can answer that question reasonably well when the results are independent of one another. When the results depend on what happened before, the answer is much more complex because it’s very difficult to predict how events will unfold.

Could you explain through an example?

Let me try to give a concrete example with the popularity of music. A number of years ago, there was a wonderful experiment called MusicLab. The subjects thought the experiment was about musical taste, but it was really about understanding how hits happen. The subjects who came into the site saw 48 songs by unknown bands. They could listen to any song, rate it, and download it if they wanted to. Unbeknownst to the subjects, they were funneled into one of two conditions. Twenty percent went to the control condition, where they could listen, rate, and download but had no access to what anyone else did. This provided an objective measure of the quality of songs as social interaction was absent.

What about the other 80%?

The other 80 percent went into one of 8 social worlds. Initially, the conditions were the same as the control group, but in these cases the subjects could see what others before them had done. So social interaction was present, and by having eight social worlds the experiment effectively set up alternate universes. The results showed that social interaction had a huge influence on the outcomes. One song, for instance, was in the middle of the pack in the control condition, the #1 hit on one of the social worlds, and #40 in another social world. The researchers found that poorly rated songs in the control group rarely did well in the social worlds—failure was not hard to predict—but songs that were average or good had a wide range of outcomes. There was an inherent lack of predictability. I think I can make the statement ever more general: whenever you can assess a product or service across multiple dimensions, there is no objective way to say which is “best.”

What is the takeaway for investors?

The leap to investing is a small one. Investing, too, is an inherently social exercise. From time to time, investors get uniformly optimistic or pessimistic, pushing prices to extremes.

Was a book like Harry Potter inevitable as has often been suggested after the success of the book?

This is very related to our discussion before about hit songs. When what happens next depends on what happened before, which is often the case when social interaction is involved, predicting outcomes is inherently difficult. The MusicLab experiment, and even simpler simulations, indicate that Harry Potter’s success was not inevitable. This is very difficult to accept because now that we know that Harry Potter is wildly popular, we can conjure up many explanations for that success. But if you re-played the tape of the world, we would see a very different list of best sellers. The success of Harry Potter, or Star Wars, or the Mona Lisa, can best be explained as the result of a social process similar to any fad or fashion. In fact, one way to think about it is the process of disease spreading. Most diseases don’t spread widely because of a lack of interaction or virulence. But if the network is right and the interaction and virulence are sufficient, disease will propagate. The same is true for a product that is deemed successful through a social process.

And this applies to investing as well?

This applies to investing, too. Instead of considering how the popularity of Harry Potter, or an illness, spreads across a network you can think of investment ideas. Tops in markets are put in place when most investors are infected with bullishness, and bottoms are created by uniform bearishness. The common theme is the role of social process.

What about someone like Warren Buffett or for that matter Bill Miller were they just lucky, or was there a lot of skill as well?

Extreme success is, almost by definition, the combination of good skill and good luck. I think that applies to Buffett and Miller, and I think each man would concede as much. The important point is that neither skill nor luck, alone, is sufficient to launch anyone to the very top if it’s a field where luck helps shape outcomes. The problem is that our minds equate success with skill so we underestimate the role of randomness. This was one of Nassim Taleb’s points in Fooled by Randomness. All of that said, it is important to recognize that results in the short-term reflect a lot of randomness. Even skillful managers will slump, and unskillful managers will shine. But over the long haul, good process wins.

How do you explain the success of Facebook in lieu of the other social media sites like Orkut, Myspace, which did not survive?

Brian Arthur, an economist long affiliated with the Santa Fe Institute, likes to say, “of networks there shall be few.” His point is that there are battles for networks and standards, and predicting the winners from those battles is notoriously difficult. We saw a heated battle for search engines, including AltaVista, Yahoo, and Google. But the market tends to settle on one network, and the others drop to a very distant second. I’d say Facebook’s success is a combination of good skill, good timing, and good luck. I’d say the same for almost every successful company. The question is if we played the world over and over, would Facebook always be the obvious winner. I doubt that.

Would you say that when a CEO’s face is all over the newspapers and magazines like is the case with the CEO of Facebook , he has enjoyed good luck?

One of the most important business books ever written is The Halo Effect by Phil Rosenzweig. The idea is that when things are going well, we attribute that success to skill—there’s a halo effect. Conversely, when things are going poorly we attribute it to poor skill. This is often true for the same management of the same company over time. Rosenzweig offers Cisco as a specific example. So the answer is that great success, the kind that lands you on the covers of business magazines, almost always includes a very large dose of luck. And we’re not very good at parsing the sources of success.

You have also suggested that trying to understand the stock market by tuning into so called market experts is not the best way of understanding it. Why do you say that?

The best way to answer this is to argue that the stock market is a great example of a complex adaptive system. These systems have three features. First, they are made up of heterogeneous agents. In the stock market, these are investors with different information, analytical approaches, time horizons, etc. And these agents learn, which is why we call them adaptive. Second, the agents interact with one another, leading to a process called emergence. The interaction in the stock market is typically through an exchange. And, finally, we get a global system—the market itself.

So what’s the point you are trying to make?

Here’s a key point: There is no additivity in these systems. You can’t understand the whole simply by looking at the behaviors of the parts. Now this is in sharp contrast to other systems, where reductionism works. For example, an artisan could take apart my mechanical wristwatch and understand how each part contributes to the working of the watch. The same approach doesn’t work in complex adaptive systems.

Could you explain through an example?

Let me give you one of my favorite examples, that of an ant colony. If you study ants on the colony level, you’ll see that it’s robust, adaptive, follows a life cycle, etc. It’s arguably an organism on the colony level. But if you ask any individual ant what’s going on with the colony, they will have no clue. They operate solely with local information and local interaction. The behavior of the colony emerges from the interaction between the ants. Now it’s not hard to see that the stock market is similar. No individual has much of a clue of what’s going on at the market level. But this lack of understanding smacks right against our desire to have experts tell us what’s going on. The record of market forecasters has been studied, and the jury is in: they are very bad at it. So I recommend people listen to market experts for entertainment, not for elucidation.

How does the media influence investment decisions?

The media has a natural, and understandable, desire to find people who have views that are toward the extremes. Having someone on television explaining that this could happen, but then again it may be that, does not make for exciting viewing. Better is a market boomster, who says the market will skyrocket, or a market doomster, who sees the market plummeting.

Any example?

Phil Tetlock, a professor of psychology at the University of Pennsylvania, has done the best work I know of on expert prediction. He has found that experts are poor predictors in the realms of economic and political outcomes. But he makes two additional points worth mentioning. The first is that he found that hedgehogs, those people who tend to know one big thing, are worse predictors than foxes, those who know a little about a lot of things. So, strongly held views that are unyielding tend not to make for quality predictions in complex realms. Second, he found that the more media mentions a pundit had, the worse his or her predictions. This makes sense in the context of what the media are trying to achieve—interesting viewing. So the people you hear and see the most in the media are among the worst predictors.

Why do most people make poor investment decisions? I say that because most investors aren’t able to earn even the market rate of return?

People make poor investment decisions because they are human. We all come with mental software that tends to encourage us to buy after results have been good and to sell after results have been poor. So we are wired to buy high and sell low instead of buy low and sell high. We see this starkly in the analysis of time-weighted versus dollar-weighted returns for funds. The time-weighted return, which is what is typically reported, is simply the return for the fund over time. The dollar-weighted return calculates the return on each of the dollars invested. These two calculations can yield very different results for the same fund.

Could you explain that in some detail?

Say, for example, a fund starts with $100 and goes up 20% in year 1. The next year, it loses 10%. So the $100 invested at the beginning is worth $108 after two years and the time-weighted return is 3.9%. Now let’s say we start with the same $100 and first year results of 20%. Investors see this very good result, and pour an additional $200 into the fund. Now it is running $320—the original $120 plus the $200 invested. The fund then goes down 10%, causing $32 of losses. So the fund will still have the same time-weighted return, 3.9%. But now the fund will be worth $288, which means that in the aggregate investors put in $300—the original $100 plus $200 after year one—and lost $12. So the fund has positive time-weighted returns but negative dollar-weighted returns. The proclivity to buy high and sell low means that investors earn, on average, a dollar-weighted return that is only about 60% of the market’s return. Bad timing is very costly.

What is reversion to the mean?

Reversion to the mean occurs when an extreme outcome is followed by an outcome that has an expected value closer to the average. Let’s say you are a student whose true skill suggests you should score 80% on a test. If you are particularly lucky one day, you might score 90%. How are you expected to do for your next test? Closer to 80%. You are expected to revert to your mean, which means that your good luck is not expected to persist. This is a huge topic in investing, for precisely the reason we just discussed. Investors, rather than constantly considering reversion to the mean, tend to extrapolate. Good results are expected to lead to more good results. This is at the core of the dichotomy between time-weighted and dollar-weighted returns. I should add quickly that this phenomenon is not unique to individual investors. Institutional investors, people who are trained to think of such things, fall into the same trap.

In one of your papers you talk about a guy who manages his and his wife’s money. With his wife’s money he is very cautious and listens to what the experts have to say. With his own money his puts it in some investments and forgets about it. As you put it, threw it in the coffee can. And forgot about it. It so turned out that the coffee can approach did better. Can you take us through that example?

This was a case, told by Robert Kirby at Capital Guardian, from the 1950s. The husband managed his wife’s fund and followed closely the advice from the investment firm. The firm had a research department and did their best to preserve, and build, capital. It turns out that unbeknownst to anyone, the man used $5,000 of his own money to invest in the firm’s buy recommendations. He never sold anything and never traded, he just plopped the securities into a proverbial coffee can(those were the days of paper). The husband died suddenly and the wife then came back to the investment firm to combine their accounts. Everyone was surprised to see that the husband’s account was a good deal larger than his wife’s. The neglected portfolio fared much better than the tended one. It turns out that a large part of the portfolio’s success was attributable to an investment in Xerox.

So what was the lesson drawn?

Kirby drew a more basic lesson from the experience. Sometimes doing nothing is better than doing something. In most businesses, there is some relationship between activity and results. The more active you are, the better your results. Investing is one field where this isn’t true. Sometimes, doing nothing is the best thing. As Warren Buffett has said, “Inactivity strikes us as intelligent behavior.” As I mentioned before, there is lots of evidence that the decisions to buy and sell by individuals and institutions does as much, if not more, harm than good. I’m not saying you should buy and hold forever, but I am saying that buying cheap and holding for a long time tends to do better than guessing what asset class or manager is hot.

(The interview was originally published in the Daily News and Analysis(DNA) on June 4,2012. http://www.dnaindia.com/money/interview_people-should-listen-to-market-experts-for-entertainment-not-elucidation_1697709)

(Interviewer Kaul is a writer and can be reached at [email protected])

‘I’ve never found a good pick by reading a news story’

Aswath Damodaran is one of the world’s premier experts in the field of equity valuation. He has written several books like Damodaran on Valuation, Investment Fables, The Dark Side of Valuation and most recently The Little Book of Valuation: How to Value a Company, Pick a Stock and Profit, on the subject. He is a Professor of Finance at the Stern School of Business at New York University where he teaches corporate finance and equity valuation. . In this interview he speaks to Vivek Kaul.

How did you get into the field of valuation?

I started in finance as a general area and then I got interested in valuation when I started teaching. Valuation is a piece of almost everything you do and I was surprised how ill developed it was as a field of thought. It was almost random and not much thinking had gone into thinking about how to do it systematically.

A lot of valuation is basically compound interest when you discount the expected cash flows. So how much of it is math and how much of it is art?

Much of it is not the compound interest or the discount factor it is really the cashflows you have to estimate. So most of it is actually is in the numerator. It is about figuring out what business you are in. Figuring out how you make money. Figuring out what the margins are. What the competition is going to be. So numerator is where all the action is and it is actually very little to do with mathematics. It is more an understanding of business and actually getting it into numbers.

Can you give us an example?

So if you are trying to value Facebook getting the discount rate for Facebook is trivial. It is easy. It is about 11.5%. It is about the 80th percentile in terms of riskiness of companies. The trouble with Facebook is figuring out, first what business they are going to be in, because they haven’t figured it out themselves. How are they going to convert a billion users into revenues and income? And second, if they even manage to do it, how much those revenues will be, what will the margins etc. And those are all functions where you cannot think just Facebook standing alone. It is going to compete against Google. It is going compete against Apple. It is going to compete against other social media companies. So you have to make judgement calls of how it is all going to play out. It is numbers but the numbers come from understanding business. Understanding strategy. Understanding competition. Understanding all the things that kind of come into play.

You just mentioned that the discounting rate for expected cash flows from Facebook was at 11.5%. How did you arrive at that?

I have the cost of capital for by every sector in the US.

So this is the cost of capital for dotcoms?

This is actually the cost of capital for risky technology capitals. So basically I am saying is that I could sit there and try to finesse it and say is it 11.8% or is it 11.2%. But it doesn’t really matter. Getting the revenues and margins is more critical than getting the discount rate narrowed down.

This 11.5% would be from a combination of equity and debt?

For a young growth company it is almost going to be all equity. You don’t borrow money if you are that small and when you are in a high growth phase it is not worth it. It is almost all equity.

I recently read a blog of yours where you said that you have sold Apple shares even though they were undervalued. Why did you do that?

There are two parts to the investment process. One is the value part to the process. And the other is the pricing part to the process. To make money you need to be comfortable with both parts. You want to feel comfortable with value and you have to feel comfortable that price is going to converge on the value. In the case of Apple for 15 years I was comfortable with my estimate of value and I was comfortable that the price would converge on value. In the last year the Apple stockholder base has had a fairly dramatic change. There has been influx of a lot of institutional investors who have coming in as herd investors and momentum investors who go wherever the price is hottest. You have also got a lot of dividend investors who came in last year because they expected Apple to start paying dividends.

What happened because of that?

So you got this influx of new investors with very different ideas of what they expect Apple to do in the future. They are all in there. And right now they are okay for the moment because Apple is able to keep them all reasonably happy. But I think this is a game where I have lost control of the pricing process because those investors turn on a dot. Like they did, when the stock went from $640 to $530 for no reason at all. You look at any news that came out. Nothing came out. So why is the stock worth $640 and eight weeks later $530? But that’s the nature of momentums stocks. It is not news that drives the price anymore, it’s the herd. Basically if it moves in one direction, prices are going to go up $20. If it moves in the other direction, it is going to go down $30. And I looked at the pricing process and said I have lost control of this part of the process. I am comfortable with the value still. But I am leaving not forever. If these guys keep pushing it down, sooner or later they are going to push it to a point where these guys leave and then I can step in buy the stock. So it’s not permanent but I think at the moment it has become a momentum stock.

You have talked about the danger of purely relying on stories while investing. But that’s how most investors invest. What are the problems with that?

Even momentum investors want a crutch. Basically stories give them a crutch. You have decided to buy the stock anyway because everyone else is doing it. You don’t want to tell people because that doesn’t sound good so you look for a story to convince yourself that you area really doing this for a good reason. The power of the story is very strong, I am not denying it. But I am saying that if there is a story my job is to bring it into the numbers and see if that story holds up to scrutiny.

Any example?

You can talk about user base. Facebook the story is that they have lots of users. My job is to take those billion users and talk about what that might mean in revenues and margins and operating income and cash flows. And not just say that there are lot of users therefore the company must be worth a lot. If a Chinese company says we are going to be valued. There are a billion Chinese. Okay. What does that mean? You have a billion Chinese but how much will be you able to sell? How much will they buy your product? So I think you need to get past the macro big story telling because it is easy to fall into saying that hey this company is worth a lot.

Can smaller investors make money by piggybacking on investment decisions of big investors?

If you look at institutional investors they do things so badly why do you want to piggyback on them.

Someone like a Warren Buffett and Rakesh Jhunjhunwala in the Indian context?

You could but I think by the time you get the information it is usually too late. It is not like you are the only one who finds out that Warren Buffett has bought a stock. Half the world has found out. So when you get to lineup to buy the stock, everyone else is buying the stock and price has already moved up.

George Soros once said that most money is made by entering a bubble early. What are your views on that?

Everybody is guilty of hyperbole when it comes to bubbles and Soros is no exception. Soros has never been a great micro investor. He has made his money on macro bets. He has always been. He has never been a great stock picker. For him it is got to be massive macro bubbles, an asset class that gets overpriced or underpriced. You’re right if you can call macro bubbles you can make a lot of money. John Paulson called the housing bubble made a few billion dollars. So he is right and he is wrong. He is right because if you can call a macro bubble you can make a lot of money. He is wrong because if you make your investment philosophy calling macro bubbles, you better get lucky, because everybody is calling macro bubbles and most of them are going to be wrong.

You have talked about buying the 35worst stocks in the market and holding that investment and making money on it. How does that work?

It’s called the classic contrarian investment strategy where you buy the biggest holders and you hold them for a long period. There is evidence that if you hold them for a long period that they tend to be the best investments. But it comes with caveats. One is that if you buy the 35 biggest losers they often tend to be low priced stocks because they have gone down so much which increases the transaction cost of your trading. The other is that it is very dependant on your time horizon. It turns out that if you buy the lowest price stocks for the first 18 months they actually underperform. It is only after that they turnaround. This means that if you buy these stocks you are going to get about 18 months of heart burn and stomach aches. And for many people they don’t have the patience to stay in. So they often buy the worst stocks after reading these studies. About 12 months in they lose patience they sell it. It is very dependant on both those pieces of puzzle falling in.

How much role does media play in influencing investment decisions of people?

Media and analysts are followers. None of the media told us last week that Facebook was going to collapse. Now of course everybody is talking about it. So basically when I see in the media news stories I see a reflection of what has already happened. It is a lagging indicator. It is not a leading indicator. I have never ever found a good investment by reading a news story. But I have heard about why an investment was good in hindsight by reading a news story about it.

I am not a great believer that I can find good investments in the media. That’s not their job anyway.

(The interview was originally published in the Daily News and Analysis(DNA) on June 2,2012. http://www.dnaindia.com/money/interview_ive-never-found-a-good-pick-by-reading-a-news-story_1696935)

(Vivek Kaul is a writer and can be reached at [email protected])

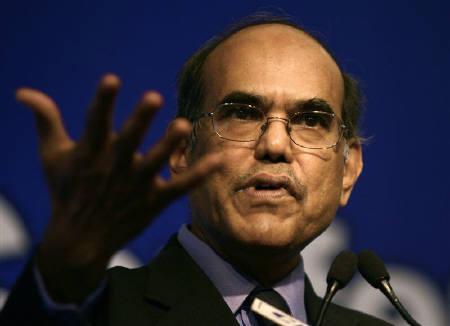

No, Subbarao won’t be able to clean UPA’s garbage dump

Vivek Kaul

Duvvuri Subbarao, the current governor of the Reserve Bank of India must be a troubled man these days, professionally that is. The gross domestic product (GDP) growth has fallen to 5.3% for the period of January to March 2012. And now he is expected to come to the rescue of the Indian economy by cutting interest rates, so that people and businesses can easily borrow more, and we all can live happily ever after.

Cows would fly, only if it was as simple as that!

The mid quarter review of the monetary policy is scheduled for June 18,2012. On that day the Subbarao led Reserve Bank of India(RBI) is expected to cut the repo rate by at least 50 basis points (one basis point is one hundredth of a percentage). The repo rate is the rate at which banks borrow from the RBI.

Repo rate is a short term interest rate and by cutting this interest rate the RBI tries to manage the other interest rates in the economy, including long term interest rates like the rate at which the bond market lends to the government, the interest offered by banks on their fixed deposits, and the interest charged by banks on long term loans like home loans, and loans to businesses.

But the fact of the matter is it really has no control on these interest rates in the current state of things. To understand why, let us deviate a little.

Greenspan and Clinton

Alan Greenspan and Bill Clinton came from the opposite ends of the political spectrum. Greenspan had been a lifelong Republican whereas Clinton was a Democrat. Unlike India where there are a large number of political parties, America has basically two parties, the Republican Party and the Democratic Party. Greenspan was the Chairman of the Federal Reserve of United States, the American central bank, from 1987 to 2006.

But despite coming from the opposite ends of the political spectrum they got along fabulously well. In fact, when Clinton became the President of America in early 1993, Greenspan approached him with what Americans call a “proposition”.

Greenspan told Clinton that since 1980 the rate of inflation had fallen from a high of around 15% to the current 4%. But during the same period the interest rate on home loans had fallen only by 400 basis points from 13% to 9%. Despite the fact that the Federal Funds Rate (the American equivalent of the Indian repo rate) stood at a low 3%.

Why was the difference between the Federal Funds rate which was a short term interest rate and the home loan interest rate, which was a long term interest rate, so huge?

High fiscal deficit

The difference in interest rates was primarily because of the high fiscal deficit that the government of United States was incurring. Fiscal deficit is the difference between what the government earns and what it spends in a particular year.

When Clinton took over as President on January 20, 1993, the American government had just run a record fiscal deficit amounting to $290.3billion or 4.7% of the GDP for 1992. And this had led to high long term interest rates even though the Federal Reserve had set the short term Federal Funds rate at 3%.

The government was borrowing long term to fund its fiscal deficit. And since its borrowing needs were high because of the large fiscal deficit it needed to offer a higher rate of interest to attract lenders. When the government borrowed more it crowded private borrowing, meaning, there was lesser pool of “savings” for the private borrowers to borrow from.

Hence, banks and other financial institutions which needed to borrow in order to give out home loans had to offer an even higher rate of interest than the government to attract lenders. Even otherwise, the private sector has to offer a higher rate of interest than the government, because lending to the government is deemed to be the safest form of lending. Due to these reasons the difference in short term interest rates and long term interest rates in the US was high. So the repo rate was at 3% and the home loan rate was at 9%.

The proposition

Greenspan was rightly of the opinion that a high fiscal deficit was holding economic growth back. This was the argument he made to President Clinton when he first met him. As Greenspan writes in his autobiography The Age of Turbulence – Adventures in a New World “Long term interest rates were still stubbornly high. They were acting as a brake on economic activity by driving up costs of home mortgages (the American term for home loans) and bond issuance.”

Other than the government which issues bonds to finance its fiscal deficit, companies also issue bonds to raise debt to meet the needs of their business. If interest rates are high companies normally tend to put expansion plans on hold because high interest rates may not make the plan financially viable.

Greenspan’s proposition to Clinton was that if the Wall Street got enough of a hint that the government was serious about bringing down the fiscal deficit, long term interest rates would start to fall . This would be good for the overall economy because at lower interest rates people would borrow more to buy houses and as well as everything else that needs to be bought to make a house a “home”.

As Greenspan writes “Improve investors’ expectations, I told Clinton, and long-term rates could fall, galvanizing the demand for new homes and the appliances, furnishings, and the gamut of consumer items associated with home ownership. Stock values too, would rise, as bonds became less attractive and investors shifted into equities.”

The US Congressional and Budget Office(CBO), a US government agency which provides economic data to the US Congress (the American parliament) to help better decision making, upped its projection of the fiscal deficit at that point of time. It said that the fiscal deficit is likely to reach $360billion a year by 1997. This data point put out by the US CBO helped buttress Greenspan’s point further and Clinton decided to do something about the fiscal deficit.

The Clinton plan

Clinton put out a plan which would cut the deficit by $500billion over a period of four years through a combination of higher tax rates as well as lower spending by the government. The fiscal deficit of the United States of America which had been growing steadily for years, started to fall from 1993. In 1993, it was down by 12% to $255billion. By 1997, the fiscal deficit was down to $21billion. In Clinton’s second term as President, the deficit turned into a surplus, something that had not happened since 1971. Between 1998 and 2001, the US government earned a surplus of $559.4billiondollars.

A lower fiscal deficit led to lower long term interest rates and good economic growth. The United States of America grew at an average rate of 3.9% between 1993 and 2000. In the eight years prior to that the country had grown at an average rate of 2.9% per year. So the US grew at a much faster rate on a higher base because the fiscal deficit was turned into a fiscal surplus.

This was also the period of the dotcom bubble but the fiscal surplus was clearly not the reason for it.

The moral of the story

As we clearly see from the above example, at times there is not much that a central bank can do on the interest rate front, especially when the government is running a high fiscal deficit. As I have often said over the past one month the fiscal deficit of the government of India has increased by 312% between 2007 and 2012. During the same period its income has increased by only 36%. The fiscal deficit target for the current financial year is at Rs Rs 5,13,590 crore, a little lower from the last year’s target. But as we have seen in the past this government has a tendency to miss its fiscal deficit targets regularly. So the government will have to borrow to finance its fiscal deficit and that means an environment in which long term interest rates will remain high.

In fact, some banks have quietly raised the interest rates they charge to their existing home loan borrowers, after the Subbarao led RBI last cut the repo rate by 50 basis points on April 17, 2012.

The interest being charged to some of the existing home loan borrowers has even crossed 14.5%, a difference of more than 6% between a long term interest rate and the repo rate, as was the case in America.

India has another problem which America did not in the early 1990s, high inflation. The consumer price inflation was at 10.36% for the month of April 2012. Urban inflation was at 11.1% whereas rural inflation was just below 10% at 9.86%. If Subbarao goes about cutting the repo rate in a rapid manner, he runs the danger of inciting further inflation.

So the only way out of this mess is to cut subsidies. Cut fuel subsidies. Cut fertilizer subsidies. This of course would mean higher prices in the short term, particularly if diesel prices are raised. An increase in the price of diesel will immediately lead to higher inflation, given that diesel is the major transport fuel, and any increase in its price is passed onto the consumers. The government thus has to make a choice whether it wants high interest rates for the long term or high inflation for the short term. It need not be said it will be a politically difficult decision to make.

Over the longer term it also needs to figure out how to bring more Indians under the tax ambit and lower the portion of the “black” economy in the overall economy. (You can read this in detail here: It’s not Greece: Cong policies responsible for rupee crashhttp://www.firstpost.com/economy/dont-blame-greece-cong-policies-responsible-for-rupees-crash-318280.html)

And there is nothing that RBI can do on any of these fronts. The predicament of the RBI was best explained in a recent column titled Seeking Divine Intervention, written by Rajeev Malik, an economist at CLSA. He said: “There are three institutions that keep India running: the Supreme Court, the Election Commission and the Reserve Bank of India (RBI). To be sure, most of the economic mess in India has the government behind it. And often the RBI is called in as a vacuum cleaner. But even the world’s best vacuum cleaner cannot be successfully used to clean up a garbage dump.”

(The article originally appeared at www.firstpost.com on June 4,2012. http://www.firstpost.com/economy/no-subbarao-wont-be-able-to-clean-upas-garbage-dump-331114.html)

(Vivek Kaul is a writer and can be reached at [email protected])

Sonia’s UPA is taking us to new ‘Hindu’ rate of growth

Vivek Kaul

Raj Krishna, a professor at the Delhi School of Economics, came up with the term “Hindu rate of growth” to refer to Indian economy’s sluggish gross domestic product (GDP) growth of 3.5% per year between the 1950s and the 1980s. The phrase has been much used and abused since then.

A misinterpretation that is often made is that Krishna used the term to infer that India grew slowly because it was a nation dominated by Hindus. In fact he never meant anything like that. Krishna was a believer in free markets and wasn’t a big fan of the socialistic model of development put forward by Jawahar Lal Nehru and the Congress party.

In fact he realised over the years looking at the slow economic growth of India that the Nehruvian model of socialism wasn’t really working. This was visible in the India’s secular or long term economic growth rate which averaged around 3.5% during those days.

The word to mark here is “secular”. The word in its common every day usage refers to something that is not specifically related to a particular religion. Like our country India. One of the fundamental rights Indians have is the right to freedom of religion which allows us to practice and propagate any religion.

But the world “secular” has another meaning. It also means a long term trend. Hence when economists like Krishna talk about the secular rate of growth they are talking about the rate at which a country like India has grown year on year, over an extended period of time. And this secular rate of growth in India’s case was 3.5%. This could hardly be called a rate of growth for a country like India which was growing from a very low base and needed to grow at a much faster pace to pull its millions out of poverty.

So Krishna came up with the word “Hindu” which was the direct opposite of the word “secular” to take a dig at Jawahar Lal Nehru and his model of development. Nehru was a big believer in secularism. Hence by using the word “Hindu” Krishna was essentially taking a dig on Nehru and his brand of economic development, and not Hindus.

The policies of socialism and the license quota raj followed by Nehru, his daughter Indira Gandhi and grandson Rajiv ensured that India grew at a very slow rate of growth. While India was growing at a sub 4% rate of growth, South Korea grew at 9%, Taiwan at 8% and Indonesia at 6%. These were countries which were more or less at a similar point where India was in the late 1940s.

The Indian economic revolution stared in late July 1991, when a certain Manmohan Singh, with the blessings of PV Narsimha Rao, initiated the economic reform process. The country since then has largely grown at the rates of 7-8% per year, even crossing 9% over the last few years.

Over the years this economic growth has largely been taken for granted by the Congress led UPA politicians, bureaucrats and others in decision making positions. Come what may, we will grow by at least 9%. When the growth slipped below 9%, the attitude was that whatever happens we will grow by 8%. When it slipped further, we can’t go below 7% was what those in decision making positions constantly said. On a recent TV show Montek Singh Ahulwalia, the Deputy Chairman of the Planning Commission, kept insisting that a 7% economic growth rate was a given. Turns out it’s not.

The latest GDP growth rate, which is a measure of economic growth, for the period of January to March 2012 has fallen to 5.3%. I wonder, what is the new number, Mr Ahulwalia and his ilk will come up with now. “Come what may we will grow at least by 4%!” is something not worth saying on a public forum.

But chances are that’s where we are headed. As Ruchir Sharma writes in his recent book Breakout Nations – In Pursuit of the Next Economic Miracles “India is already showing some of the warning signs of failed growth stories, including early-onset of confidence.”

The history of economic growth

Sharma’s basic point is that economic growth should never be taken for granted. History has proven otherwise. Only six countries which are classified as emerging markets by the western world have grown at the rate of 5% or more over the last forty years. These countries are Malaysia, Singapore, South Korea, Taiwan, Thailand and Hong Kong. Of these two, Hong Kong and Taiwan are city states with a very small area and population. Hence only four emerging market countries have grown at a rate of 5% or more over the last forty years. Only two of these countries i.e. Taiwan and South Korea have managed to grow at 5% or more for the last fifty years.

“In many ways “mortality rate” of countries is as high as that of stocks. Only four companies – Procter & gamble, General Electric, AT&T, and DuPont- have survived on the Dow Jones index of the top-thirty U.S. industrial stocks since the 1960s. Few front-runners stay in the lead for a decade, much less many decades,” writes Sharma.

The history of economic growth is filled with examples of countries which have flattered to deceive. In the 1950s and 1960s, India and China, the two biggest emerging markets now, were struggling to grow. The bet then was on Iraq, Iran and Yemen. In the 1960s, the bet was Philippines, Burma and Sri Lanka to become the next East Asian tigers. But that as we all know that never really happened.

India is going the Brazil way

Brazil was to the world what China is to it now in the 1960s and the 1970s. It was one of the fastest growing economies in the world. But in the seventies it invested in what Sharma calls a “premature construction of a welfare state”, rather than build road and other infrastructure important to create a viable and modern industrial economy. What followed was excessive government spending and regular bouts of hyperinflation, destroying economic growth.

India is in a similar situation now. Over the last five years the Congress party led United Progressive Alliance is trying to gain ground which it has lost to a score of regional parties. And for that it has been very aggressively giving out “freebies” to the population. The development of infrastructure like roads, bridges, ports, airports, education etc, has all taken a backseat.

But the distribution of “freebies” has led to a burgeoning fiscal deficit. Fiscal deficit is the difference between what a government earns and what it spends.

For the financial year 2007-2008 the fiscal deficit stood at Rs 1,26,912 crore against Rs 5,21,980 crore for the current financial year. In a time frame of five years the fiscal deficit has shot up by nearly 312%. During the same period the income earned by the government has gone up by only 36% to Rs 7,96,740 crore. The huge increase in fiscal deficit has primarily happened because of the subsidy on food, fertilizer and petroleum.

This has meant that the government has had to borrow more and this in turn has pushed up interest rates leading to higher EMIs. It has also led to businesses postponing expansion because higher interest rates mean that projects may not be financially viable. It has also led to people borrowing lesser to buy homes, cars and other things, leading to a further slowdown in a lot of sectors. And with the government borrowing so much there is no way the interest rate can come down.

As Sharma points out: “It was easy enough for India to increase spending in the midst of a global boom, but the spending has continued to rise in the post-crisis period…If the government continues down this path India, may meet the same fate as Brazil in the late 1970s, when excessive government spending set off hyperinflation and crowded out private investment, ending the country’s economic boom.”

Where are the big ticket reforms?

India reaped a lot of benefits because of the reforms of 1991. But it’s been 21 years since then. A new set of reforms is needed. Countries which have constantly grown over the years have shown to be very reform oriented. “In countries like South Korea, China and Taiwan, they consistently had a plan which was about how do you keep reforming. How do you keep opening up the economy? How do you keep liberalizing the economy in terms of how you grow and how you make use of every crisis as an opportunity?” says Sharma.

India has hardly seen any economic reform in the recent past. The Direct Taxes Code was initiated a few years back has still not seen the light of day, but even if it does see the light of day, it’s not going to be of much use. In its original form it was a treat to read with almost anyone with a basic understanding of English being able to read and understand it. The most recent version has gone back to being the “Greek” that the current Income Tax Act is.

It has been proven the world over that simpler tax systems lead to greater tax revenues. Then the question is why have such complicated income tax rules? The only people who benefit are CAs and the Indian Revenue Service officers.

Opening up the retail sector for foreign direct investment has not gone anywhere for a long time. This is a sector which is extremely labour intensive and can create a lot of employment.

What about opening up the aviation sector to foreigners instead of pumping more and more money into Air India? As Warren Buffett wrote in a letter to shareholders of Berkshire Hathaway, the company whose chairman he is, a few years back “The worst sort of business is one that grows rapidly, requires significant capital to engender the growth, and then earns little or no money. Think airlines. Here a durable competitive advantage has proven elusive ever since the days of the Wright Brothers. Indeed, if a farsighted capitalist had been present at Kitty Hawk, he would have done his successors a huge favor by shooting Orville down…The airline industry’s demand for capital ever since that first flight has been insatiable. Investors have poured money into a bottomless pit, attracted by growth when they should have been repelled by it.”

If foreigners want to burn their money running airlines in India why should we have a problem with it?

The insurance sector is bleeding and needs more foreign money, but there is a cap of 26% on foreign investment in an insurance company. Again this limit needs to go up. The sector very labour intensive and has potential to create employment. The same is true about the print media in India.

The list of pending economic reforms is endless. But in short India needs much more economic reform in the days to come if we hope to grow at the rates of growth we were growing.

To conclude

Raj Krishna was a far sighted economist. He knew that the Nehruvian brand of socialism was not working. It never has. It never did. And it never will. But somehow the Congress party’s fascination for it continues. And in continuance of that, the party is now distributing money to the citizens of India through the various so called “social-sector” schemes. If economic growth could be created by just distributing money to everyone, then India would have been a developed nation by now. But that’s not how economic growth is created. The distribution of money creates is higher inflation which leads to higher interest rates and in turn lower economic growth. Also India is hardly in a position to become a welfare state. The government just doesn’t earn enough to support the kind of money it’s been spending and plans to spend.

Its time the mandarins who run the Congress party and effectively the country realize that. Or rate of growth of India’s economy (measured by the growth in GDP) will continue to fall. And soon it will be time to welcome the new “Hindu” rate of economic growth. And how much shall that be? Let’s say around 3.5%.

(The article originally appeared at www.firstpost.com on June 1,2012. http://www.firstpost.com/politics/sonias-upa-is-taking-us-to-new-hindu-rate-of-growth-328428.html)

(Vivek Kaul is a writer and can be reached at [email protected])